A Budget Plan Document Sample for Small Business provides a structured template to outline income, expenses, and financial goals. It helps small business owners manage cash flow, allocate resources efficiently, and plan for growth. Using a clear and detailed budget plan improves decision-making and ensures financial stability.

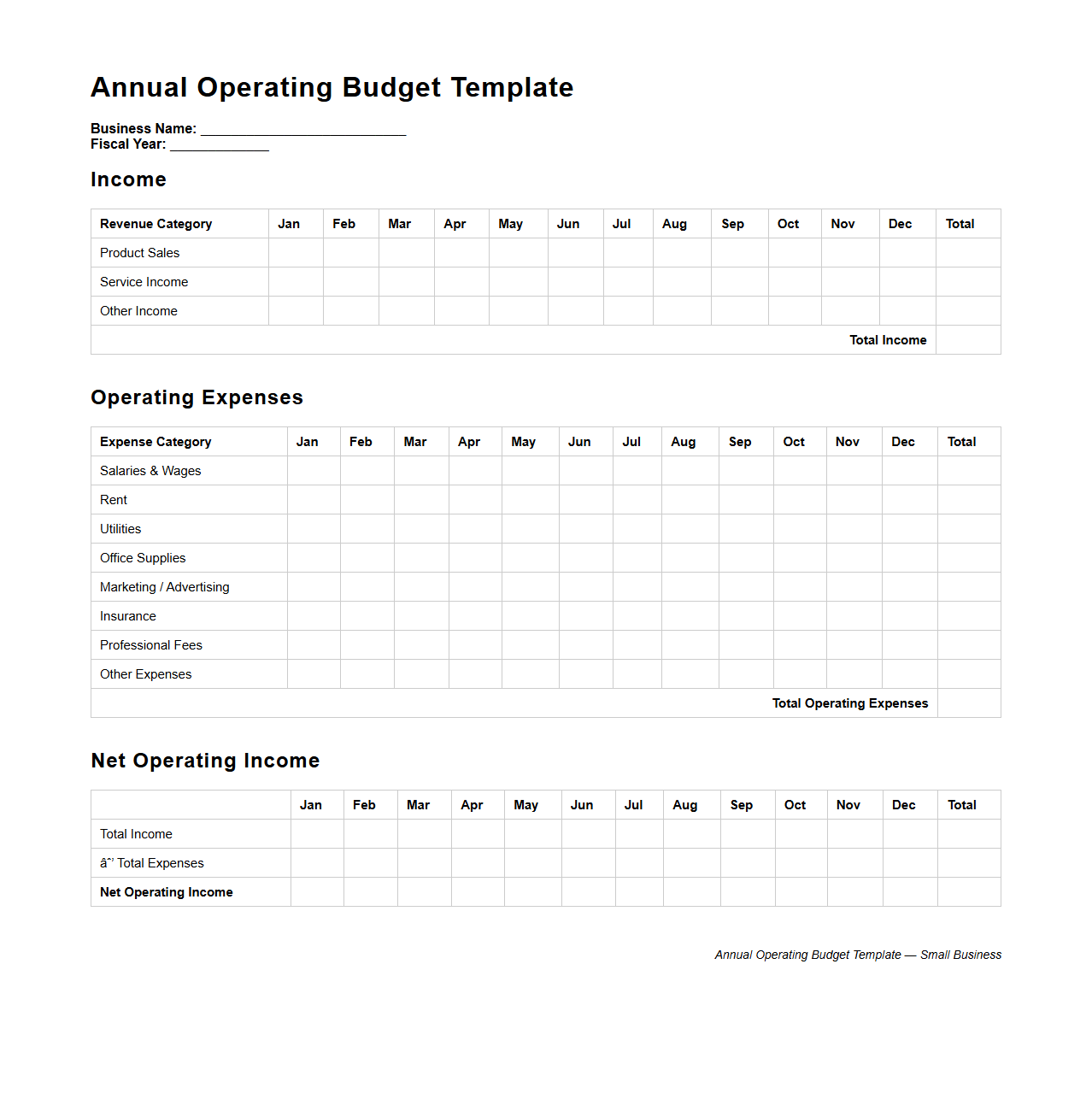

Annual Operating Budget Template for Small Businesses

An

Annual Operating Budget Template for small businesses is a structured financial planning document that outlines expected income, expenses, and cash flow over a fiscal year. It helps business owners allocate resources efficiently, track financial performance, and forecast profitability. This template typically includes categories such as sales projections, fixed and variable costs, and contingency funds to support strategic decision-making.

Monthly Expense Tracking Sheet for Startups

A

Monthly Expense Tracking Sheet for startups is a crucial financial document designed to systematically record and monitor all business-related expenditures during a specific month. It helps startups maintain budget control, identify spending patterns, and optimize cash flow management. This sheet typically includes categories such as operational costs, marketing expenses, salaries, and miscellaneous outlays, providing a clear overview of financial health.

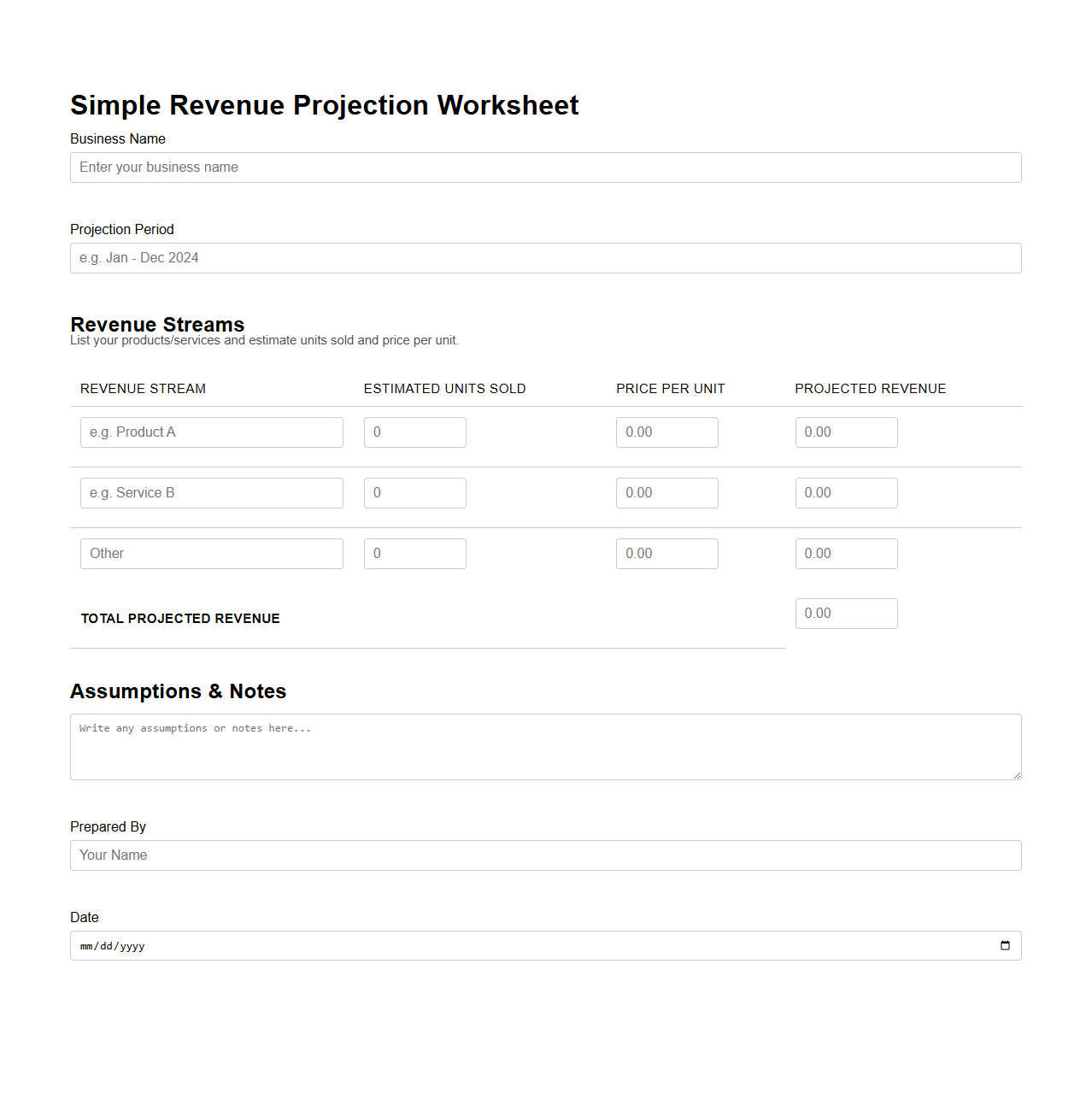

Simple Revenue Projection Worksheet for Entrepreneurs

A

Simple Revenue Projection Worksheet for entrepreneurs is a financial tool designed to estimate future income based on sales forecasts, pricing strategies, and market demand. This document helps business owners plan budgets, set realistic goals, and make informed decisions by outlining monthly or yearly revenue expectations. It typically includes columns for product or service categories, expected units sold, price per unit, and total projected revenue.

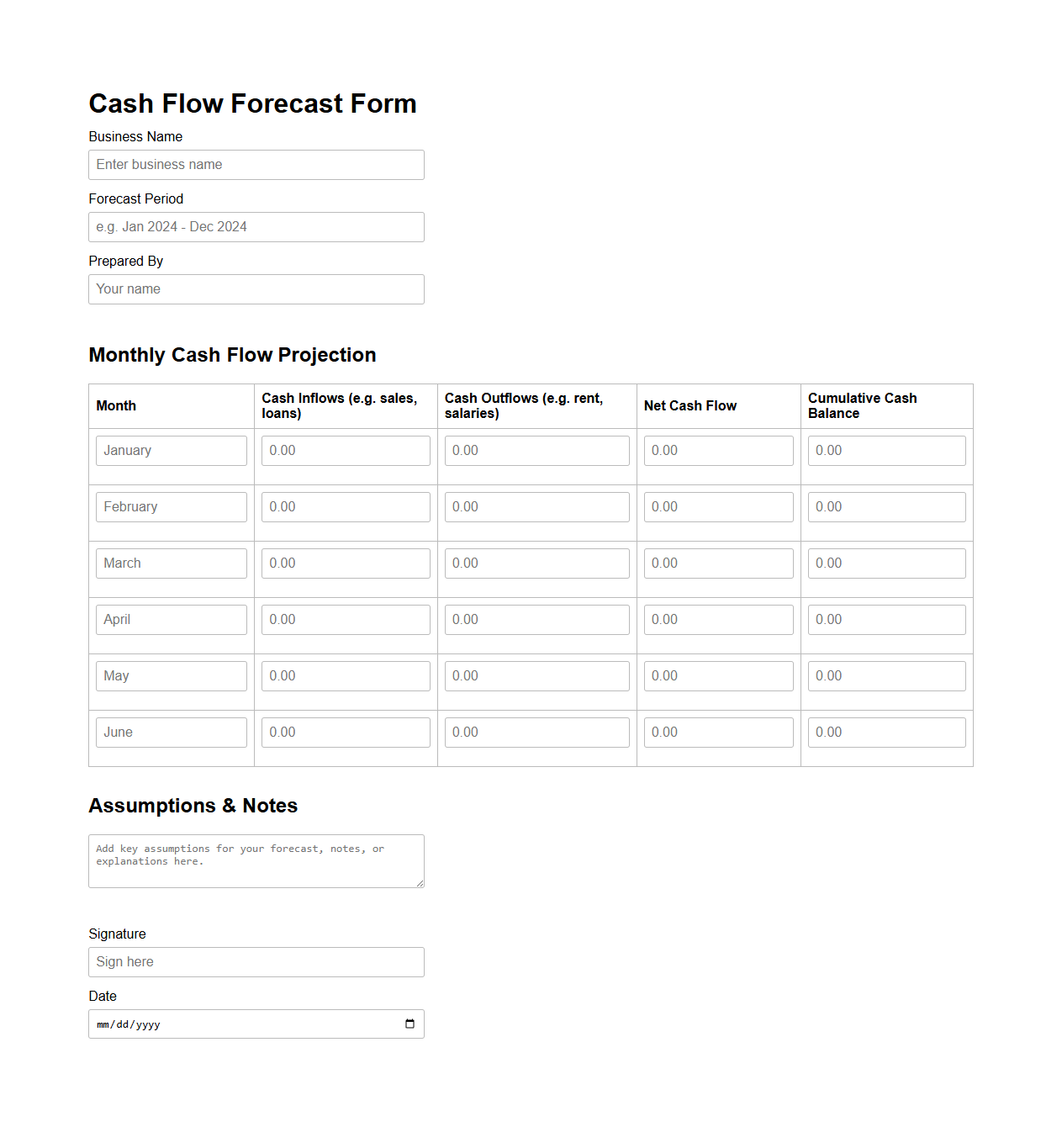

Cash Flow Forecast Form for Small Enterprises

A

Cash Flow Forecast Form for Small Enterprises is a financial tool designed to project future cash inflows and outflows over a specific period. It helps small business owners anticipate liquidity needs, plan expenses, and avoid cash shortages by providing a clear view of expected revenue and payments. Accurate use of this form supports informed decision-making and effective financial management.

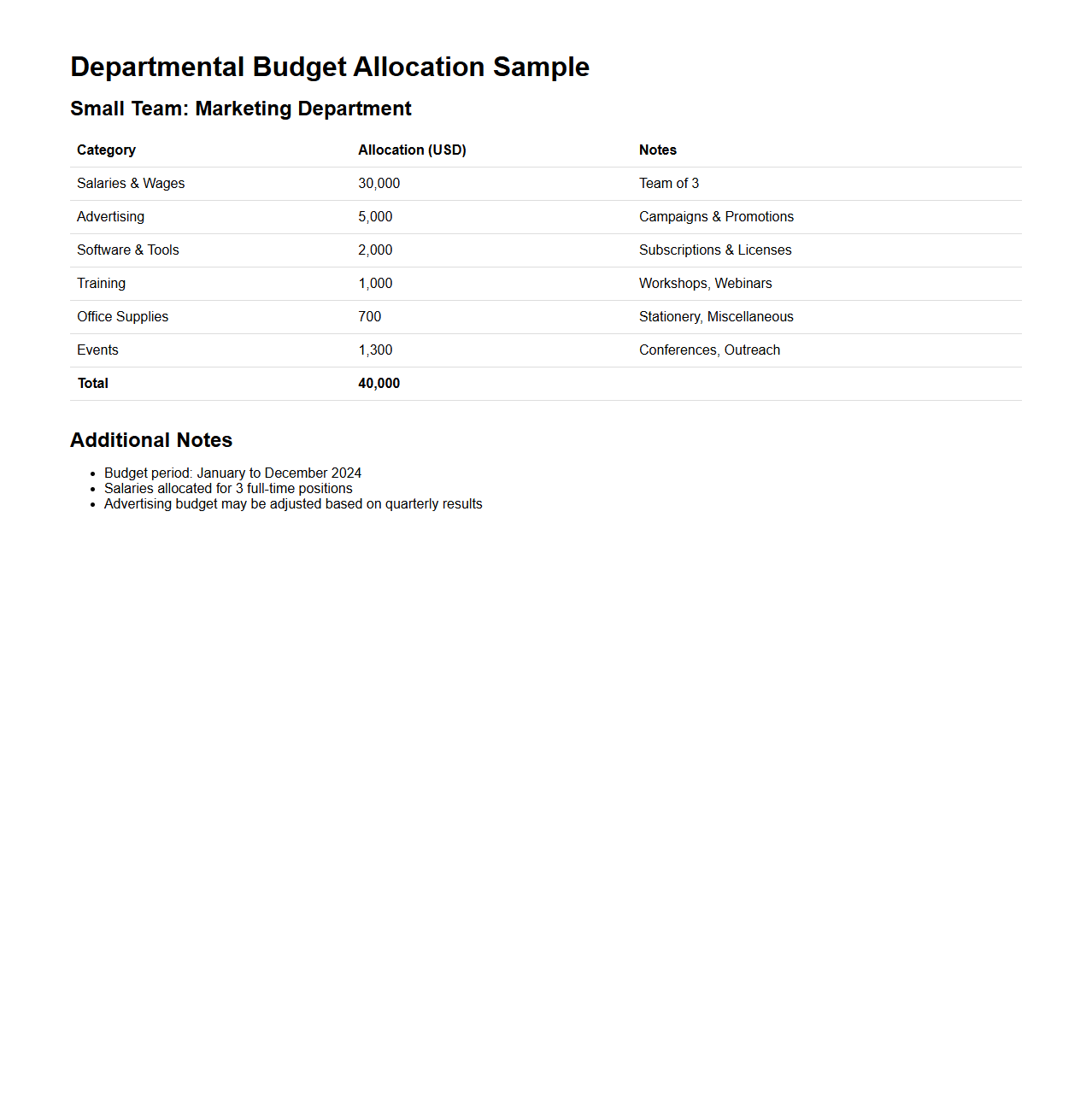

Departmental Budget Allocation Sample for Small Teams

The

Departmental Budget Allocation Sample for Small Teams document provides a structured template outlining the distribution of financial resources across various functions within a small team or department. It includes detailed categories such as personnel costs, operational expenses, and project-specific funding, ensuring effective and transparent budget management. This sample aids managers in planning, tracking, and optimizing budget usage to align with organizational goals and improve team performance.

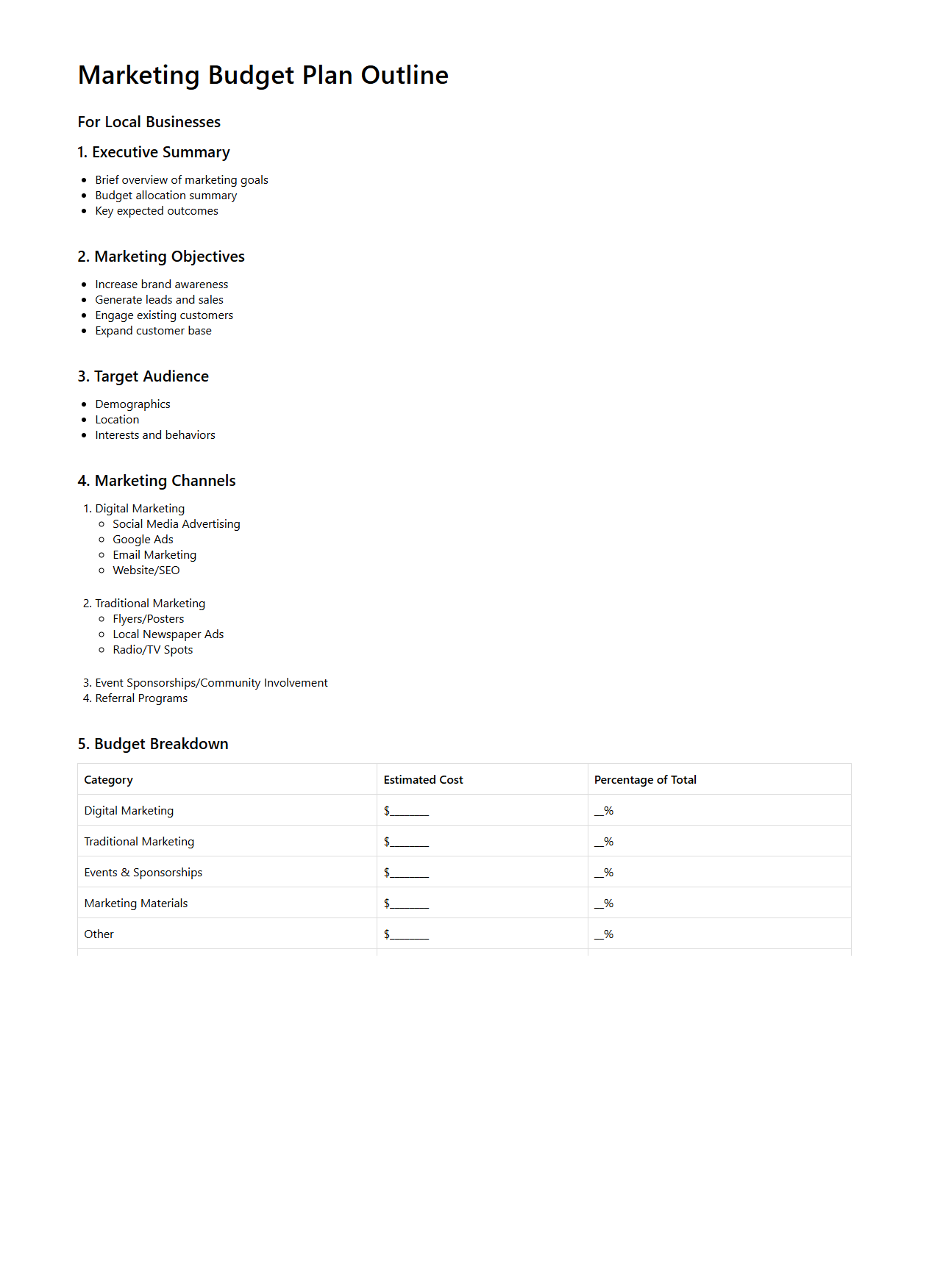

Marketing Budget Plan Outline for Local Businesses

A

Marketing Budget Plan Outline for local businesses is a strategic document that details the allocation of financial resources across various marketing activities tailored to regional markets. It includes categories such as advertising, promotions, digital marketing, and community engagement, ensuring expenses align with projected revenue and business goals. This outline helps local businesses maximize ROI by prioritizing cost-effective channels and tracking performance against specific local customer segments.

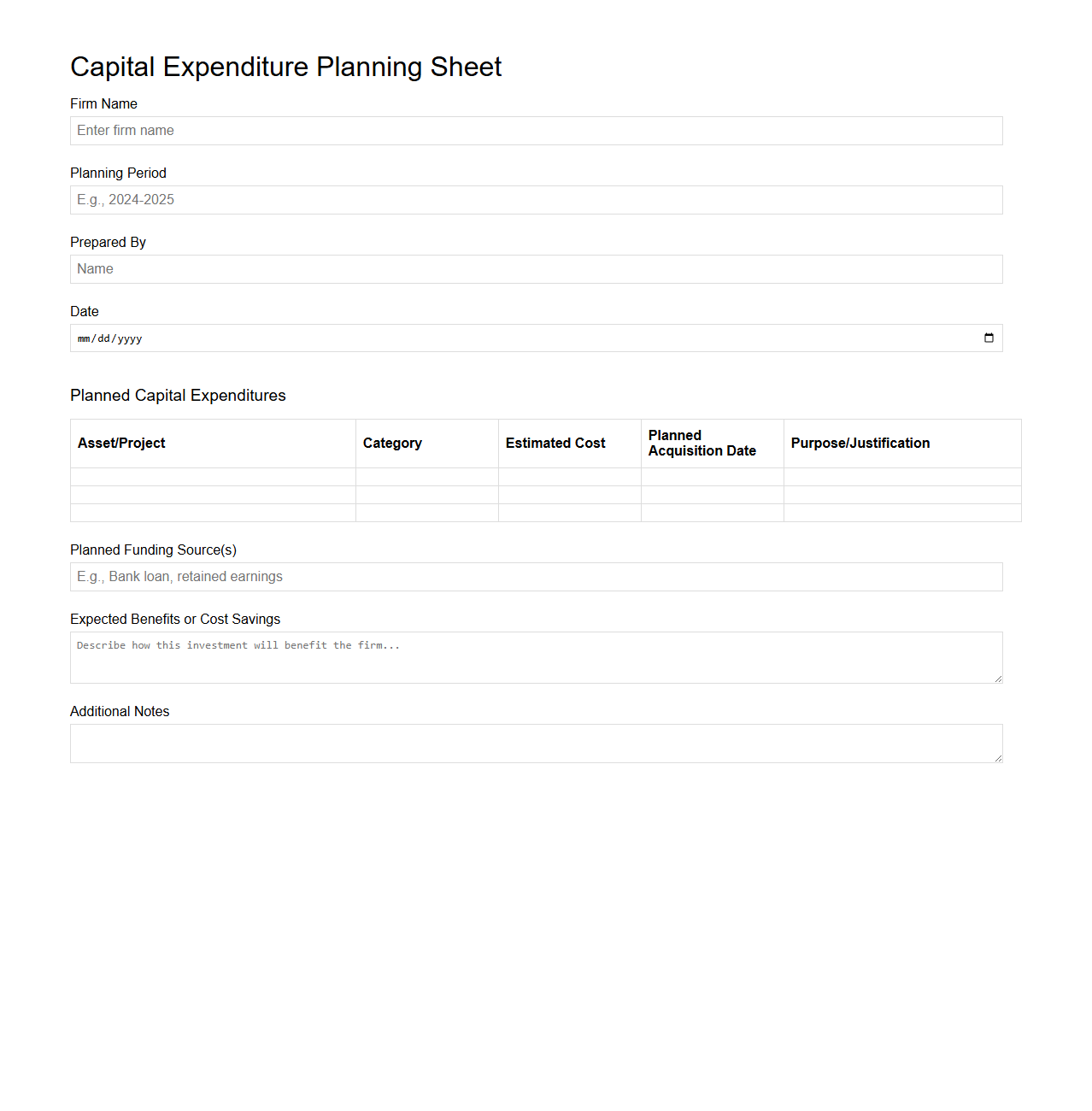

Capital Expenditure Planning Sheet for Small Firms

A

Capital Expenditure Planning Sheet for small firms is a crucial financial tool used to forecast and manage long-term investments in assets such as equipment, property, or technology. This document helps businesses allocate budgets effectively, prioritize capital projects, and ensure alignment with strategic growth objectives. By detailing anticipated expenditures, timelines, and expected returns, it enables informed decision-making and supports sustainable financial management.

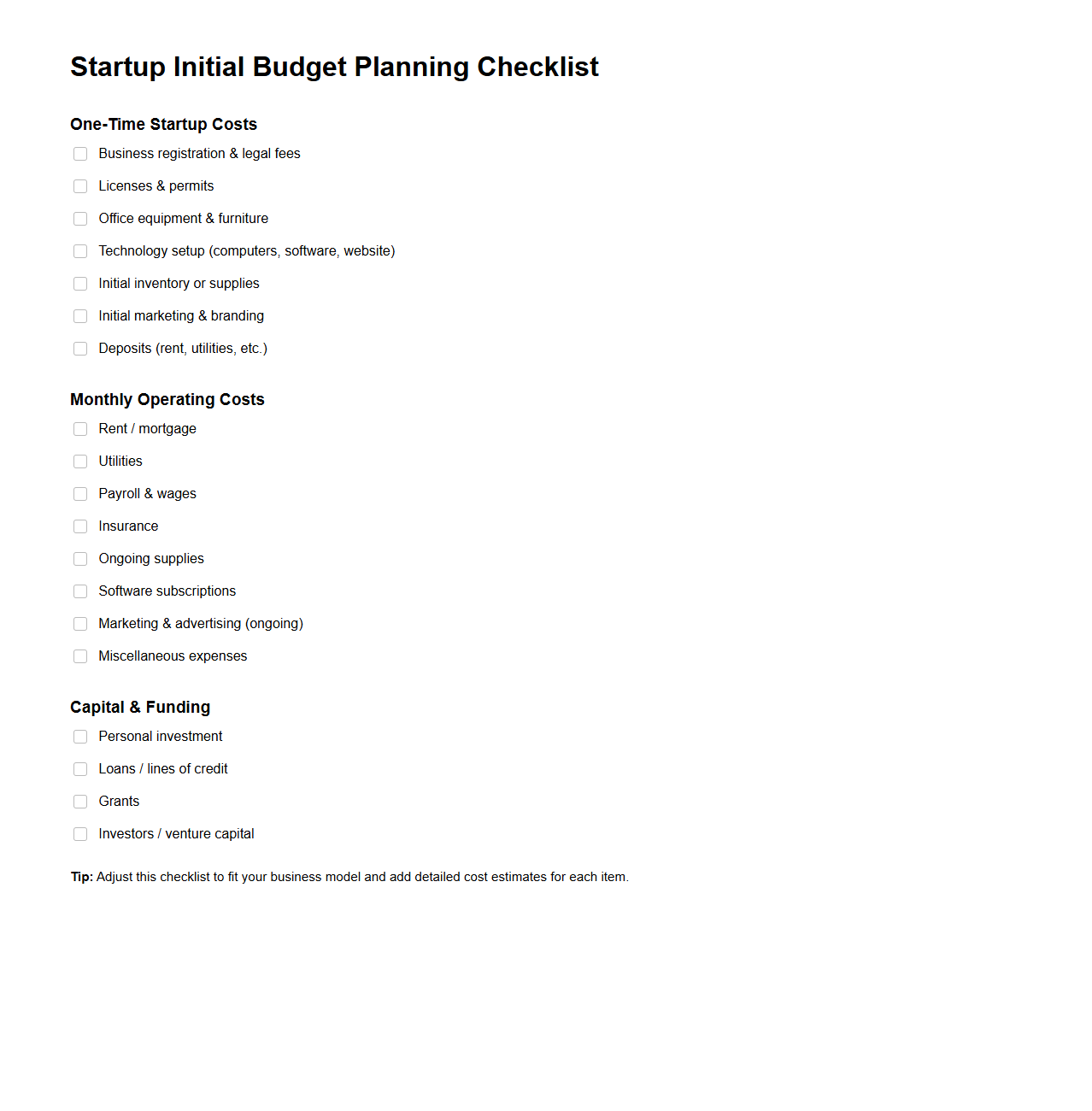

Startup Initial Budget Planning Checklist

A

Startup Initial Budget Planning Checklist document is a comprehensive tool designed to guide entrepreneurs in outlining all necessary financial components for launching a new business. It includes key categories such as capital requirements, operational expenses, marketing costs, and contingency funds, ensuring a detailed and realistic financial plan. This checklist helps improve cash flow management, identify funding needs, and supports strategic decision-making during the critical startup phase.

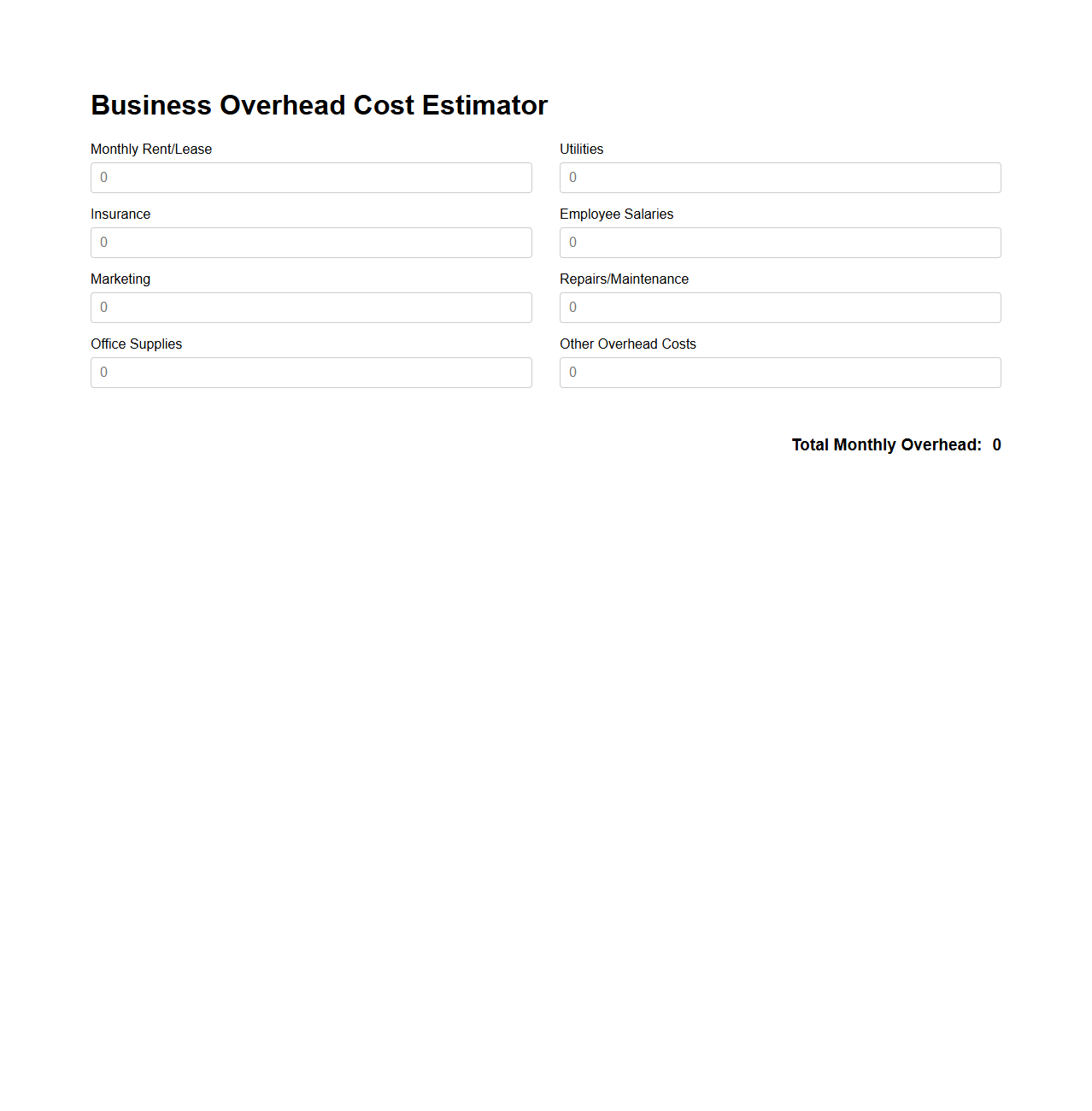

Business Overhead Cost Estimator for SMEs

The

Business Overhead Cost Estimator for SMEs is a practical tool designed to help small and medium-sized enterprises accurately calculate their fixed and variable overhead expenses. This document enables business owners to identify all operational costs such as rent, utilities, salaries, and office supplies, facilitating better budget management and financial planning. By providing a detailed overview of overhead costs, it supports informed decision-making to improve profitability and resource allocation.

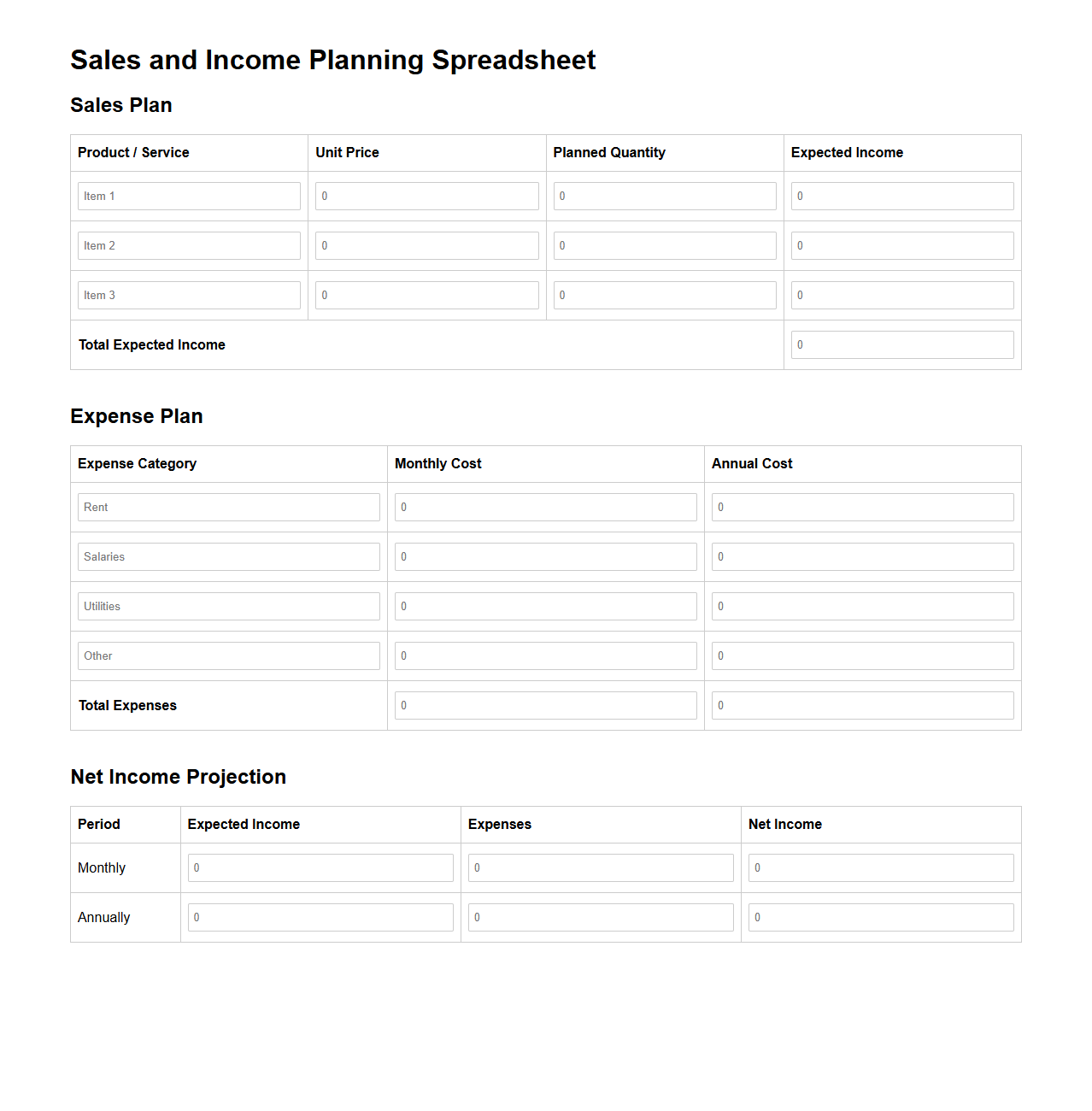

Sales and Income Planning Spreadsheet for Small Companies

A

Sales and Income Planning Spreadsheet for Small Companies document is a structured tool designed to help small businesses forecast revenue, track expenses, and manage cash flow effectively. It integrates sales projections with income and cost data, enabling users to create detailed financial plans and analyze profitability over specific periods. This spreadsheet supports informed decision-making by providing clear insights into expected business performance and resource allocation.

What essential line items should be mandatory in a small business budget plan document?

A small business budget plan document must include revenue projections to estimate future income accurately. It is essential to list all operating expenses, including rent, salaries, and utilities, to provide a clear overview of costs. Additionally, including capital expenditures for equipment or infrastructure investments ensures the plan is comprehensive and realistic.

How do you justify contingency allocations in a small business budget letter?

Contingency allocations are justified by highlighting potential risks and unforeseen expenses that could impact business operations. Emphasizing the need for financial flexibility shows preparedness for unexpected costs like market fluctuations or emergency repairs. This allocation ensures the business can maintain stability without disrupting planned spending or growth initiatives.

Which financial assumptions must be clarified within the budget plan document?

The budget plan must clearly state assumptions on sales growth rates based on historical data or market analysis. It should also clarify expected cost variations due to inflation or supplier price changes. Additionally, assumptions about payment terms and credit availability must be transparent to prevent misunderstandings regarding cash flow.

What supporting documents strengthen a budget plan request letter for funding?

Supporting documents such as financial statements (income statements and balance sheets) provide verifiable proof of business performance. Including sales forecasts and market research reports adds credibility and demonstrates thorough planning. A well-prepared business plan detailing operational strategies further convinces funders of the project's viability.

How should projected cash flow be presented in a small business budget document?

Projected cash flow should be presented in a clear, month-by-month cash flow statement to highlight inflows and outflows over time. Use visuals like tables or graphs to make trends and critical points easily understandable. This presentation helps stakeholders assess liquidity and anticipate periods of potential cash shortages or surpluses effectively.