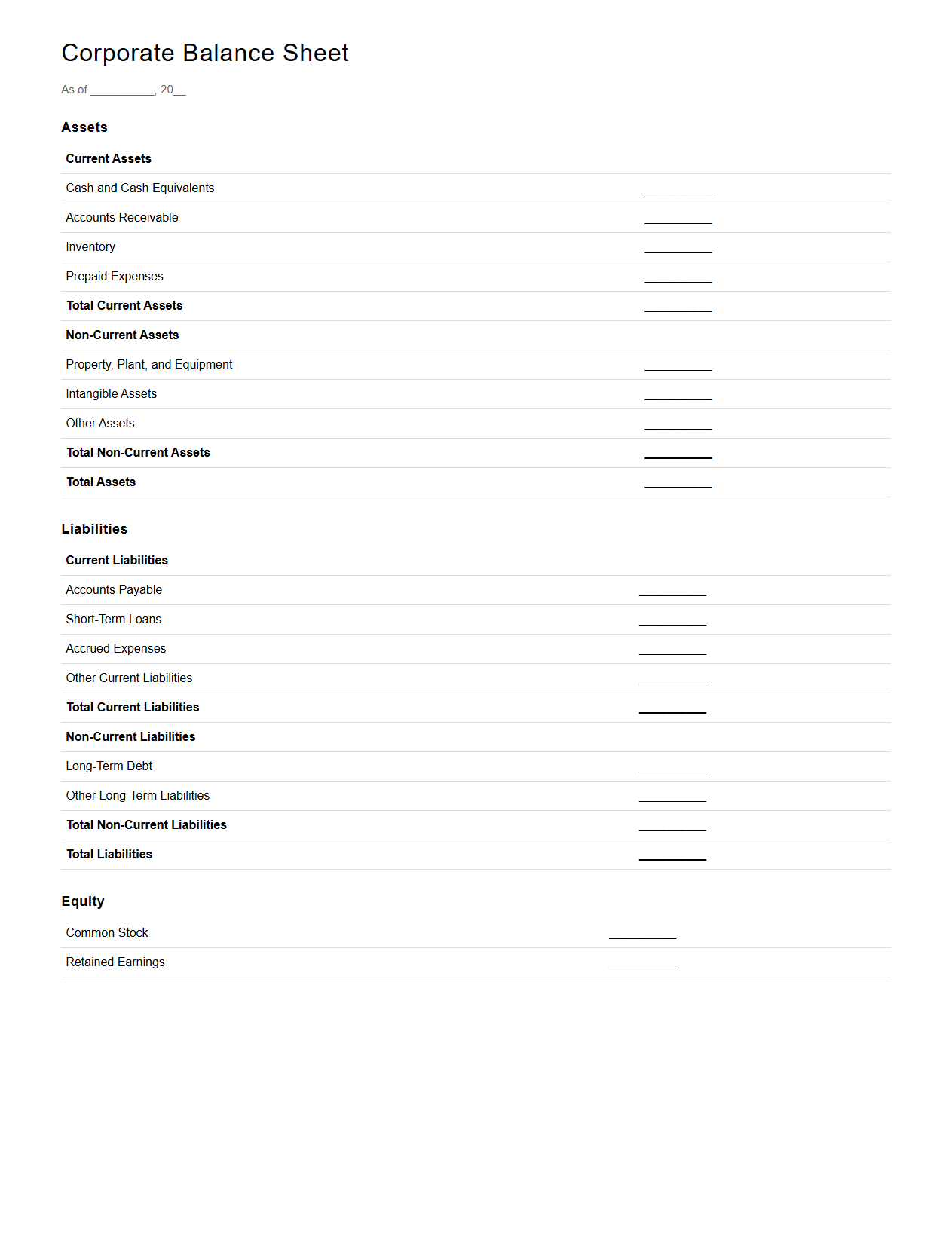

A Balance Sheet Document Sample for Corporate Finance provides a clear snapshot of a company's financial position at a specific point in time. It details assets, liabilities, and shareholders' equity, essential for analyzing financial health and making strategic decisions. This sample helps finance professionals accurately prepare and interpret balance sheets for corporate reporting and planning.

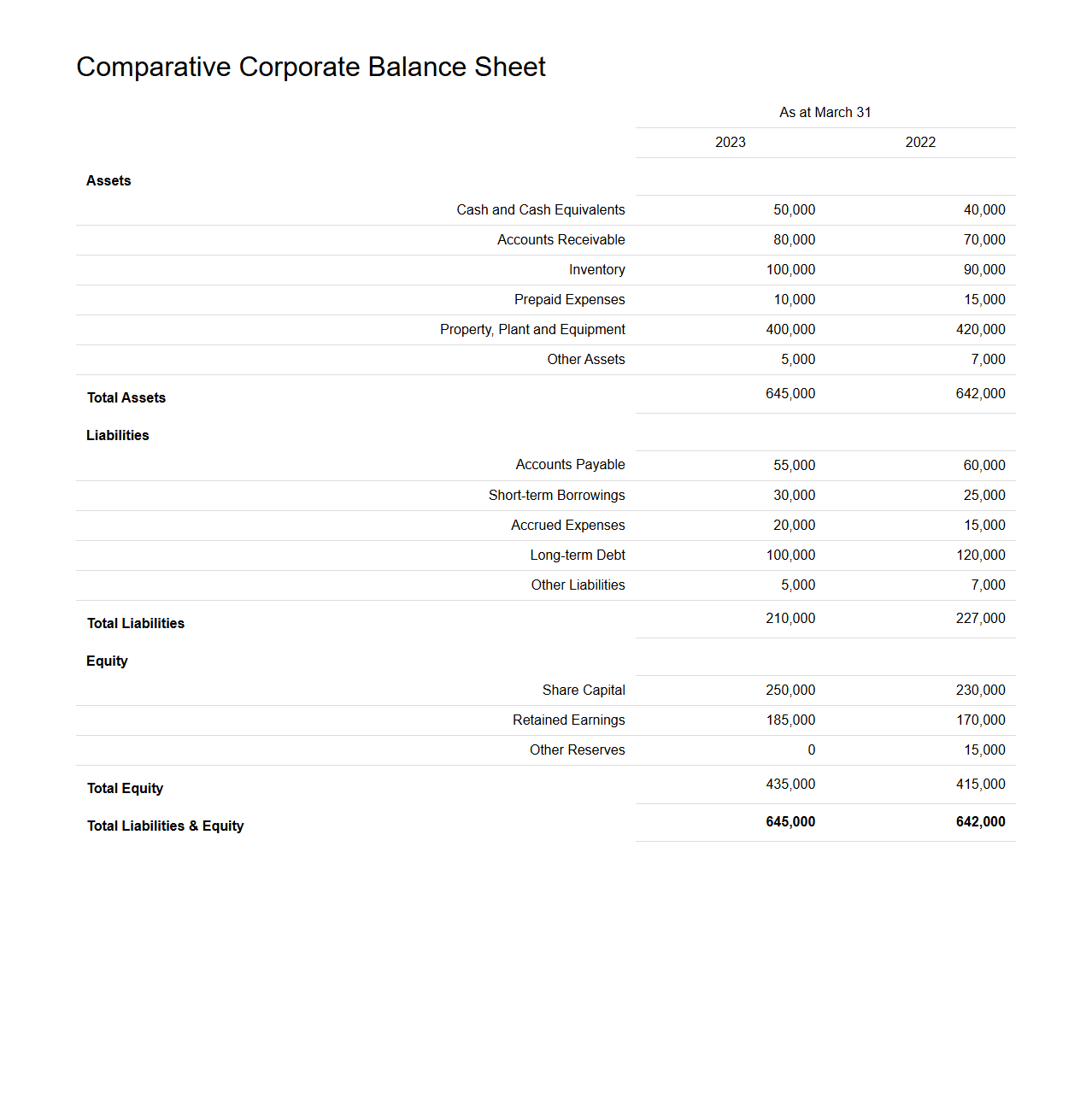

Comparative Corporate Balance Sheet Example

A

Comparative Corporate Balance Sheet Example document presents side-by-side financial statements from multiple accounting periods, allowing for easy analysis of changes in assets, liabilities, and equity. This comparison highlights trends and financial health indicators, helping stakeholders make informed decisions based on period-to-period variations. It is a vital tool in financial reporting, budgeting, and strategic planning within corporate finance.

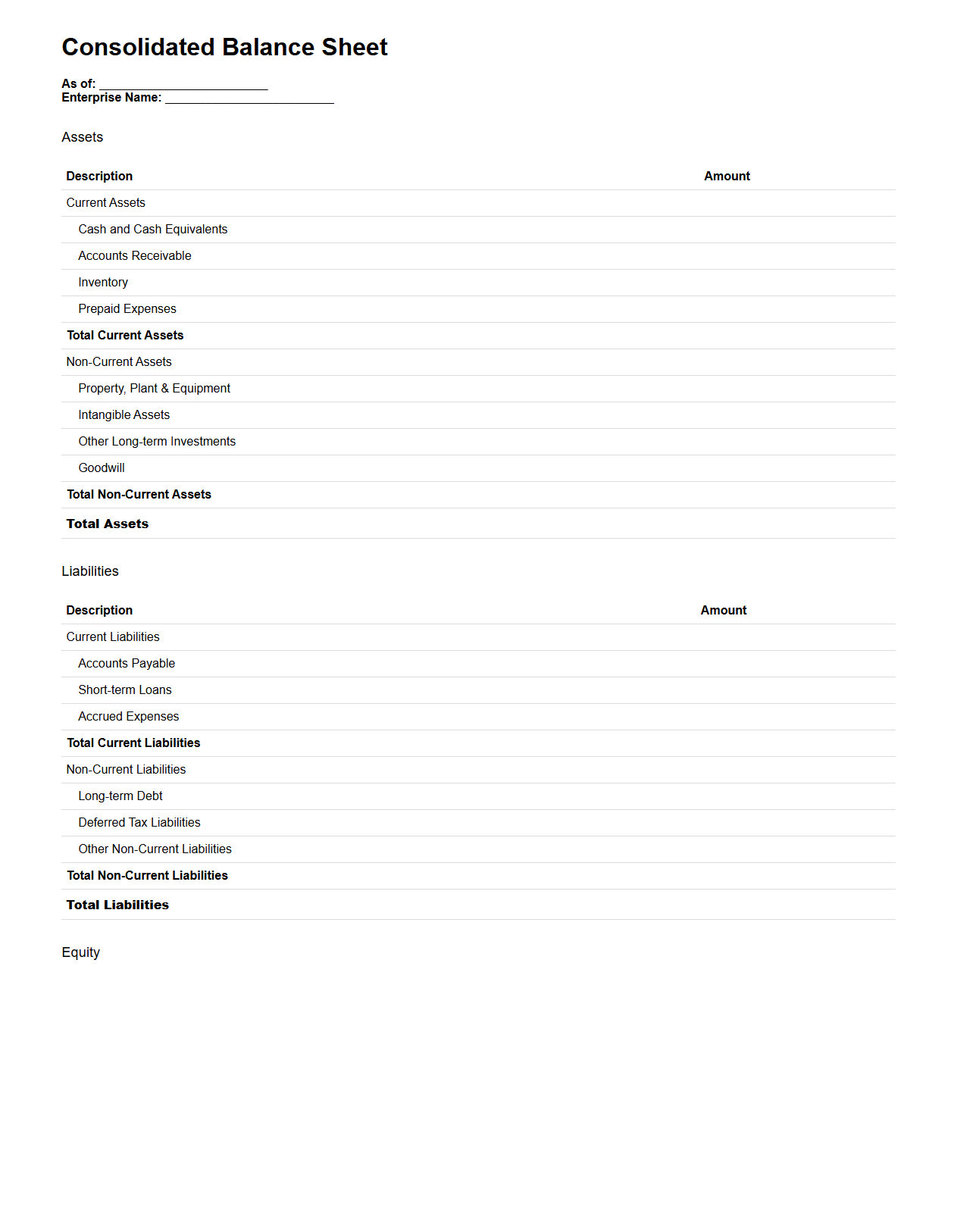

Consolidated Balance Sheet Template for Enterprises

A

Consolidated Balance Sheet Template for Enterprises is a structured financial statement that combines the assets, liabilities, and equity of a parent company and its subsidiaries into one comprehensive document. This template ensures accuracy by eliminating intercompany transactions and balances to present a true financial position of the entire corporate group. It is essential for stakeholders to assess the overall financial health and stability of multi-entity enterprises.

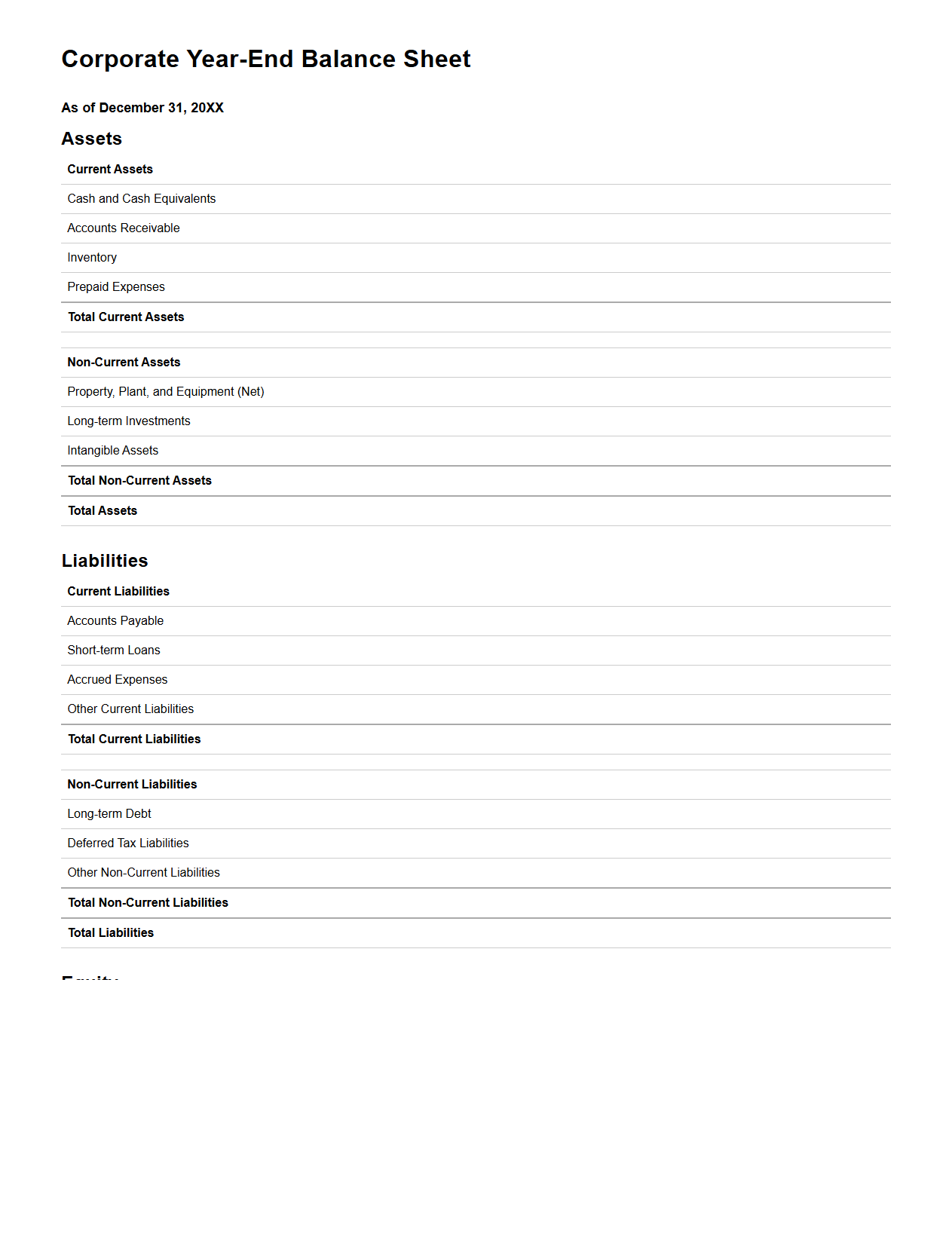

Corporate Year-End Balance Sheet Format

The

Corporate Year-End Balance Sheet Format document is a standardized financial statement template used by companies to summarize their assets, liabilities, and equity at the close of the fiscal year. This format ensures consistency and compliance with accounting principles, facilitating accurate financial analysis and reporting. It serves as a critical tool for stakeholders to assess corporate financial health and make informed decisions.

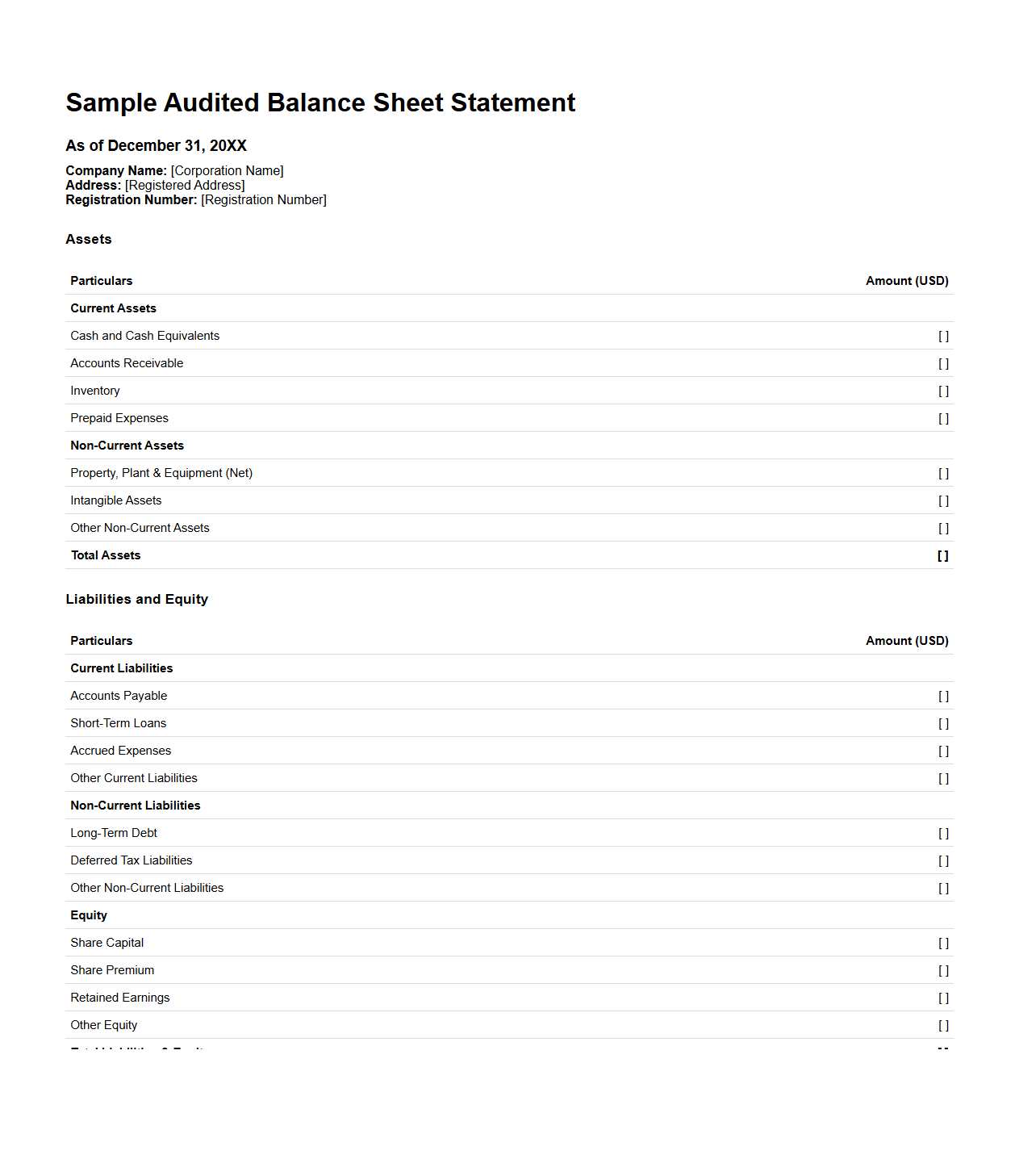

Audited Balance Sheet Statement for Corporations

An

Audited Balance Sheet Statement for corporations is a financial document that presents a company's assets, liabilities, and shareholders' equity at a specific point in time, verified by an independent auditor. This statement provides assurance that the financial information is accurate and complies with accounting standards, enhancing its reliability for stakeholders and investors. It serves as a critical tool for assessing a corporation's financial health and making informed business decisions.

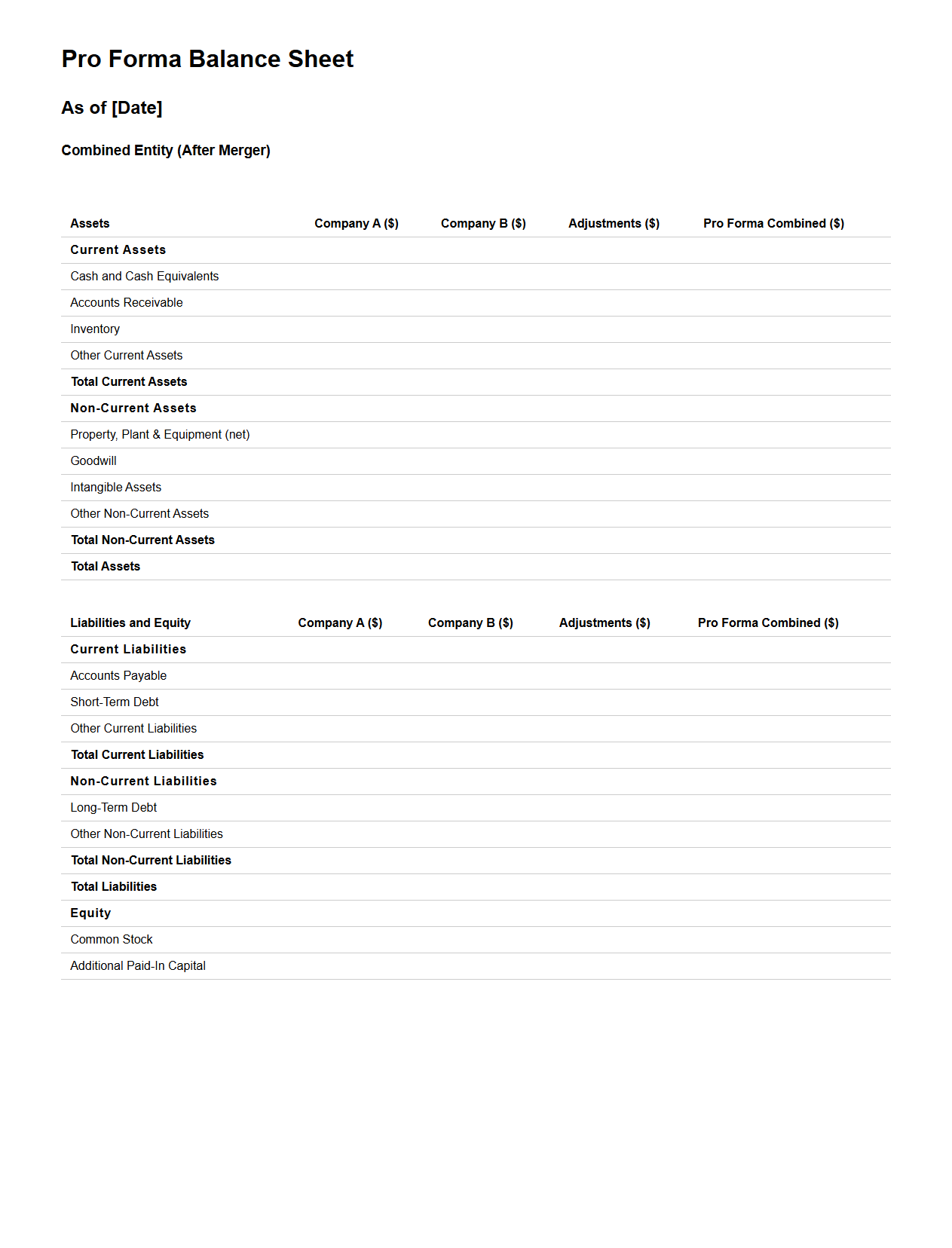

Pro Forma Balance Sheet Sample for Mergers

A

Pro Forma Balance Sheet Sample for Mergers document provides a projected financial snapshot of the combined entities after a merger, reflecting anticipated assets, liabilities, and equity. It serves as a critical tool for stakeholders to evaluate the financial impact and integration outcomes before the transaction is finalized. This document helps ensure transparency and aids in strategic decision-making during merger negotiations.

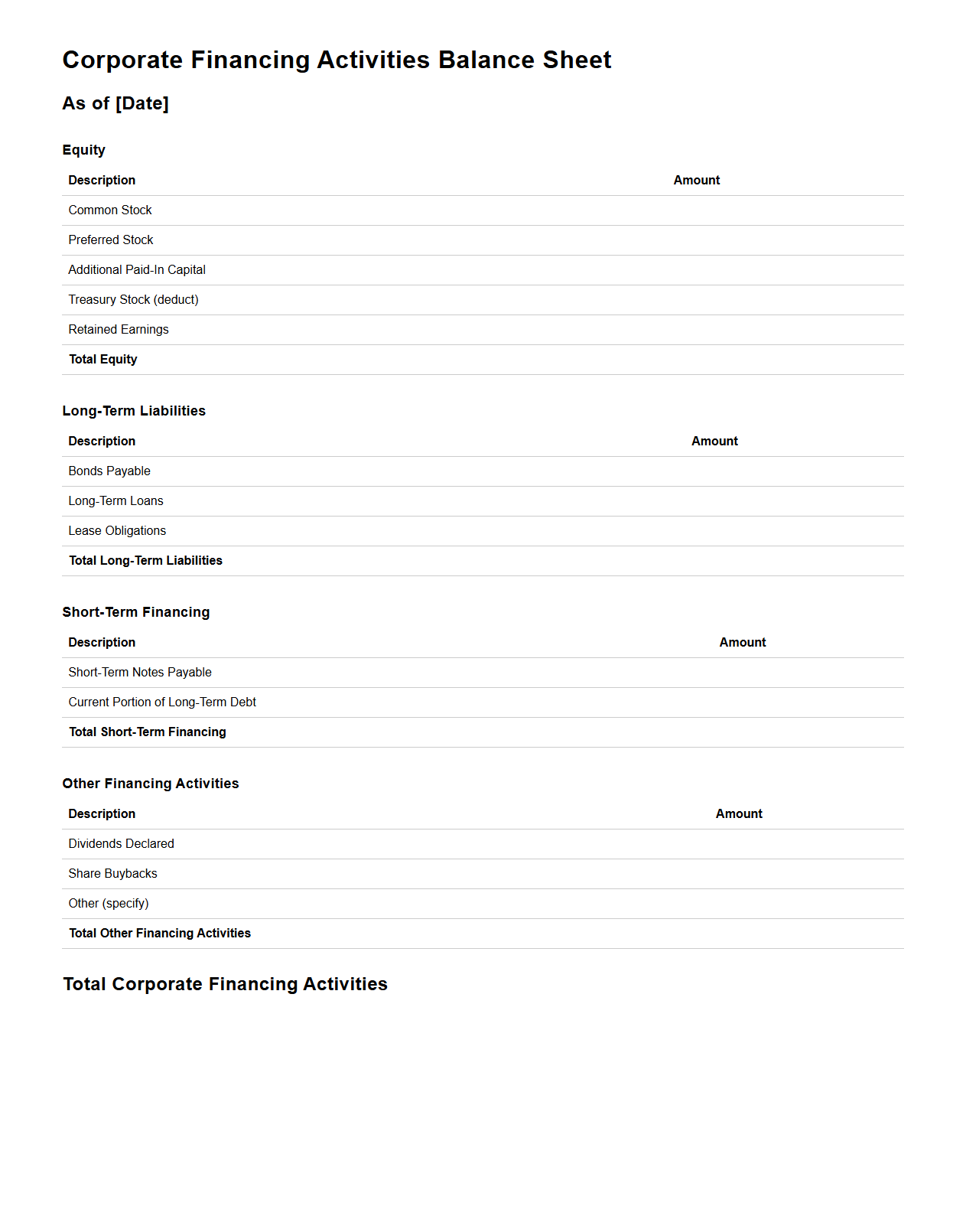

Corporate Financing Activities Balance Sheet Layout

The

Corporate Financing Activities Balance Sheet Layout document outlines the structure and presentation of financial information related to a company's sources and uses of capital, including debt, equity, and retained earnings. It provides a clear framework for organizing liabilities and shareholders' equity sections, enabling accurate analysis of a firm's financial health and funding strategies. This document ensures compliance with accounting standards and facilitates transparent reporting for stakeholders and regulatory bodies.

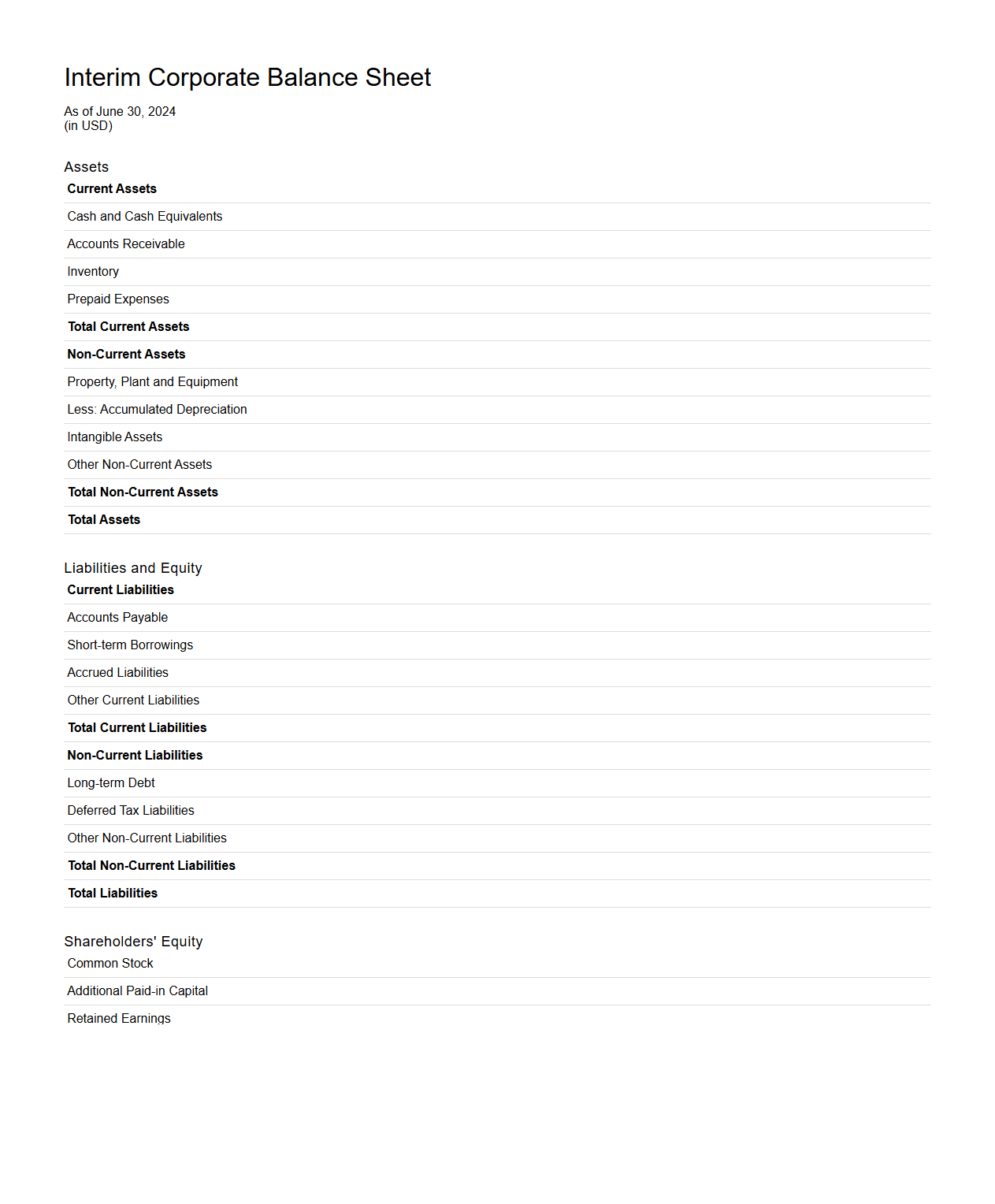

Interim Corporate Balance Sheet Example

An

Interim Corporate Balance Sheet Example document provides a snapshot of a company's financial position during a specific period within the fiscal year. It details assets, liabilities, and shareholders' equity at that point, allowing stakeholders to assess financial health and liquidity before final year-end statements. This document is essential for informed decision-making, budgeting, and financial planning in fast-changing business environments.

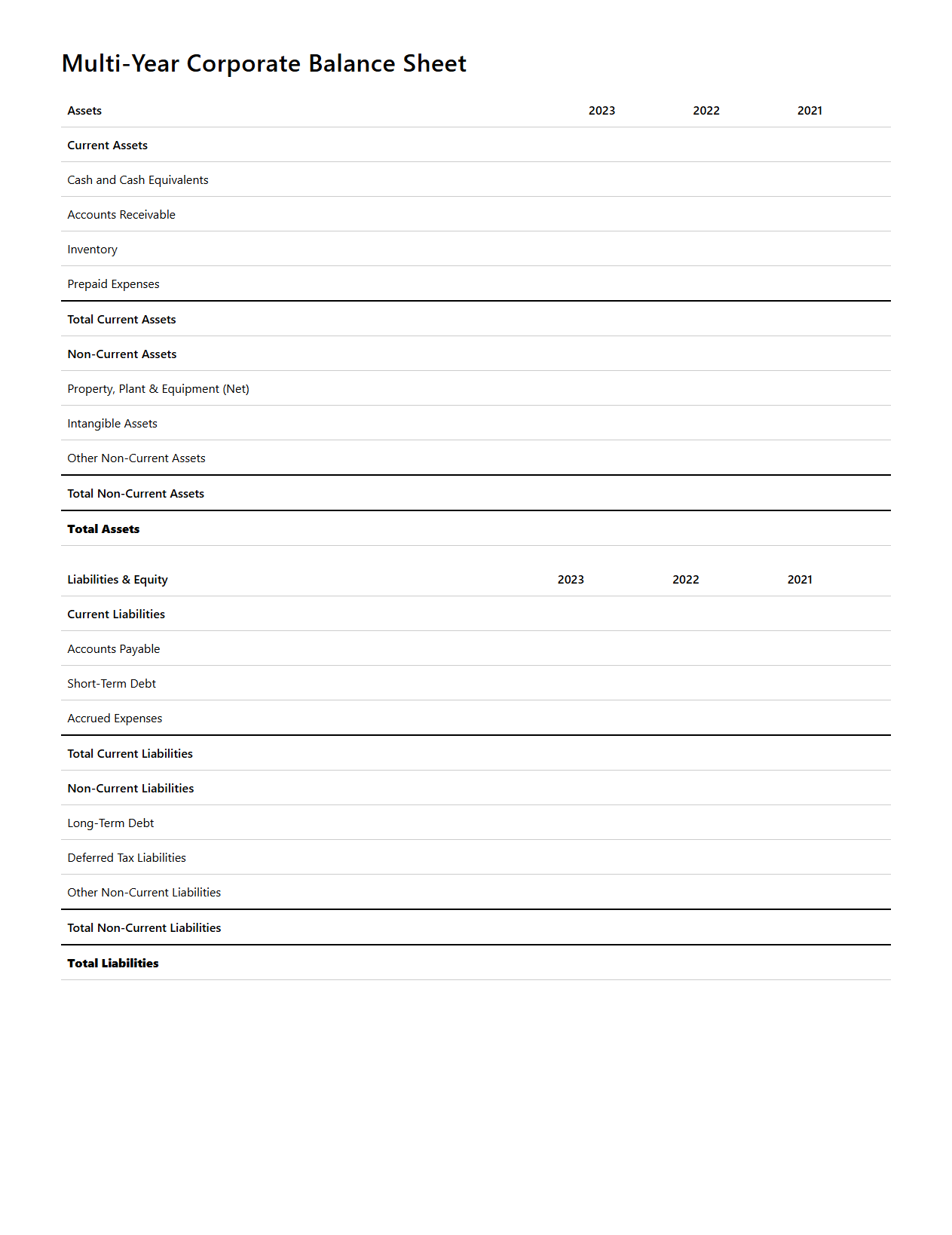

Multi-Year Corporate Balance Sheet Sample

A

Multi-Year Corporate Balance Sheet Sample document provides a detailed financial snapshot of a company's assets, liabilities, and equity over multiple fiscal years, enabling trend analysis and performance assessment. This document is essential for stakeholders such as investors, analysts, and management to evaluate financial stability and growth prospects. It often includes comparative data that highlight changes in financial position, helping in strategic planning and risk management.

Small Business Corporate Balance Sheet Template

A

Small Business Corporate Balance Sheet Template document is a structured financial statement that summarizes a company's assets, liabilities, and shareholders' equity at a specific point in time. It helps small businesses analyze their financial position, track capital investment, and assess liquidity and solvency. This template is essential for accurate bookkeeping, financial planning, and meeting regulatory reporting requirements.

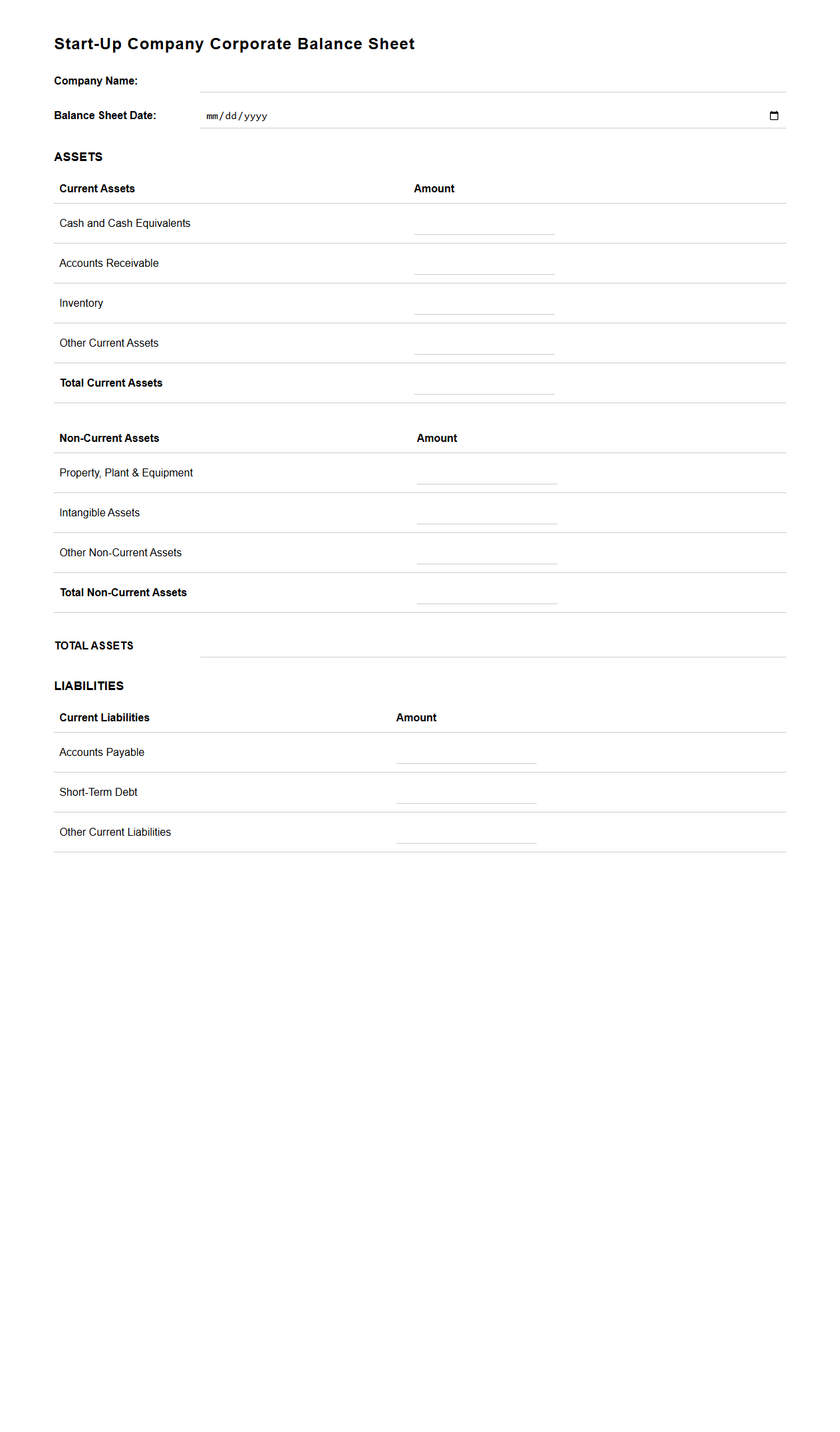

Start-Up Company Corporate Balance Sheet Form

The

Start-Up Company Corporate Balance Sheet Form is a financial document that provides a snapshot of a start-up's assets, liabilities, and equity at a specific point in time. It helps entrepreneurs and investors assess the company's financial health and stability by detailing current and long-term financial positions. This form is essential for tracking financial growth, securing funding, and meeting regulatory reporting requirements.

How are intercompany transactions reflected in the consolidated balance sheet?

Intercompany transactions are eliminated in the consolidated balance sheet to avoid double counting of assets, liabilities, revenues, and expenses. This ensures that the consolidated financials present the financial position of the entire group as a single economic entity. The elimination process typically involves offsetting intercompany receivables against payables and revenues against expenses.

What methods are used for valuing intangible assets on the balance sheet?

Intangible assets are valued primarily using the cost method or the revaluation method. The cost method records the asset at its acquisition cost minus accumulated amortization and impairment losses. Alternatively, the revaluation method adjusts the asset to fair value, reflecting its current market conditions, often used when an active market exists.

How is deferred tax liability disclosed within the corporate balance sheet?

Deferred tax liability is presented under non-current liabilities on the balance sheet, representing taxes payable in the future due to temporary differences. It is disclosed separately to inform stakeholders of future tax obligations arising from timing differences between accounting and tax treatments. Notes to the financial statements often provide additional details about the nature and origin of these liabilities.

What detail is required for contingent liabilities on balance sheet notes?

Contingent liabilities must be disclosed in the notes to the balance sheet when there is a possible obligation that depends on future events. The disclosure should describe the nature, estimated financial impact, and likelihood of the contingency. Transparency ensures users understand potential risks not recognized as actual liabilities.

How does lease capitalization affect the equity section of the balance sheet?

Lease capitalization recognizes leased assets and corresponding liabilities on the balance sheet, impacting total assets and liabilities. Initially, this does not directly change equity, but over time, depreciation and interest expenses reduce net income, thereby affecting retained earnings within equity. This accounting treatment increases financial transparency regarding lease commitments.