A Budget Planning Document Sample for Small Business helps entrepreneurs outline their expected income, expenses, and financial goals clearly. This template ensures effective allocation of resources to maintain cash flow and identify potential cost-saving opportunities. Using a structured budget plan promotes better decision-making and financial stability for small enterprises.

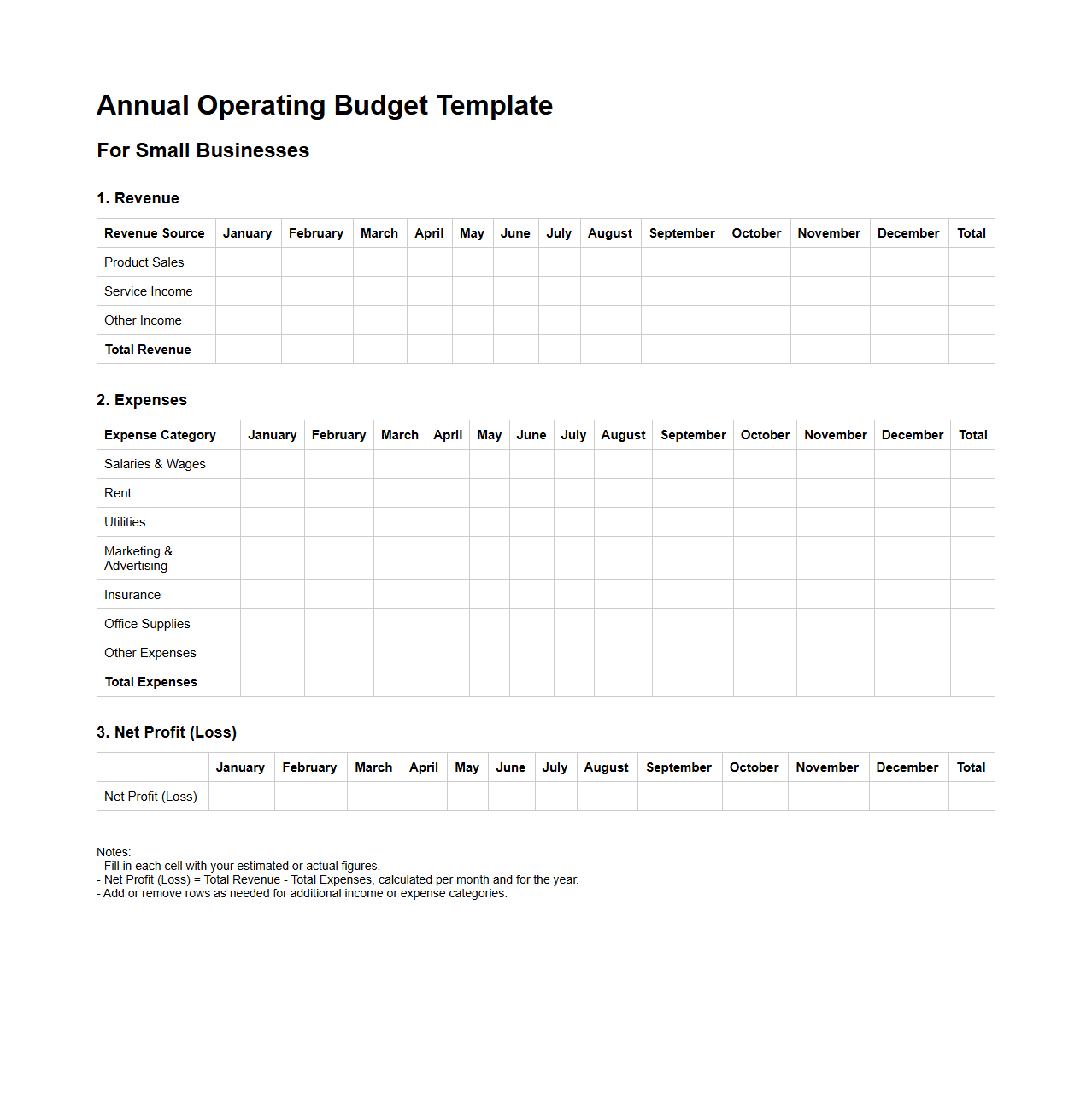

Annual Operating Budget Template for Small Businesses

The

Annual Operating Budget Template for Small Businesses is a structured financial planning tool designed to help small enterprises outline their projected revenues and expenses over a one-year period. This document facilitates accurate cash flow management, resource allocation, and cost control by providing clear categories for income sources and operational costs. Utilizing this template enables small business owners to make informed financial decisions, monitor performance, and support strategic growth objectives.

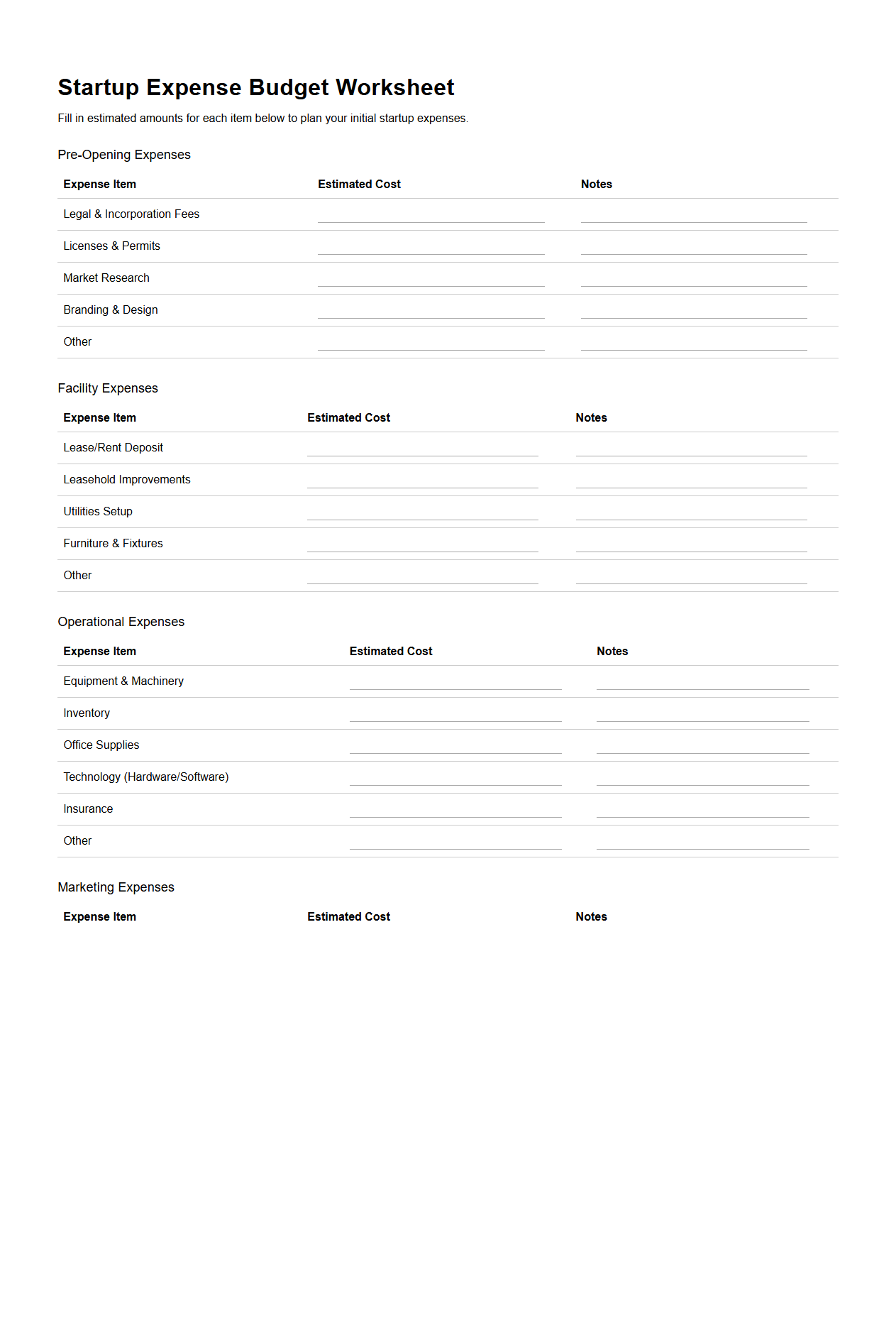

Startup Expense Budget Worksheet for Entrepreneurs

A

Startup Expense Budget Worksheet for entrepreneurs is a detailed financial tool designed to estimate and track the initial costs involved in launching a new business. It includes categories such as equipment, legal fees, marketing expenses, and operating costs, helping entrepreneurs allocate funds effectively and avoid unexpected financial shortfalls. This worksheet serves as a critical guide for budgeting and securing funding from investors or lenders.

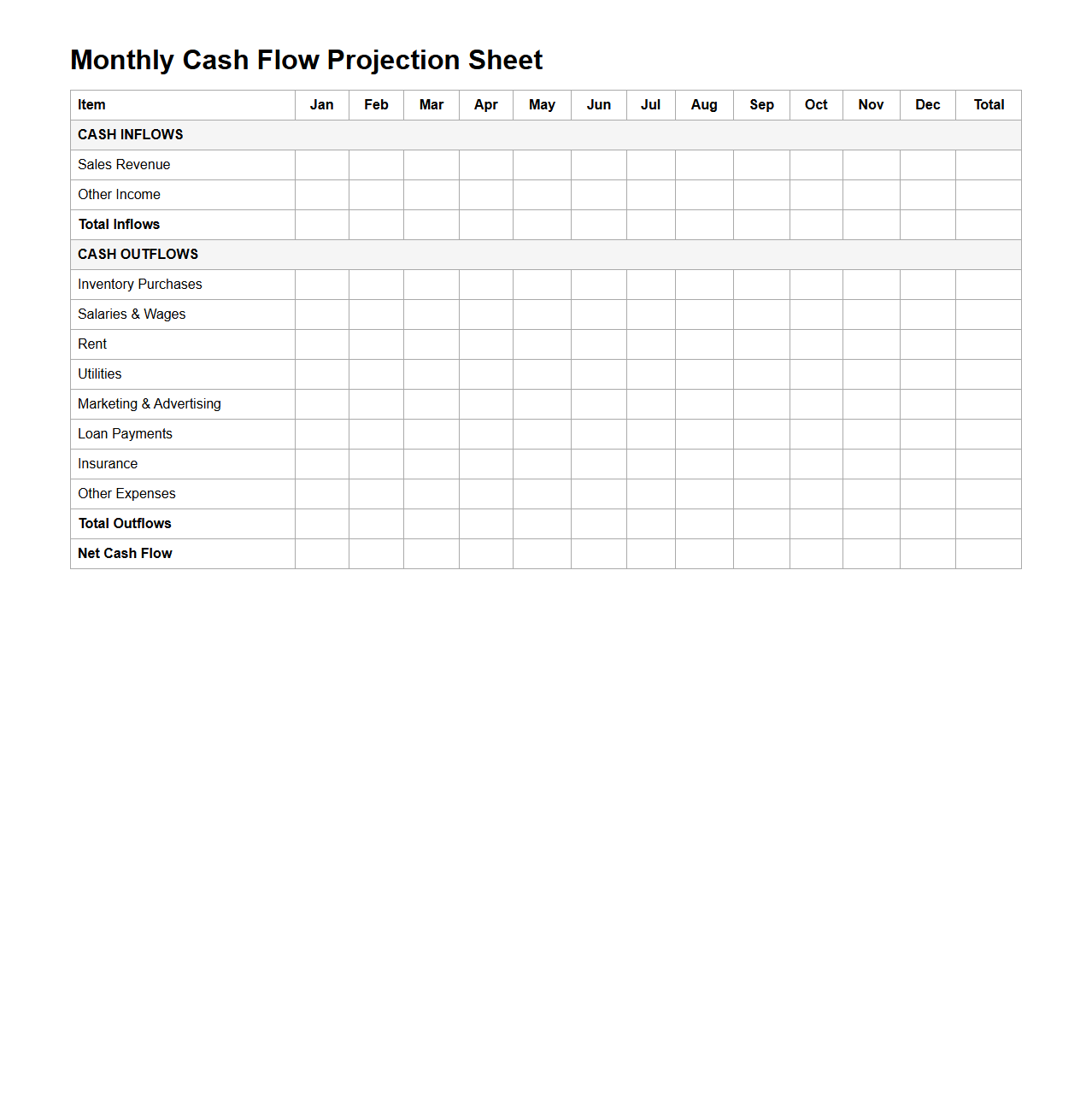

Monthly Cash Flow Projection Sheet for Small Companies

A

Monthly Cash Flow Projection Sheet for small companies is a financial tool that estimates monthly incoming and outgoing cash to help businesses manage liquidity effectively. This document tracks expected revenues, operating expenses, and other cash transactions, allowing companies to anticipate periods of surplus or shortfall. Small businesses use it to plan budgets, ensure timely payments, and make informed financial decisions.

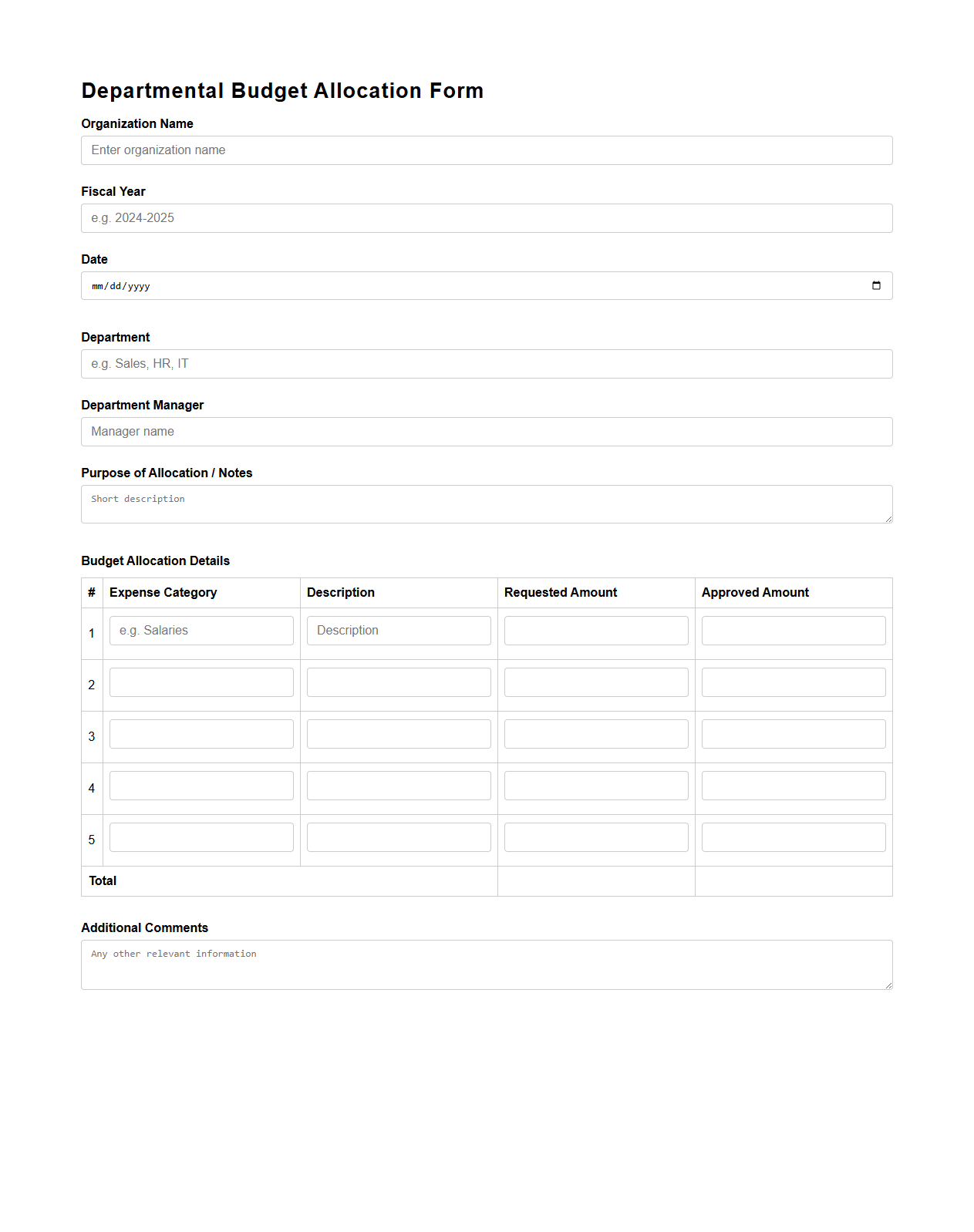

Departmental Budget Allocation Form for SMEs

The

Departmental Budget Allocation Form for SMEs is a critical financial document that outlines the distribution of funds across various departments within a small or medium-sized enterprise. This form enables efficient resource management by specifying budget limits, tracking expenses, and ensuring alignment with strategic business goals. Accurate departmental budget allocation helps SMEs maintain financial discipline, optimize operational performance, and support sustainable growth.

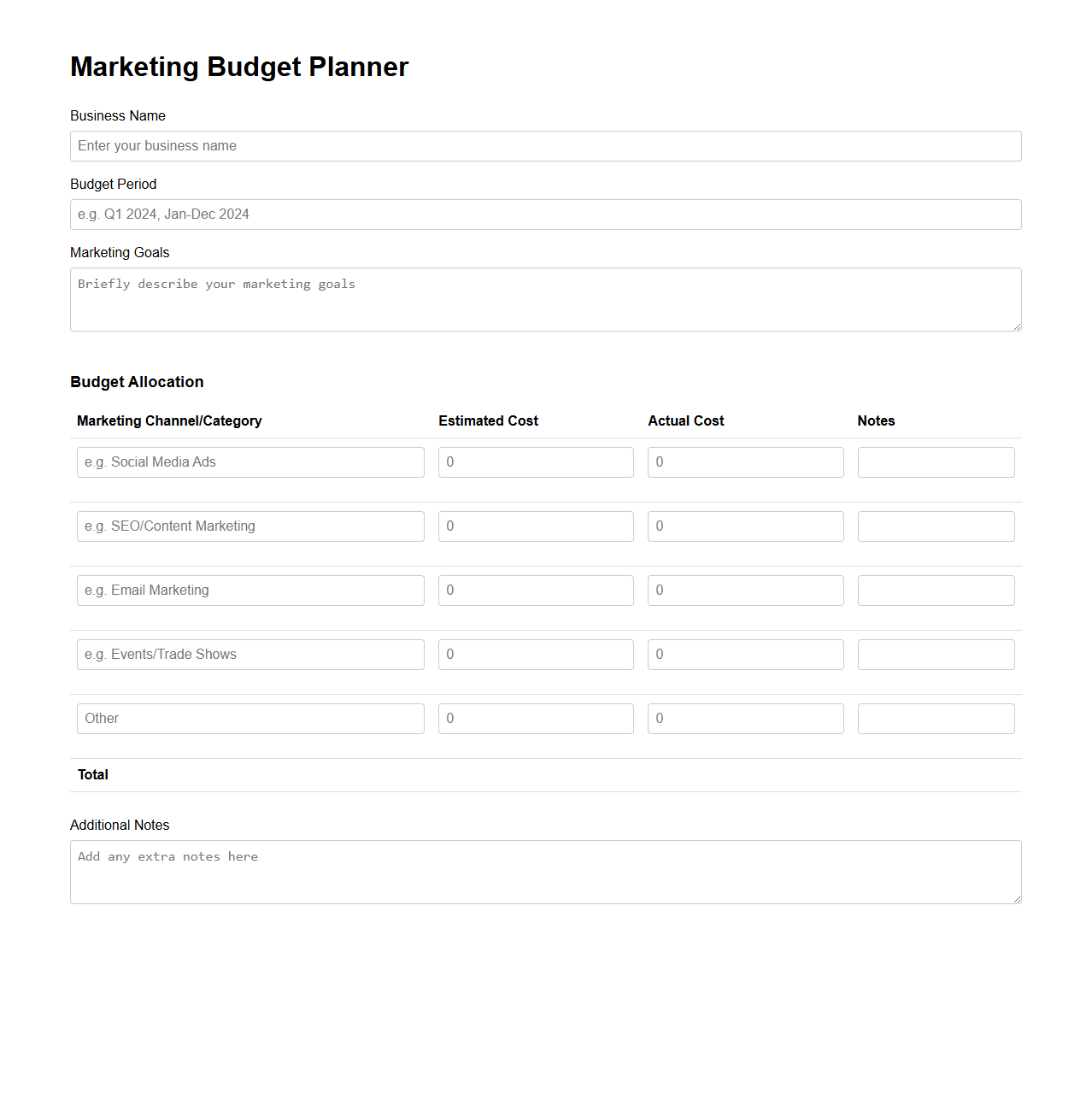

Marketing Budget Planner for Small Business Owners

A

Marketing Budget Planner for small business owners is a strategic tool designed to allocate financial resources effectively across various marketing channels. It helps identify key expenses, forecast costs, and track spending to maximize return on investment (ROI). This document ensures small businesses maintain control over marketing expenditures while optimizing campaigns for growth and customer acquisition.

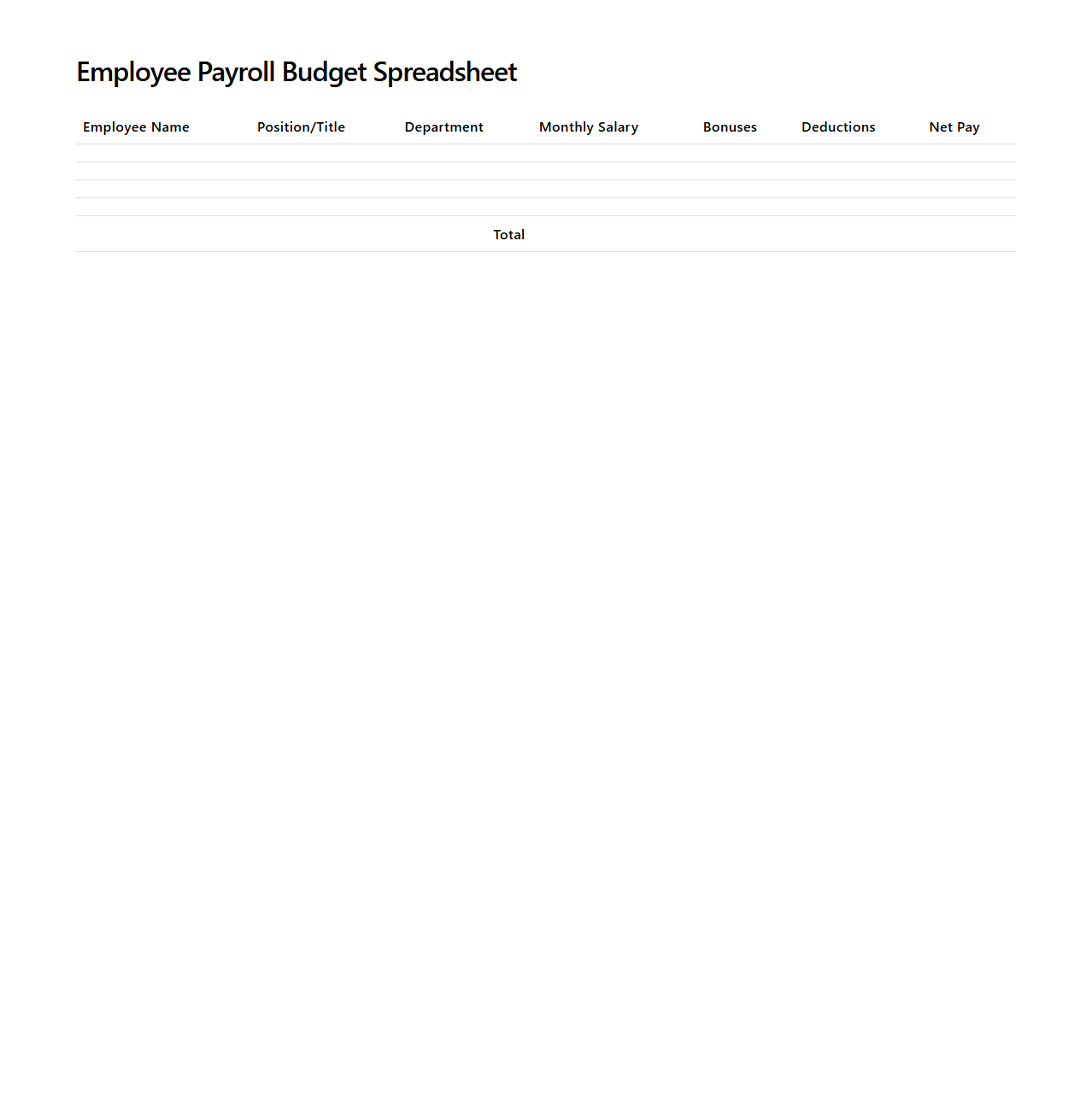

Employee Payroll Budget Spreadsheet for Small Enterprises

The

Employee Payroll Budget Spreadsheet for small enterprises is a comprehensive tool designed to track and manage employee compensation, including salaries, taxes, benefits, and bonuses. This document helps businesses forecast payroll expenses, maintain financial accuracy, and comply with tax regulations. By organizing payroll data efficiently, it supports budgeting decisions and cash flow management critical for small business sustainability.

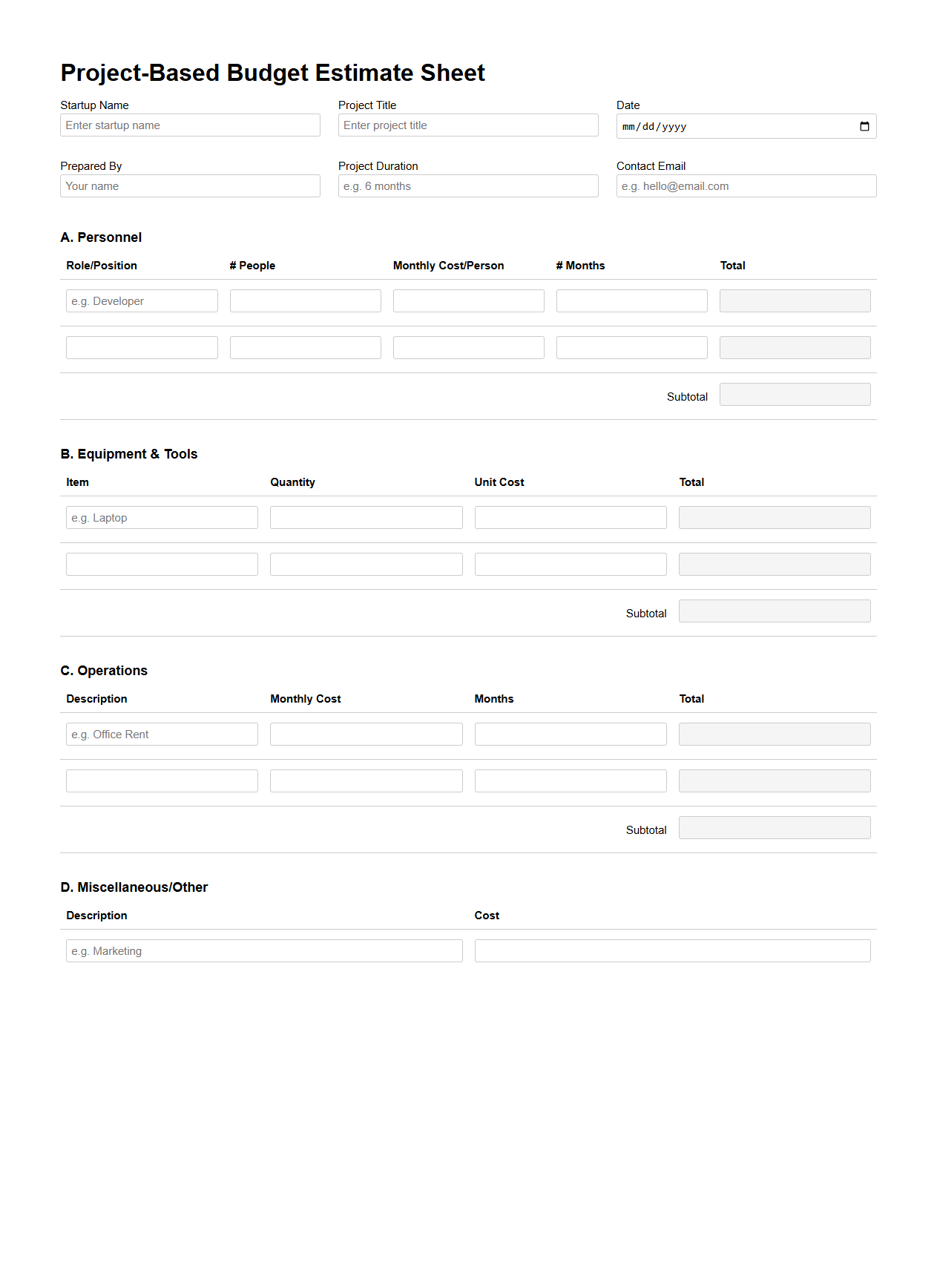

Project-Based Budget Estimate Sheet for Startups

A

Project-Based Budget Estimate Sheet for startups is a detailed financial document that outlines projected costs associated with specific projects, helping founders allocate resources effectively. It includes estimated expenses such as materials, labor, marketing, and miscellaneous costs, providing a clear framework for budget management. This sheet aids in financial planning, risk assessment, and securing funding by presenting transparent and organized budget forecasts tailored to each project.

Expense Tracking Document for Small Business Budgeting

An

Expense Tracking Document for small business budgeting is a detailed record that captures all business-related expenditures, categorized by type and date, to monitor cash flow accurately. It enables business owners to identify spending patterns, control unnecessary costs, and maintain financial discipline essential for effective budget management. Regular updating of this document ensures informed decision-making and helps optimize resource allocation to support growth and profitability.

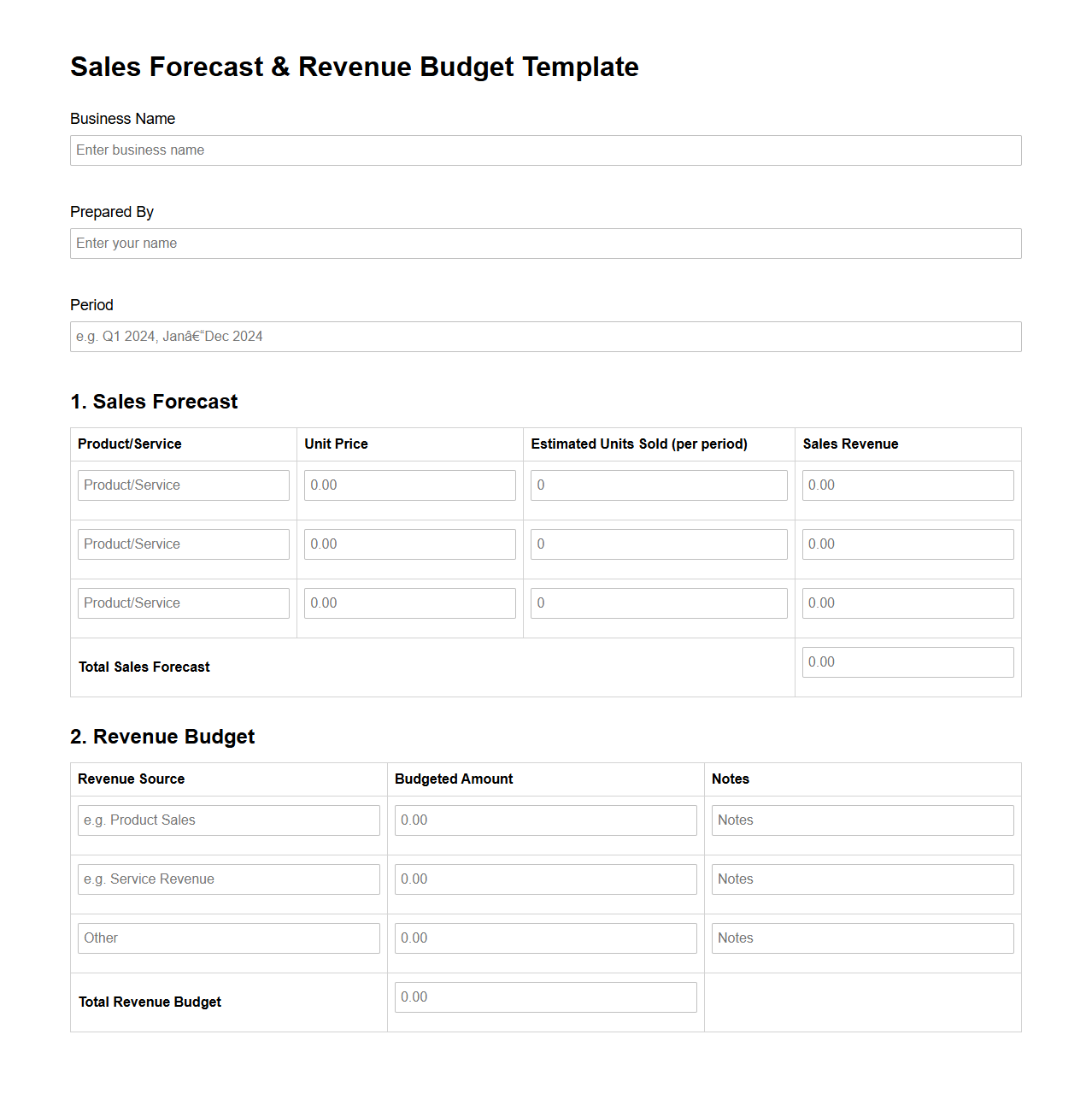

Sales Forecast and Revenue Budget Template for SMEs

A

Sales Forecast and Revenue Budget Template for SMEs is a strategic tool designed to project future sales income and allocate financial resources efficiently. This document helps small and medium-sized enterprises estimate monthly or annual revenue streams by analyzing market trends, historical sales data, and pricing strategies. By using this template, businesses can set realistic financial goals, monitor performance, and make informed decisions to drive growth and profitability.

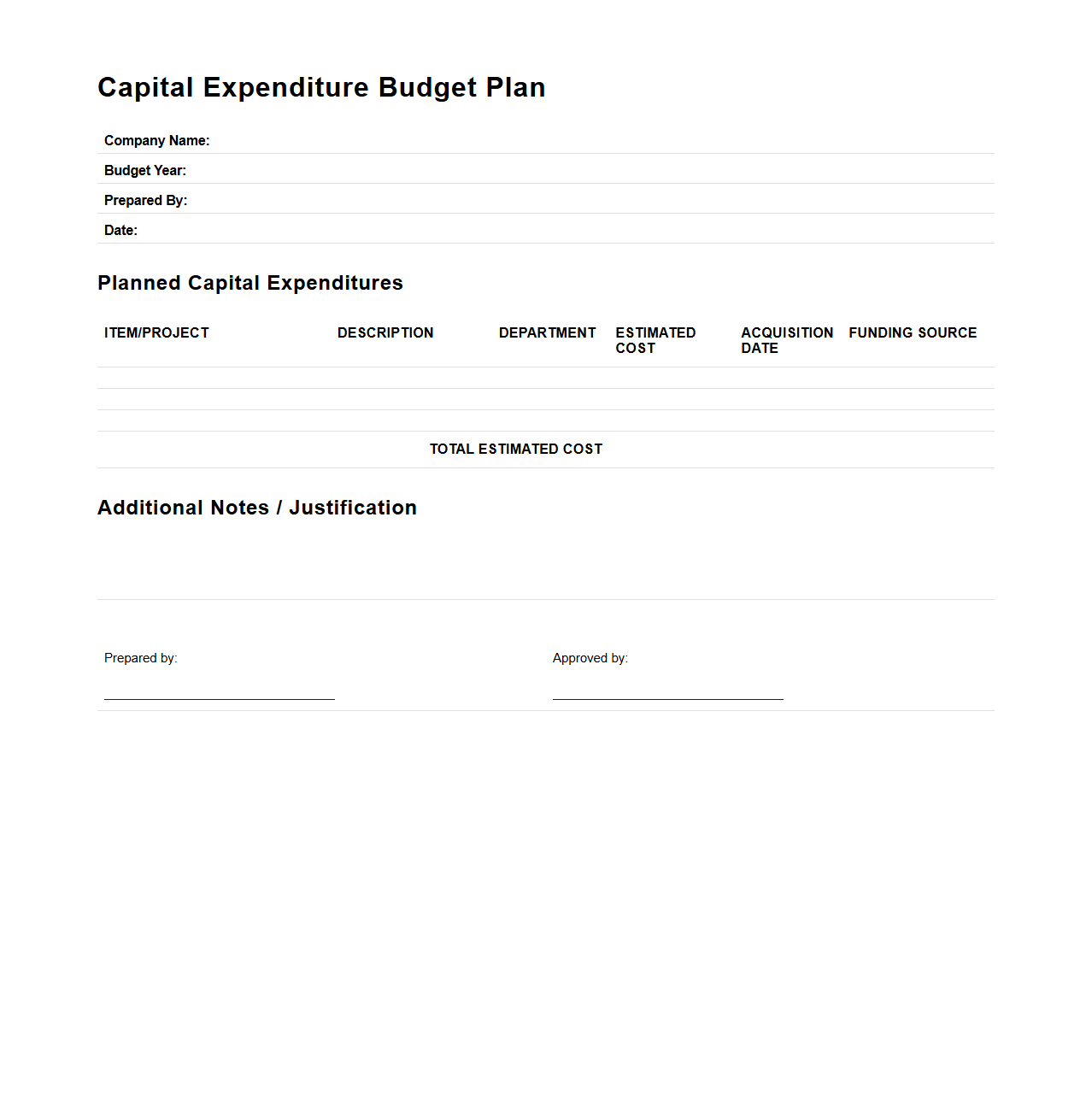

Capital Expenditure Budget Plan for Small Firms

A

Capital Expenditure Budget Plan for small firms is a strategic financial document outlining projected investments in long-term assets such as equipment, property, or technology upgrades. It helps businesses allocate funds efficiently, prioritize essential purchases, and forecast cash flow impacts over a specific period. This plan supports informed decision-making to drive growth and maintain operational efficiency.

What key expense categories should a small business prioritize in a budget planning document?

Small businesses should prioritize fixed costs such as rent, utilities, and salaries in their budget planning document to ensure operational stability. Variable expenses, including marketing and raw materials, must also be carefully monitored to manage cash flow effectively. Additionally, allocating funds for contingency reserves is essential to handle unexpected costs or economic downturns.

How do you incorporate seasonal revenue fluctuations into a small business budget plan?

Incorporating seasonal revenue fluctuations requires analyzing historical sales data to identify high and low periods. Businesses should adjust their expense forecasts accordingly, reducing costs during slower months and preparing for increased spending in peak seasons. Maintaining a flexible budget allows for strategic planning and ensures sufficient cash flow throughout the year.

Which financial software integrations are best for tracking budget adherence in small enterprises?

Top financial software for small businesses includes QuickBooks, Xero, and FreshBooks, which offer comprehensive budget tracking features. These platforms easily integrate with other tools like payment processors and payroll systems to provide real-time financial data. Utilizing such integrations enables accurate monitoring of budget adherence and improves financial decision-making.

What are common budget planning document mistakes small business owners make?

Small business owners often make the mistake of underestimating expenses or overestimating revenue, leading to unrealistic budgets. Ignoring unexpected costs and failing to revise the budget regularly can result in cash flow problems. Additionally, not involving key team members during the planning process limits the budget's accuracy and effectiveness.

How can a small business document justify budget increases to stakeholders or investors?

A small business can justify budget increases by presenting clear data on market opportunities and expected return on investment from additional funding. Detailed explanations of how increased spending will enhance operational capacity or revenue growth build stakeholder confidence. Providing transparent financial projections and risk assessments further strengthens the case for budget expansion.