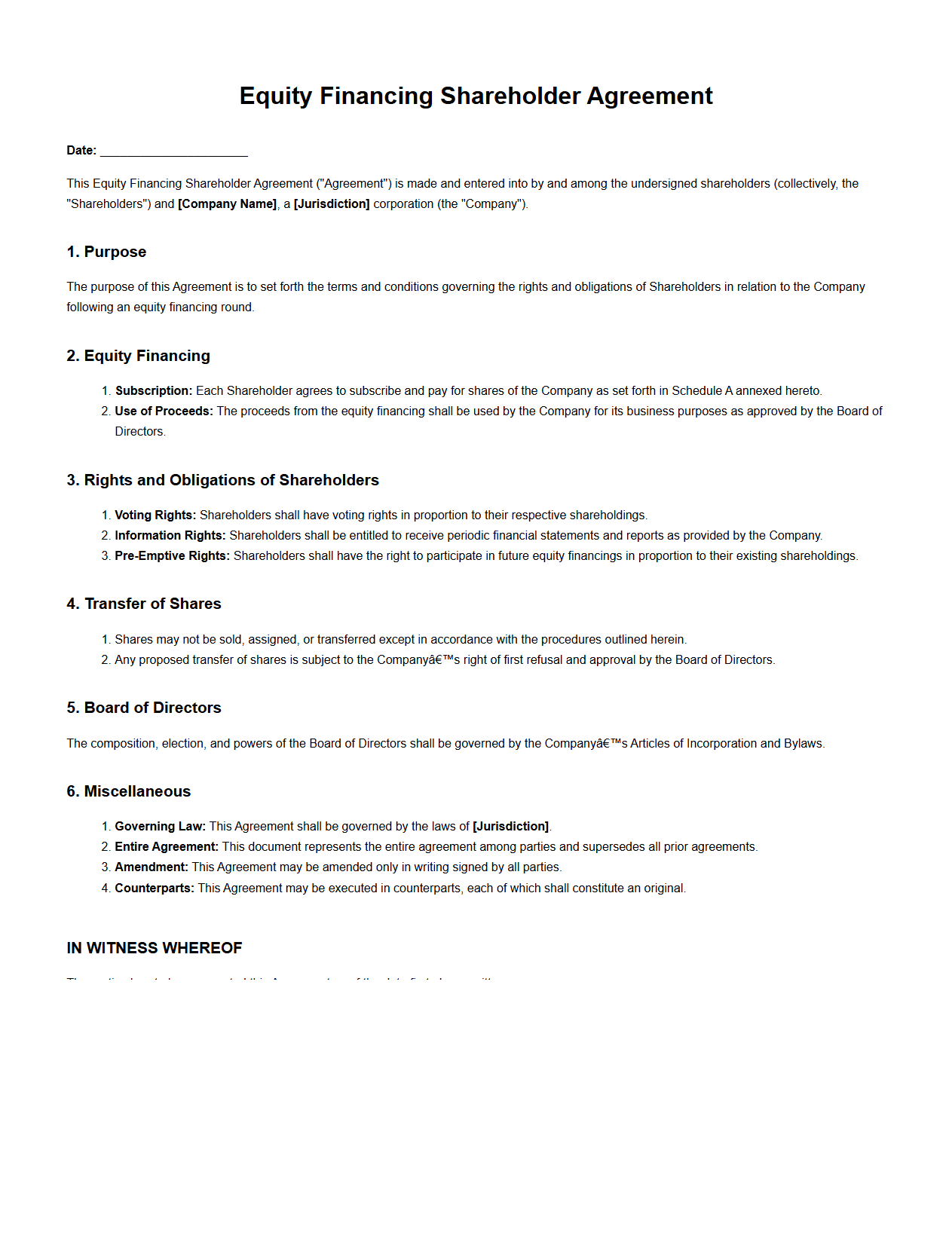

Equity Financing Shareholder Agreement Template

An

Equity Financing Shareholder Agreement Template is a legal document designed to outline the rights, responsibilities, and obligations of shareholders in a company during equity financing rounds. It establishes the terms for investment, dividend distribution, voting rights, and exit strategies, ensuring clear governance and protection for all parties involved. Using this template helps streamline negotiations and provides a standardized framework for equity ownership and capital raising.

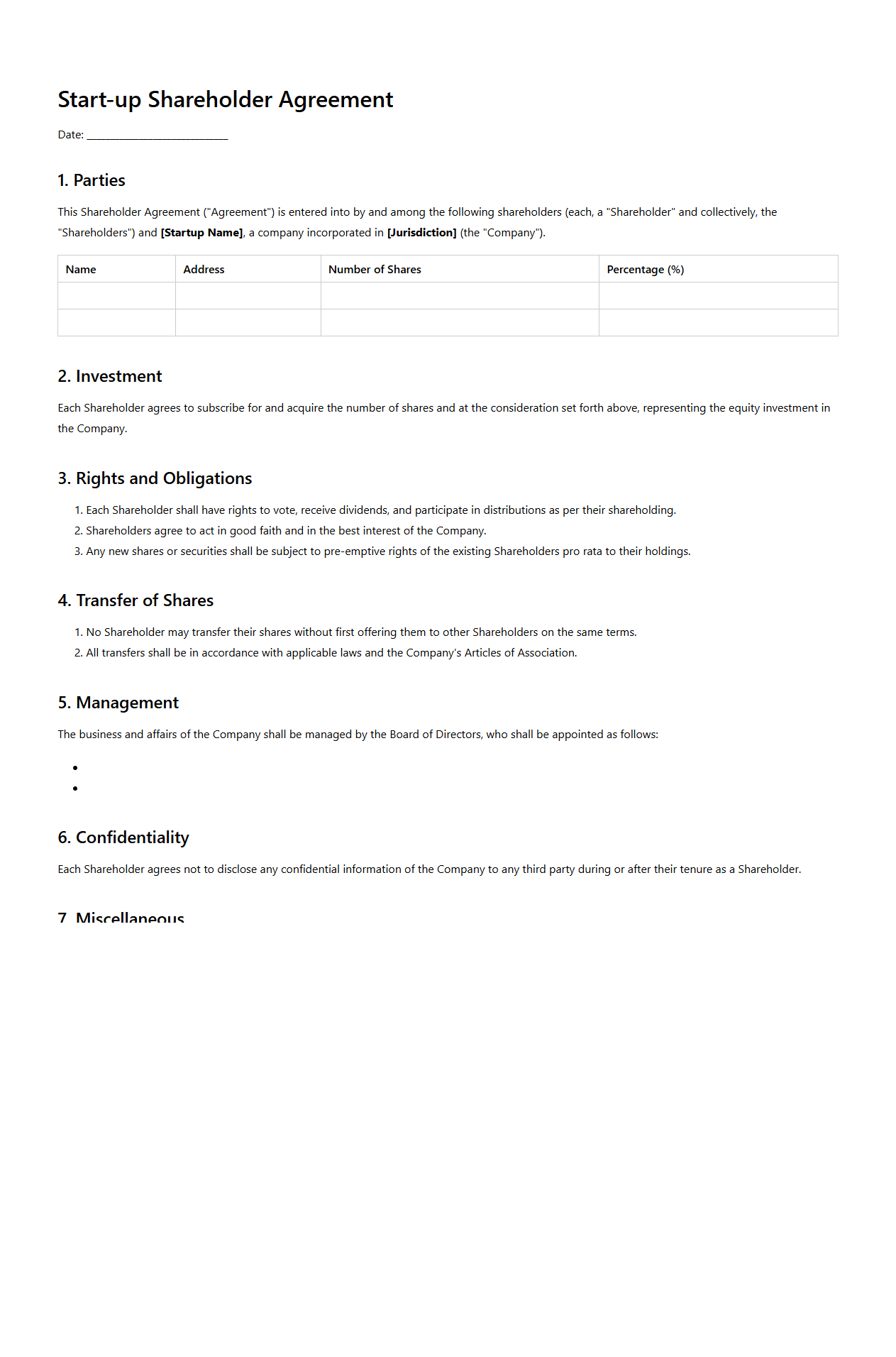

Start-up Shareholder Agreement for Equity Investment

A

Start-up Shareholder Agreement for Equity Investment is a legal document that outlines the rights, responsibilities, and obligations of shareholders in a start-up company. It details the terms of equity investment, including share distribution, voting rights, dividend policies, and exit strategies. This agreement ensures clear governance and protects investors' interests during the company's growth and fundraising phases.

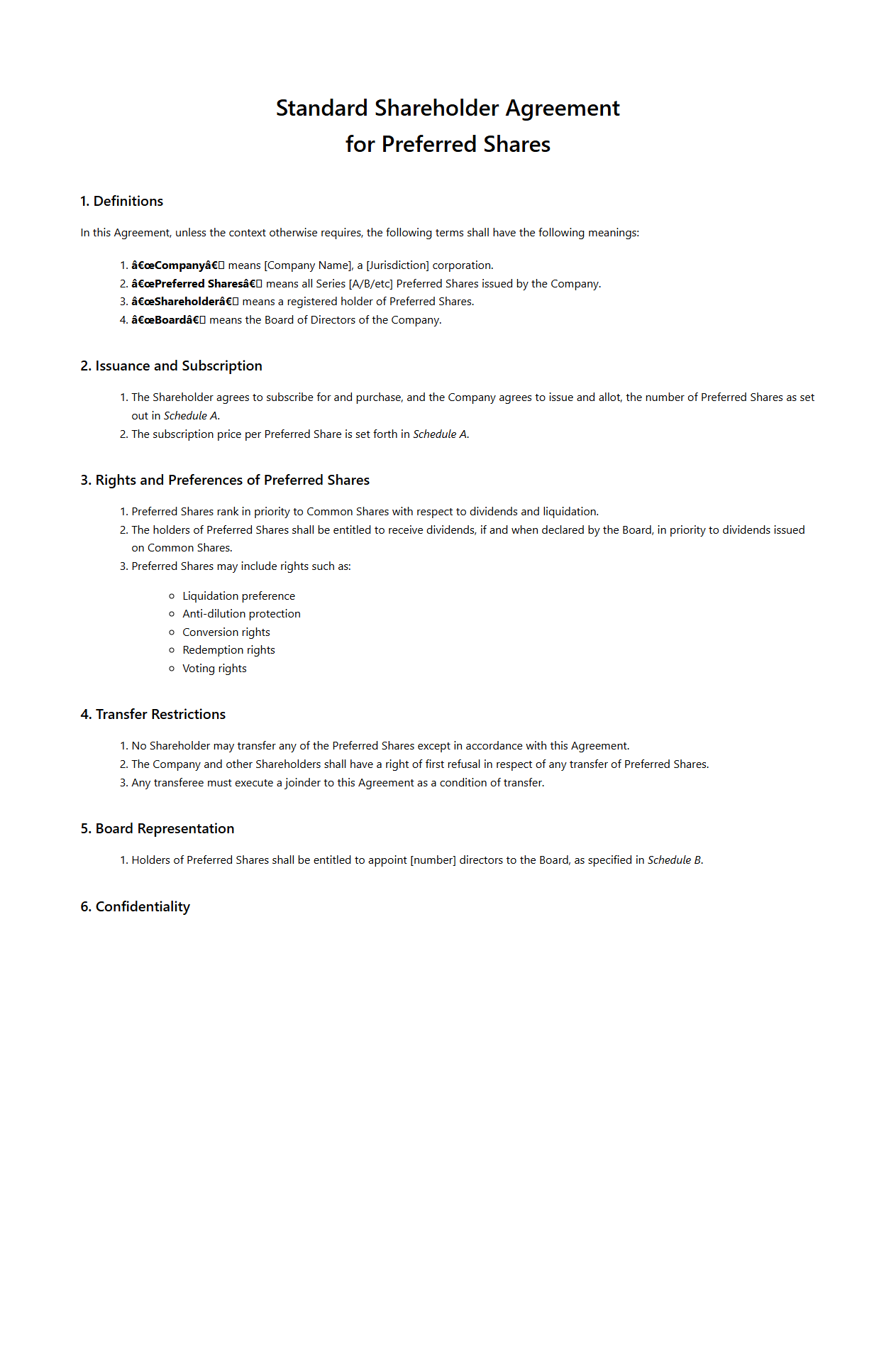

Standard Shareholder Agreement for Preferred Shares

A

Standard Shareholder Agreement for Preferred Shares is a legal document outlining rights, obligations, and protections for preferred shareholders in a corporation. It defines terms such as dividend preferences, voting rights, conversion rights, and liquidation preferences, ensuring clarity and mutual understanding between investors and the company. This agreement safeguards both parties by regulating transfer restrictions, dispute resolution, and governance matters.

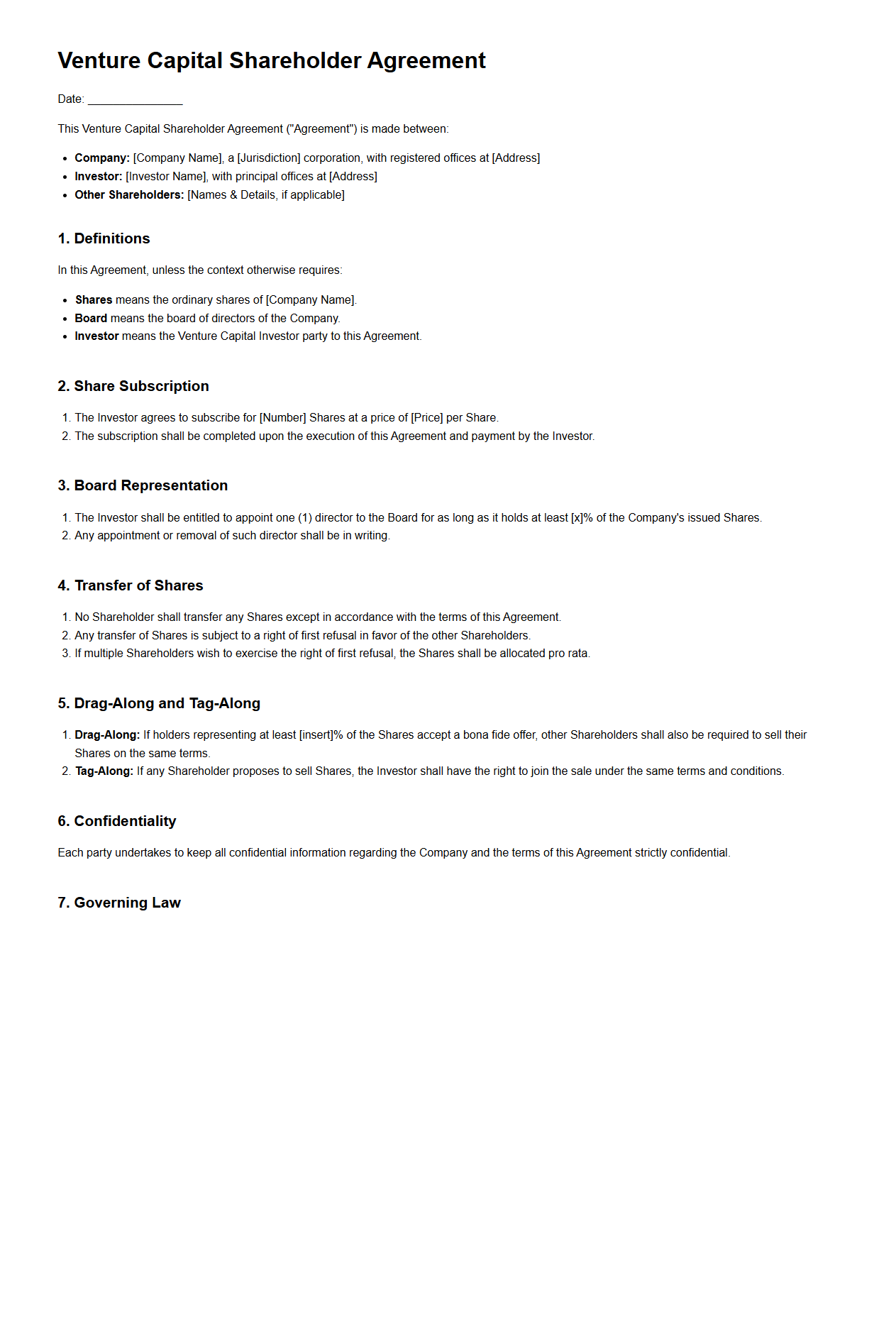

Venture Capital Shareholder Agreement Example

A

Venture Capital Shareholder Agreement Example document outlines the terms and conditions between investors and company founders during a venture capital investment. It typically includes provisions on equity ownership, voting rights, board composition, and exit strategies, ensuring clear governance and protection of stakeholders' interests. This agreement serves as a legal framework to manage the relationship and expectations among shareholders in a startup or growing company.

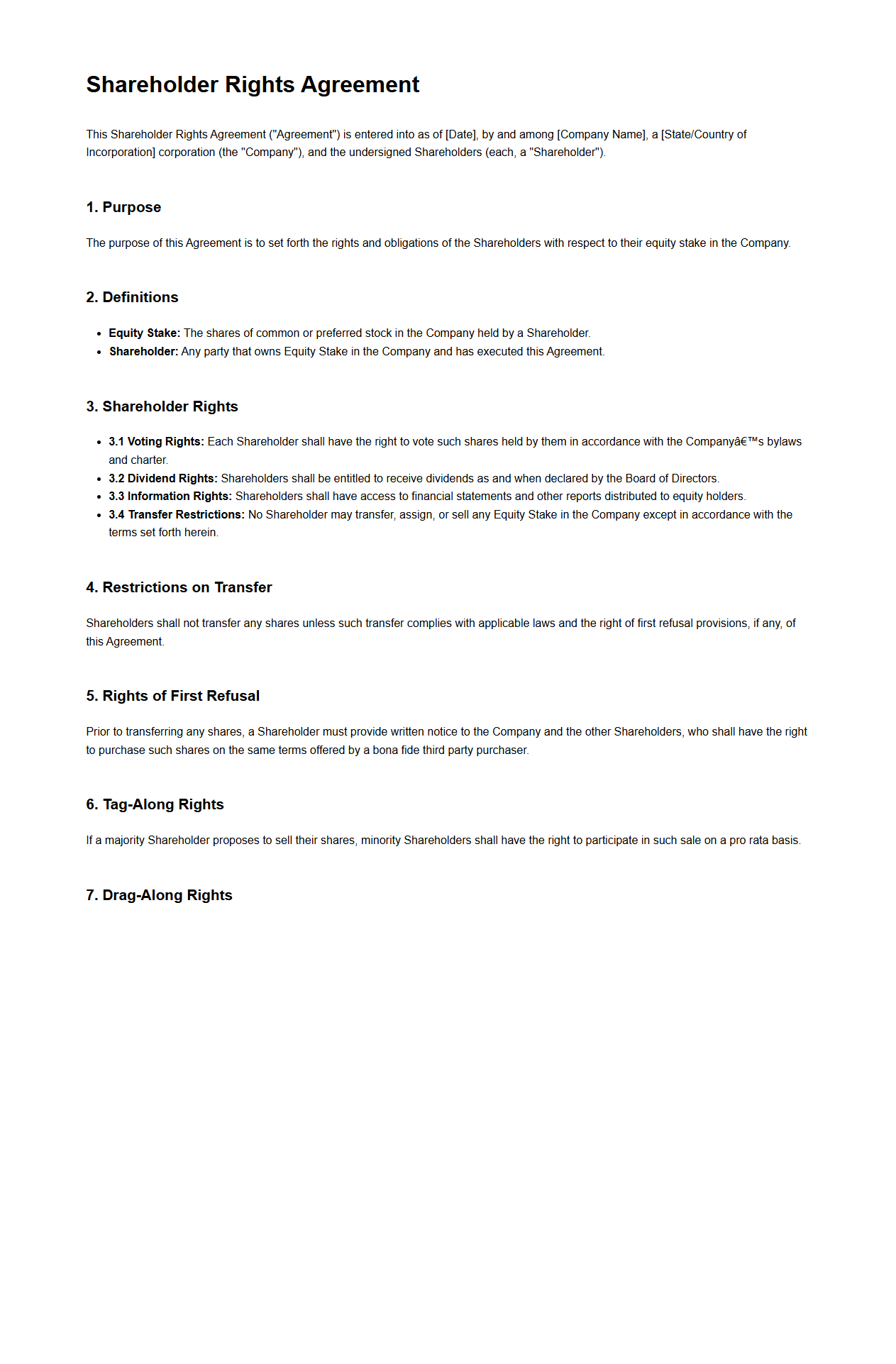

Shareholder Rights Agreement for Equity Stake

A

Shareholder Rights Agreement for an equity stake document outlines the specific rights and obligations of shareholders within a company, ensuring protection of their investments and control over key decisions. It typically covers voting rights, dividend entitlements, transfer restrictions, and dispute resolution mechanisms, establishing a clear framework for shareholder interactions. This agreement is crucial for maintaining governance balance and safeguarding minority and majority shareholder interests.

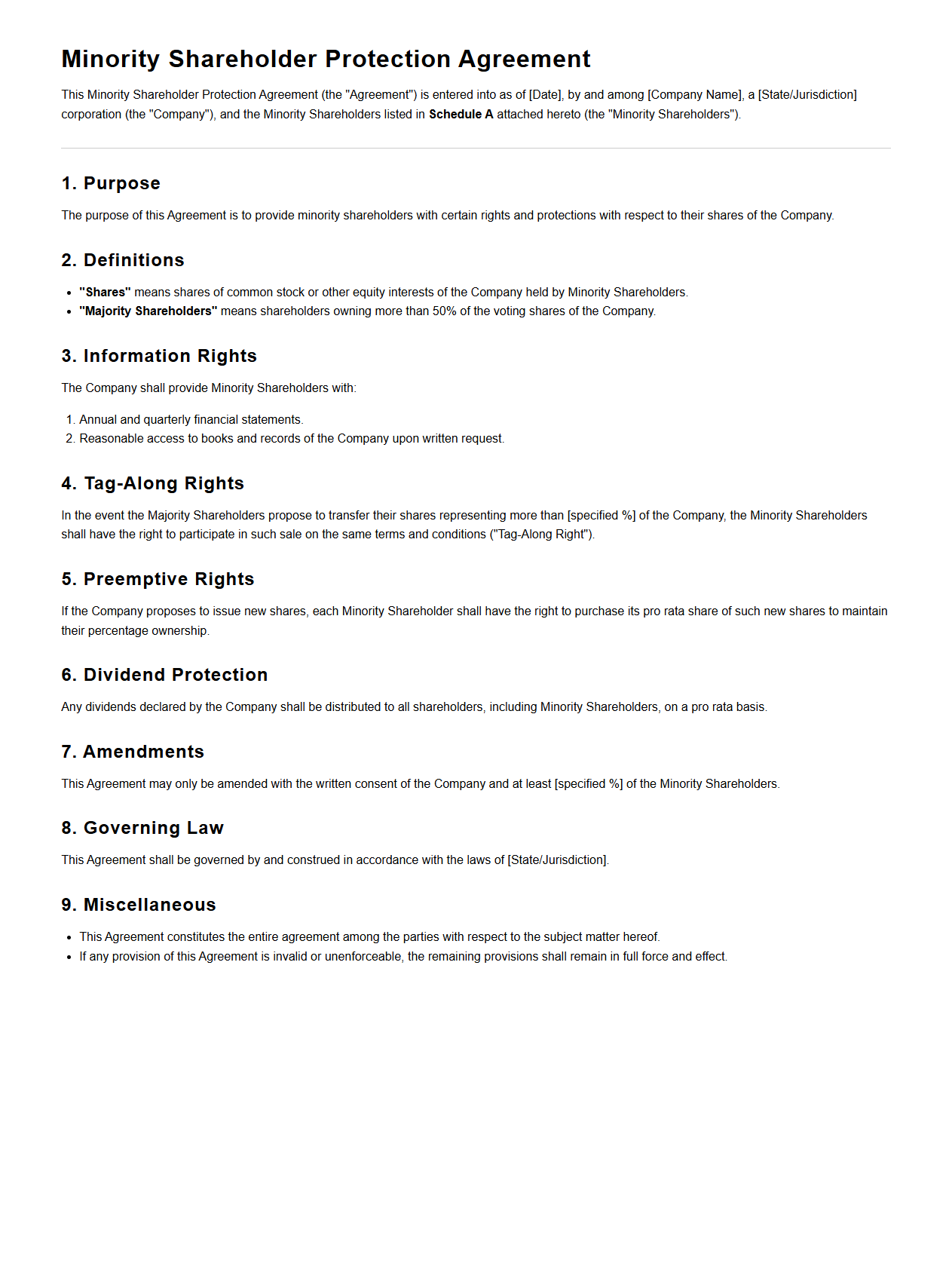

Minority Shareholder Protection Agreement Sample

A

Minority Shareholder Protection Agreement sample document outlines the rights and safeguards provided to minority shareholders within a company, ensuring their interests are protected against majority shareholder decisions. This agreement typically includes provisions on voting rights, information access, dividend entitlements, and mechanisms to resolve disputes or prevent unfair treatment. By clearly defining these protections, the document helps maintain transparency and fairness in corporate governance, promoting confidence among minority stakeholders.

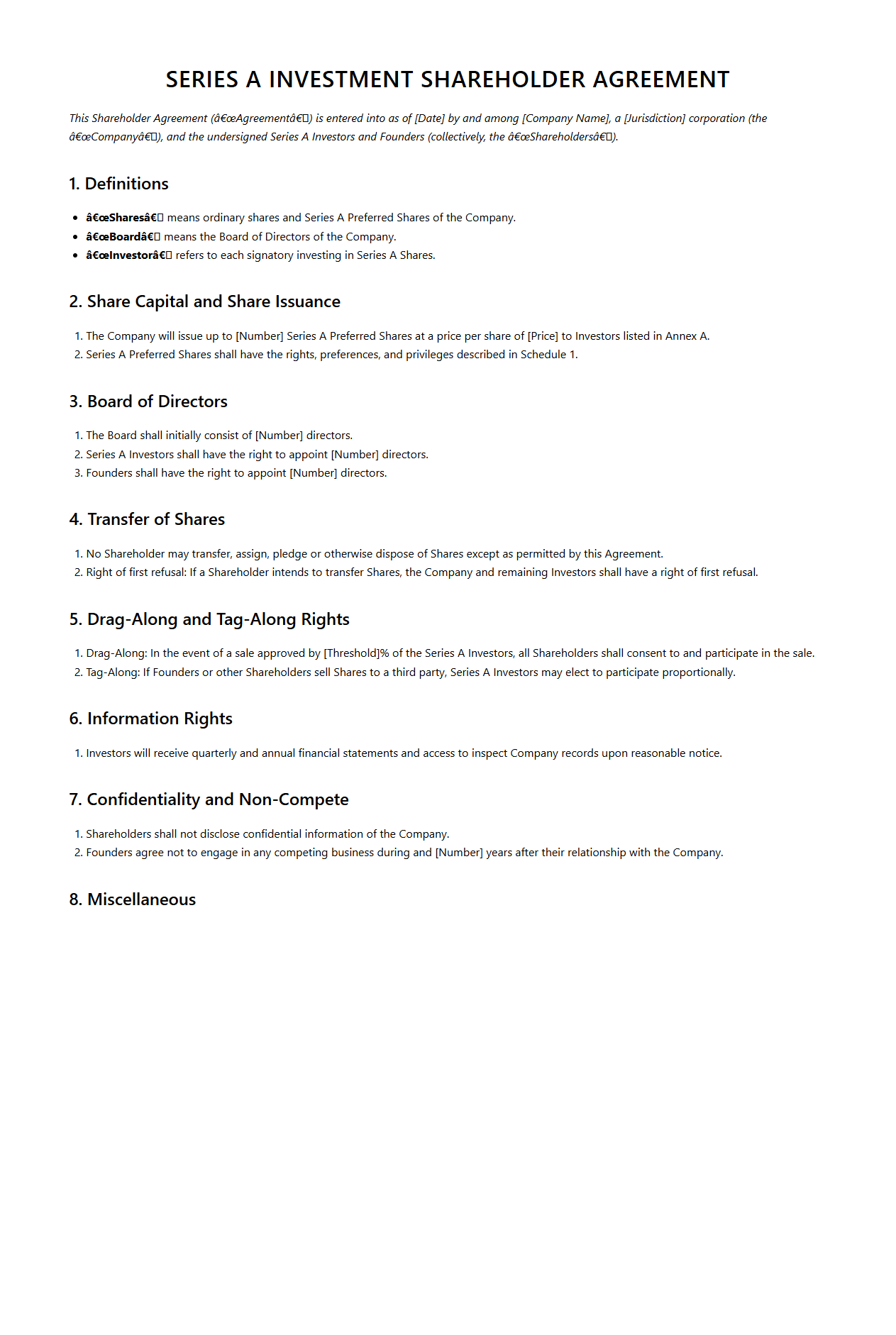

Series A Investment Shareholder Agreement

A

Series A Investment Shareholder Agreement is a legal document that outlines the rights, obligations, and protections for investors and founders during a Series A funding round. It specifies terms such as equity ownership, voting rights, board composition, and exit provisions to ensure clear governance and alignment between stakeholders. This agreement plays a crucial role in safeguarding investor interests while supporting the company's growth trajectory.

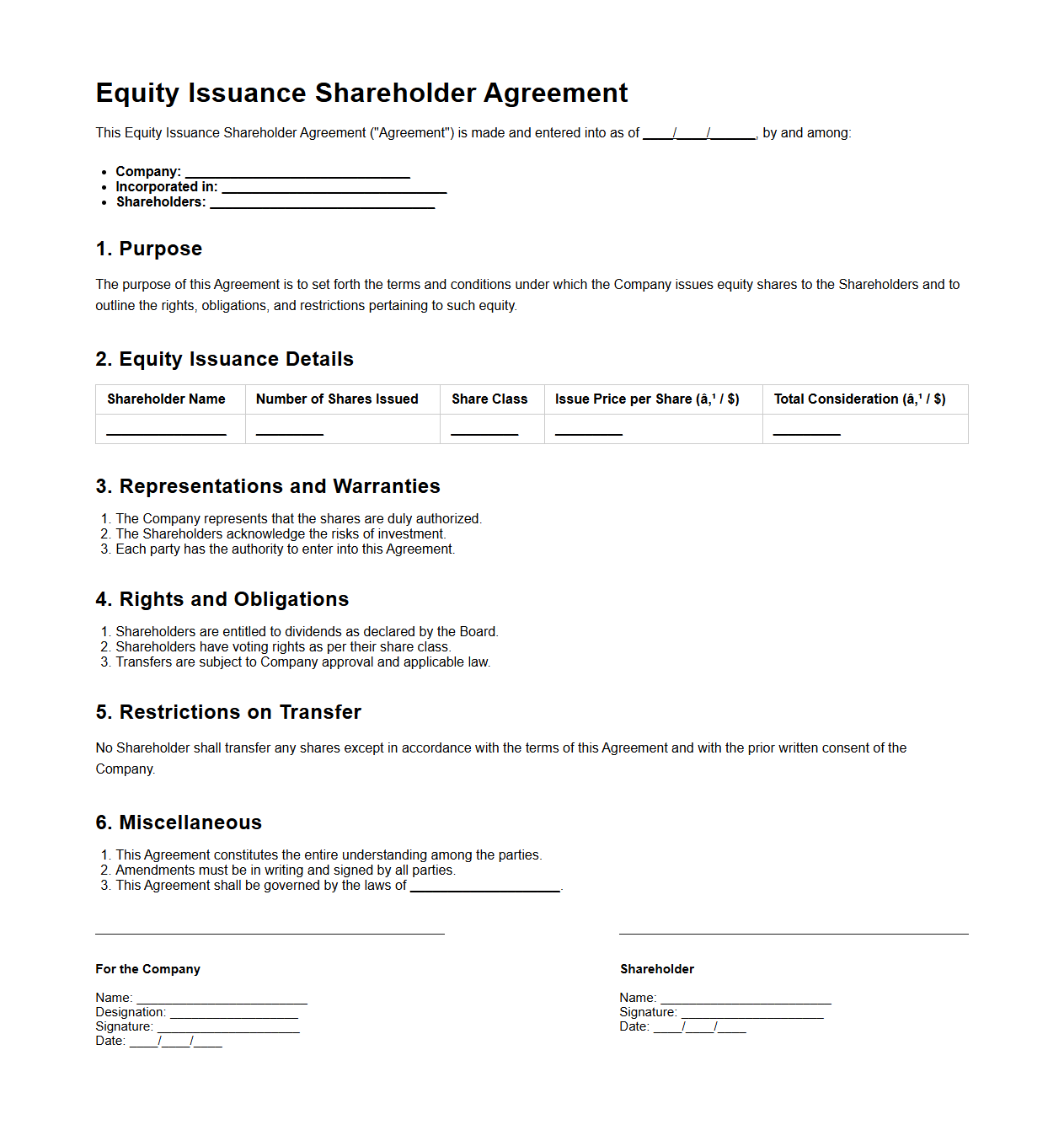

Equity Issuance Shareholder Agreement Format

The

Equity Issuance Shareholder Agreement Format document outlines the legally binding terms and conditions under which new shares are issued to shareholders, ensuring clarity on rights, obligations, and privileges. It serves as a template to formalize the issuance process, including share valuation, payment terms, and shareholder voting rights. This format is essential for maintaining corporate governance and protecting investor interests during equity transactions.

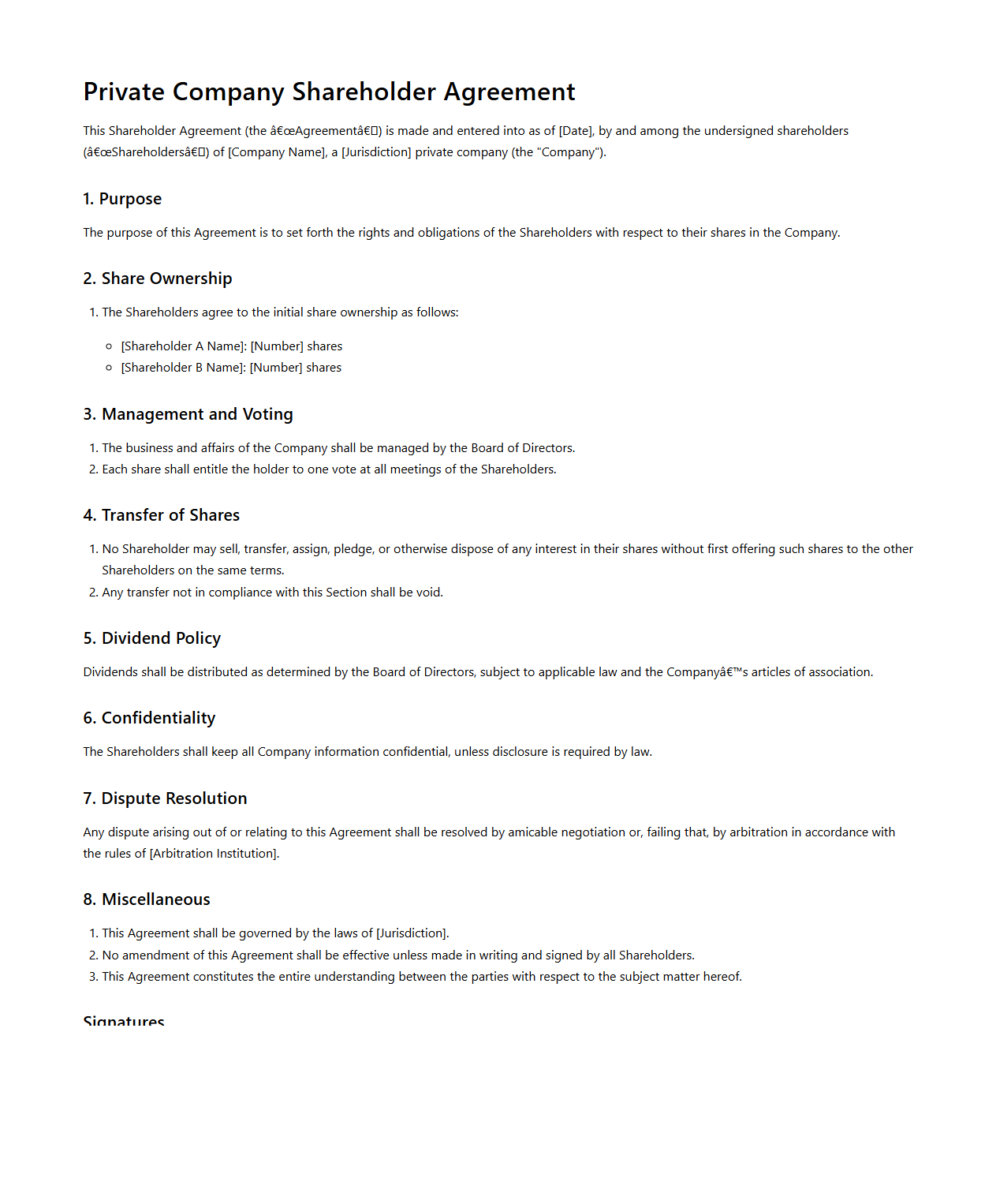

Private Company Shareholder Agreement Example

A

Private Company Shareholder Agreement Example document serves as a legally binding template outlining the rights, duties, and obligations of shareholders within a private company. It typically includes provisions for share ownership, decision-making processes, dispute resolution, and restrictions on share transfers to protect both the company and its investors. This document ensures clarity and mutual understanding among shareholders, helping to prevent conflicts and secure the company's long-term stability.

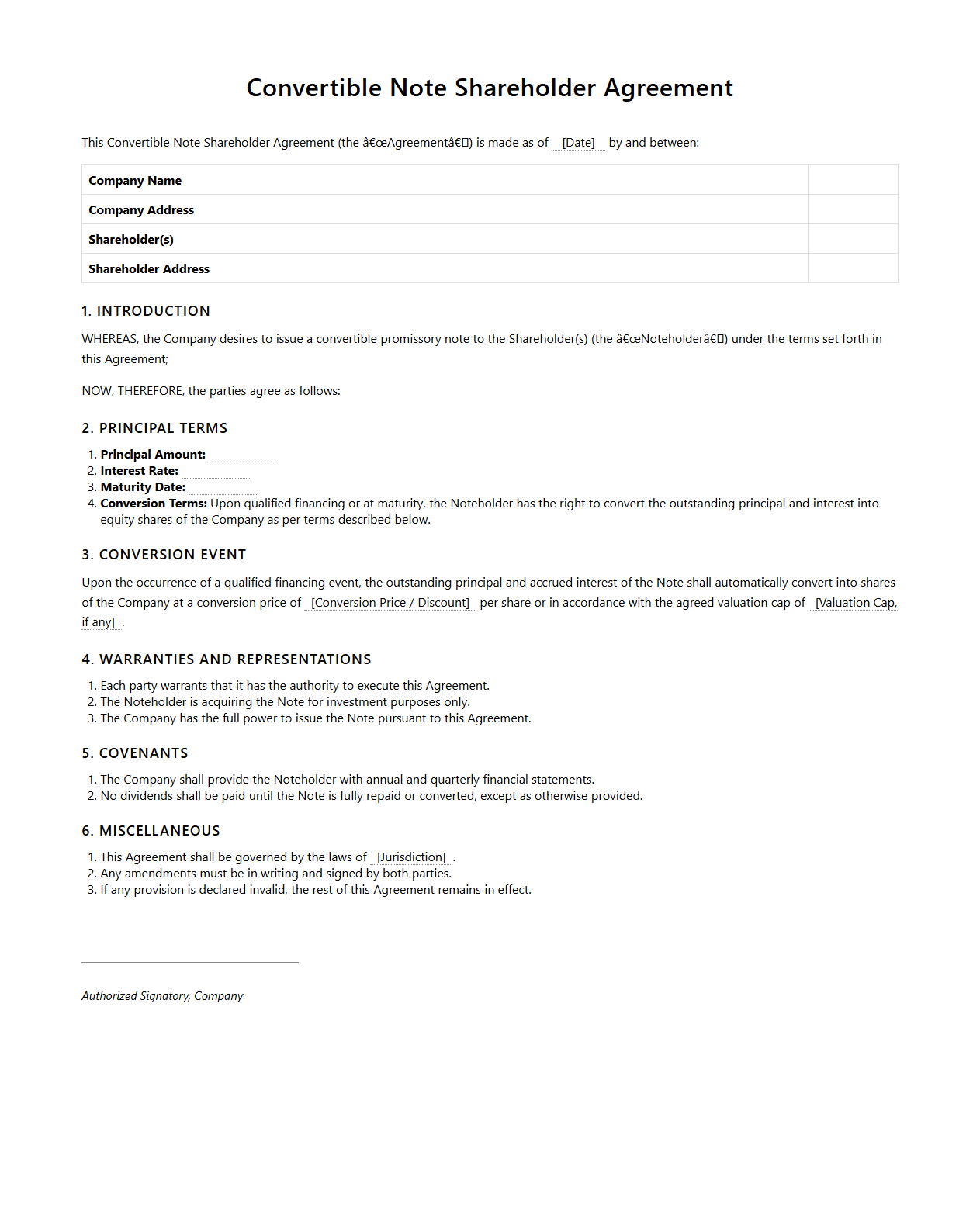

Convertible Note Shareholder Agreement Template

A

Convertible Note Shareholder Agreement Template is a legal document designed to outline the terms and conditions under which convertible notes are issued and converted into equity shares of a company. It provides clarity on investor rights, conversion mechanisms, valuation caps, and maturity dates, ensuring protection for both the company and its investors. This template helps streamline negotiations and formalize the relationship between shareholders and the issuing company during early-stage financing.

What clauses in the Shareholder Agreement protect minority shareholders during equity financing rounds?

The Shareholder Agreement includes minority protection clauses designed to safeguard the interests of minority shareholders during equity financing rounds. These provisions typically include rights such as tag-along rights and rights of first refusal to ensure minority shareholders are not unfairly excluded. Such clauses create a balanced framework preventing dilution or disadvantageous terms against minority interests.

How does the document address shareholder preemptive rights on new equity issuances?

Preemptive rights are explicitly stated in the agreement to allow existing shareholders the first option to purchase new shares issued by the company. This mechanism helps shareholders maintain their proportional ownership and voting power during equity expansions. The document ensures these rights are honored unless specifically waived by a shareholder, thus preserving ownership stakes.

What are the stipulated conditions for anti-dilution protection in the agreement?

The agreement sets forth anti-dilution protection clauses that adjust the number of shares or price per share when new equity is issued at a lower valuation. These provisions protect shareholders from value dilution during down rounds or significant equity issuances. Conditions specify the formulas or triggers, such as weighted average or full ratchet methods, applied to maintain shareholder value.

Which decision thresholds trigger shareholder voting under equity financing scenarios?

The agreement defines specific voting thresholds required for approval of equity financing events, often differentiating between ordinary and special resolutions. Typically, significant financing decisions require a supermajority or unanimous consent to protect shareholder interests. These thresholds ensure transparent and democratic decision-making processes for equity changes.

How does the agreement outline the process for amending equity allocation provisions?

Amendments to equity allocation provisions are governed by a clear procedural framework within the agreement. This process generally mandates shareholder approval through specified voting thresholds, often requiring a special resolution. The agreement also delineates notice requirements and timelines to ensure all shareholders have sufficient opportunity to consider proposed changes.