A Capital Expenditure Document Sample for Corporate Investment provides a detailed template outlining the allocation of funds for long-term assets and infrastructure. It includes essential components such as budget forecasts, approval processes, and impact analysis to ensure transparent and strategic financial planning. This document serves as a critical tool for evaluating potential investments and securing stakeholder buy-in.

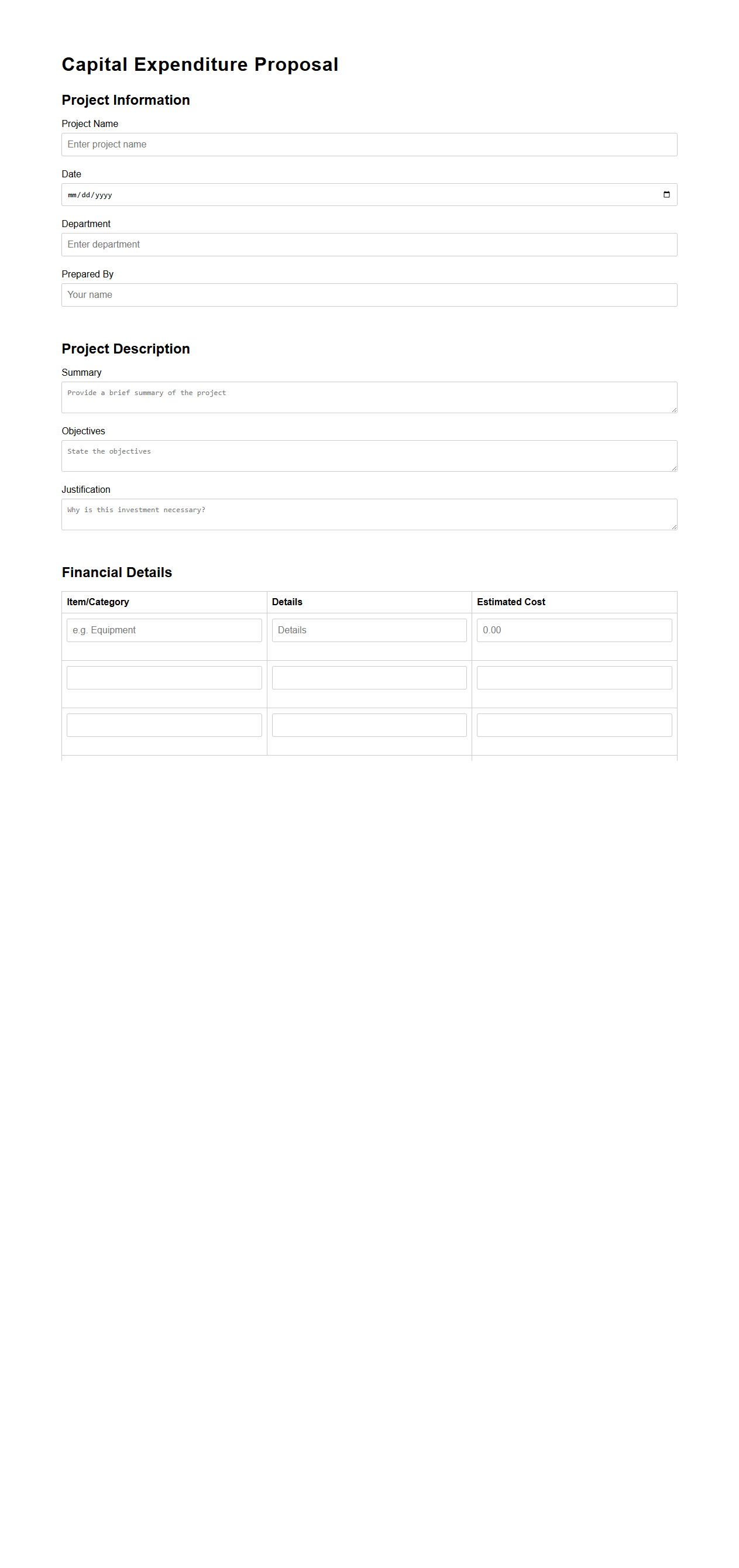

Capital Expenditure Proposal Template for Corporate Investments

A

Capital Expenditure Proposal Template for Corporate Investments is a structured document used to outline and justify significant financial investments in fixed assets or major projects within a company. It provides a detailed analysis of projected costs, expected benefits, return on investment (ROI), and risk assessment to support informed decision-making by stakeholders. This template ensures consistency, transparency, and thorough evaluation of capital expenditures to align with corporate financial strategies.

Corporate Investment Capital Appropriation Request Form

The

Corporate Investment Capital Appropriation Request Form is a formal document used by organizations to request approval for allocating funds toward significant investment projects or capital expenditures. It details the purpose, amount, expected returns, and strategic impact of the proposed investment, providing decision-makers with essential financial and operational information. This form ensures transparent capital planning and aligns investments with corporate financial goals.

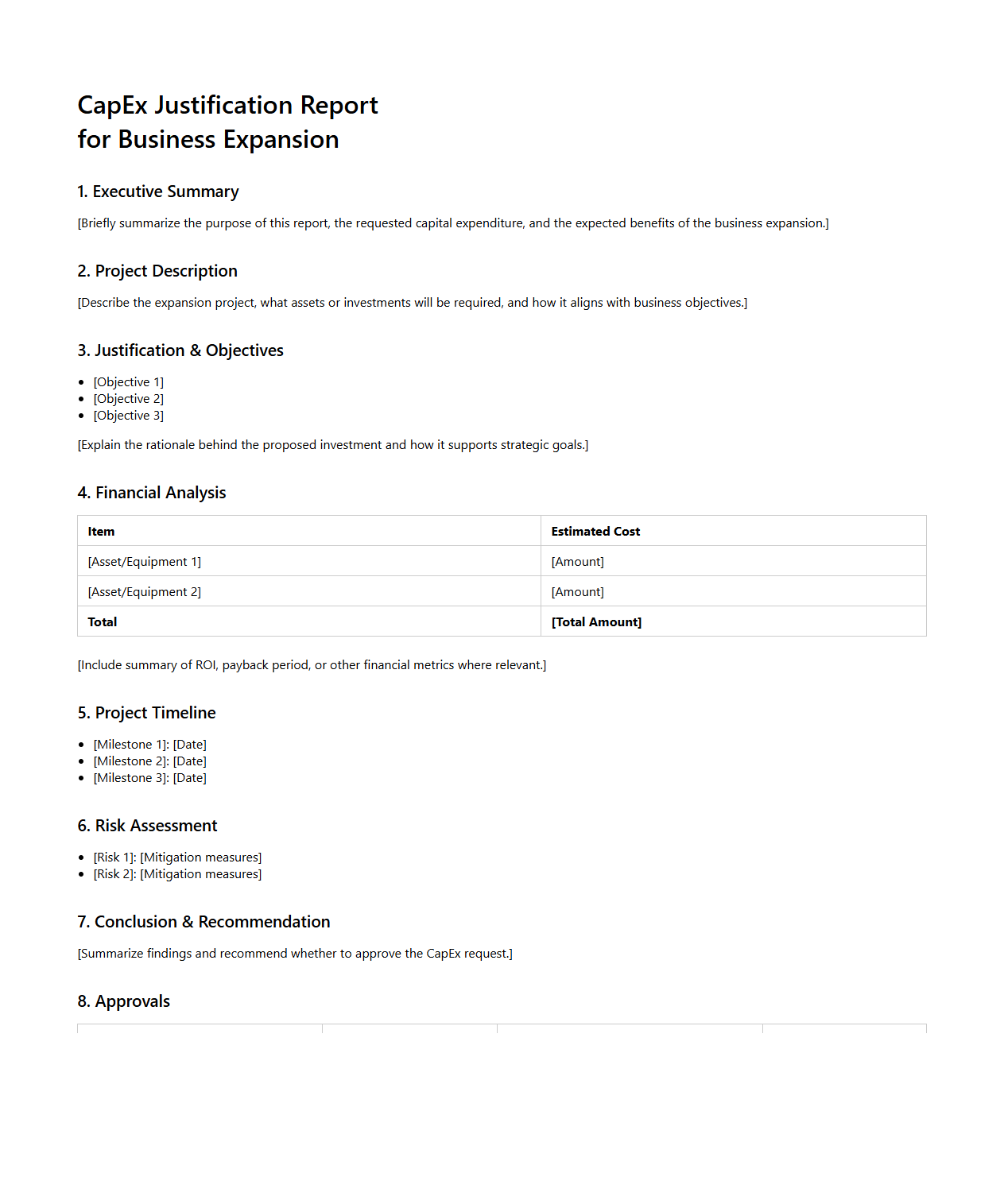

CapEx Justification Report for Business Expansion

A

CapEx Justification Report for Business Expansion is a detailed document that outlines the financial reasoning and strategic benefits behind proposed capital expenditures. It evaluates the projected costs, expected returns, and potential risks associated with investing in new assets or infrastructure to support business growth. This report helps stakeholders make informed decisions by presenting data-driven analysis on the long-term value and impact of the expansion investment.

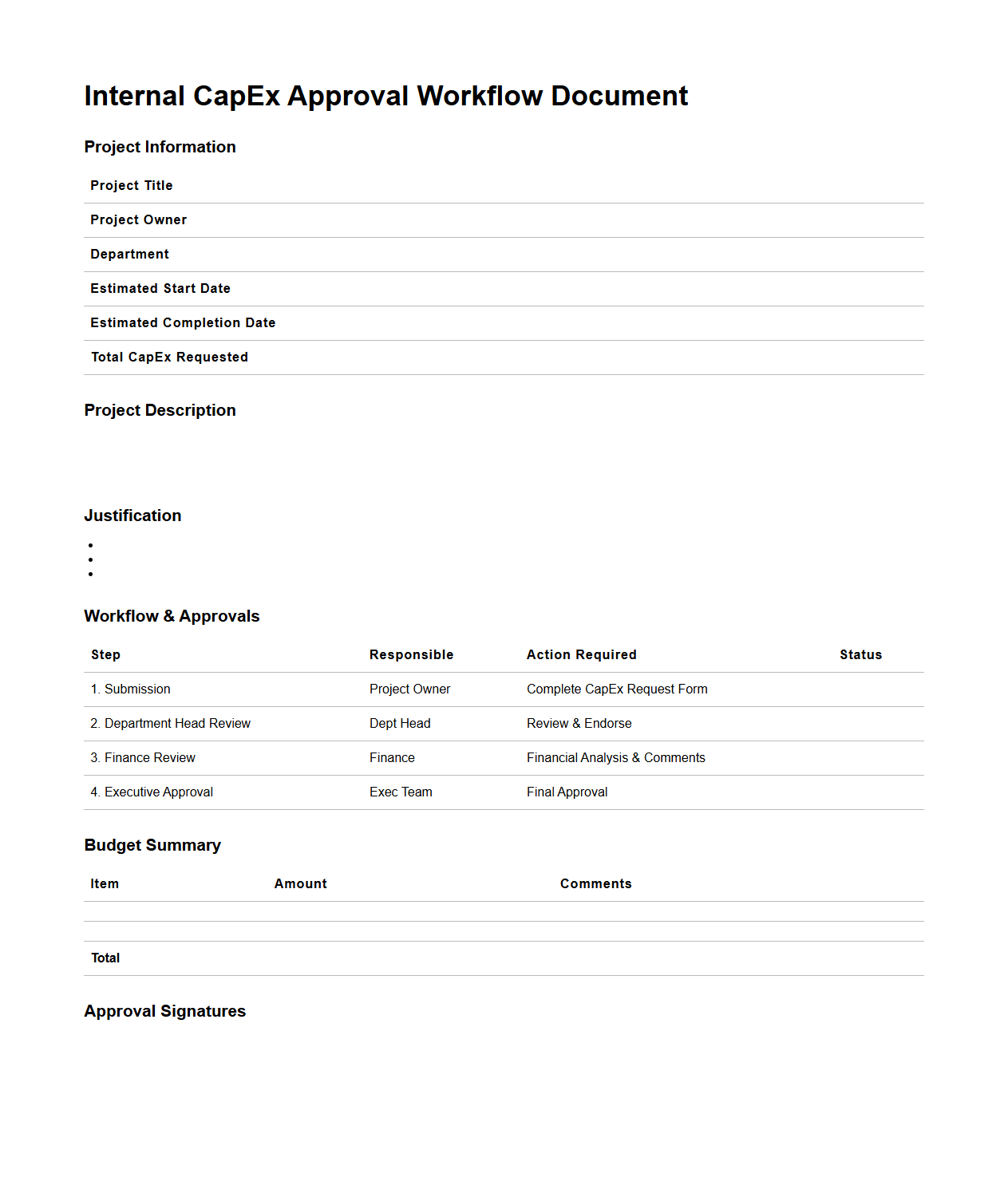

Internal CapEx Approval Workflow Document

The

Internal CapEx Approval Workflow Document outlines the step-by-step process for obtaining authorization to incur capital expenditures within an organization. It defines roles, responsibilities, and required documentation to ensure compliance with budgetary constraints and financial controls. This document streamlines decision-making and enhances transparency in capital investment projects.

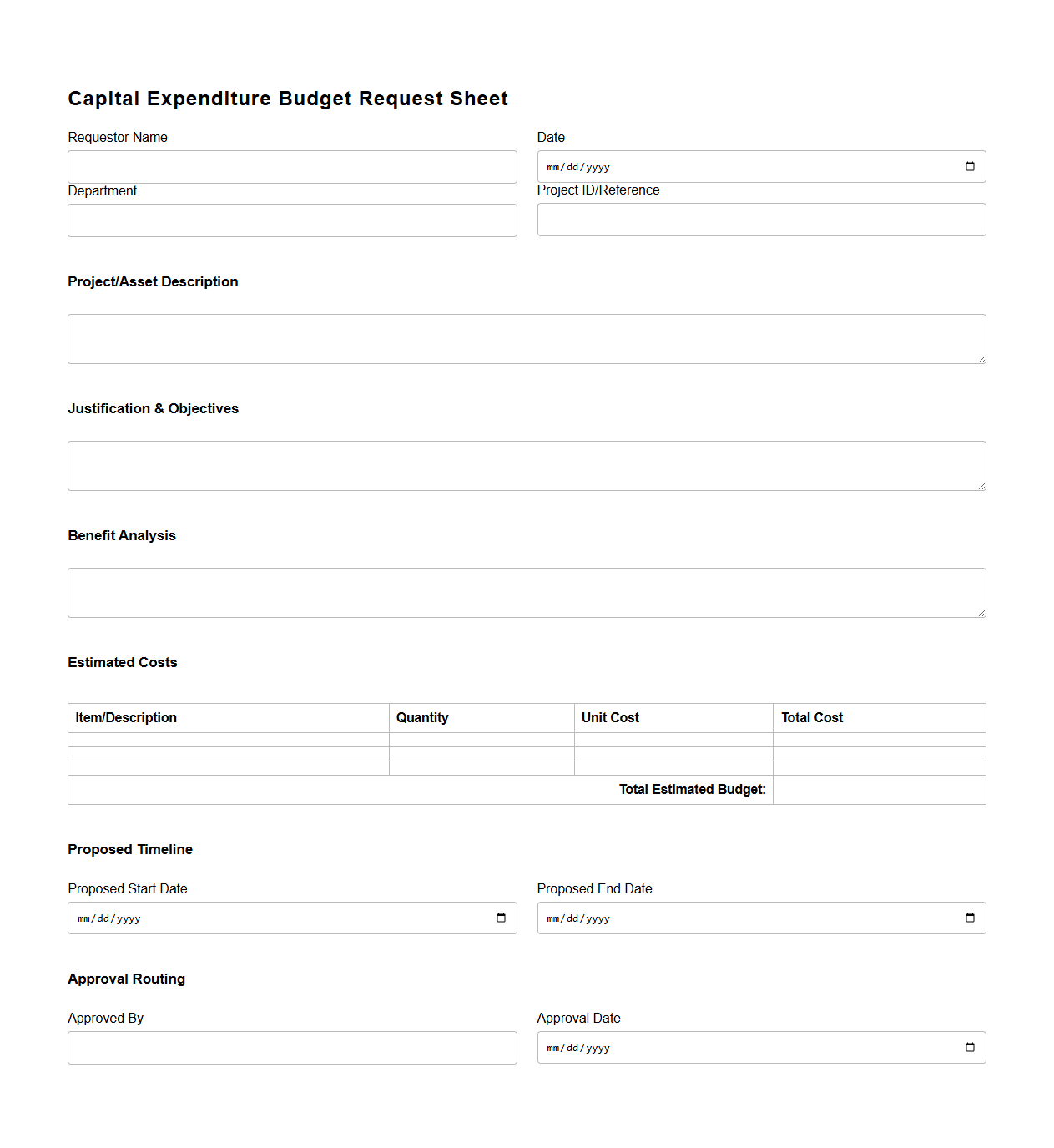

Capital Expenditure Budget Request Sheet

A

Capital Expenditure Budget Request Sheet document is used by organizations to formally propose and justify the allocation of funds for long-term asset purchases or improvements. It outlines detailed cost estimates, project scope, and expected benefits, facilitating informed decision-making by management or finance departments. This document ensures transparency and alignment with strategic financial planning for capital investments.

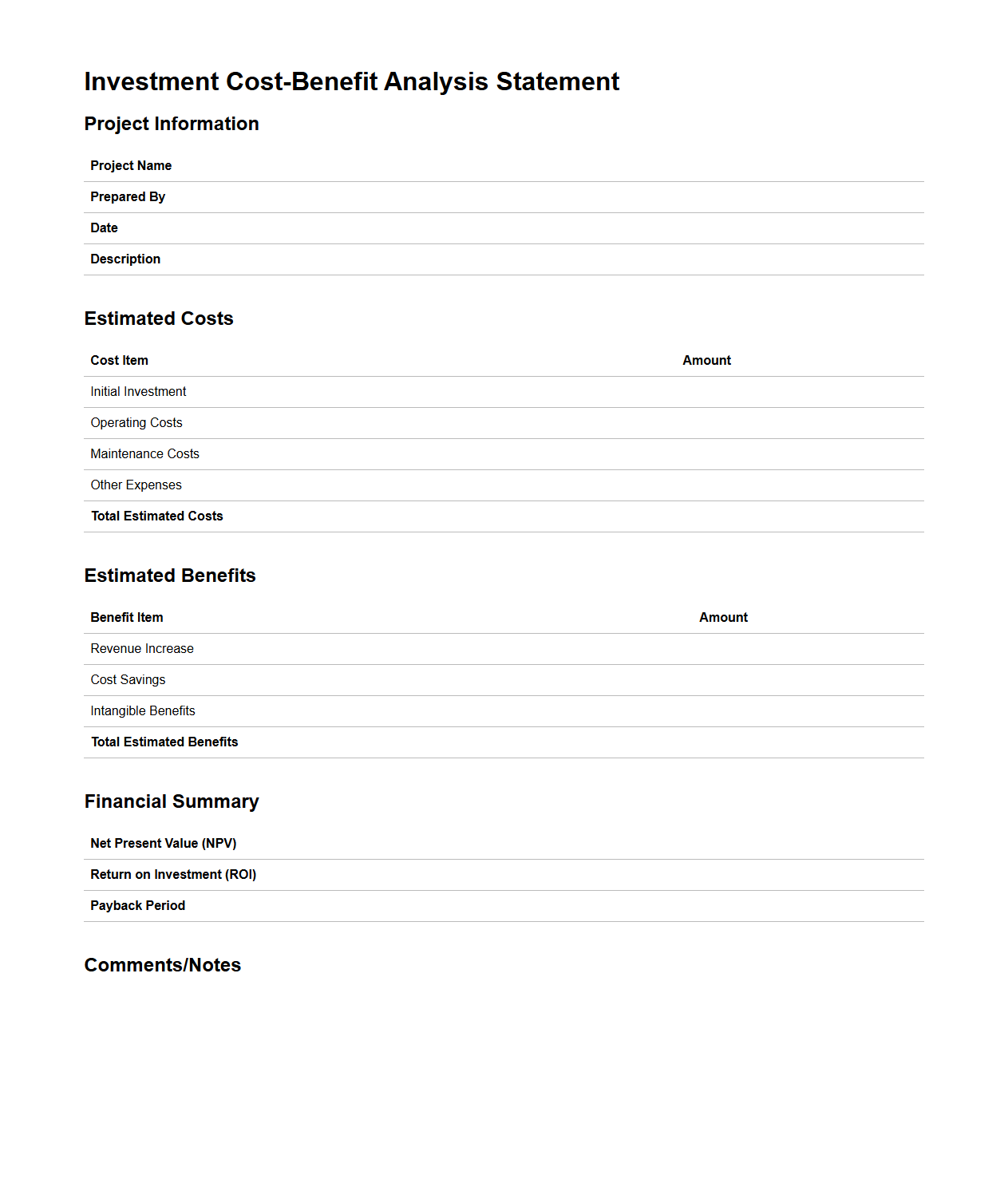

Investment Cost-Benefit Analysis Statement

An

Investment Cost-Benefit Analysis Statement document evaluates the financial viability of a project by comparing its expected costs with anticipated benefits. It quantifies monetary values of all relevant expenses and returns to provide a clear picture of potential profitability and risks. This statement aids decision-makers in prioritizing investments by highlighting economic efficiency and long-term value.

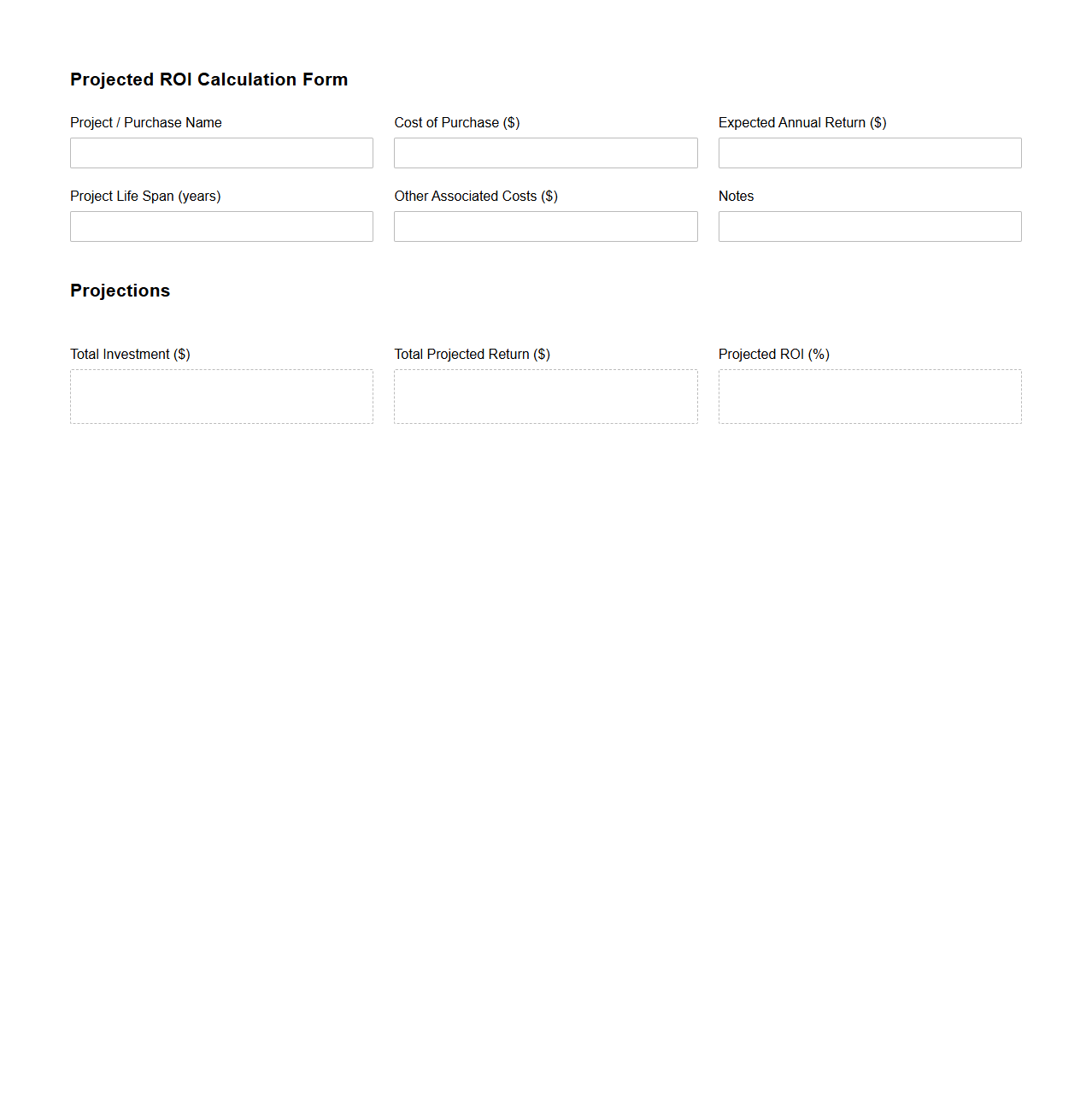

Projected ROI Calculation Form for Major Purchases

The

Projected ROI Calculation Form for Major Purchases is a financial tool designed to estimate the potential return on investment before committing to significant expenditures. This document systematically evaluates costs, anticipated benefits, and timeframes to help businesses make informed decisions. It serves as a critical resource for assessing the viability and expected profitability of large-scale purchases.

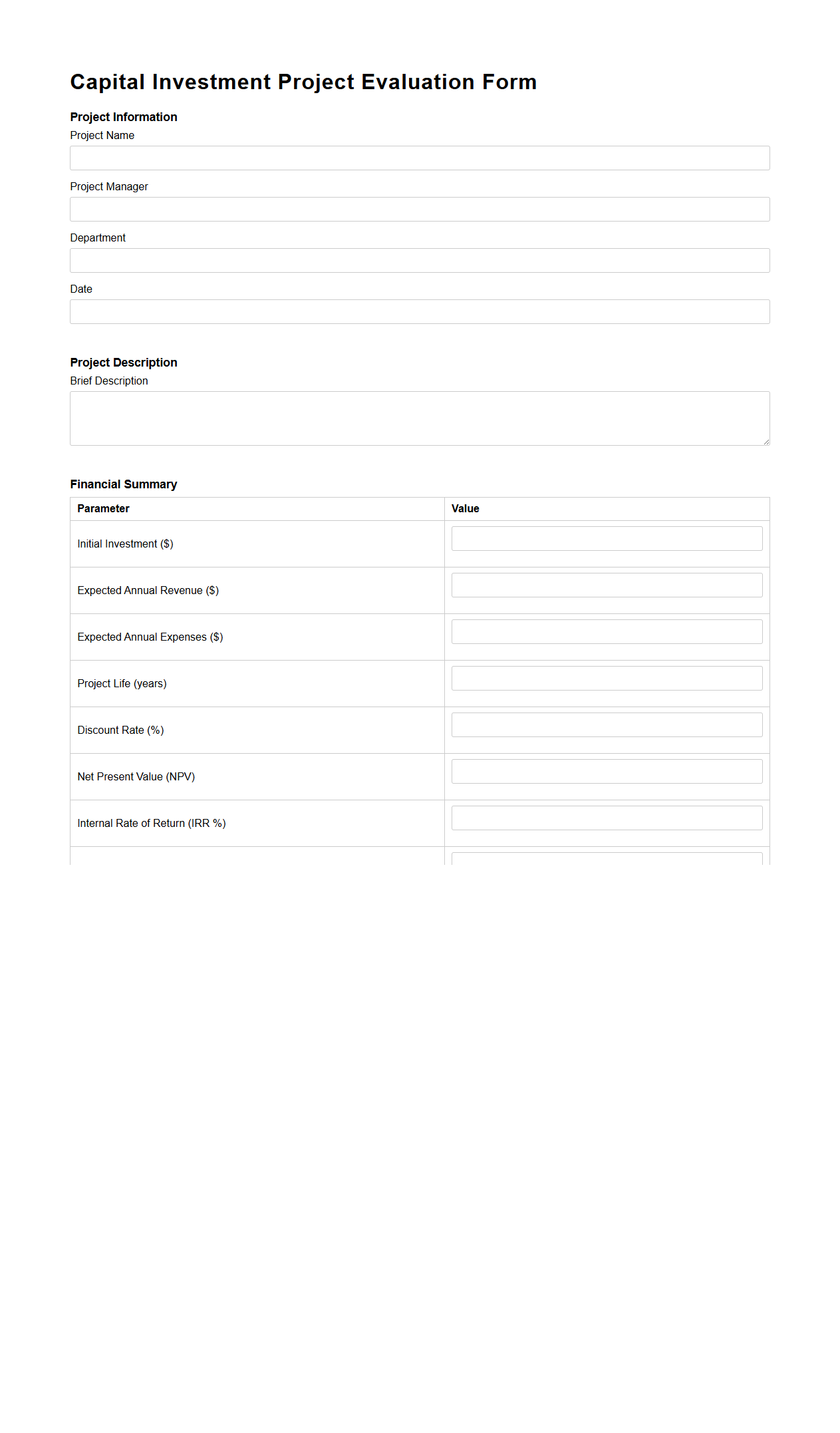

Capital Investment Project Evaluation Form

The

Capital Investment Project Evaluation Form is a structured document used to assess the viability and potential return on investment of proposed capital projects. It typically includes sections for financial analysis, risk assessment, project objectives, and key performance indicators to ensure informed decision-making. This form helps organizations prioritize projects by comparing costs, benefits, and strategic alignment.

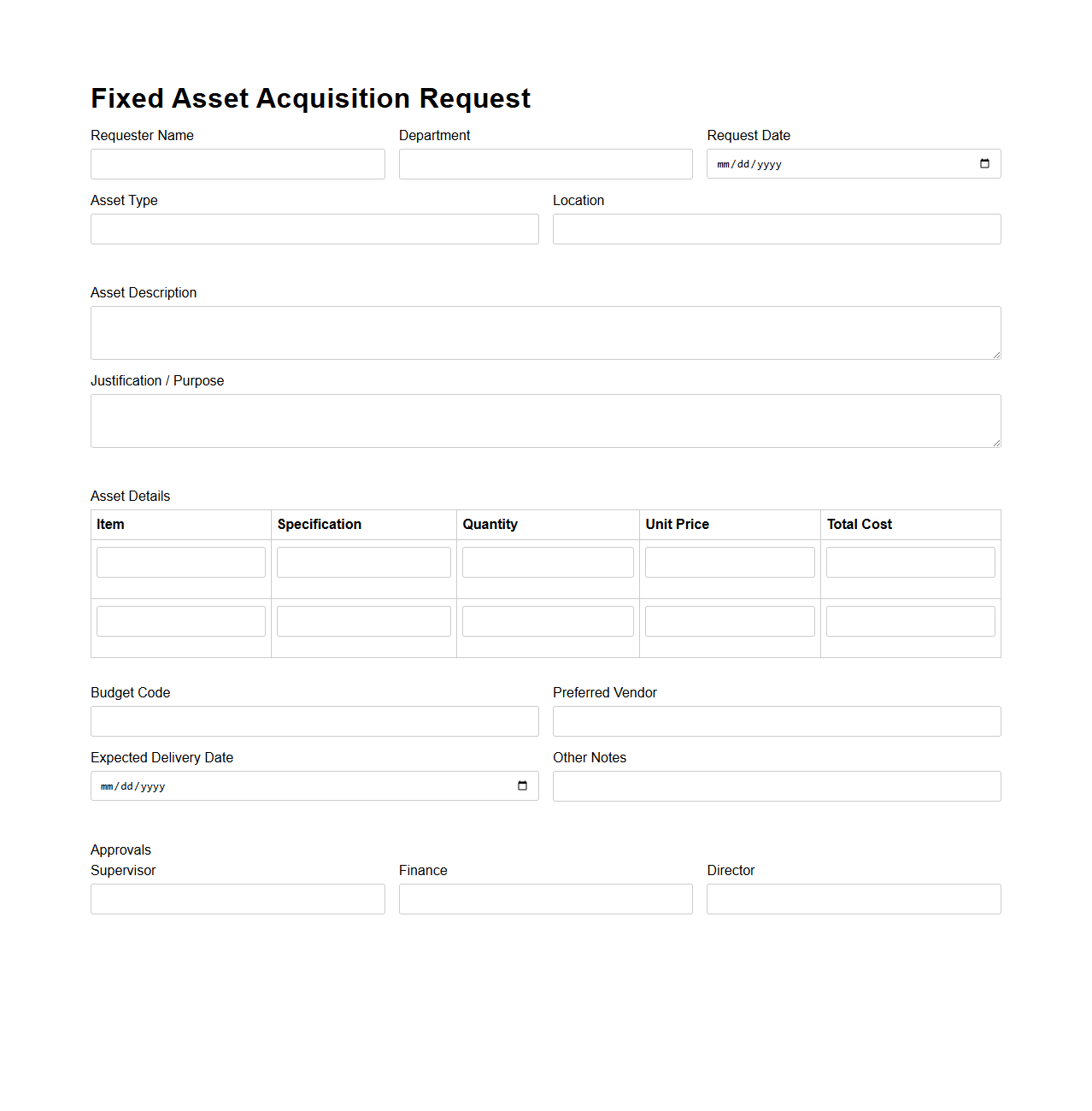

Fixed Asset Acquisition Request Template

A

Fixed Asset Acquisition Request Template document is a standardized form used by organizations to formally request the purchase or acquisition of fixed assets such as machinery, equipment, or property. This template captures essential details including asset description, cost estimates, justification for the acquisition, and approval signatures to ensure proper budgeting and compliance with procurement policies. Using this document streamlines the approval process and maintains accurate records for asset management and financial reporting.

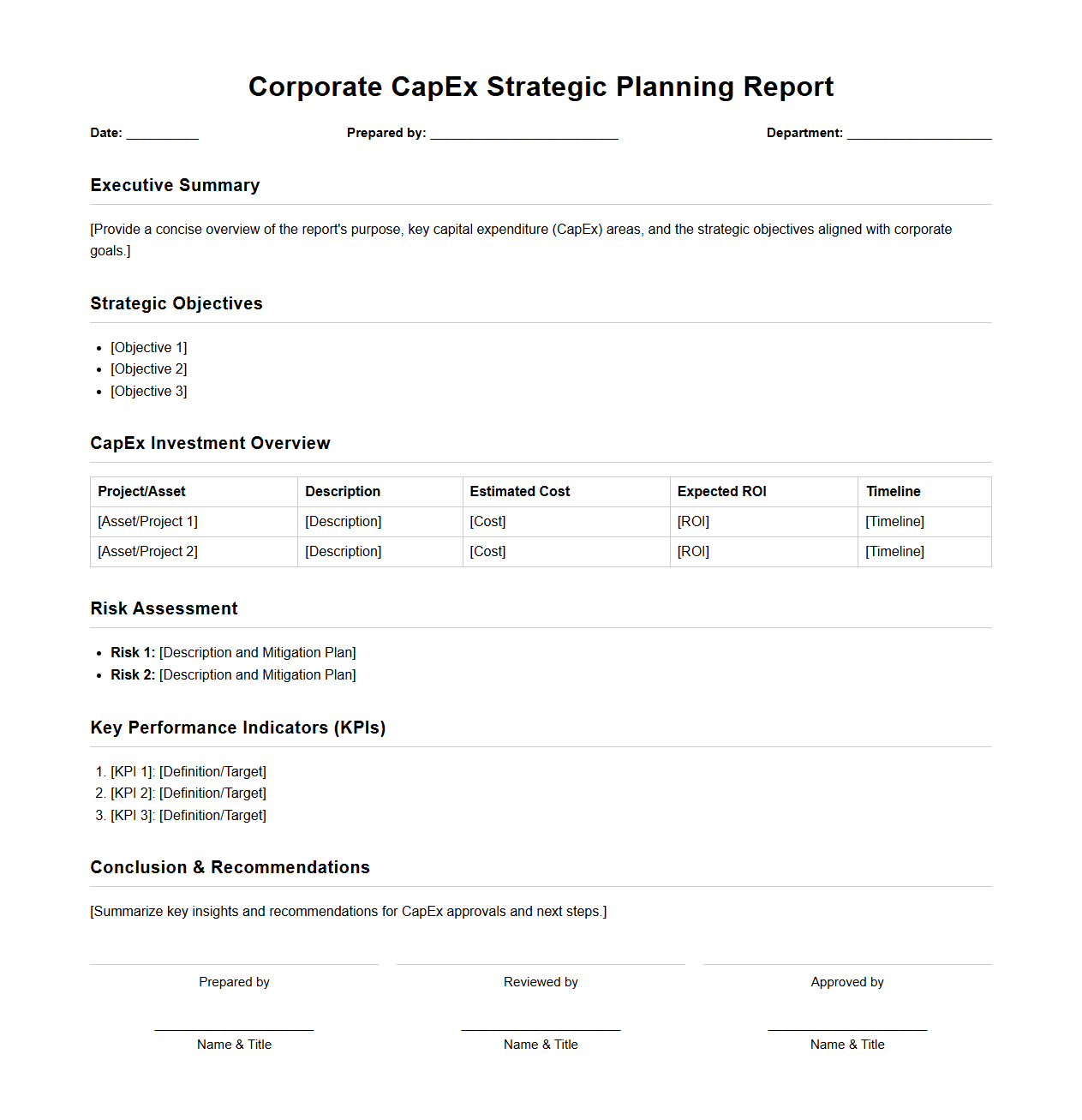

Corporate CapEx Strategic Planning Report

A

Corporate CapEx Strategic Planning Report is a comprehensive document outlining a company's projected capital expenditures to support long-term growth and operational efficiency. It details planned investments in fixed assets such as property, plant, and equipment, aligning spending priorities with organizational objectives and market conditions. This report serves as a vital tool for financial forecasting, resource allocation, and stakeholder communication.

What essential data should a Capital Expenditure Document include for technology infrastructure investments?

A Capital Expenditure (CapEx) Document for technology infrastructure must include detailed cost estimates, project timelines, and scope of work. It should outline hardware and software needs, integration plans, and future scalability options. Additionally, clear justifications for the expenditure and expected benefits must be presented.

How should risk assessment be structured within a CapEx document for multinational projects?

The risk assessment section should identify potential geopolitical, regulatory, and operational risks across all involved countries. It must include mitigation strategies, probability assessments, and impact analyses. This ensures comprehensive understanding and proactive management of multinational project challenges.

What supporting documents are required for environmental compliance in CapEx proposals?

Supporting documents must include environmental impact assessments, sustainability certifications, and regulatory permits. Detailed reports on waste management and energy consumption should also be attached. These ensure adherence to environmental laws and corporate social responsibility standards.

How do you justify ROI projections in a CapEx letter for intangible asset investments?

ROI projections should be supported by market analysis, competitive benchmarking, and measurable performance indicators. Clear linkage between the intangible asset's value and future revenue streams is essential. Incorporating sensitivity analysis adds robustness to the financial forecast.

What approval workflows are mandatory for CapEx documents in publicly traded companies?

Approval workflows typically involve multiple tiers, including department heads, finance committees, and the board of directors. Compliance with corporate governance policies and regulatory requirements is critical. Documentation of each approval step ensures transparency and accountability.