A Payroll Document Sample for Employee Compensation outlines detailed information about an employee's wages, deductions, and net pay for a specific period. It serves as an official record ensuring transparency and accuracy in salary disbursement. This document helps both employers and employees maintain clear financial accountability.

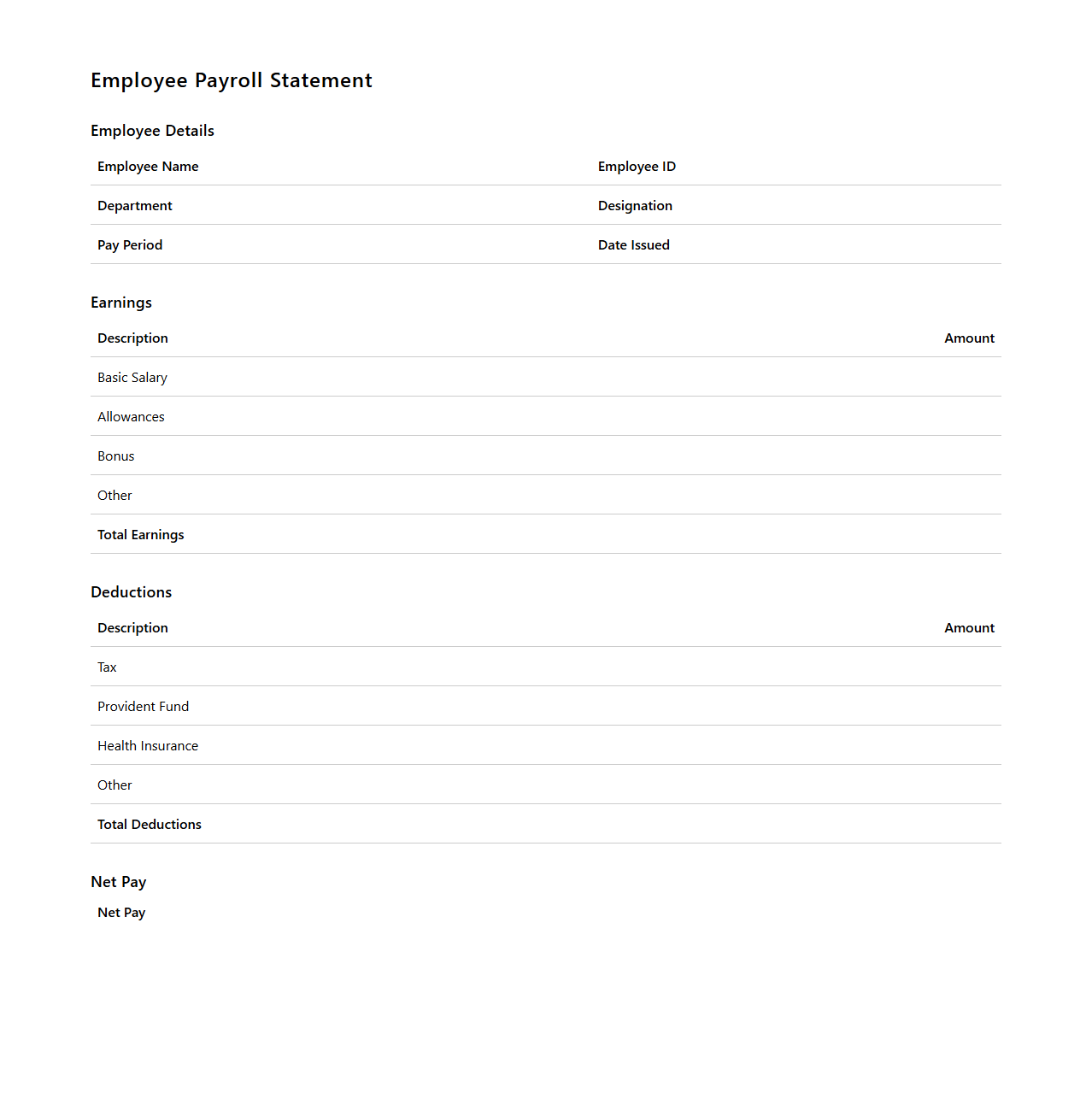

Employee Payroll Statement Sample

An

Employee Payroll Statement Sample is a detailed document that outlines an employee's earnings, deductions, taxes, and net pay for a specific pay period. It serves as a transparent record to help employees understand their salary components and ensures compliance with financial and legal standards. This sample document is useful for payroll departments to standardize information presentation and verify accuracy.

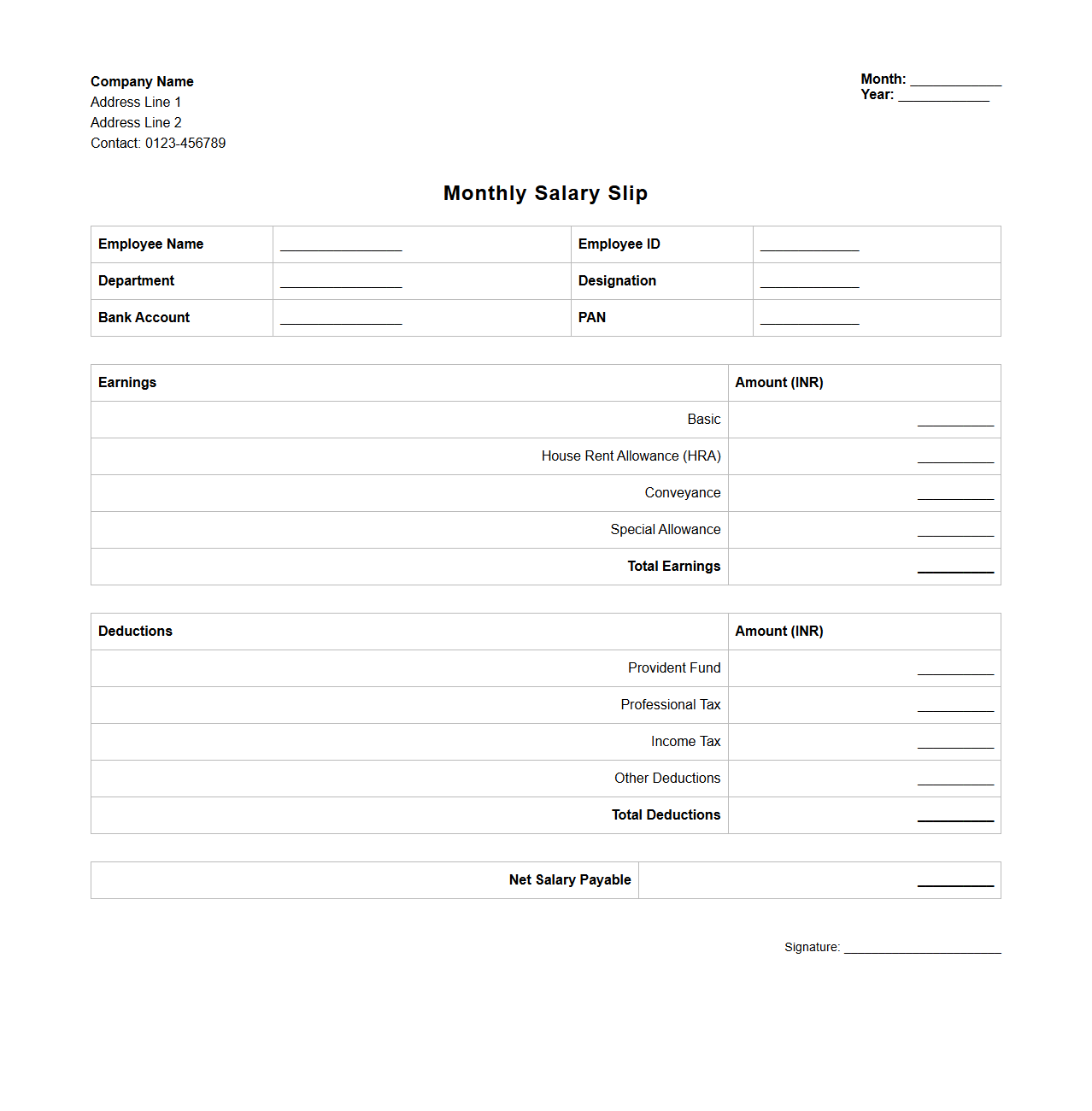

Monthly Salary Slip Sample

A

Monthly Salary Slip Sample document provides a detailed breakdown of an employee's earnings, deductions, and net salary for a specific month. It typically includes information such as basic pay, allowances, taxes, and other deductions, ensuring transparency and accurate financial record-keeping. Employers use this document to maintain payroll compliance and facilitate employee financial planning.

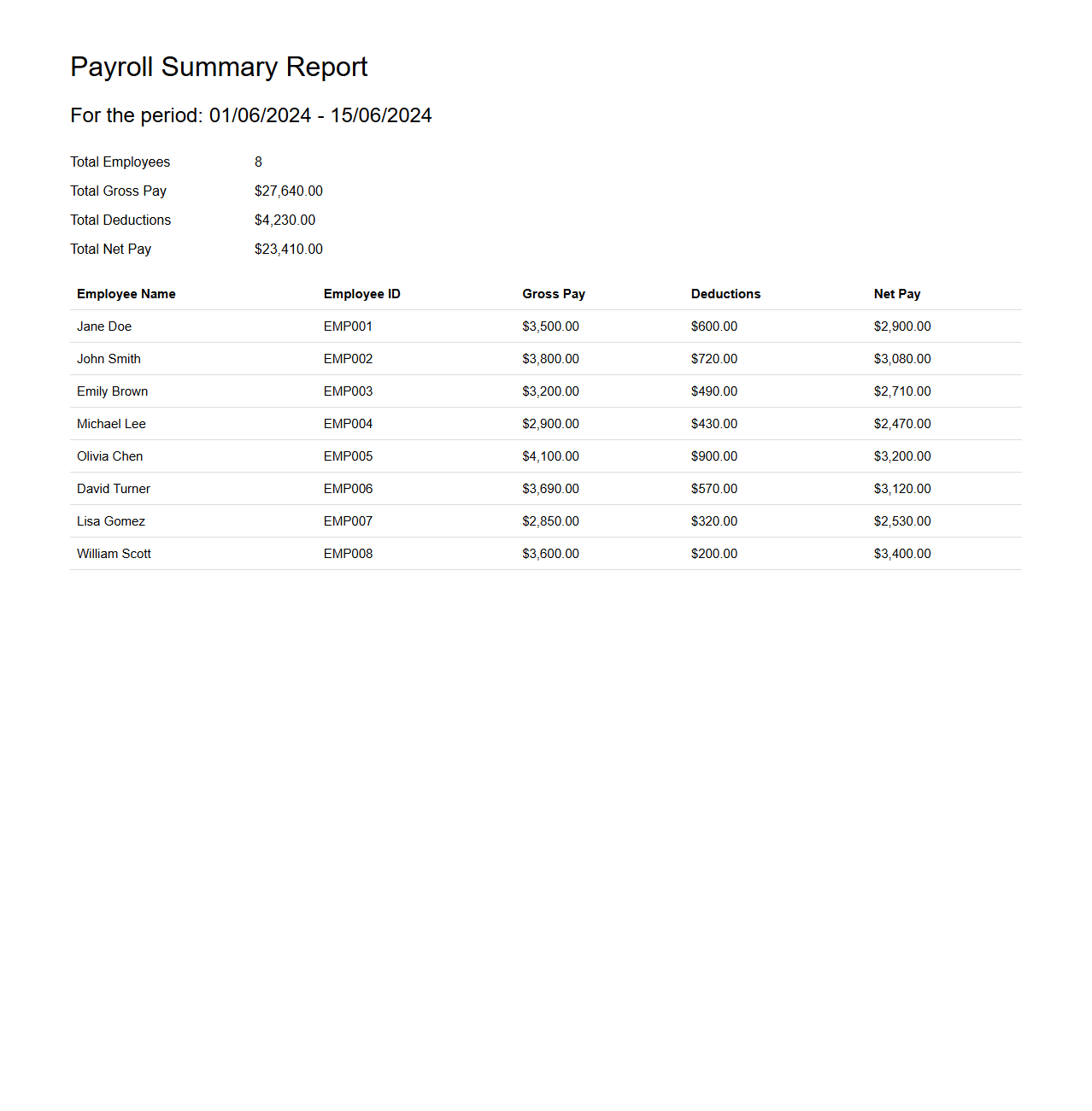

Payroll Summary Report Sample

A

Payroll Summary Report Sample document provides a concise overview of employee compensation, including total wages, taxes withheld, deductions, and net pay for a specific period. It serves as a vital tool for payroll processing, compliance audits, and financial analysis, ensuring accurate record-keeping and regulatory adherence. Businesses use this report to verify payroll accuracy, manage budgets, and prepare tax filings.

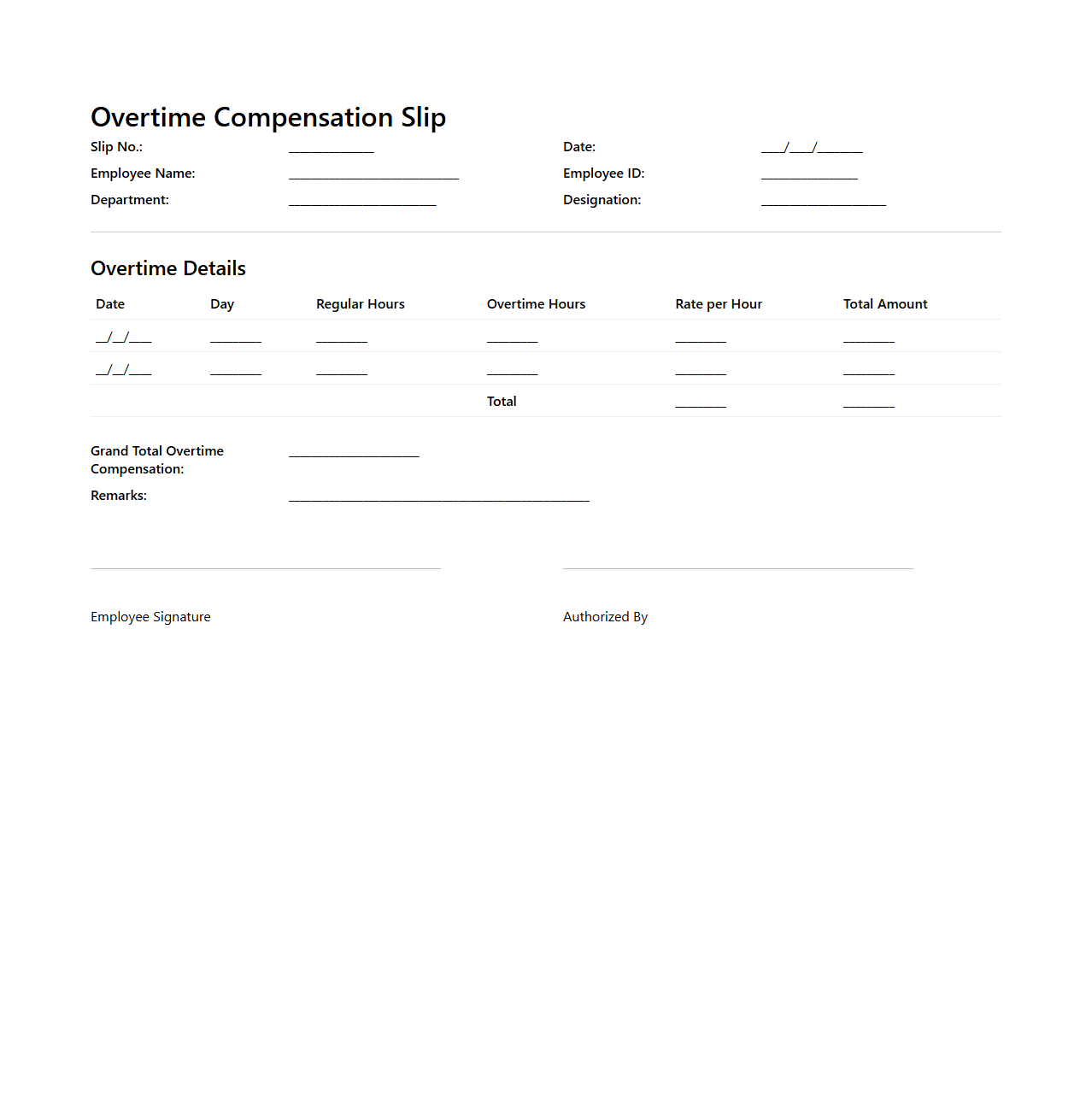

Overtime Compensation Slip Sample

An

Overtime Compensation Slip Sample document serves as a formal record detailing the extra hours an employee has worked beyond their regular schedule, along with the corresponding payment for those hours. This slip typically includes employee information, dates and hours of overtime worked, the rate of pay applied, and the total amount compensated. Employers use this document to ensure transparency and proper wage calculation compliant with labor laws and company policies.

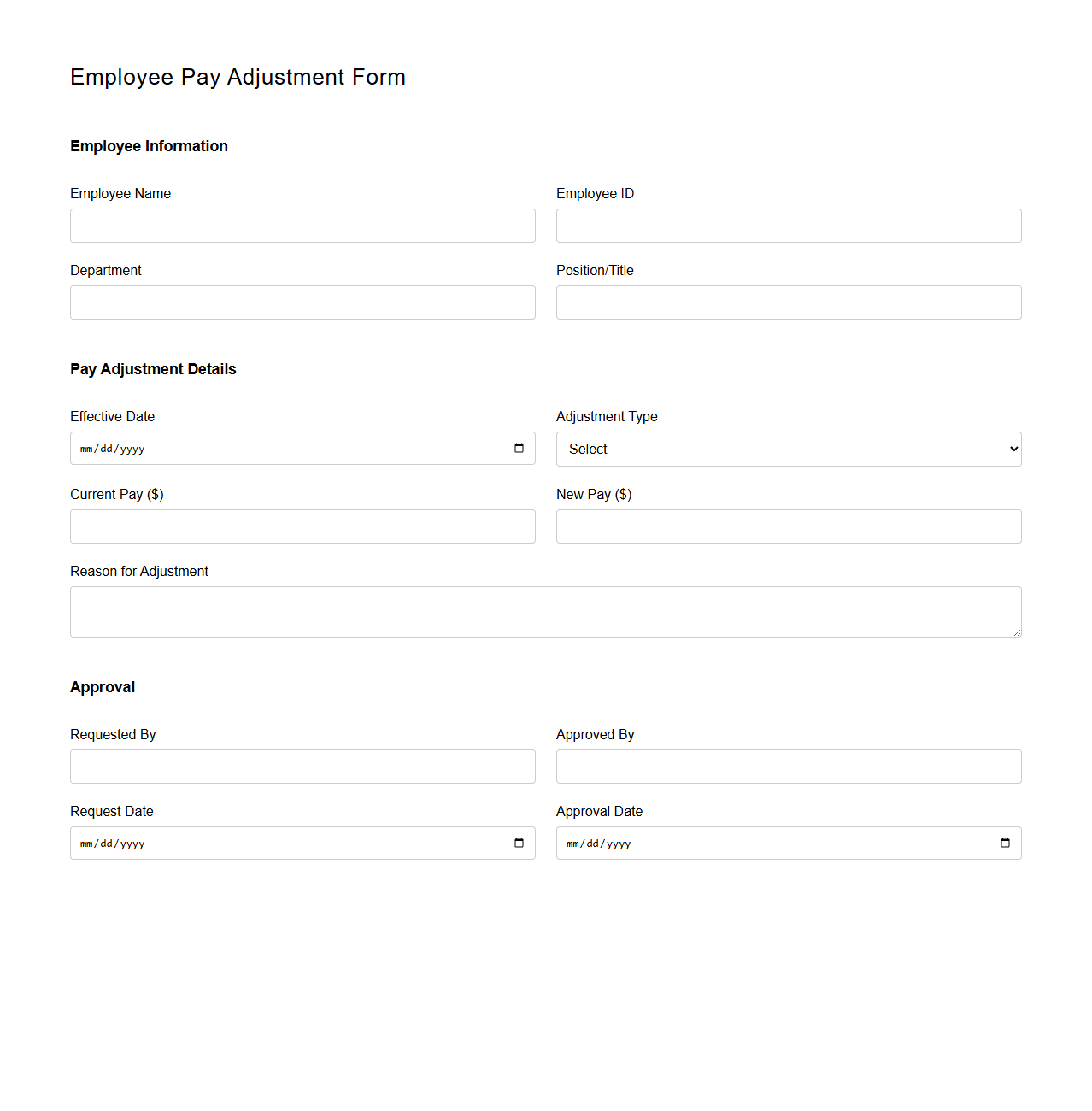

Employee Pay Adjustment Form Sample

An

Employee Pay Adjustment Form Sample document is a standardized template used by organizations to formally record and approve changes in an employee's salary or wage. This form typically includes essential details such as the employee's name, current pay rate, proposed adjustment, effective date, and approval signatures. It serves as an official record to ensure transparency and proper authorization in compensation modifications.

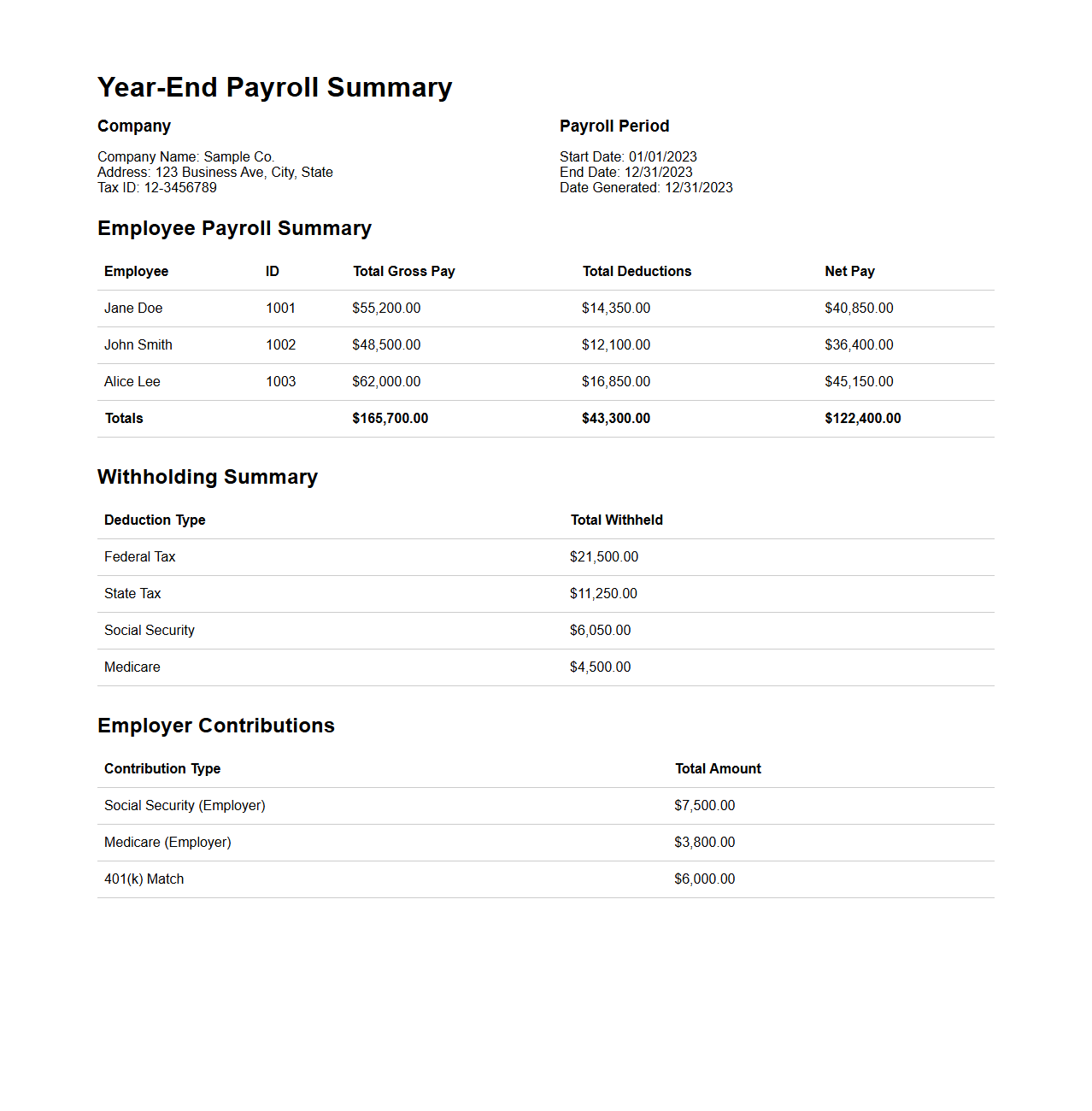

Year-End Payroll Summary Sample

A

Year-End Payroll Summary Sample document provides a detailed overview of an employee's total earnings, tax withholdings, and deductions throughout the fiscal year. It includes essential data such as gross wages, federal and state taxes, Social Security, Medicare contributions, and any year-end bonuses or adjustments. This summary assists in accurate tax filing and financial record-keeping for both employers and employees.

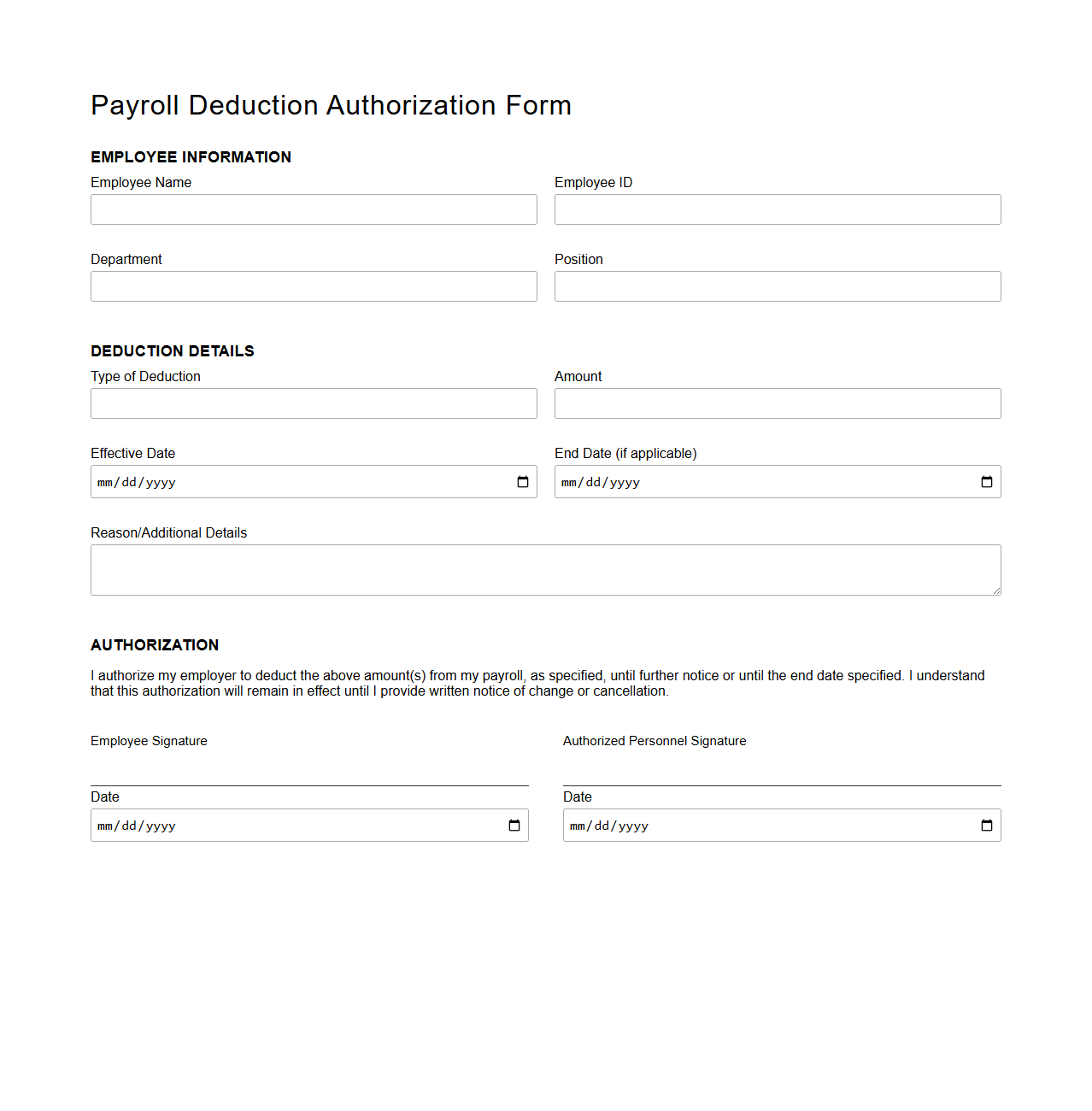

Payroll Deduction Authorization Form Sample

A

Payroll Deduction Authorization Form Sample document is a pre-designed template that allows employees to authorize their employer to deduct specific amounts from their wages for designated purposes such as benefits, loan repayments, or charitable contributions. This form ensures clear communication and legal compliance between employers and employees by specifying the deduction amount, frequency, and purpose. Utilizing a sample document helps streamline the payroll process, maintain accurate records, and protect both parties' rights.

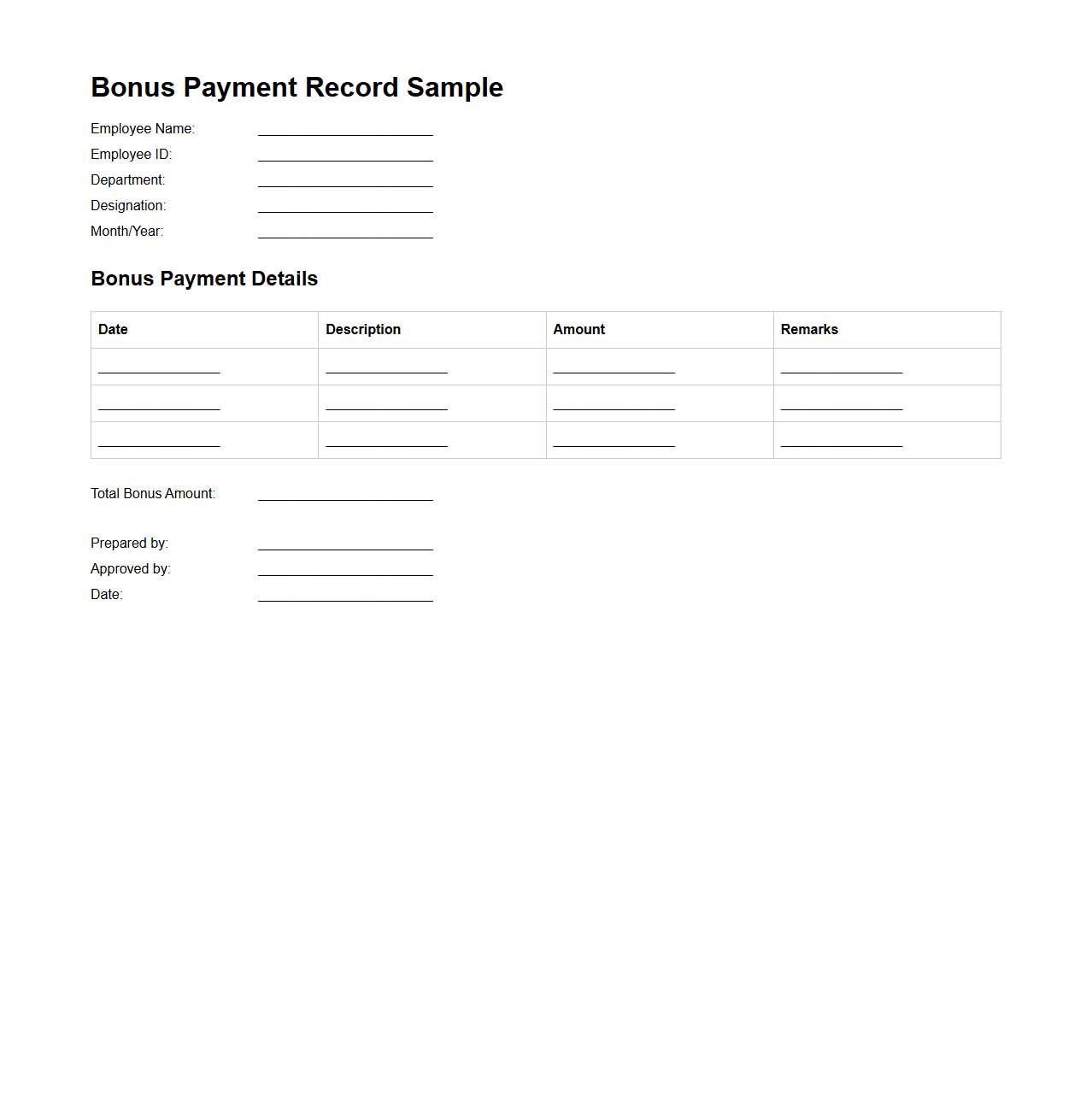

Bonus Payment Record Sample

A

Bonus Payment Record Sample document provides a structured example of how companies track and document employee bonus payments. It includes details such as employee names, bonus amounts, payment dates, and applicable performance metrics or criteria. This record ensures transparency, accuracy, and compliance with payroll and tax regulations.

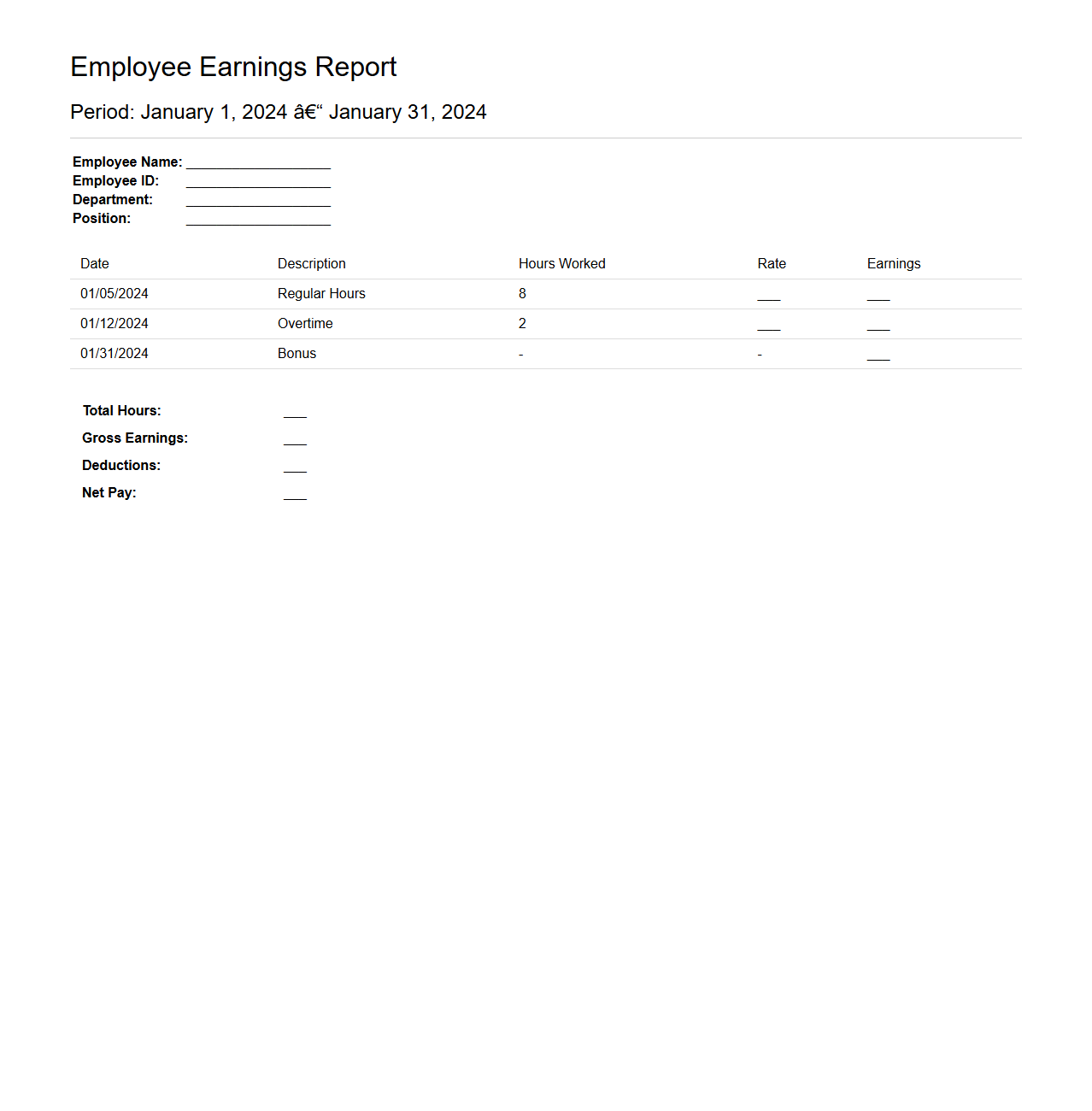

Employee Earnings Report Sample

An

Employee Earnings Report Sample document provides a detailed summary of an employee's wages, including gross pay, deductions, and net pay for a specific period. This report is essential for payroll accuracy, tax filing, and financial record-keeping. Employers use it to ensure compliance with tax regulations and to provide transparent compensation information to employees.

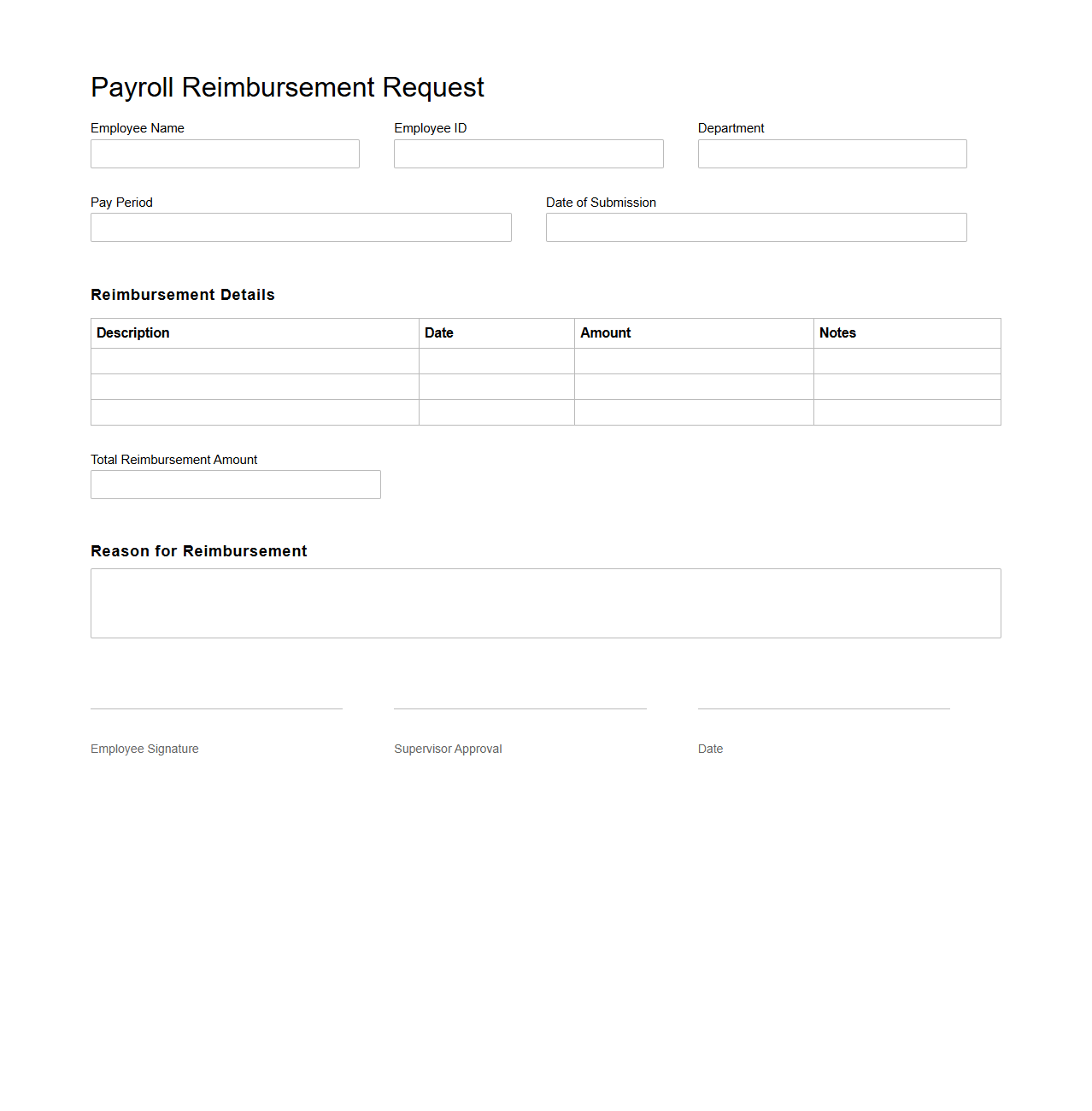

Payroll Reimbursement Request Sample

A

Payroll Reimbursement Request Sample document serves as a formal template for employees to request repayment of expenses or deductions related to their payroll. This document includes essential details such as the employee's information, amount to be reimbursed, reason for reimbursement, and supporting evidence like receipts. Proper use of this sample ensures accurate record-keeping, timely processing, and clear communication between employees and payroll departments.

What mandatory details must be included in a payroll document for statutory compliance?

A legally compliant payroll document must include the employee's full name, identification number, and the pay period dates. It should also specify gross salary, statutory deductions such as taxes and social security, and the net pay. Including employer information and payment dates is essential for transparency and regulatory adherence.

How should overtime compensation be itemized in an employee payroll letter?

Overtime compensation must be clearly itemized separately in the payroll letter, specifying the number of hours worked beyond regular shifts. The pay rate for overtime should be distinctly listed, often at a higher, legally mandated rate. This transparency ensures the employee understands their extra earnings and complies with labor laws.

What is the best format to confidentially communicate salary deductions in a payroll document?

Salary deductions should be presented in a clear and itemized list within the payroll document, using secure and employee-only accessible methods such as encrypted PDFs or secure portals. Each deduction must be labeled precisely, explaining the purpose, like taxes, insurance, or loan repayments. Confidentiality and clarity protect employee privacy and maintain trust.

How should payroll letters address multi-currency payments for international employees?

Payroll letters for international employees must specify the currency used for payment alongside the amount to avoid confusion. It is crucial to mention the exchange rate applied if conversions are involved and date of conversion to provide transparency. This clarifies payment details and ensures proper financial understanding across borders.

What specific language ensures payroll document clarity regarding benefits and allowances?

Using precise terms like "taxable benefits," "non-taxable allowances," and "monetary and in-kind benefits" ensures clarity in payroll documents. Explicitly stating the value, frequency, and tax implications helps employees understand their total compensation package. Clear, unambiguous language prevents disputes and aids compliance with tax authorities.