A Investment Appraisal Document Sample for Project Finance provides a detailed evaluation of the financial viability and potential risks associated with a proposed project. It typically includes cost-benefit analysis, cash flow projections, and key financial metrics such as net present value (NPV) and internal rate of return (IRR). This document serves as a critical tool for stakeholders to make informed decisions regarding project funding and resource allocation.

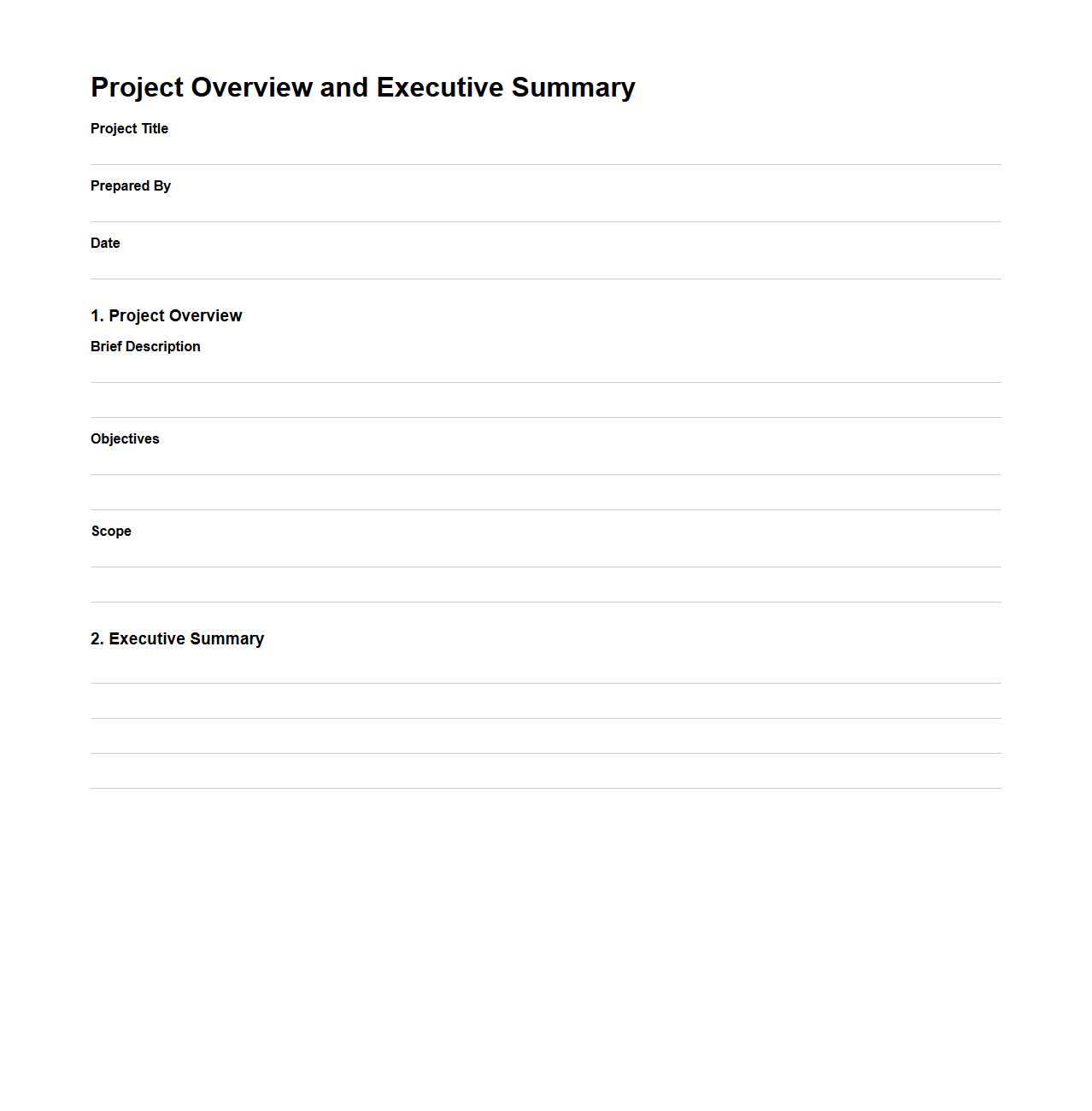

Project Overview and Executive Summary Template

A

Project Overview and Executive Summary Template document provides a structured format to concisely present key project details, objectives, scope, and expected outcomes to stakeholders. It highlights critical information such as project goals, timeline, budget estimates, and key deliverables, enabling quick and informed decision-making. This template ensures consistency and clarity in communication for project proposals, status updates, and executive reviews.

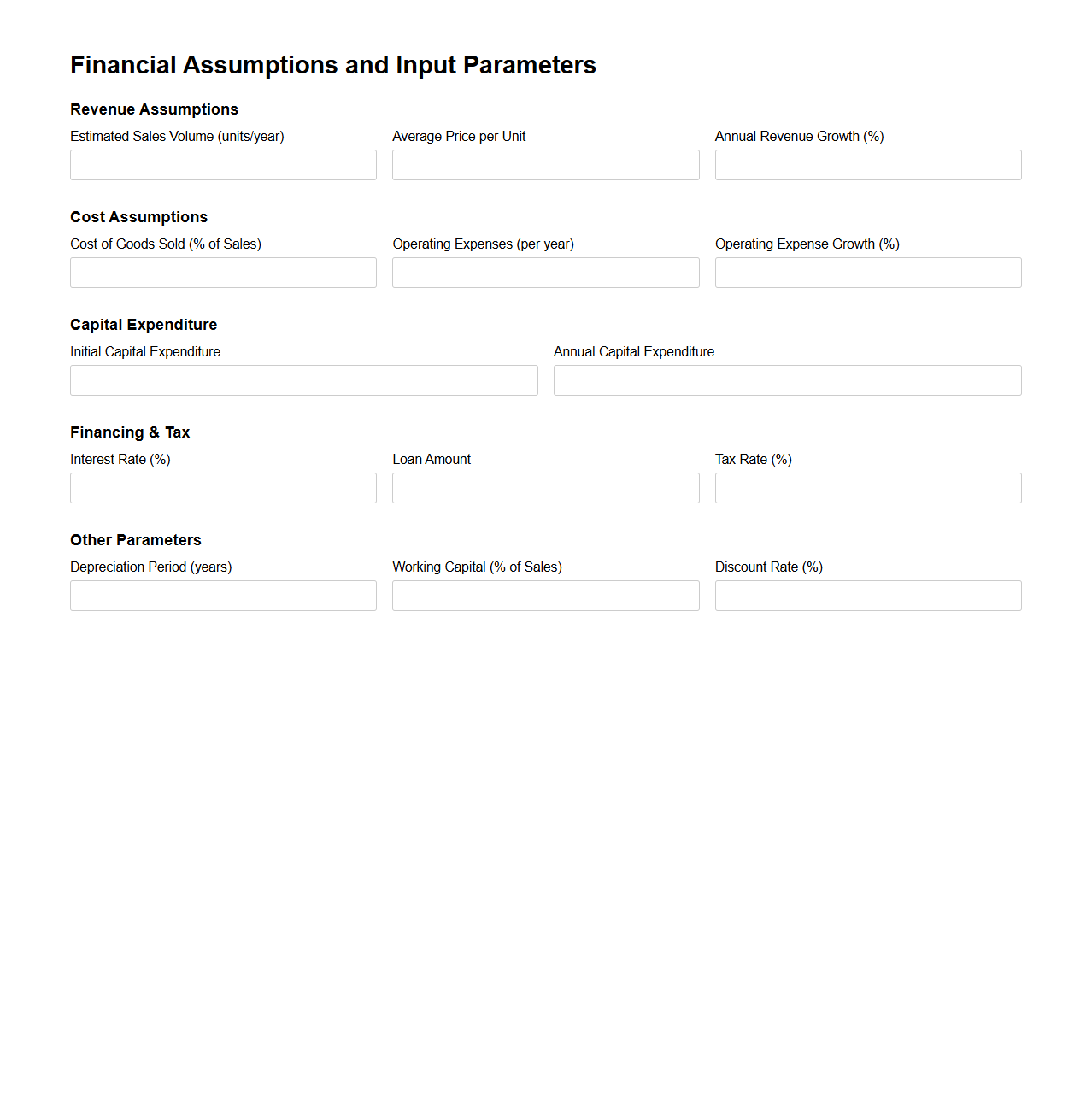

Financial Assumptions and Input Parameters Form

The

Financial Assumptions and Input Parameters Form document outlines key variables and projections used to build financial models, including revenue growth rates, cost estimates, and capital expenditure plans. It serves as a critical reference for analysts to input standardized data ensuring consistency across budgeting, forecasting, and investment analysis. Accurate financial assumptions in this form directly impact the reliability of financial statements and strategic decision-making.

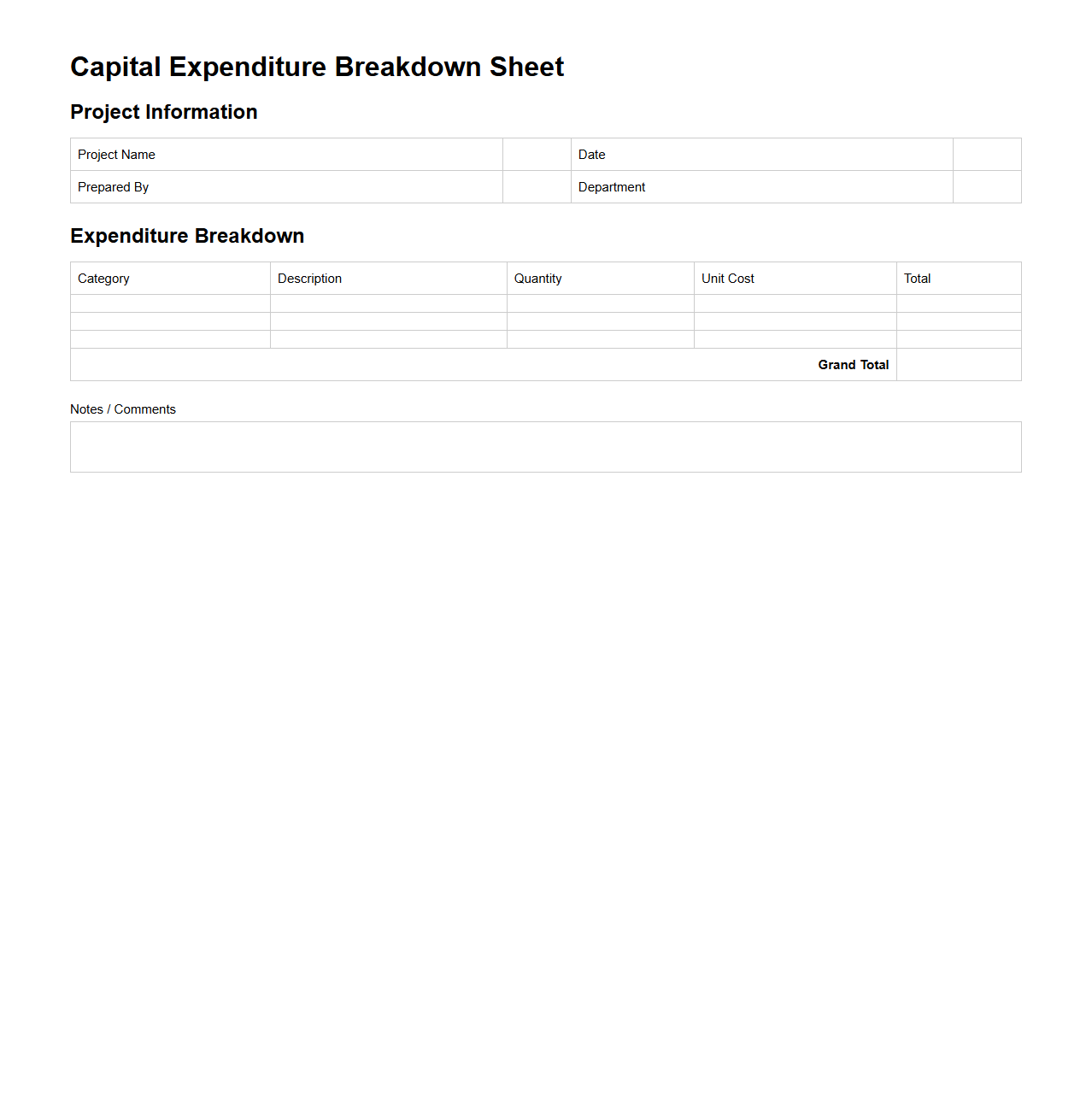

Capital Expenditure Breakdown Sheet

A

Capital Expenditure Breakdown Sheet document provides a detailed categorization of funds allocated for long-term investments in assets or infrastructure. It itemizes various expense components, enabling businesses to track, plan, and manage large-scale spending efficiently. This breakdown aids in budgeting accuracy, financial analysis, and strategic decision-making for capital projects.

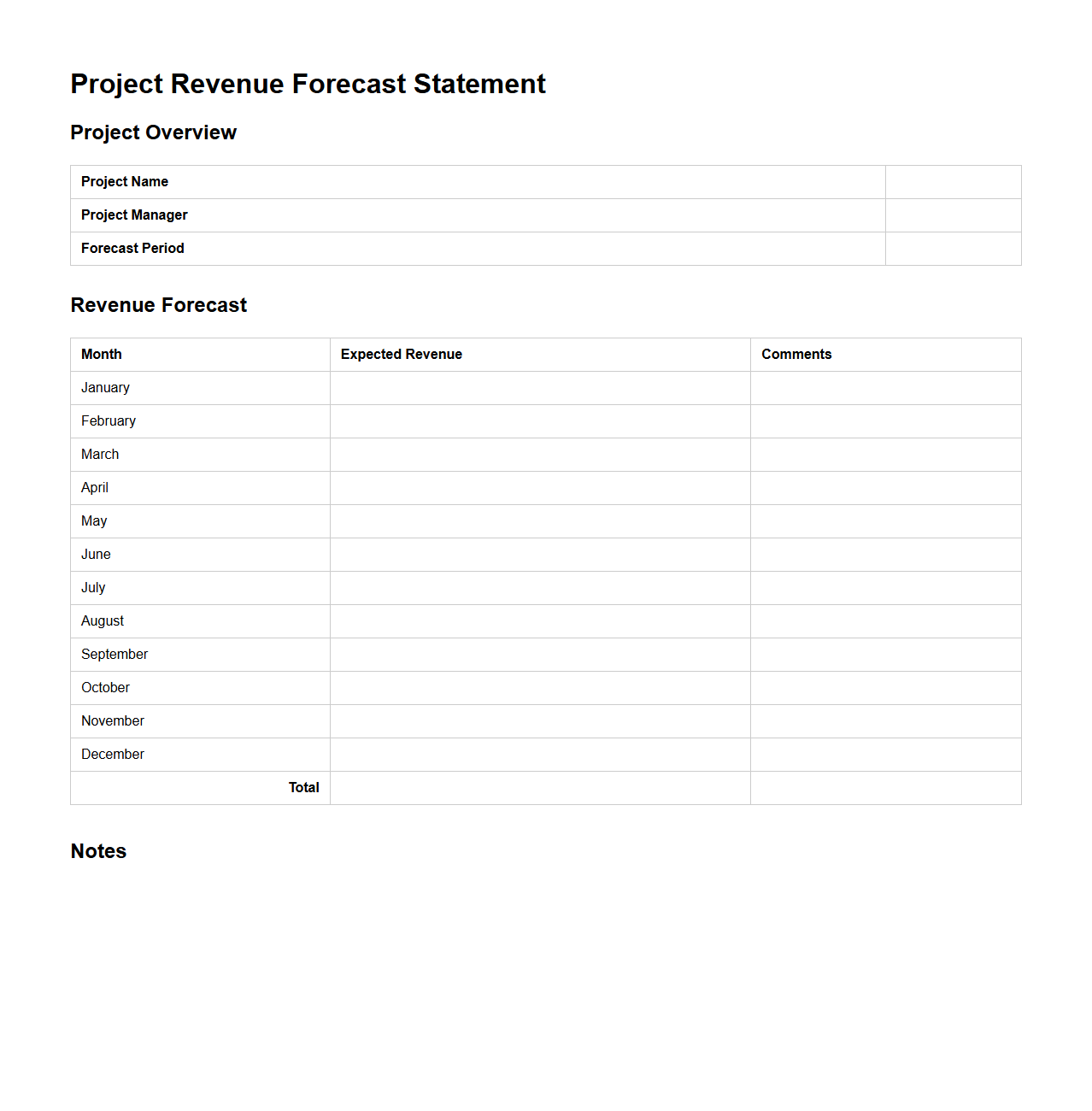

Project Revenue Forecast Statement

A

Project Revenue Forecast Statement document provides detailed projections of the expected income generated from a specific project over a defined period. It includes estimated sales, pricing strategies, market demand analysis, and revenue streams, helping stakeholders assess financial viability and plan resource allocation. This forecast serves as a critical tool for budgeting, performance tracking, and strategic decision-making throughout the project lifecycle.

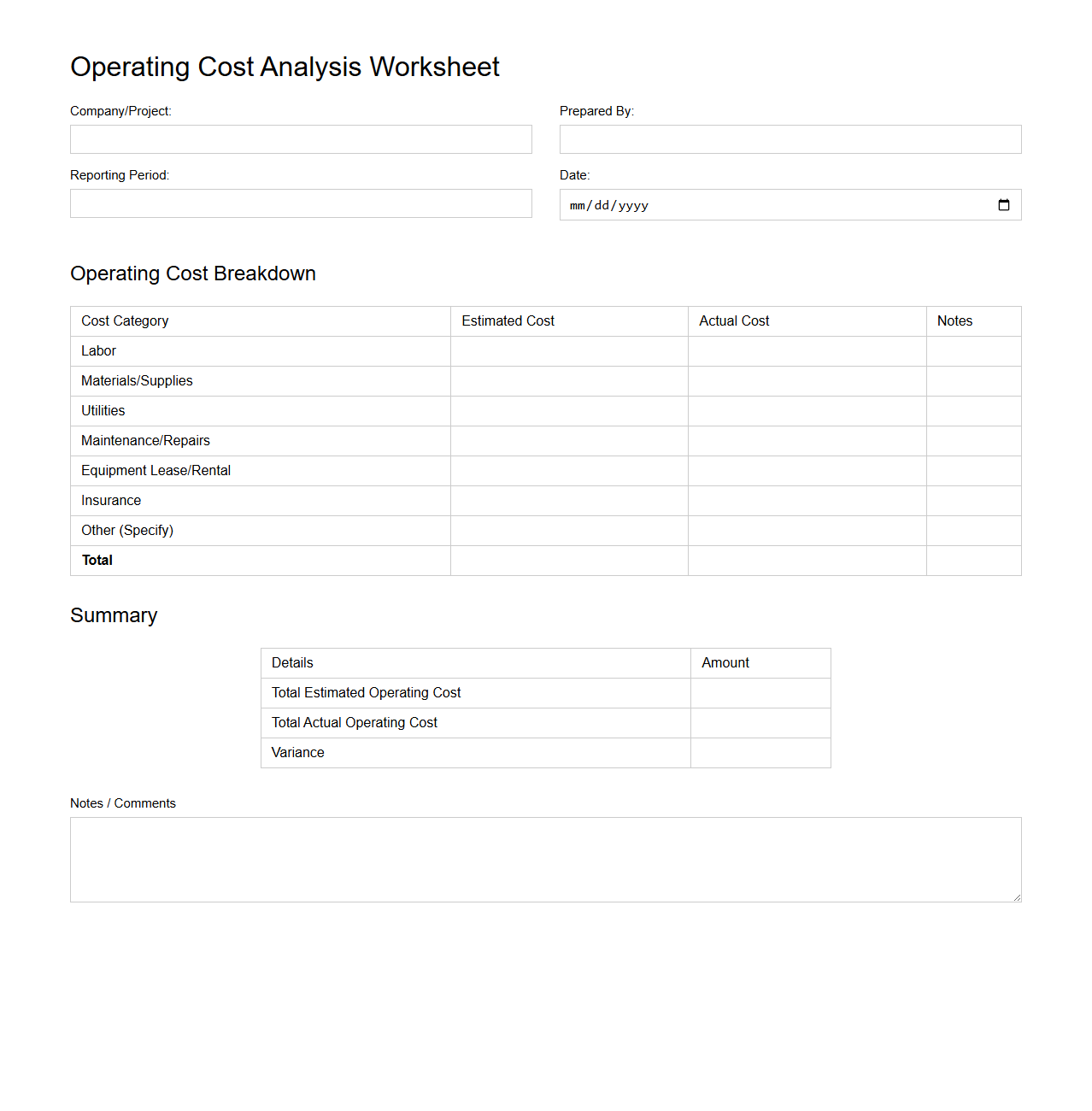

Operating Cost Analysis Worksheet

An Operating Cost Analysis Worksheet is a detailed financial tool used to systematically track and evaluate the expenses associated with running a business or project. This document breaks down costs into categories such as labor, materials, overhead, and utilities, allowing management to identify areas for potential savings and improve budgeting accuracy. By providing a clear overview of ongoing expenditures, the

Operating Cost Analysis Worksheet supports strategic decision-making and enhances overall financial efficiency.

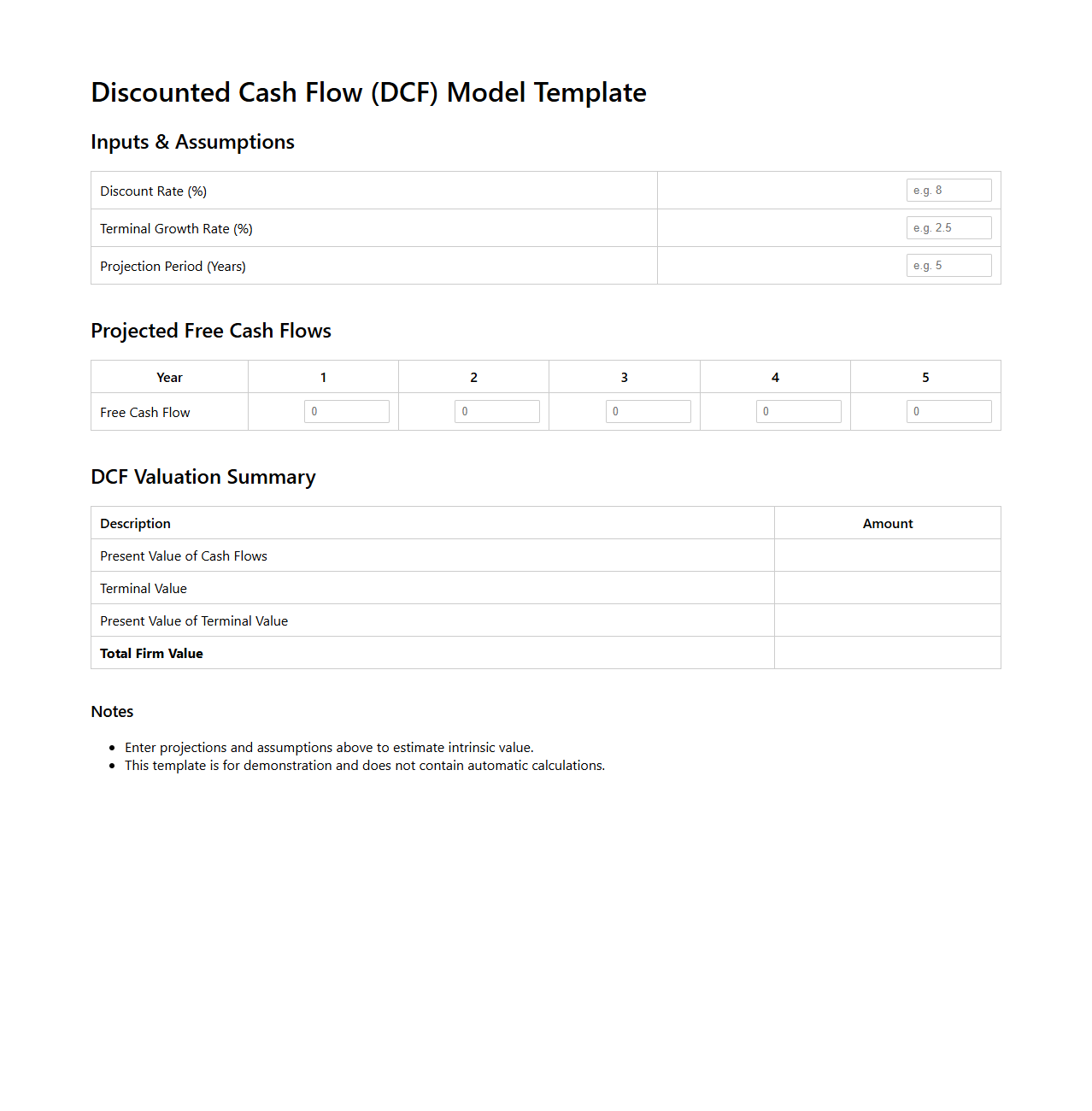

Discounted Cash Flow (DCF) Model Template

The Discounted Cash Flow (DCF) Model Template document is a financial analysis tool designed to estimate the value of an investment based on its expected future cash flows, discounted to their present value using a specific discount rate. This template helps investors and analysts assess the intrinsic worth of a project or company by incorporating projections of revenues, expenses, capital expenditures, and changes in working capital. By using the

DCF Model Template, users can make informed decisions grounded in detailed cash flow forecasting and risk assessment.

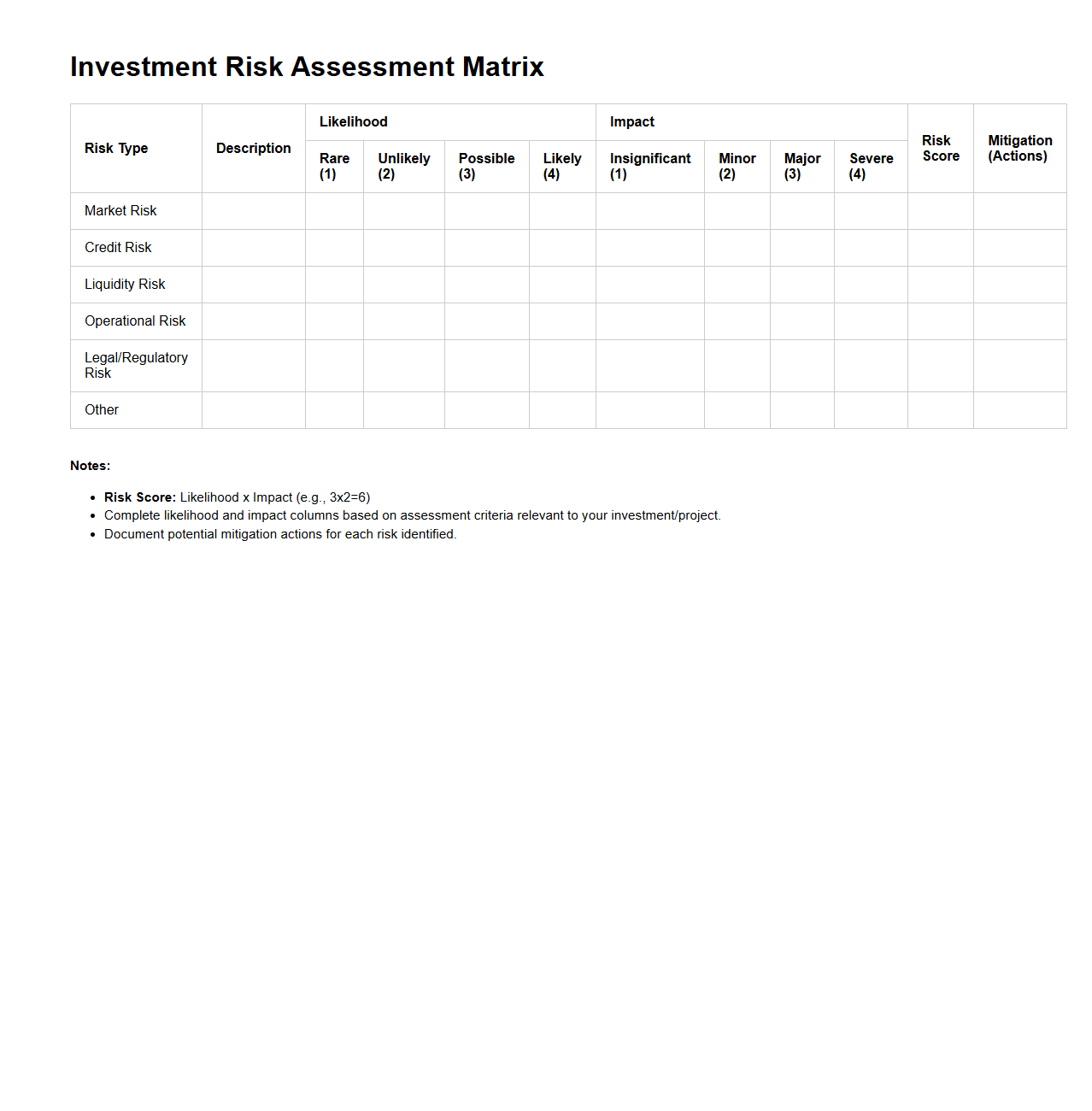

Investment Risk Assessment Matrix

The

Investment Risk Assessment Matrix document systematically evaluates potential risks associated with various investment options by categorizing them based on likelihood and impact. This tool enables investors and financial analysts to visualize and prioritize risks, facilitating informed decision-making and risk mitigation strategies. It provides a structured framework to balance risk and reward, ensuring portfolios align with an investor's risk tolerance and financial goals.

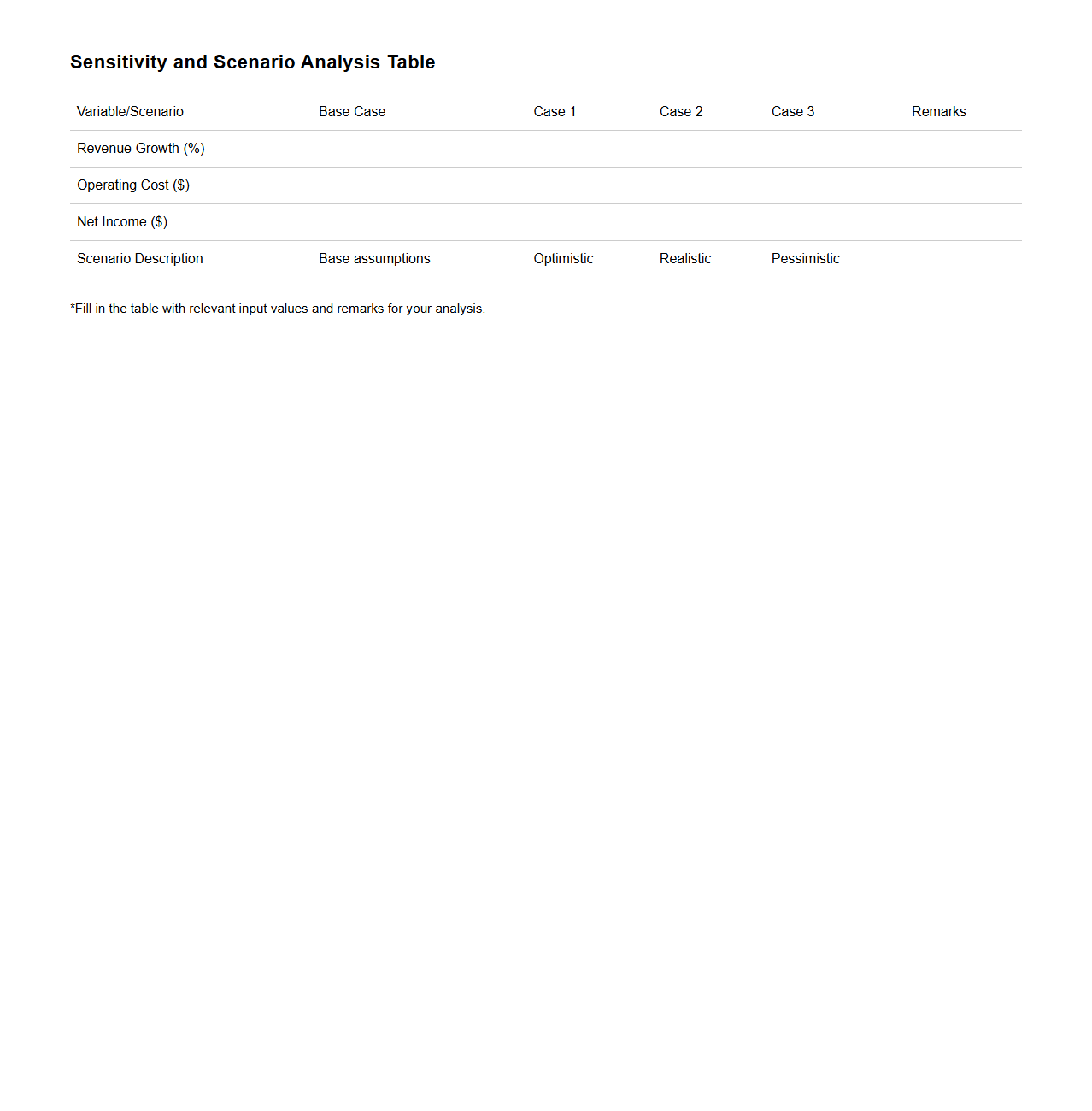

Sensitivity and Scenario Analysis Table

A

Sensitivity and Scenario Analysis Table document systematically evaluates how changes in key variables impact financial models or business outcomes, helping to identify critical risk factors. By comparing multiple scenarios, it enables decision-makers to anticipate potential results under varying assumptions and uncertainties. The table format presents clear, organized data that supports strategic planning and risk management processes.

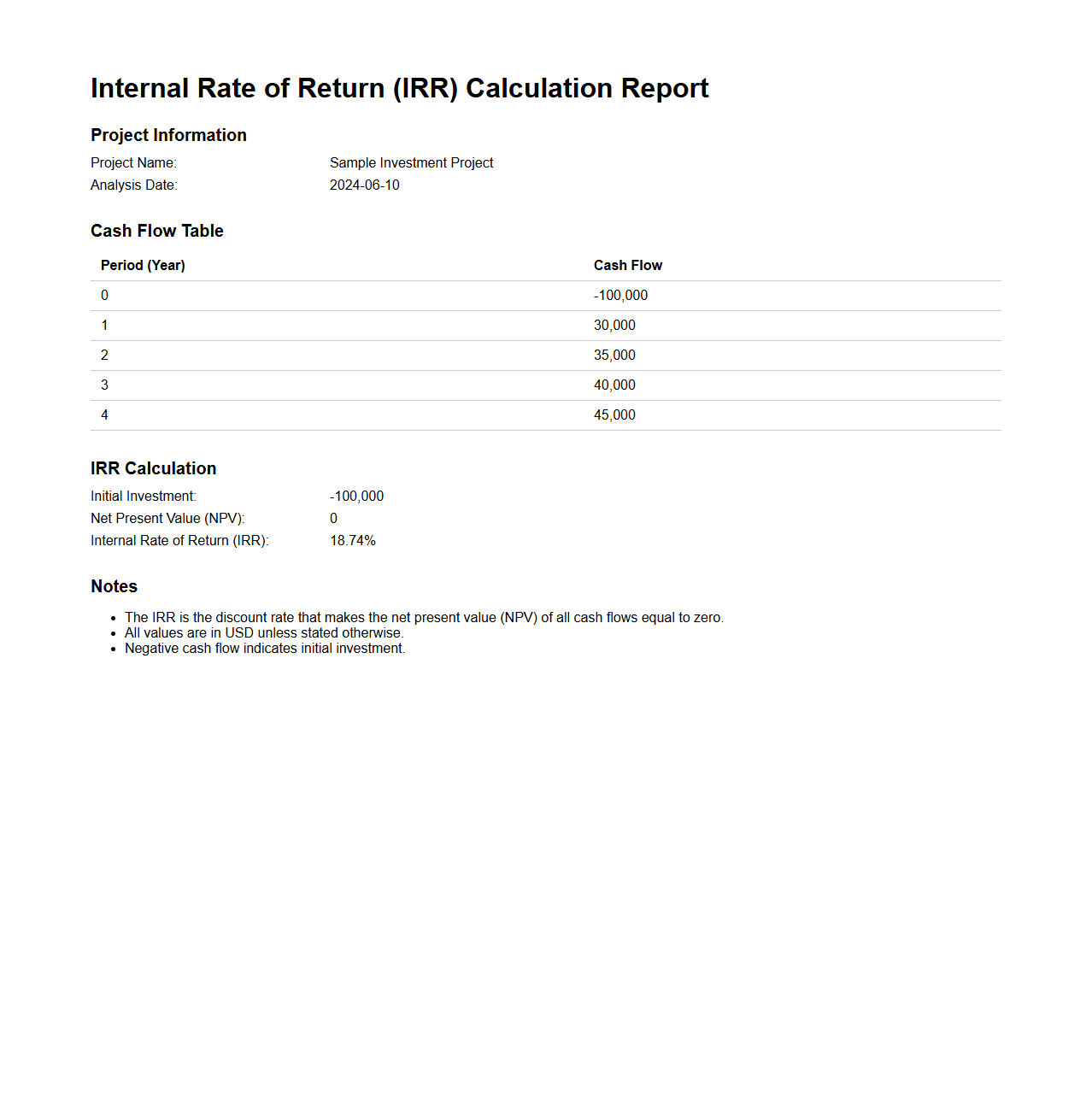

Internal Rate of Return (IRR) Calculation Report

The

Internal Rate of Return (IRR) Calculation Report document presents a detailed analysis of the profitability and efficiency of investment projects by calculating the IRR, which is the discount rate that makes the net present value (NPV) of cash flows equal to zero. This report typically includes projected cash flows, assumptions used in calculations, and sensitivity analysis to assess potential variations in returns. Business decision-makers rely on this document to compare investment options and determine the feasibility of capital expenditures.

Project Finance Approval Recommendation Document

The

Project Finance Approval Recommendation Document outlines a detailed assessment of a project's financial viability, risk factors, and expected returns to support decision-making by funding bodies or stakeholders. It compiles critical financial models, due diligence findings, and compliance checks to ensure alignment with investment criteria and regulatory standards. This document serves as a formal endorsement for project financing, guiding approval authorities toward informed funding decisions.

Key Financial Metrics in Investment Appraisal Document

The Investment Appraisal Document must detail crucial financial metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period to assess project viability. These metrics provide insight into the project's profitability, efficiency, and risk. Additionally, metrics like Return on Investment (ROI) and profitability index help investors understand potential returns and value creation.

Addressing Risk Factors and Sensitivity Analysis

The document explores risk factors by identifying potential threats to project success and quantifying their impact. Sensitivity analysis is used to examine how changes in key variables such as cost, revenue, and interest rates affect project outcomes. This approach ensures stakeholders understand the range of possible results and the robustness of financial projections.

Assumptions on Cash Flow Projections

The appraisal document justifies assumptions about cash flow projections by basing them on historical data, market trends, and realistic growth rates. It details expected inflows and outflows including operating costs, capital expenditures, and financing expenses. Clear assumptions ensure transparency and enhance the credibility of financial forecasts.

Compliance and Regulatory Considerations

Compliance and regulatory considerations are addressed by outlining applicable laws, industry standards, and environmental regulations. The document highlights necessary permits and licenses required to undertake the project legally. It also evaluates potential legal risks and mitigation strategies to ensure adherence to regulatory frameworks.

Evaluation Criteria for Financing Structures

The appraisal document uses evaluation criteria such as cost of capital, repayment terms, and financial flexibility to select appropriate financing structures. It compares options like debt, equity, and hybrid instruments by analyzing their impact on project cash flow and risk profile. The goal is to optimize capital structure while ensuring financial sustainability and stakeholder alignment.