A Financial Statement Document Sample for Annual Reporting provides a clear framework for presenting an organization's financial performance and position over the fiscal year. This sample includes essential elements such as the balance sheet, income statement, cash flow statement, and notes, ensuring compliance with regulatory standards. Businesses use these documents to communicate transparency and fiscal responsibility to stakeholders.

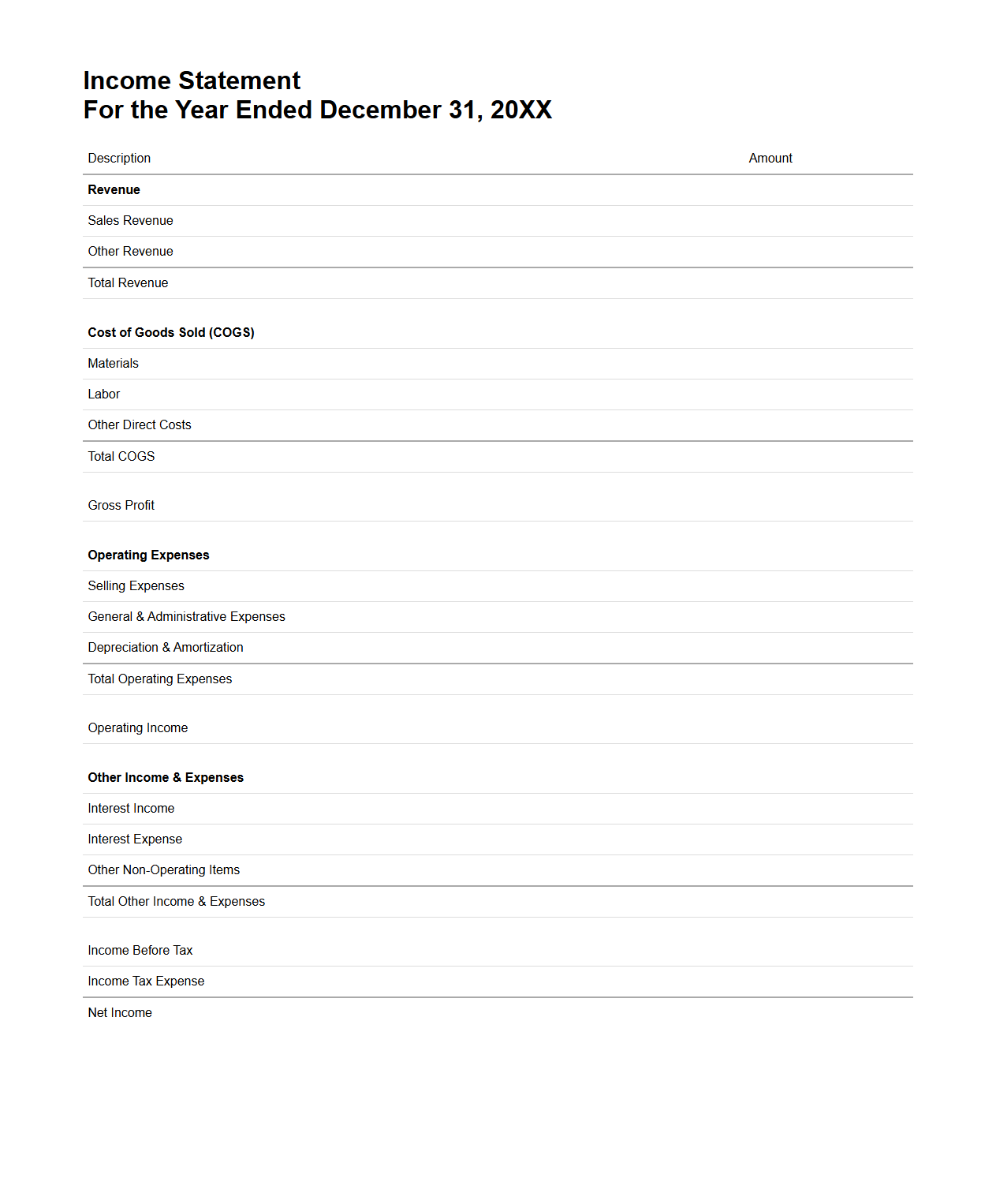

Income Statement Template for Annual Reporting

An

Income Statement Template for Annual Reporting is a structured document that helps businesses systematically record and present their revenues, expenses, and net profit or loss over a fiscal year. It provides a clear overview of financial performance, enabling stakeholders to assess profitability and operational efficiency. This template ensures consistency and accuracy in financial reporting by standardizing the layout for income and expense classifications.

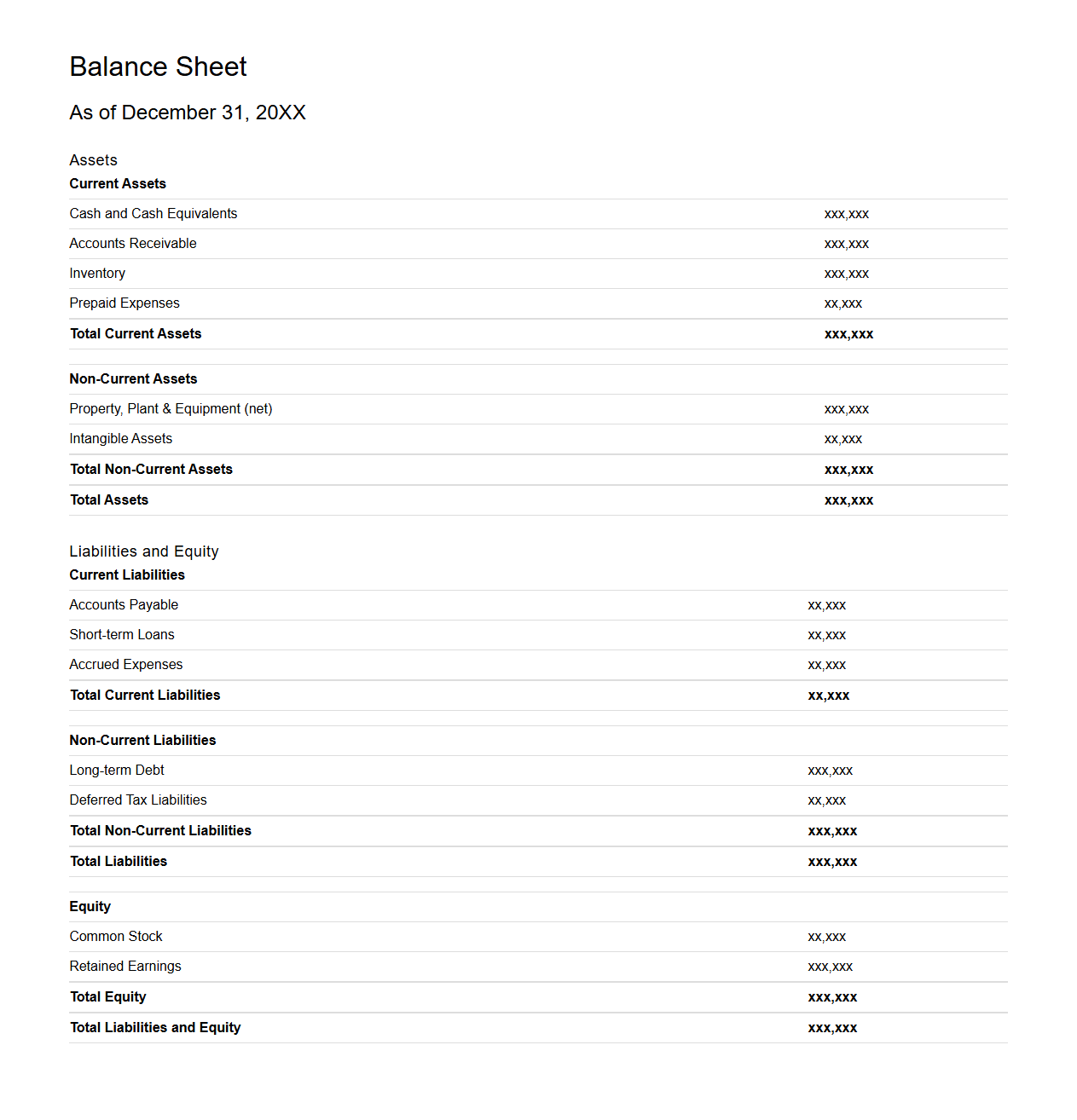

Balance Sheet Example for Year-End Financials

A

Balance Sheet Example for Year-End Financials document provides a detailed snapshot of a company's financial position at the close of the fiscal year by listing its assets, liabilities, and shareholders' equity. It helps stakeholders assess the organization's liquidity, solvency, and overall financial health. This example serves as a practical template for accurately preparing and analyzing year-end financial reports.

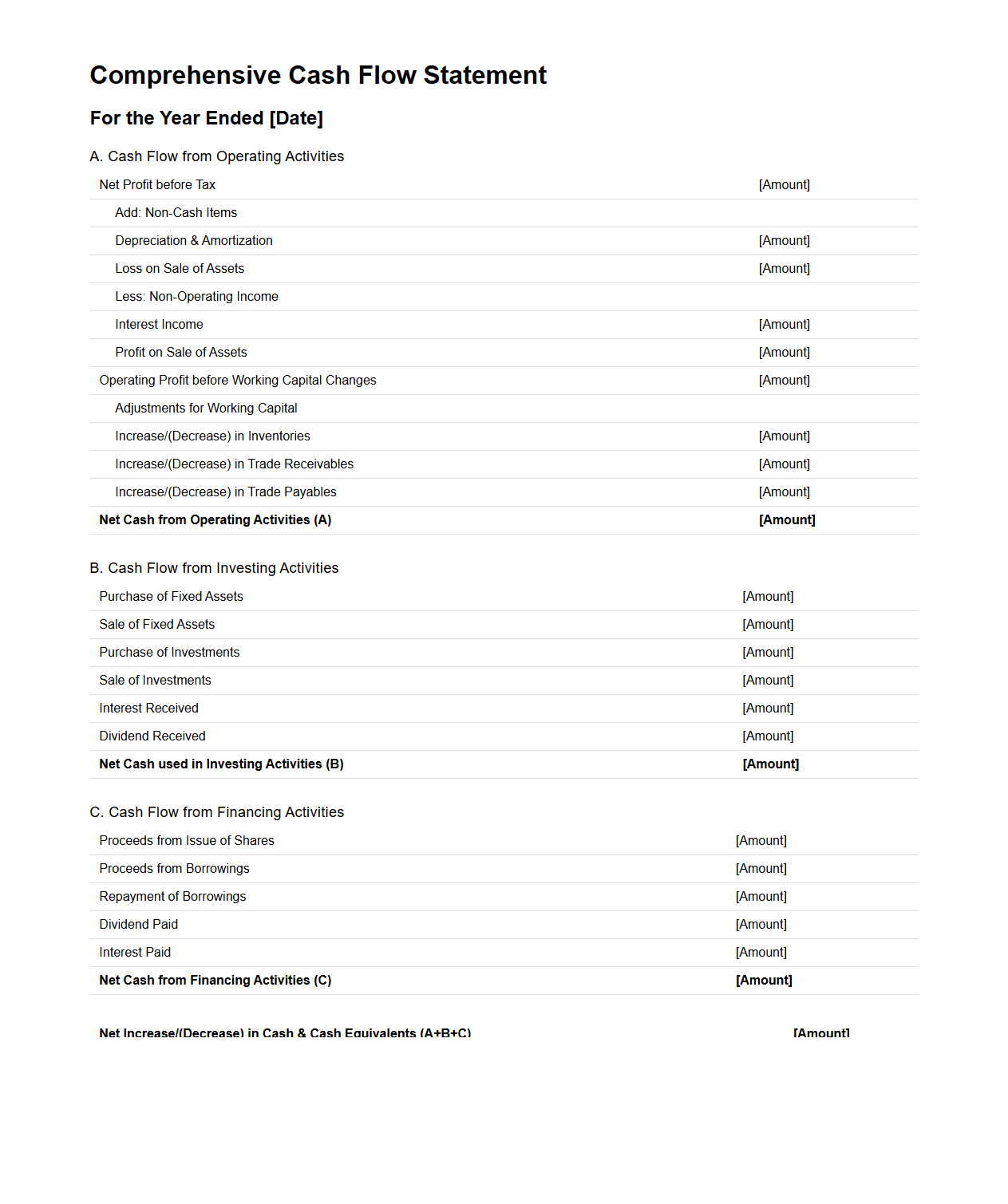

Comprehensive Cash Flow Statement Format

A

Comprehensive Cash Flow Statement Format document provides a detailed outline for recording and analyzing all cash inflows and outflows within a business over a specific period. It categorizes cash movements into operating, investing, and financing activities to help stakeholders evaluate liquidity, financial health, and cash management efficiency. This format is essential for accurate financial reporting and strategic decision-making.

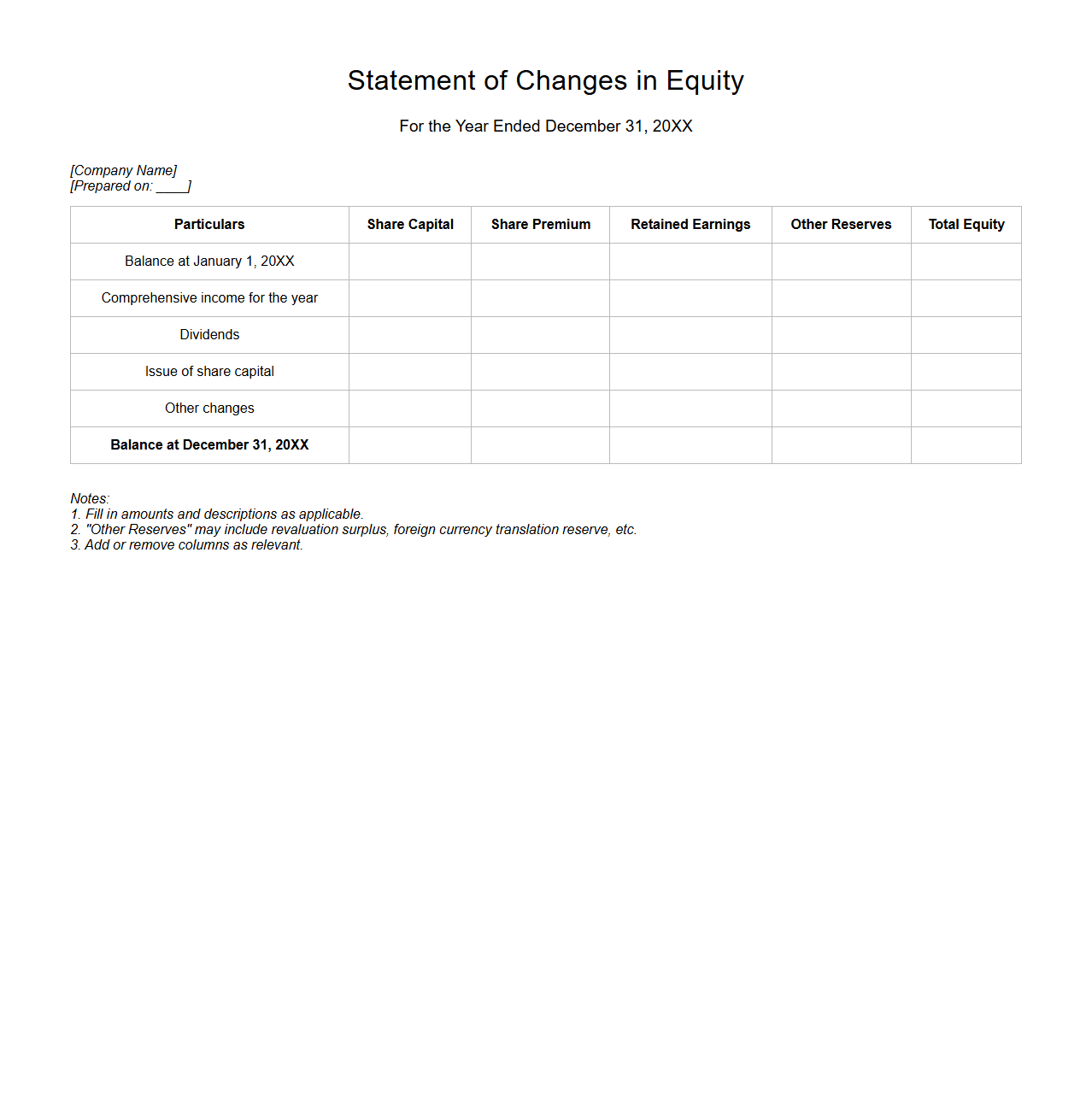

Statement of Changes in Equity Outline

The Statement of Changes in Equity Outline document provides a detailed summary of the movements in shareholders' equity during an accounting period, including profits, dividends, issue or repurchase of shares, and other comprehensive income. This financial statement is essential for understanding how equity components like retained earnings and share capital have fluctuated, offering transparency for investors and stakeholders. The

Statement of Changes in Equity enhances financial reporting by linking the income statement and balance sheet through equity variations.

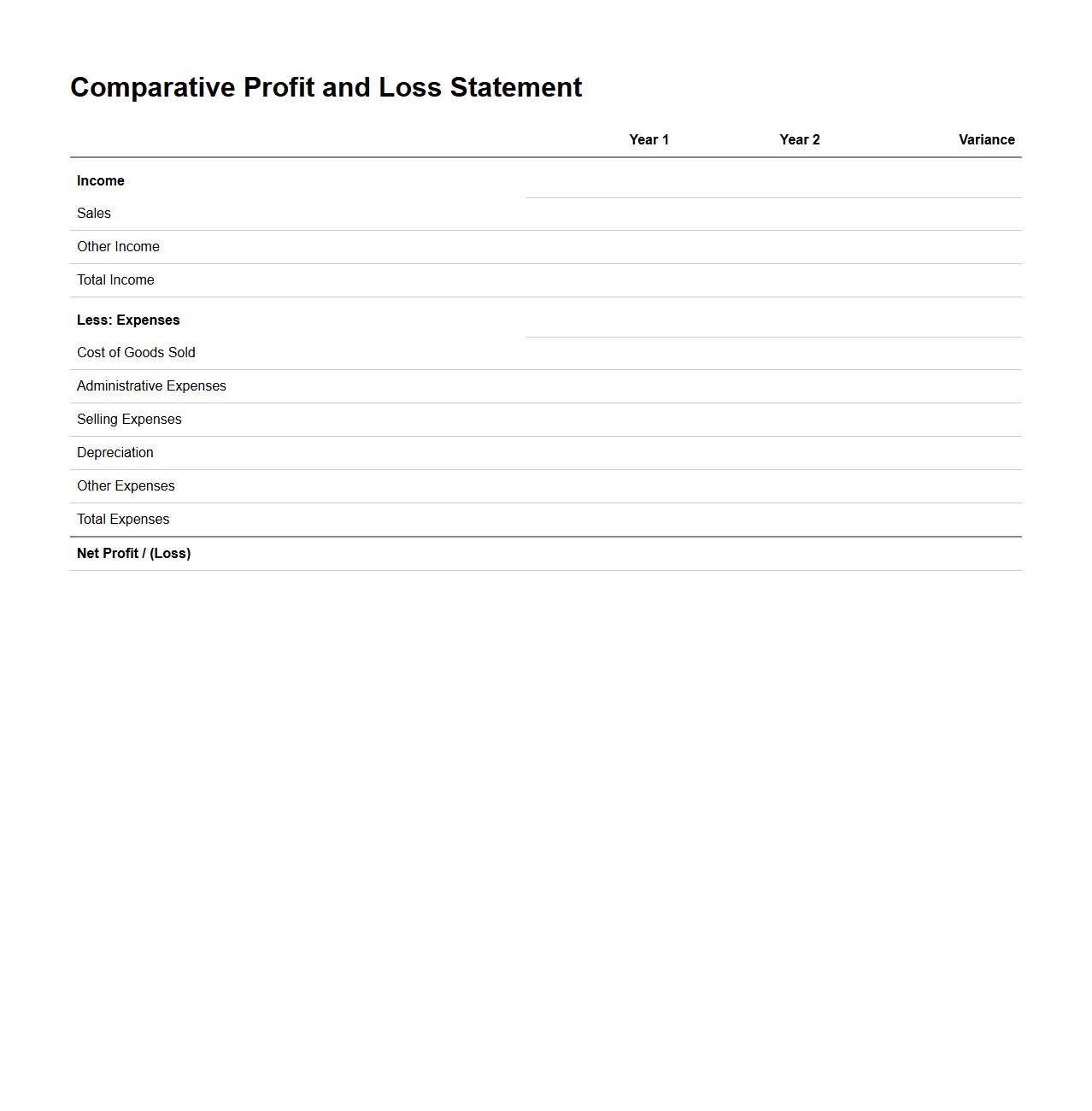

Comparative Profit and Loss Statement Sample

A

Comparative Profit and Loss Statement Sample document presents financial performance data of a business over multiple periods, allowing for easy analysis of trends and fluctuations in revenue, expenses, and net profit. This sample format highlights side-by-side comparisons, enabling stakeholders to assess growth, cost management, and profitability efficiently. It serves as a valuable tool for accountants, managers, and investors to make informed financial decisions and strategic plans.

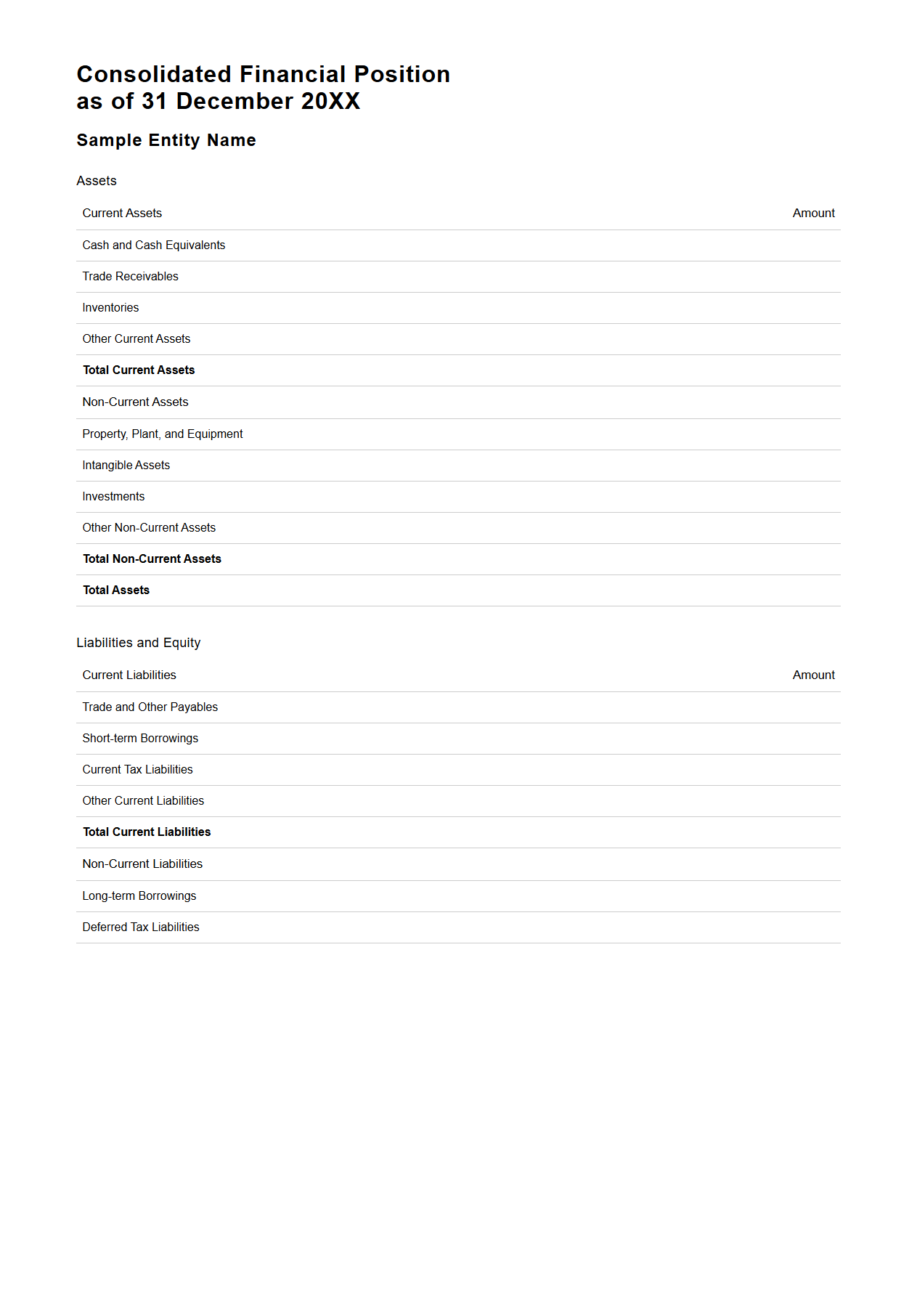

Consolidated Financial Position Report Layout

The

Consolidated Financial Position Report Layout document outlines the structured format and presentation standards for depicting a company's combined financial status, including assets, liabilities, and equity across all subsidiaries. It ensures uniformity in reporting, enabling stakeholders to accurately assess the overall financial health and stability of the entire corporate group. This document is critical for compliance with accounting standards and facilitates clear, comparable financial analysis.

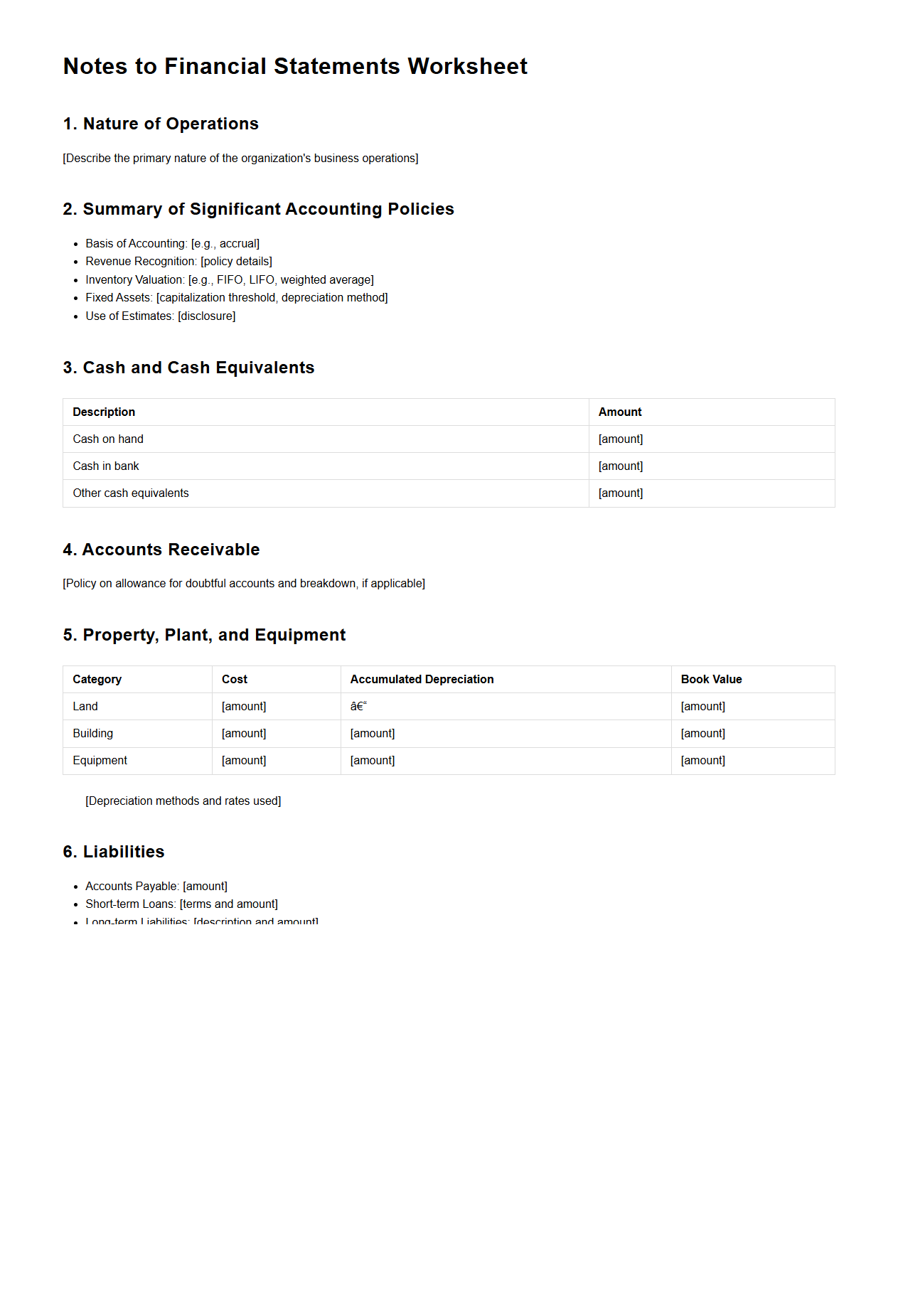

Notes to Financial Statements Worksheet

The

Notes to Financial Statements Worksheet document serves as a detailed guide that accompanies the primary financial statements, providing essential explanations and additional context to the reported figures. It includes information on accounting policies, contingencies, commitments, and disclosures required by regulatory standards such as GAAP or IFRS. This worksheet ensures transparency, enhances comprehension, and supports accurate interpretation of an organization's financial health.

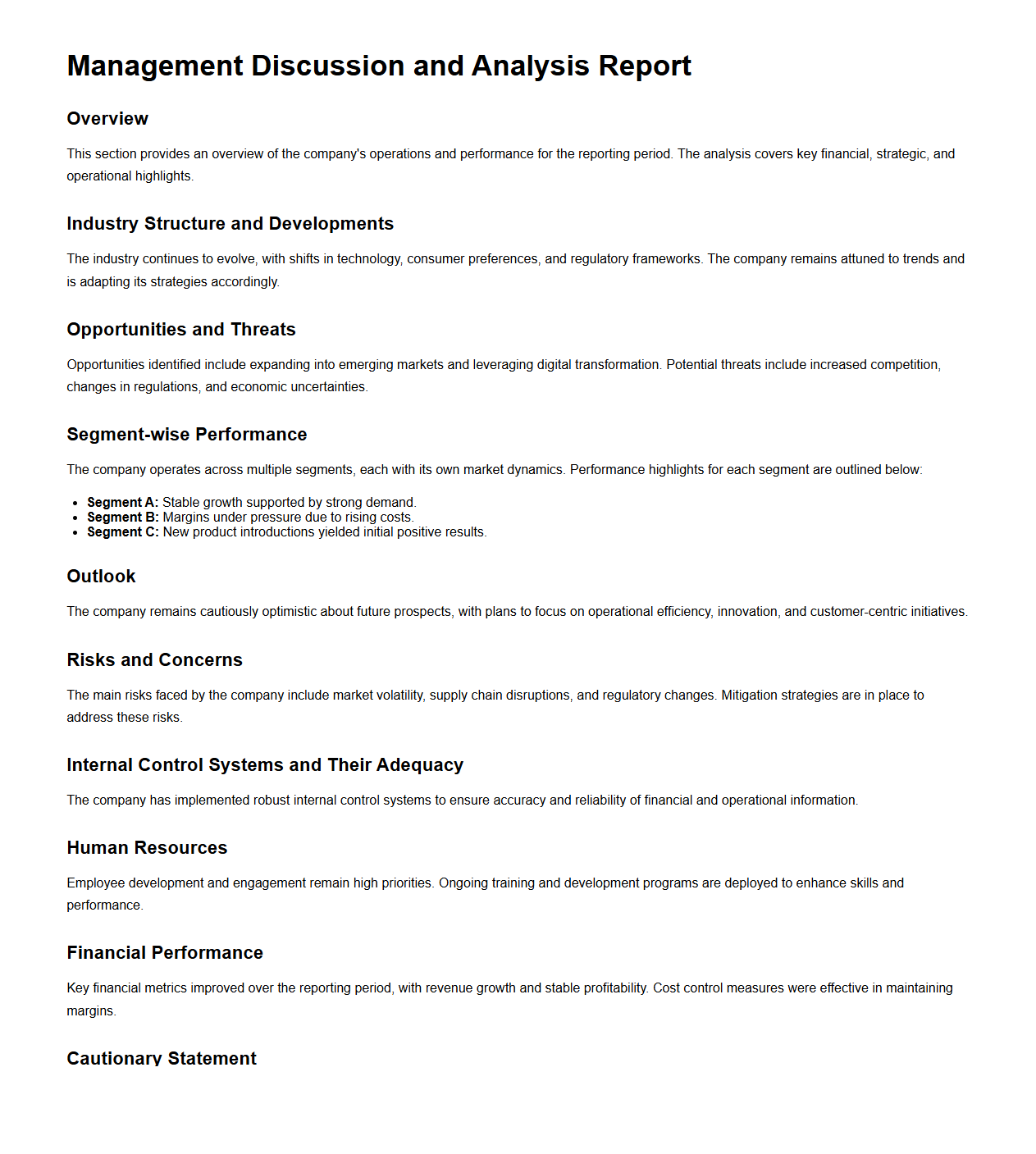

Management Discussion and Analysis Report

The

Management Discussion and Analysis (MD&A) Report provides a comprehensive overview of a company's financial performance, operational results, and strategic initiatives. It offers management's insights into factors influencing the business, including market conditions, risks, and future outlook. Investors and stakeholders use this narrative to better understand the numbers presented in financial statements and assess the company's ongoing viability.

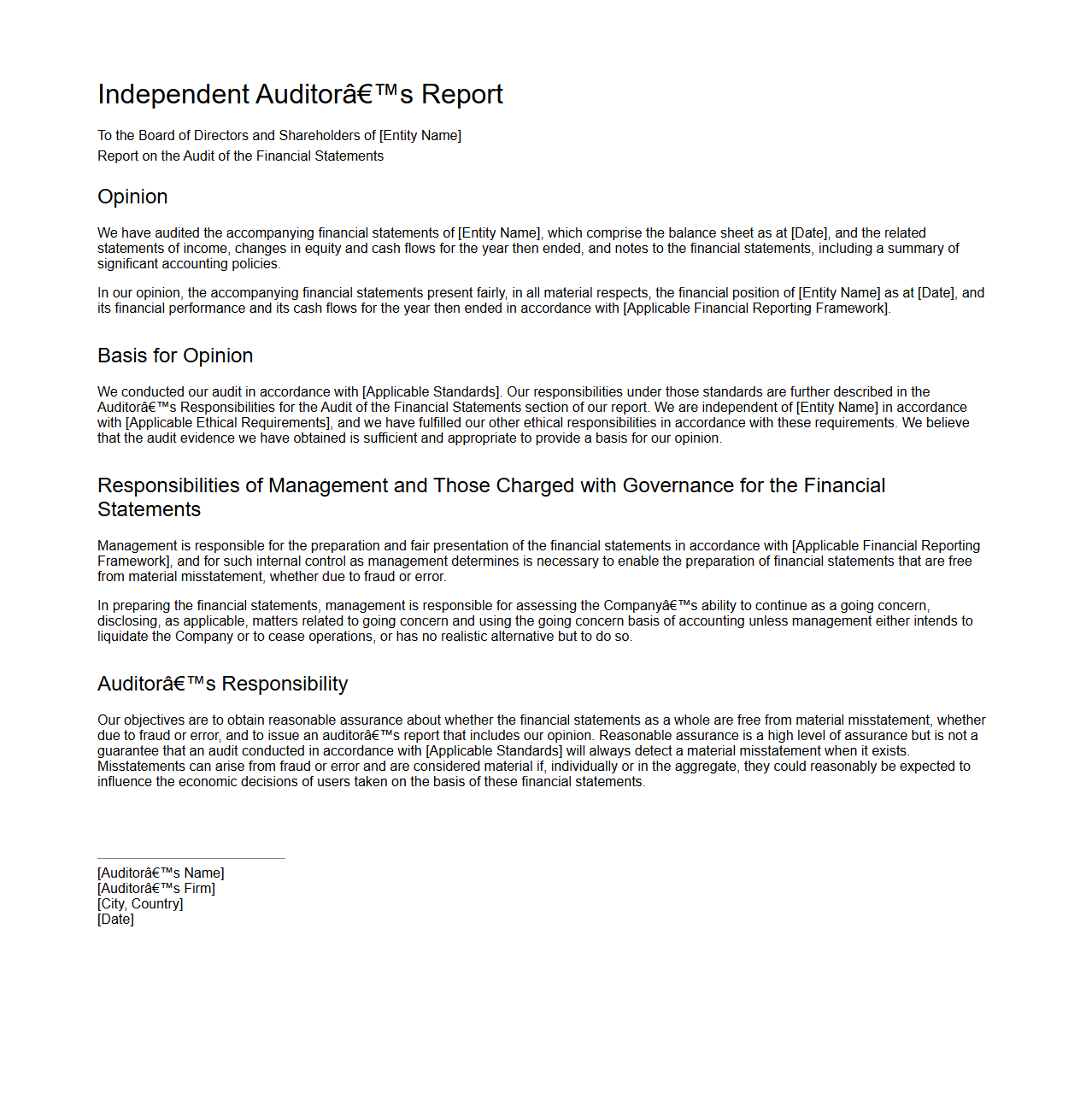

Auditor’s Financial Statement Opinion Template

An

Auditor's Financial Statement Opinion Template is a standardized document used by auditors to provide a formal, professional evaluation of an organization's financial statements. It outlines the auditor's opinion on whether the financial statements present a true and fair view in accordance with the applicable accounting framework. This template ensures consistency, clarity, and compliance with auditing standards while facilitating efficient communication of the audit findings to stakeholders.

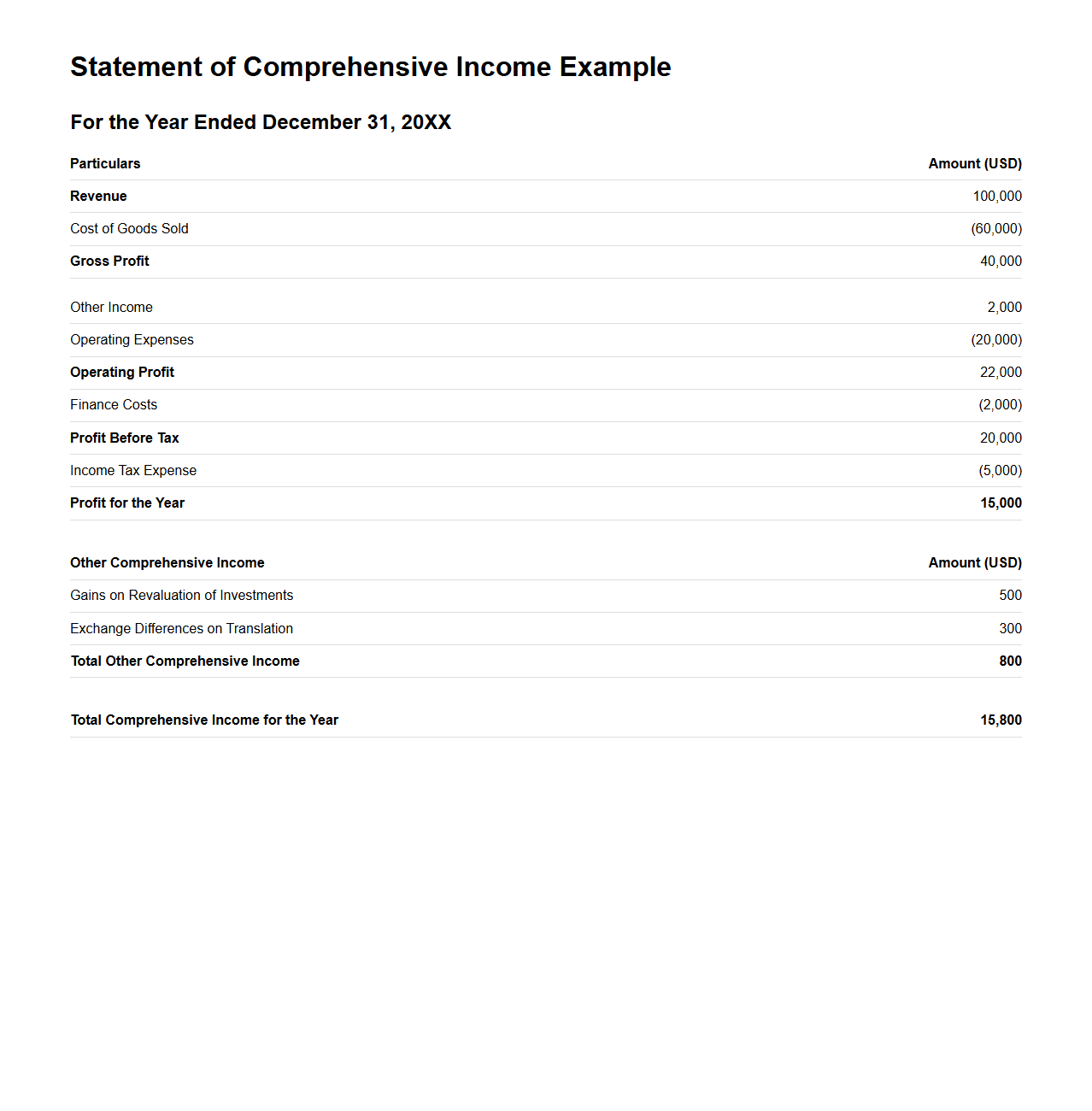

Statement of Comprehensive Income Example

A

Statement of Comprehensive Income example document illustrates a company's financial performance by detailing revenues, expenses, gains, and losses over a specific period. It includes items that are not typically reported in the income statement, such as foreign currency translation adjustments and unrealized gains or losses on certain investments. This document helps stakeholders assess overall profitability and changes in equity beyond net income alone.

What key compliance disclosures are required in the financial statement for annual reports?

The key compliance disclosures in financial statements include details on accounting policies, legal contingencies, and related party transactions. These disclosures ensure transparency and adherence to regulatory frameworks such as IFRS or GAAP. Accurate reporting of these elements is essential to maintain investor confidence and regulatory approval.

How do you verify the authenticity of third-party audit notes in the annual financial statement?

Verifying the authenticity of third-party audit notes involves cross-checking the auditor's credentials and audit firm reputation. Additionally, reviewing the audit report for consistency with financial data and confirmation of adherence to auditing standards is crucial. Digital verification methods such as secure access to audit reports can also enhance authenticity checks.

Which line items in the financial statement are most scrutinized by regulators during annual reporting?

Regulators most scrutinize line items such as revenue recognition, provisions, and asset valuations. These items pose significant risks for misstatement or manipulation and impact the overall financial health portrayal. Close examination ensures compliance with accounting standards and protects stakeholder interests.

What supporting documents are essential to append with the annual financial statement for transparency?

Essential supporting documents include audit reports, notes to the accounts, management discussion and analysis, and schedules of fixed assets and liabilities. These documents provide additional context and justification for reported figures, fostering transparency. Comprehensive documentation supports regulatory reviews and boosts investor confidence.

How should contingent liabilities be documented in annual financial statement reports?

Contingent liabilities must be clearly disclosed in the notes section of the financial statements with detailed explanations. The nature, timing, and potential financial impact of these liabilities should be articulated to inform stakeholders of possible risks. Proper documentation ensures compliance with accounting standards and aids in risk assessment.