A Bank Reconciliation Document Sample for Monthly Closing provides a clear template to compare the company's recorded transactions with the bank statement. It helps identify discrepancies such as outstanding checks or deposits in transit, ensuring accurate financial records. This document streamlines the reconciliation process, enhancing accuracy and efficiency during month-end closing.

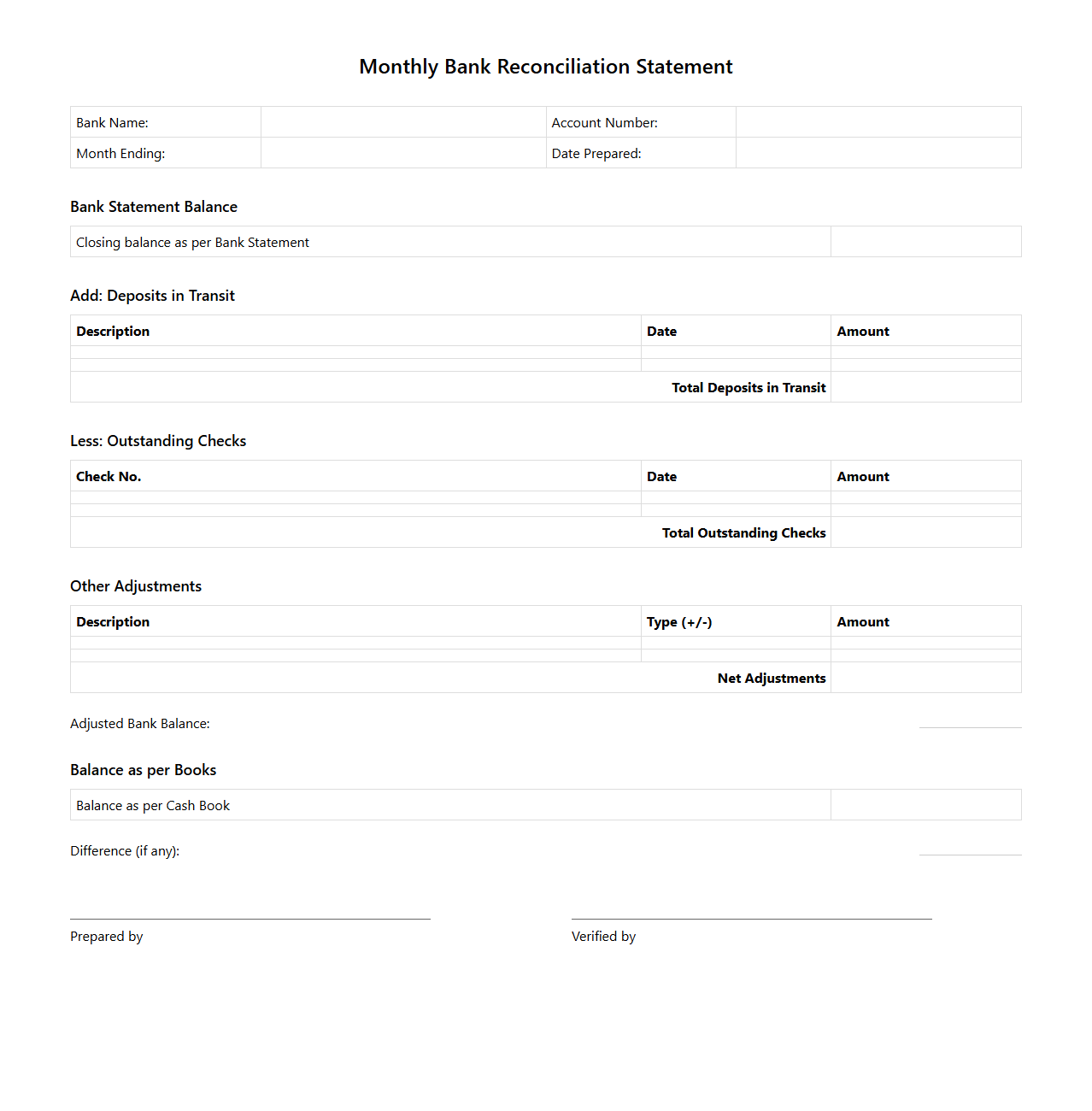

Monthly Bank Reconciliation Statement Template

A

Monthly Bank Reconciliation Statement Template is a structured document used to compare and match a company's financial records with the bank statement for a specific month. It helps identify discrepancies such as outstanding checks, deposits in transit, or bank errors, ensuring accuracy in cash flow management. This template streamlines the reconciliation process, making it easier to detect and resolve differences promptly.

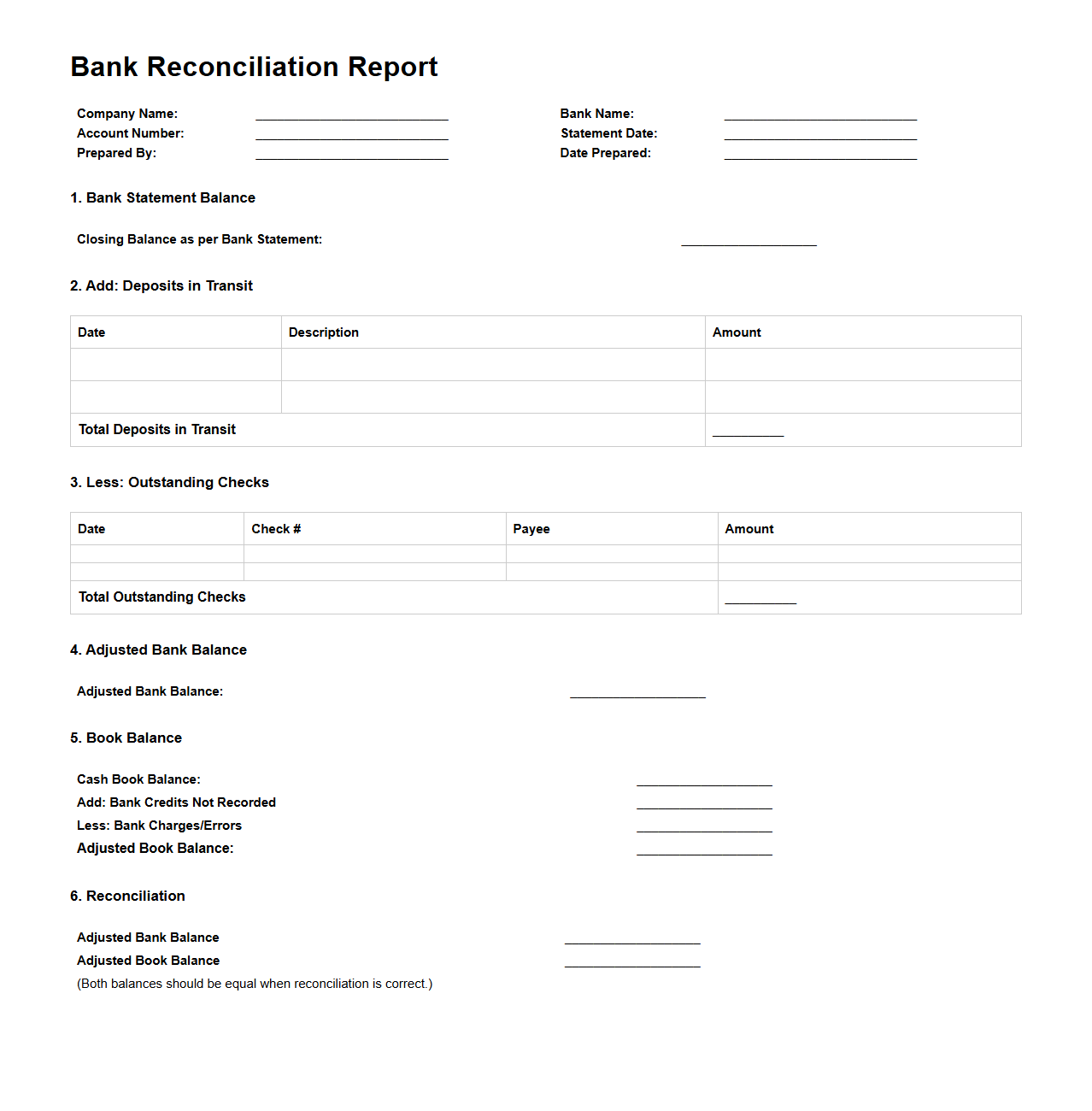

Standard Bank Reconciliation Report Example

A

Standard Bank Reconciliation Report Example document demonstrates the process of matching and verifying the company's financial records against bank statements to ensure accuracy and identify discrepancies. It typically includes transaction dates, descriptions, amounts, outstanding checks, and deposits in transit to reconcile the ending balances. This report is essential for maintaining accurate accounting records and detecting errors or fraudulent activities.

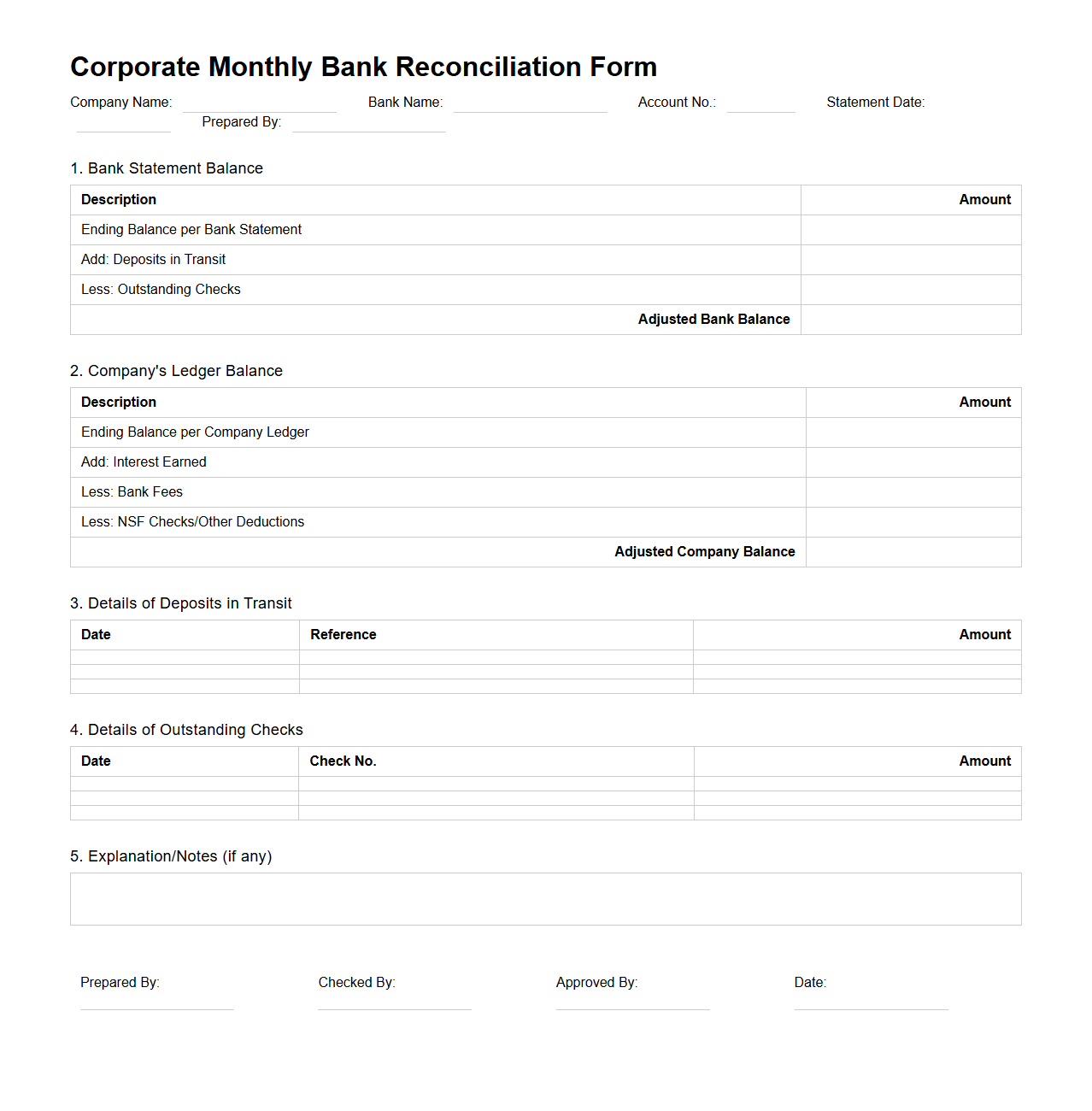

Corporate Monthly Bank Reconciliation Form

The

Corporate Monthly Bank Reconciliation Form is a financial document used by businesses to compare and verify their internal cash records with the bank statements on a monthly basis. This form helps identify discrepancies such as outstanding checks, deposits in transit, or bank errors, ensuring accurate financial reporting and cash flow management. It is essential for maintaining the integrity of a company's accounting records and preventing potential fraud or accounting mistakes.

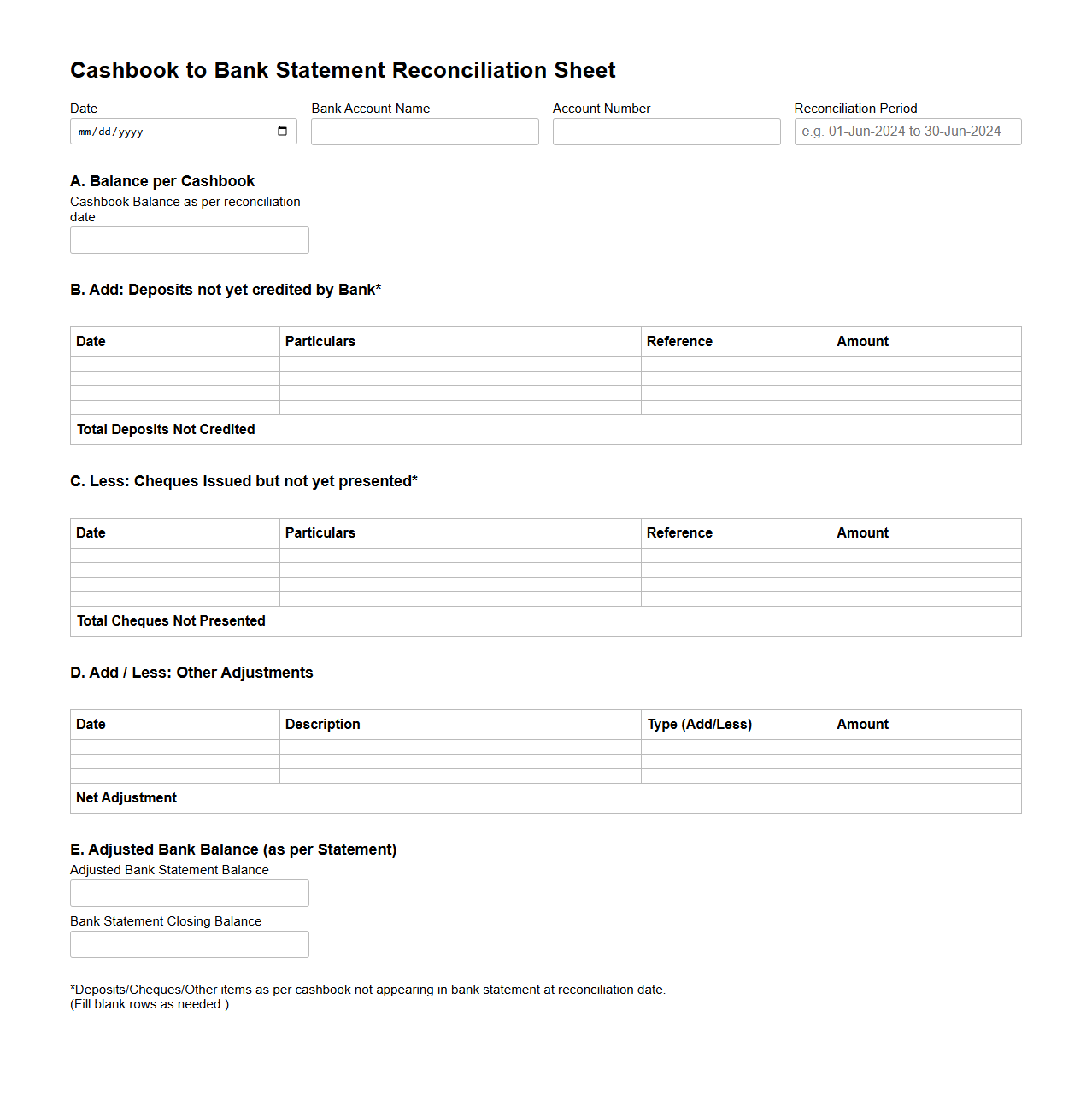

Cashbook to Bank Statement Reconciliation Sheet

The

Cashbook to Bank Statement Reconciliation Sheet is a financial document used to compare and match the cashbook records with the bank statement. It identifies discrepancies such as outstanding checks, deposits in transit, and errors, ensuring the accuracy of financial data. This reconciliation process is essential for maintaining consistent and reliable accounting records.

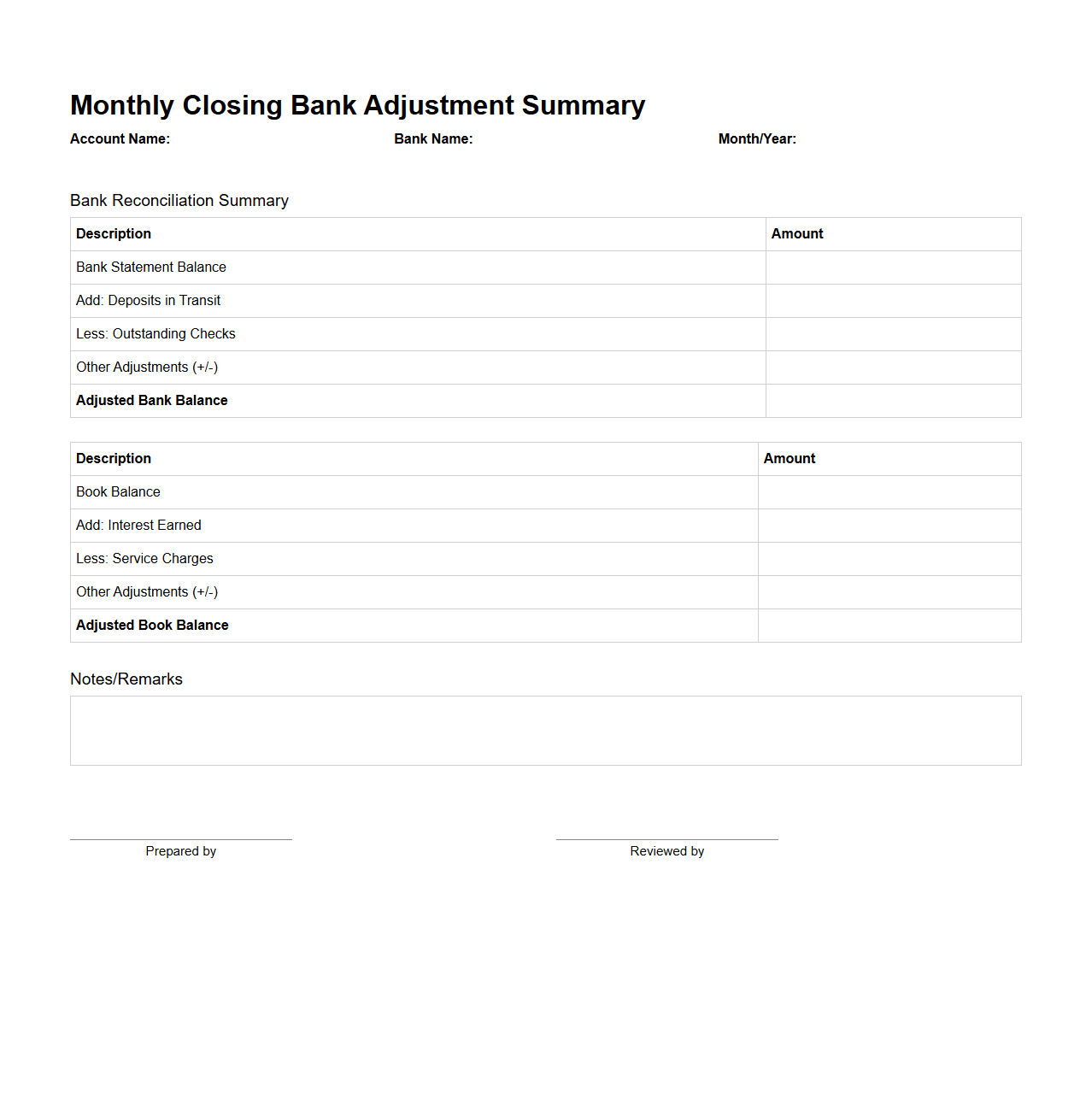

Monthly Closing Bank Adjustment Summary

The

Monthly Closing Bank Adjustment Summary document provides a detailed overview of all bank account adjustments made during the monthly closing process, ensuring accuracy in financial records. It highlights discrepancies such as errors, reconciliations, and corrections between bank statements and company ledgers. This summary is essential for validating account balances and supporting financial audits.

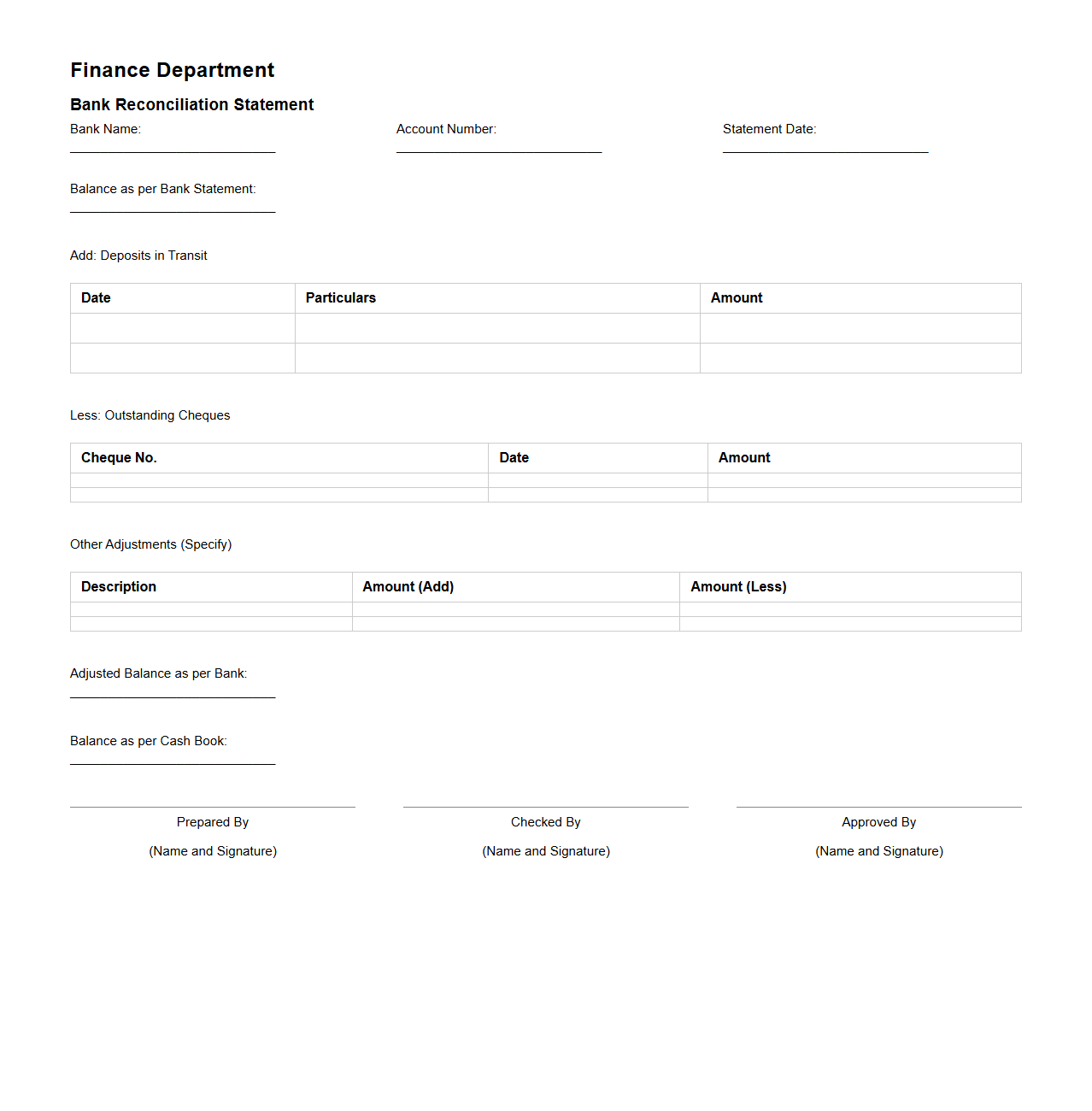

Finance Department Bank Reconciliation Format

A

Finance Department Bank Reconciliation Format document is a structured template used to systematically match and verify the bank statement balances against the company's internal financial records. It helps identify discrepancies such as outstanding checks, deposits in transit, or errors, ensuring accuracy in cash management and financial reporting. This document is essential for maintaining transparency and preventing fraud within the organization's financial operations.

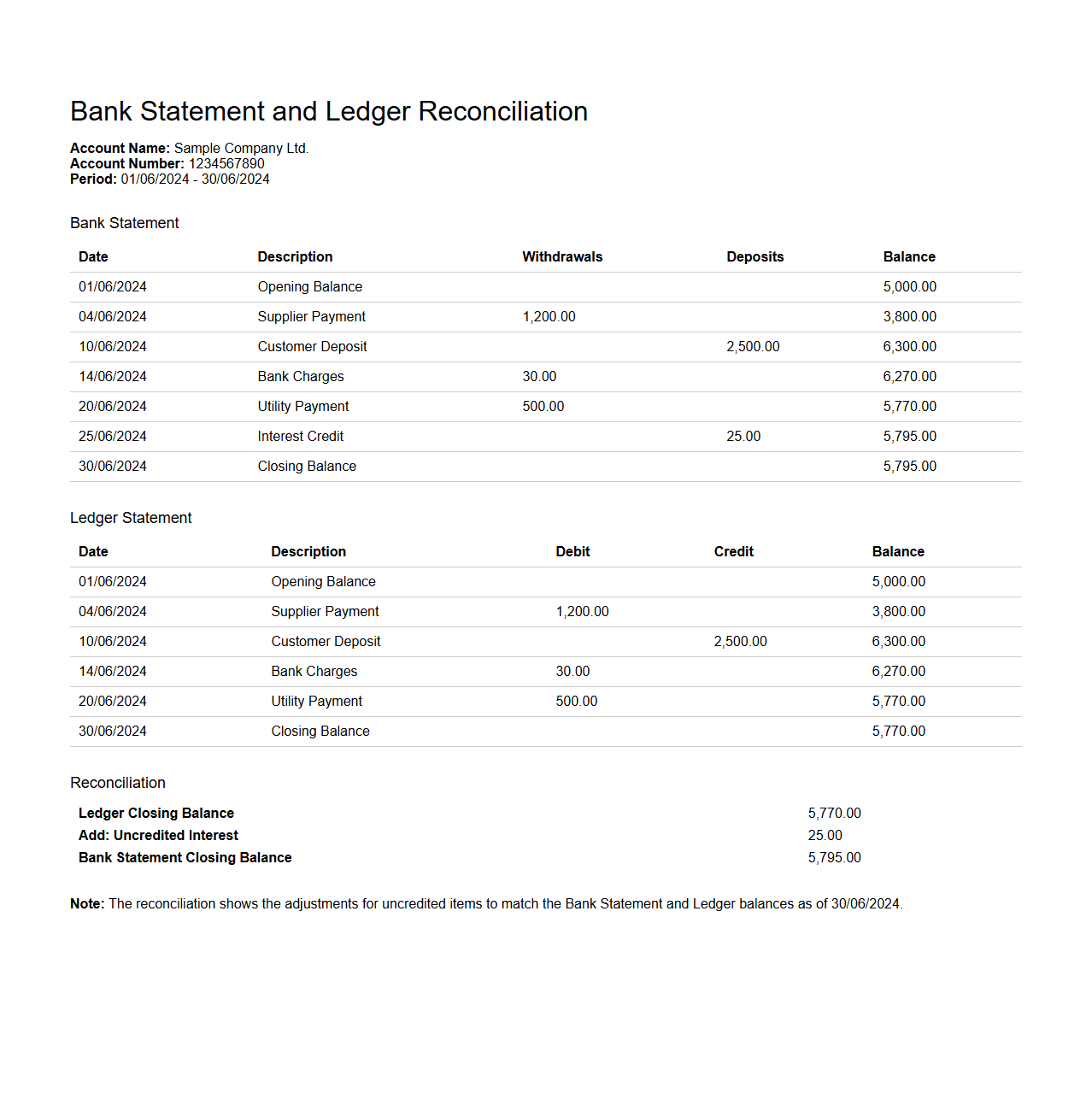

Bank Statement and Ledger Reconciliation Sample

A

Bank Statement and Ledger Reconciliation Sample document provides a detailed comparison between the bank statement records and the company's ledger entries to identify and resolve discrepancies. This sample serves as a practical guide for verifying transactions, adjusting errors, and ensuring accurate financial reporting. It enables businesses to maintain precise cash flow records and uphold financial integrity.

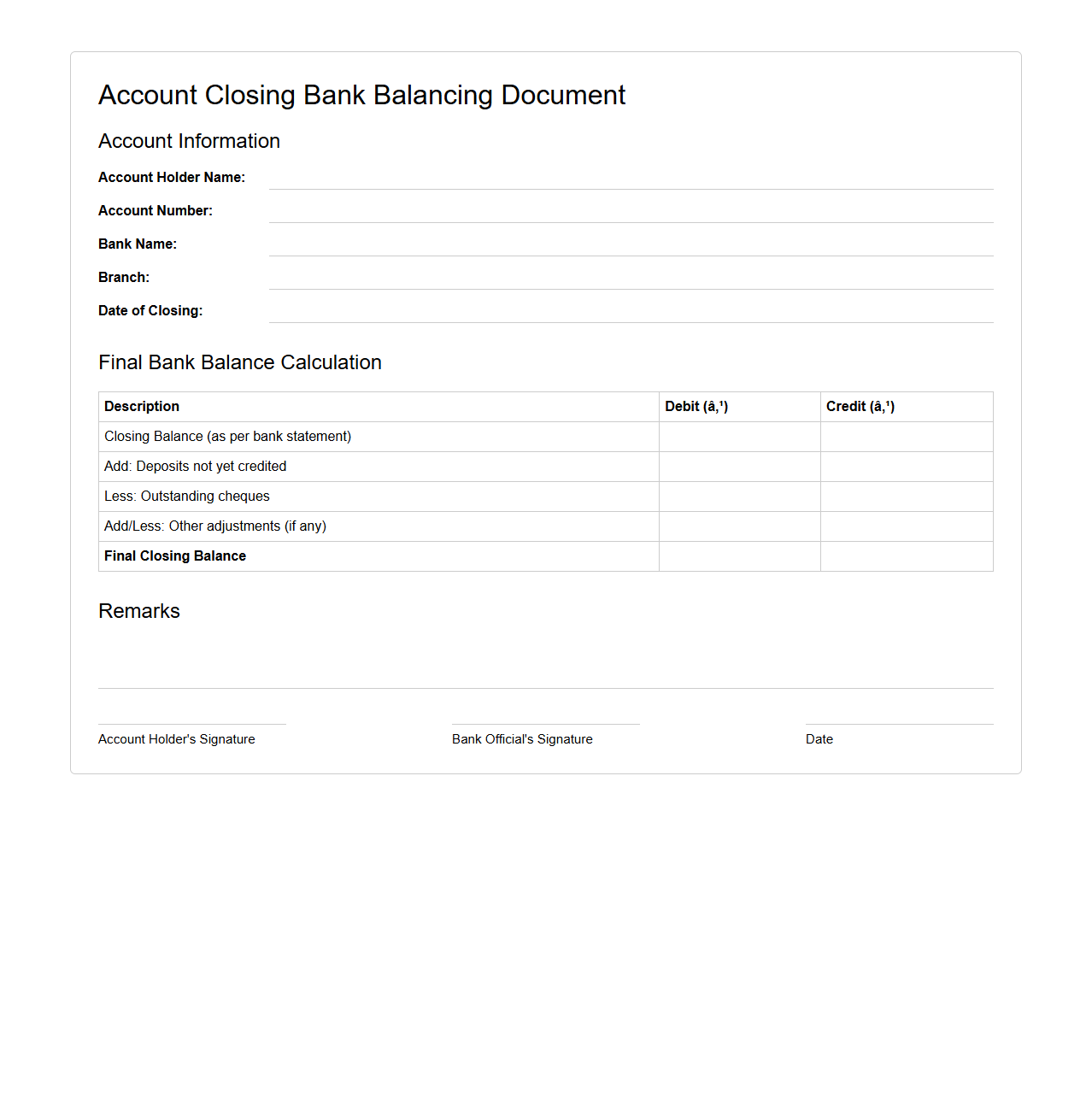

Account Closing Bank Balancing Document

The

Account Closing Bank Balancing Document is a critical financial record used to reconcile and verify all transactions within a bank account before it is closed. It ensures that the final account balance is accurate by documenting all deposits, withdrawals, fees, and adjustments. This document is essential for maintaining transparent financial records and preventing discrepancies during the account closure process.

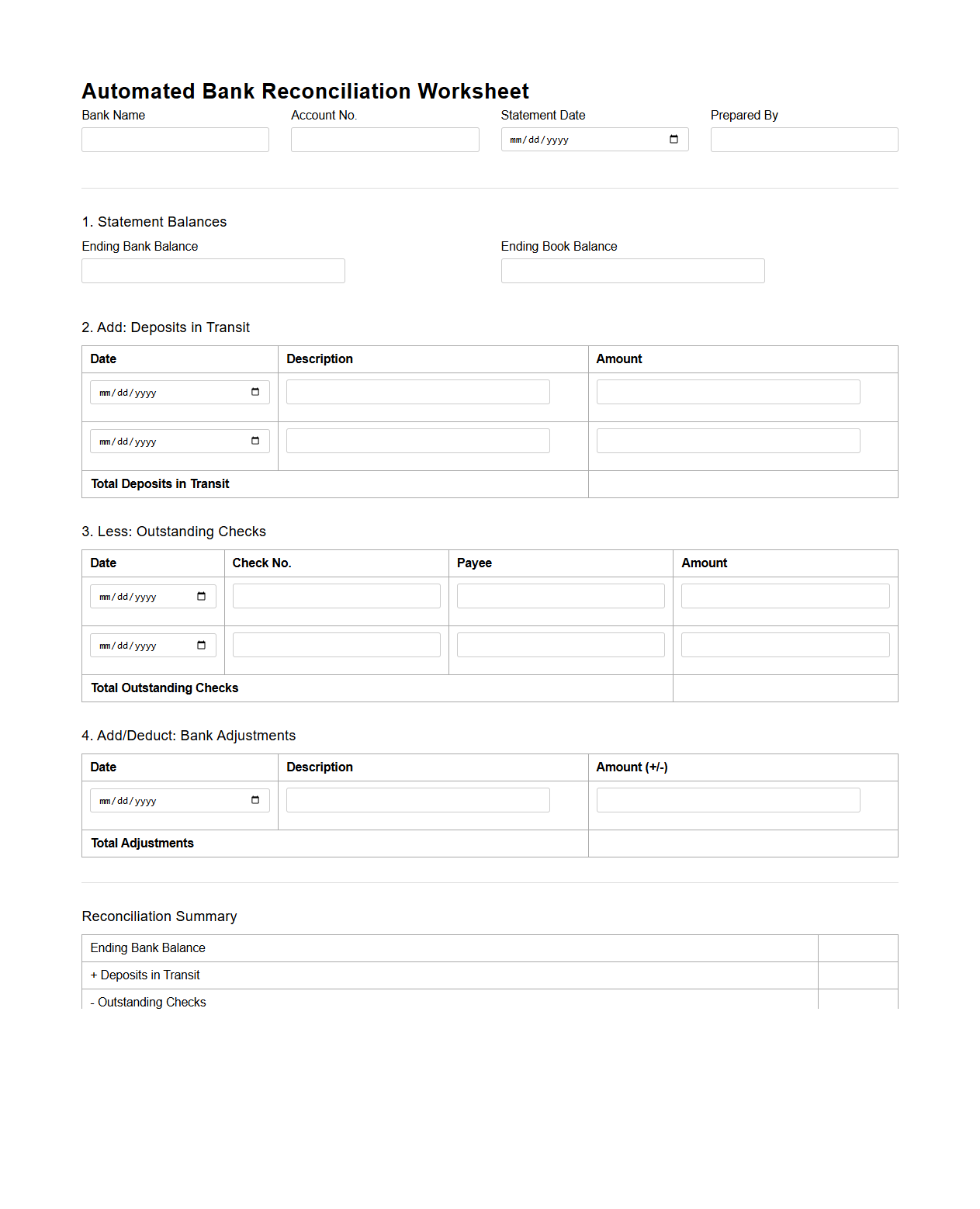

Automated Bank Reconciliation Worksheet

The

Automated Bank Reconciliation Worksheet is a financial document designed to streamline the process of matching transactions recorded in a company's accounting system with those on the bank statement. It uses software algorithms to quickly identify discrepancies, such as outstanding checks or deposits in transit, ensuring accurate and timely financial reporting. This automation reduces manual errors, saves time, and enhances the reliability of cash flow management.

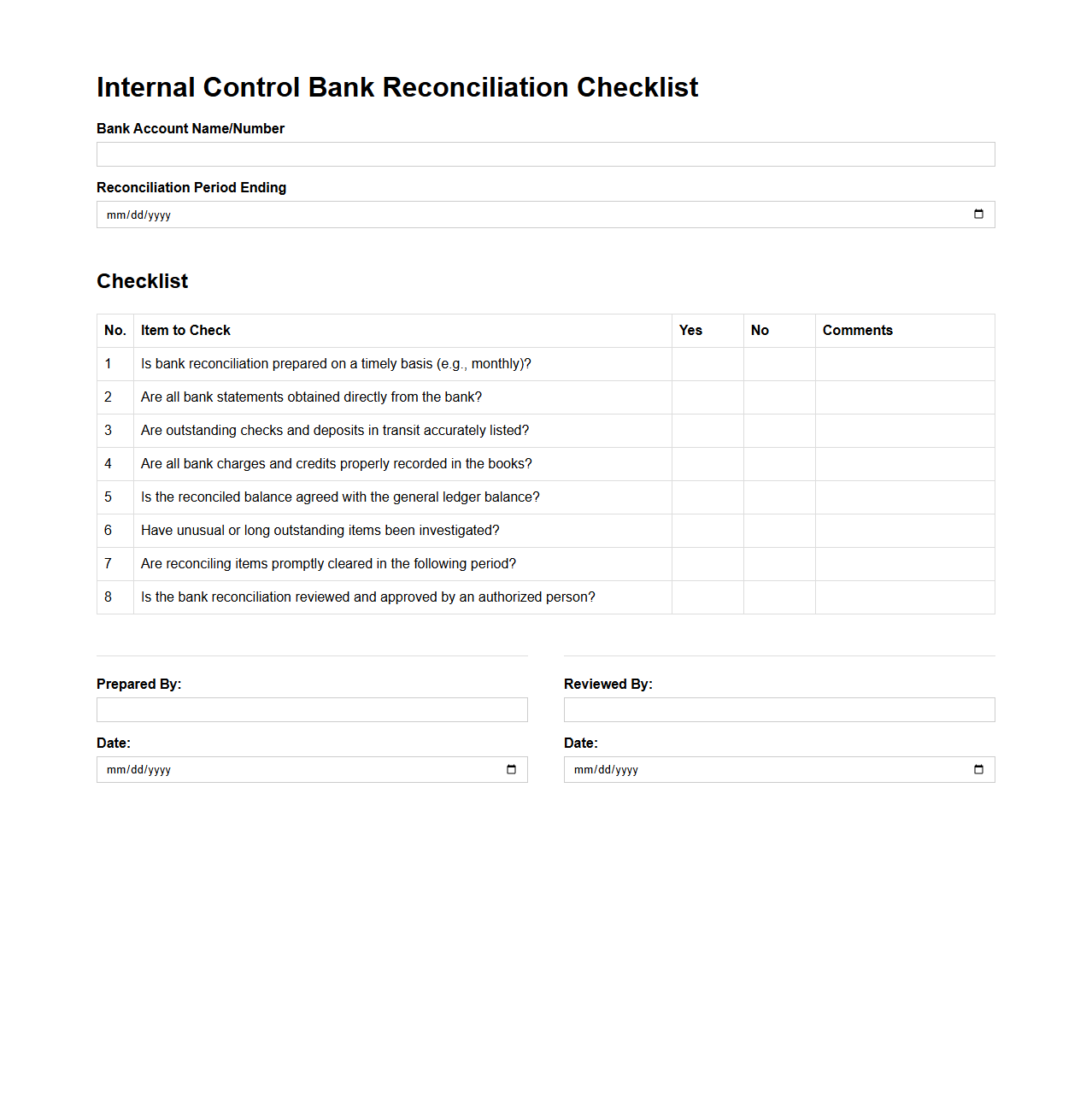

Internal Control Bank Reconciliation Checklist

The

Internal Control Bank Reconciliation Checklist document ensures accuracy and completeness in reconciling bank statements with company records, helping to identify discrepancies such as errors or unauthorized transactions. This checklist guides organizations in verifying transaction dates, amounts, and posting accuracy to maintain financial integrity and prevent fraud. Regular use of this control tool supports compliance with accounting standards and enhances the reliability of financial reporting.

What supporting documents are required for monthly bank reconciliation during closing?

Supporting documents for monthly bank reconciliation typically include bank statements, the company's cash ledger, and outstanding checks list. These documents ensure accurate verification of transactions and balances. Maintaining these records is crucial for a transparent and effective monthly closing process.

How are outstanding checks documented in the bank reconciliation letter?

Outstanding checks are listed with detailed information such as check number, date, and amount in the bank reconciliation letter. This helps in identifying payments not yet cleared by the bank. Clear documentation of outstanding checks ensures accurate adjustment and reconciliation of the cash balance.

What format should be used to report bank errors in the closing reconciliation?

Bank errors should be reported in a structured format highlighting the error description, date, and amount. This format allows for clear identification and follow-up on discrepancies. Using a standardized report ensures prompt correction in the closing reconciliation.

Are interdepartmental transfers detailed in the monthly reconciliation document?

Yes, interdepartmental transfers are detailed with specific references and amounts in the monthly reconciliation document. This inclusion ensures transparency between different departments' cash movements. Proper documentation of interdepartmental transfers aids in accurate financial reporting.

How should unexplained variances be annotated in the reconciliation letter for monthly close?

Unexplained variances must be clearly annotated with remarks indicating investigation status or pending review. This highlights areas requiring further attention before finalizing the reconciliation. Annotating unexplained variances is essential for maintaining control and accuracy during the monthly close.