A Payment Receipt Document Sample for Client Transactions serves as a formal acknowledgment confirming the successful payment made by a client. It typically includes essential details such as the date of payment, amount received, payment method, and transaction reference number. This document helps maintain accurate financial records and ensures transparency between businesses and clients.

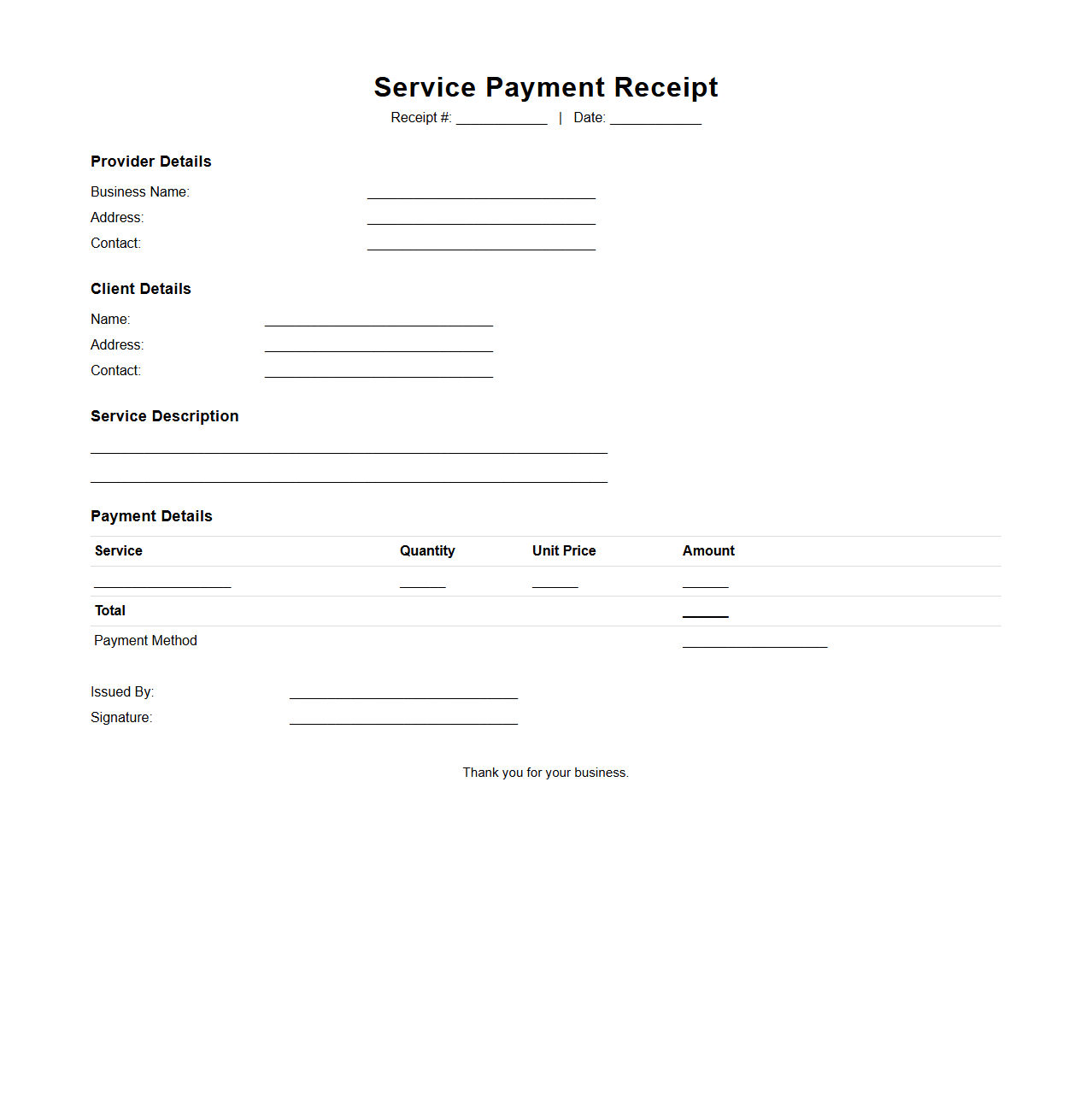

Service Payment Receipt Template for Client Transactions

A

Service Payment Receipt Template for client transactions is a standardized document used to provide proof of payment for services rendered. It typically includes essential details such as the client's name, payment date, amount paid, service description, and transaction ID, ensuring transparency and record-keeping accuracy. This template helps businesses maintain organized financial documentation and fosters trust with clients by providing clear confirmation of completed payments.

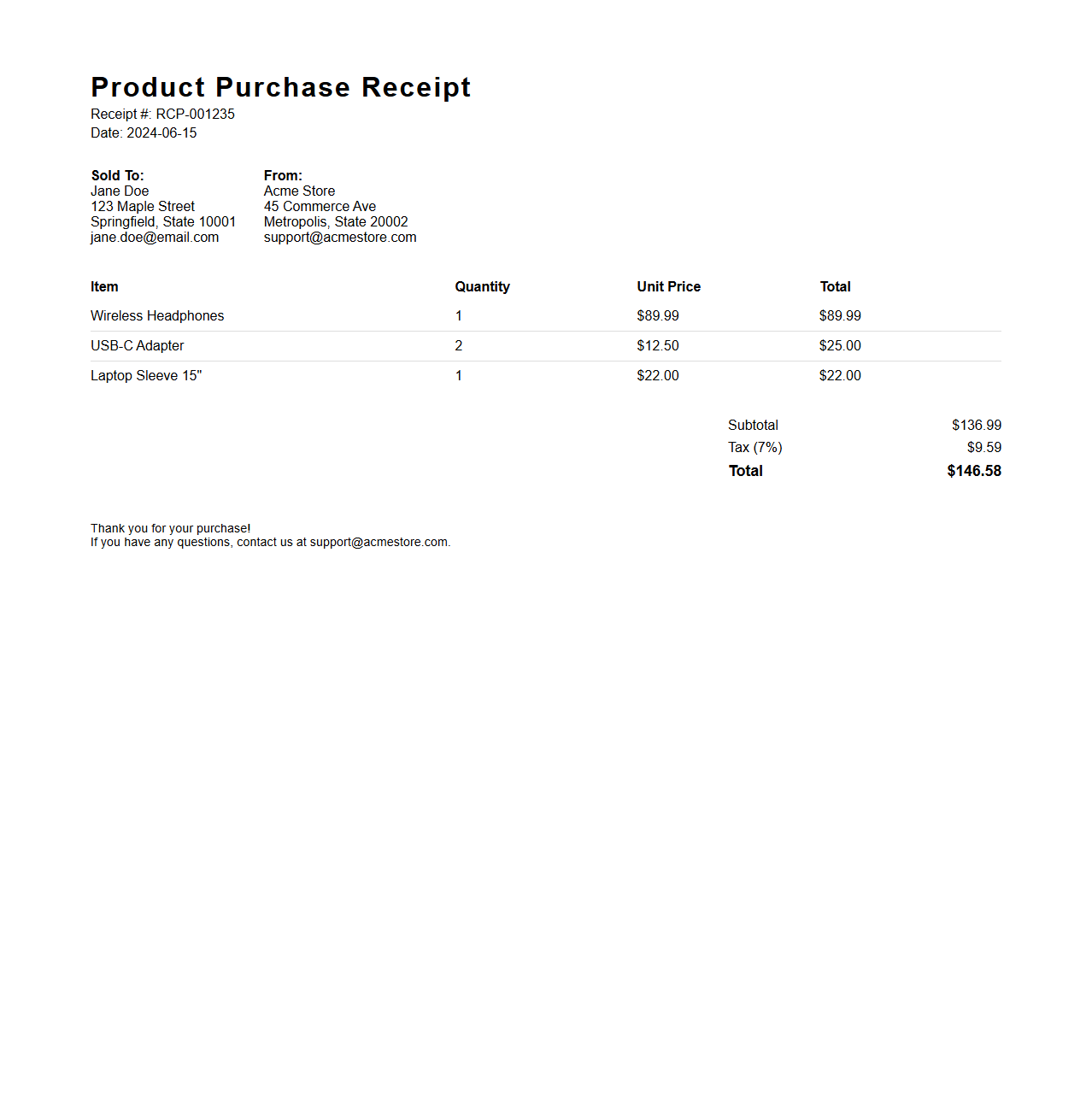

Product Purchase Receipt Example for Customers

A

Product Purchase Receipt Example for Customers document serves as a detailed proof of transaction, listing items bought, quantities, prices, and payment methods. It helps customers verify their purchases and track expenses while also facilitating returns or warranty claims. This document enhances transparency and trust between buyers and sellers by clearly outlining purchase details.

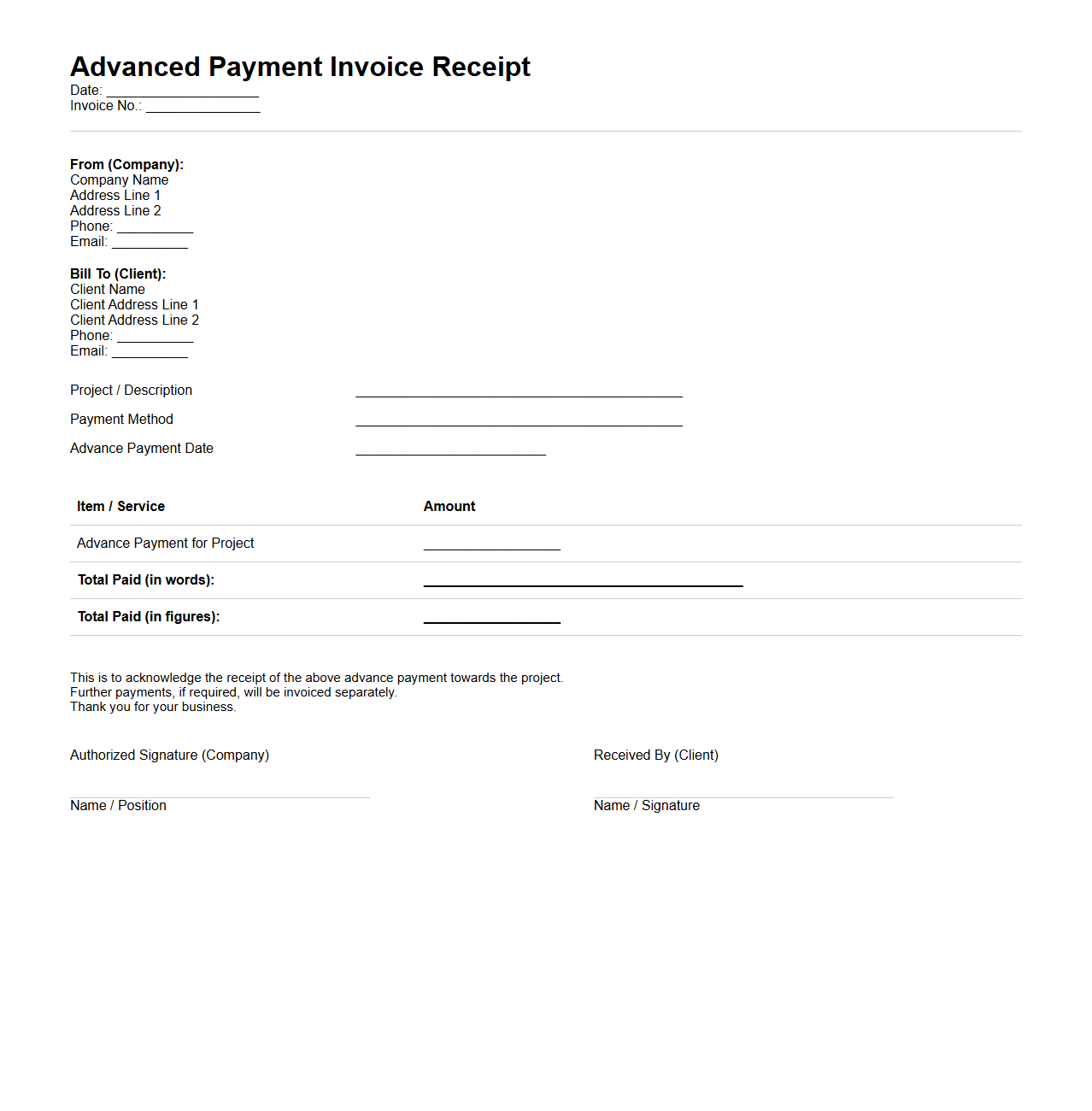

Advanced Payment Invoice Receipt Sample for Clients

An

Advanced Payment Invoice Receipt Sample for clients is a formal document used to acknowledge the receipt of funds paid in advance before services or products are delivered. This receipt outlines key details such as the amount paid, payment date, client information, and transaction reference, ensuring transparency and trust between the service provider and client. It serves as proof of payment and helps in maintaining accurate financial records for both parties.

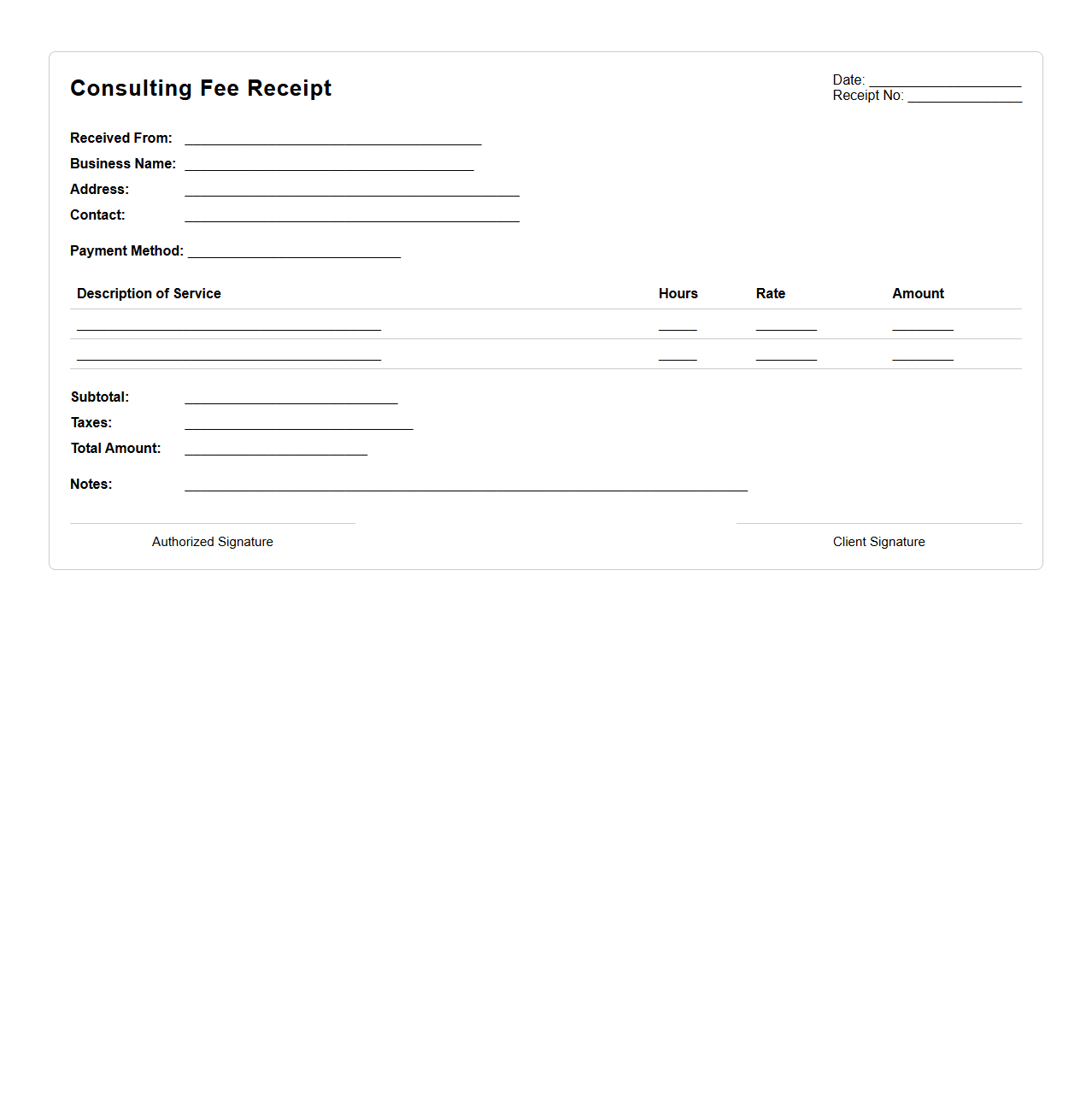

Consulting Fee Receipt Format for Business Clients

A

Consulting Fee Receipt Format for Business Clients document is a structured template used to acknowledge payment received for professional consulting services. It typically includes essential details such as the consultant's name, client information, service description, payment amount, date of transaction, and receipt number. This document ensures transparent financial records, facilitates tax compliance, and strengthens trust between consultants and their business clients.

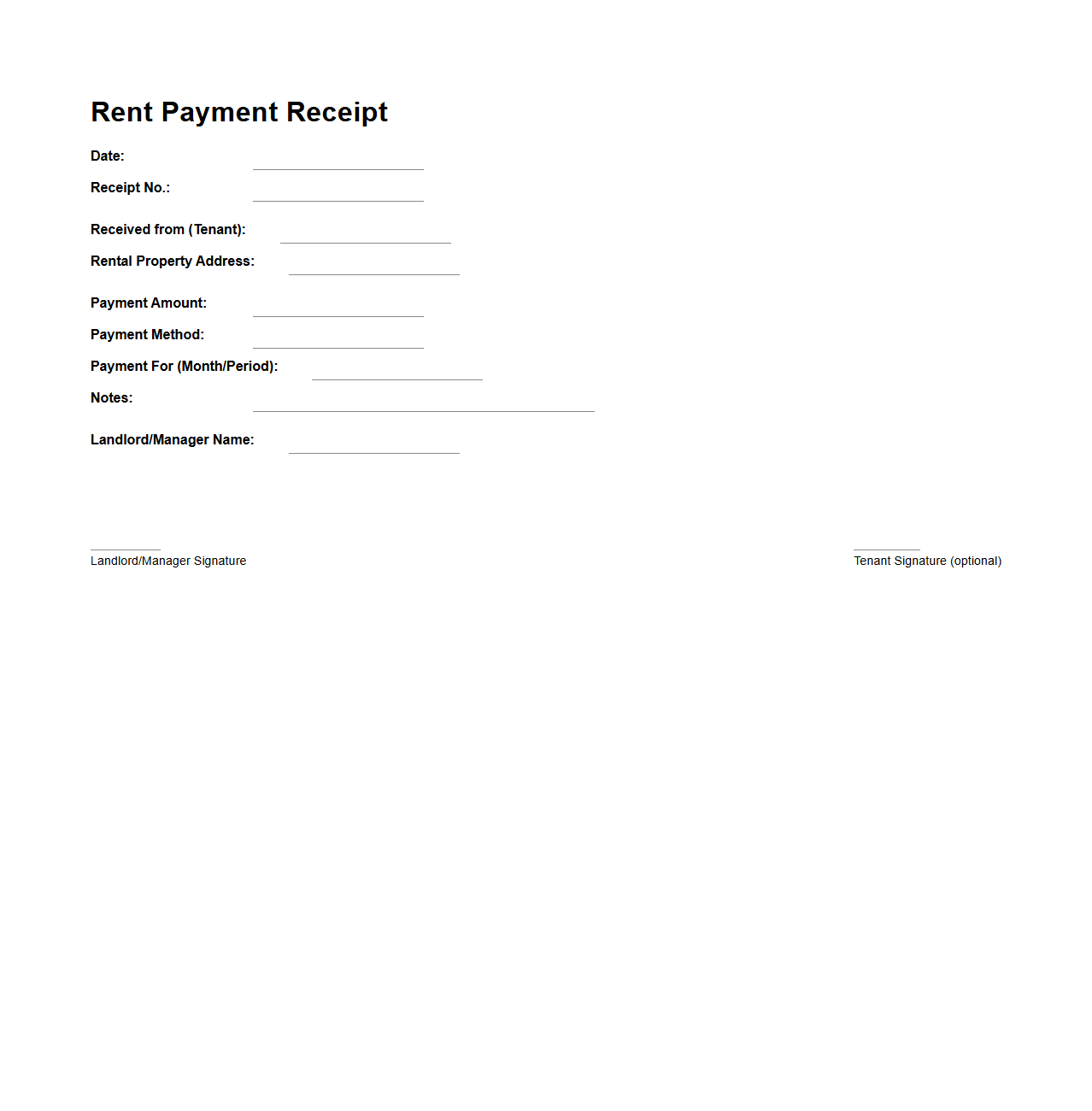

Rent Payment Receipt Example for Landlords

A

Rent Payment Receipt Example for Landlords document serves as a formal record confirming that a tenant has paid their rent for a specific period. It includes essential details such as the tenant's name, payment amount, date received, rental property address, and payment method. This receipt helps landlords maintain accurate financial records and provides tenants with proof of payment for their rental obligations.

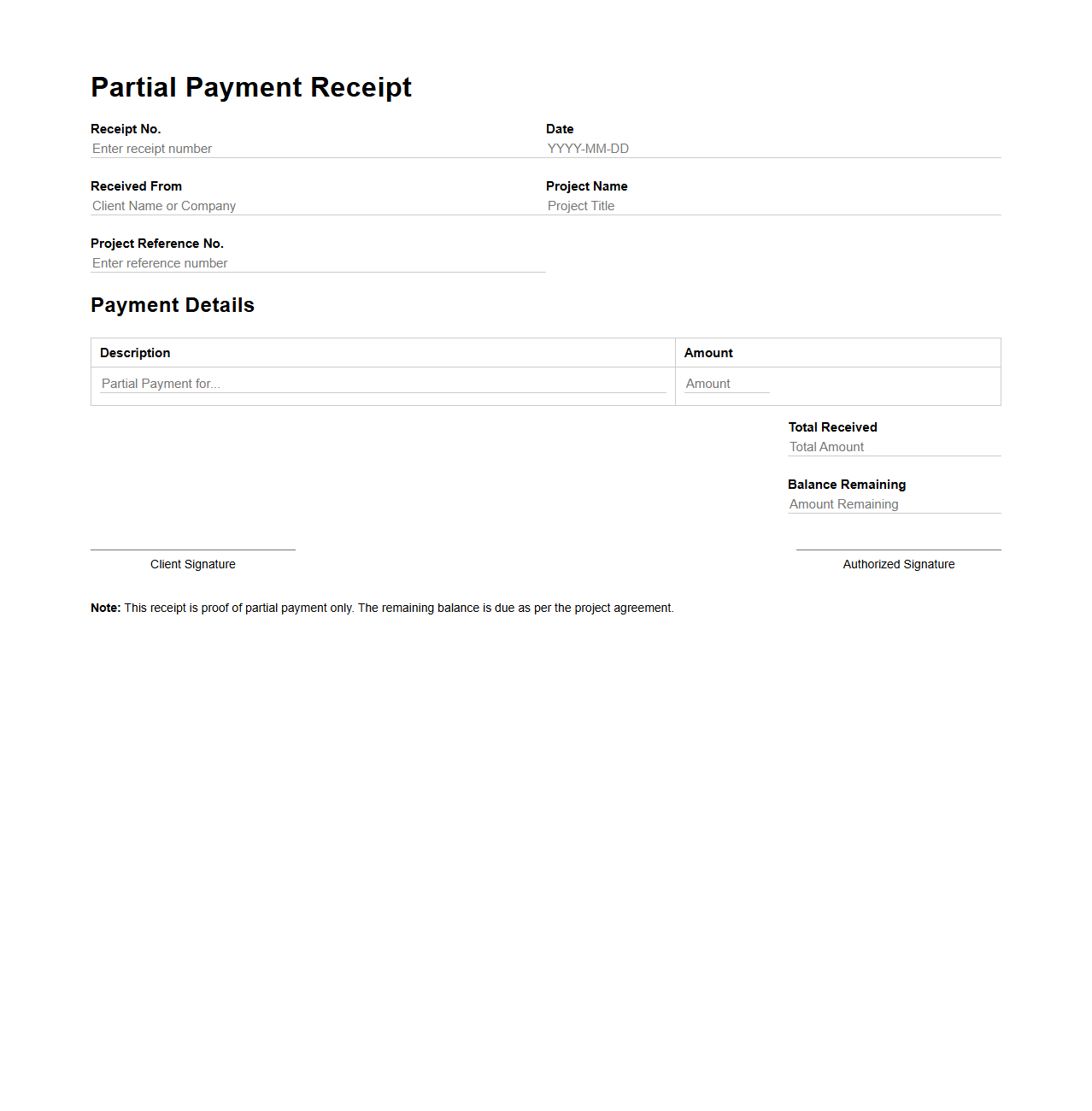

Partial Payment Receipt Template for Project Clients

A

Partial Payment Receipt Template for project clients is a structured document used to acknowledge the receipt of a portion of the total payment agreed upon for a project. It details the amount paid, outstanding balance, payment date, and client information, serving as a formal record to maintain transparency and trust between service providers and clients. This template ensures clear financial communication, reduces disputes, and enhances project payment tracking efficiency.

Final Payment Confirmation Receipt for Services

A

Final Payment Confirmation Receipt for Services is a formal document issued by a service provider to acknowledge the full payment received from a client for rendered services. It serves as proof of settlement and details the transaction amount, payment date, and the scope of services paid for. This receipt helps both parties maintain clear financial records and prevents future disputes regarding payment status.

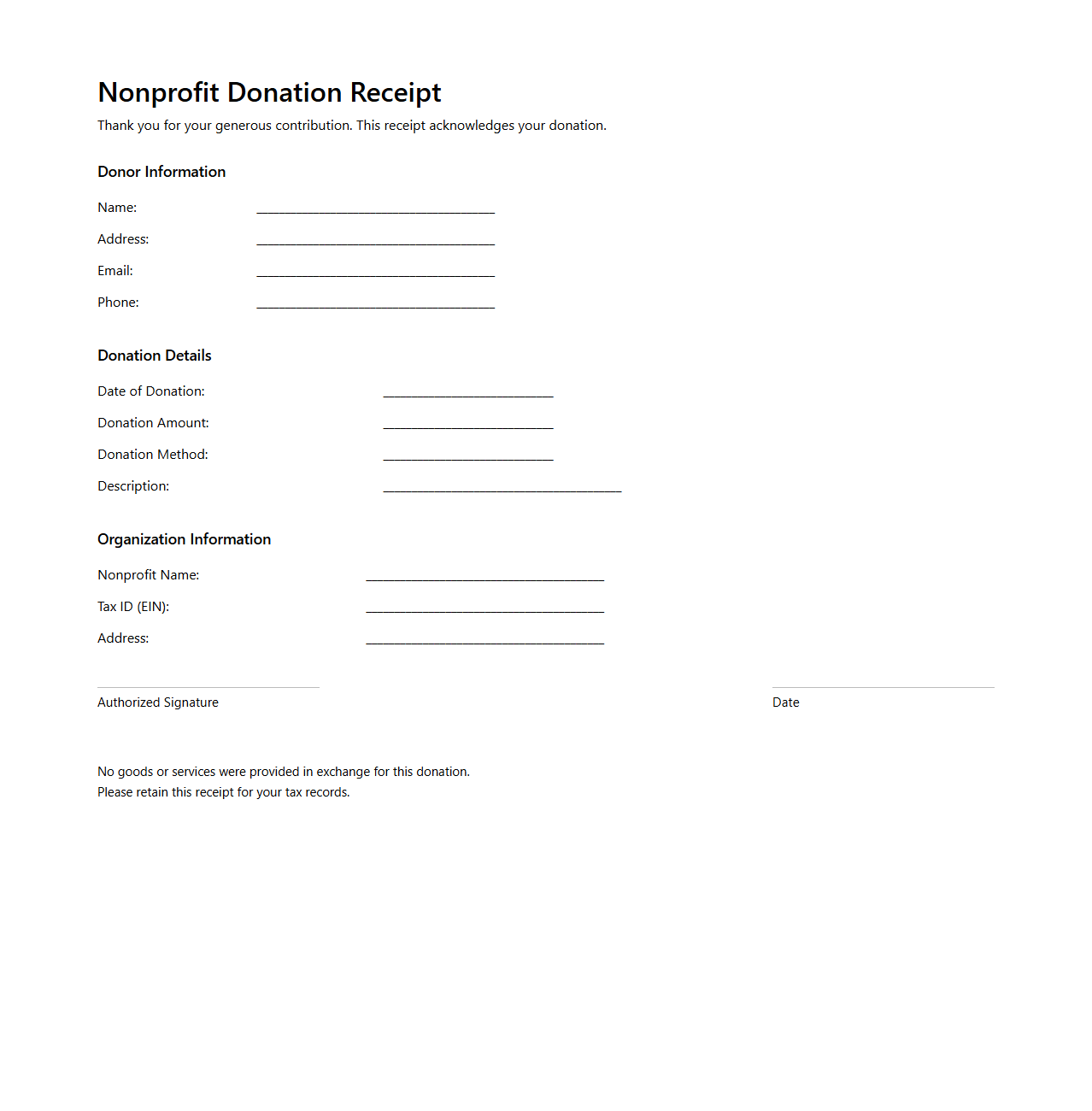

Nonprofit Donation Receipt Sample for Donors

A

Nonprofit Donation Receipt Sample for Donors document serves as an official proof of charitable contributions made by donors to nonprofit organizations. This receipt includes essential details such as the donor's name, donation amount, date of donation, and the nonprofit's tax-exempt status, ensuring compliance with IRS regulations. Donors use this document to claim tax deductions and maintain accurate records of their philanthropic activities.

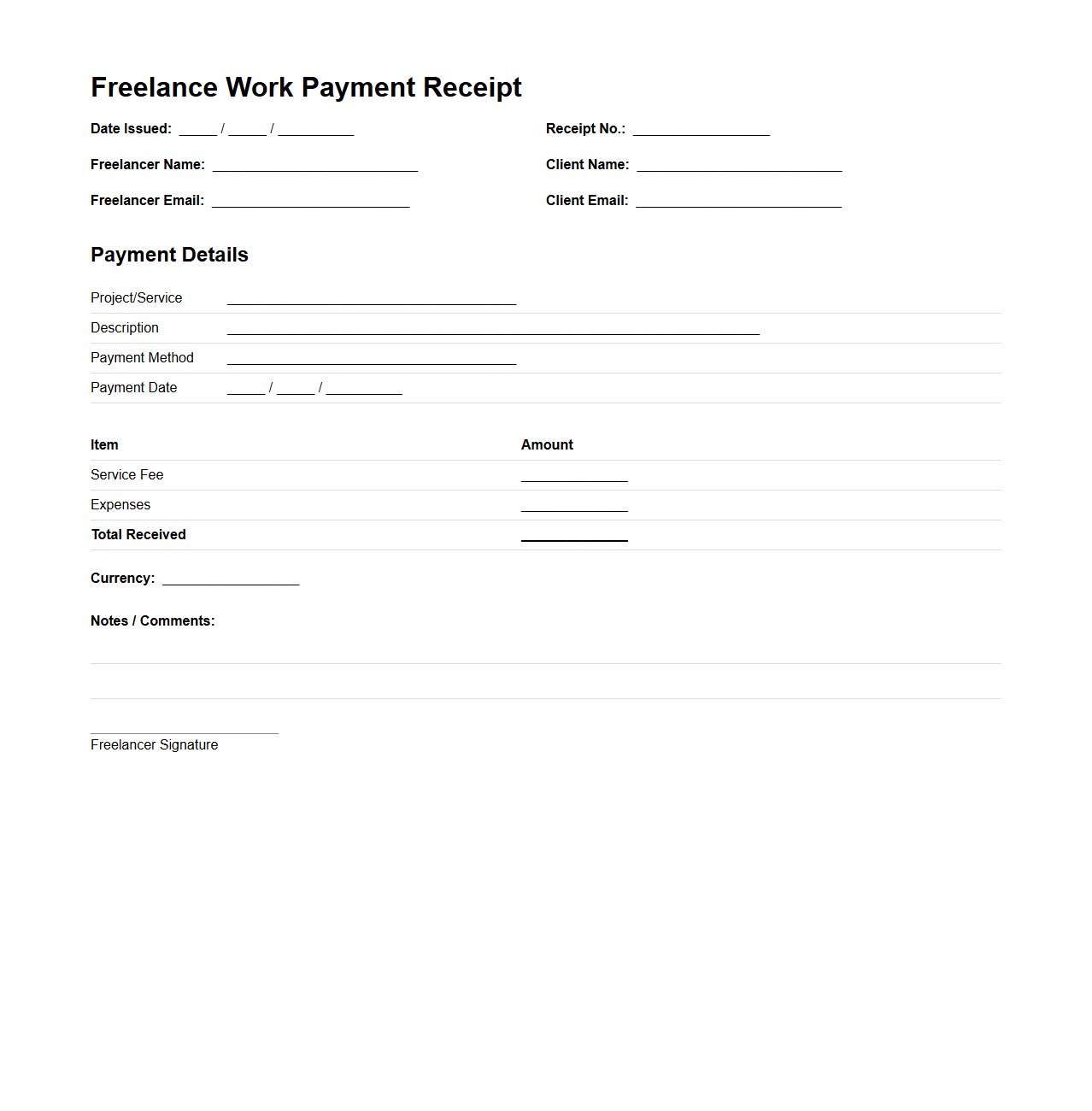

Freelance Work Payment Receipt Example

A

Freelance Work Payment Receipt Example document serves as proof of payment for services rendered by a freelancer. It typically includes details such as the freelancer's name, client information, payment amount, date of transaction, and description of the completed work. This receipt ensures transparency and helps both parties maintain accurate financial records for tax and auditing purposes.

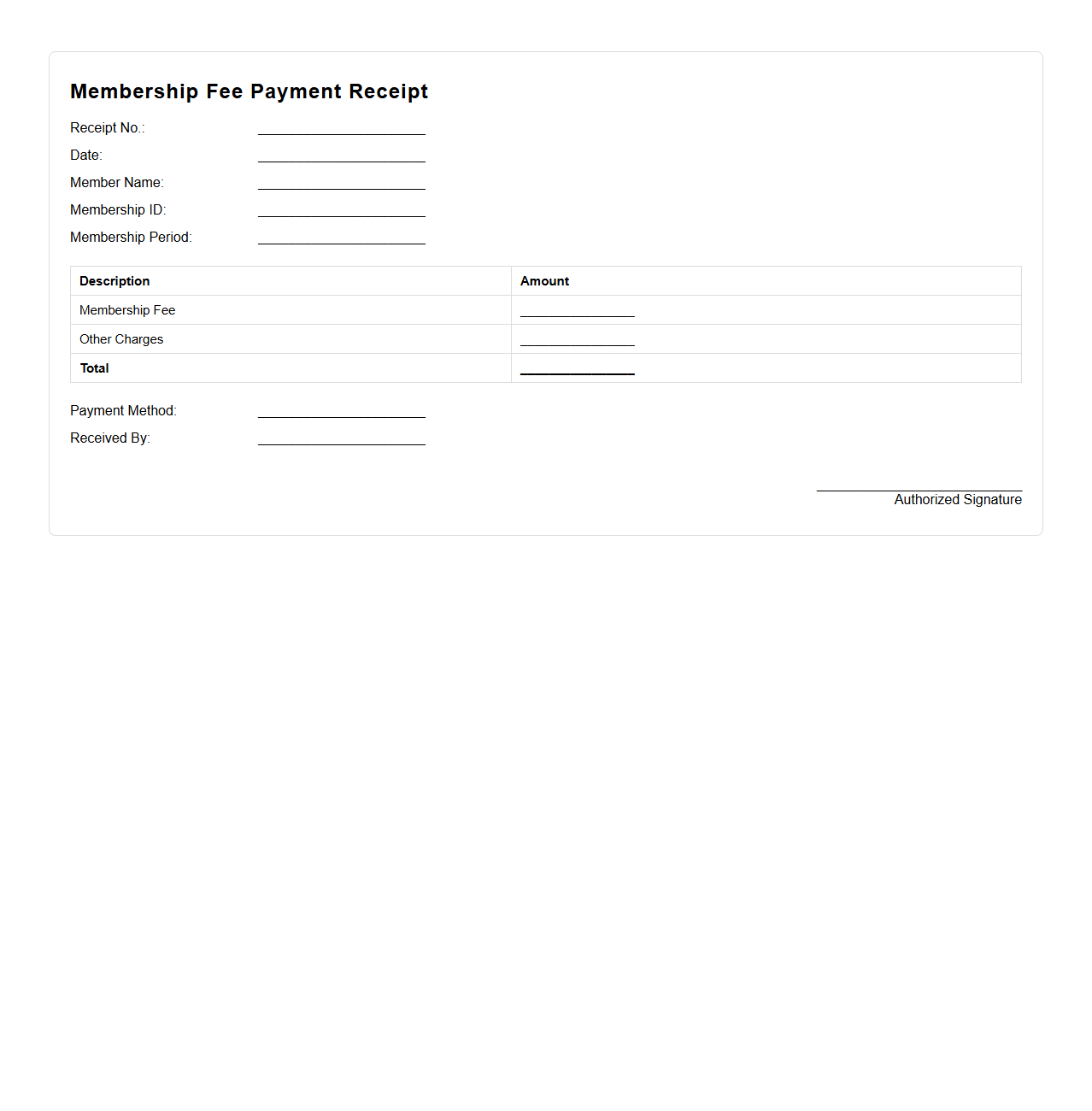

Membership Fee Payment Receipt Format

A

Membership Fee Payment Receipt Format document serves as an official record confirming payment of membership dues by an individual or organization. It typically includes details such as the payer's name, membership ID, payment amount, date of transaction, and method of payment. This receipt format ensures transparency and accountability within membership-based organizations or clubs.

How to verify the authenticity of a payment receipt document for client transactions?

To verify the authenticity of a payment receipt, first confirm the payment details such as date, amount, and payer information against your records. Check for the presence of official company logos, authorized signatures, and consistent formatting. Additionally, contacting the issuing party directly to confirm the transaction can ensure the receipt is genuine.

What key details must be included in a legal payment receipt document?

A legal payment receipt must include the payer's name, transaction date, and the exact amount paid. It should also feature details such as the payment method, a unique receipt number, and the issuer's contact information. Including the purpose of the payment ensures clarity for both parties involved.

Which digital tools are best for issuing secure payment receipt documents?

Secure payment receipt documents can be issued using trusted platforms like QuickBooks, Zoho Invoice, and Adobe Sign for digital signatures. These tools offer encryption, tamper-proof formats, and audit trails that enhance document security. Integration with payment gateways also improves real-time verification and record-keeping.

How should discrepancies on payment receipt documents be handled with clients?

When discrepancies arise, promptly acknowledge the issue and review the receipt alongside transaction records to identify errors. Communicate transparently with the client to resolve misunderstandings and issue corrected receipts if necessary. Maintaining detailed documentation throughout the process promotes trust and prevents future conflicts.

What are the compliance requirements for storing client payment receipts?

Client payment receipts must be stored securely in compliance with data protection laws such as GDPR or PCI DSS standards where applicable. Retention periods typically range from 3 to 7 years depending on jurisdiction and business type. Implementing access controls and regular audits ensures that sensitive financial data remains confidential and intact.