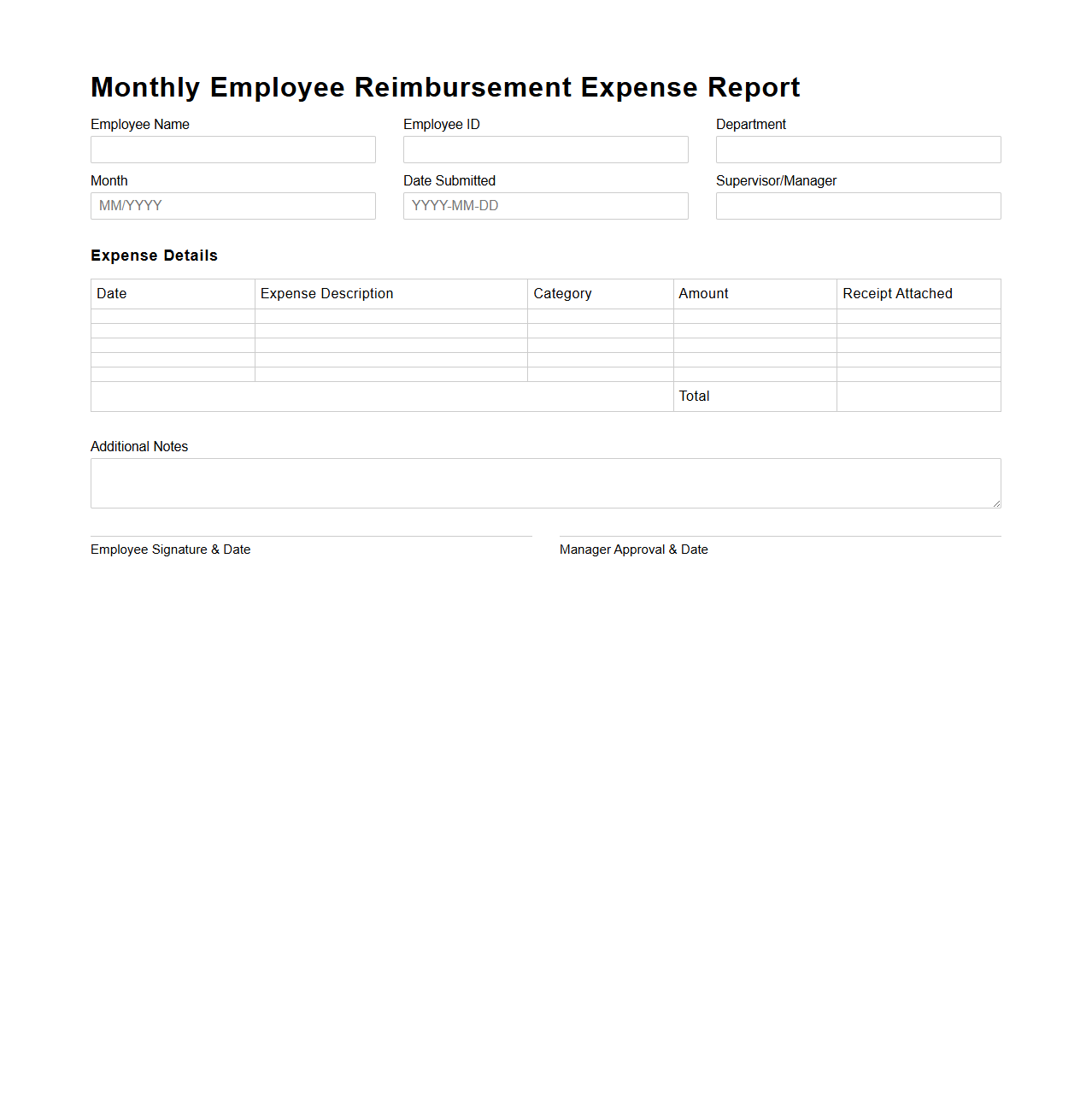

Monthly Employee Reimbursement Expense Report Template

The

Monthly Employee Reimbursement Expense Report Template document is designed to systematically capture and organize employees' business-related expenses incurred within a month. It allows for detailed recording of expense categories, dates, amounts, and justifications, facilitating accurate reimbursement processing and financial tracking. This template supports compliance with company policies and simplifies audit procedures by providing a standardized format for reporting and reviewing expenditures.

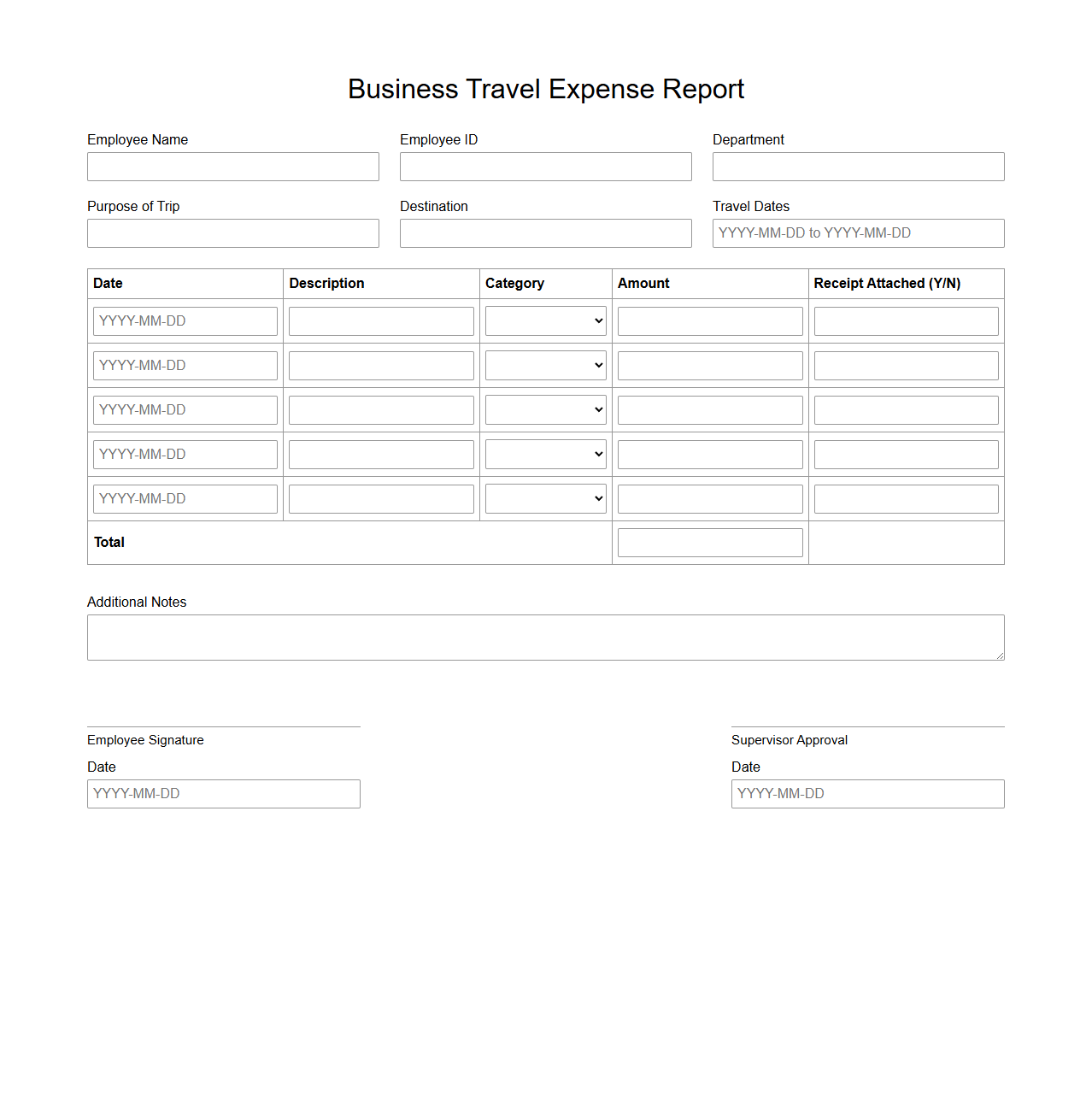

Business Travel Expense Report for Employee Reimbursement

A

Business Travel Expense Report for Employee Reimbursement is a detailed document that itemizes all costs incurred by an employee during work-related travel, including transportation, lodging, meals, and incidentals. It serves as an official record submitted to the employer to verify expenses and request reimbursement according to company policies. This report typically requires receipts, dates of travel, and purpose details to ensure accurate accounting and compliance with financial guidelines.

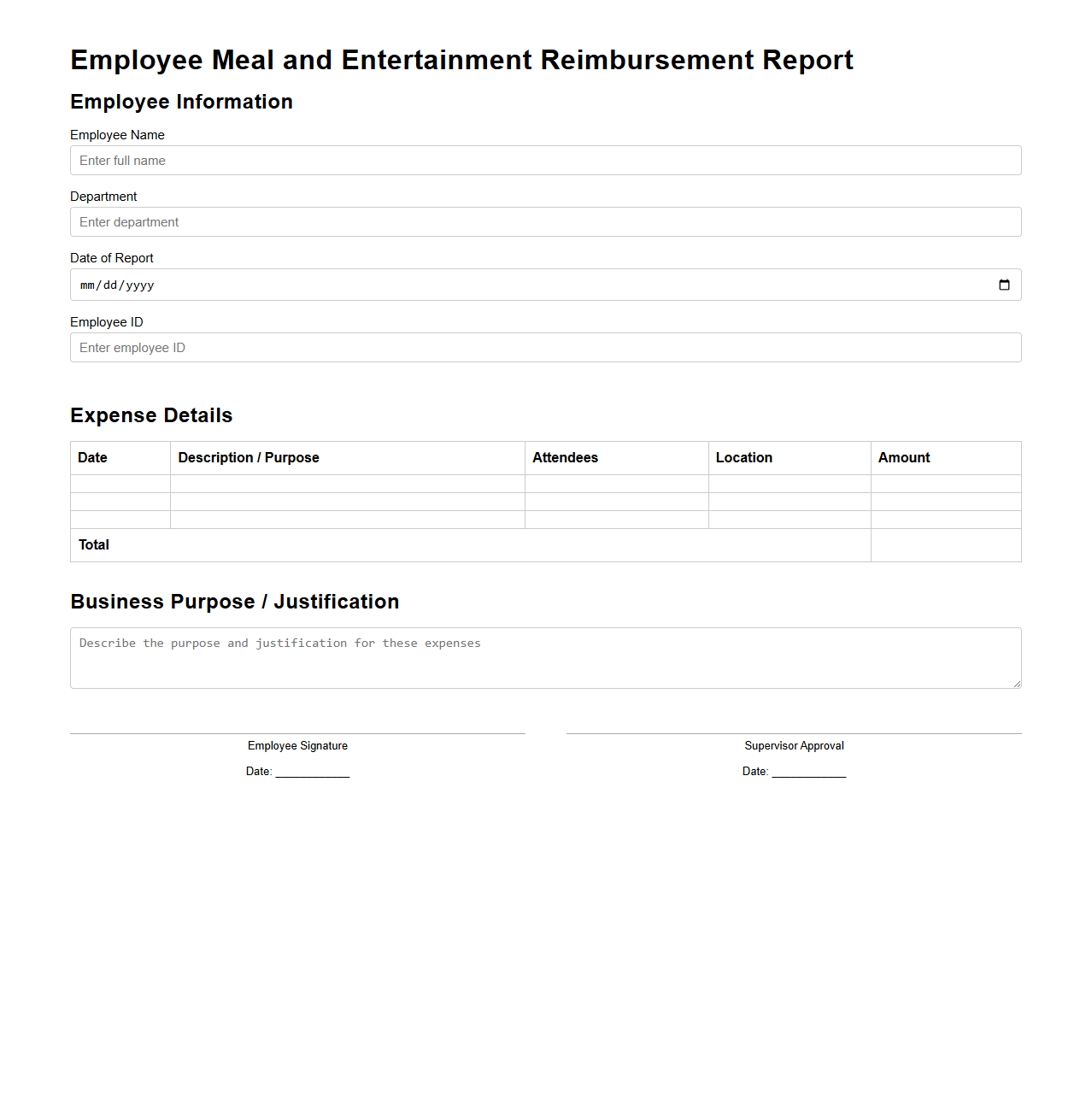

Employee Meal and Entertainment Reimbursement Report Sample

An

Employee Meal and Entertainment Reimbursement Report Sample document serves as a detailed template for employees to itemize expenses related to meals and entertainment incurred during business activities. It helps organizations maintain accurate financial records, ensuring compliance with tax regulations and company policies. The report typically includes sections for date, purpose, attendees, cost breakdown, and approval signatures.

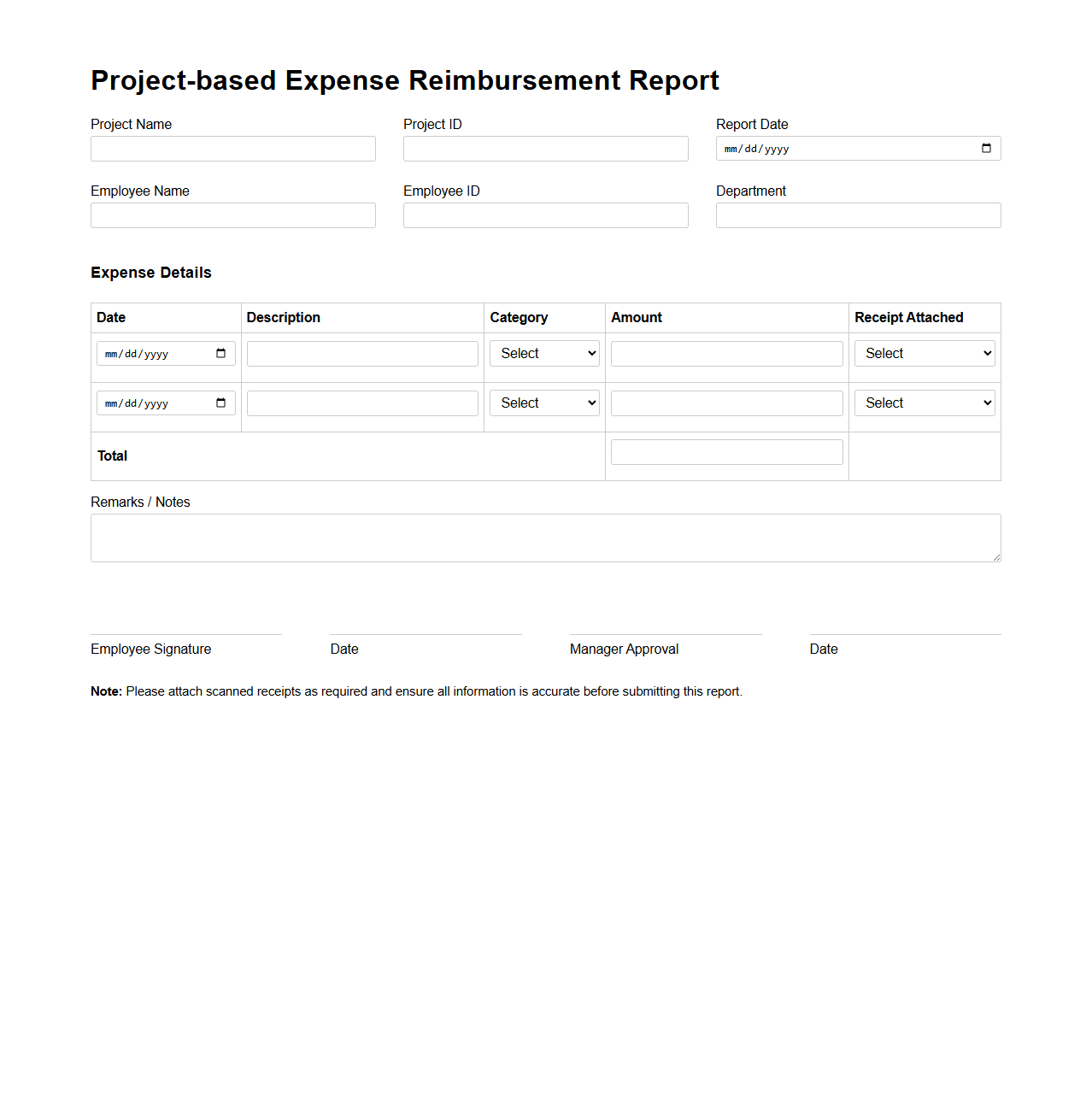

Project-based Expense Reimbursement Report Format

The

Project-based Expense Reimbursement Report Format document is designed to systematically capture and organize expenses incurred during a specific project. It helps ensure all project-related costs, such as travel, materials, and labor, are accurately recorded for reimbursement purposes. This format provides transparency, supports budget tracking, and facilitates quicker approval of expense claims.

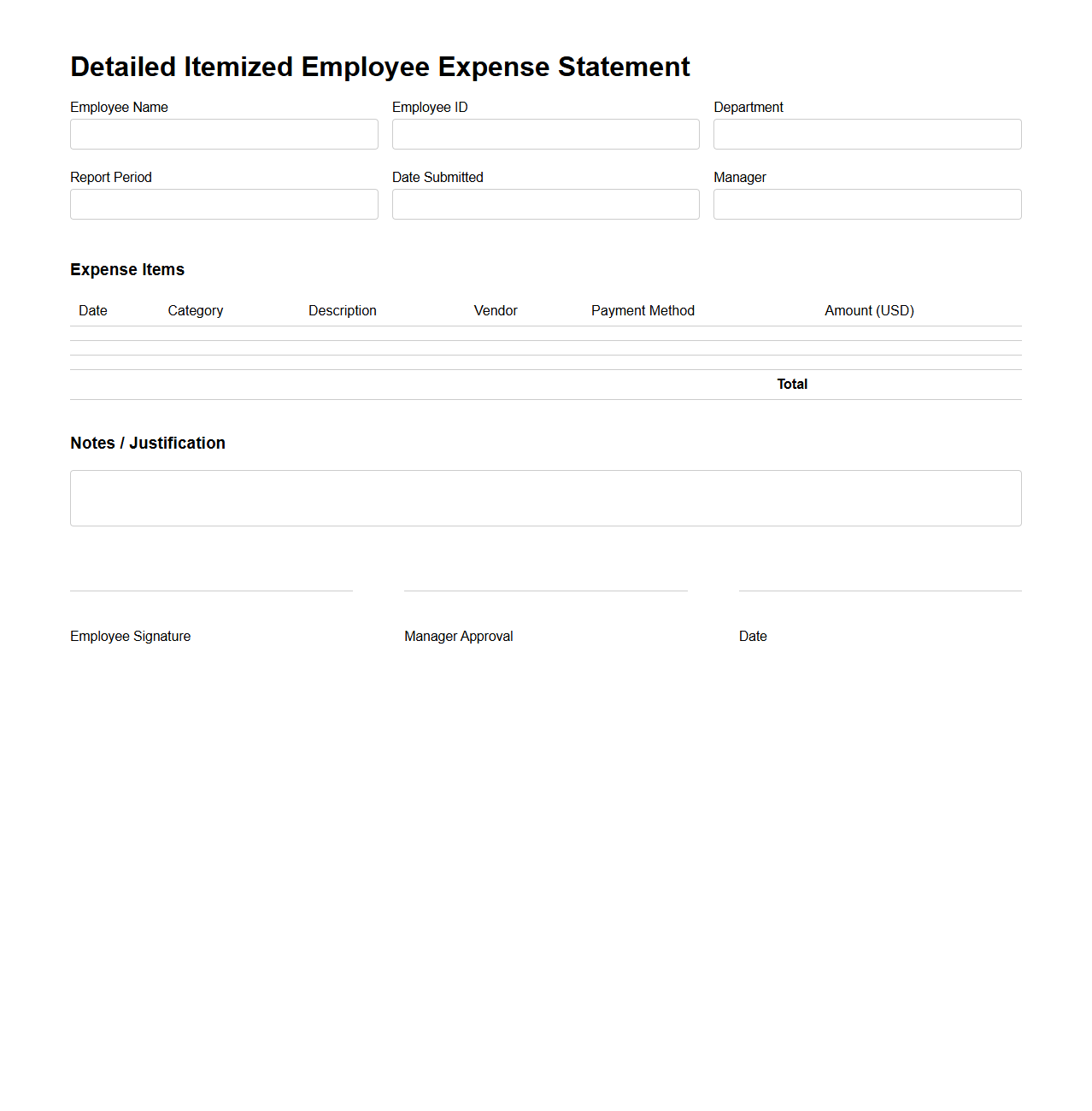

Detailed Itemized Employee Expense Statement

A

Detailed Itemized Employee Expense Statement document provides a comprehensive breakdown of all business-related expenses incurred by an employee during a specific period. It lists each expense with descriptions, dates, amounts, and corresponding receipts or proof of purchase to ensure transparency and compliance with company policies. This detailed record facilitates accurate reimbursement processing and financial auditing.

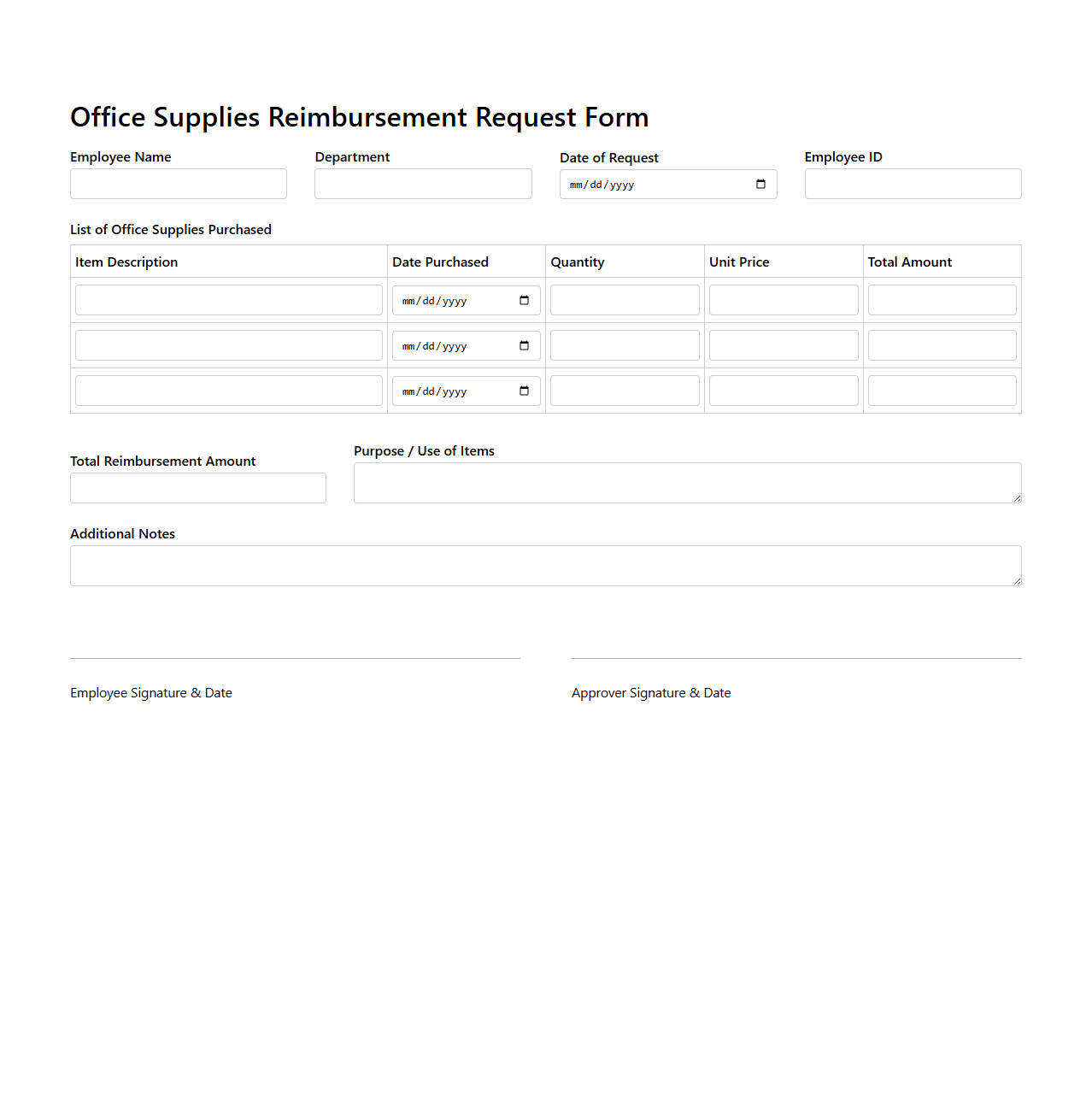

Office Supplies Reimbursement Request Form Example

An

Office Supplies Reimbursement Request Form Example document serves as a standardized template for employees to claim expenses incurred while purchasing office materials. This form typically includes fields for item descriptions, purchase dates, amounts, and receipts to ensure accurate processing and approval by the finance department. Utilizing this document streamlines reimbursement procedures, promotes transparency, and maintains organized financial records within an organization.

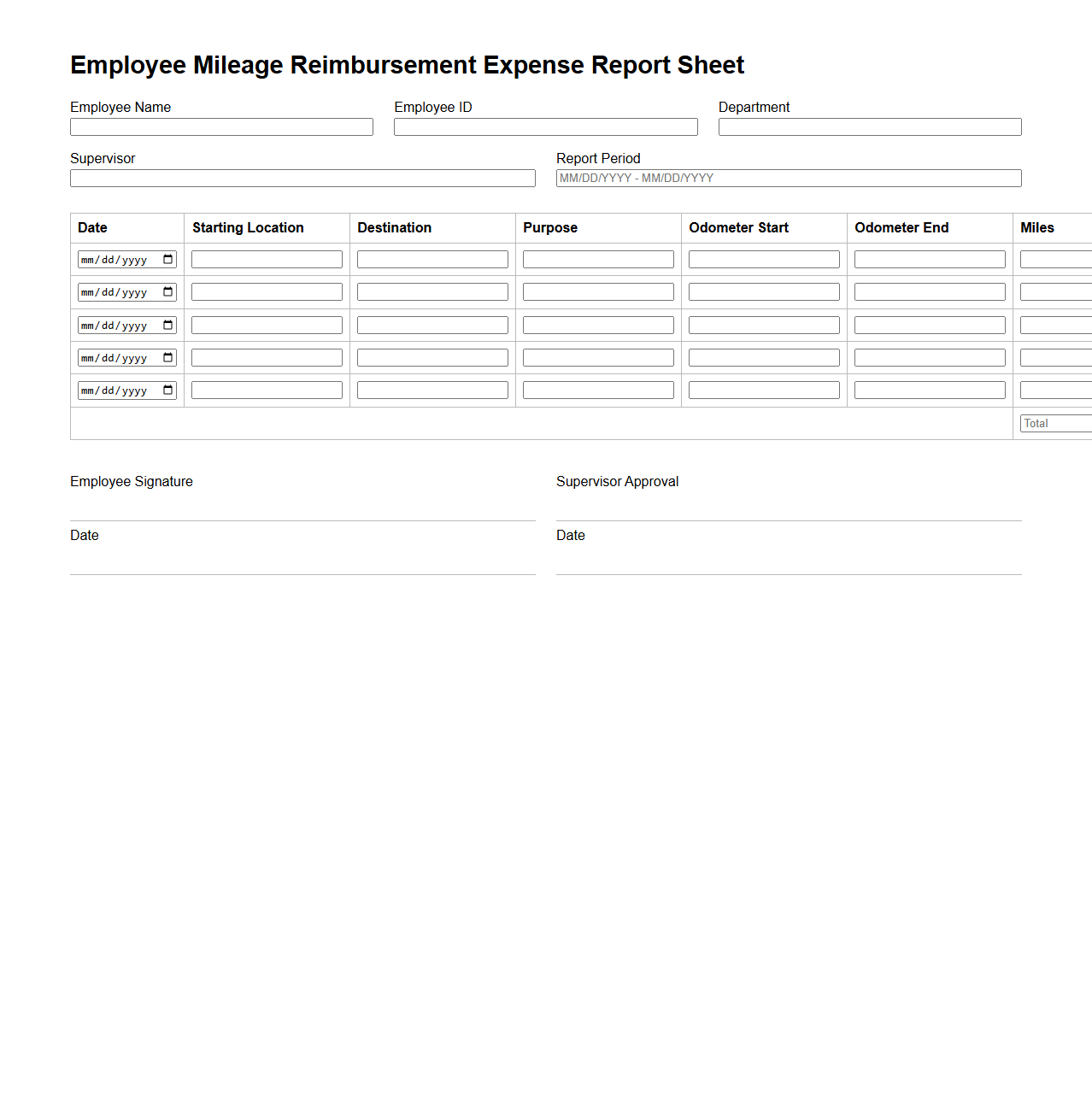

Employee Mileage Reimbursement Expense Report Sheet

An

Employee Mileage Reimbursement Expense Report Sheet document records the distance an employee travels for work-related activities, ensuring accurate compensation for vehicle expenses. It typically includes fields for date, starting point, destination, purpose of travel, miles driven, and reimbursement rate per mile. This document helps organizations maintain transparent expense tracking and streamline payroll reimbursements.

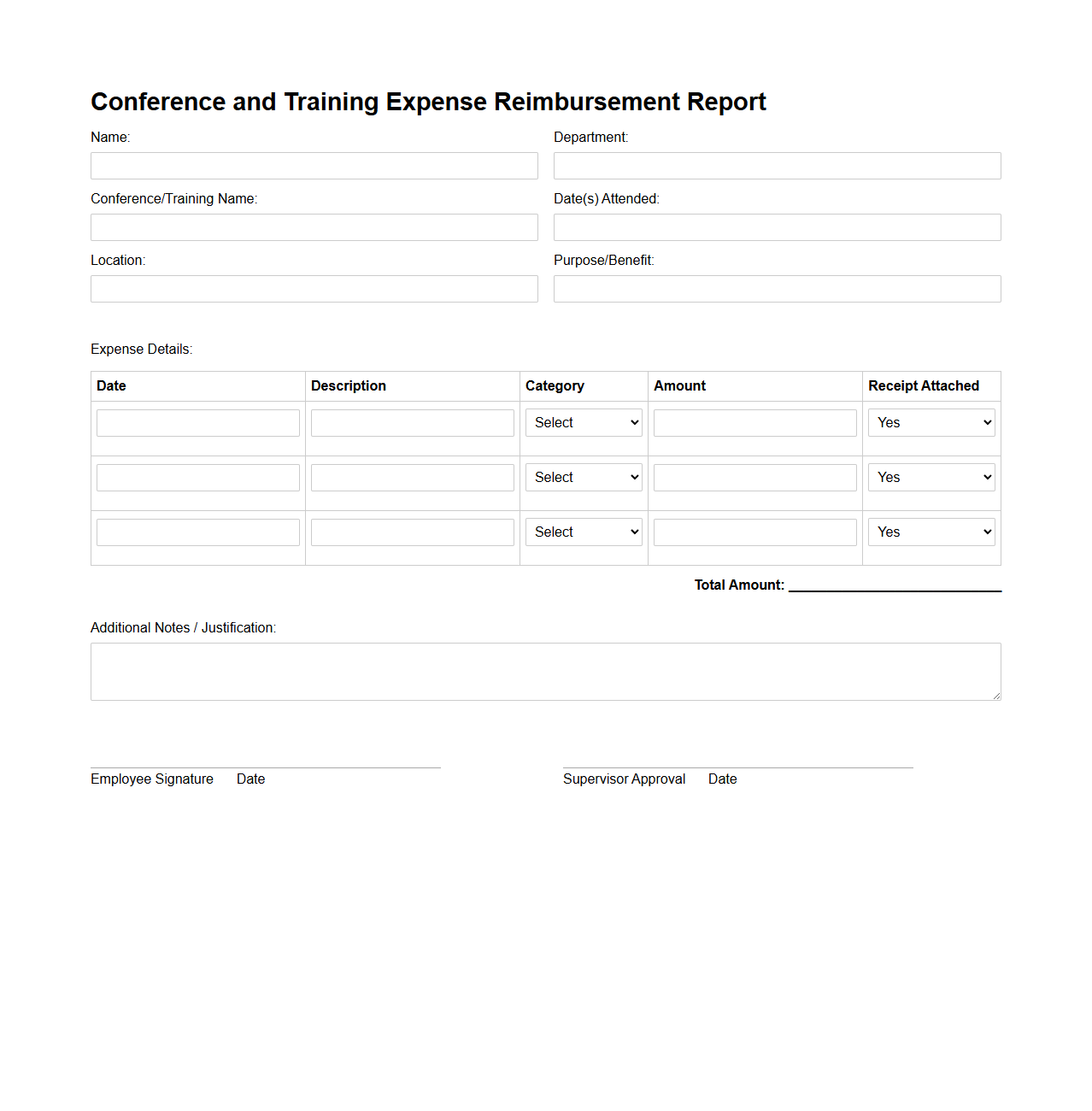

Conference and Training Expense Reimbursement Report

A

Conference and Training Expense Reimbursement Report document itemizes costs incurred by employees attending professional development events, such as conferences or training sessions. It includes detailed entries for travel, lodging, meals, registration fees, and other related expenses, ensuring transparent and accurate reimbursement processing. This report helps organizations maintain compliance with expense policies and facilitates efficient financial tracking and auditing.

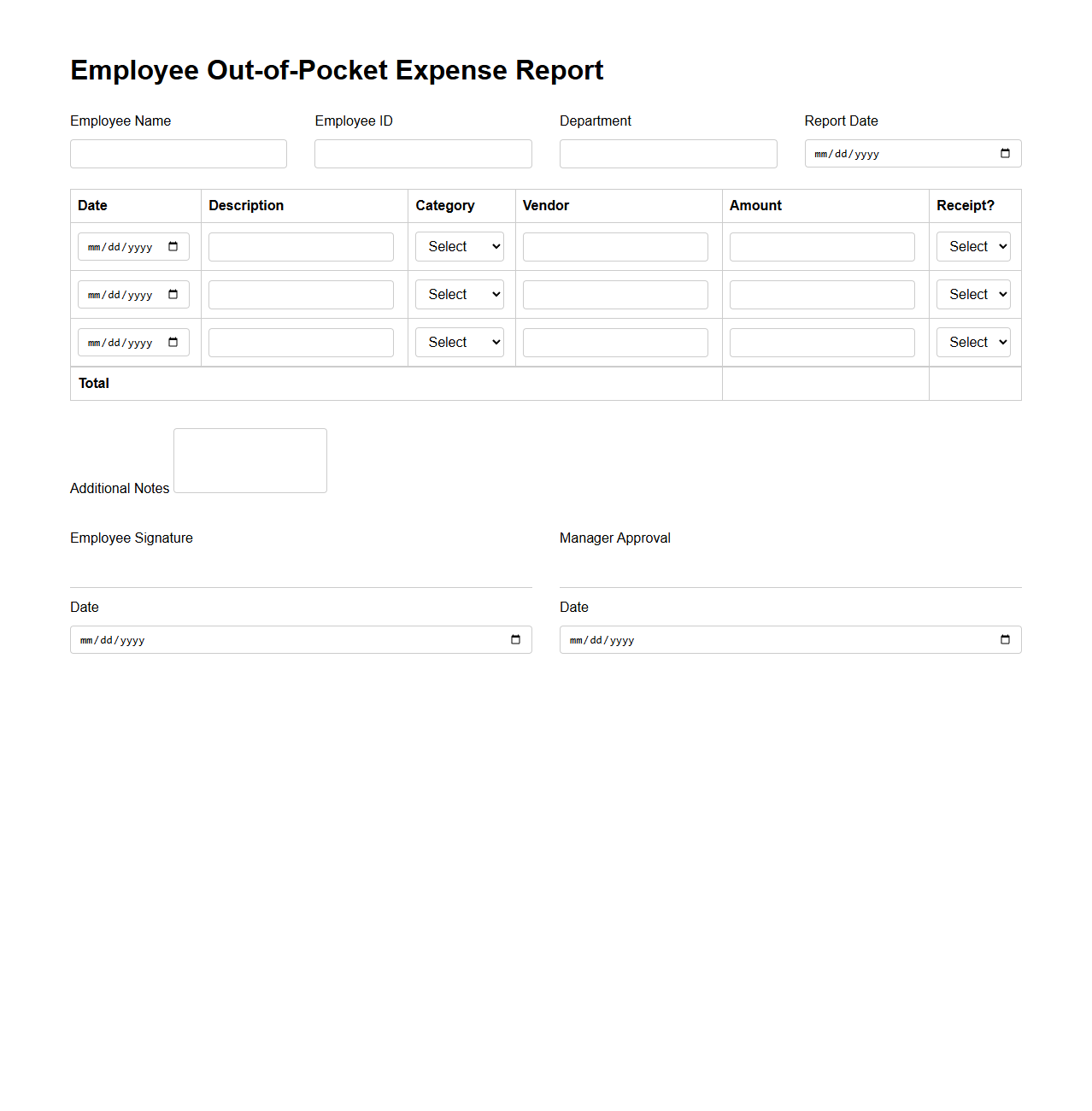

Employee Out-of-Pocket Expense Report Layout

An

Employee Out-of-Pocket Expense Report Layout document is a structured template used to record and submit expenses incurred by employees during business activities that are not reimbursed upfront by the company. This document typically includes fields for date, expense category, amount, description, and receipts attachment, ensuring transparency and accuracy in expense reporting. Proper use of this layout facilitates efficient expense tracking, timely reimbursement, and compliance with company policies.

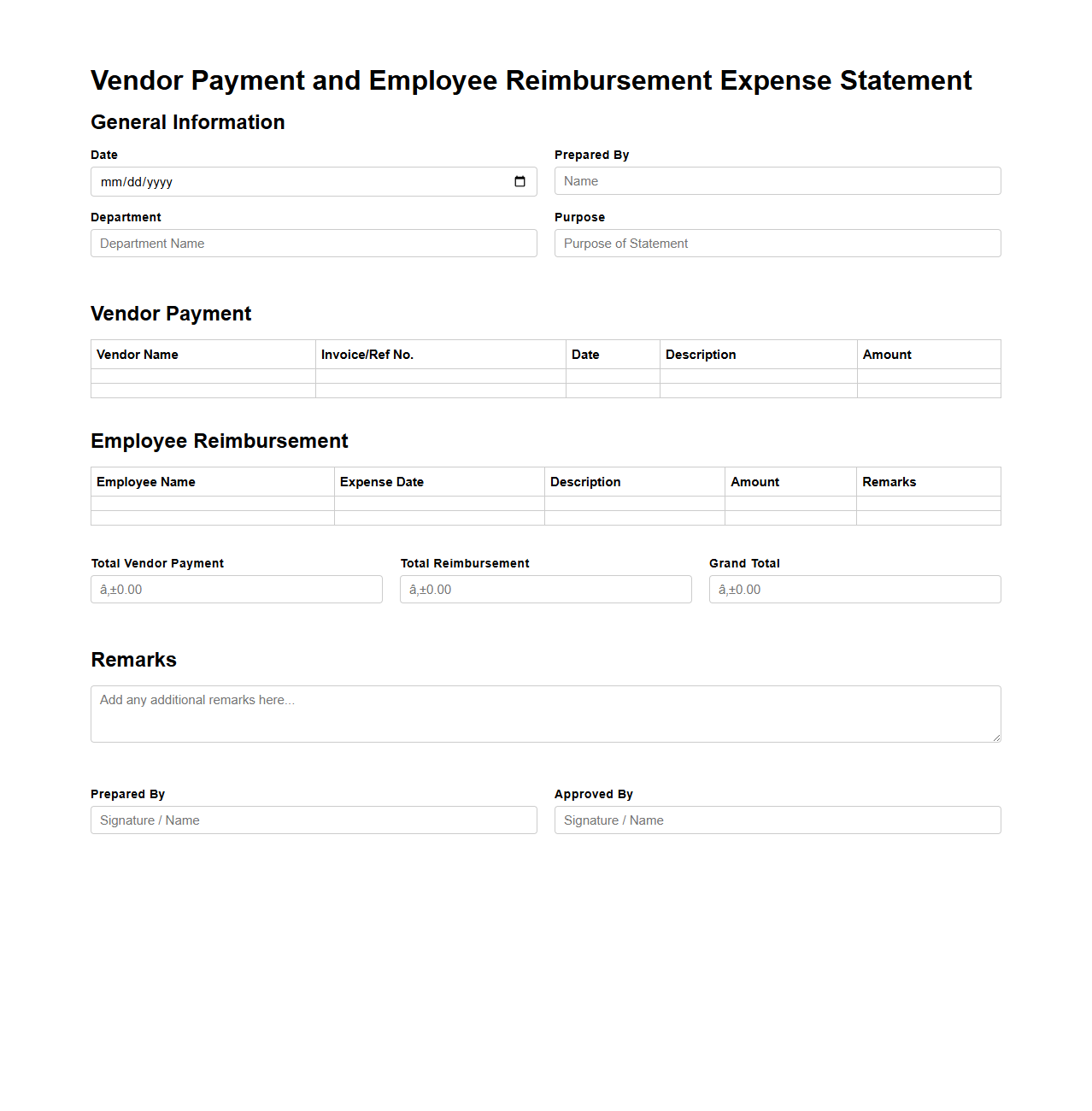

Vendor Payment and Employee Reimbursement Expense Statement

A

Vendor Payment and Employee Reimbursement Expense Statement document details financial transactions where payments are made to suppliers for goods or services and reimbursements are processed for employee-incurred expenses. This statement ensures accurate tracking of business expenses, aids in financial reconciliation, and supports compliance with accounting standards. It typically includes payment dates, amounts, vendor or employee names, and descriptions of the transactions for clear auditing and budget management.

What supporting receipts are required for each expense category in the reimbursement report?

Each expense category requires specific receipts to validate the costs. For meals, original itemized receipts are mandatory to ensure compliance. Travel-related expenses must include tickets, boarding passes, and hotel invoices as proof of purchase.

How should mileage or travel expenses be documented for approval?

Mileage claims need accurate logs detailing the date, distance traveled, and purpose of the trip. Travel expenses must be supported by receipts and itemized itineraries for verification. All documentation should clearly indicate the business justification for expedited approval.

Are there limits or caps per item that need to be stated in the expense letter?

Yes, clear expense limits or caps per item are essential in the reimbursement policy. These thresholds prevent overspending and ensure fair and consistent expense management. Including these limits in the expense letter helps employees understand allowable amounts upfront.

What is the process for correcting errors in a submitted expense report document?

To correct errors in an expense report, employees must promptly submit a revised report with accurate information. Corrections should be accompanied by updated receipts or documentation if necessary. The amendment goes through the same approval workflow to maintain audit integrity.

How are disputed or rejected expenses communicated to the employee in writing?

Disputed or rejected expenses are communicated via formal written notifications, typically through email or the expense management system. The communication clearly states the reason for rejection with reference to relevant policies or missing documentation. This allows employees to respond or provide additional evidence for reconsideration.