A Loan Agreement Document Sample for Business Financing outlines the terms and conditions under which a lender provides funds to a business borrower. It specifies the loan amount, interest rate, repayment schedule, and obligations of both parties to ensure legal clarity and protection. This document serves as a crucial reference to prevent disputes and facilitate smooth financial transactions.

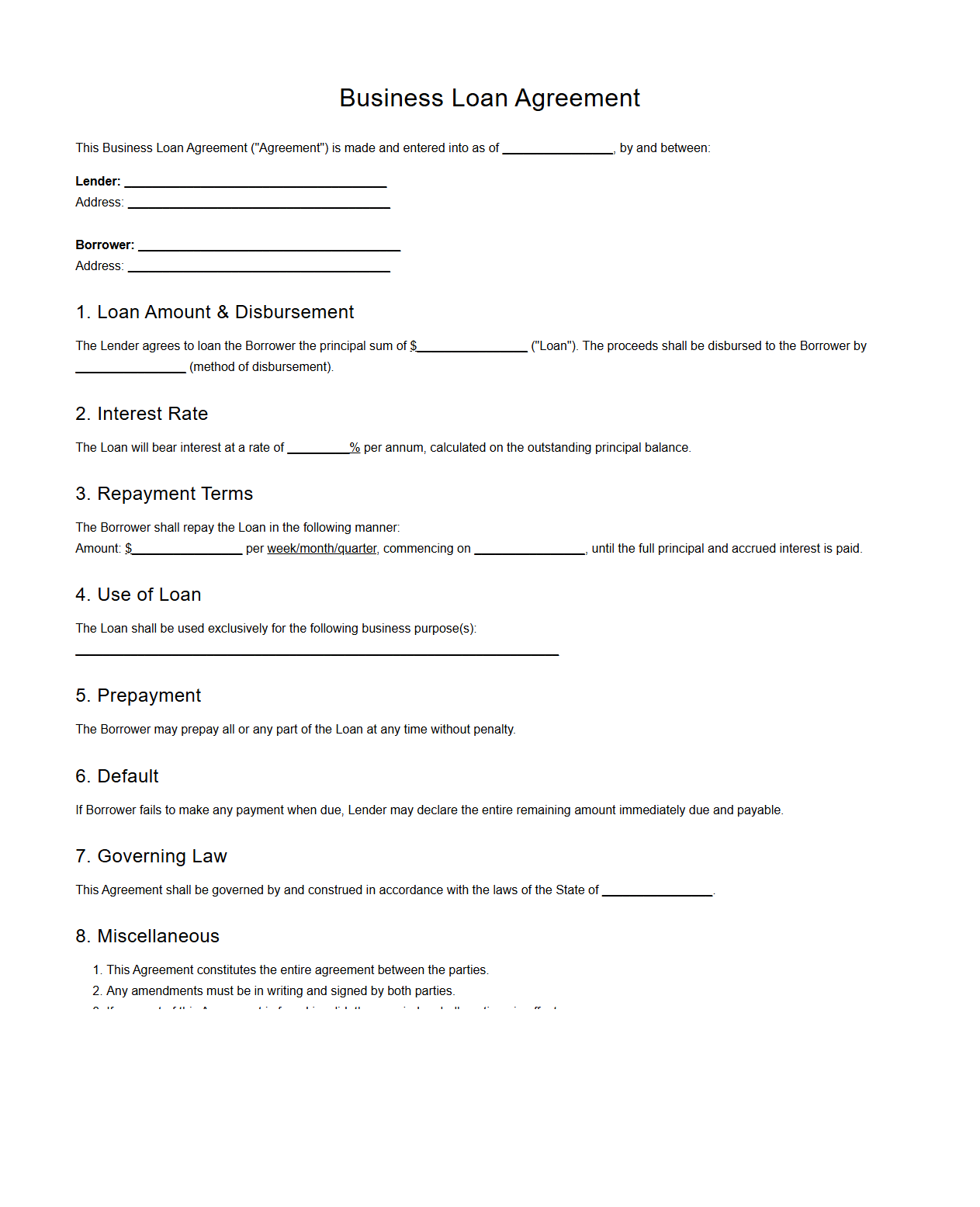

Business Loan Agreement Template

A

Business Loan Agreement Template document is a pre-formatted contract designed to outline the terms and conditions between a lender and a borrower in a business loan transaction. It specifies key elements such as loan amount, interest rate, repayment schedule, collateral, and default consequences to protect both parties' interests. Using this template ensures legal clarity, consistency, and efficiency in formalizing business financing agreements.

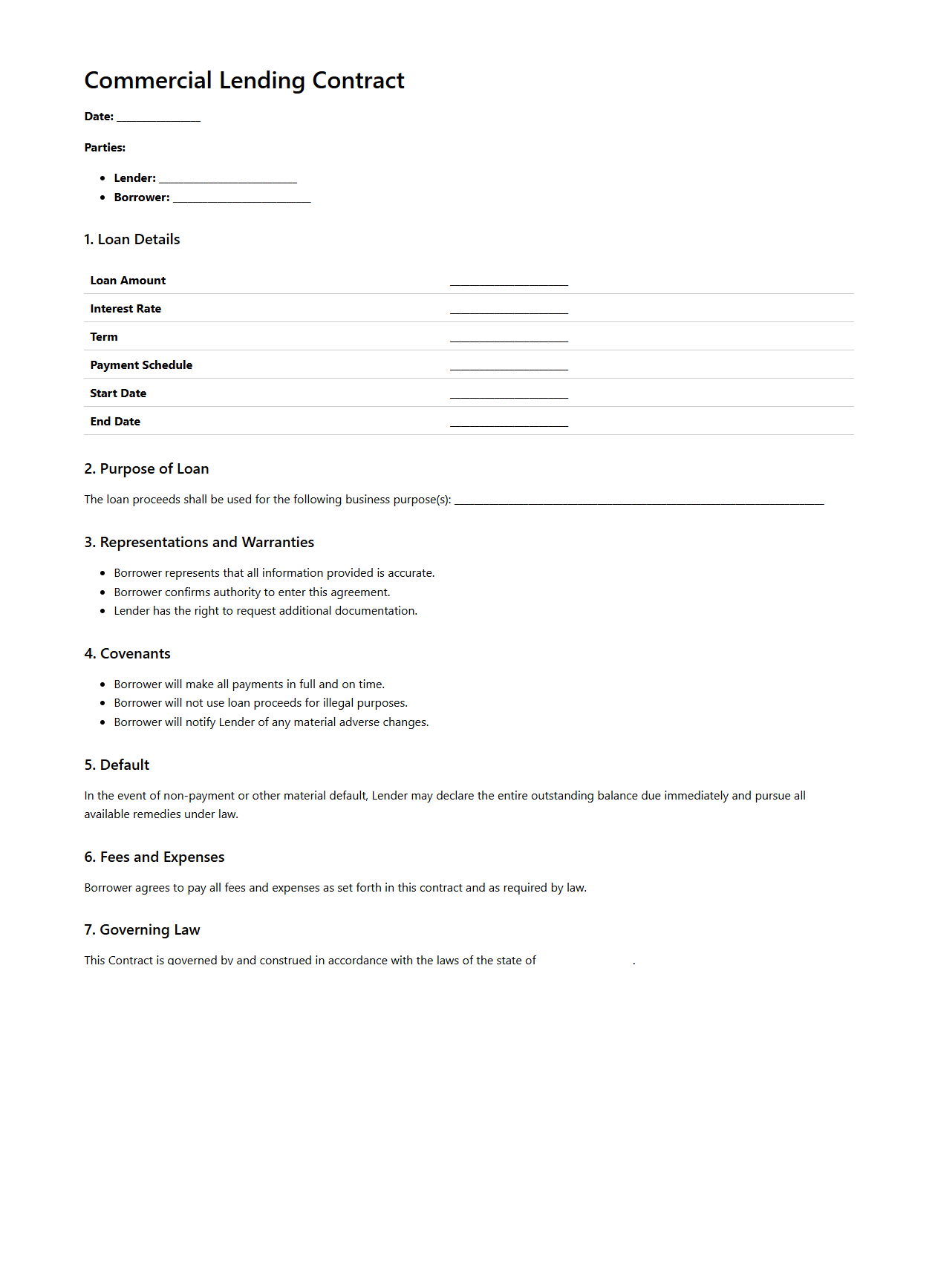

Commercial Lending Contract Example

A

Commercial Lending Contract Example document outlines the terms and conditions between a lender and a borrower for business-related loans. It typically includes details such as loan amount, interest rates, repayment schedule, collateral, and default clauses to protect both parties. This contract serves as a legally binding agreement ensuring clarity and accountability throughout the borrowing process.

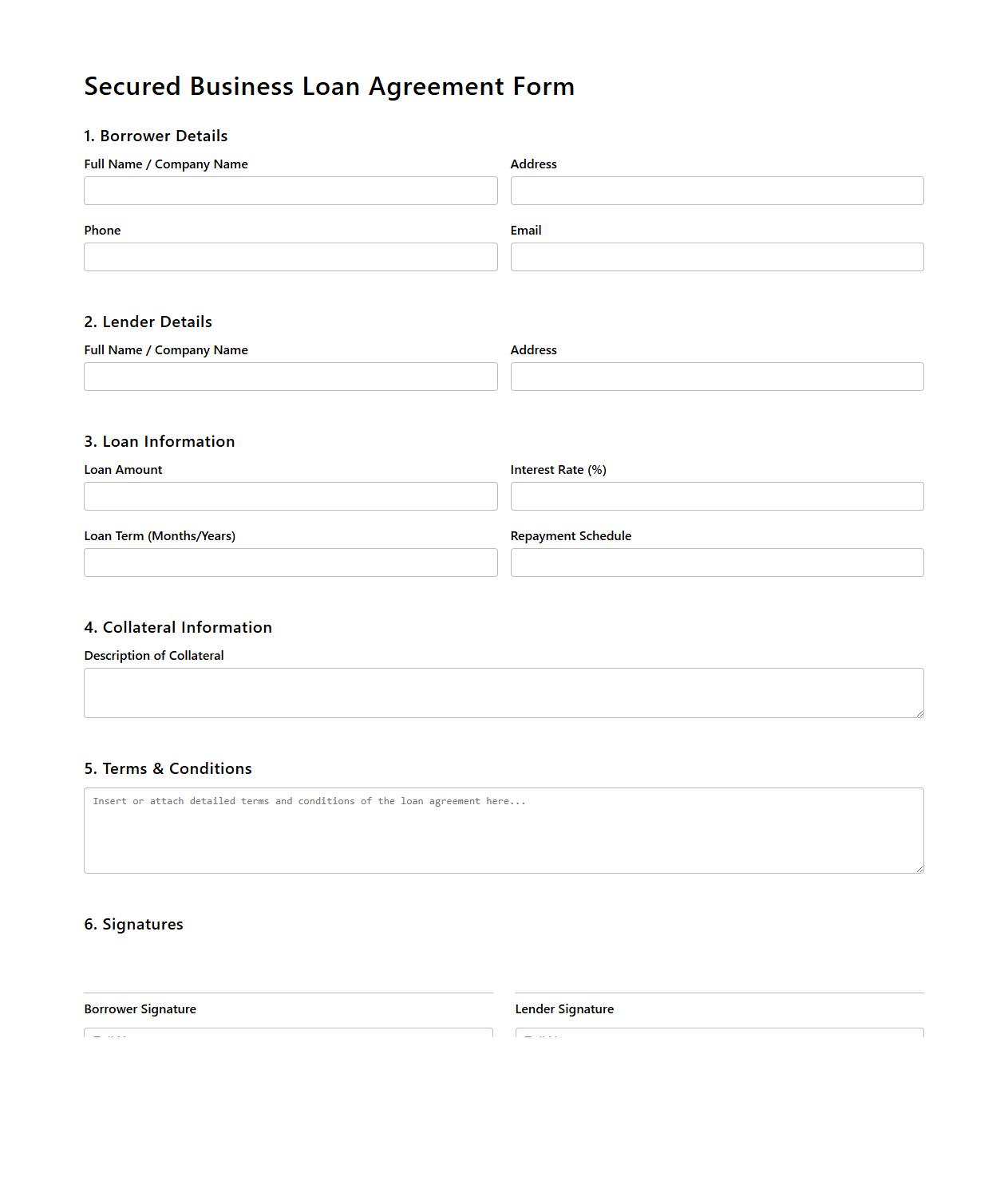

Secured Business Loan Agreement Form

A

Secured Business Loan Agreement Form is a legal document that outlines the terms and conditions under which a business borrows funds by pledging assets as collateral. This form specifies the loan amount, interest rate, repayment schedule, and the rights of the lender to seize the collateral if the borrower defaults. It ensures both parties have a clear understanding of their obligations, providing financial protection and formalizing the secured lending arrangement.

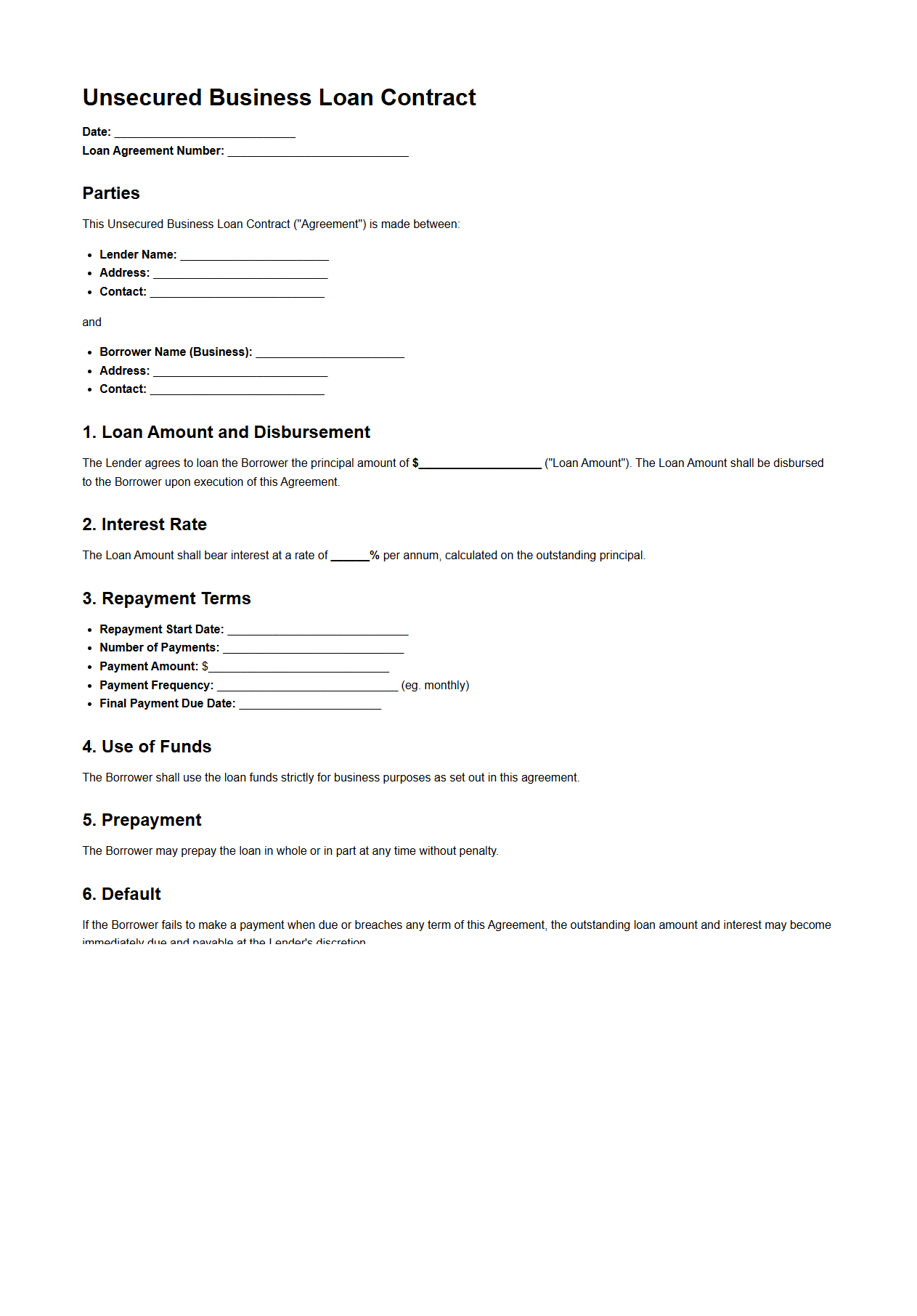

Unsecured Business Loan Contract Sample

An

Unsecured Business Loan Contract Sample document outlines the terms and conditions agreed upon by the lender and borrower without requiring collateral. It specifies the loan amount, interest rate, repayment schedule, and default consequences, ensuring clarity and legal protection for both parties. This sample serves as a reference for businesses seeking funds based solely on creditworthiness rather than assets.

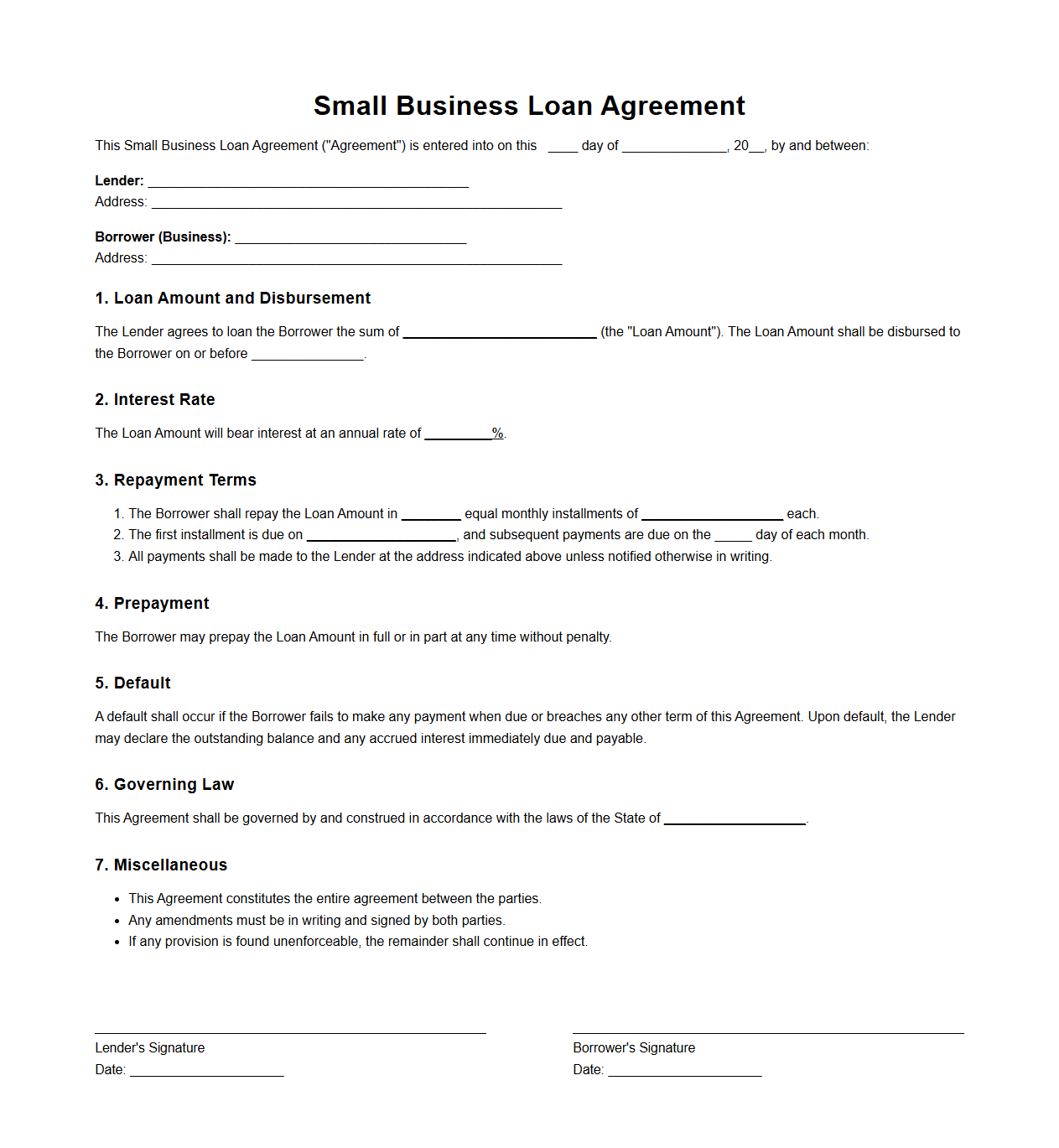

Small Business Loan Agreement Format

A

Small Business Loan Agreement Format document outlines the terms and conditions between a lender and a borrower for a business loan, ensuring clear communication of repayment schedules, interest rates, and loan amounts. This format serves as a legally binding contract that protects both parties by specifying obligations, penalties, and dispute resolution methods. It is essential for maintaining transparency and mitigating risks in financial transactions within the small business sector.

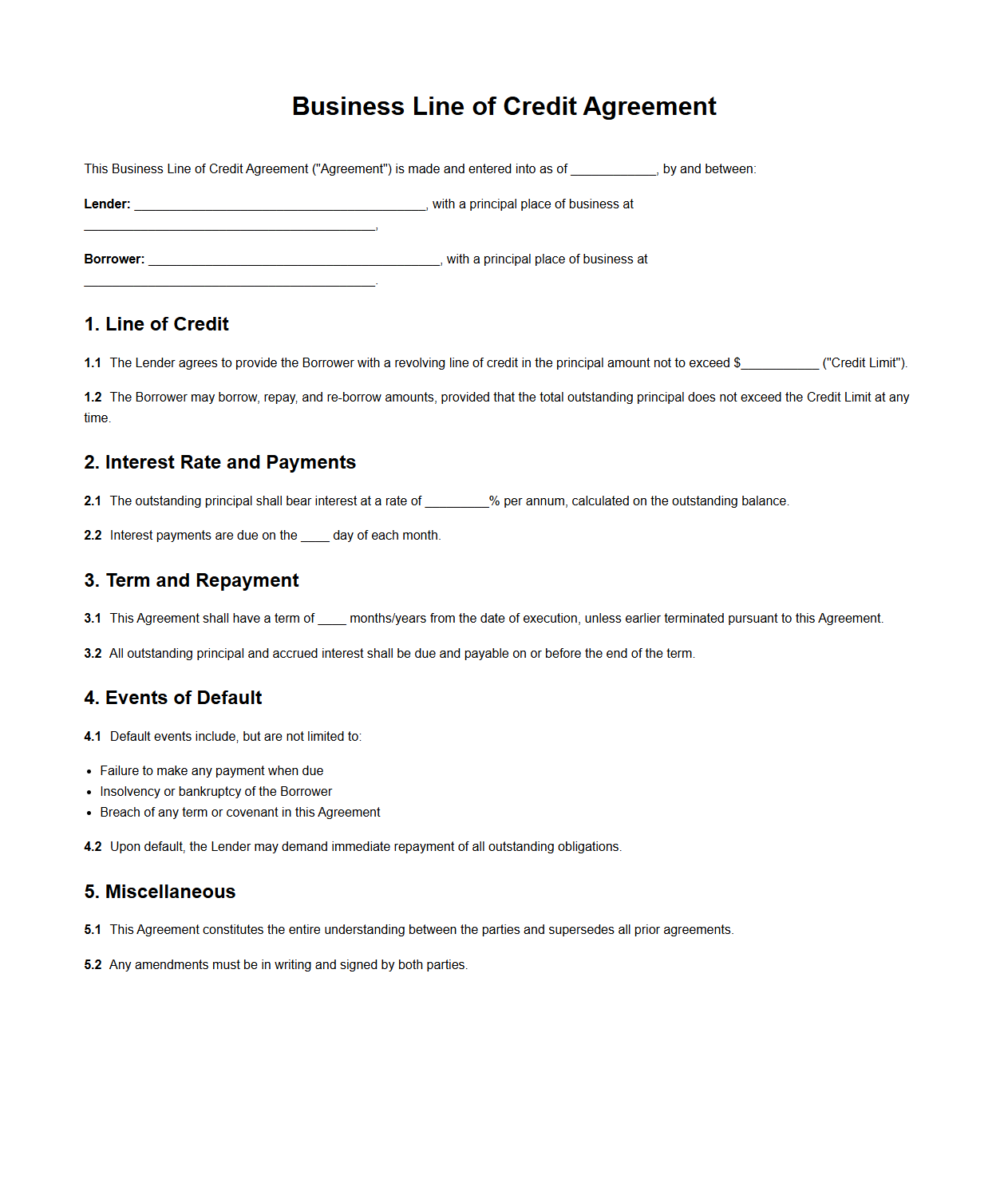

Business Line of Credit Agreement Template

A

Business Line of Credit Agreement Template document outlines the terms and conditions between a lender and a business borrower, specifying the credit limit, interest rates, repayment schedule, and usage guidelines. It serves as a legally binding contract that facilitates flexible access to funds for operational expenses or growth opportunities. This template ensures clarity and consistency in managing revolving credit arrangements.

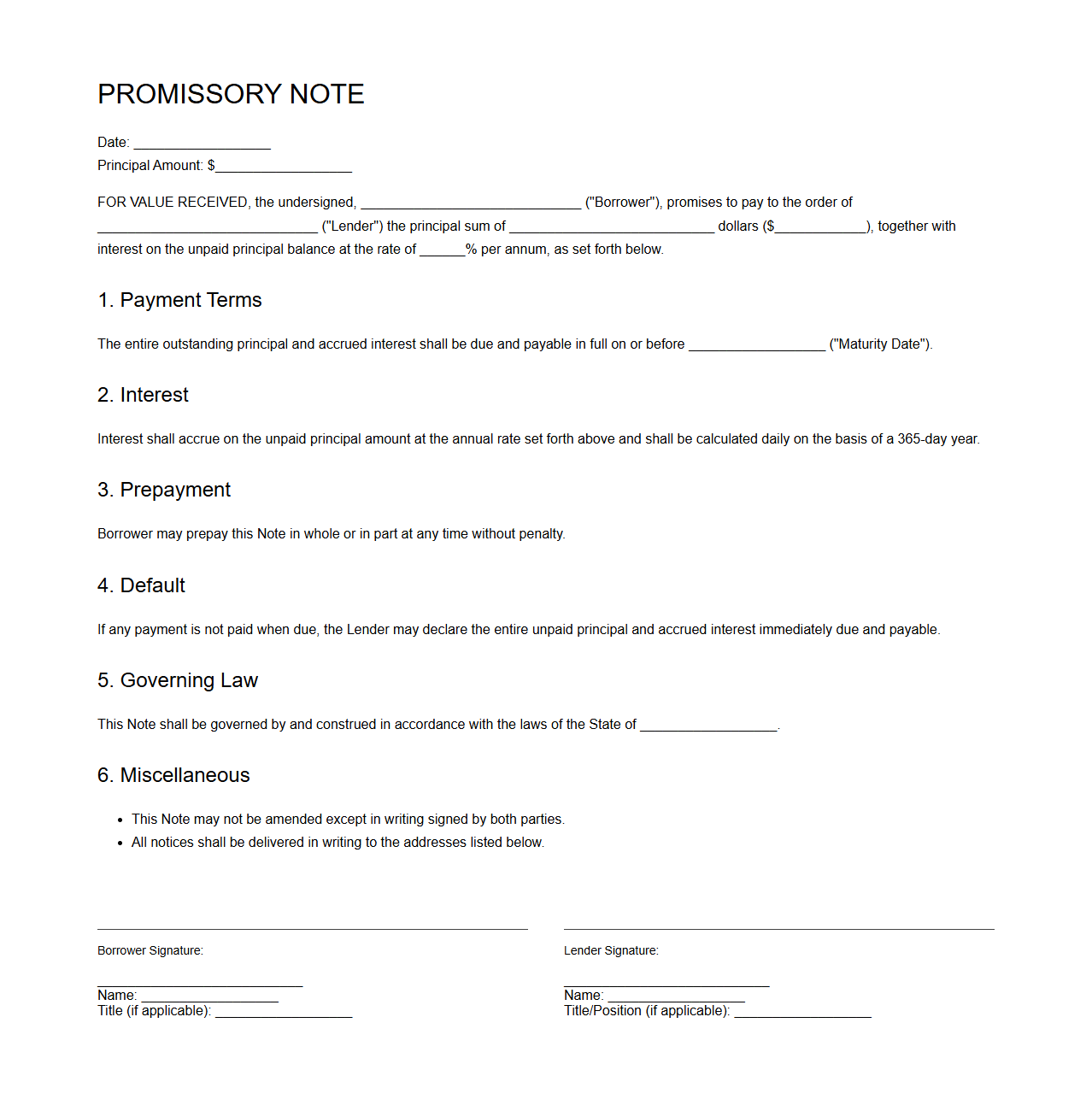

Promissory Note for Business Funding Sample

A

Promissory Note for Business Funding is a legally binding document that outlines the terms and conditions under which a borrower agrees to repay a loan to a lender, including the amount, interest rate, repayment schedule, and maturity date. This sample document serves as a template to ensure clarity, protect both parties' rights, and facilitate smooth financial transactions in business funding. Accurate details and signatures within the note help prevent disputes and provide a reliable record of the loan agreement.

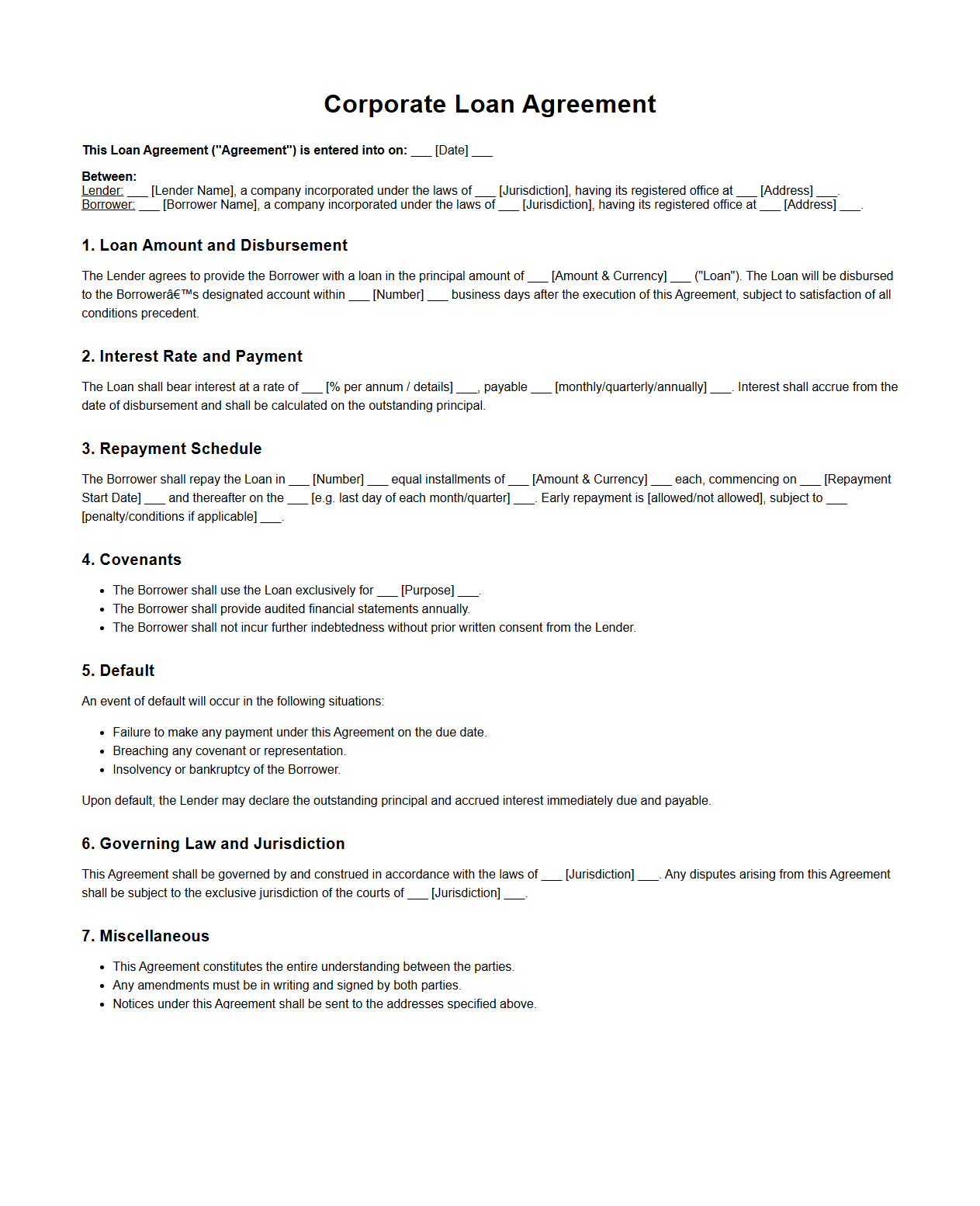

Corporate Loan Agreement Specimen

A

Corporate Loan Agreement Specimen document serves as a standardized template outlining the terms and conditions under which a corporation borrows funds from a lender. It details key elements such as the loan amount, interest rate, repayment schedule, covenants, and default provisions to ensure legal clarity and protect both parties' interests. This specimen aids businesses and financial institutions in drafting tailored loan contracts while maintaining compliance with regulatory frameworks.

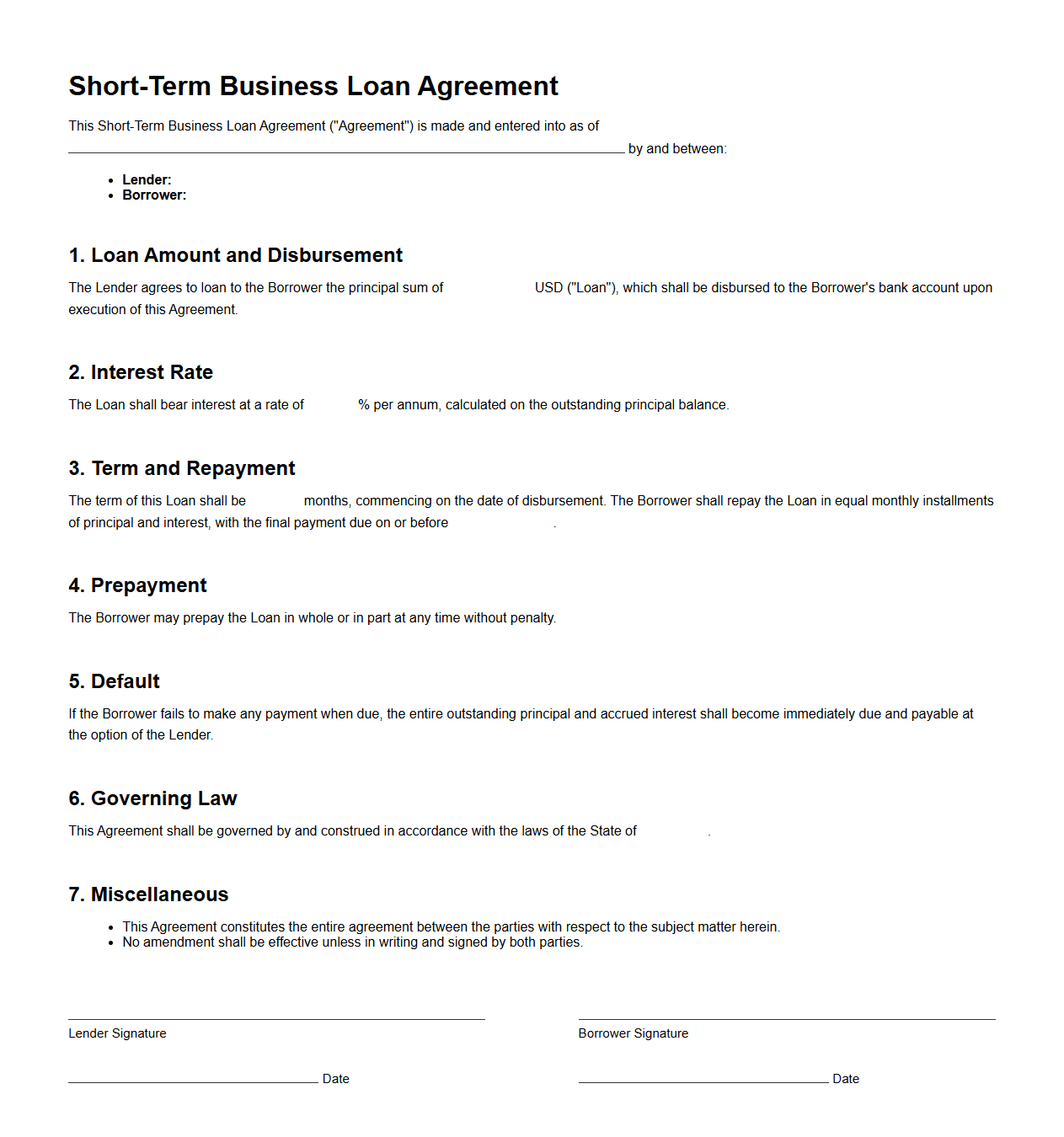

Short-Term Business Loan Agreement Example

A

Short-Term Business Loan Agreement Example document outlines the terms and conditions between a lender and borrower for a loan with a repayment period typically under one year. It includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral requirements to protect both parties. This example serves as a practical template to ensure clarity and legal compliance in short-term business financing arrangements.

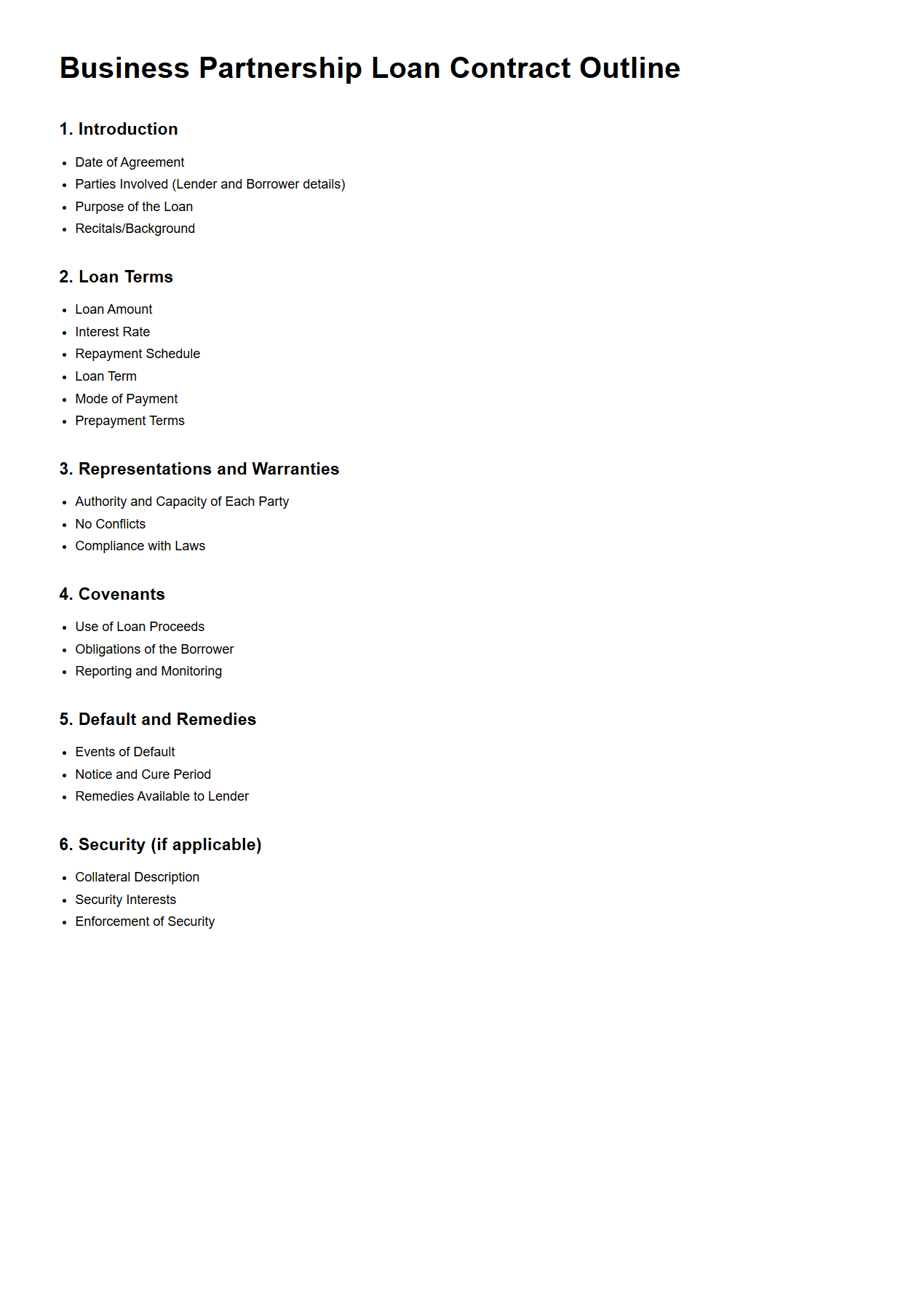

Business Partnership Loan Contract Outline

A

Business Partnership Loan Contract Outline is a foundational document that details the terms and conditions of a loan agreement between business partners. It specifies the loan amount, repayment schedule, interest rates, and obligations of each partner to ensure transparency and legal clarity. This outline helps prevent disputes by clearly defining financial responsibilities and protecting all parties involved in the partnership.

What are the key collateral requirements specified in the loan agreement document?

The loan agreement mandates collateral that must be pledged by the borrower to secure the loan. Typically, this includes assets such as real estate, equipment, or receivables valued proportionately to the loan amount. The document outlines the conditions for maintaining and potentially substituting the collateral during the loan term.

How are prepayment penalties detailed within the business financing terms?

Prepayment penalties are clearly defined to discourage early repayment of the loan. The terms specify the penalty rate, calculation method, and any applicable time frames during which penalties apply. These provisions protect the lender's expected interest income while allowing some prepayment flexibility.

What events constitute a default under this loan agreement?

The loan agreement identifies several default events, such as non-payment, breach of covenants, insolvency, or misrepresentation. Occurrence of any default event typically triggers remedial actions or acceleration of the loan repayment. The document specifies how defaults are communicated and resolved.

Are there specific covenants or financial reporting obligations imposed on the borrower?

Yes, the agreement often includes covenants requiring the borrower to maintain certain financial ratios and comply with operational restrictions. It mandates periodic financial reporting including audited statements and compliance certificates. These measures ensure lender oversight and ongoing creditworthiness.

How is the interest rate calculated and adjusted in the loan agreement document?

The interest rate calculation is based on a defined benchmark such as LIBOR, prime rate, or a fixed margin. The agreement details how rates are periodically adjusted to reflect market changes or borrower risk profile. Clear terms on rate changes help both parties manage financial expectations throughout the loan's life.