A Credit Application Document Sample for Lending Institutions serves as a standardized template to collect essential borrower information, including financial history, employment details, and credit references. This document ensures consistency and accuracy in evaluating creditworthiness, streamlining the loan approval process. Lending institutions rely on such samples to minimize risks and make informed lending decisions.

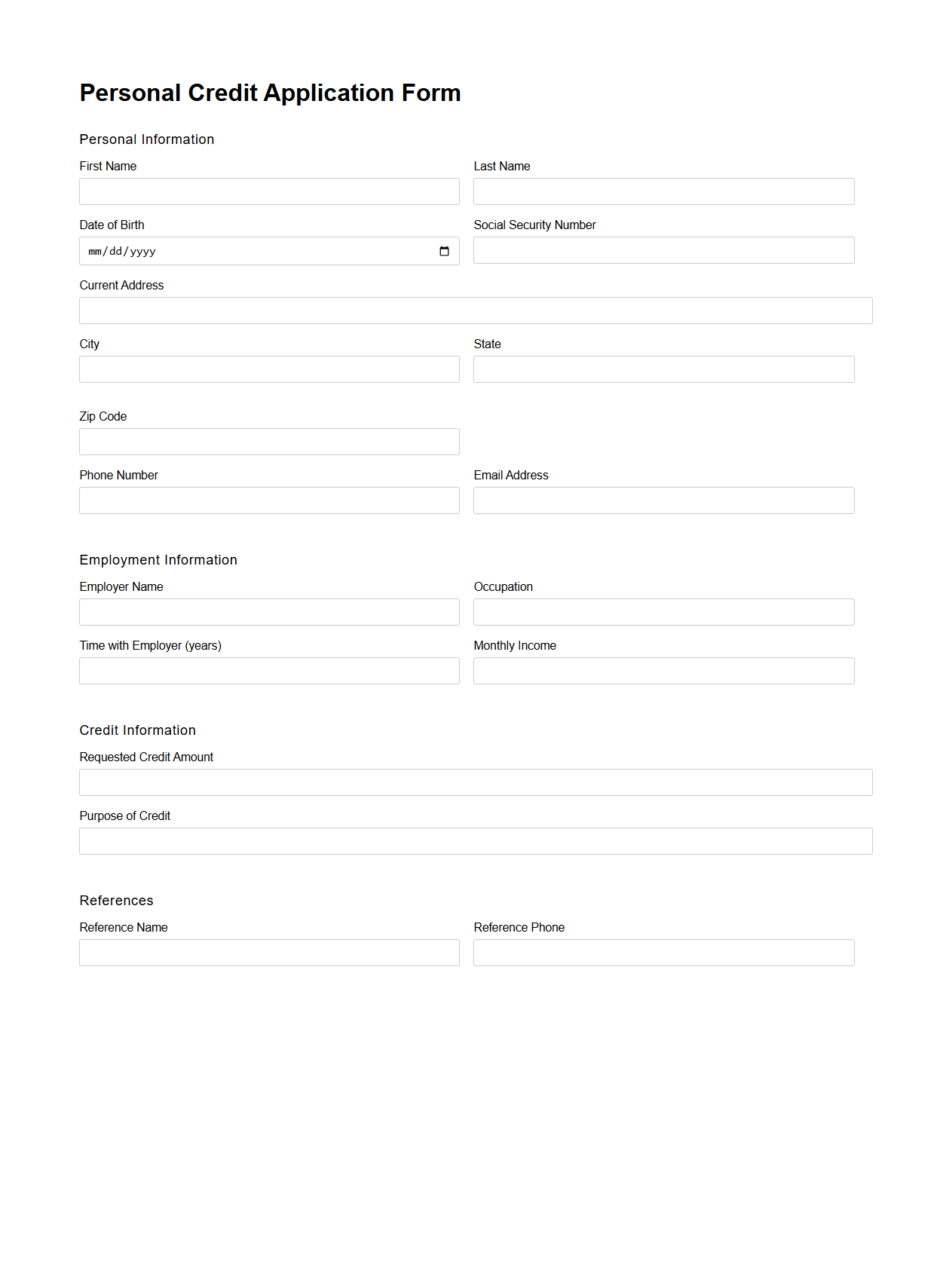

Personal Credit Application Form Template

A

Personal Credit Application Form Template is a standardized document used by lenders to gather essential financial and personal information from individuals seeking credit. This form typically includes fields for income details, credit history, employment status, and contact information to assess the applicant's creditworthiness. Using a template streamlines the evaluation process and ensures consistent data collection for accurate credit risk assessment.

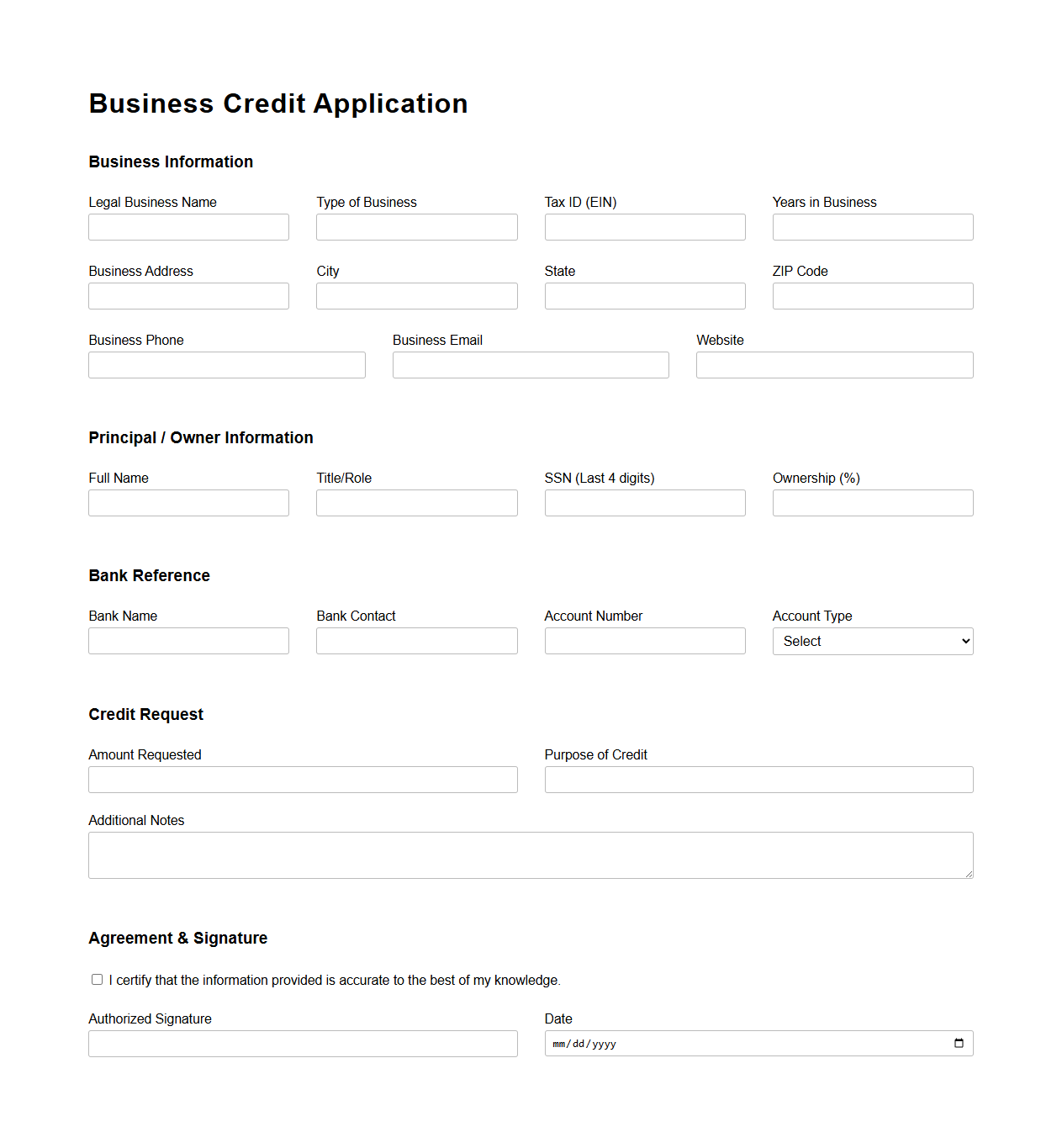

Business Credit Application Form Example

A

Business Credit Application Form Example document serves as a template for companies to request financial information from potential clients or vendors seeking credit terms. It typically includes sections for business identification, credit references, banking details, and trade history, enabling businesses to assess creditworthiness effectively. Utilizing a standardized form streamlines the evaluation process and helps mitigate financial risk by ensuring consistent data collection.

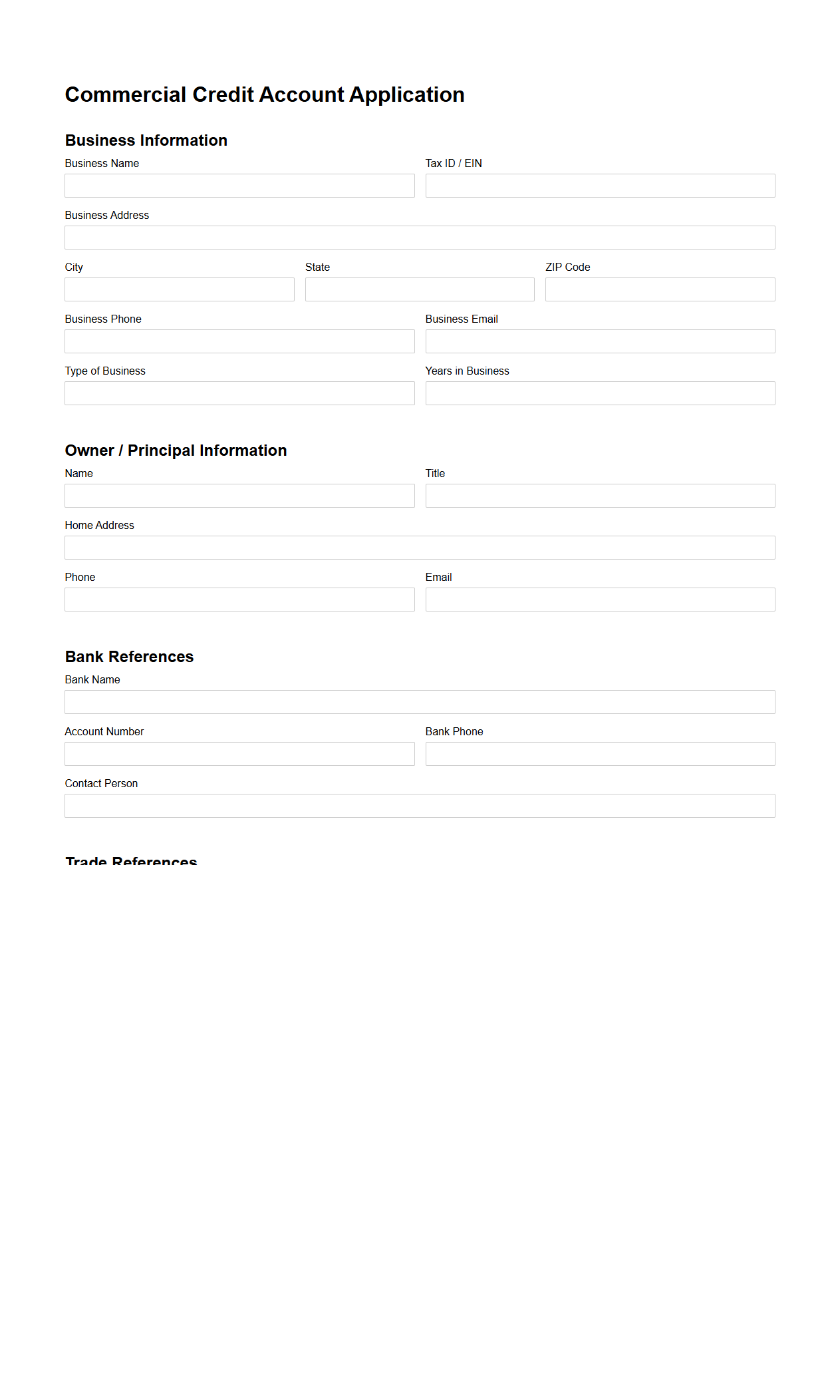

Commercial Credit Account Application Format

A

Commercial Credit Account Application Format document is a structured form used by businesses to apply for credit from suppliers or financial institutions. It typically includes essential information such as company details, financial statements, trade references, and credit limits to assess the applicant's creditworthiness. This document facilitates a streamlined approval process for establishing business credit accounts and managing commercial transactions efficiently.

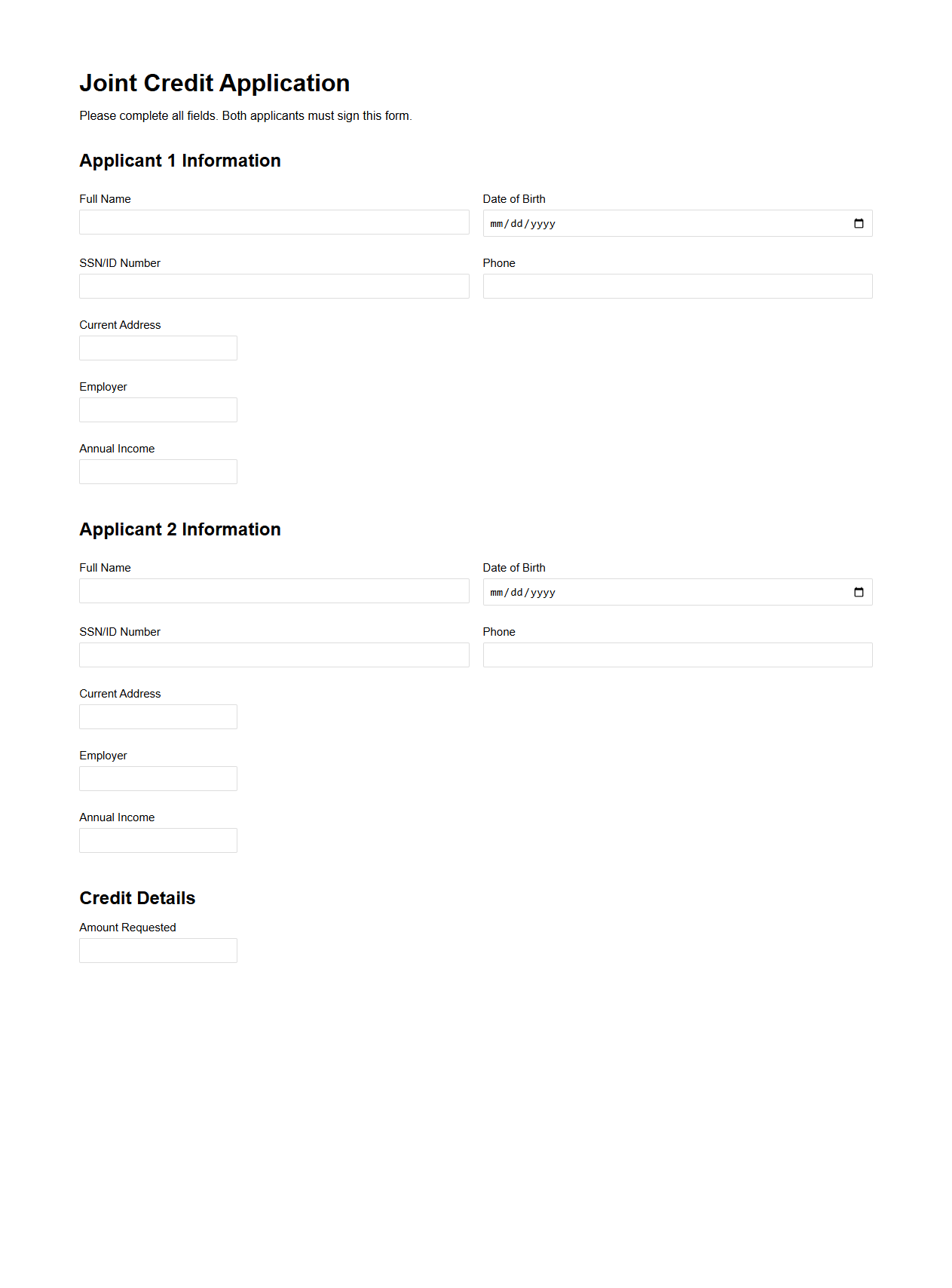

Joint Credit Application Document Sample

A

Joint Credit Application Document Sample is a standardized form used by two or more applicants to apply for credit simultaneously. It includes detailed personal, financial, and employment information from all parties involved, facilitating the lender's assessment of creditworthiness. This document ensures transparency and accuracy in the credit approval process for shared loans or credit lines.

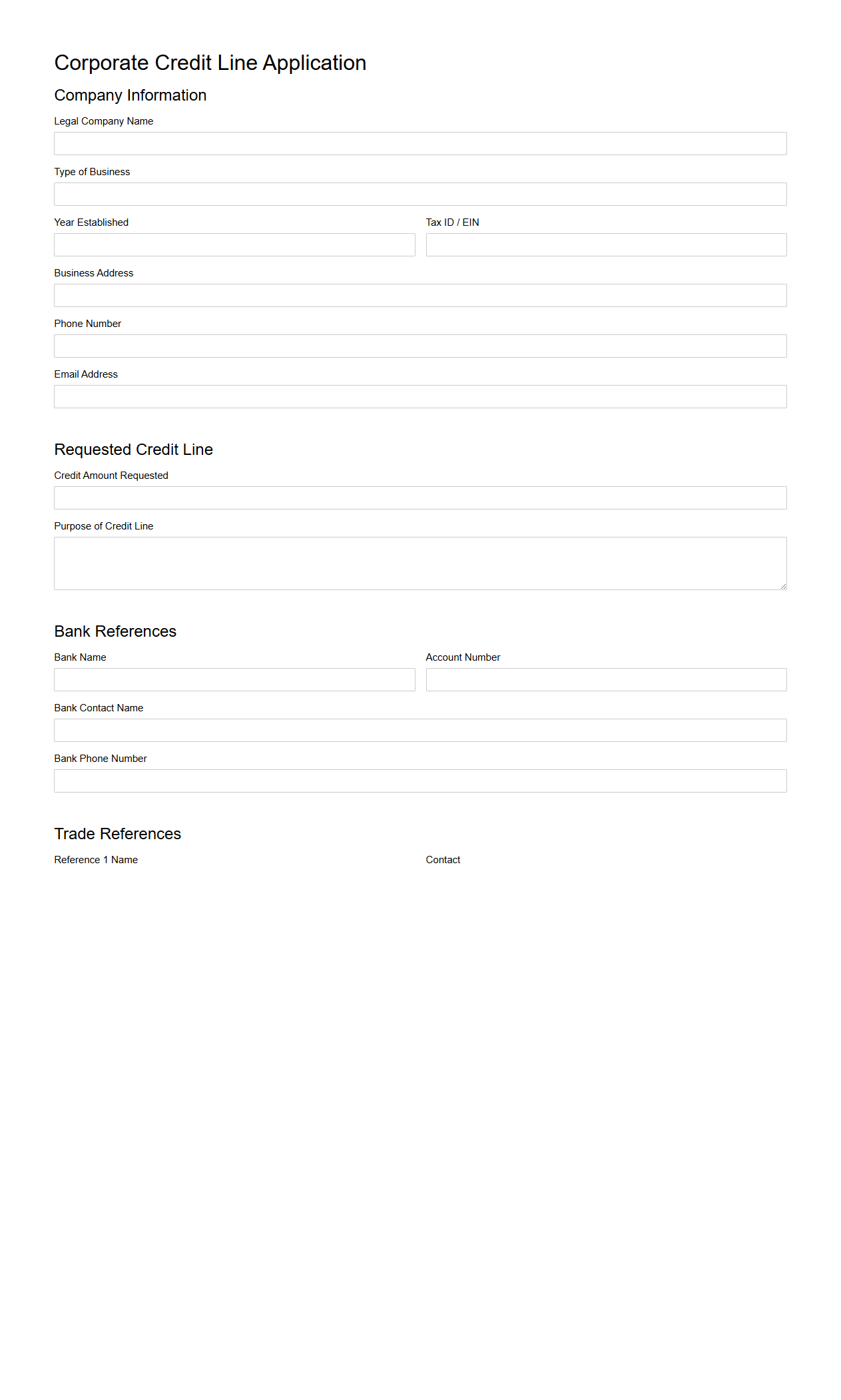

Corporate Credit Line Application Template

A

Corporate Credit Line Application Template document is a structured form used by businesses to apply for a credit line with financial institutions. It typically includes essential information such as company details, financial statements, credit history, and the requested credit limit. This template streamlines the application process, ensuring all necessary data is consistently presented to facilitate lender evaluation.

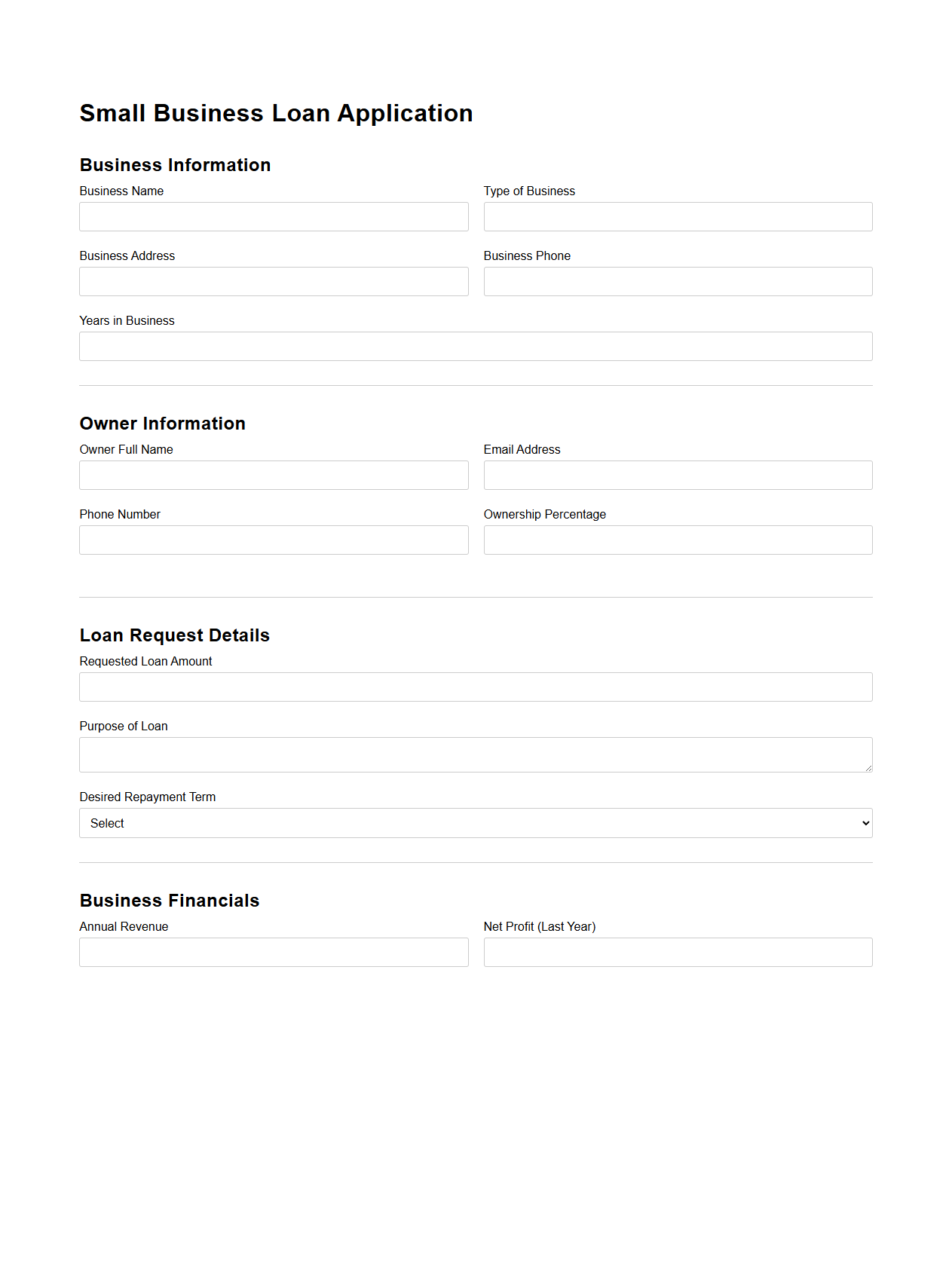

Small Business Loan Application Sample

A

Small Business Loan Application Sample document serves as a detailed template that guides entrepreneurs through the process of preparing required financial and operational information for lenders. It typically includes sections for business details, financial statements, loan amount justification, and repayment plans, ensuring a comprehensive representation of the borrower's creditworthiness. Utilizing this sample can increase the accuracy and professionalism of a loan application, improving the chances of approval from banks or financial institutions.

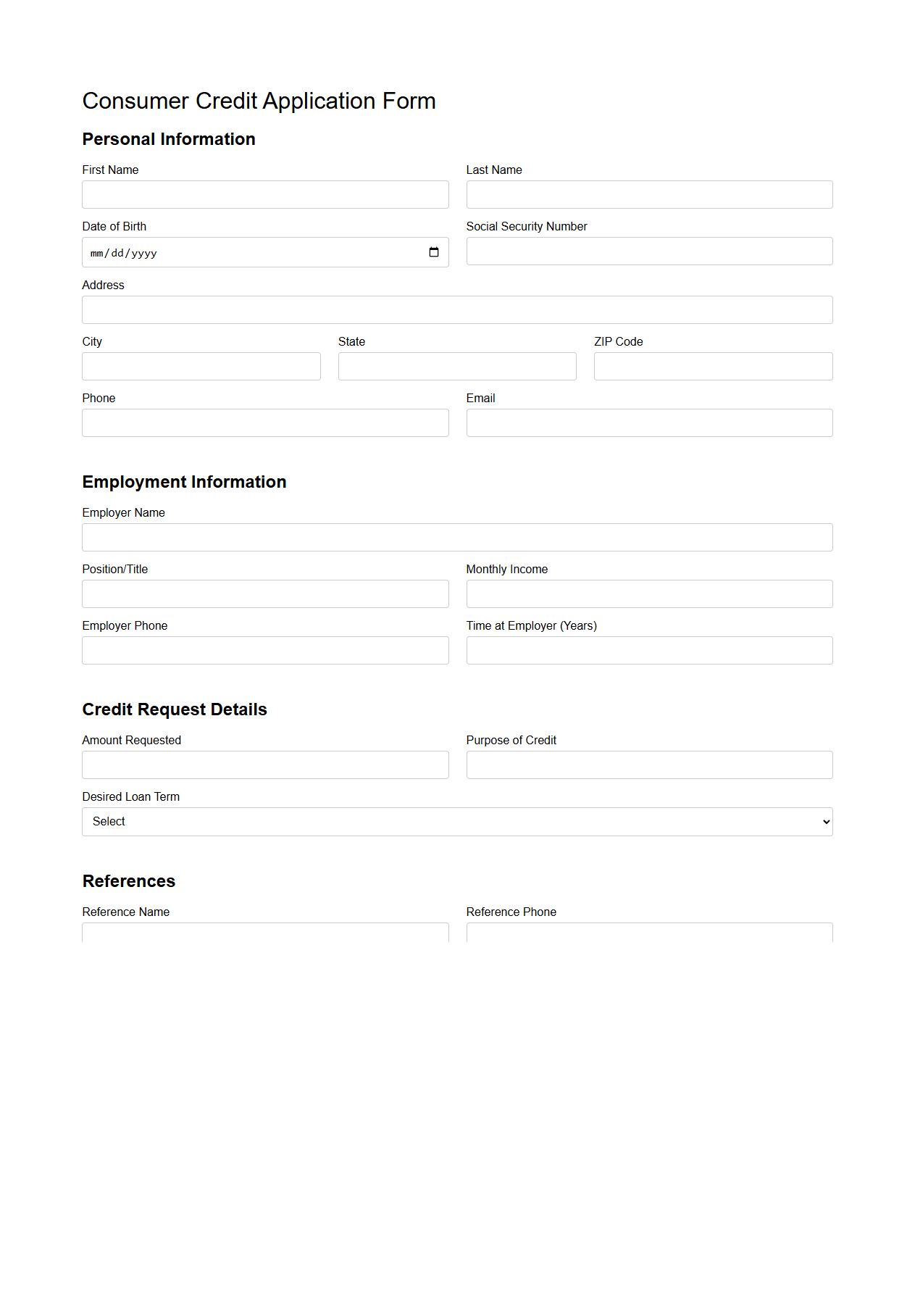

Consumer Credit Application Form Example

A

Consumer Credit Application Form Example document serves as a template for individuals seeking credit from financial institutions, outlining essential information such as personal details, employment status, income, and credit history. It facilitates the evaluation process by lenders to determine creditworthiness and eligibility for loans or credit cards. This standardized form streamlines application processing and ensures compliance with regulatory requirements.

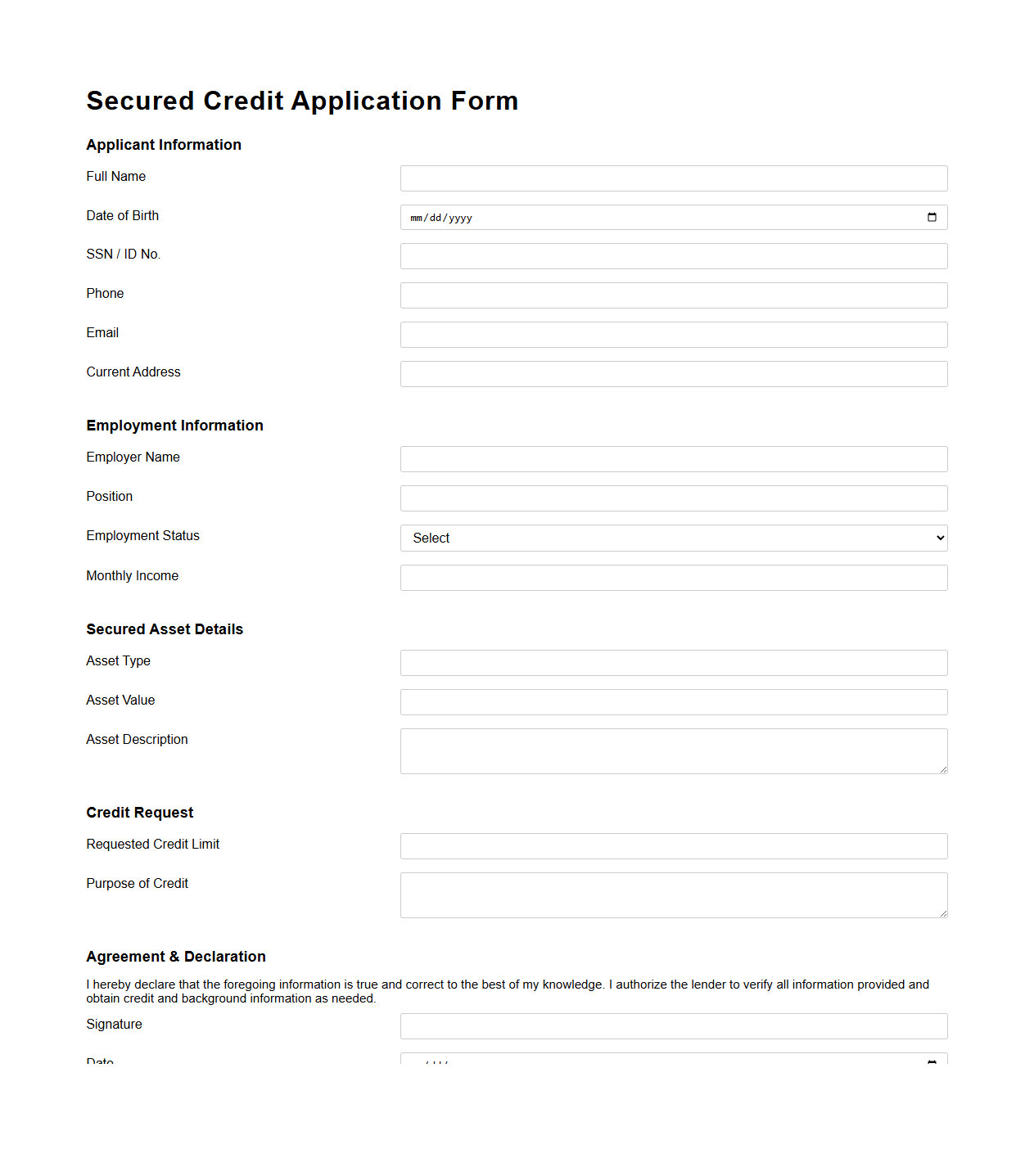

Secured Credit Application Form Template

A

Secured Credit Application Form Template is a standardized document used by lenders to collect detailed financial information and credit history from applicants seeking secured loans. This form helps verify collateral details, assess creditworthiness, and streamline the approval process. It ensures consistent data collection while protecting both the lender and borrower in credit transactions.

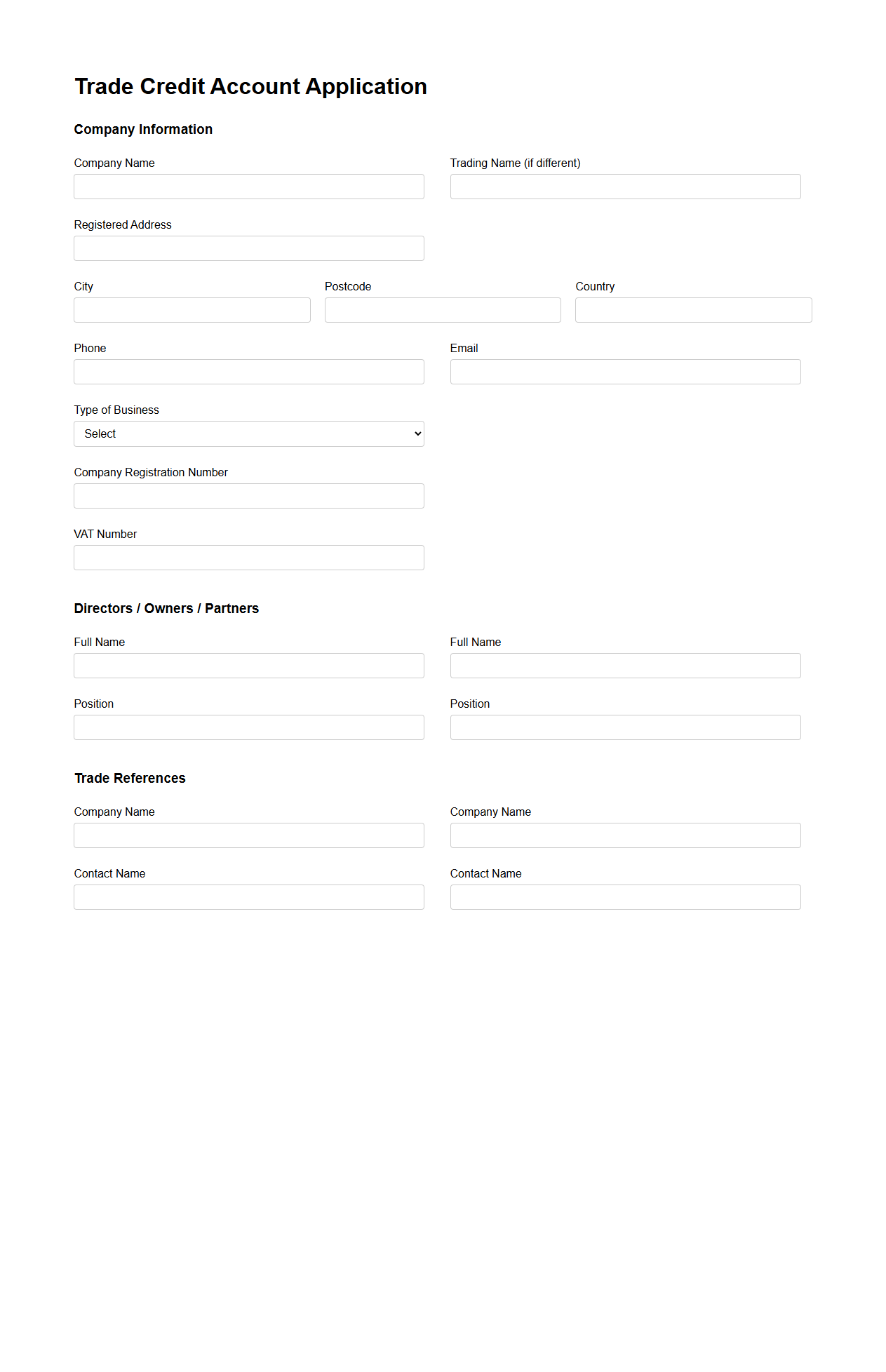

Trade Credit Account Application Sample

A

Trade Credit Account Application Sample document is a standardized form used by businesses to request credit terms from suppliers, outlining essential company information and financial history. It facilitates the establishment of credit accounts by providing details such as business name, trade references, payment terms, and authorized signatures. This document helps suppliers assess the creditworthiness of applicants and streamline the approval process for trade credit.

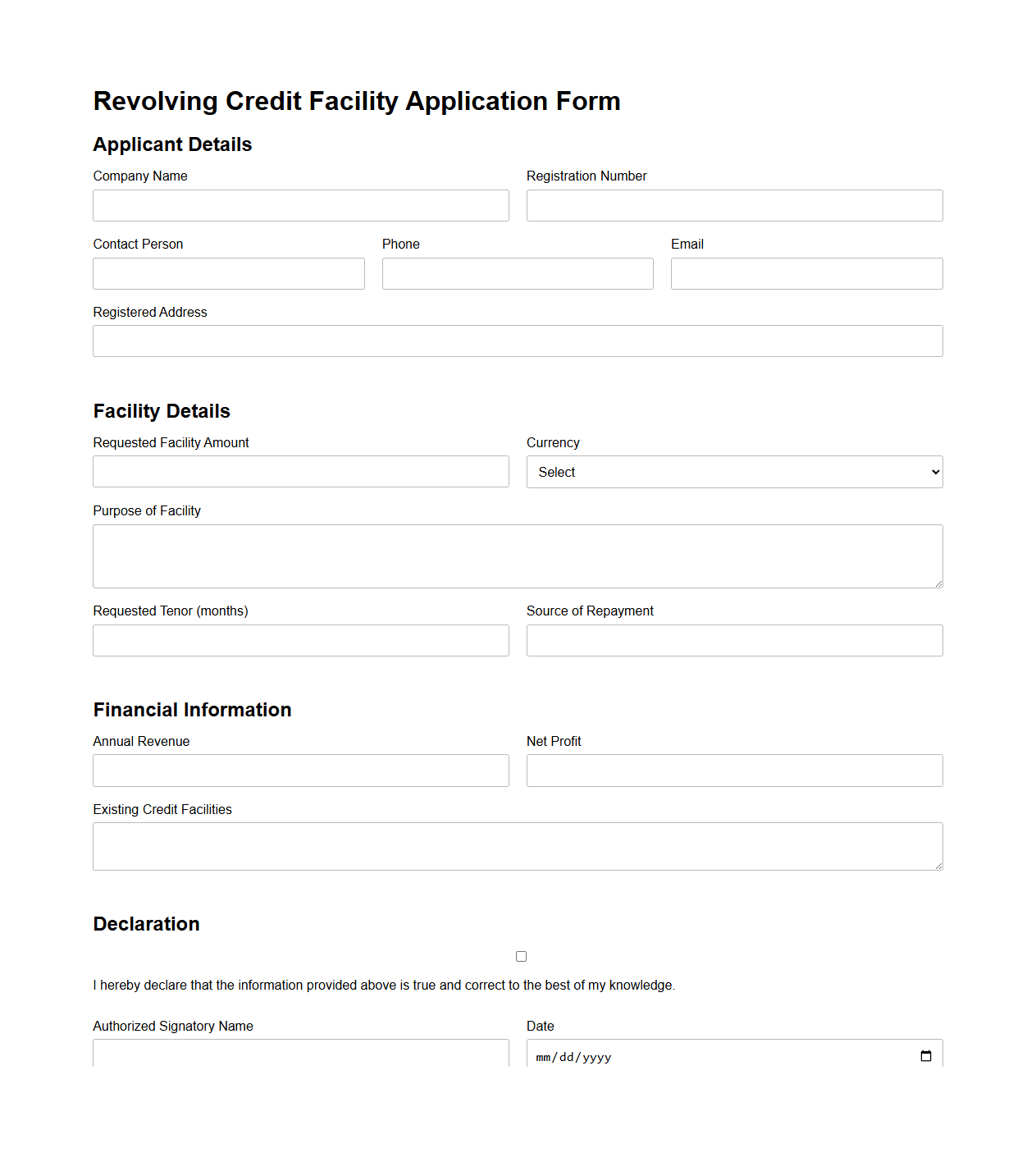

Revolving Credit Facility Application Form

The

Revolving Credit Facility Application Form is a financial document used by borrowers to request access to a revolving line of credit from a lender. It collects essential information such as personal details, financial statements, credit history, and the desired credit limit to assess the borrower's creditworthiness. This form serves as the foundation for the credit approval process, enabling flexible access to funds up to a predetermined limit.

What supporting documents are required to verify income in a credit application letter?

To verify income in a credit application letter, applicants must provide recent pay stubs or salary statements as primary evidence. Additionally, tax returns and bank statements are commonly requested to corroborate the reported income. These documents ensure lenders accurately assess the borrower's repayment capability.

How should risk disclosures be articulated in credit application documents for SMEs?

Risk disclosures in credit applications for SMEs must be clear, concise, and prominently placed to ensure full understanding by the applicant. They should include potential risks related to interest rate changes, repayment failures, and credit default consequences. Effective risk disclosures protect both the lender and borrower by promoting transparency.

What compliance clauses must be included to meet regulatory requirements in credit applications?

Compliance clauses in credit applications must address data protection, anti-money laundering, and fair lending practices to adhere to regulatory standards. These clauses ensure that the lender operates within legal frameworks and protects applicant rights. Including such provisions minimizes regulatory risks and fosters trust.

How is collateral information detailed in a formal credit application letter for banks?

Collateral information should be precisely described, including the type, value, and ownership details of the assets offered as security. Banks require documentation such as property deeds, vehicle titles, or inventory lists to validate collateral claims. Accurate collateral details enhance the credit application's credibility and approval likelihood.

What verification processes do lending institutions follow after receiving a credit application document?

Lending institutions typically conduct a thorough background check, including credit history review and employment verification. They also validate the authenticity of submitted documents and assess the applicant's financial stability. These steps are critical to mitigating lending risks and ensuring sound credit decisions.