A Tax Return Document Sample for Corporate Tax Filing provides a detailed example of how corporations should prepare and organize their financial information for submission to tax authorities. It includes essential sections such as income statements, balance sheets, and tax liability calculations to ensure compliance with tax regulations. This sample serves as a practical guide for accurate reporting and helps businesses avoid common filing errors.

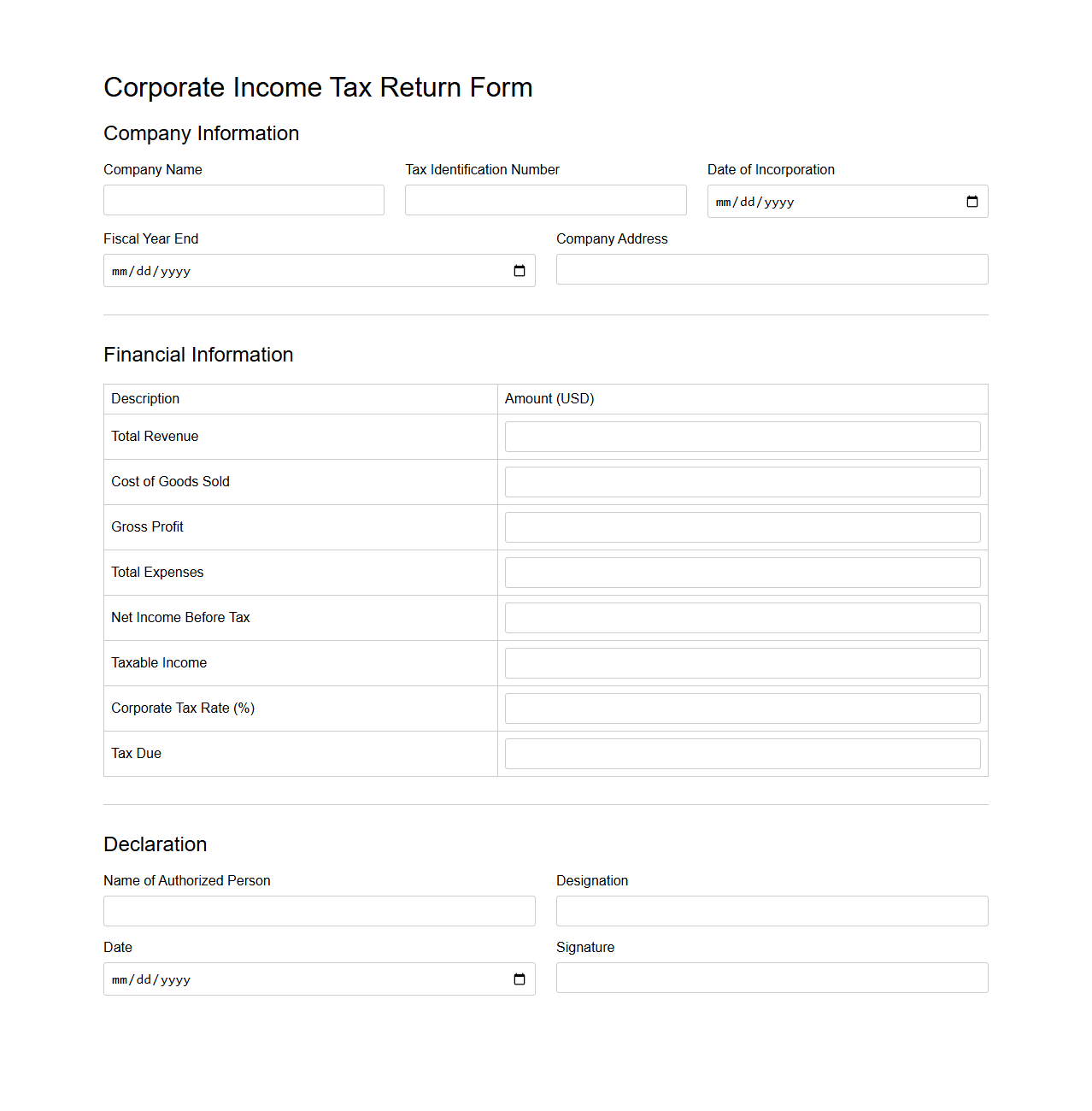

Corporate Income Tax Return Form Example

A

Corporate Income Tax Return Form Example document serves as a practical guide illustrating how corporations report their income, deductions, and tax liabilities to the tax authorities. It provides a template or sample that helps businesses accurately complete their tax filings by detailing essential sections such as gross income, allowable expenses, tax credits, and payment calculations. This example ensures compliance with legal requirements while facilitating efficient and error-free submission of corporate tax returns.

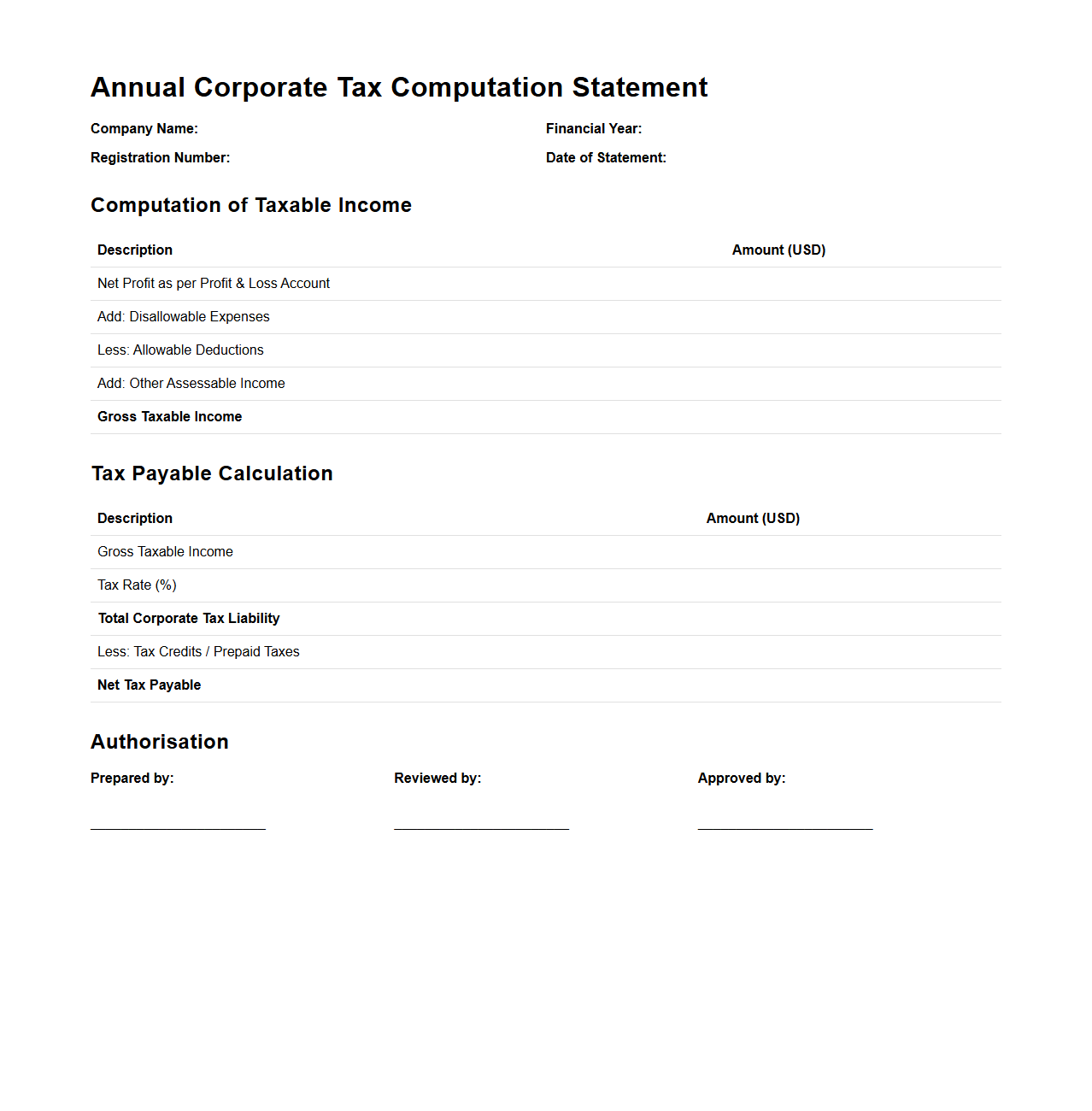

Annual Corporate Tax Computation Statement Sample

An

Annual Corporate Tax Computation Statement Sample document demonstrates the detailed calculation of a company's taxable income, incorporating revenues, allowable expenses, deductions, and tax rates for the fiscal year. This sample helps businesses accurately determine their corporate tax liabilities in compliance with local tax regulations. It serves as a practical reference for accountants and financial officers during tax preparation and submission processes.

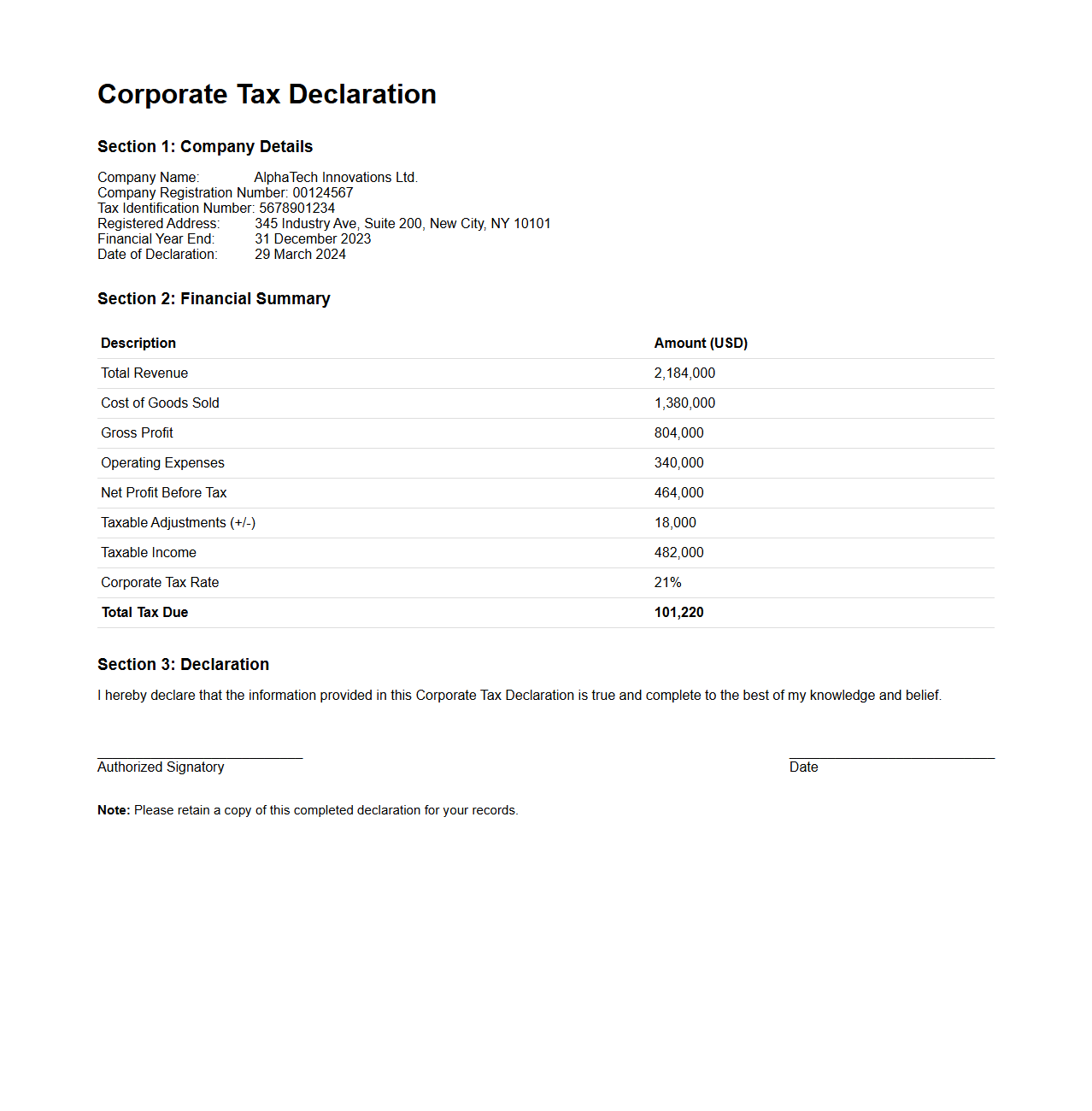

Completed Corporate Tax Declaration Sample

A

Completed Corporate Tax Declaration Sample document serves as a detailed example that illustrates how a company reports its taxable income, expenses, deductions, and tax liabilities to tax authorities. It includes filled sections such as financial statements, tax calculation worksheets, and relevant supporting schedules, ensuring accurate compliance with corporate tax regulations. This sample aids businesses and accountants in preparing precise tax filings while minimizing errors and potential audits.

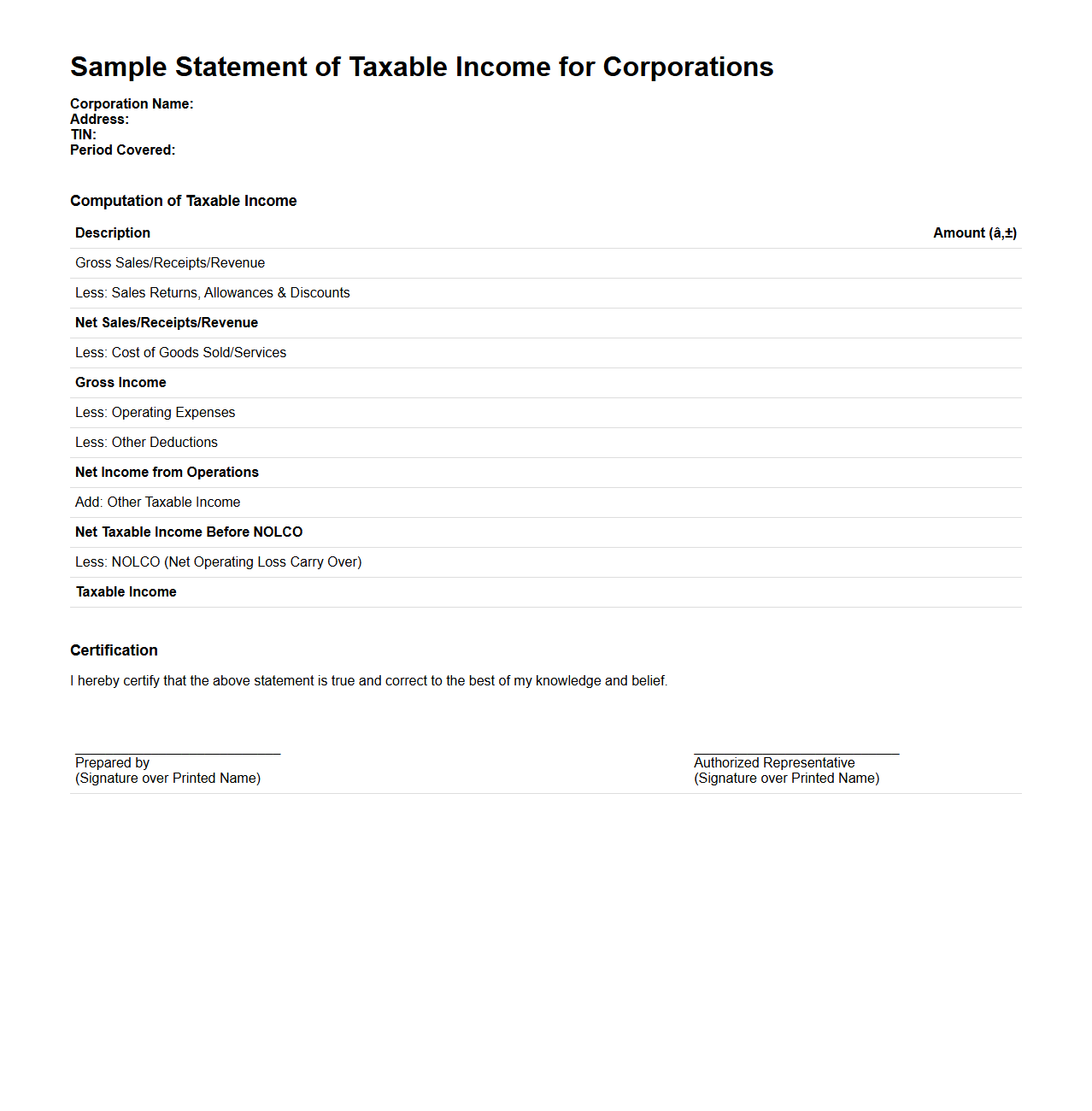

Sample Statement of Taxable Income for Corporations

A

Sample Statement of Taxable Income for Corporations document illustrates the breakdown of a company's income subject to taxation, including revenues, allowable deductions, and taxable amounts. It serves as a guide for preparing accurate tax returns by showcasing typical entries and calculations used in corporate tax reporting. This document helps ensure compliance with tax regulations and aids in understanding how taxable income is determined for corporations.

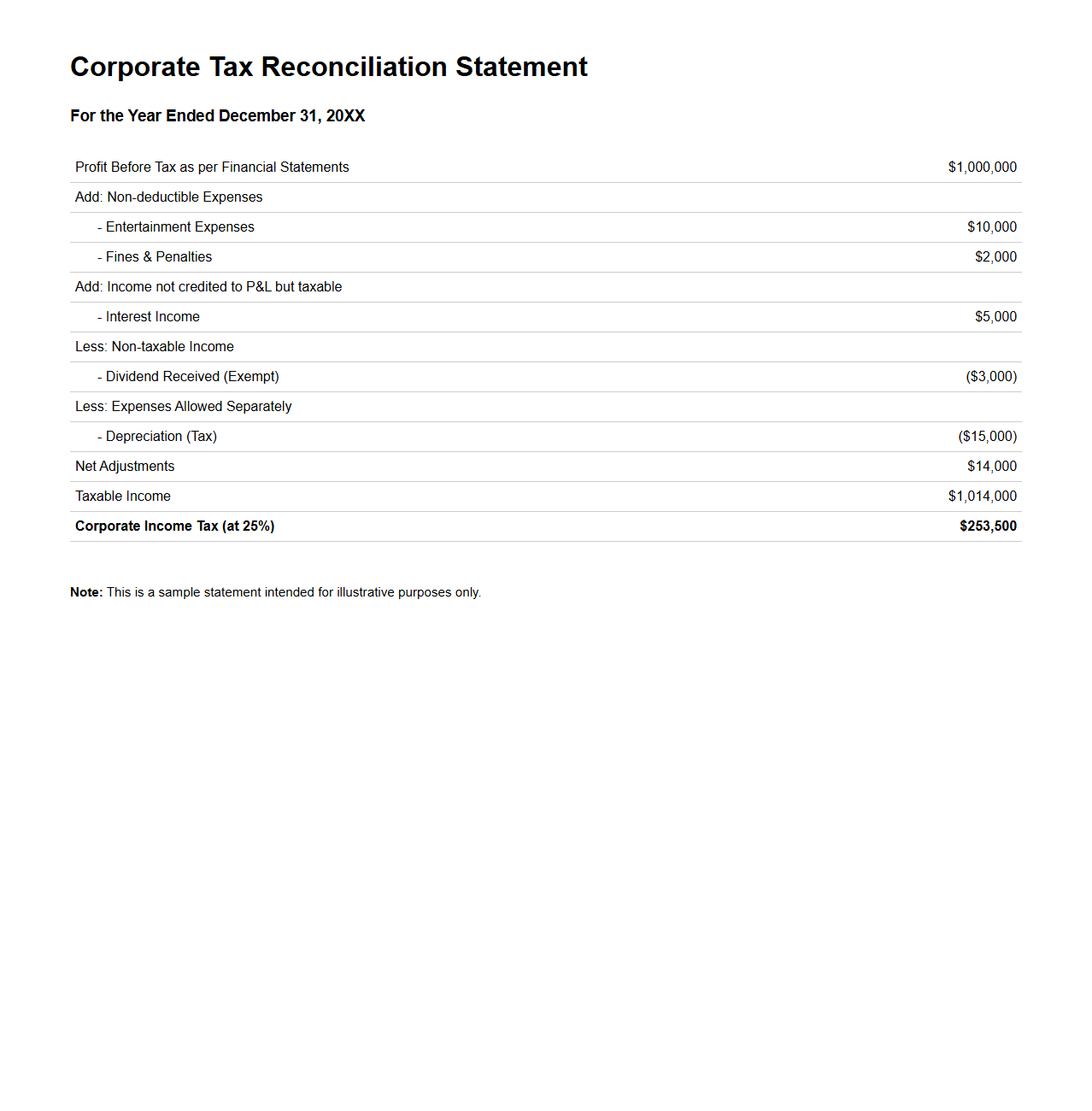

Corporate Tax Reconciliation Statement Example

A

Corporate Tax Reconciliation Statement Example document illustrates the process of aligning a company's accounting profit with its taxable income by detailing adjustments for non-deductible expenses, tax exemptions, and differences in depreciation methods. It serves as a critical tool for ensuring compliance with tax regulations and accurate tax liability calculations. This document aids tax professionals and corporate accountants in identifying discrepancies and supporting transparent financial reporting.

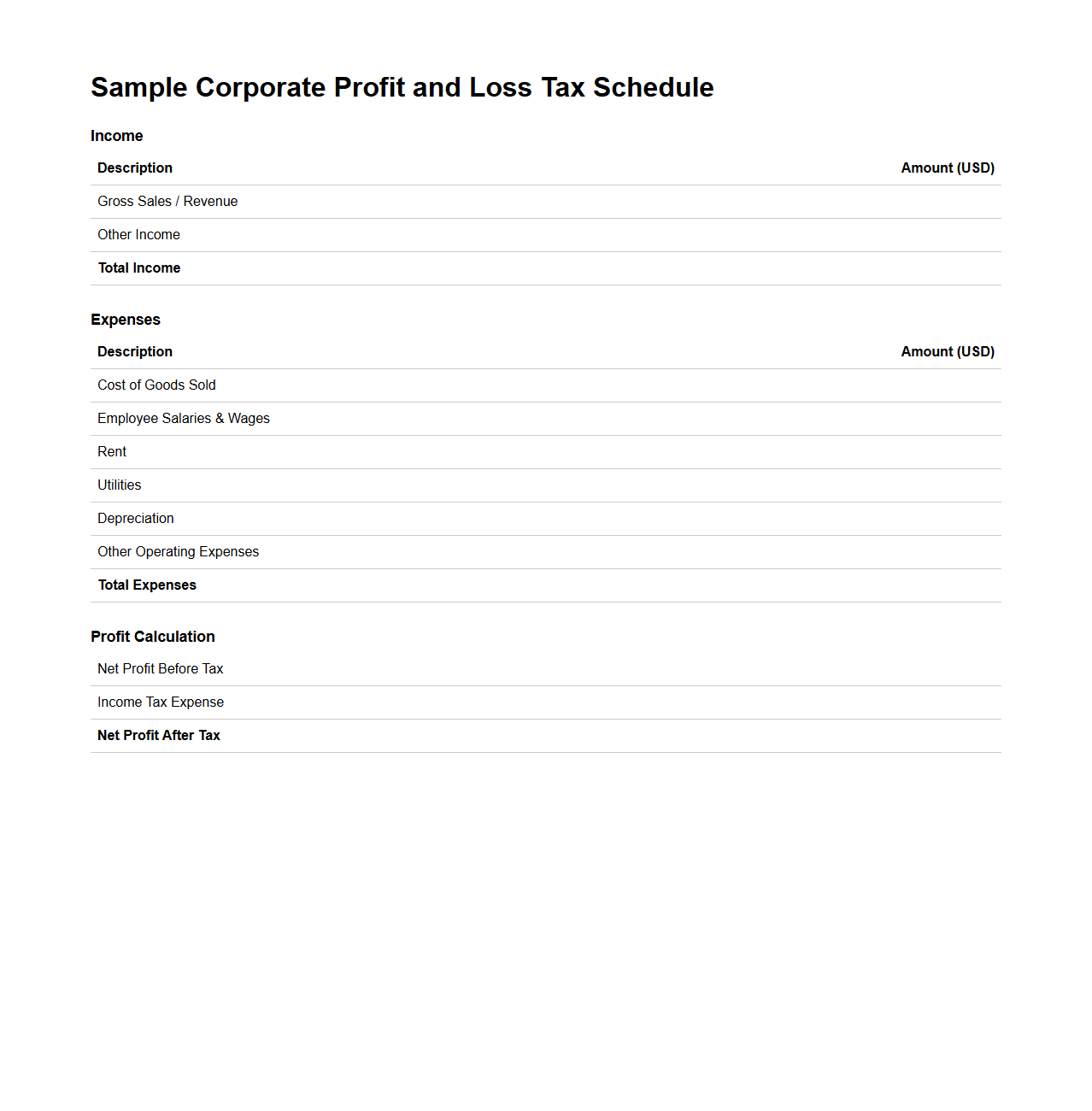

Sample Corporate Profit and Loss Tax Schedule

A

Sample Corporate Profit and Loss Tax Schedule document outlines a company's revenue, expenses, and net profit for a specific tax period, providing a detailed summary used for tax reporting purposes. It helps businesses accurately calculate taxable income by categorizing various income streams and deductible expenses in accordance with tax regulations. This document is essential for ensuring compliance with tax authorities and facilitating efficient financial audits.

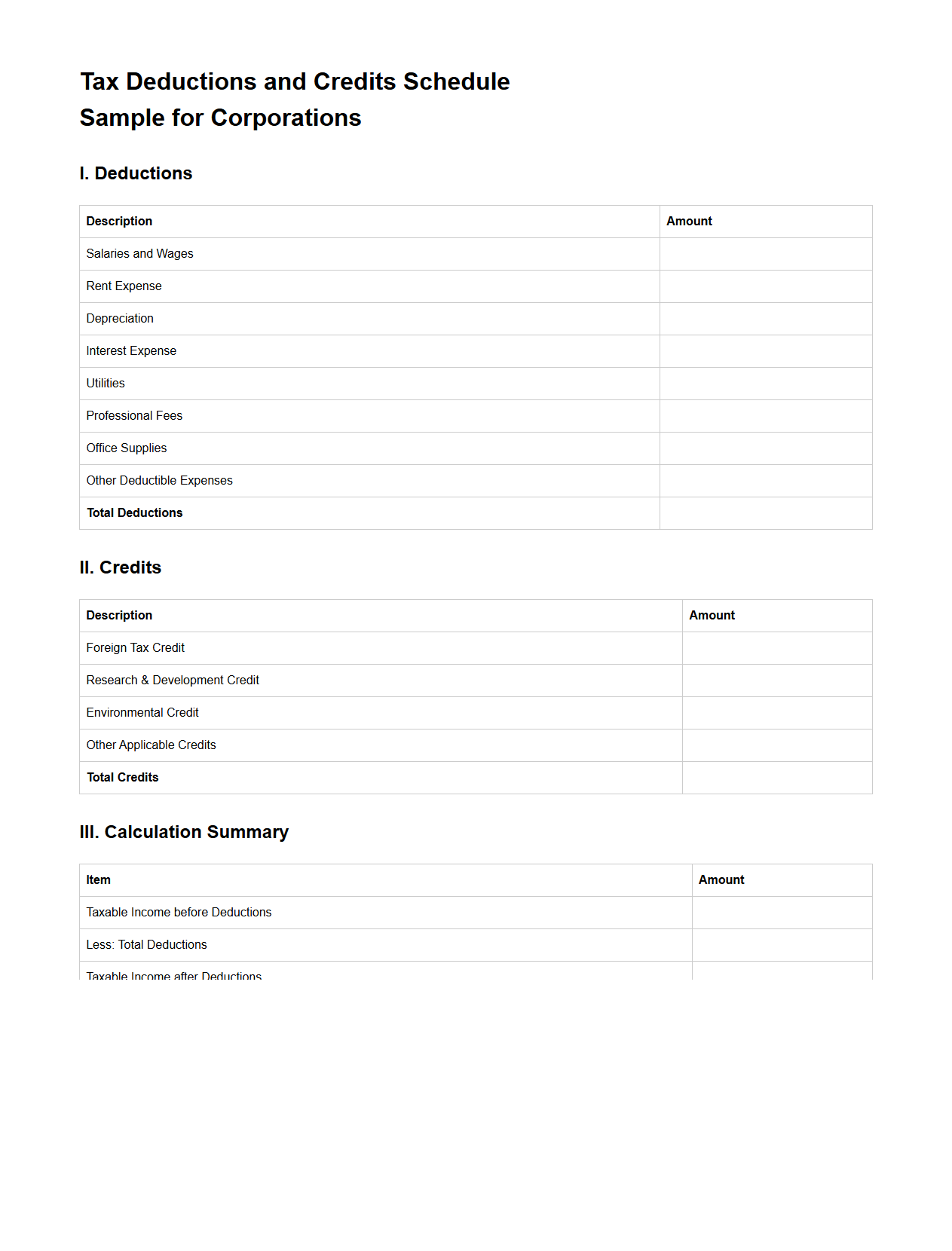

Tax Deductions and Credits Schedule Sample for Corporations

The

Tax Deductions and Credits Schedule Sample for Corporations document outlines specific deductions and credits that corporations can claim to reduce taxable income and overall tax liability. It serves as a detailed guide for identifying eligible expenses, such as research and development costs or energy-efficient investments, which can qualify for tax benefits under current tax regulations. Corporations use this schedule to ensure accurate tax filing and maximize financial savings by leveraging available tax incentives.

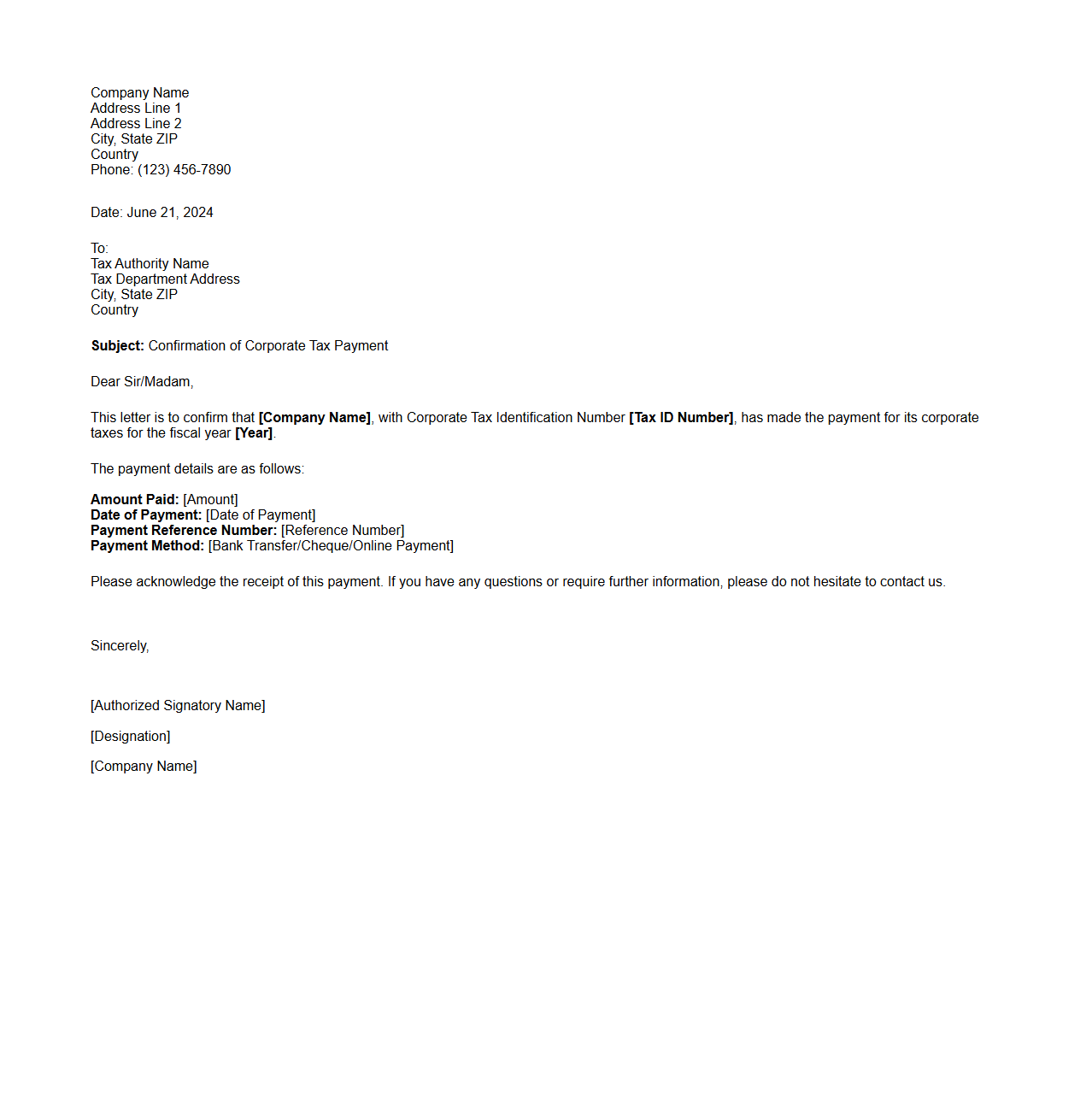

Corporate Tax Payment Confirmation Letter Sample

A

Corporate Tax Payment Confirmation Letter Sample is an official document issued by tax authorities or a company's finance department confirming the receipt of tax payments made by a corporation. This letter serves as proof of compliance with tax obligations and may include details such as payment amount, date, tax period, and taxpayer identification number. Businesses use this confirmation for audit purposes, loan applications, or regulatory compliance verification.

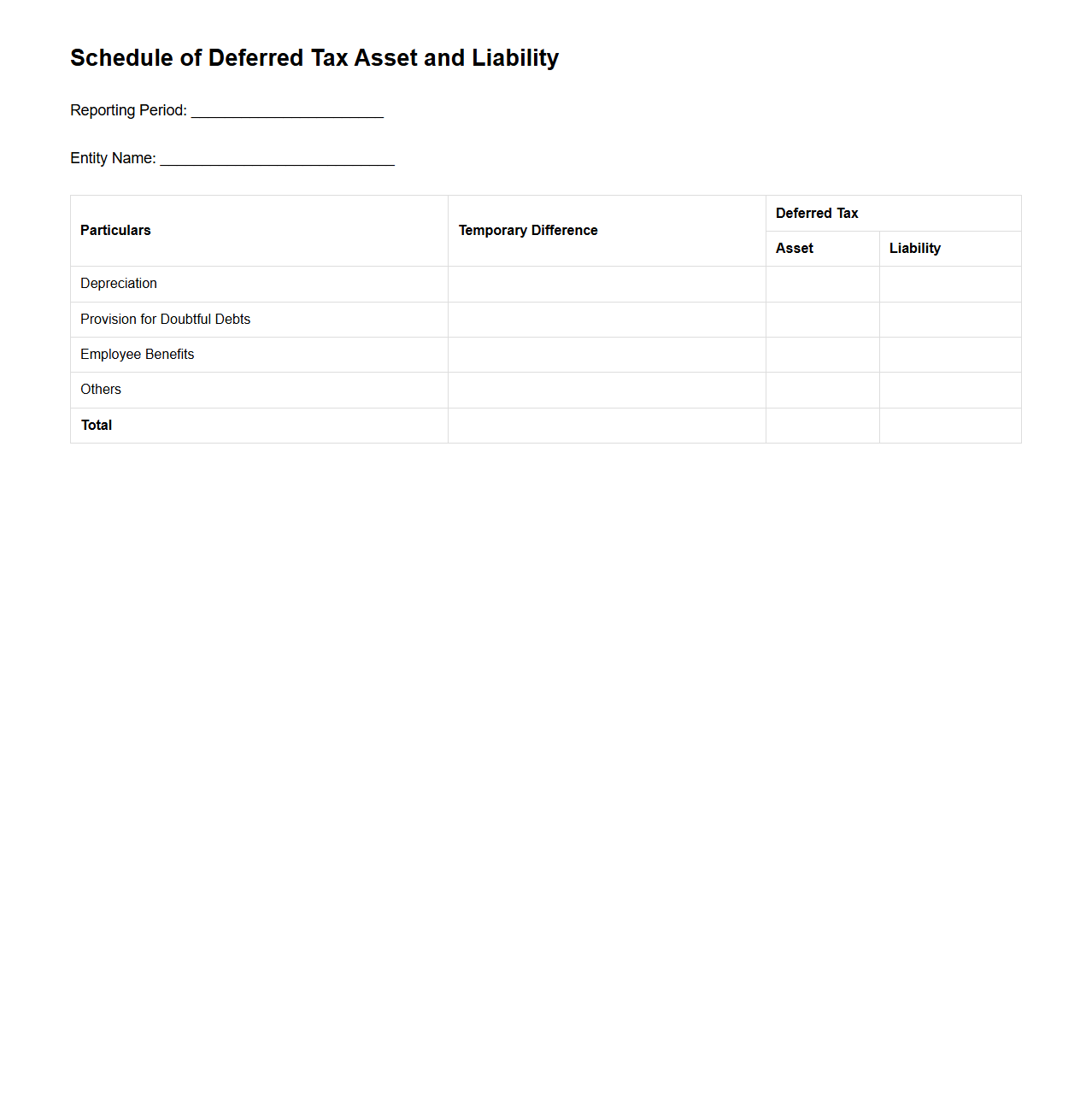

Schedule of Deferred Tax Asset and Liability Template

The

Schedule of Deferred Tax Asset and Liability Template document is used by accounting professionals to systematically record and track deferred tax amounts arising from temporary differences between accounting and tax bases of assets and liabilities. This template helps ensure accurate financial reporting and compliance with tax regulations by detailing the origins, movements, and balances of deferred tax assets and liabilities over specific periods. It serves as a critical tool for reconciling tax expense in the financial statements and supporting tax provision disclosures.

Corporate Tax Return Supporting Documents Checklist Example

A

Corporate Tax Return Supporting Documents Checklist Example is a comprehensive guide that outlines all essential documents required to accurately prepare and file a corporate tax return. These documents typically include financial statements, receipts, payroll records, and tax payment confirmations, ensuring compliance with tax regulations and facilitating a smooth audit process. Utilizing this checklist helps businesses organize their financial information efficiently, reducing errors and the risk of penalties.

What supporting schedules must accompany a corporate tax return letter?

The corporate tax return letter must include essential supporting schedules such as the balance sheet, income statement, and cash flow statement. Schedules detailing tax credits and deductions should also be attached. Additionally, a breakdown of depreciation and amortization schedules is crucial for accurate tax filing.

How should confidential financial data be referenced in the cover letter?

Confidential financial data must be referenced with a clear confidentiality disclaimer in the cover letter. Use language that emphasizes the sensitive nature of the information and request limited access. Avoid disclosing detailed numbers and instead refer to data by category or section for privacy protection.

What language is recommended for disclosing estimated vs. final tax figures?

It is recommended to use precise language such as "estimated figures" when final tax amounts are not confirmed. Clearly state that these figures are subject to adjustment upon the final audit or assessment. Use terms like provisional or preliminary to prevent misunderstandings.

Which attachments are mandatory when detailing foreign subsidiaries?

When detailing foreign subsidiaries, mandatory attachments include the foreign income statement and the tax jurisdiction details. A summary of intercompany transactions and transfer pricing documentation must also be included. Proper disclosure ensures compliance with international tax regulations.

How to address incomplete prior-year adjustments in the return document?

Incomplete prior-year adjustments should be clearly noted with a footnote explanation in the return document. Include a plan to rectify discrepancies in subsequent filings and estimated timelines. Transparency in these adjustments supports regulatory compliance and smooth audit processes.