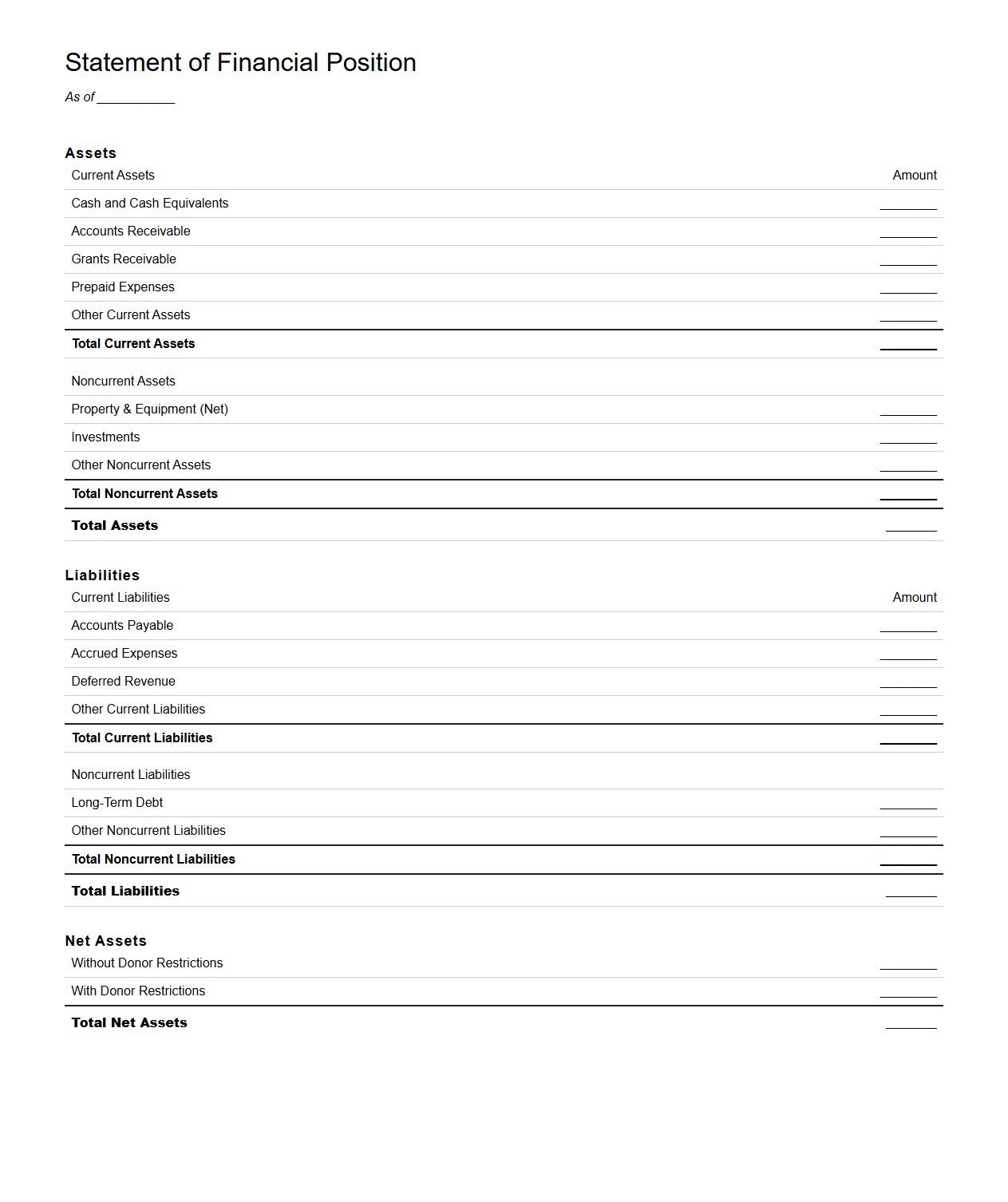

Nonprofit Statement of Financial Position Template

A

Nonprofit Statement of Financial Position Template document is a structured financial report format designed to display a nonprofit organization's assets, liabilities, and net assets at a specific point in time. It helps track and communicate the financial health and stability of the organization, allowing stakeholders to assess resource availability and obligations. This template ensures accurate, consistent reporting aligned with accounting standards for nonprofits, facilitating transparency and informed decision-making.

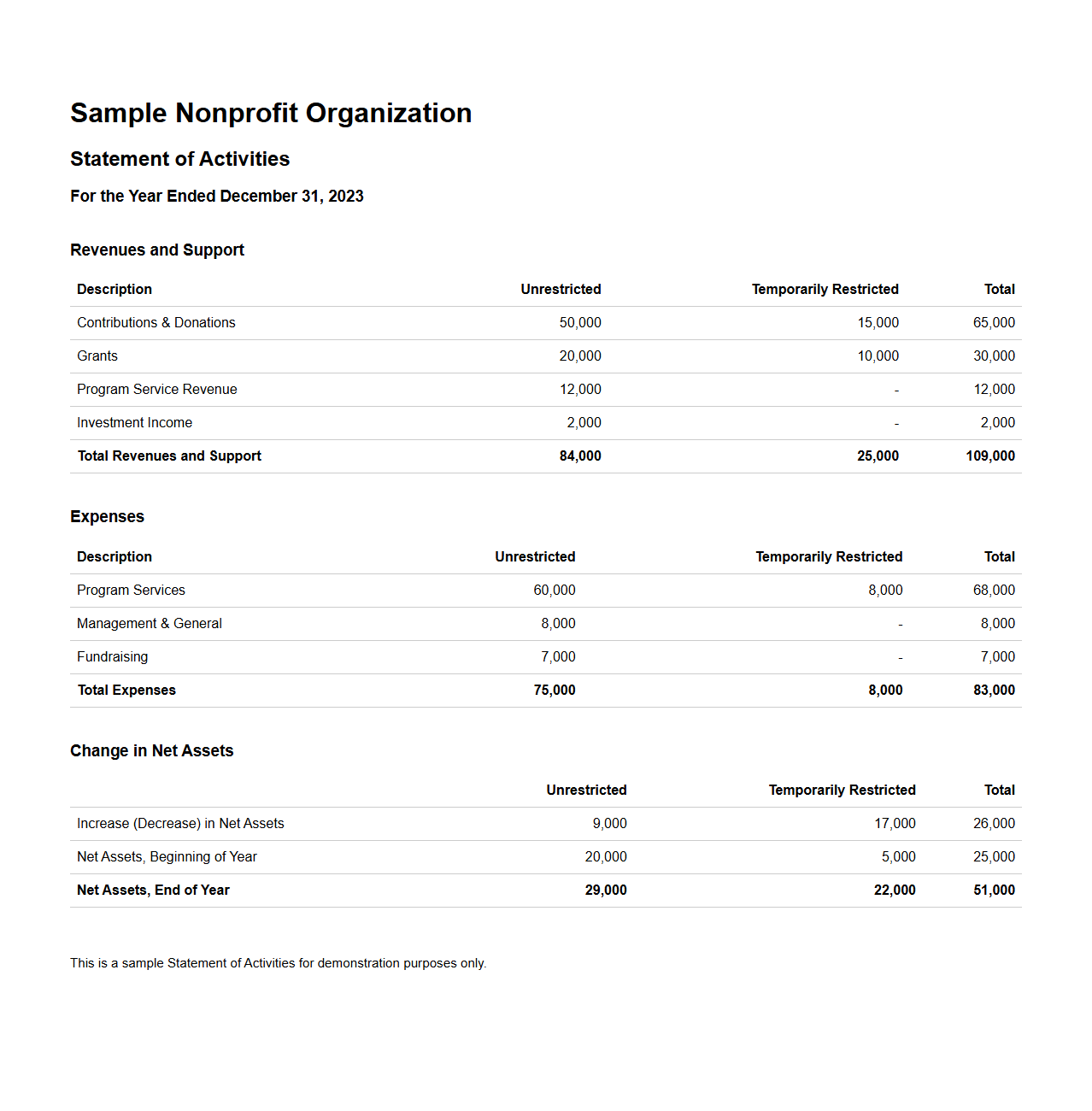

Nonprofit Statement of Activities Example

A

Nonprofit Statement of Activities Example document provides a detailed report of a nonprofit organization's financial performance over a specific period, highlighting revenues, expenses, and changes in net assets. This statement serves as a key tool for transparency, helping stakeholders assess how effectively the organization manages its resources to support its mission. It typically includes categories such as contributions, grants, program services, administrative costs, and fundraising expenses, showcasing the financial health and operational efficiency of the nonprofit.

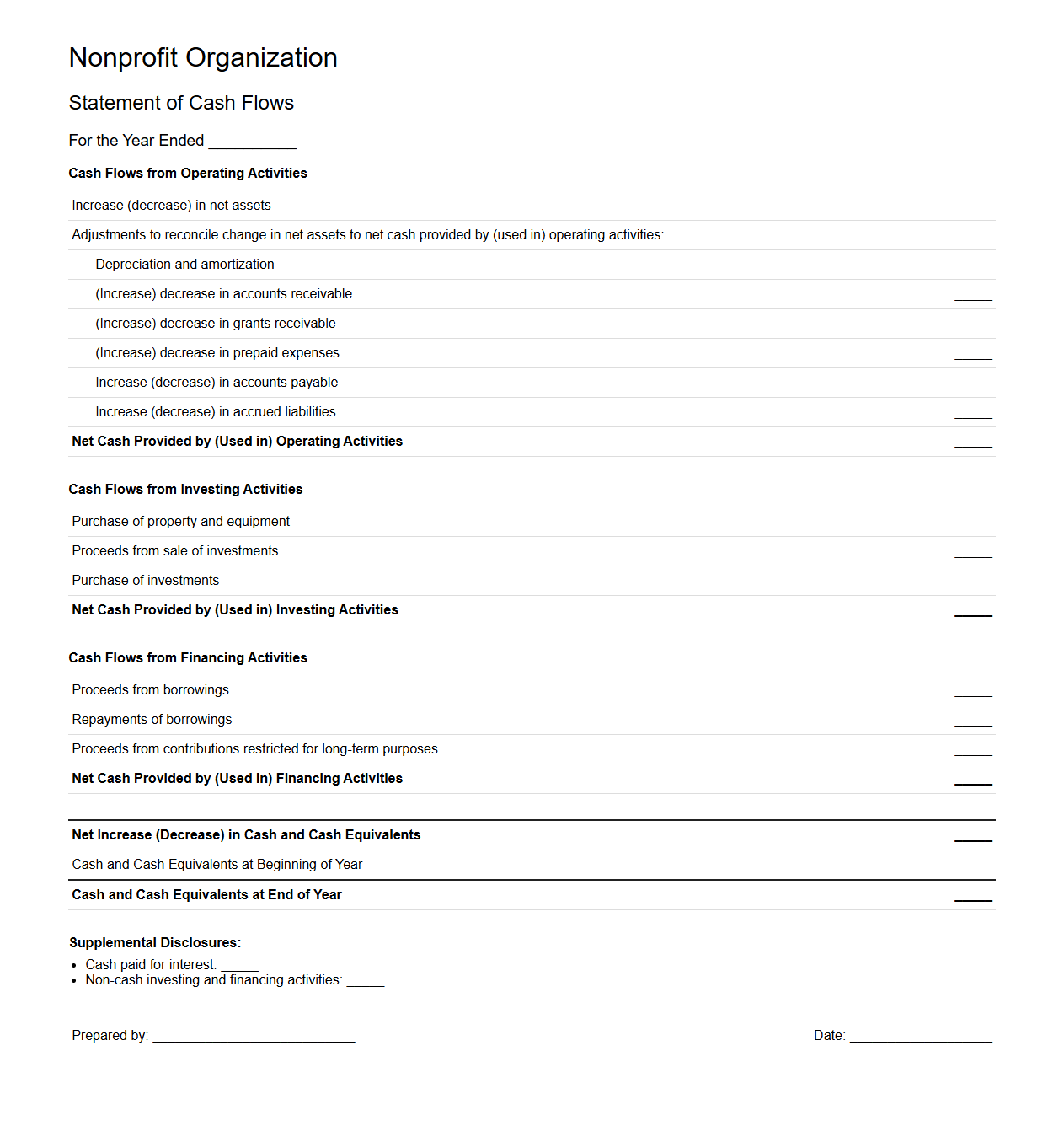

Nonprofit Statement of Cash Flows Format

The

Nonprofit Statement of Cash Flows Format document outlines the structured presentation of cash inflows and outflows categorized into operating, investing, and financing activities specific to nonprofit organizations. This format ensures transparent financial reporting by reflecting how cash is generated and utilized to support the organization's mission-driven initiatives without focusing on profit generation. It complies with accounting standards such as FASB ASC 958, facilitating accurate assessment of financial health and liquidity for stakeholders.

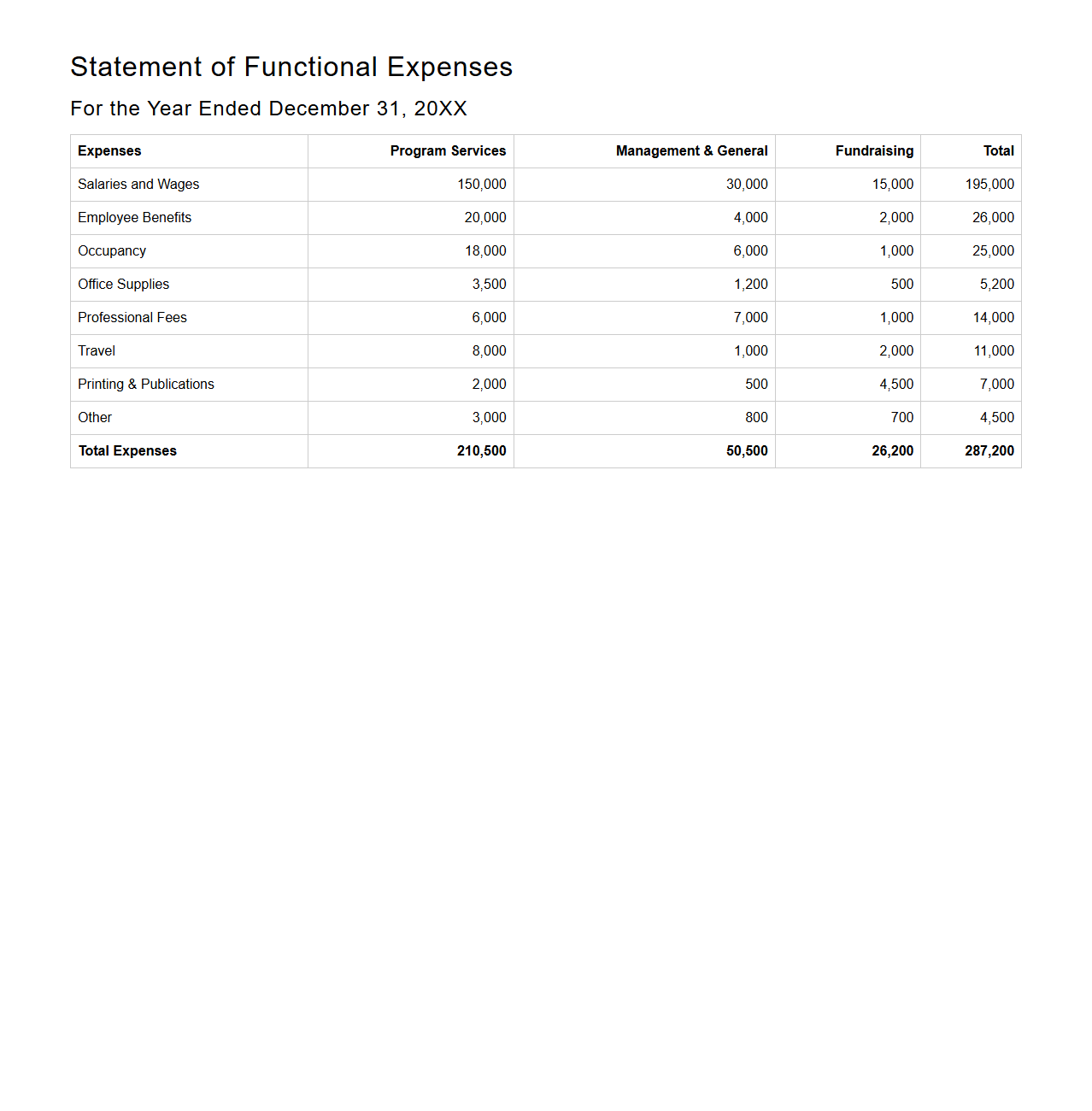

Nonprofit Statement of Functional Expenses Sample

A

Nonprofit Statement of Functional Expenses Sample document provides a detailed breakdown of an organization's expenses categorized by function, such as program services, management, and fundraising. This statement helps stakeholders understand how funds are allocated to support the mission versus administrative costs. It is essential for transparency, compliance with regulatory requirements, and effective financial management in nonprofit organizations.

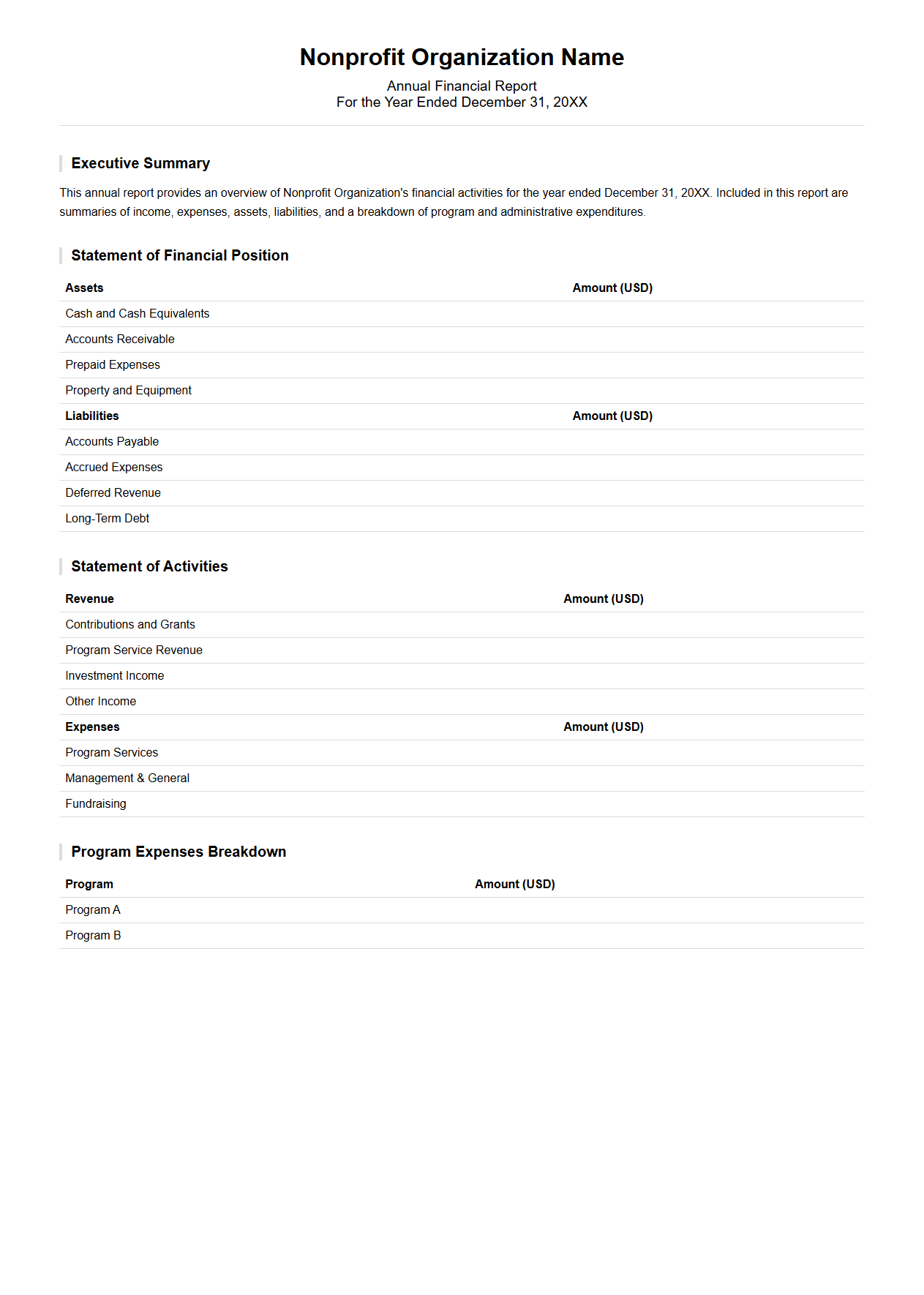

Nonprofit Annual Financial Report Layout

A

Nonprofit Annual Financial Report Layout document provides a structured framework for presenting an organization's financial performance and position over the fiscal year. It typically includes sections such as the statement of financial activities, balance sheet, cash flow statement, and notes to the accounts, ensuring transparency and compliance with accounting standards. This layout facilitates stakeholder understanding and supports regulatory filing requirements for nonprofits.

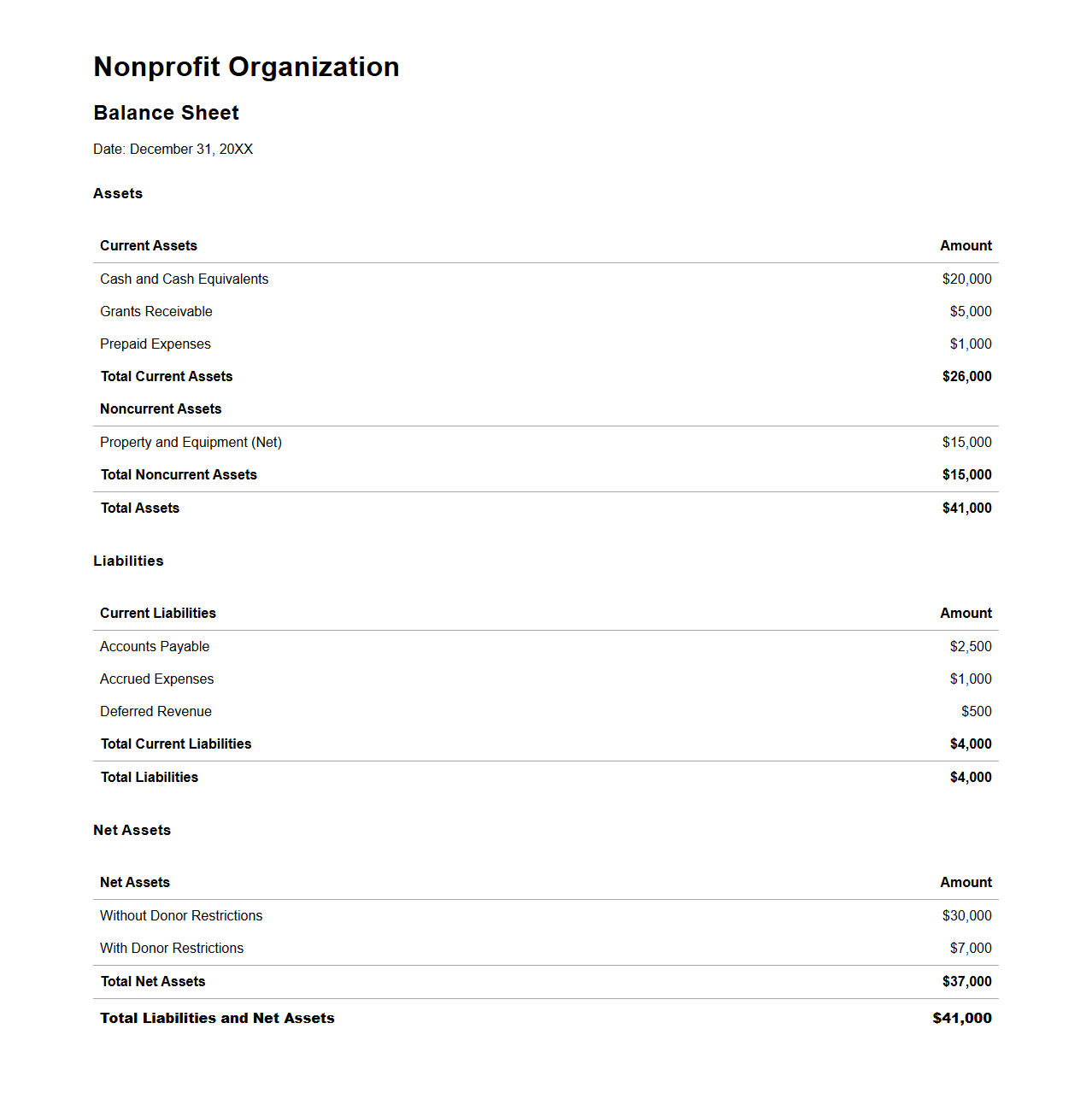

Nonprofit Balance Sheet Example

A

Nonprofit Balance Sheet Example document provides a detailed snapshot of a nonprofit organization's financial position at a specific point in time, listing assets, liabilities, and net assets. This document helps stakeholders assess the organization's financial health, sustainability, and resource allocation. Accurate representation on the balance sheet ensures transparency and supports compliance with accounting standards like GAAP or the FASB guidelines.

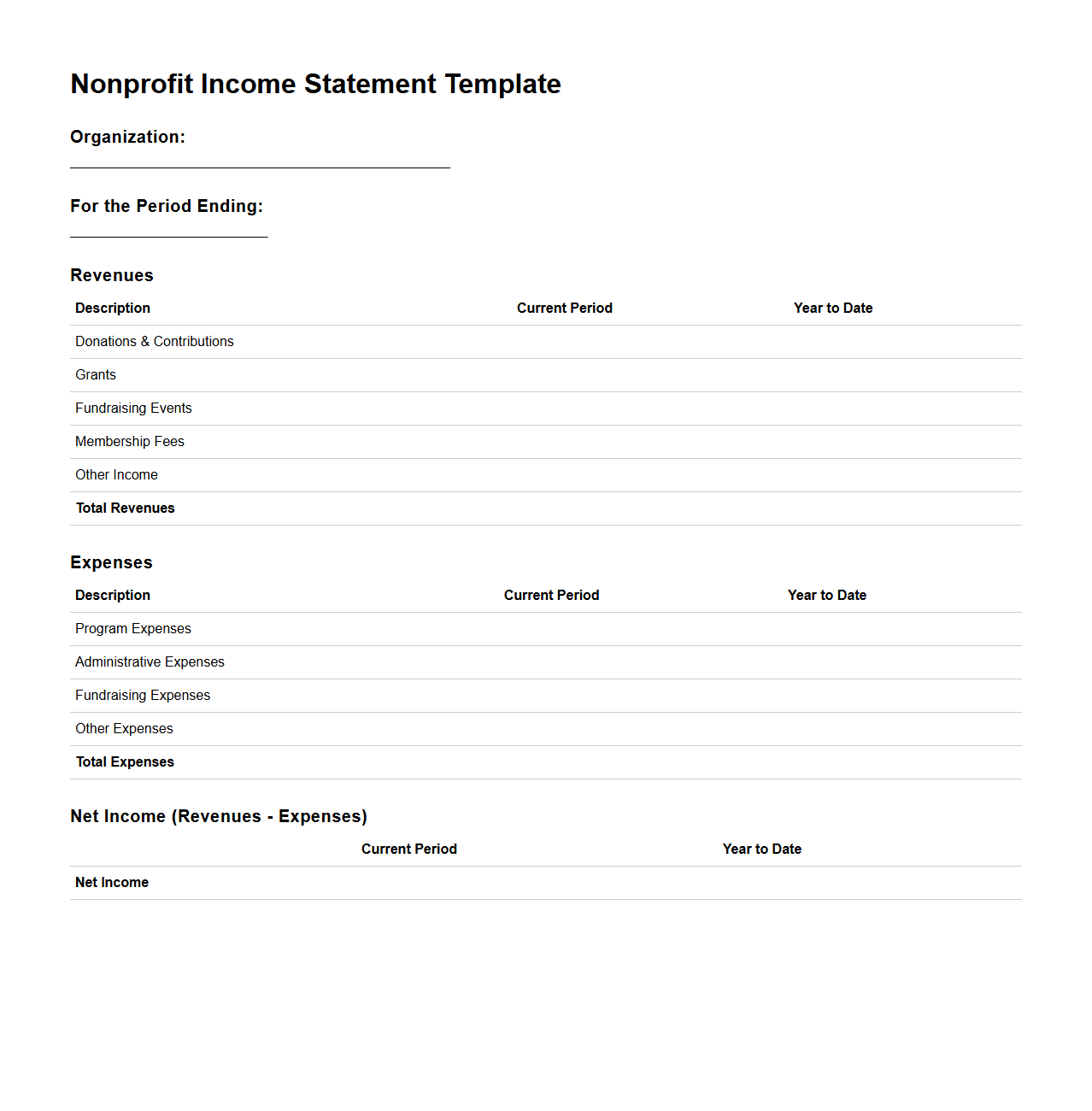

Nonprofit Income Statement Template

A

Nonprofit Income Statement Template is a financial document designed to summarize the revenues and expenses of a nonprofit organization over a specific period. It helps in tracking donation income, grants, program service revenues, and operational costs, providing a clear overview of the organization's financial performance. This template is essential for transparency, budgeting, and financial reporting to stakeholders and regulatory bodies.

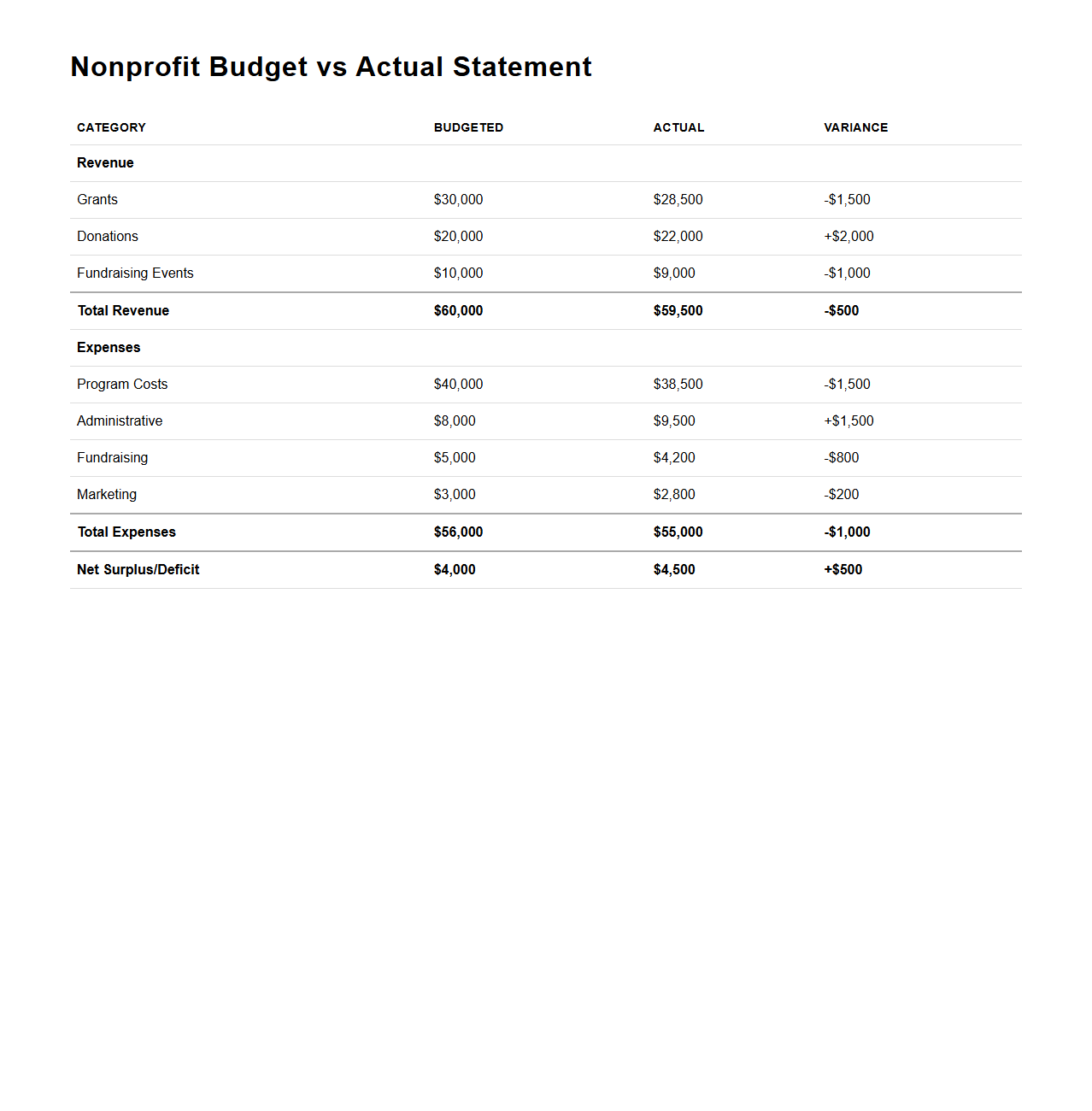

Nonprofit Budget vs Actual Statement Sample

A

Nonprofit Budget vs Actual Statement sample document compares projected financial plans with actual income and expenses over a specific period. This report helps organizations track performance, identify variances, and make informed decisions to ensure fiscal responsibility. It is essential for transparent financial management and effective resource allocation in nonprofit operations.

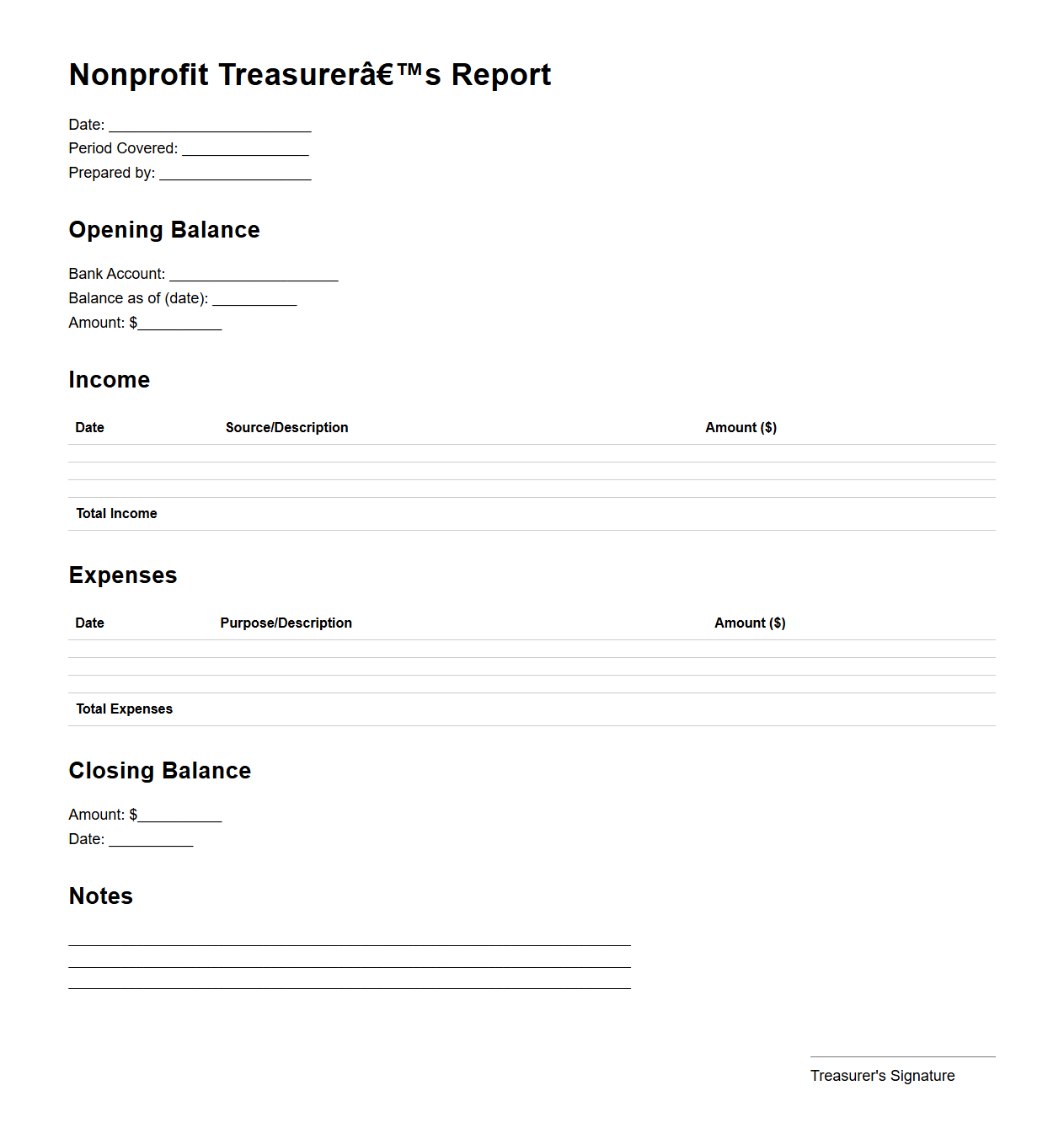

Nonprofit Treasurer’s Report Format

The

Nonprofit Treasurer's Report Format document provides a structured template for presenting the financial status of a nonprofit organization during board meetings. It typically includes income and expense summaries, budget comparisons, cash flow statements, and balance sheet details to ensure transparent and accurate financial reporting. This format supports compliance with regulatory requirements and fosters informed decision-making by stakeholders.

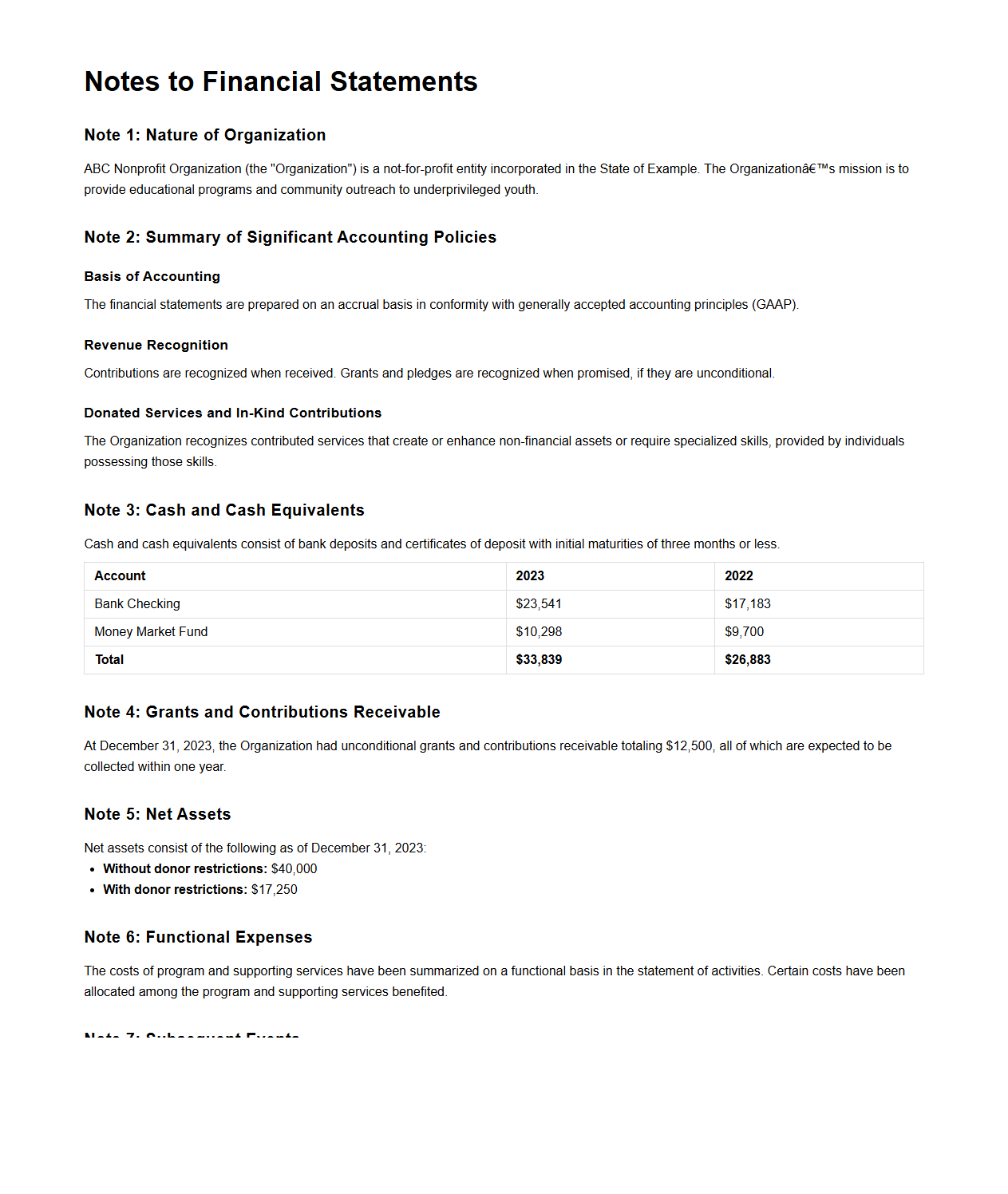

Nonprofit Financial Notes Disclosure Example

A

Nonprofit Financial Notes Disclosure Example document provides detailed supplementary information to the primary financial statements of a nonprofit organization, explaining accounting methods, significant policies, and key financial activities. These notes enhance transparency by clarifying the organization's revenue recognition, grant restrictions, and assets valuation, ensuring compliance with standards like FASB ASC 958. Properly prepared disclosures assist stakeholders in understanding the financial health, risks, and operational commitments of the nonprofit entity.

What restricted fund disclosures are required in a nonprofit financial statement letter?

Nonprofit financial statement letters must include disclosures of restricted funds to clarify the nature and purpose of the restrictions. These disclosures help readers understand how donors' conditions affect fund availability. It is essential to specify both temporary and permanent restrictions in the letter for full transparency.

How should in-kind donations be referenced in the document letter?

In-kind donations should be explicitly acknowledged in the financial statement letter to reflect their non-cash contribution value. The letter must describe the type and estimated value of such donations to provide a clear picture of the nonprofit's resources. Proper referencing ensures donor recognition and compliance with reporting standards.

Which board approvals must be noted for financial statement authenticity?

The letter should note the board of directors' approval of the financial statements to affirm their authenticity. Highlighting this approval confirms the board's oversight and ensures accountability. Including the date and method of approval strengthens the document's credibility.

Are grant compliance assurances addressed in the covering letter?

Grant compliance assurances are typically included in the covering letter to affirm adherence to grant terms and conditions. This provides funders with confidence that the nonprofit is managing funds appropriately. Clear statements about compliance help mitigate audit risks and demonstrate fiscal responsibility.

How are donor-designated gifts itemized in letter summaries?

Donor-designated gifts should be itemized separately in letter summaries to respect donor intentions. The letter must specify the gifts' purposes and amounts to maintain transparency. Detailed itemization supports trust and enhances reporting accuracy in nonprofit financial communications.