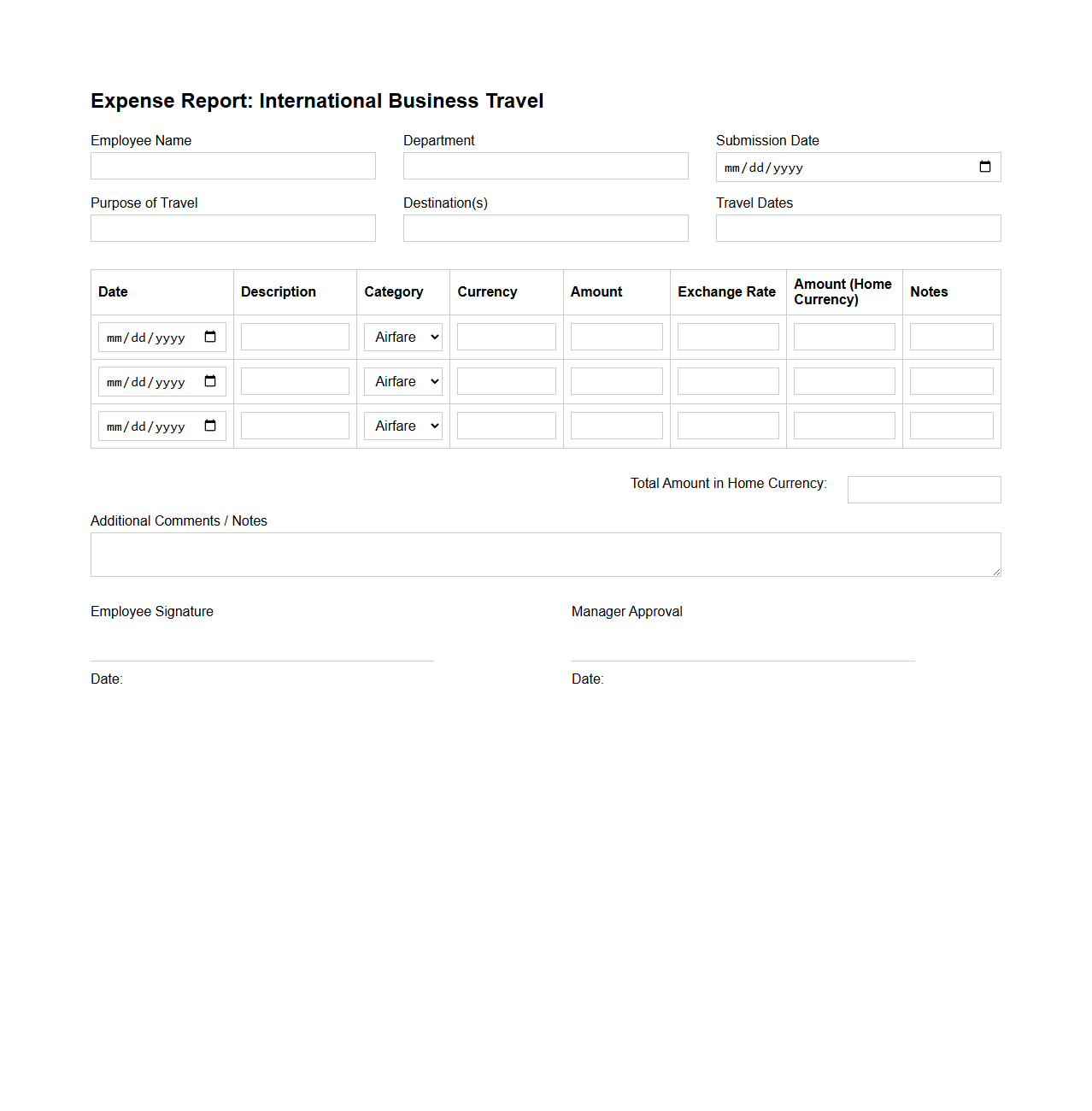

Expense Report Template for International Business Travel

An

Expense Report Template for International Business Travel is a standardized document designed to track and categorize costs incurred during overseas business trips, including airfare, accommodation, meals, and transportation. It helps organizations maintain accurate financial records, ensure compliance with company policies, and streamline the reimbursement process. This template typically includes fields for date, expense type, amount, currency conversion rates, and receipts attached, facilitating clarity and accountability in international expense management.

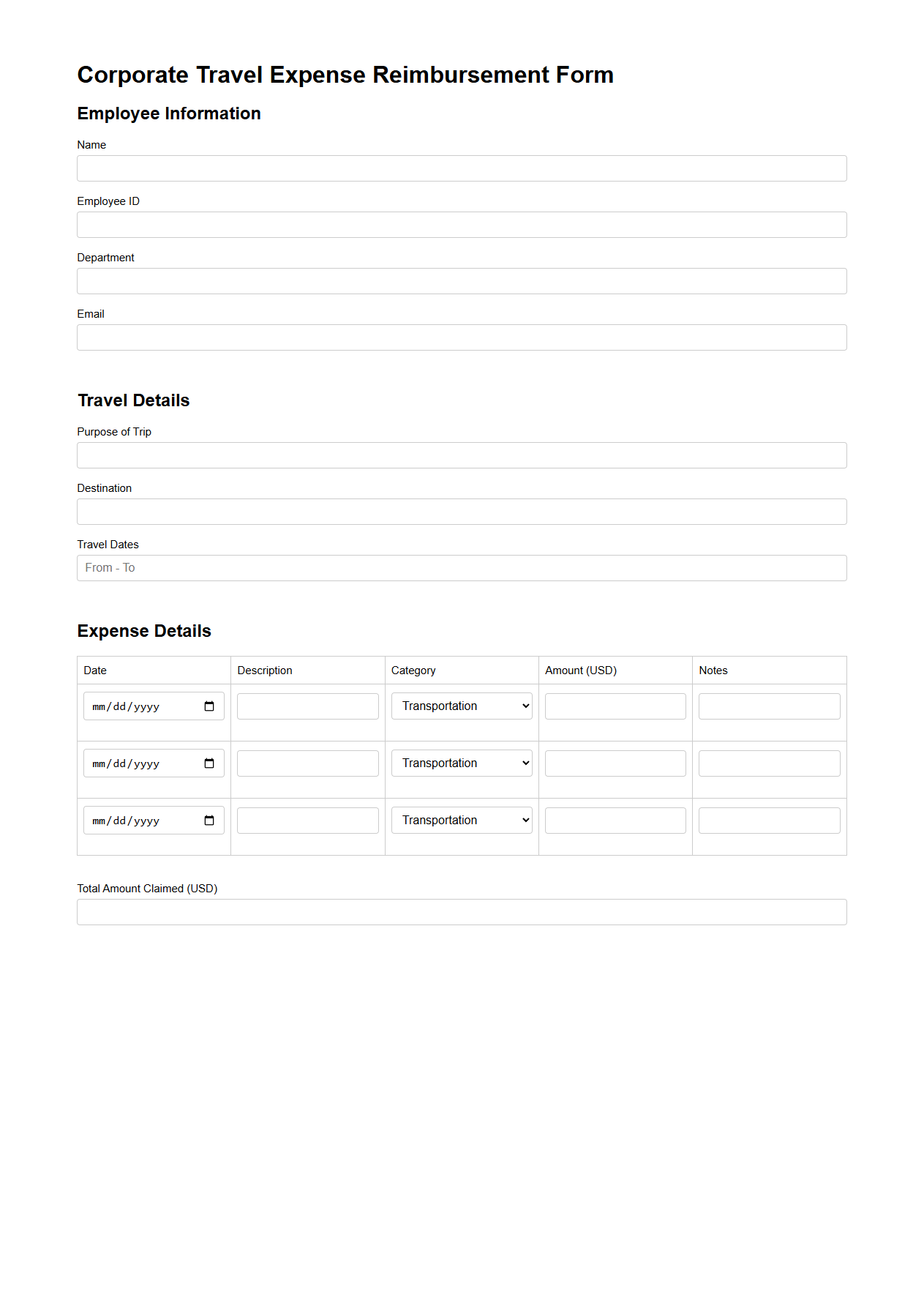

Corporate Travel Expense Reimbursement Form

A

Corporate Travel Expense Reimbursement Form is a standardized document used by companies to record and process employee expenses incurred during business travel. It typically includes sections for itemizing travel-related costs such as airfare, lodging, meals, transportation, and other incidentals, along with required receipts and approval signatures. This form ensures accurate tracking, compliance with company policies, and timely reimbursement of legitimate travel expenses.

Business Trip Expense Tracking Sheet

A

Business Trip Expense Tracking Sheet is a document designed to systematically record and manage all expenses incurred during a business trip, including transportation, accommodation, meals, and incidental costs. This sheet helps ensure accurate reimbursement, budget adherence, and financial reporting by providing a clear, organized format for employees and accounting teams. It typically includes fields for date, expense category, amount, payment method, and receipts, facilitating transparency and accountability in corporate travel expenditure management.

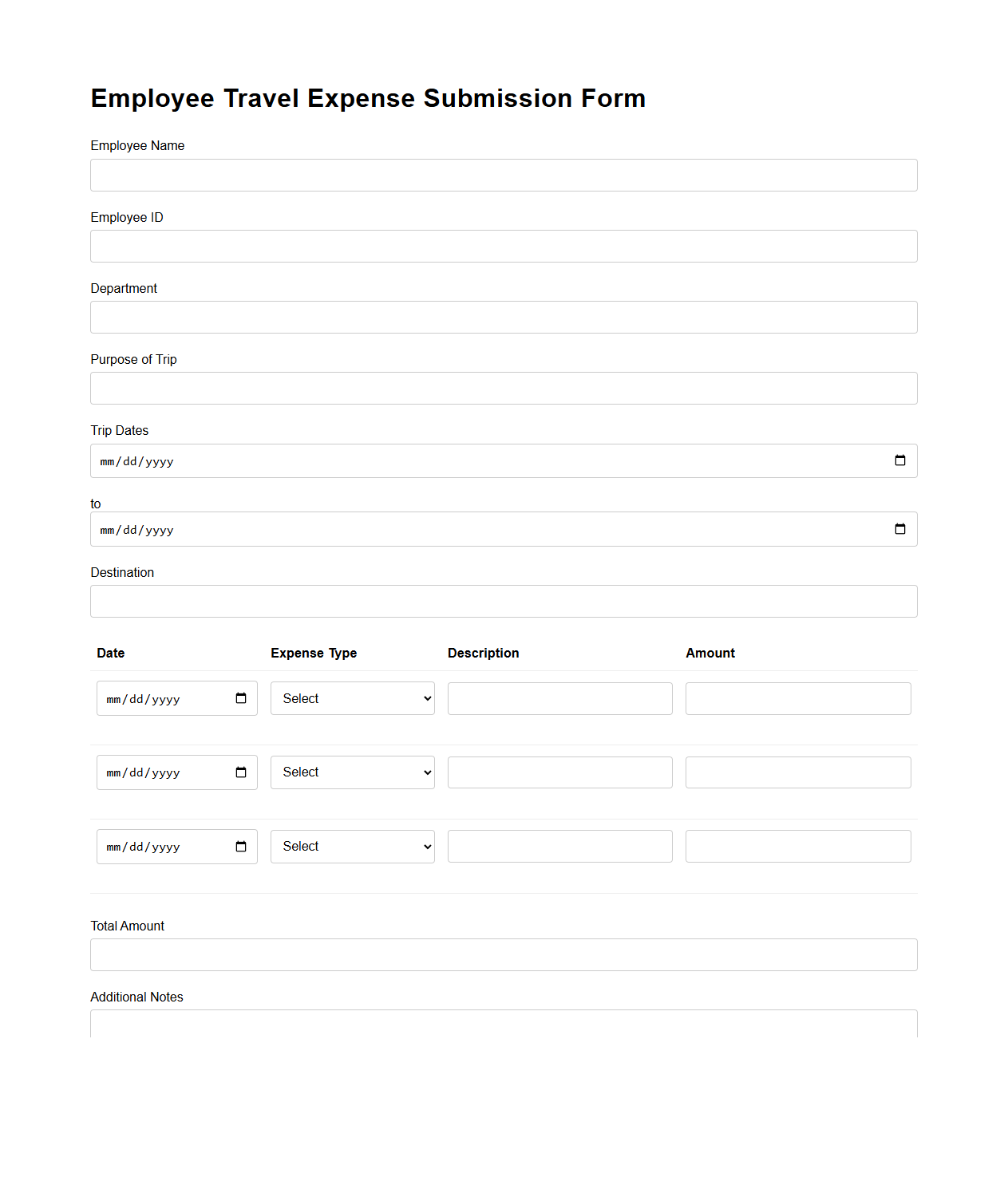

Employee Travel Expense Submission Form

The

Employee Travel Expense Submission Form is a crucial document used by organizations to systematically record and process expenses incurred by employees during business travel. It captures essential information such as travel dates, destinations, expense categories, and receipts, ensuring accurate reimbursement and financial accountability. This form aids in maintaining transparent expense tracking and supports compliance with company travel policies and tax regulations.

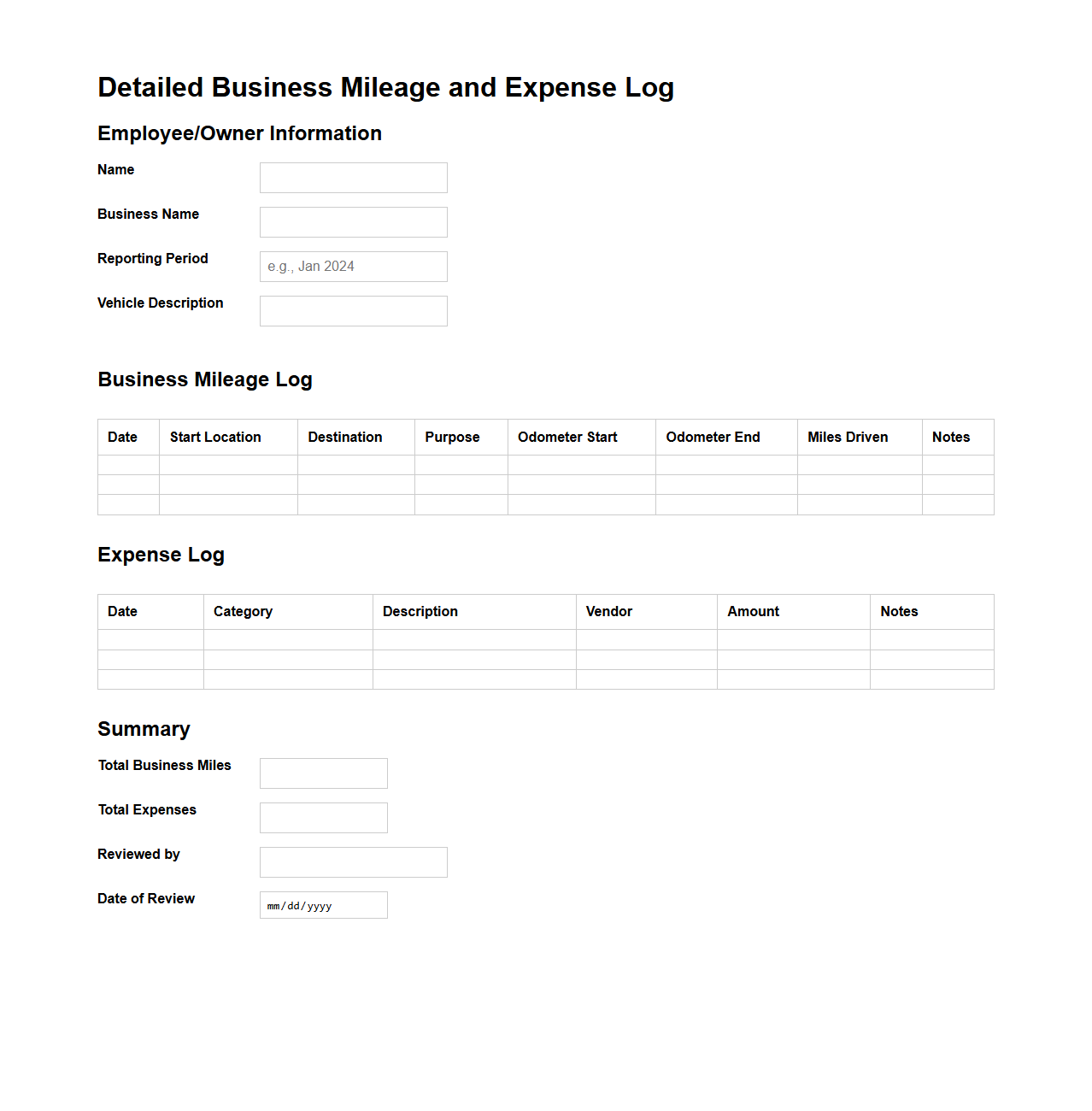

Detailed Business Mileage and Expense Log

A

Detailed Business Mileage and Expense Log document meticulously records all vehicle miles driven and related expenses for business purposes, ensuring accurate tracking and reimbursement. It includes essential information such as dates, trip destinations, purpose of each trip, starting and ending odometer readings, and costs incurred like fuel, tolls, and parking fees. Maintaining this log helps comply with tax regulations and supports precise financial reporting.

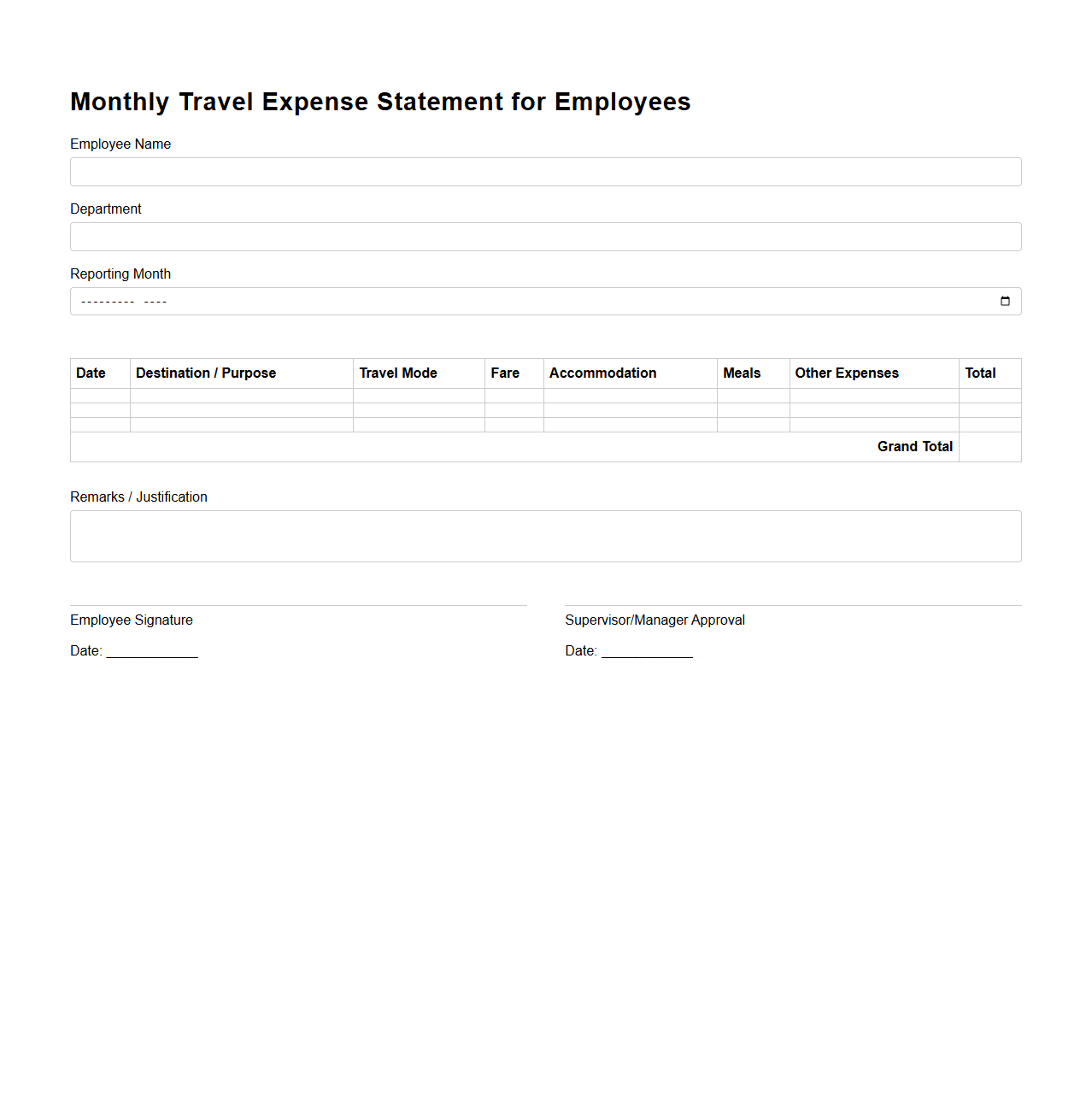

Monthly Travel Expense Statement for Employees

A

Monthly Travel Expense Statement for Employees is a financial document used to record and report all travel-related costs incurred by employees during official business trips within a specific month. It typically includes details such as transportation, accommodation, meals, and incidental expenses, ensuring accurate reimbursement and compliance with company travel policies. This statement streamlines expense tracking, facilitates budget management, and supports transparency in corporate travel expenditures.

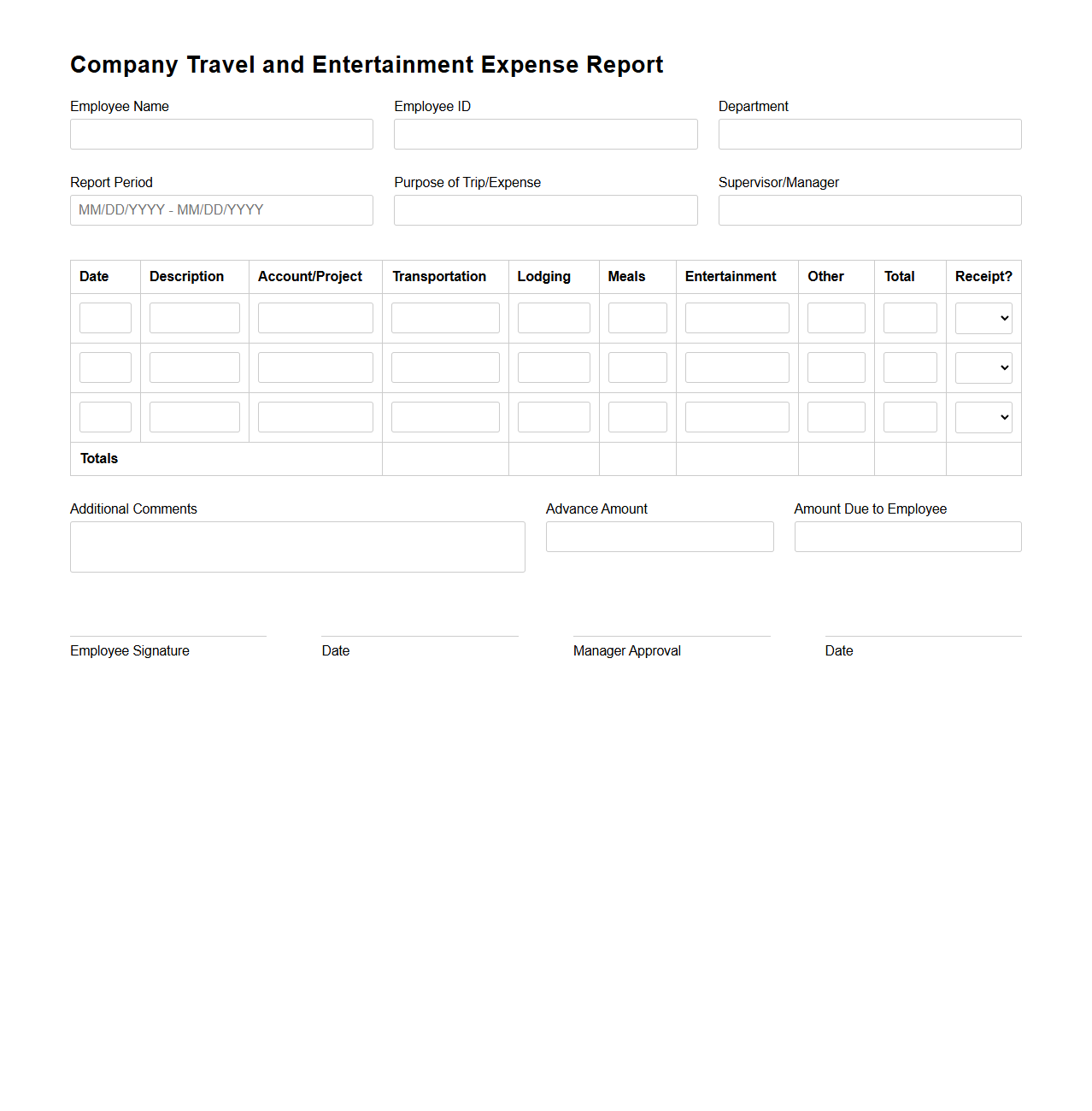

Company Travel and Entertainment Expense Report

A

Company Travel and Entertainment Expense Report document is a detailed record used by businesses to track and manage expenses incurred by employees during work-related travel and entertainment activities. This report typically includes categories such as transportation, lodging, meals, client entertainment, and incidental costs, ensuring accurate reimbursement and budget control. Maintaining this document enhances financial transparency, supports compliance with company policies, and facilitates efficient audit processes.

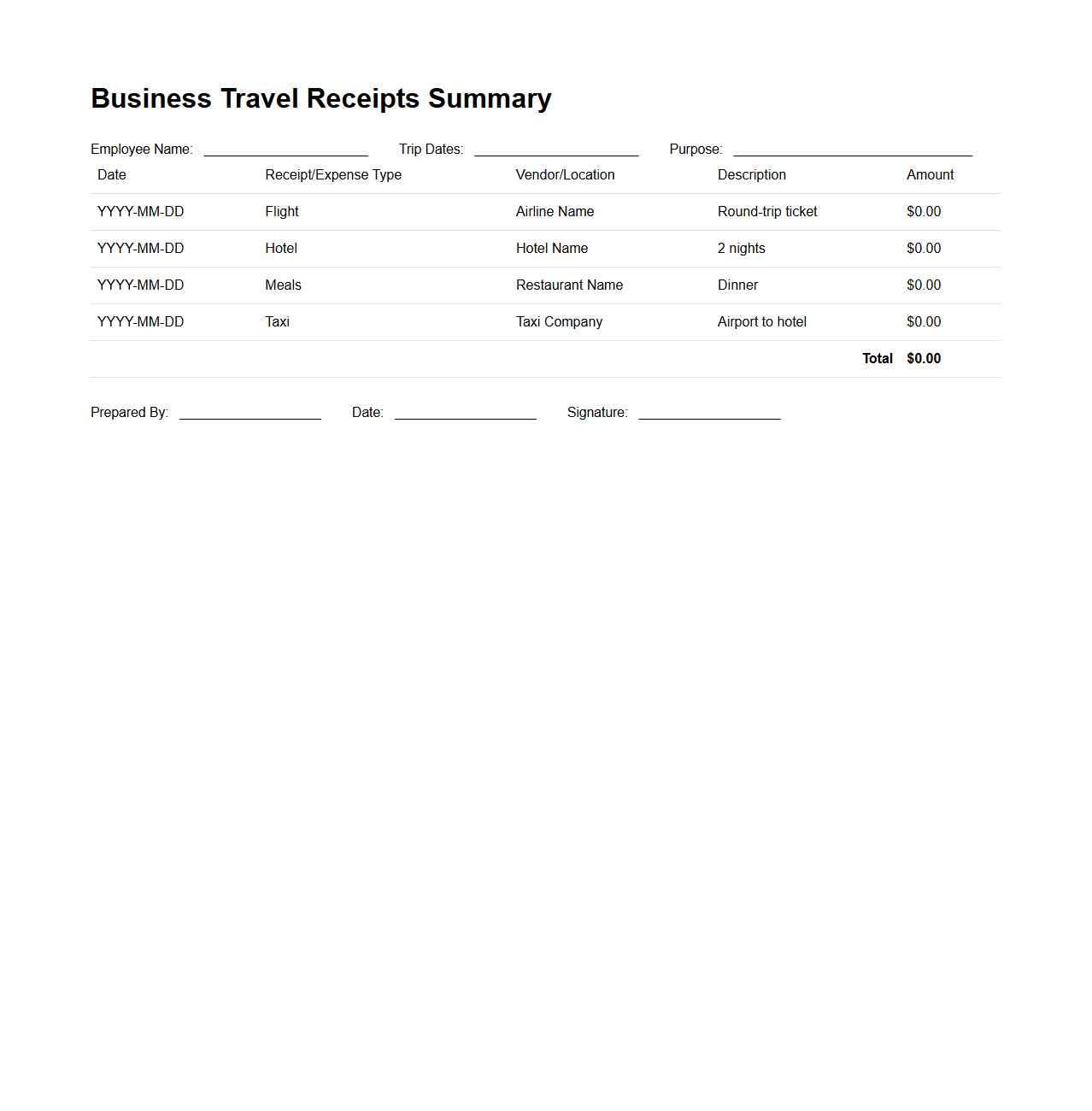

Sample Business Travel Receipts Summary

A

Sample Business Travel Receipts Summary document consolidates all expenses incurred during a business trip, including transportation, lodging, meals, and incidental costs. This summary helps streamline the reimbursement process by providing a clear, organized record of receipts for accounting and auditing purposes. It ensures compliance with company policies and aids in accurate financial reporting.

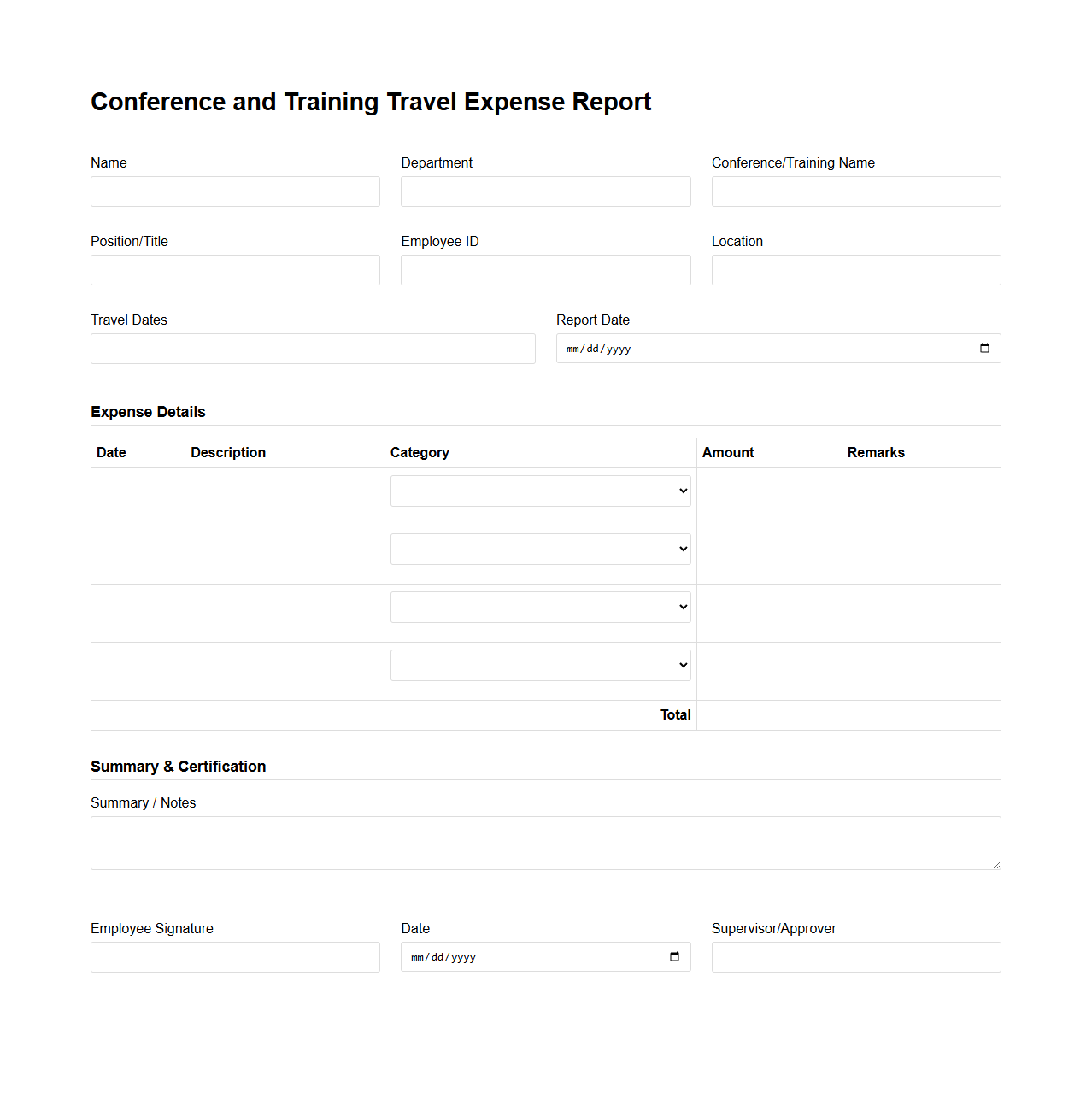

Conference and Training Travel Expense Report

A

Conference and Training Travel Expense Report document is used to systematically record and itemize all expenses incurred during business-related travel for conferences and training sessions. This report typically includes costs such as transportation, lodging, meals, and registration fees, ensuring accurate reimbursement and budget tracking. Maintaining detailed expense reports supports organizational financial accountability and compliance with company travel policies.

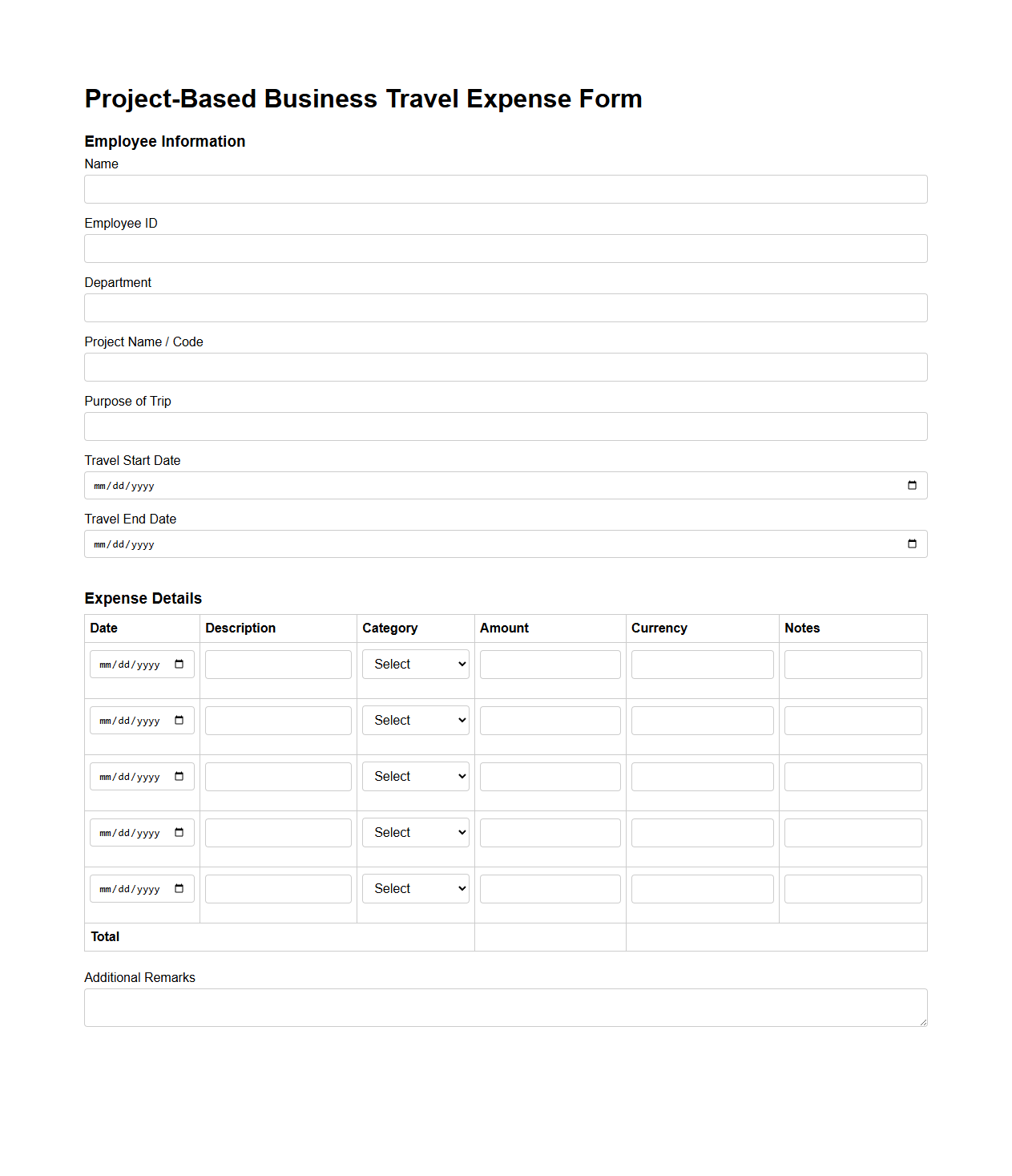

Project-Based Business Travel Expense Form

The

Project-Based Business Travel Expense Form is a document used to record and categorize expenses incurred during business trips specifically related to individual projects. It ensures accurate tracking of costs such as transportation, lodging, meals, and incidentals against project budgets for efficient financial management. This form supports accountability and helps streamline reimbursement processes within organizations.

Required Supporting Receipts for Each Expense in a Business Travel Report

Every business travel expense must be supported by official receipts that clearly indicate the date, amount, and vendor. Receipts for transportation, lodging, meals, and other incidental expenses are crucial for accurate reimbursement claims. Digital copies or physical receipts are both acceptable, providing verifiable proof of the expenditure.

Documentation of Per Diem Allowances in the Expense Report Letter

The per diem allowance should be explicitly stated in the expense report letter, including the daily rate and number of days covered. It is important to specify whether the per diem includes meals, lodging, or both for transparency. Providing this detailed information ensures compliance with company policies and simplifies the reimbursement process.

Details of Foreign Currency Conversions in Travel Expense Documentation

Foreign currency expenses need to be converted to the home currency using the exchange rate applicable on the transaction date or report submission date. Documentation must include the original foreign currency amount, the exchange rate used, and the converted amount. This transparency guarantees accurate financial reporting and prevents discrepancies in the expense reconciliation.

Specific Business Purposes Required for Each Listed Travel Cost

Each travel cost must be accompanied by a clear business purpose such as client meetings, conferences, or project site visits. Including detailed justifications helps to validate the expenses as work-related and aligns with company reimbursement policies. This documentation is critical for audit trails and financial accountability.

Approval Workflow Indicated in the Expense Report Document

The expense report document should outline a clear approval workflow including submission, managerial review, and finance department authorization. Each expense needs to be signed off by the relevant stakeholders to ensure compliance and budget control. This structured approval process helps to maintain organizational accountability and prevents unauthorized spending.