A Bank Reconciliation Document Sample for Accounting provides a clear template to match the company's financial records with bank statements, ensuring accuracy and identifying discrepancies. It includes detailed entries for deposits, withdrawals, and bank fees, facilitating the detection of errors or fraud. This document is essential for maintaining updated and reliable financial statements in accounting practices.

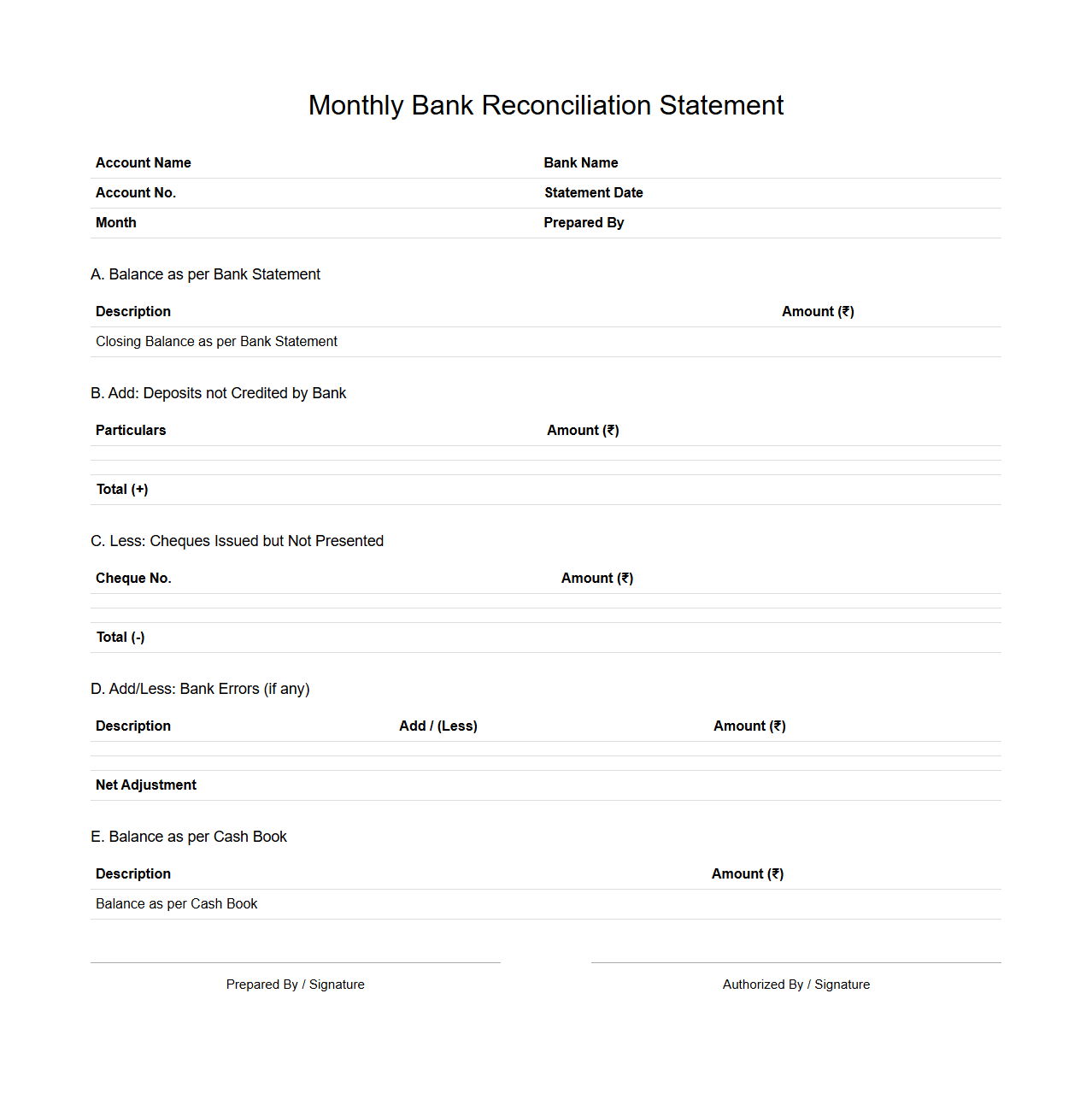

Monthly Bank Reconciliation Statement Template

A

Monthly Bank Reconciliation Statement Template document is a structured tool used to systematically compare and verify the balances between a company's cash records and bank statements each month. It helps identify discrepancies such as outstanding checks, deposits in transit, or bank errors, ensuring financial accuracy and preventing fraud. This template streamlines the reconciliation process by providing predefined sections for transaction dates, descriptions, amounts, and adjustments, enhancing efficiency and consistency in financial reporting.

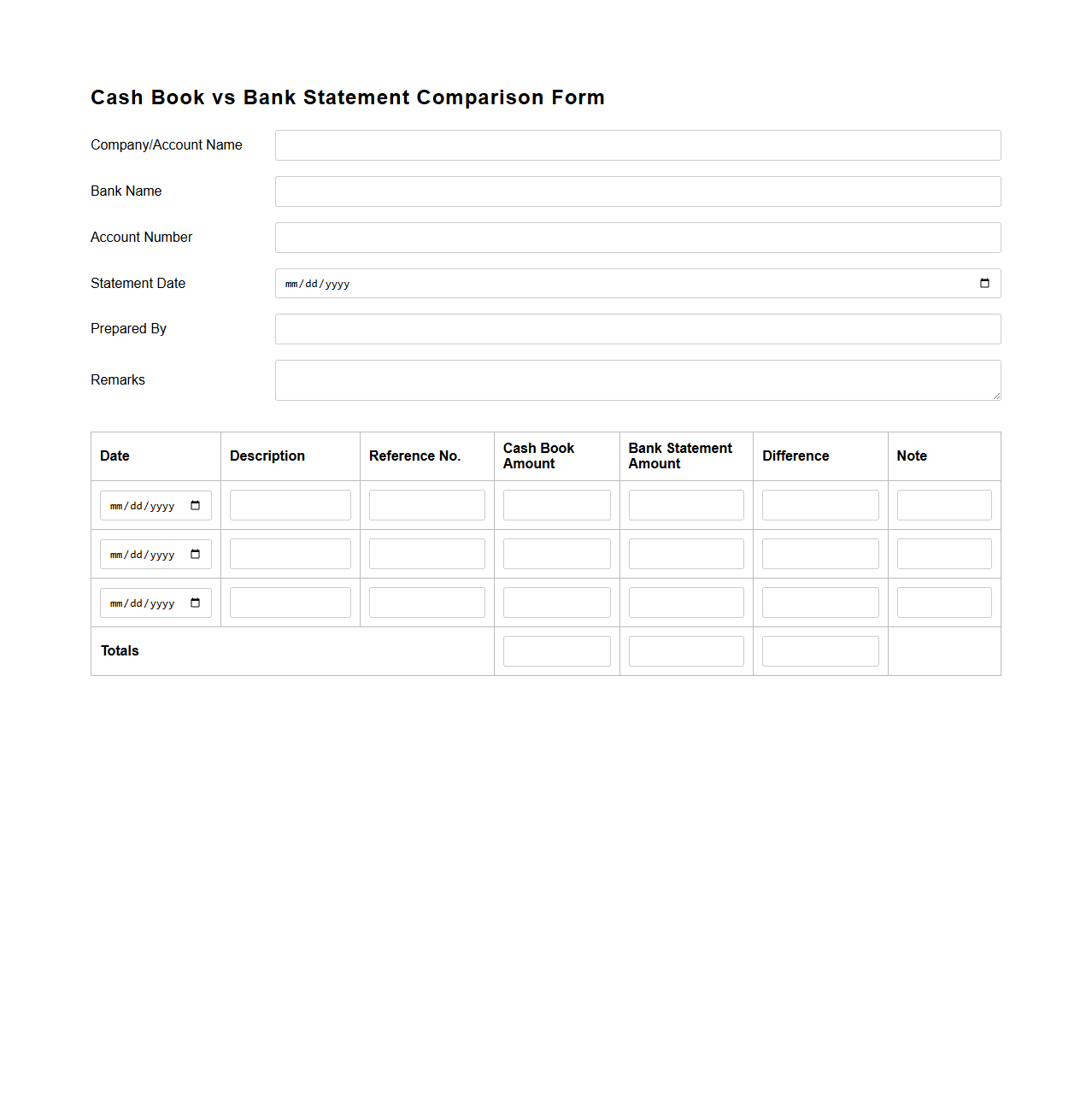

Cash Book versus Bank Statement Comparison Form

The

Cash Book versus Bank Statement Comparison Form is a financial tool used to reconcile discrepancies between an organization's cash book records and the bank statement. It helps identify errors, unauthorized transactions, or timing differences by systematically comparing deposits, withdrawals, and balances reported by both sources. Accurate completion of this document ensures reliable financial reporting and effective cash flow management.

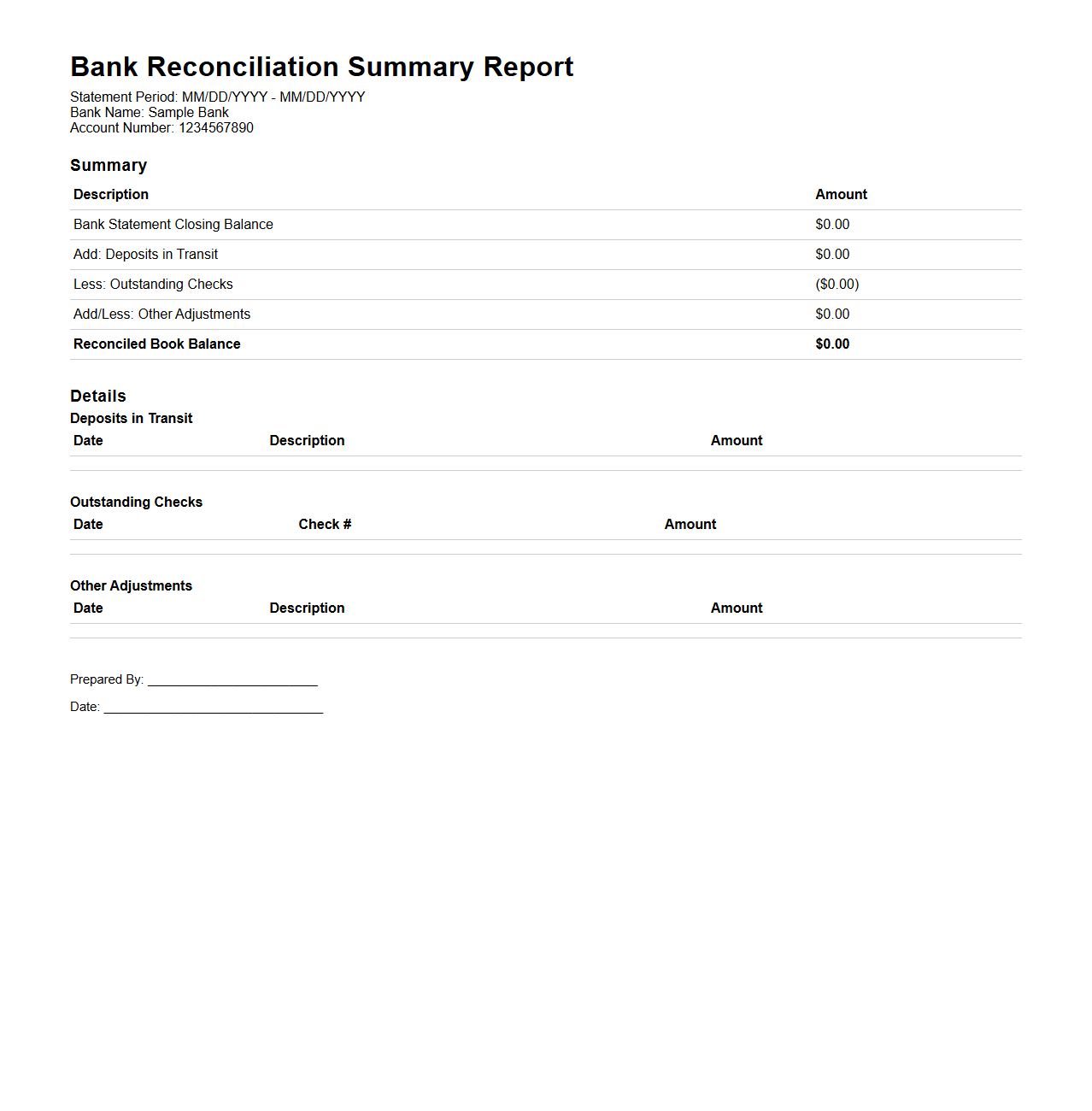

Bank Reconciliation Summary Report Sample

A

Bank Reconciliation Summary Report Sample document provides a clear overview of the differences between a company's cash records and bank statements to ensure accuracy in financial reporting. It highlights discrepancies such as outstanding checks, deposits in transit, and bank fees, allowing businesses to identify errors or unauthorized transactions. This document serves as a vital tool for maintaining accurate financial records and supporting audit requirements.

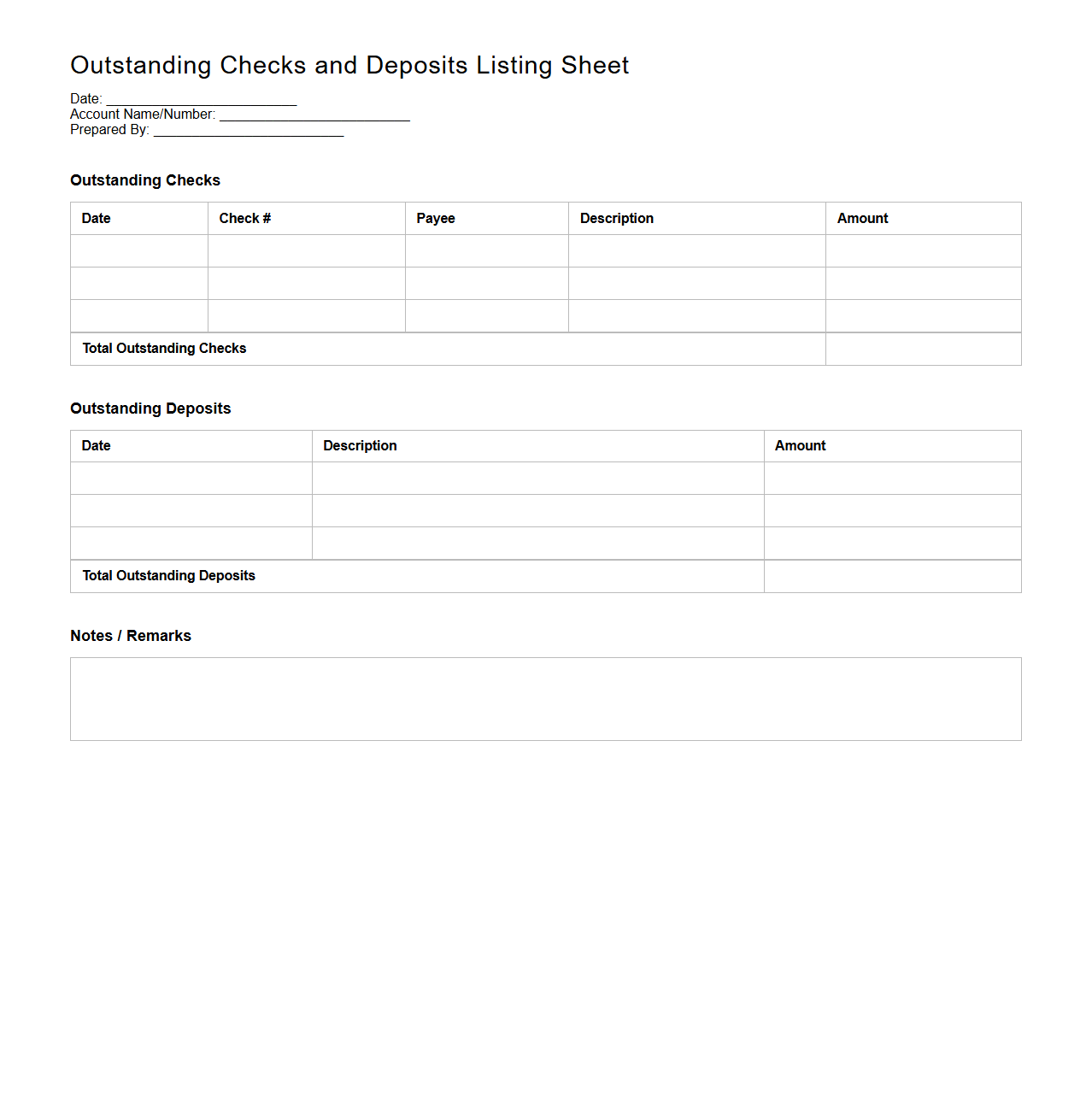

Outstanding Checks and Deposits Listing Sheet

The

Outstanding Checks and Deposits Listing Sheet is a financial document used to track checks issued but not yet cleared by the bank and deposits made that have not been credited to the account. This sheet helps businesses reconcile their bank statements by providing a detailed list of pending transactions, ensuring accurate cash flow management. It is essential for identifying discrepancies between the company's records and the bank's records, facilitating timely error correction.

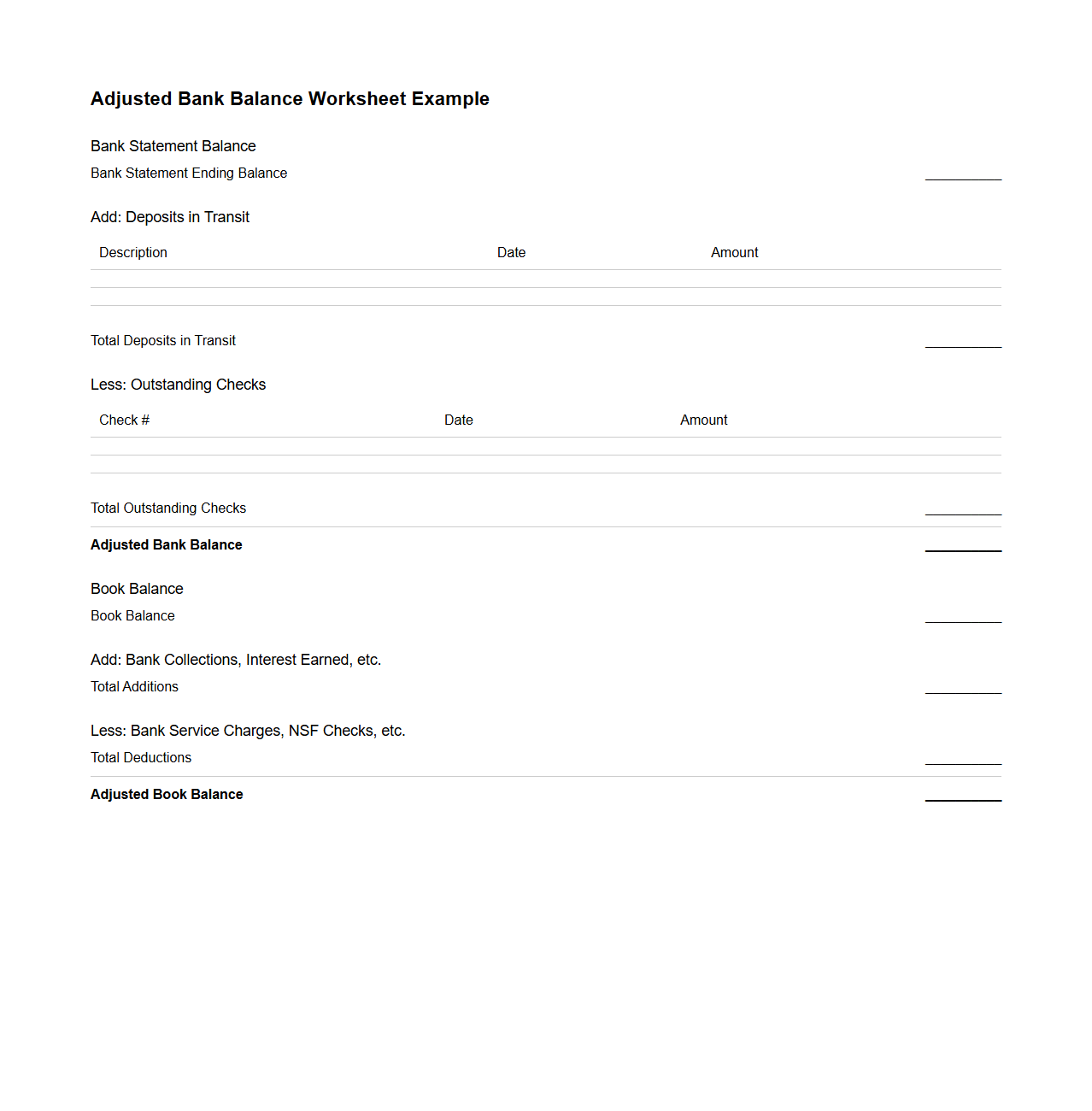

Adjusted Bank Balance Worksheet Example

The

Adjusted Bank Balance Worksheet Example document is a financial tool used to reconcile the discrepancies between a company's cash account balance and the bank statement balance. It highlights important adjustments such as outstanding checks, deposits in transit, and bank errors to ensure accurate financial reporting. This worksheet aids accountants in maintaining precise cash balances for effective cash management and audit compliance.

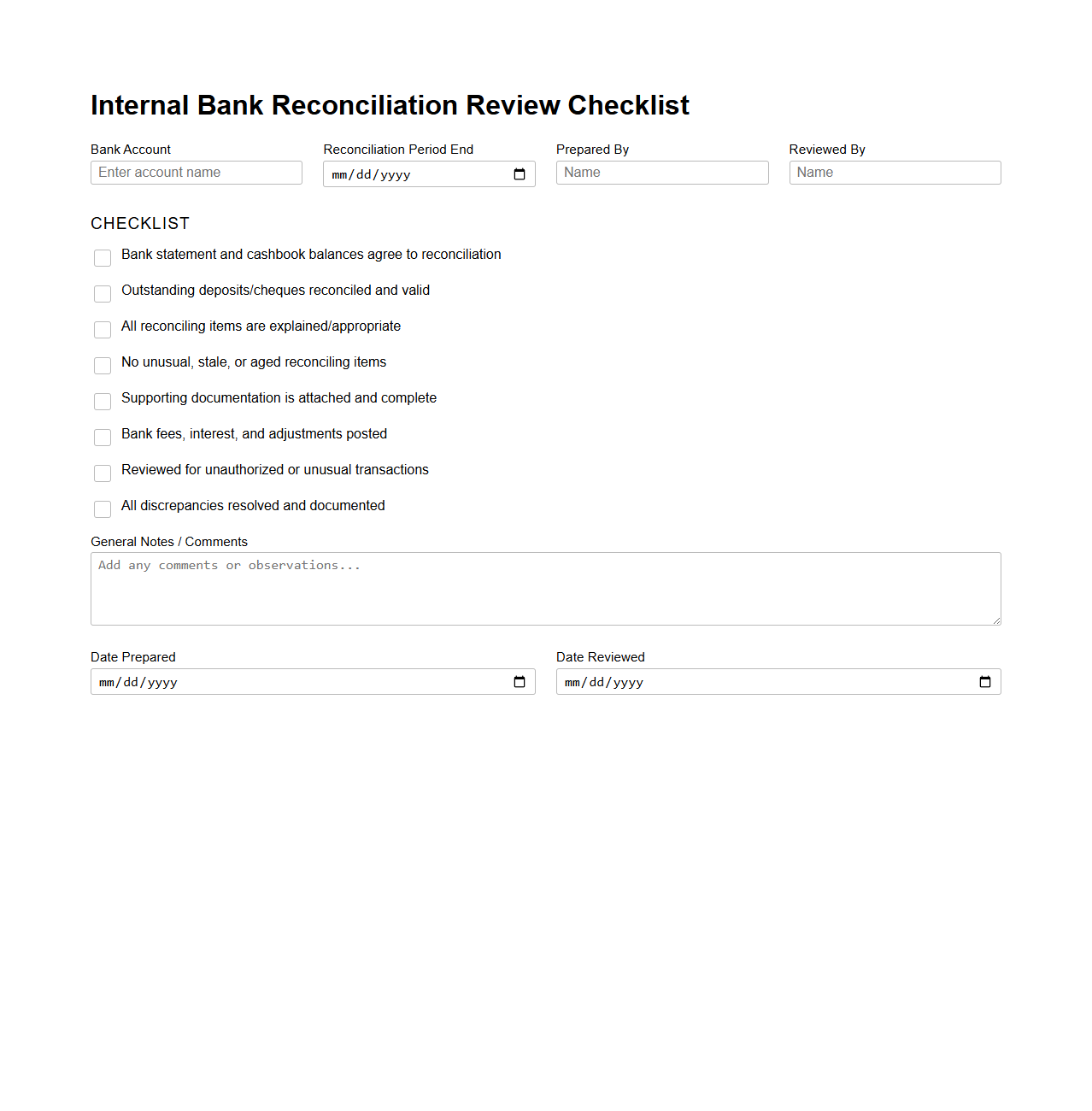

Internal Bank Reconciliation Review Checklist

The

Internal Bank Reconciliation Review Checklist document is a crucial tool used to systematically verify the accuracy and completeness of bank reconciliation statements within an organization. It ensures that all bank transactions are properly recorded and matched with the company's ledger, helping to identify discrepancies such as outstanding checks, deposits in transit, or unauthorized transactions. Regular use of this checklist enhances financial accuracy, supports internal controls, and mitigates risks of fraud or errors in cash management.

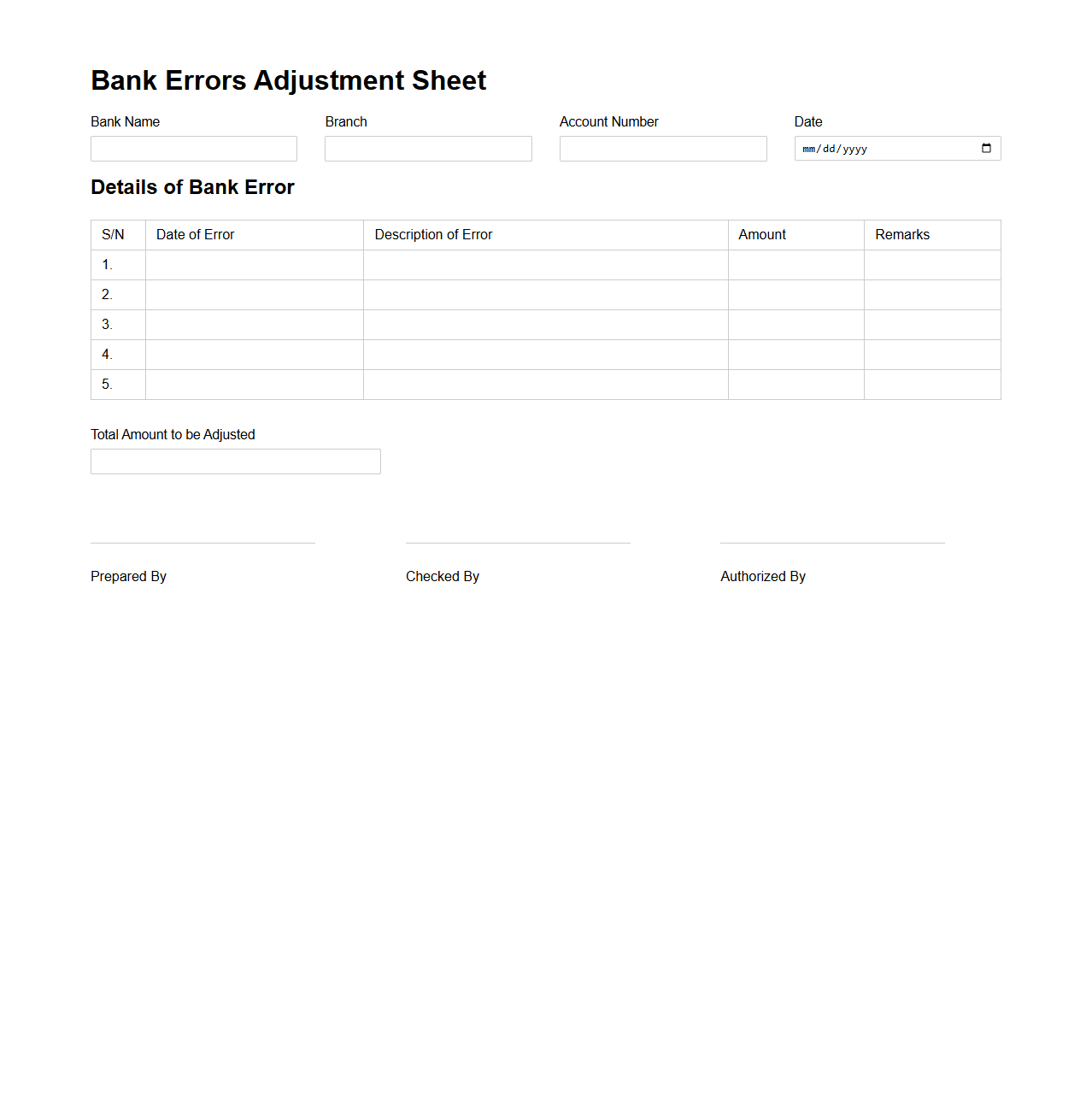

Bank Errors Adjustment Sheet Format

A

Bank Errors Adjustment Sheet Format document is used to record and rectify discrepancies identified between a company's accounting records and bank statements. It helps organizations systematically track errors such as incorrect charges, unauthorized withdrawals, or recording mistakes to ensure accurate financial reporting. Maintaining this document supports efficient reconciliation and enhances the integrity of cash management processes.

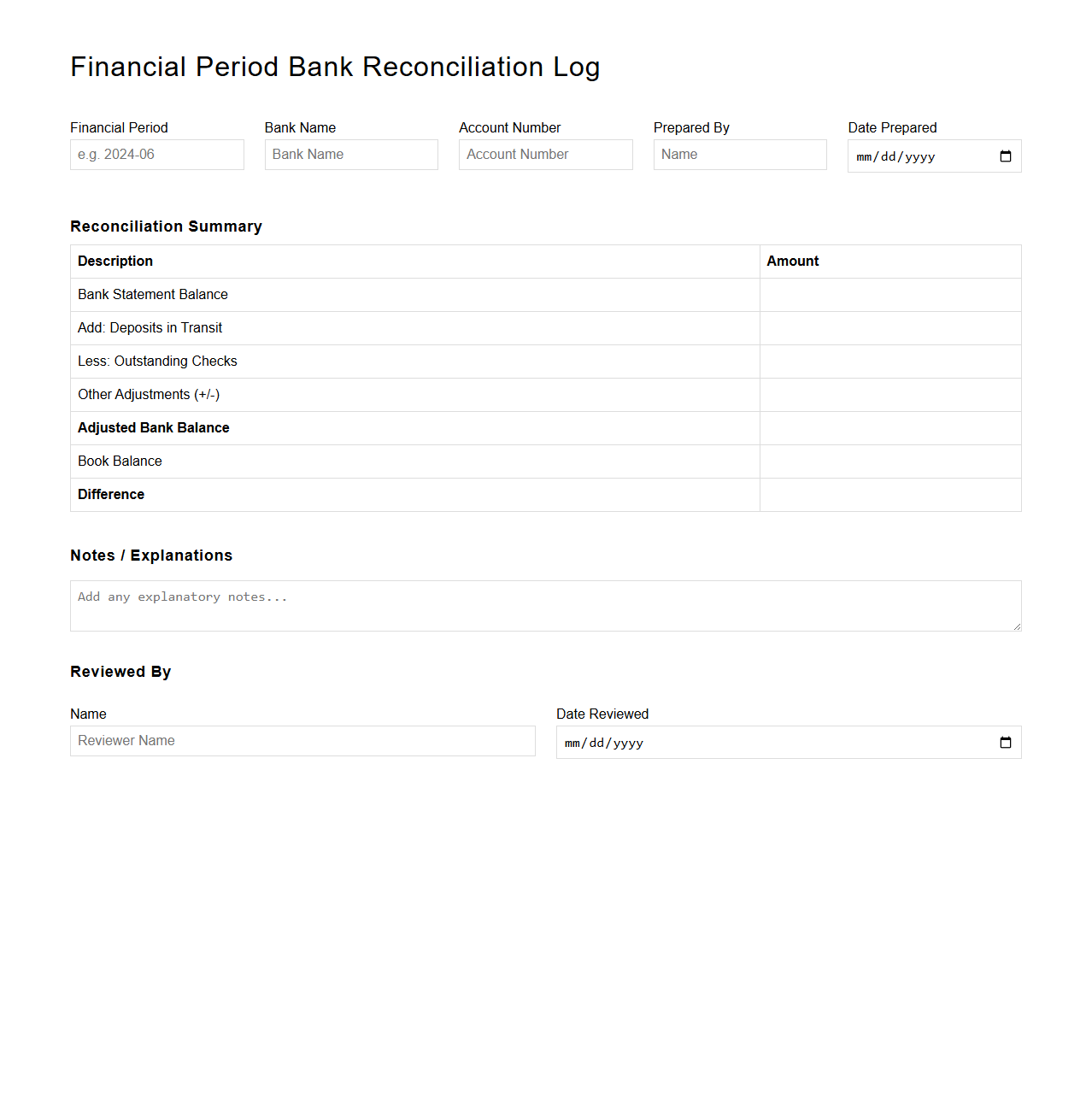

Financial Period Bank Reconciliation Log

The

Financial Period Bank Reconciliation Log document serves as a crucial record that tracks the reconciliation process between an organization's financial records and bank statements for a specified accounting period. It details discrepancies, adjustments, and verification steps to ensure accuracy in cash balances and detect errors or fraudulent activities. This document enhances transparency and supports audit trails, fostering effective financial management and compliance.

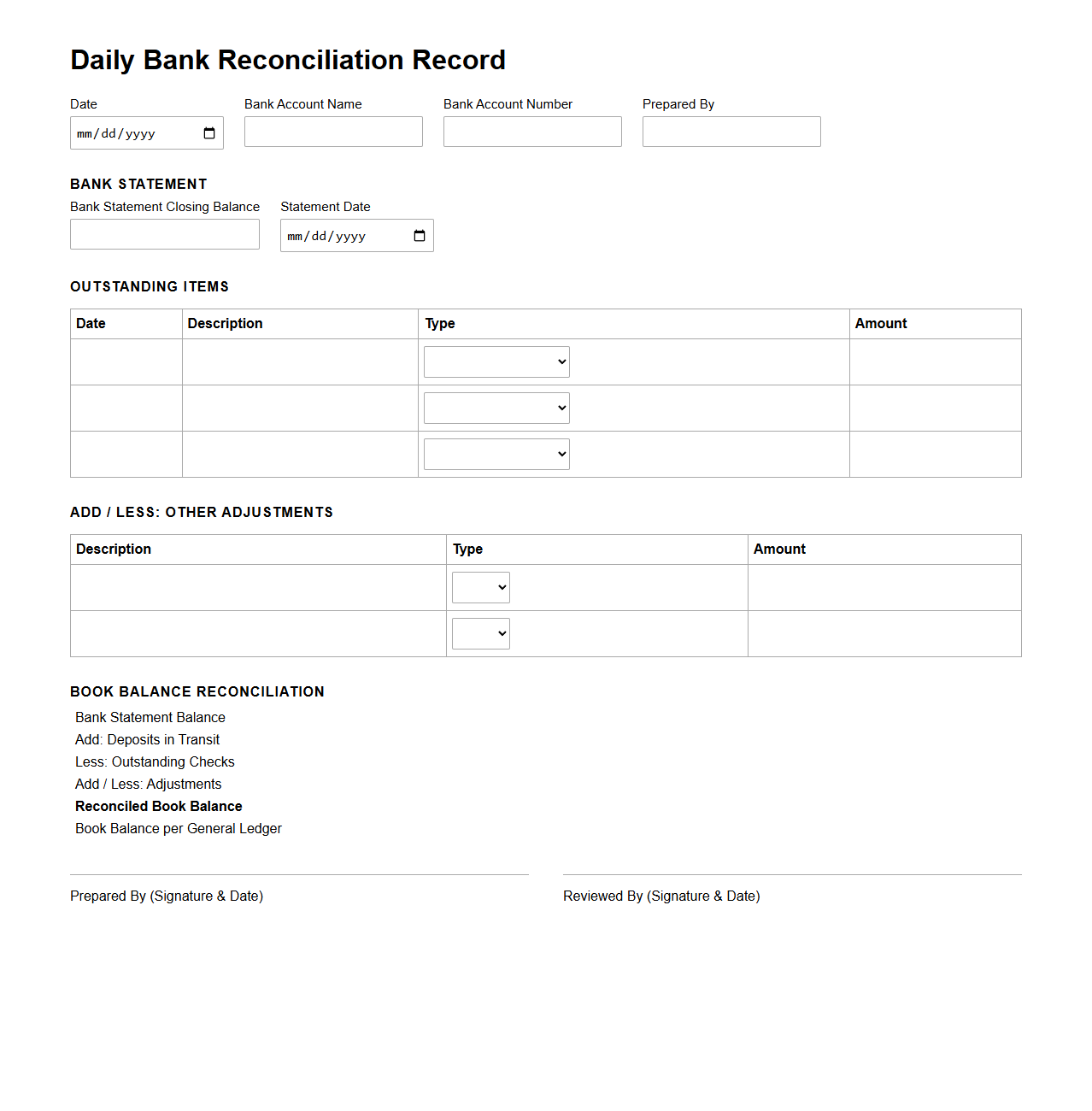

Daily Bank Reconciliation Record Sample

A

Daily Bank Reconciliation Record Sample document is a template used to systematically compare and verify the daily transactions recorded in a company's cash book against the corresponding entries in the bank statement. This process helps identify discrepancies, such as outstanding checks or deposits in transit, ensuring accurate financial records and effective cash flow management. Maintaining daily reconciliation supports timely detection of errors or fraudulent activities, contributing to improved financial control and accountability.

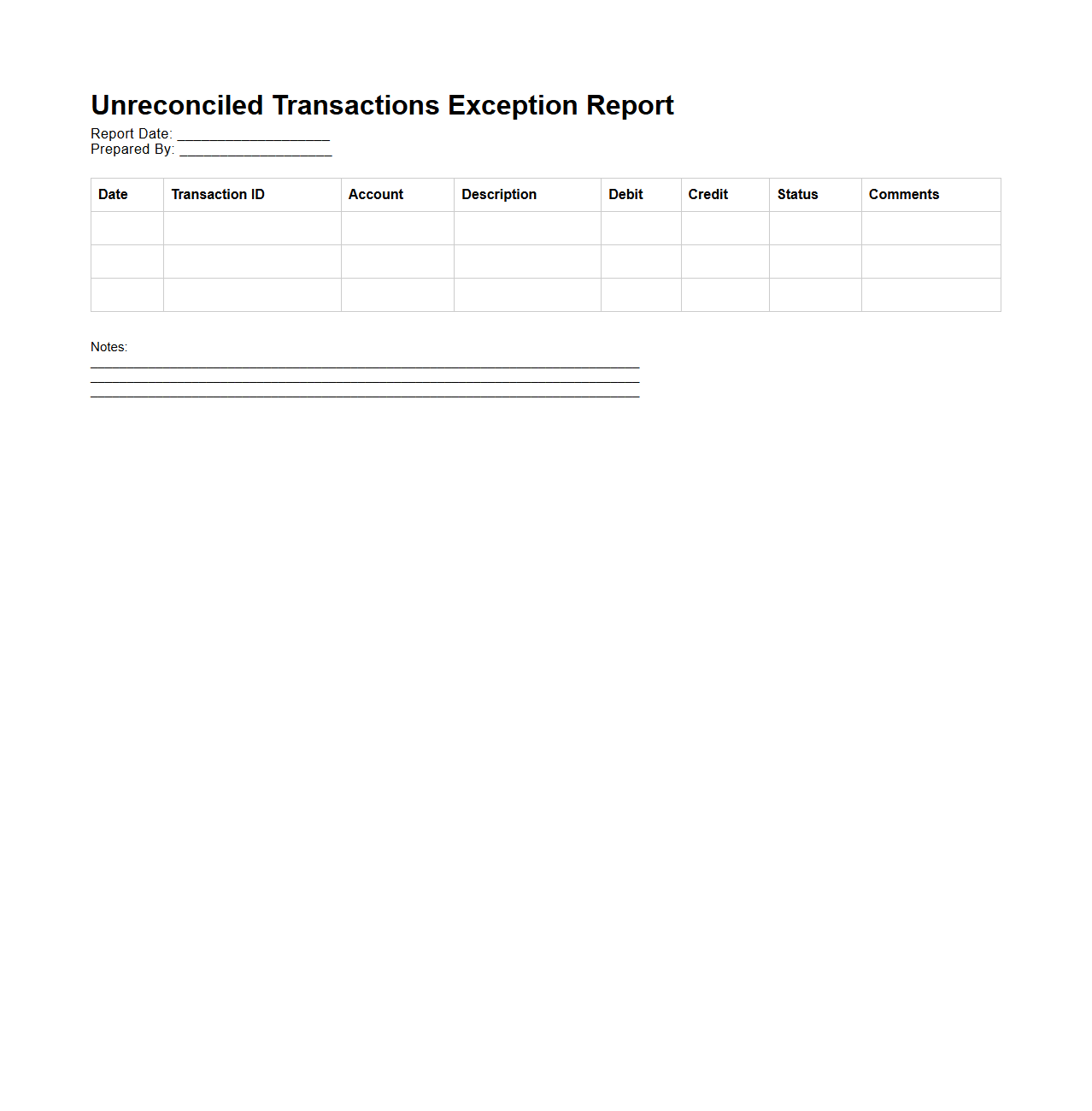

Unreconciled Transactions Exception Report

The

Unreconciled Transactions Exception Report document identifies discrepancies between recorded transactions and bank statements, highlighting any unmatched or outstanding entries. It enables finance teams to quickly pinpoint errors, omissions, or timing differences that require investigation. This report is essential for maintaining accurate financial records and ensuring the integrity of account reconciliations.

What supporting documents are required to validate discrepancies in a bank reconciliation statement?

To validate discrepancies in a bank reconciliation statement, key supporting documents include bank statements, deposit slips, and canceled checks. These documents provide evidence for transactions recorded in the company's books but not yet reflected in the bank's records. Additionally, any internal memos explaining adjustments or errors help clarify unusual items.

How is an outstanding deposit documented and referenced in a reconciliation letter?

An outstanding deposit is documented by listing the deposit amount, date, and deposit slip number in the reconciliation letter. It is referenced as a timing difference, indicating the deposit was recorded in the company's books but not yet processed by the bank. Clear notation of this item helps reconcile balances accurately between the bank and company records.

Which reconciliation document format complies with annual audit requirements?

The reconciliation document format compliant with annual audit requirements includes detailed transaction listings, adjusted bank balance, and reconciled book balance with explanations. It must be clear, signed off by responsible personnel, and provide traceability to source documents. Audit-ready formats often use standardized templates that facilitate review and verification by auditors.

How should recurring bank fees be documented in monthly reconciliation reports?

Recurring bank fees should be consistently recorded in the monthly reconciliation reports as deductions from the bank balance. Each fee entry needs a description, date, and reference to the bank statement for verification. Documenting these fees monthly ensures transparency and helps identify any unauthorized charges promptly.

What authorization signature is necessary on an official bank reconciliation document?

An official bank reconciliation document requires the signature of the authorized finance manager or controller to confirm accuracy. This authorization validates that the reconciliation was reviewed and approved according to company policies. Including the signature adds accountability and is critical for internal controls and audit compliance.