A Loan Application Document Sample for Home Financing provides a detailed outline of the necessary paperwork required when applying for a mortgage. It typically includes financial statements, proof of income, credit history, and property details to support the loan approval process. This sample helps applicants organize their documents efficiently, increasing the chances of a successful home loan application.

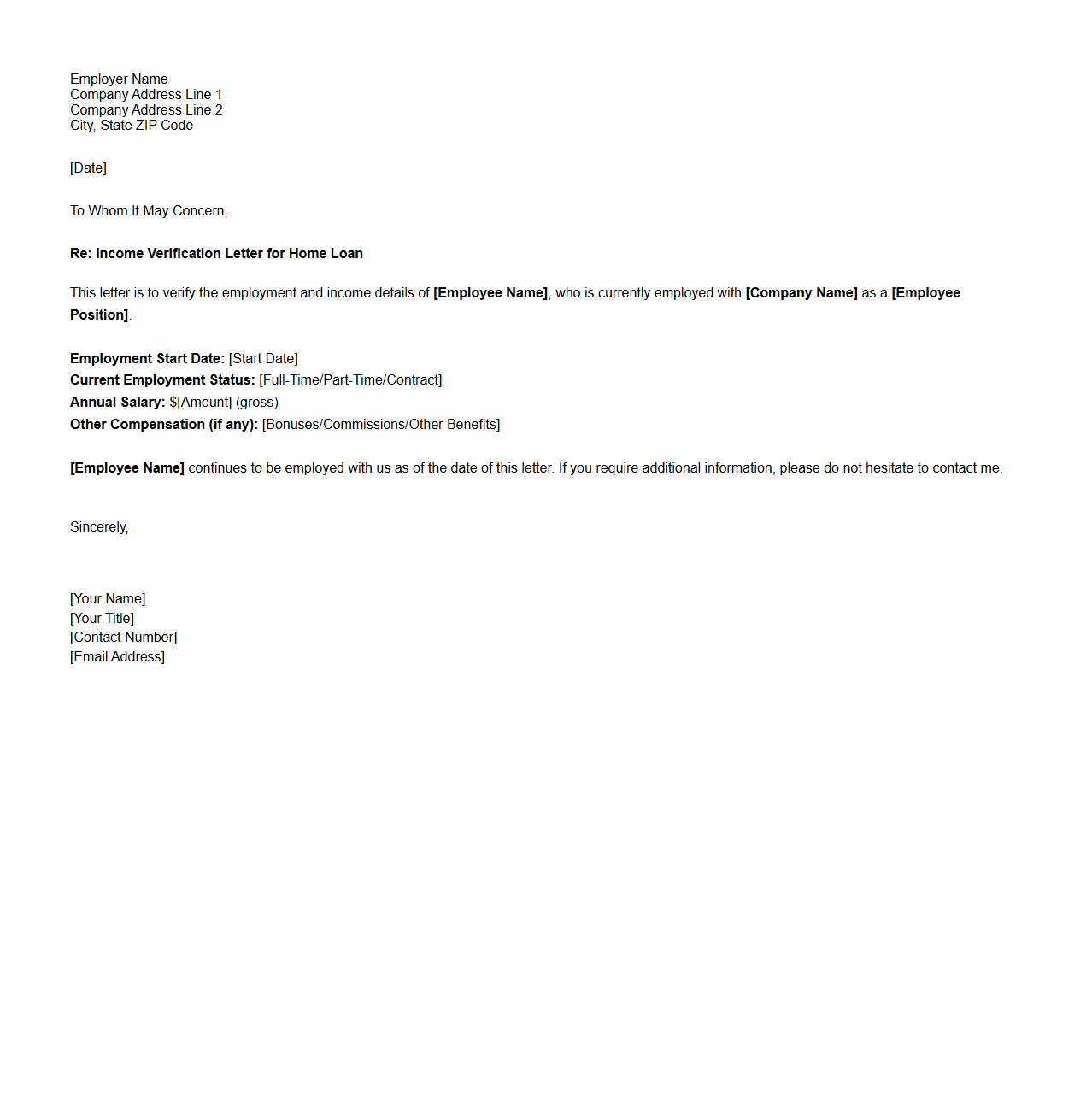

Income Verification Letter Template for Home Loan

An

Income Verification Letter Template for Home Loan is a standardized document used by lenders to confirm a borrower's income details during the mortgage approval process. It typically includes essential information such as the borrower's employer details, job position, salary, and duration of employment. This letter helps ensure that the applicant meets the financial criteria required to qualify for a home loan.

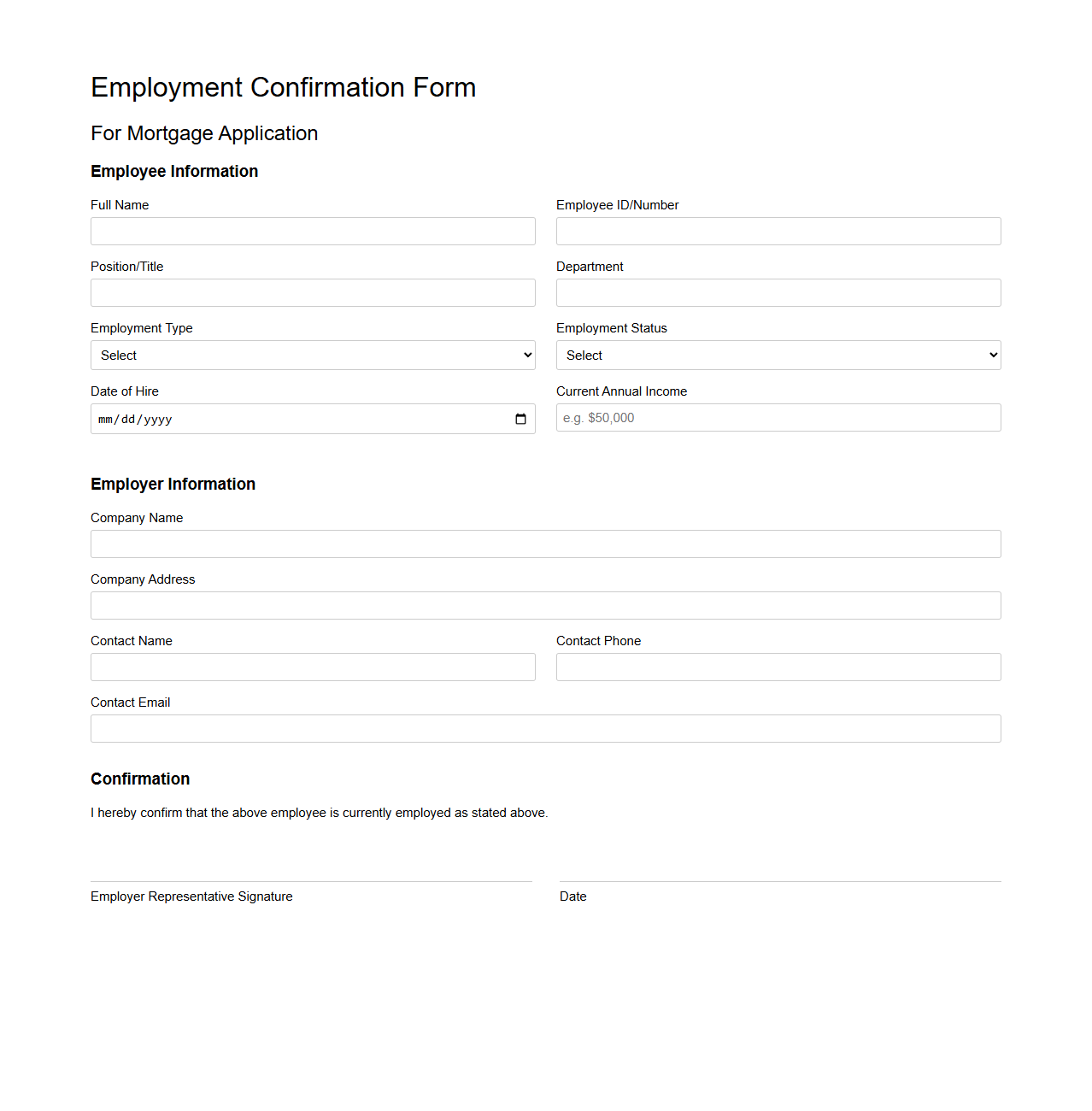

Employment Confirmation Form for Mortgage Application

An

Employment Confirmation Form for a mortgage application is a document used by lenders to verify a borrower's current job status, income, and employment history. This form typically requires the employer to confirm details such as job title, salary, length of employment, and work schedule, ensuring the borrower has a stable source of income to support mortgage payments. Accurate completion of this form helps underwriters assess credit risk and approve the mortgage application efficiently.

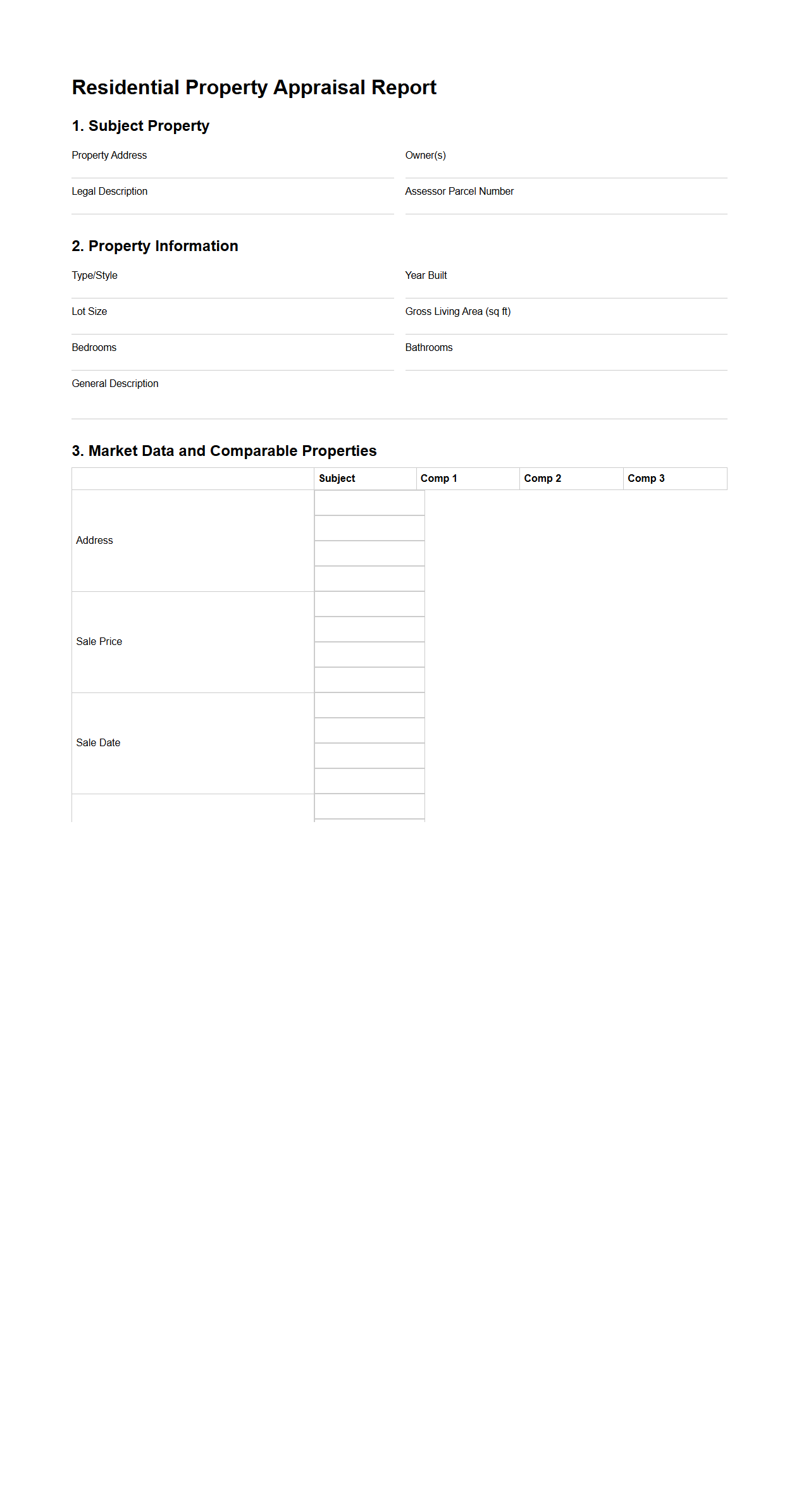

Residential Property Appraisal Report Example

A

Residential Property Appraisal Report Example document provides a detailed evaluation of a home's market value based on factors such as location, size, condition, and comparable sales. It serves as a critical resource for buyers, sellers, lenders, and real estate agents to make informed financial decisions. This report typically includes measurements, photographs, neighborhood analysis, and an appraiser's professional opinion on property worth.

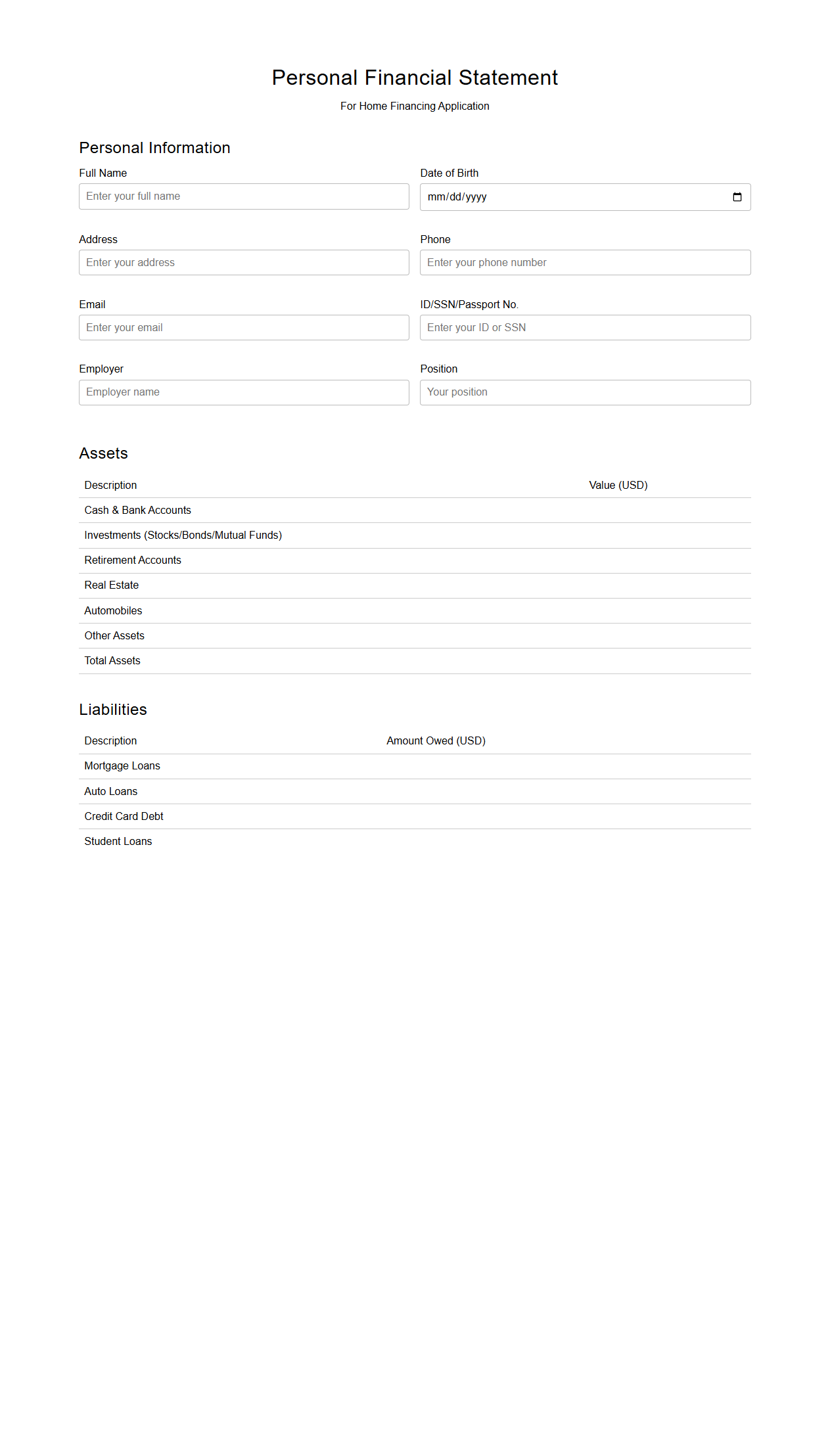

Personal Financial Statement Format for Home Financing

A

Personal Financial Statement Format for home financing is a structured document used by lenders to evaluate an individual's financial health and creditworthiness when applying for a mortgage. It typically includes detailed information on assets, liabilities, income, expenses, and net worth, providing a comprehensive snapshot of the applicant's financial stability. This format helps lenders assess the borrower's ability to repay the loan and make informed decisions about home financing approvals.

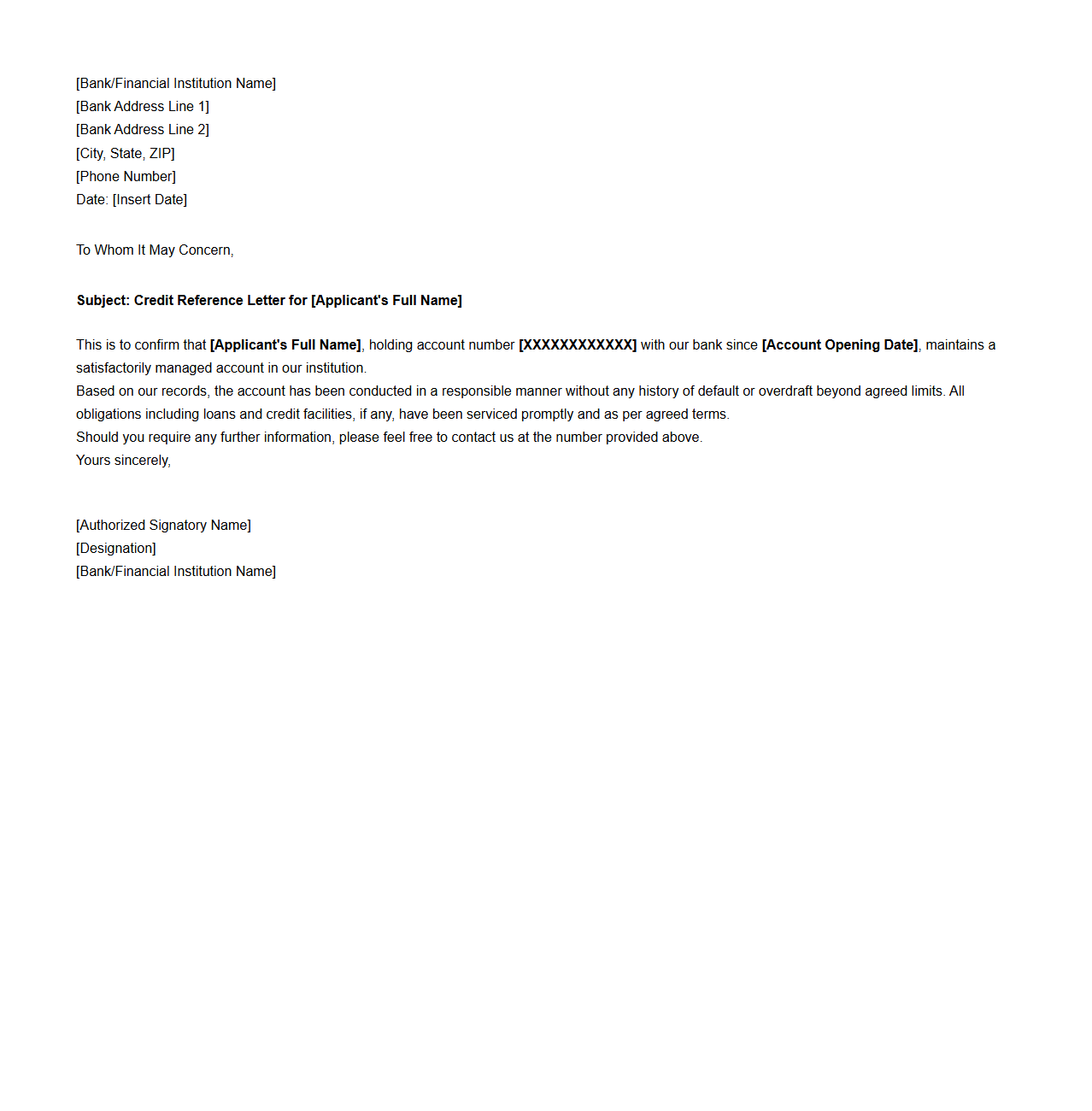

Credit Reference Letter Sample for Home Loan

A

Credit Reference Letter Sample for Home Loan is a formal document provided by a financial institution or previous lender, detailing an individual's credit history and repayment behavior. This letter helps the home loan provider assess the applicant's creditworthiness and reliability in managing debts. It typically includes information such as loan amounts, repayment schedules, and credit standing to support the loan approval process.

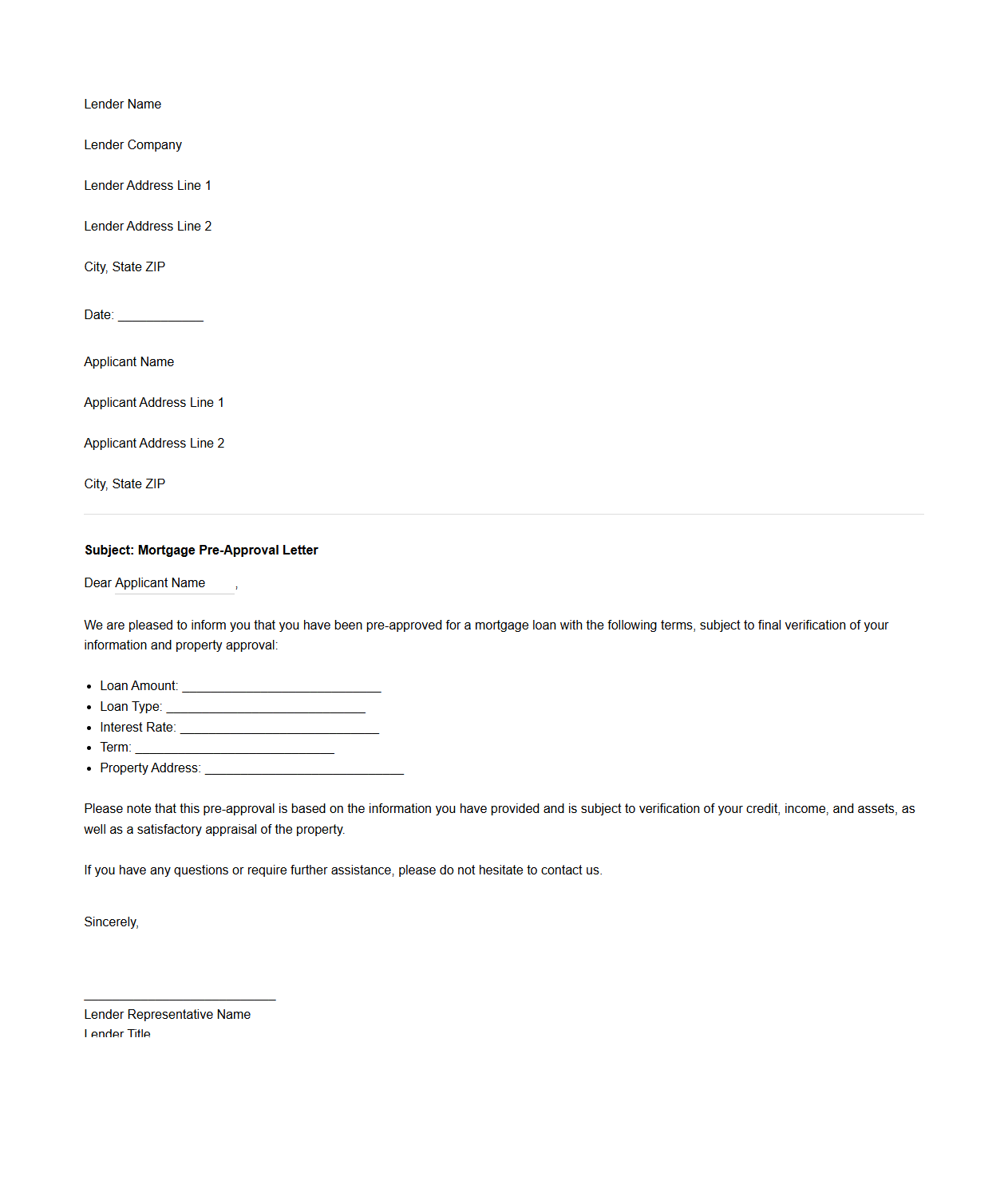

Mortgage Pre-Approval Letter Template

A

Mortgage Pre-Approval Letter Template is a standardized document used by lenders to confirm a borrower's preliminary eligibility for a home loan based on financial information provided. This template typically includes key details such as the borrower's credit score, income, loan amount, and terms, offering a clear snapshot of loan approval status. It serves as an essential tool for homebuyers to demonstrate financial readiness and credibility to sellers during real estate transactions.

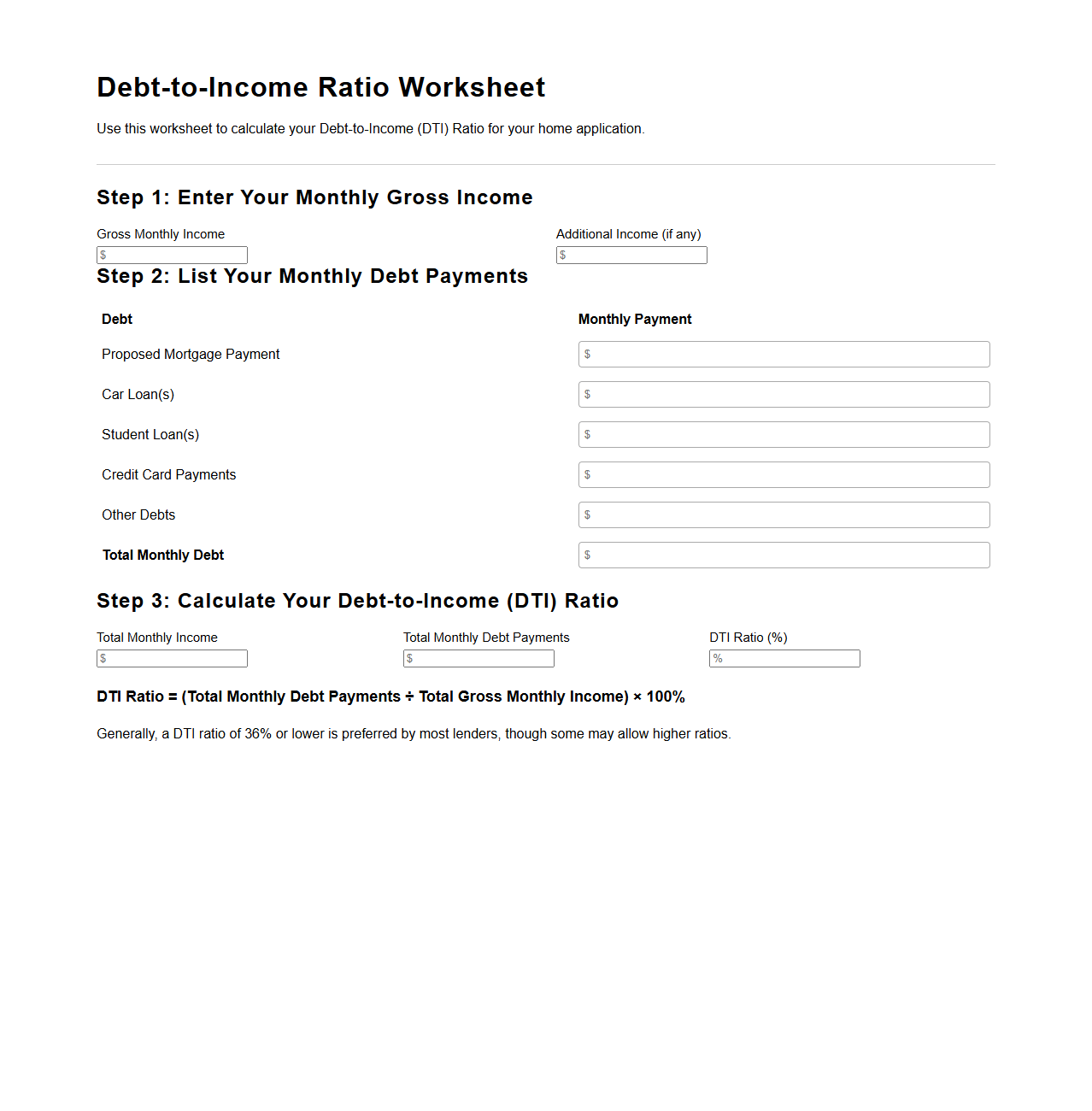

Debt-to-Income Ratio Worksheet for Home Application

A

Debt-to-Income Ratio Worksheet for a home application document helps lenders evaluate a borrower's ability to manage monthly payments by comparing total monthly debt payments to gross monthly income. This worksheet itemizes debts such as mortgages, credit card payments, and student loans to calculate the percentage of income dedicated to debt repayment. Accurate completion of this document is crucial in determining loan eligibility and favorable mortgage terms.

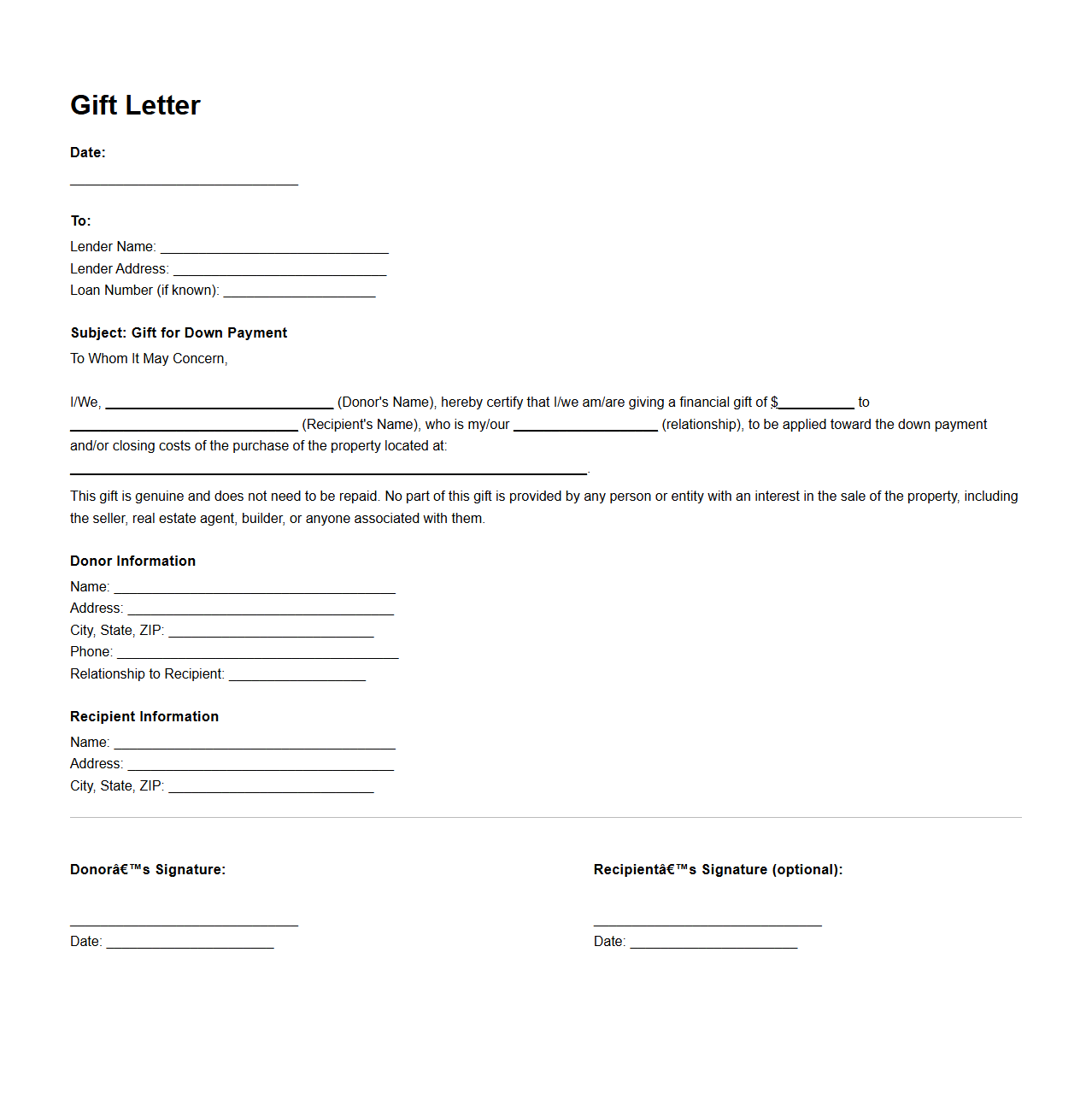

Gift Letter Sample for Home Loan Down Payment

A

Gift Letter Sample for Home Loan Down Payment is a formal document that verifies funds given by a family member or friend as a gift to assist with the down payment on a home. This letter typically includes details such as the donor's information, the amount gifted, and a statement confirming that the money is not expected to be repaid. Lenders require this document to ensure the down payment funds comply with loan guidelines and to prevent the appearance of undisclosed debt.

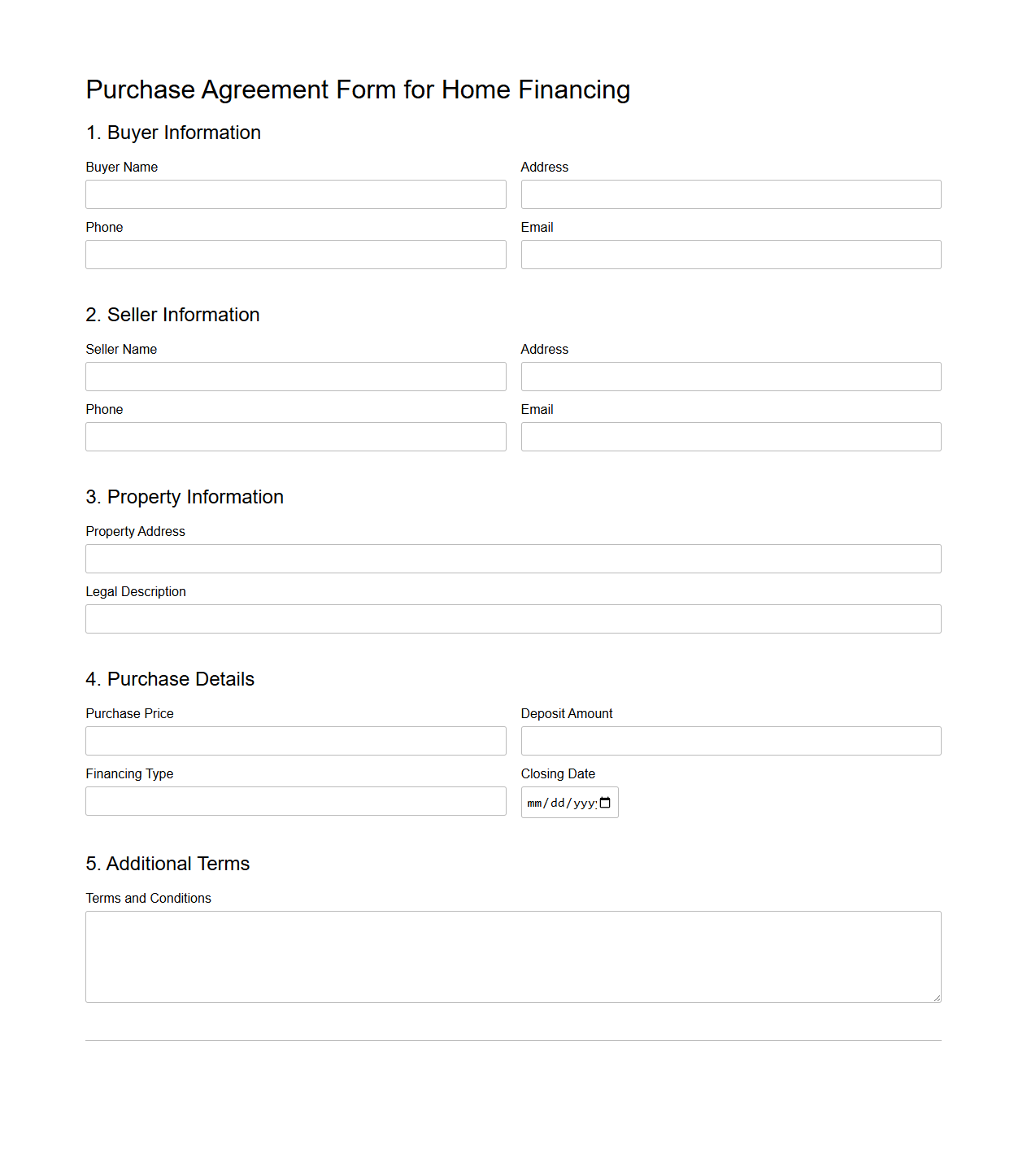

Purchase Agreement Form for Home Financing

A

Purchase Agreement Form for home financing is a legally binding contract between a buyer and seller outlining the terms of a real estate sale. It specifies important details such as the purchase price, closing date, contingencies, and property conditions, serving as a foundation for mortgage lenders to approve financing. This document protects both parties by ensuring clear communication and mutual agreement before the transaction proceeds.

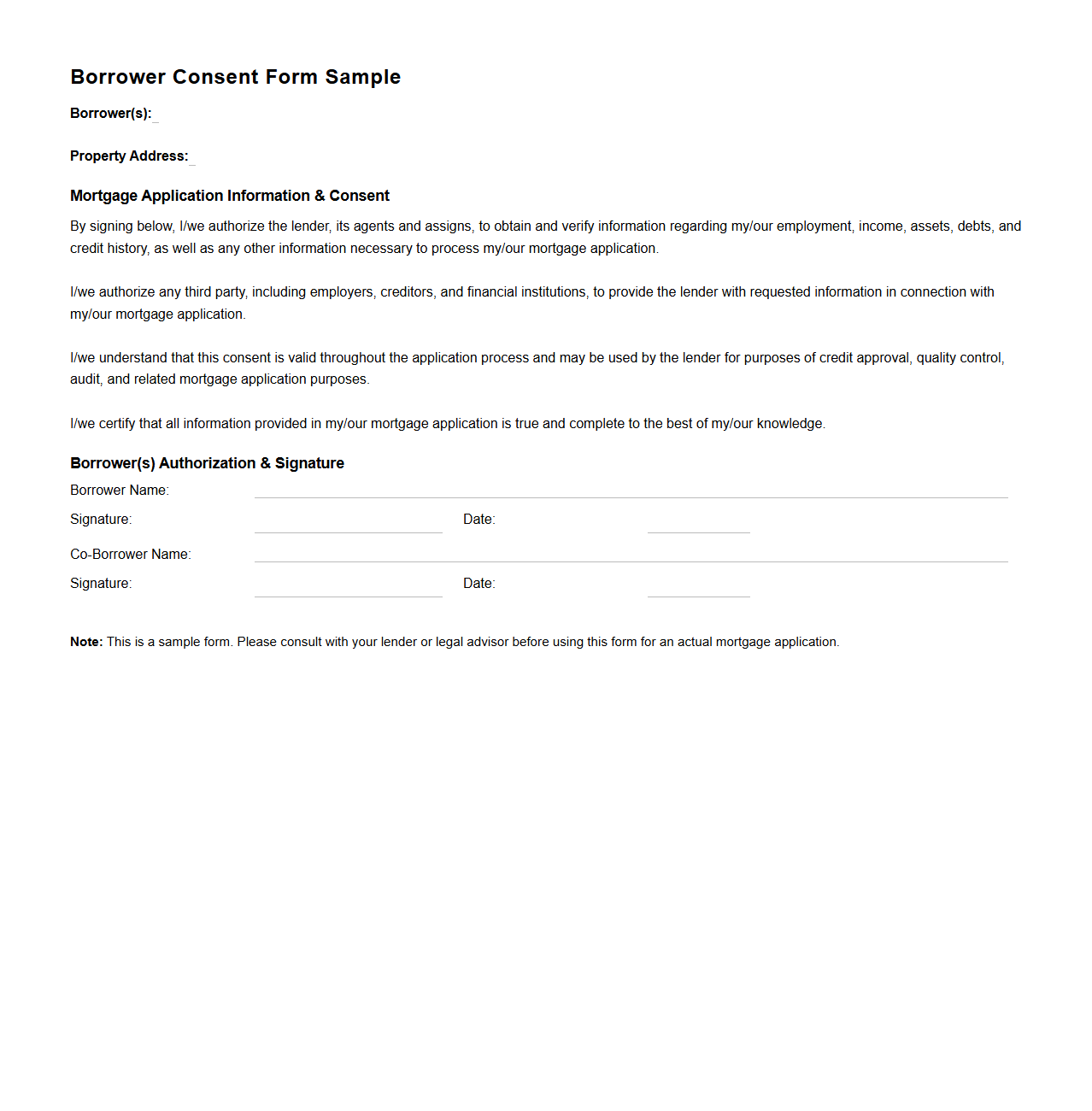

Borrower Consent Form Sample for Mortgage Application

A

Borrower Consent Form for mortgage application is a legal document that authorizes the lender to verify the borrower's financial information and credit history during the loan approval process. This form ensures compliance with privacy laws and protects both parties by obtaining explicit permission before accessing sensitive data. It is a crucial part of the mortgage application, facilitating a transparent and secure evaluation of the borrower's eligibility.

What supporting income documents are required for self-employed loan applicants?

Self-employed loan applicants must provide tax returns for the past two years to verify income. Additionally, profit and loss statements signed by a certified accountant are required. Bank statements demonstrating consistent income deposits are also essential.

How should discrepancies in address history be handled in the application?

Applicants must clarify any discrepancies in their address history by submitting a written explanation. Supporting documents such as utility bills or lease agreements can help verify the addresses. Ensuring accuracy is critical for application approval.

Are digital signatures accepted on all loan application forms?

Digital signatures are accepted on most loan application forms for convenience. However, some documents still require handwritten signatures due to legal or regulatory requirements. Applicants should confirm which forms permit digital signing.

What is the minimum credit score stated in the loan application eligibility section?

The loan application specifies a minimum credit score of 620 for eligibility. Scores below this threshold may require additional documentation or lead to application denial. It is important to review credit score requirements before applying.

Which sections of the document require notarized attachments?

Notarized attachments are required for the affidavit of income and identity verification sections. These attest to the authenticity of the information provided by the applicant. Failure to notarize may result in processing delays or rejection.