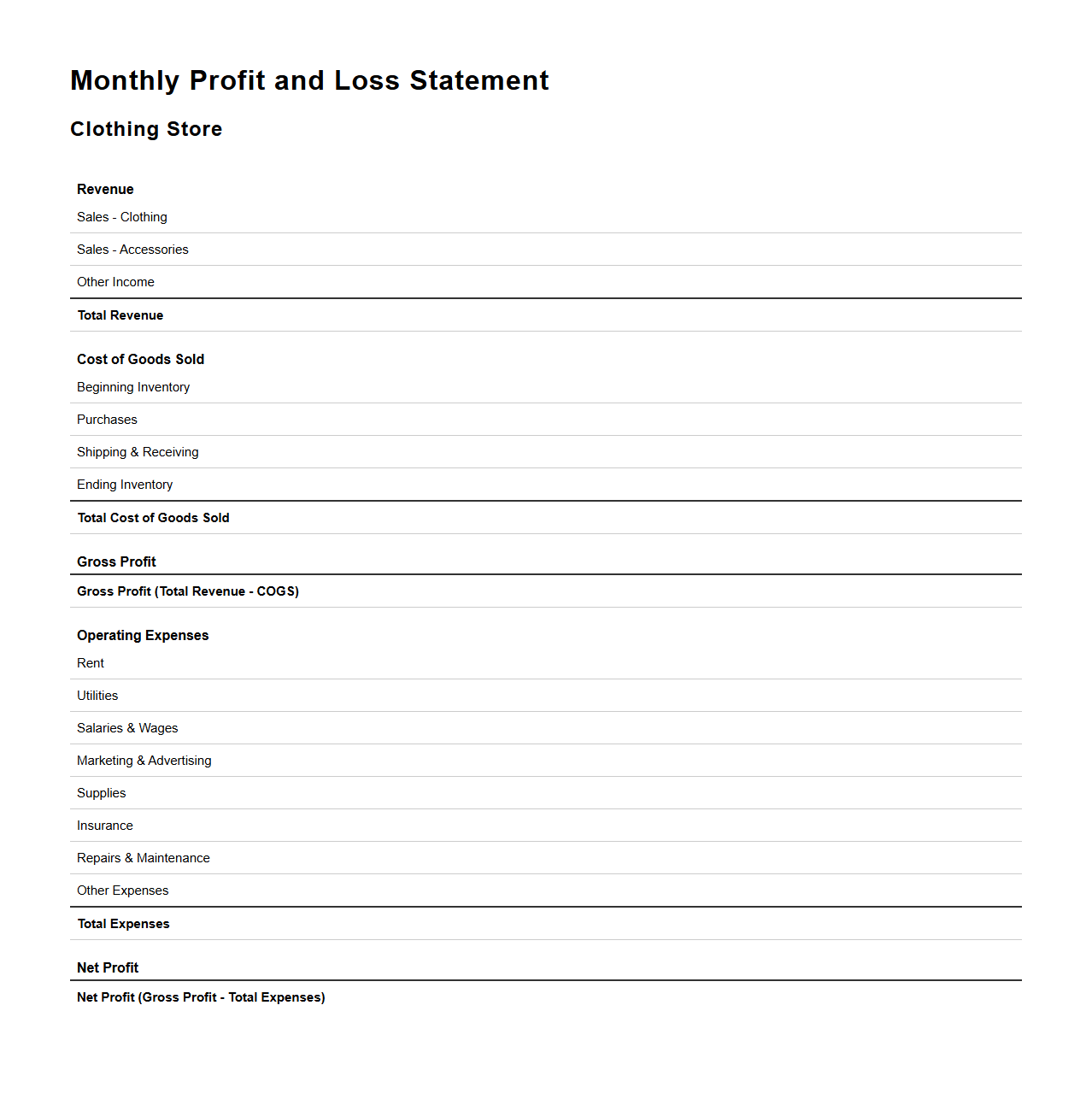

Monthly Profit and Loss Statement Template for Clothing Stores

A

Monthly Profit and Loss Statement Template for Clothing Stores is a financial document designed to track and summarize the revenue, cost of goods sold, operating expenses, and net profit of a clothing retail business over a one-month period. This template helps store owners analyze sales performance, manage inventory costs, and control expenses to make informed business decisions. By providing a clear snapshot of profitability, it supports effective financial planning and growth strategies tailored to the retail apparel industry.

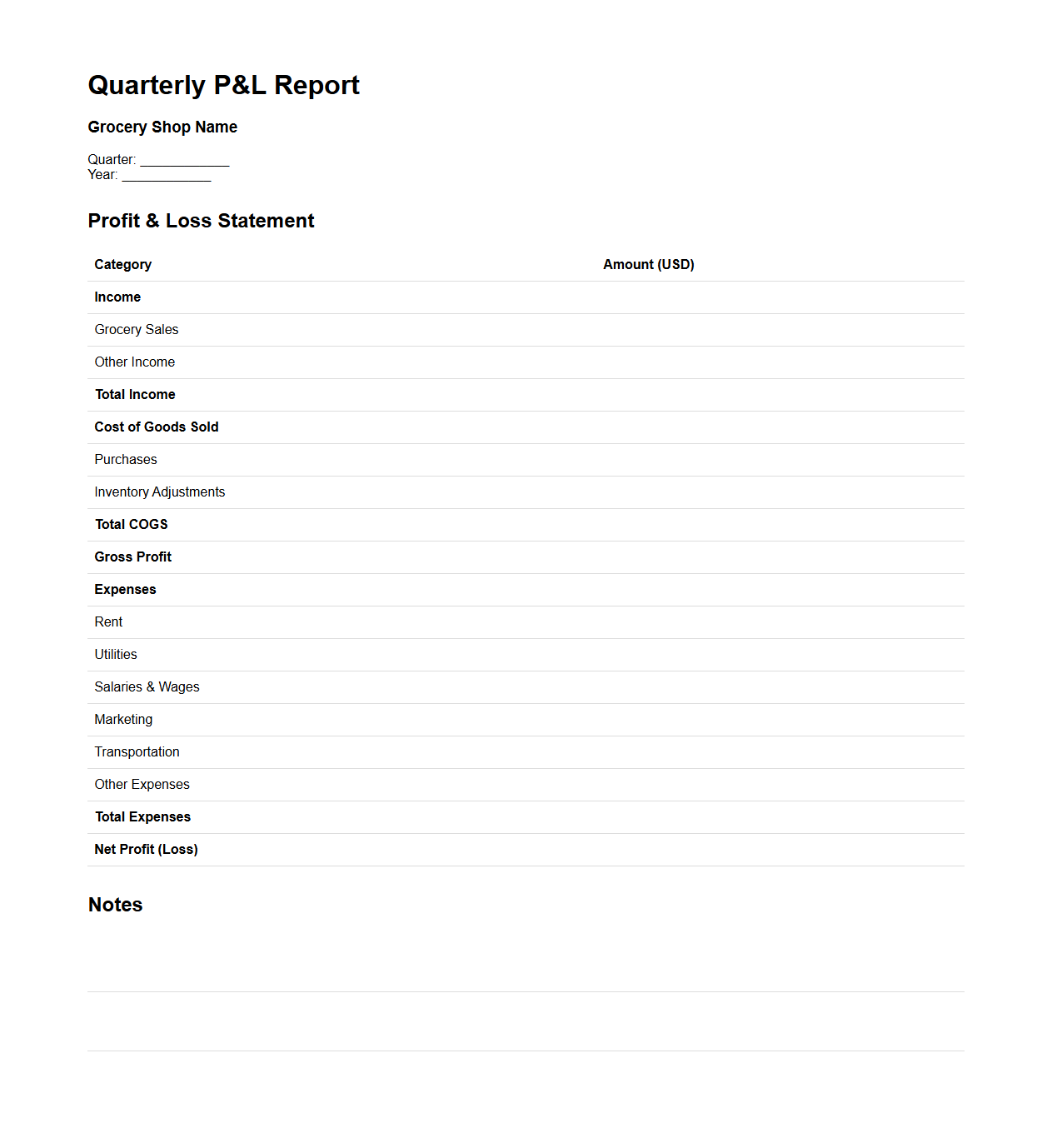

Quarterly P&L Report Layout for Grocery Shops

The

Quarterly P&L Report Layout for grocery shops is a financial document designed to systematically present revenue, costs, and profit data over a three-month period. It typically includes sections for sales breakdown by product categories, cost of goods sold, operating expenses, and net profit margins. This layout helps grocery store owners and managers analyze financial performance trends, identify cost control opportunities, and make informed decisions for future business strategies.

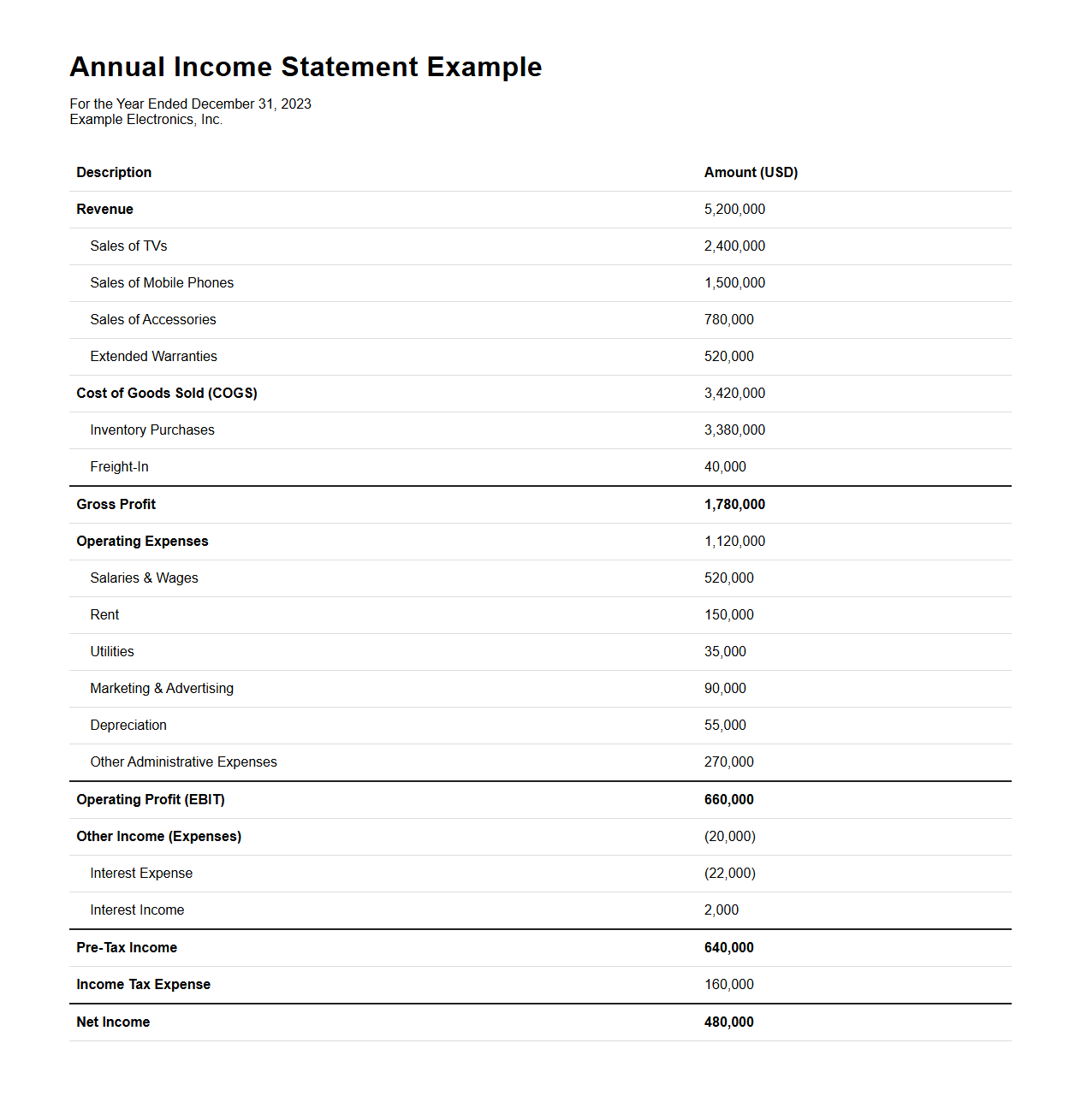

Annual Income Statement Example for Electronics Retailers

An

Annual Income Statement Example for Electronics Retailers document provides a detailed financial summary showcasing the revenue, costs, expenses, and net profit of an electronics retail business over a fiscal year. It helps store owners and stakeholders analyze sales performance, operational efficiency, and profitability trends specific to electronics products. This example serves as a practical template for budgeting, forecasting, and strategic decision-making within the electronics retail sector.

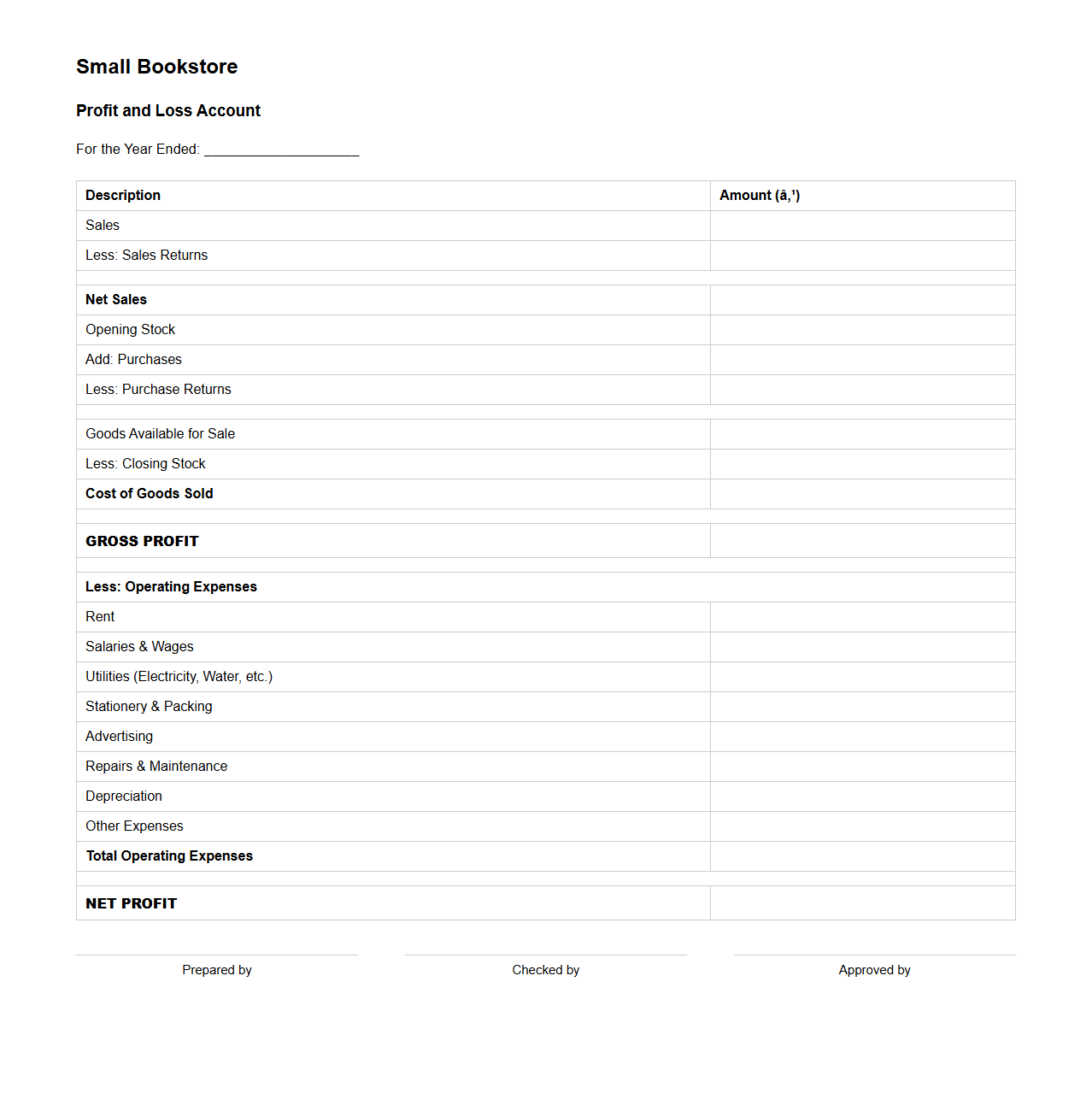

Small Bookstore Profit and Loss Account Format

A

Small Bookstore Profit and Loss Account Format document is a financial report template designed to track and summarize the bookstore's revenues, costs, and expenses over a specific period. It helps bookstore owners evaluate sales performance, calculate net profit or loss, and manage operational efficiency by organizing income from book sales and deducting expenses such as rent, salaries, and inventory costs. This format is crucial for informed decision-making and maintaining accurate financial records in small retail book businesses.

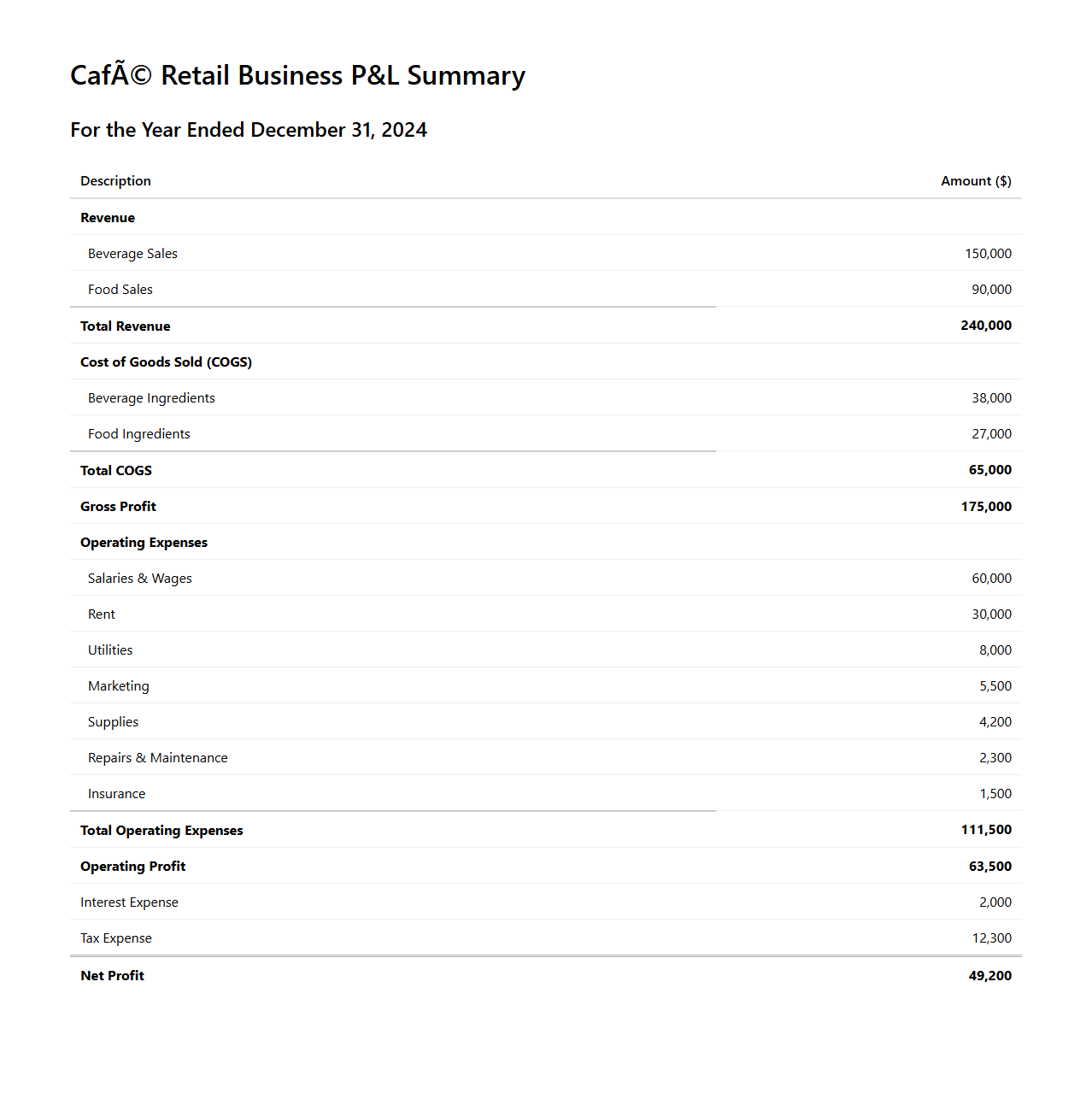

Café Retail Business P&L Summary Sample

A

Cafe Retail Business P&L Summary Sample document provides a concise overview of the profit and loss statement specific to cafe operations, highlighting revenue streams, cost of goods sold, operating expenses, and net profit. It helps cafe owners and managers assess financial performance, identify cost-saving opportunities, and make informed decisions to enhance profitability. This summary is essential for budgeting, financial planning, and securing investment or loans within the cafe retail sector.

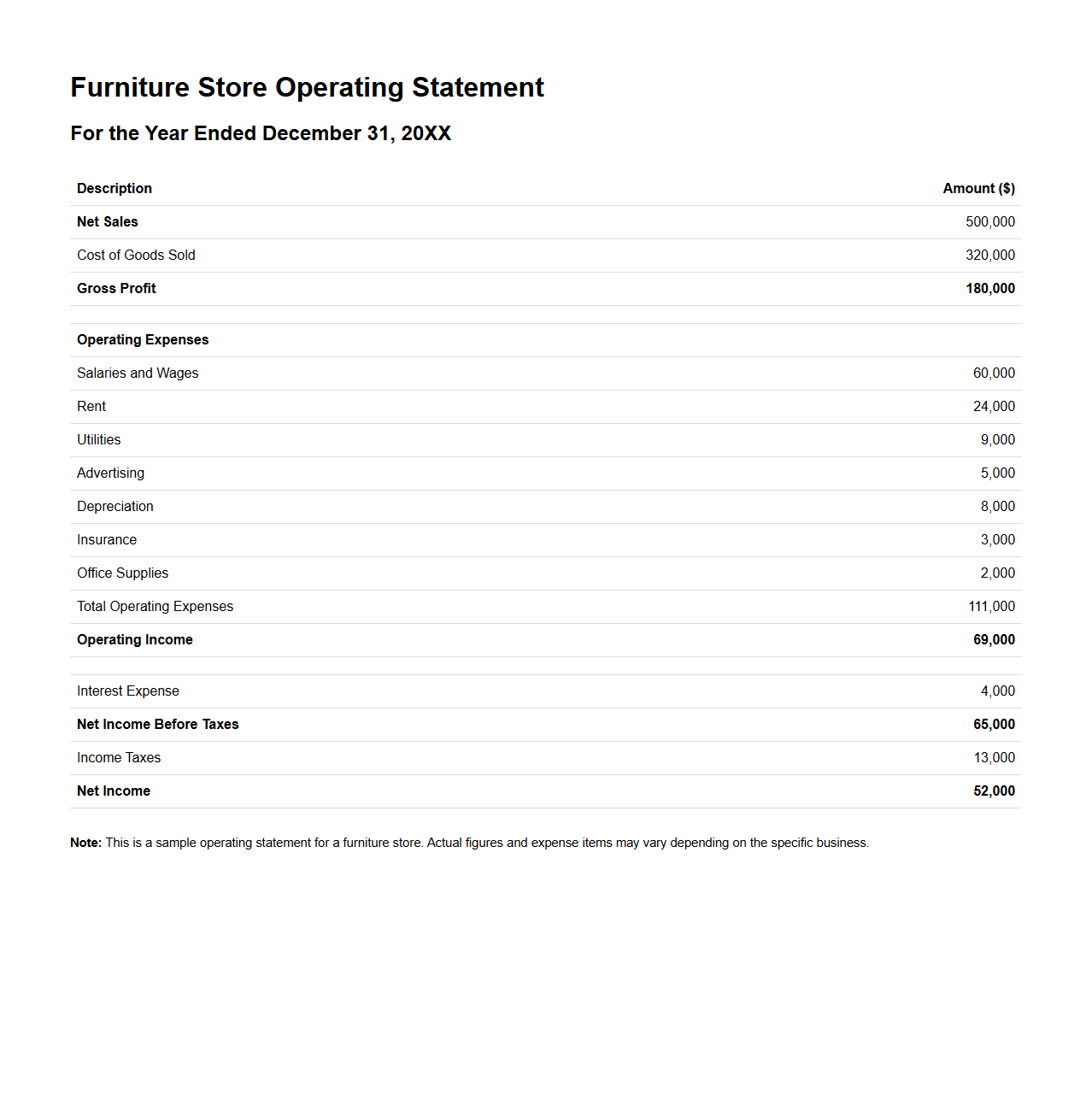

Furniture Store Operating Statement Sample

A

Furniture Store Operating Statement Sample is a financial document that outlines the revenues, expenses, and net profit or loss of a furniture retail business over a specific period. This statement provides detailed insights into sales performance, cost of goods sold, operating costs, and other financial activities essential for evaluating the store's operational efficiency. Retail managers and investors frequently use this sample document to benchmark financial health and make informed decisions about inventory management, pricing strategies, and cost control.

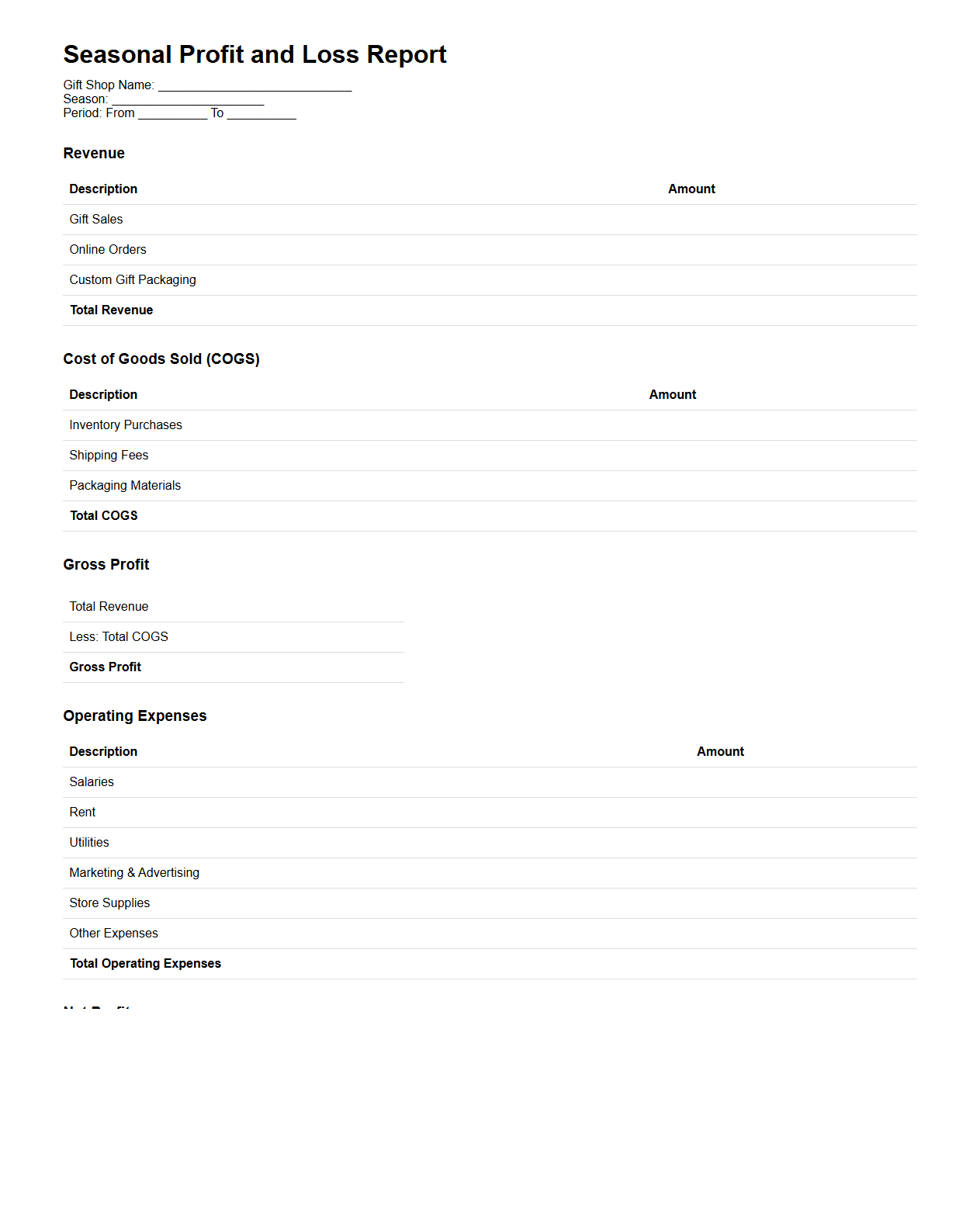

Seasonal Profit and Loss Report for Gift Shops

The

Seasonal Profit and Loss Report for gift shops is a financial document that tracks revenue, expenses, and net profit across different seasons to identify sales trends and profitability fluctuations. This report helps gift shop owners optimize inventory, marketing strategies, and staffing based on peak and off-peak seasons. By analyzing seasonal performance, businesses can make data-driven decisions to enhance overall financial health and sustainability.

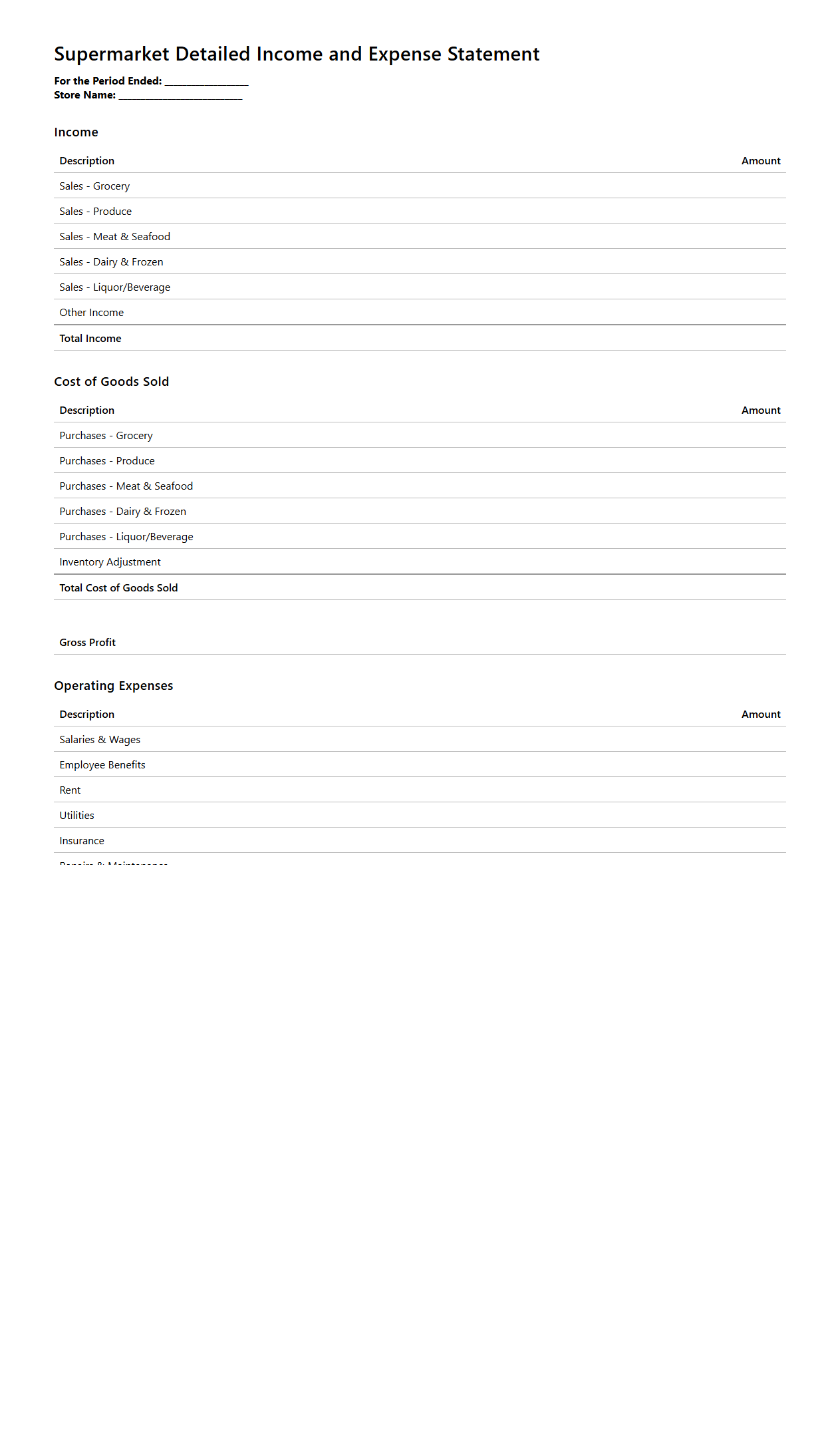

Supermarket Detailed Income and Expense Statement

A

Supermarket Detailed Income and Expense Statement document provides a comprehensive breakdown of a supermarket's financial performance by itemizing all sources of income and categorizing expenses in detail. It typically includes revenues from sales, cost of goods sold, operating expenses such as payroll and utilities, and other financial activities like taxes and interest. This statement is essential for accurate financial analysis, budgeting, and strategic decision-making within the supermarket industry.

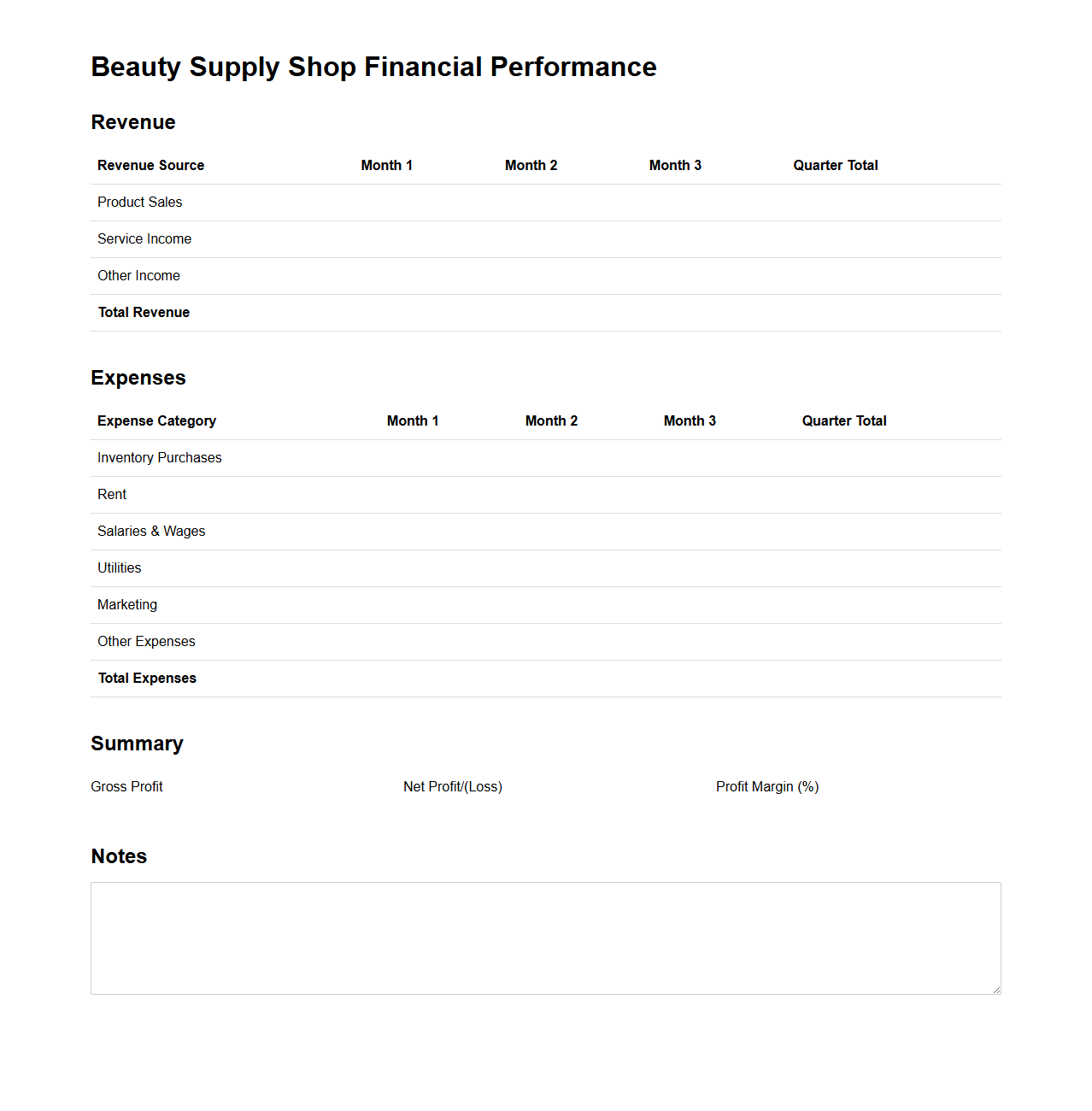

Beauty Supply Shop Financial Performance Template

The

Beauty Supply Shop Financial Performance Template document provides a comprehensive framework for tracking and analyzing the financial health of a beauty supply business. It includes detailed sections for recording revenue streams, operational expenses, profit margins, and cash flow projections, enabling owners to make data-driven decisions. This template helps identify cost-saving opportunities and optimize inventory management to maximize profitability.

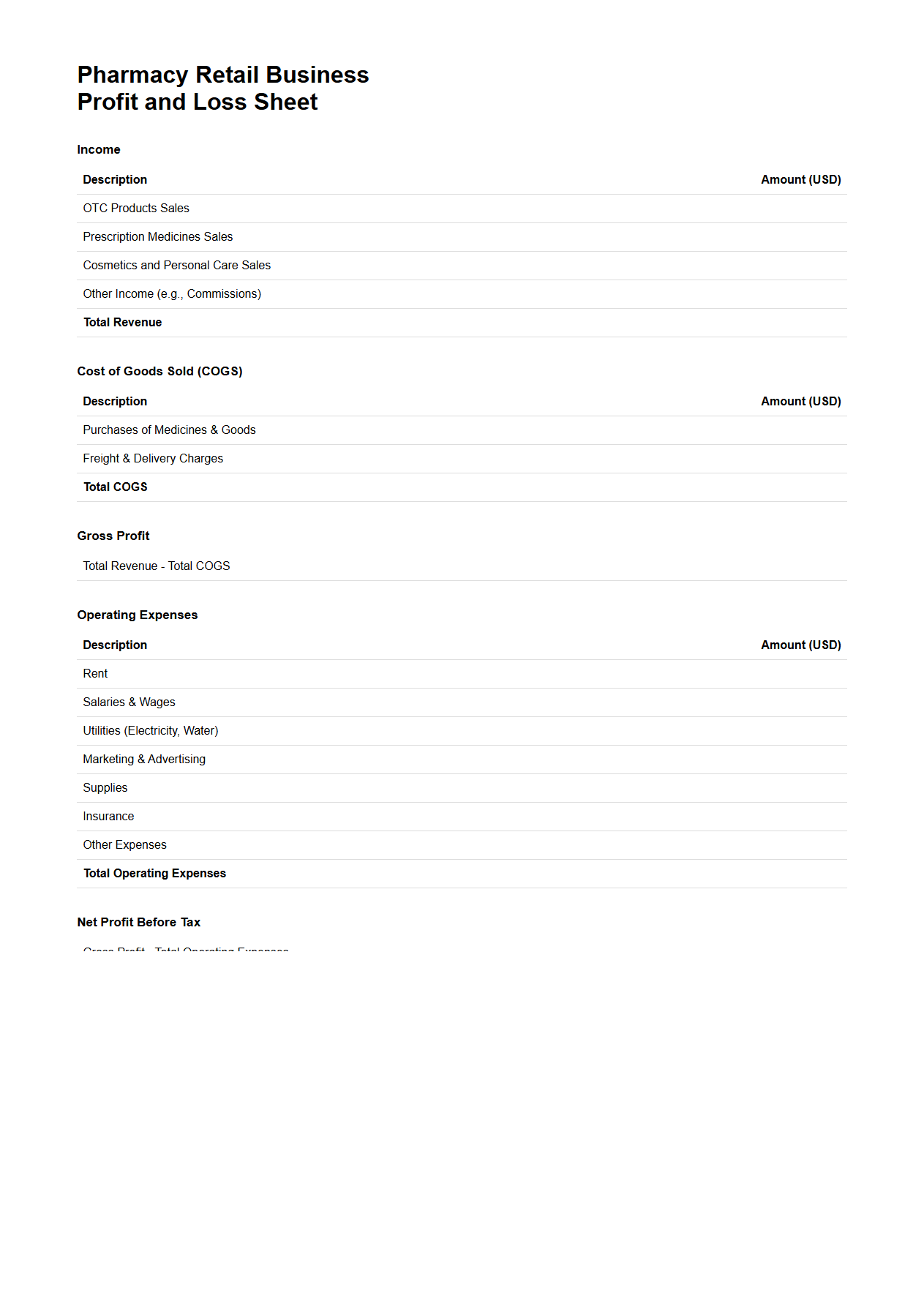

Pharmacy Retail Business Profit and Loss Sheet Example

A

Pharmacy Retail Business Profit and Loss Sheet Example document provides a detailed summary of a pharmacy's revenues, costs, and expenses over a specific period, helping to assess financial performance. It includes key sections like sales from prescription drugs and over-the-counter products, cost of goods sold, operating expenses, and net profit or loss. This document is essential for pharmacy owners to analyze profitability, manage cash flow, and make informed business decisions.

How do seasonal discounts impact the accuracy of profit and loss documents in retail?

Seasonal discounts directly affect the revenue figures reported in profit and loss documents by reducing the sales price, which can temporarily lower gross profit margins. Properly accounting for these discounts ensures that the financial statements reflect the true economic activity during peak and off-peak periods. Failure to adjust for seasonal pricing variations may lead to distorted profitability analysis and misinformed business decisions.

What line items should be included for inventory shrinkage in retail profit and loss statements?

Inventory shrinkage should be reflected as a separate expense line item in the profit and loss statement to capture losses from theft, damage, or administrative errors. This figure directly reduces gross profit and provides insight into operational inefficiencies or security issues. Including shrinkage as a distinct item helps retailers monitor and control inventory management practices effectively.

How are vendor rebates reflected in retail profit and loss documents?

Vendor rebates are typically recorded as a reduction in the cost of goods sold or as other income, depending on accounting policies. Properly recognizing these rebates improves the accuracy of net procurement costs and overall profitability metrics. Transparency in rebate reporting ensures stakeholders have a clear view of the retailer's cost optimization efforts.

What methods optimize COGS reporting in retail P&L documentation?

Optimizing COGS reporting involves accurate inventory tracking, timely purchase expense recording, and consistent application of inventory valuation methods such as FIFO or LIFO. Implementing integrated inventory management systems enhances data reliability and reduces discrepancies in cost reporting. Precise COGS measurement is critical for evaluating gross margins and making informed pricing decisions.

How should returns and refunds be tracked in a retail profit and loss document?

Returns and refunds must be recorded as deductions from sales revenue to present an accurate net sales figure. Tracking these transactions separately also helps identify product or service issues impacting customer satisfaction. Detailed monitoring supports better inventory control and more accurate profit margin assessments.