A Debt Agreement Document Sample for Structured Finance outlines the terms and conditions under which debt instruments are issued and managed in a structured finance arrangement. It serves as a crucial legal framework specifying payment schedules, interest rates, covenants, and default provisions. This sample helps stakeholders ensure clarity and compliance throughout the financing lifecycle.

Intercreditor Agreement Template for Structured Finance

An

Intercreditor Agreement Template for Structured Finance is a legal framework outlining the rights and obligations of multiple creditors involved in a complex financing arrangement. This document establishes priority of claims, voting rights, and procedures for enforcement to ensure clear coordination among lenders. Utilizing a standardized template helps streamline negotiations and reduces ambiguities in multi-lender structured finance transactions.

Loan Participation Agreement Sample for Structured Finance

A

Loan Participation Agreement Sample for structured finance outlines the terms under which multiple lenders share interests in a single loan, detailing rights, obligations, and payment distributions. It serves as a standardized reference to ensure clarity and legal compliance in complex syndicated loan transactions. This document helps participants manage risk and facilitate efficient financing arrangements in structured finance deals.

Collateral Trust Agreement Example for Structured Finance

A

Collateral Trust Agreement example in structured finance demonstrates a legal contract where a borrower pledges securities or financial assets as collateral to secure a loan or bond issuance. This document outlines the terms, conditions, and rights of both the borrower and the trustee regarding the management, custody, and disposition of the collateral. It is essential for protecting the interests of lenders by providing a clear framework for asset control in case of default.

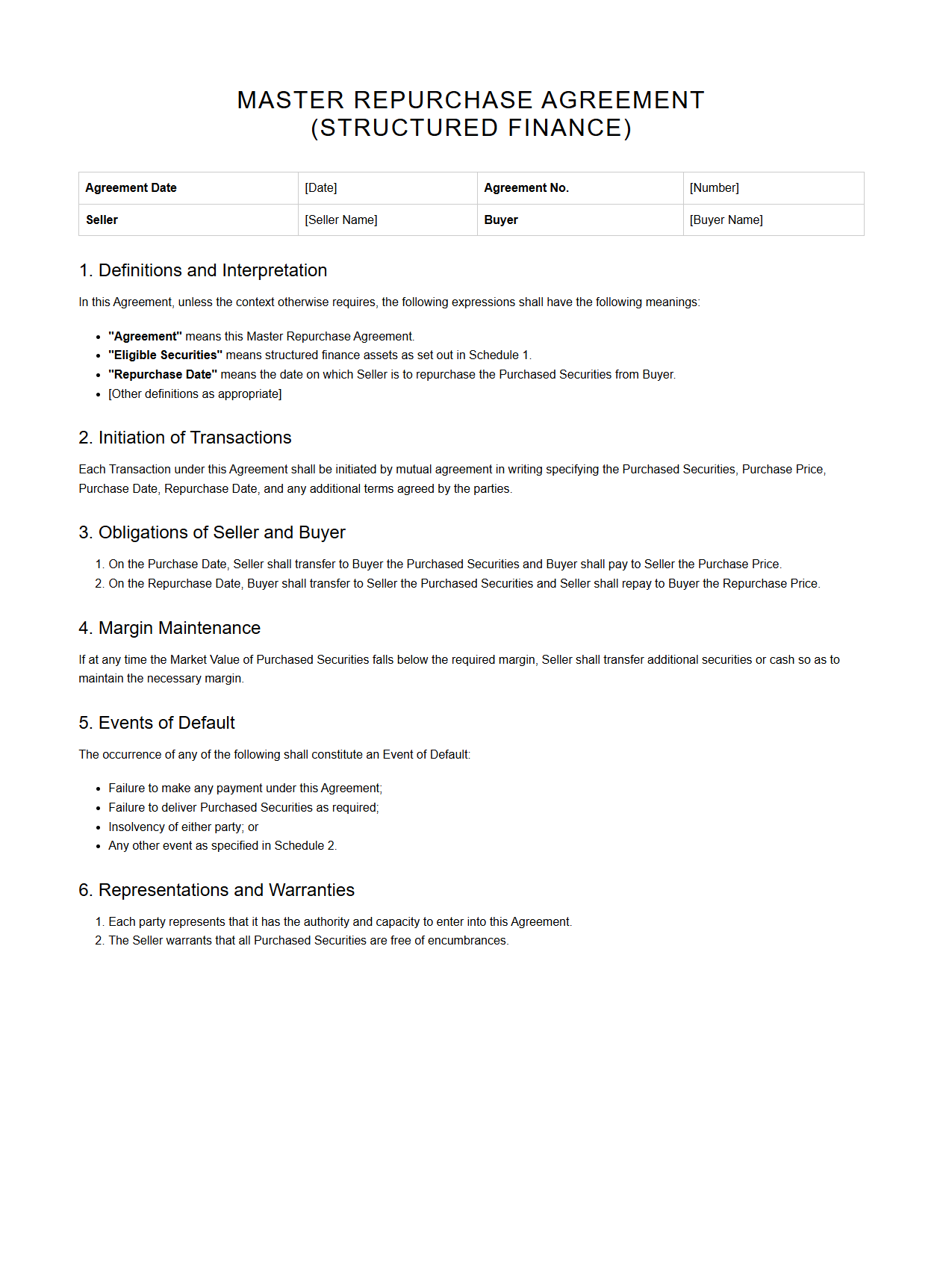

Master Repurchase Agreement Format for Structured Finance

The

Master Repurchase Agreement (MRA) format is a standardized legal document used in structured finance transactions to outline the terms and conditions under which repurchase agreements (repos) are executed. It details the rights and obligations of the parties involved, including provisions on collateral management, settlement procedures, default events, and margin requirements. This format ensures consistency, reduces counterparty risk, and facilitates efficient execution of secured lending transactions within capital markets.

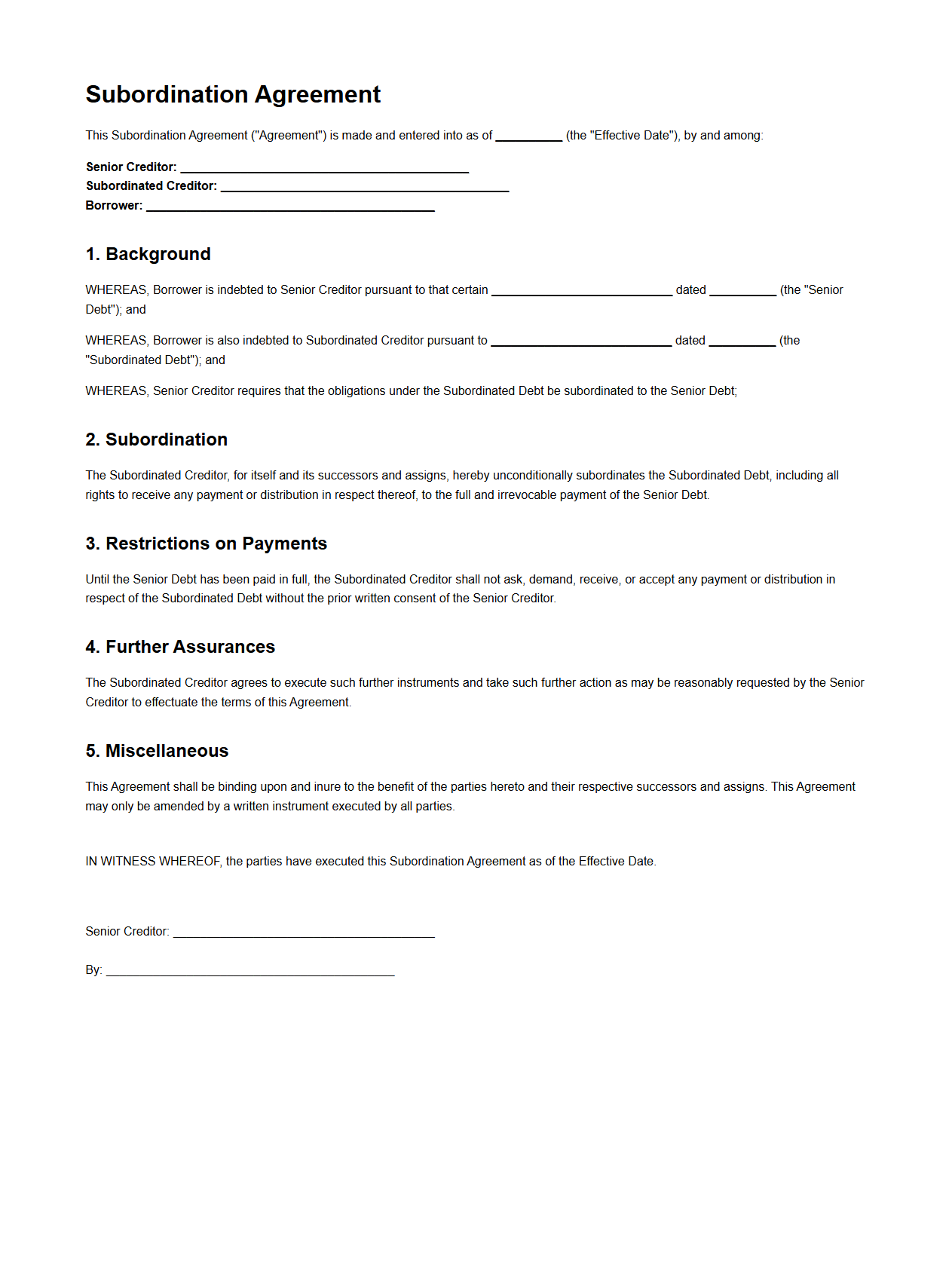

Subordination Agreement Sample for Structured Finance

A

Subordination Agreement Sample for Structured Finance is a legal document that establishes the priority of debt repayment among multiple lenders or creditors involved in a structured finance transaction. It clearly outlines the terms under which a creditor agrees to subordinate its claims to those of another creditor, ensuring proper risk allocation and collateral ranking. This agreement is crucial for maintaining transparency and protecting the interests of senior debt holders in complex financial arrangements.

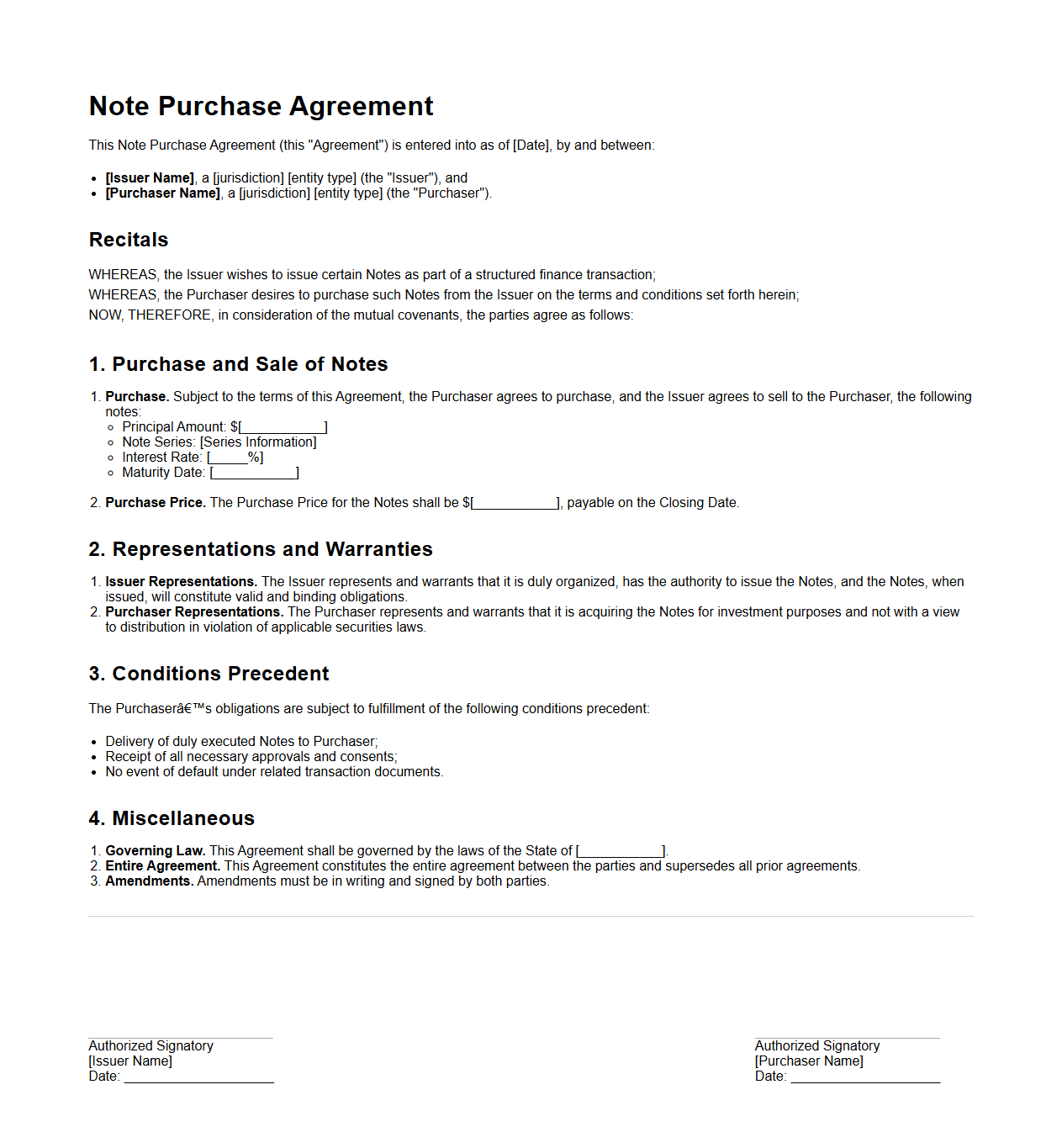

Note Purchase Agreement Example for Structured Finance

A

Note Purchase Agreement example for a structured finance document outlines the terms and conditions under which an investor agrees to purchase promissory notes issued by a special purpose vehicle or issuer. This agreement details principal amounts, interest rates, payment schedules, and representations to ensure legal clarity and risk mitigation in complex financial transactions. Such documents are essential for facilitating transparency and enforcing obligations in structured finance deals.

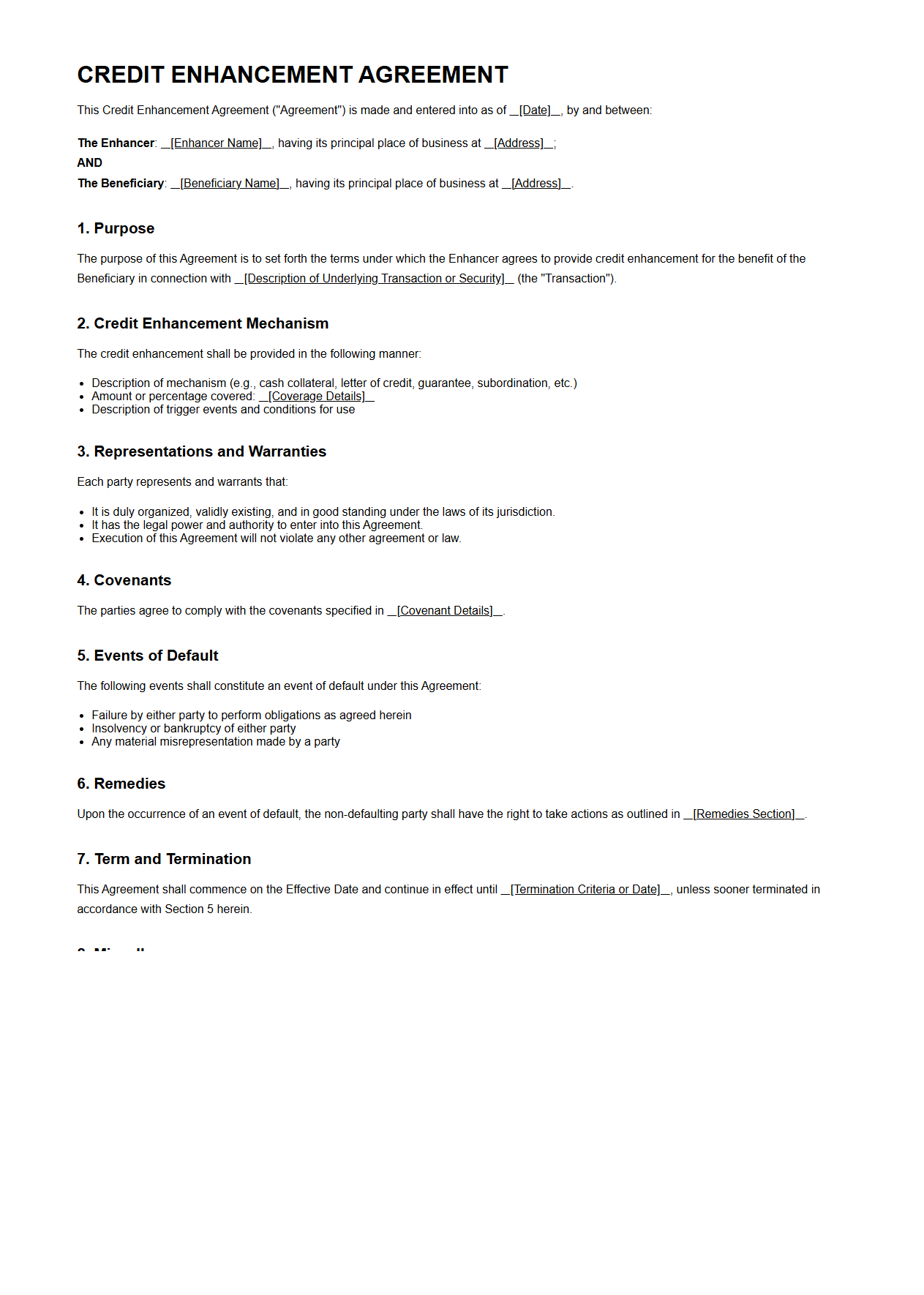

Credit Enhancement Agreement Template for Structured Finance

A

Credit Enhancement Agreement Template for Structured Finance is a legal document designed to outline the terms and conditions under which credit enhancement is provided to improve the creditworthiness of a financial transaction. This template typically details the roles of involved parties, the type of credit enhancement (such as guarantees or insurance), and the mechanisms to reduce credit risk, thereby facilitating better financing terms. It serves as a standardized framework to ensure clarity, legal compliance, and risk mitigation in complex structured finance deals.

Servicing Agreement Sample for Structured Finance

A

Servicing Agreement Sample for Structured Finance document outlines the contractual obligations between the servicer and the certificate holders or trust in a structured finance transaction. It details roles, responsibilities, payment collection, reporting requirements, and compliance standards to ensure proper management of the underlying assets. This sample serves as a reference to establish clear guidelines and protect stakeholders' interests throughout the asset servicing lifecycle.

Trust Deed Form for Structured Finance

A

Trust Deed Form in structured finance is a legal agreement that establishes a trust to hold assets on behalf of investors or beneficiaries, ensuring secure and transparent management of the underlying collateral. This document outlines the roles and responsibilities of the trustee, the rights of bondholders or noteholders, and the terms governing the enforcement of the trust in case of default. It serves as a critical framework for asset-backed securities by protecting investor interests and facilitating efficient management of pooled financial assets.

Security Agreement Template for Structured Finance

A

Security Agreement Template for Structured Finance is a legally binding document used to outline the terms and conditions under which collateral is pledged to secure a loan or financial obligation within structured finance transactions. It specifies the parties involved, describes the collateral in detail, and sets forth the rights and responsibilities regarding the security interest. This template ensures clarity and consistency, facilitating the protection of lenders' interests and compliance with regulatory requirements.

What are common covenants included in a structured finance debt agreement letter?

Common covenants in structured finance debt agreements include restrictions on additional debt issuance, limitations on asset sales, and requirements to maintain certain financial ratios. These covenants ensure the borrower's financial stability throughout the life of the agreement. Lenders rely on these terms to mitigate risks and protect their investments effectively.

How is collateral described and secured within the debt agreement document?

The debt agreement describes collateral with precise details of the assets pledged, including their valuation and legal ownership. It also outlines the process of perfecting security interests to ensure legal protection of creditor rights. This detailed description guarantees that lenders have a clear claim to the collateral in case of default.

What are the specific tranching details and priority of payments outlined?

The agreement clearly specifies the tranching of debt, dividing it into senior, mezzanine, and junior layers with distinct risk and return profiles. It also defines the priority of payments, ensuring senior tranches receive payments before subordinated tranches. This hierarchy provides transparency on cash flow distribution to investors.

How are default events and remedies explicitly defined?

Default events such as missed payments, covenant breaches, and insolvency are explicitly enumerated within the agreement. The document also details specific remedies, including acceleration of debt and enforcement of collateral rights. Clear definitions help both parties understand consequences and protect lender interests.

What disclosure requirements are mandated in the agreement for ongoing reporting?

The debt agreement mandates regular financial reporting and disclosures to keep lenders informed of the borrower's performance. Requirements often include audited financial statements, compliance certificates, and material event notices. These disclosures enhance transparency and facilitate timely risk assessment.