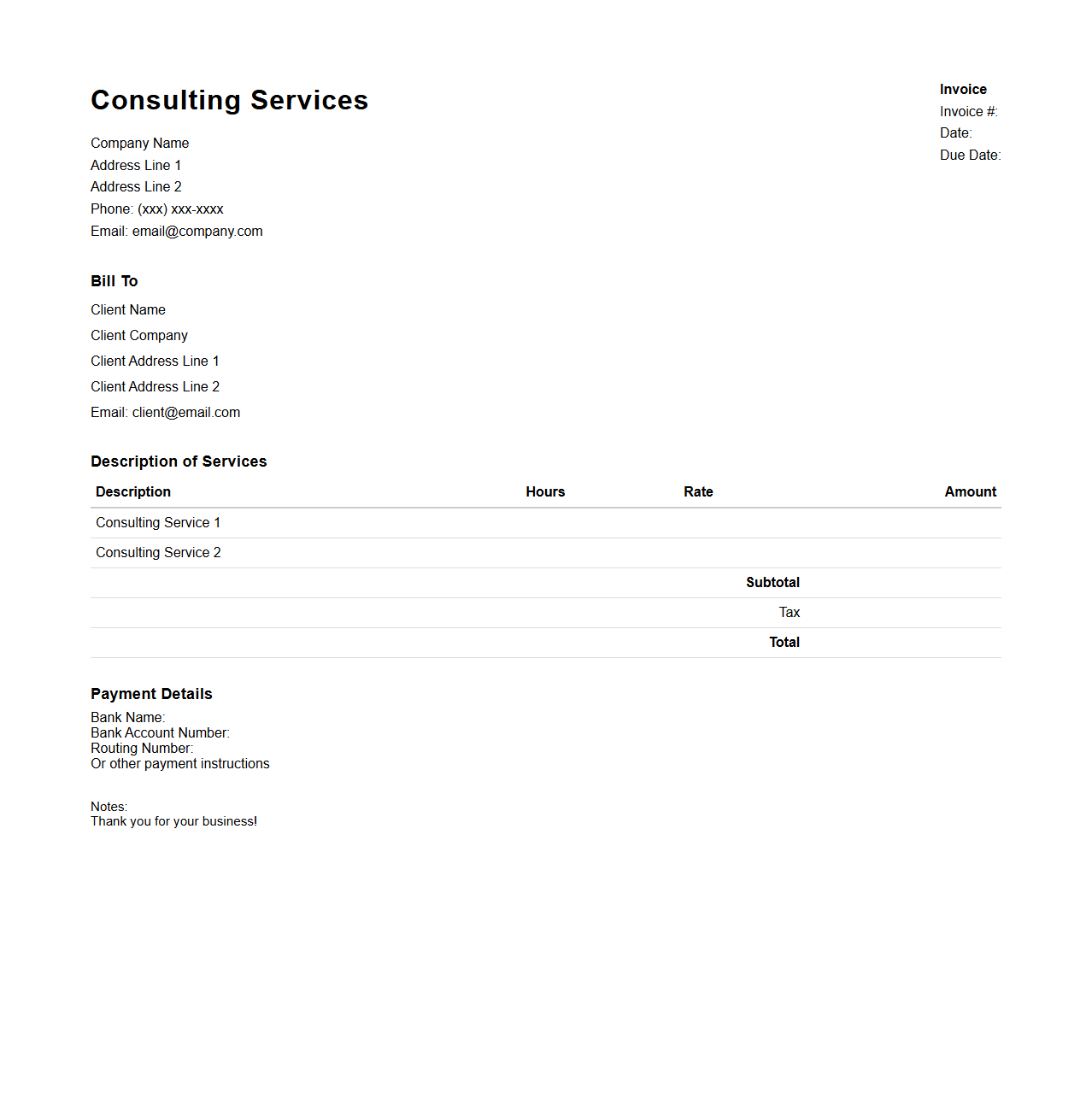

Consulting Services Invoice Template

A

Consulting Services Invoice Template is a professional document designed to streamline the billing process for consulting professionals by itemizing services rendered, hours worked, and payment terms. This template ensures clarity and accuracy in financial transactions, helping consultants maintain organized records and receive timely payments. It typically includes essential details such as client information, service descriptions, rates, invoice number, and due date.

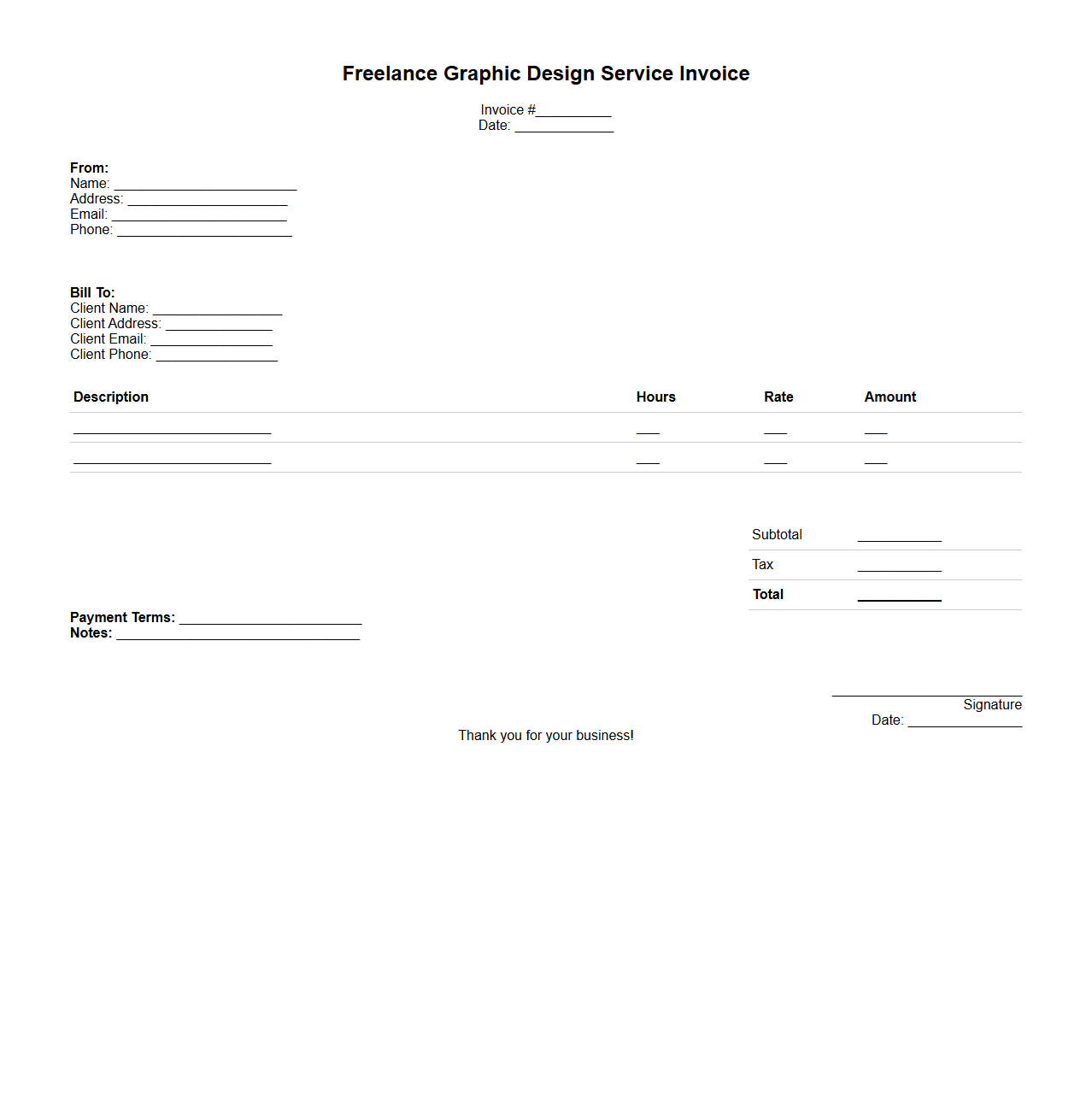

Freelance Graphic Design Service Invoice

A

Freelance Graphic Design Service Invoice document is a formal billing statement issued by freelance graphic designers to clients, detailing the services provided, hours worked, and payment amount due. It typically includes essential information such as the designer's contact details, project description, rates, payment terms, and invoice date. This document ensures clear communication of costs, facilitates timely payments, and serves as a professional record for both parties.

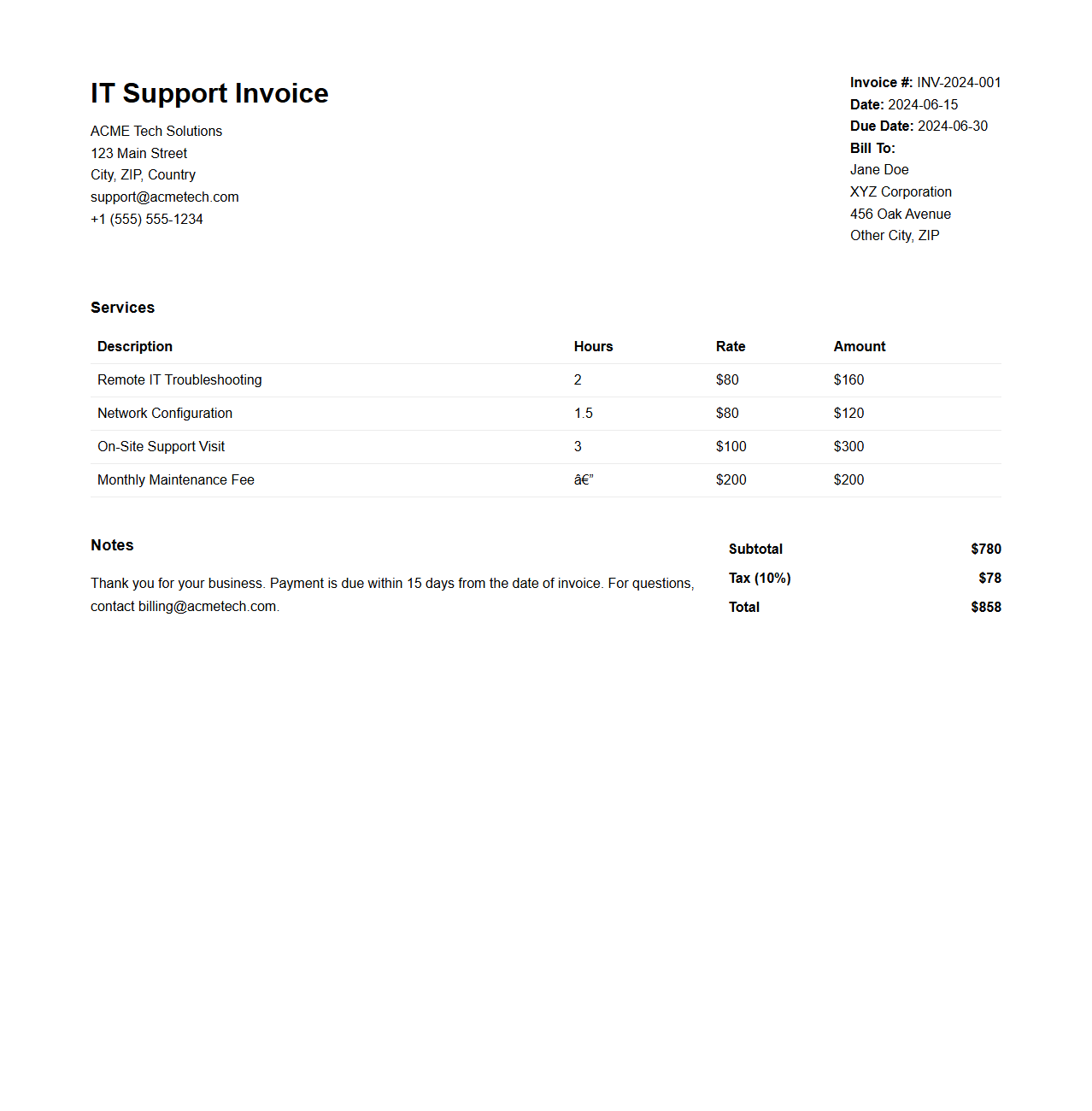

IT Support Billing Invoice Example

An

IT Support Billing Invoice Example document outlines the detailed charges for services provided by an IT support company, including labor, materials, and any additional fees. It serves as a formal request for payment, specifying the scope of work, billing rates, service dates, and payment terms. This document is essential for accurate financial tracking and clear communication between IT service providers and clients.

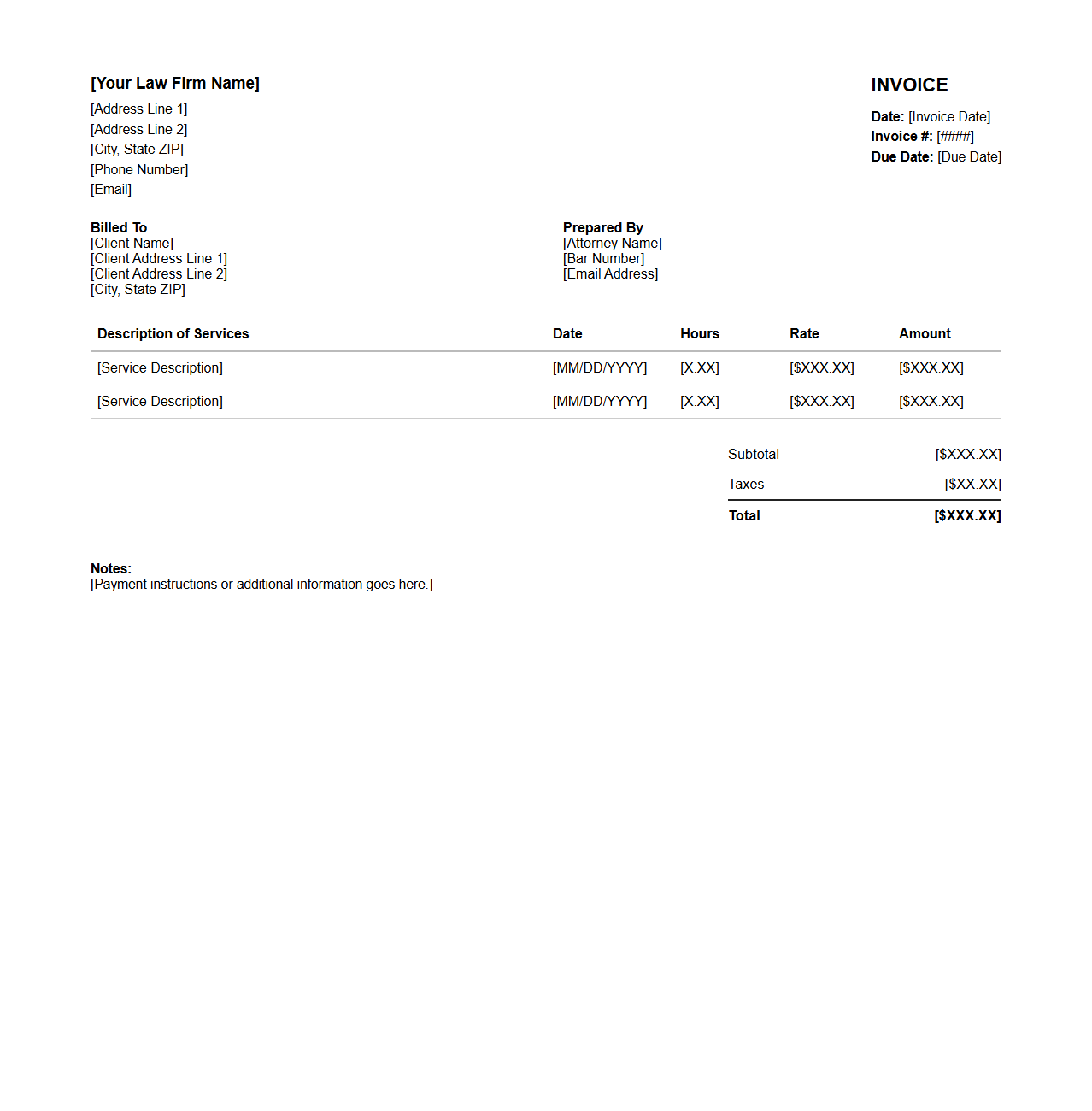

Legal Services Professional Invoice

A

Legal Services Professional Invoice document itemizes fees and charges for legal work performed, detailing client information, case specifics, billing rates, hours worked, and payment terms. This invoice ensures transparent communication between legal professionals and clients regarding costs incurred for services such as consultations, court representations, and document preparation. Its accurate and itemized format supports efficient accounting, record-keeping, and timely payment processing for law firms and legal practitioners.

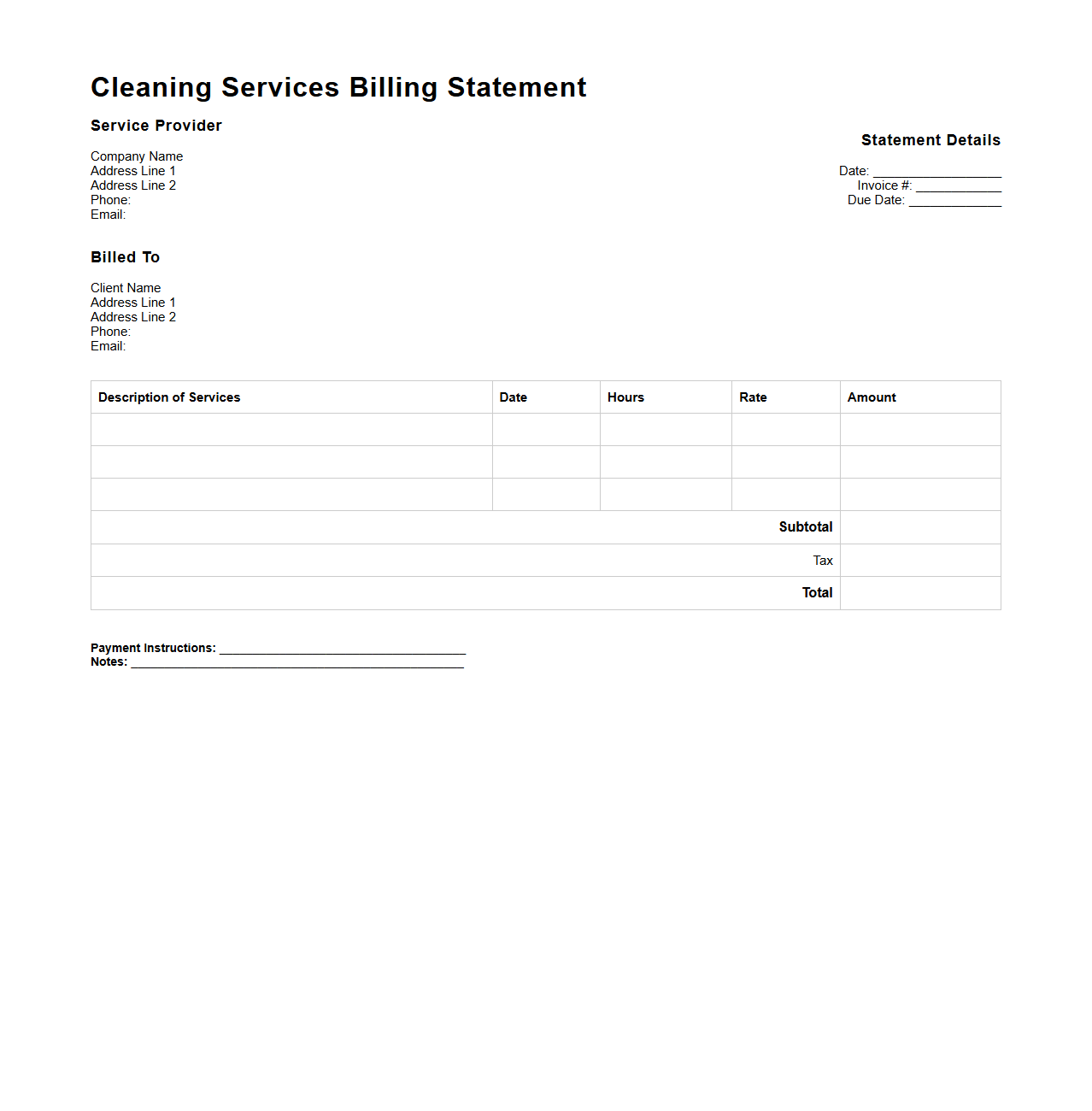

Cleaning Services Billing Statement

A

Cleaning Services Billing Statement document details the charges for cleaning tasks performed, including dates, types of services, and their respective costs. It serves as an official record for both service providers and clients to track payments and outstanding balances. This statement ensures transparency and facilitates accurate financial management in cleaning service transactions.

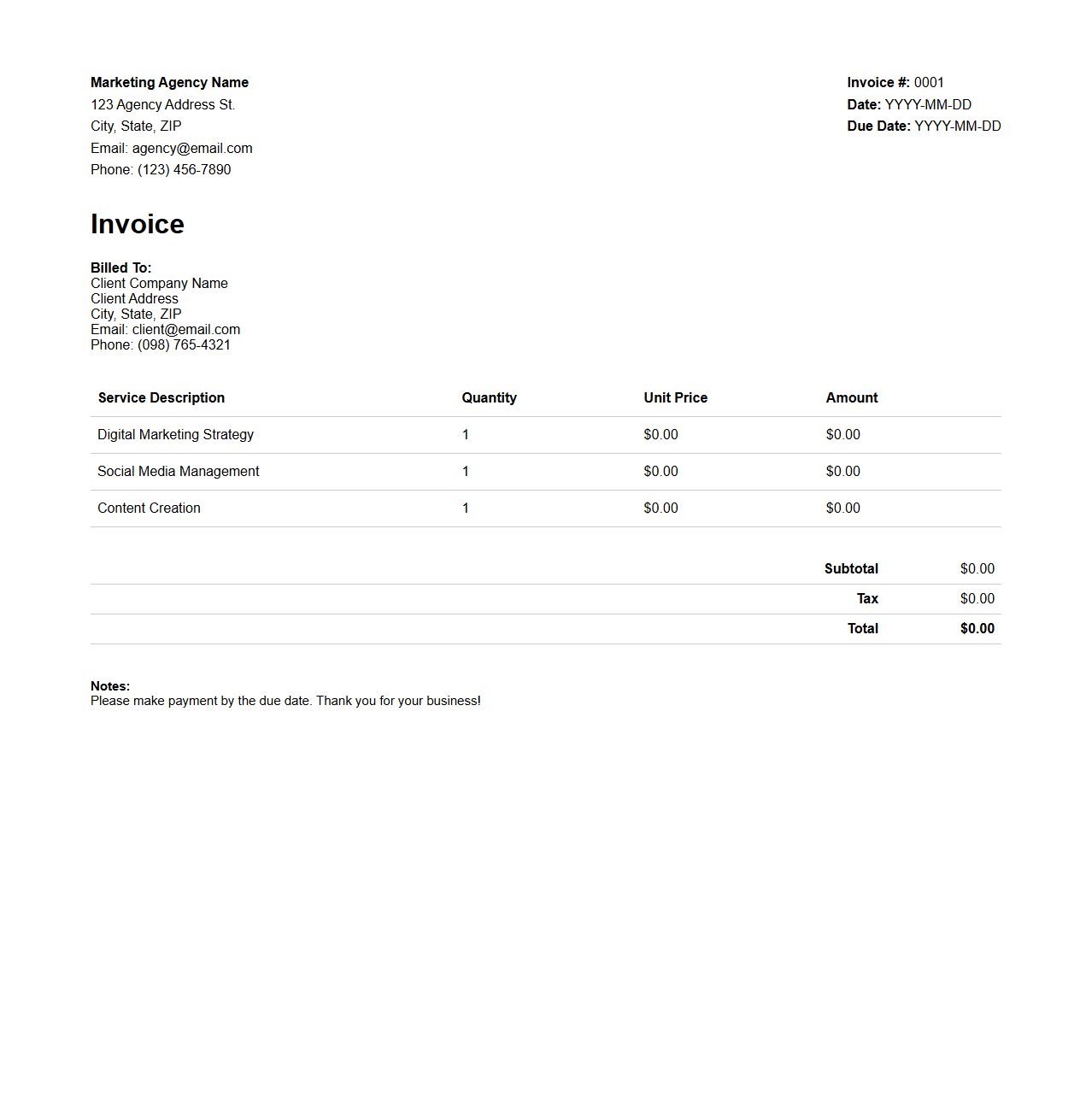

Marketing Agency Services Invoice

A

Marketing Agency Services Invoice document itemizes the costs associated with services provided by a marketing agency, including campaign management, content creation, SEO optimization, and advertising expenses. It serves as a formal request for payment, detailing service descriptions, quantities, rates, taxes, and the total amount due. This invoice ensures transparency between the agency and client, facilitating accurate financial records and timely transactions.

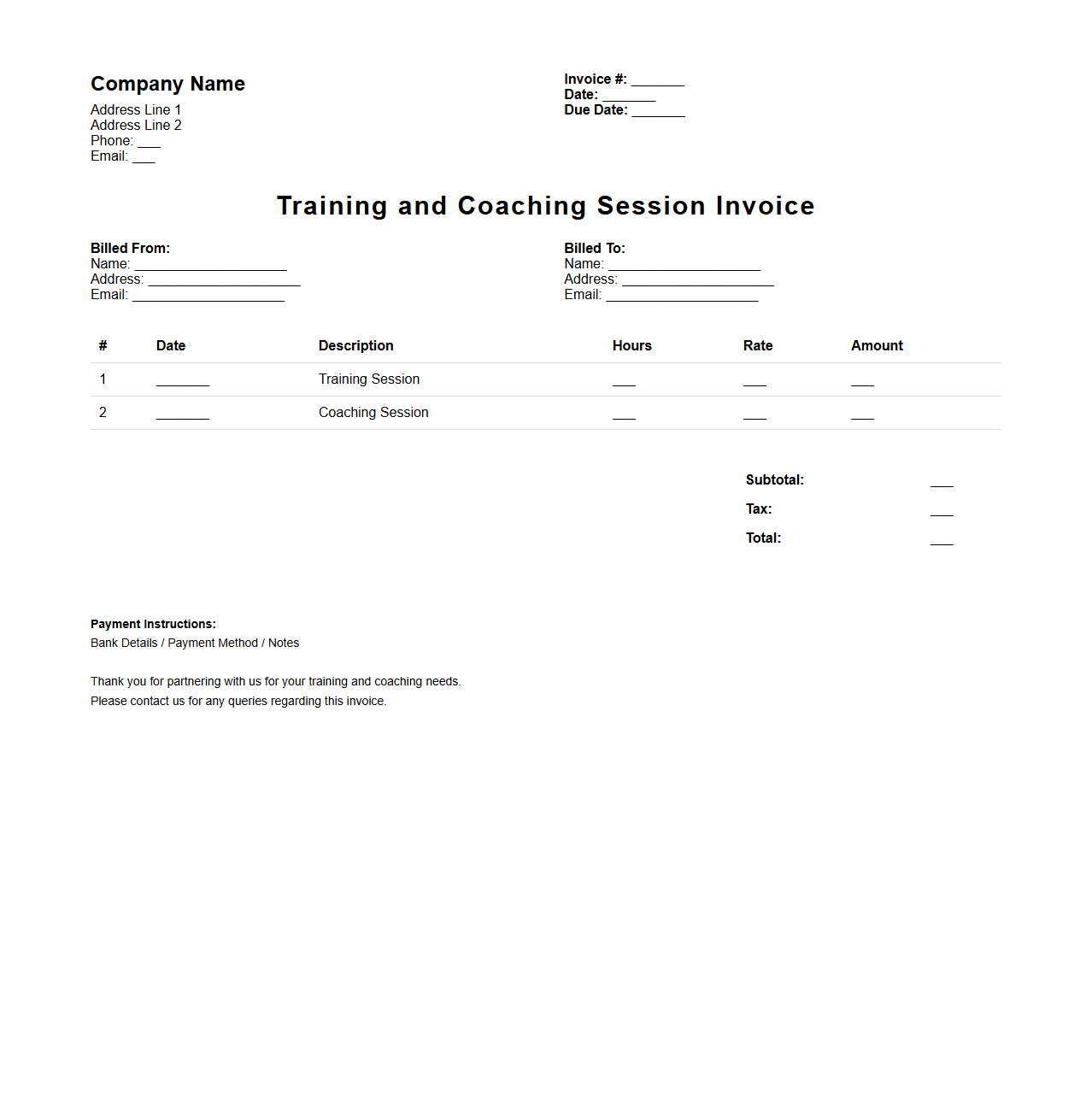

Training and Coaching Session Invoice

A

Training and Coaching Session Invoice document serves as a formal request for payment issued by a trainer or coach upon completion of their services. It details essential information such as the session dates, hours provided, hourly or package rates, and total cost due. This invoice ensures clear financial communication between the service provider and the client, facilitating timely and accurate payment processing.

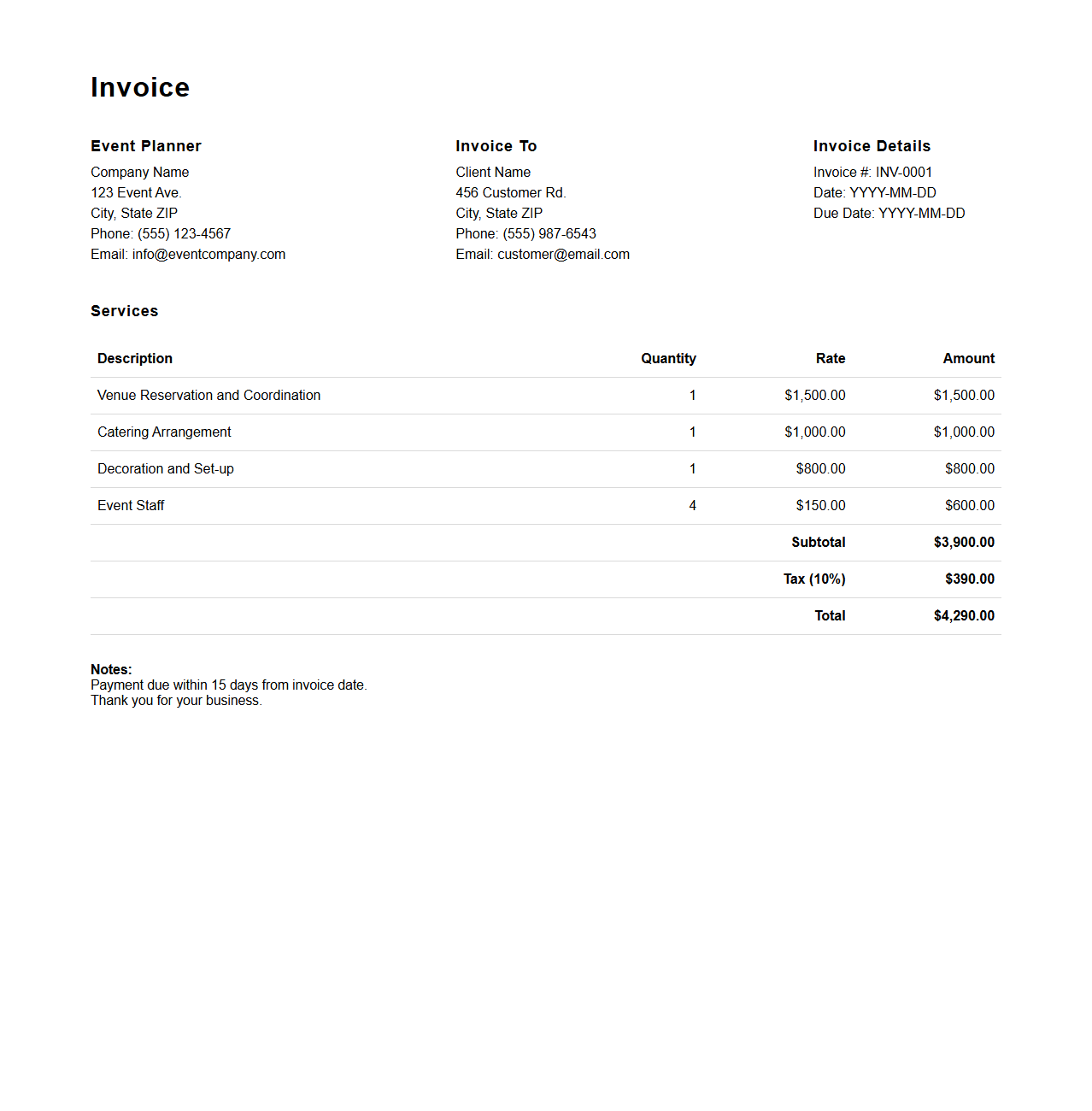

Event Planning Service Charge Invoice

An

Event Planning Service Charge Invoice document itemizes the costs associated with organizing and managing an event, including venue fees, catering, entertainment, and staffing expenses. This invoice serves as a formal request for payment, detailing each service provided along with corresponding charges and payment terms. It ensures transparency between the event planner and client, facilitating clear financial communication and record-keeping.

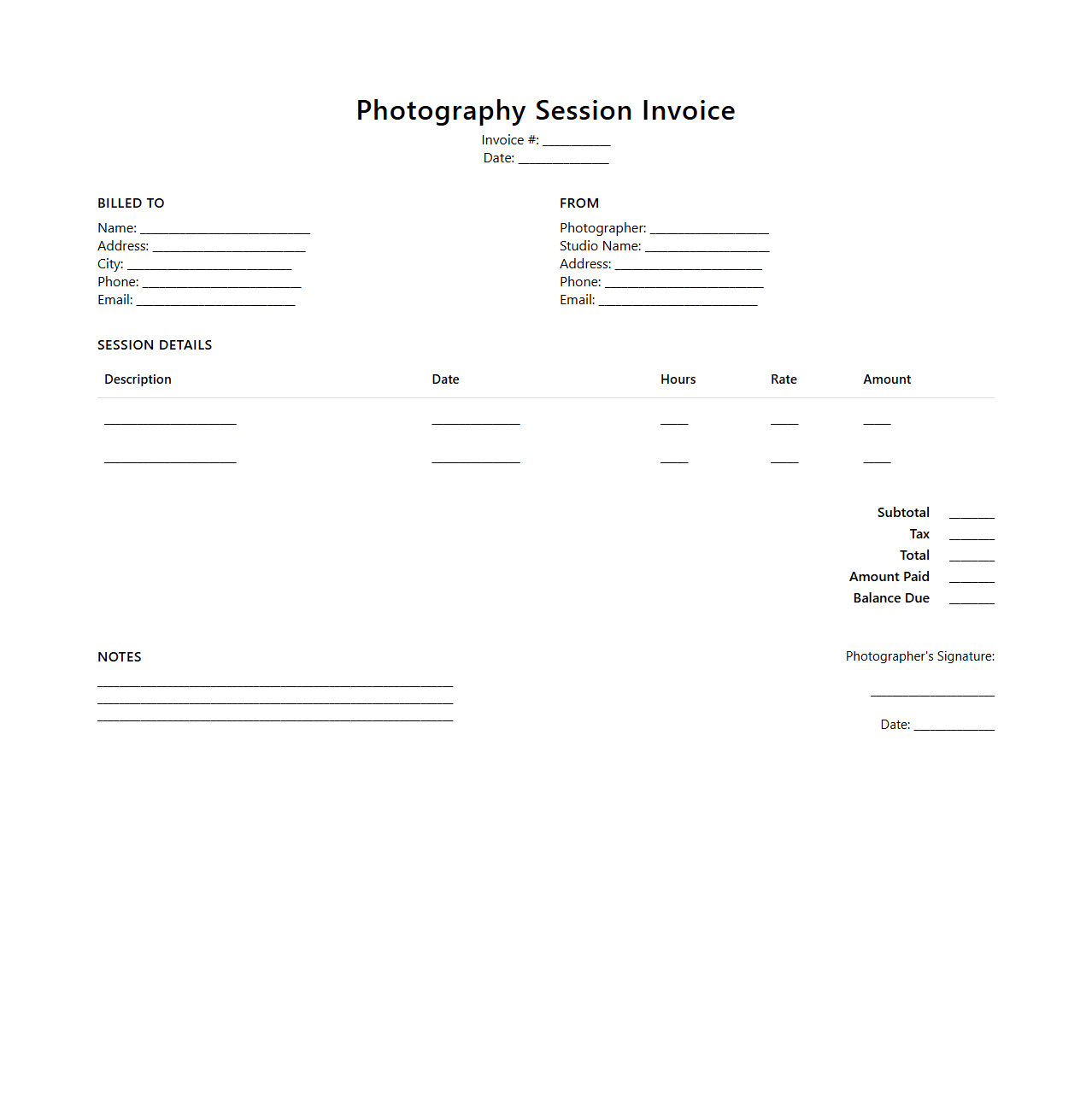

Photography Session Billing Invoice

A

Photography Session Billing Invoice document itemizes the costs associated with a photography session, including fees for hours worked, equipment used, and any extras like prints or digital files. It provides a clear transaction record for both the photographer and client, outlining payment terms, due dates, and contact details. This invoice ensures professional financial management and facilitates timely payments for photography services rendered.

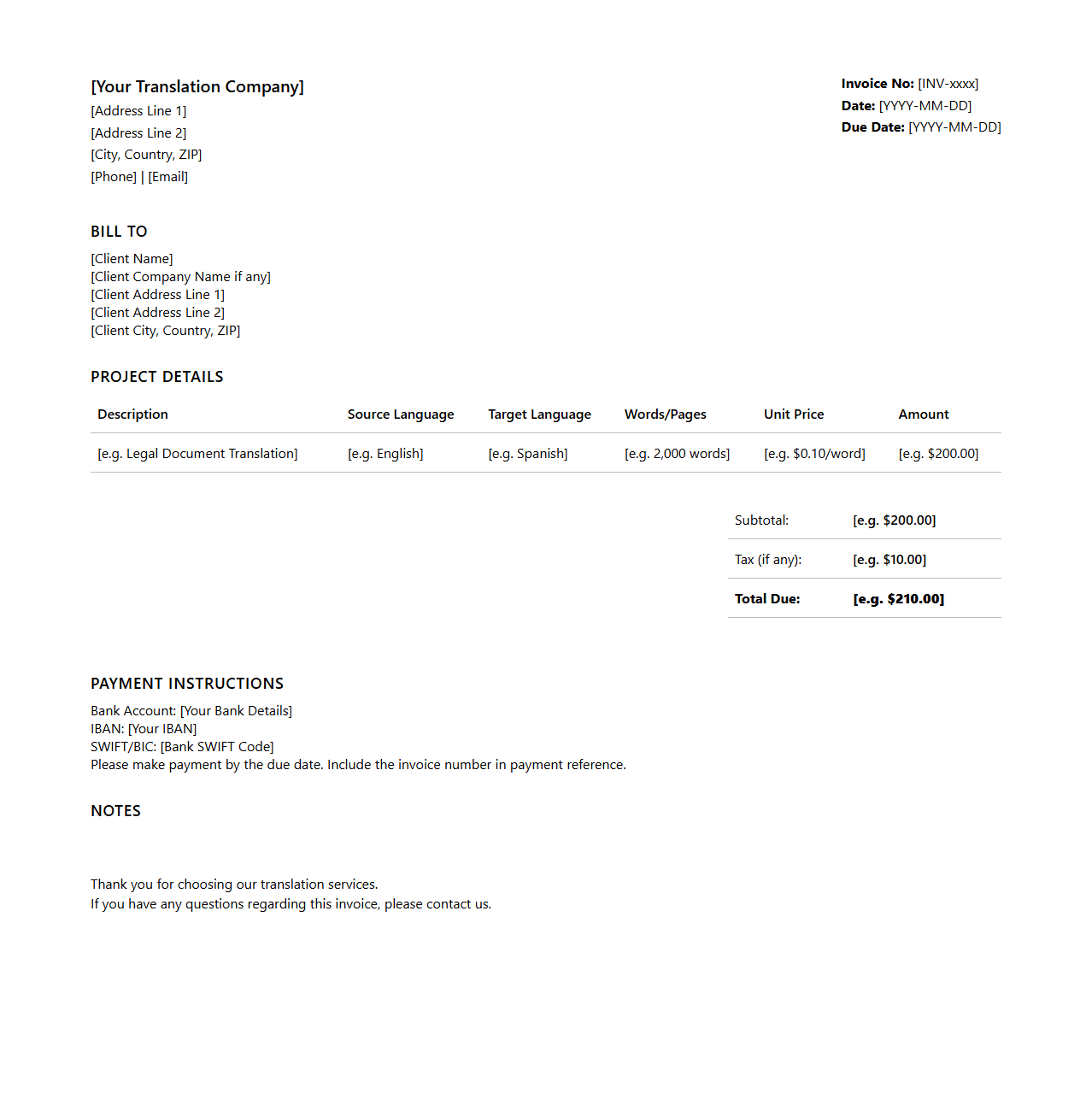

Translation Services Payment Invoice

A

Translation Services Payment Invoice document details the financial transaction between a client and a translation service provider, listing services rendered, rates, and total amount due. It includes essential information such as invoice number, payment terms, client and vendor contact details, and a breakdown of costs by language pair or project type. This document ensures transparent billing and facilitates timely payment processing for professional translation services.

What legal components must be included in a service invoice document?

A service invoice document must include the full legal name and contact details of both the service provider and the client. It should clearly state the description of services rendered, the date of service, and the total amount due including applicable taxes. Additionally, the invoice must feature a unique invoice number, payment terms, and any relevant tax identification numbers to comply with legal standards.

How can you ensure invoice numbering is compliant with local tax regulations?

To ensure invoice numbering complies with local tax regulations, use a sequential and non-repetitive numbering system. It is important to align your invoice numbering format with specific requirements such as prefixes or date codes mandated by tax authorities. Regular audits and software controls can help maintain consistency and legality in invoice numbering processes.

What are common errors found in service payment invoices that delay processing?

Common errors in service payment invoices include incorrect or missing invoice numbers, inaccurate calculation of tax amounts, and incomplete client or service provider information. These mistakes often cause delays as they require clarification or re-issuance before payments can be processed. Ensuring accuracy and completeness at the time of invoice creation minimizes processing delays significantly.

How can digital signature integration be used on electronic service invoices?

Integrating a digital signature into electronic service invoices enhances authentication and prevents tampering. This technology enables verifiable identification of the sender and ensures the document's integrity throughout the transaction process. Secure digital signature solutions comply with legal standards, making electronic invoicing both trustworthy and efficient.

What backup protocols are recommended for storing invoice documents securely?

Recommended backup protocols for invoice documents include regular automated backups to secure, encrypted cloud storage platforms. Additionally, maintaining local offline backups with restricted access provides an extra layer of security against data loss. Implementing version control and routine backup testing ensures invoice data remains intact and recoverable when needed.