A Cash Flow Statement Document Sample for Startups provides a clear overview of how cash moves in and out of a new business, highlighting operational, investing, and financing activities. This document helps startups manage liquidity, plan for future expenses, and attract potential investors by demonstrating financial health. Accessing a well-structured sample ensures accurate tracking and reporting of cash flow to support effective financial decision-making.

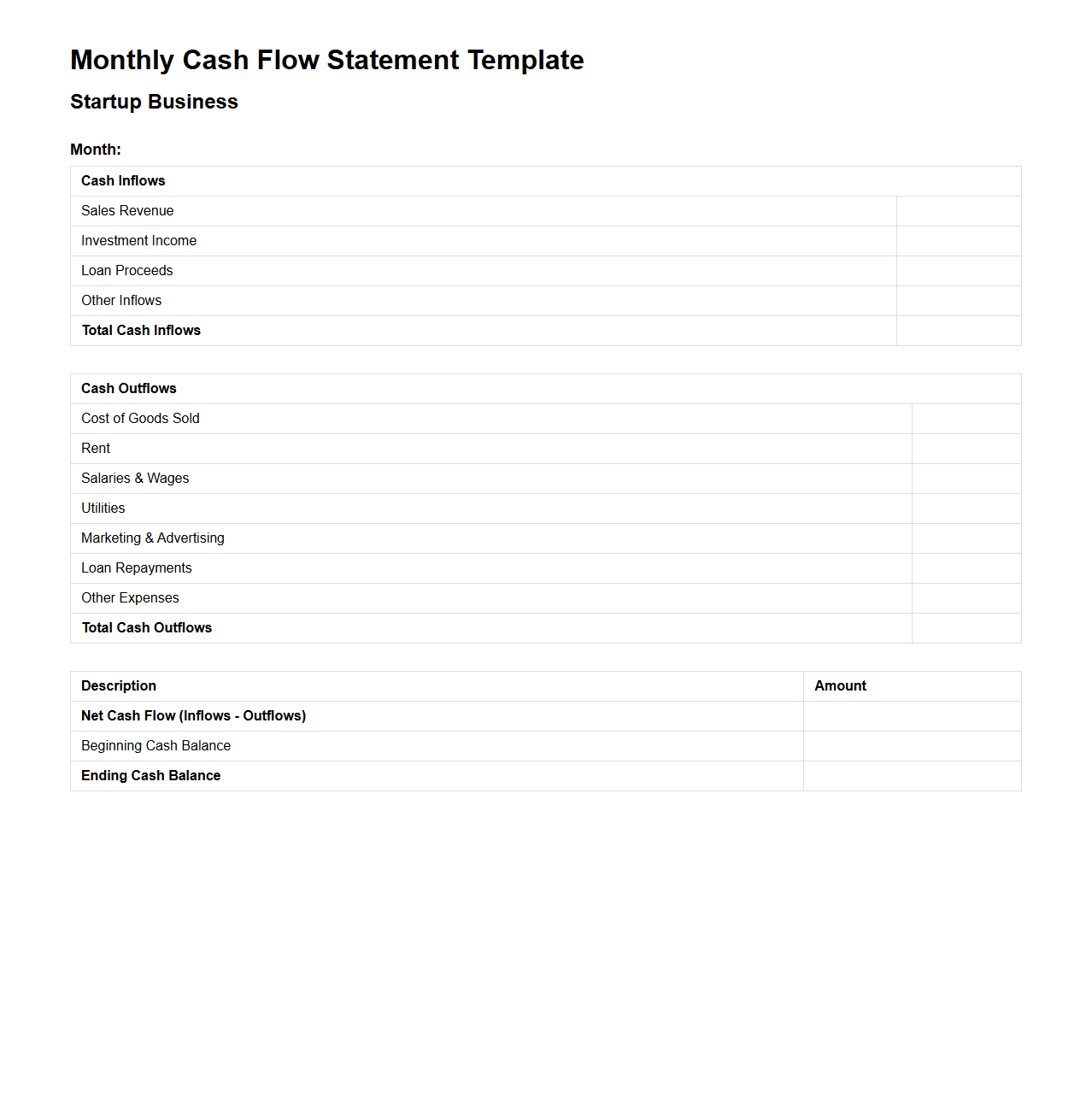

Monthly Cash Flow Statement Template for Startup Businesses

The

Monthly Cash Flow Statement Template for Startup Businesses is a financial tool designed to track and manage the inflow and outflow of cash within a startup on a monthly basis. This document helps entrepreneurs monitor liquidity, plan expenses, and forecast future cash positions to ensure business sustainability. It typically includes sections for operating activities, investing activities, and financing activities, providing a comprehensive overview of cash movements.

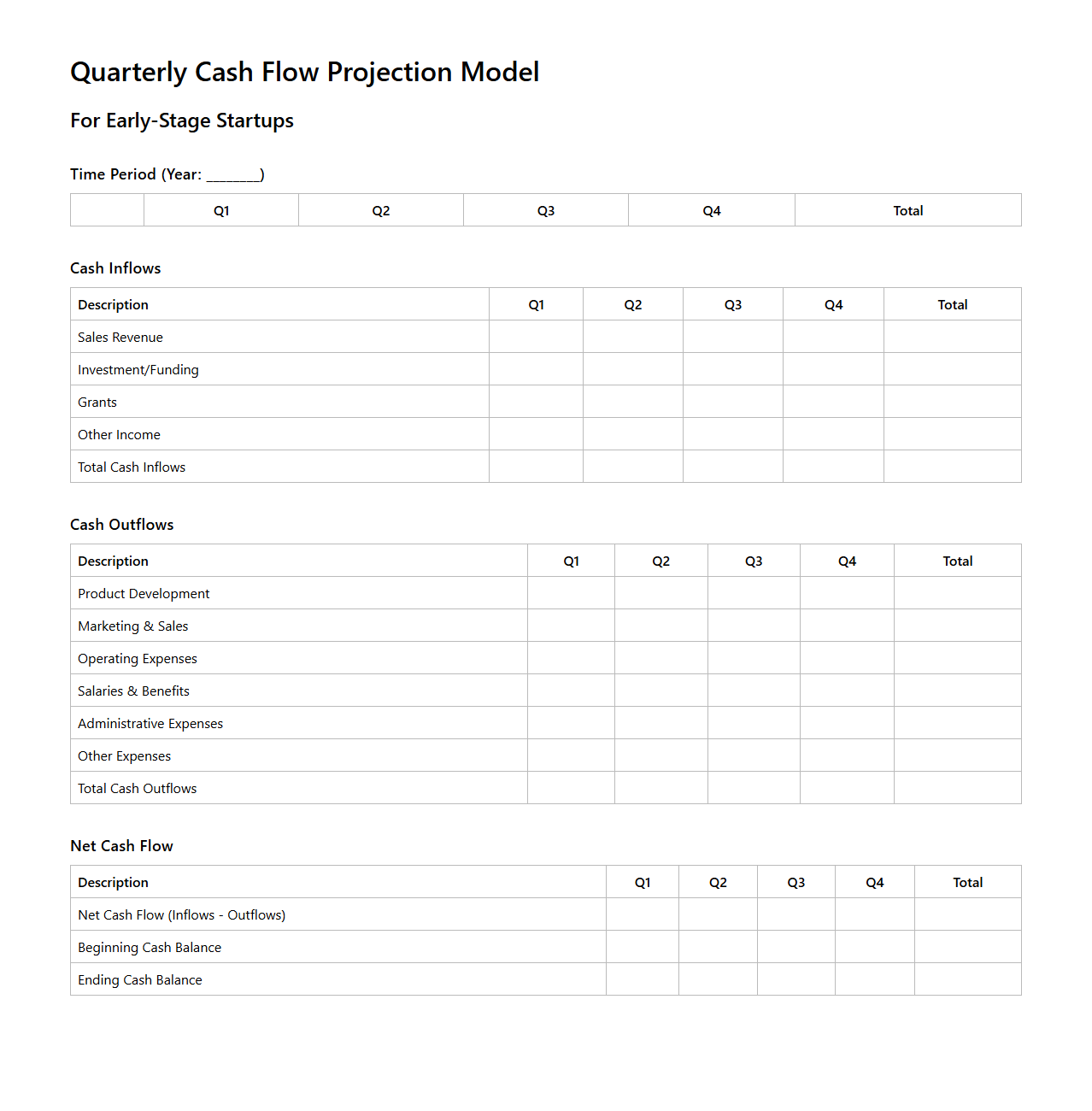

Quarterly Cash Flow Projection Model for Early-Stage Startups

The

Quarterly Cash Flow Projection Model for Early-Stage Startups is a financial tool designed to forecast inflows and outflows of cash over three-month periods, helping startups manage liquidity and plan for growth. It incorporates assumed revenue streams, operating expenses, capital expenditures, and financing activities to provide a clear view of cash availability and funding needs. This model supports decision-making by enabling founders and investors to anticipate cash shortages or surpluses and adjust strategies accordingly.

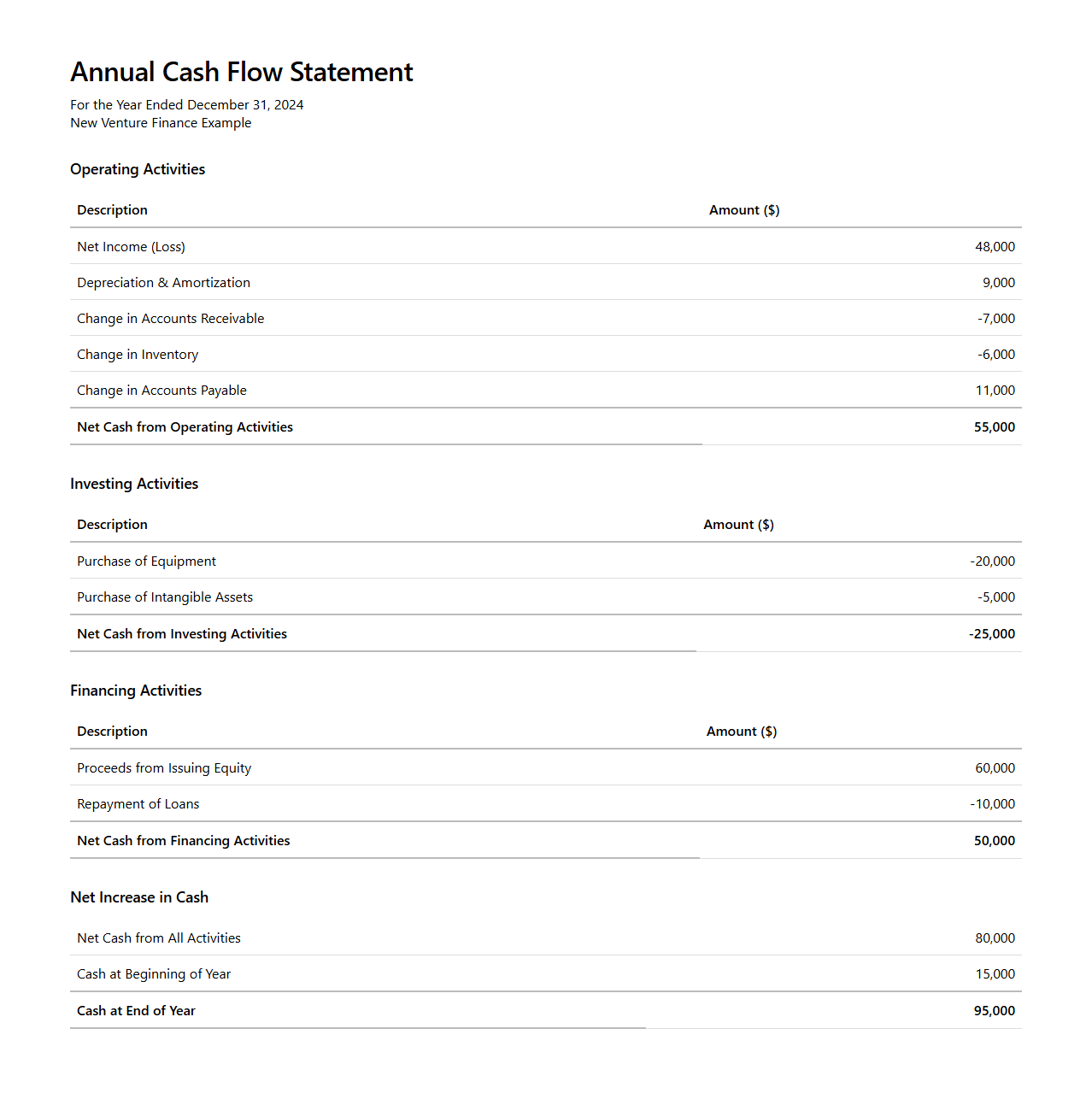

Annual Cash Flow Statement Example for New Venture Finance

An

Annual Cash Flow Statement Example for New Venture Finance illustrates the inflows and outflows of cash over a fiscal year, highlighting the startup's liquidity and financial health. This document typically details operational cash flows from sales and expenses, investing activities like asset purchases, and financing activities such as equity injections or loans. Entrepreneurs and investors use this example to assess the venture's ability to generate cash, manage expenditures, and sustain growth.

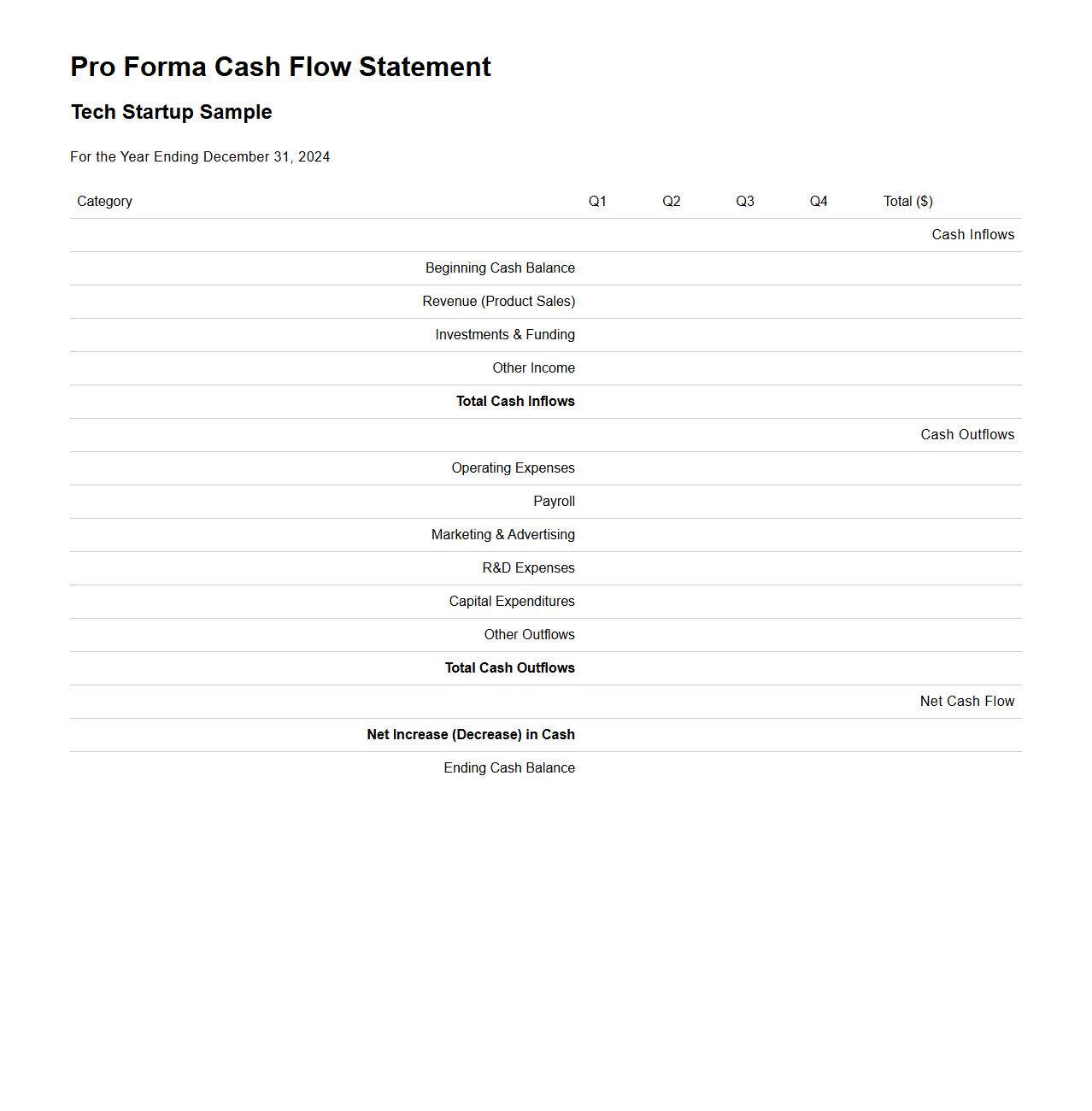

Pro Forma Cash Flow Statement for Tech Startups

A

Pro Forma Cash Flow Statement for tech startups is a financial document projecting future cash inflows and outflows based on anticipated business activities. It helps startups estimate liquidity, plan expenses, and manage funding needs during growth phases. This statement is essential for investors and founders to assess financial sustainability and operational efficiency.

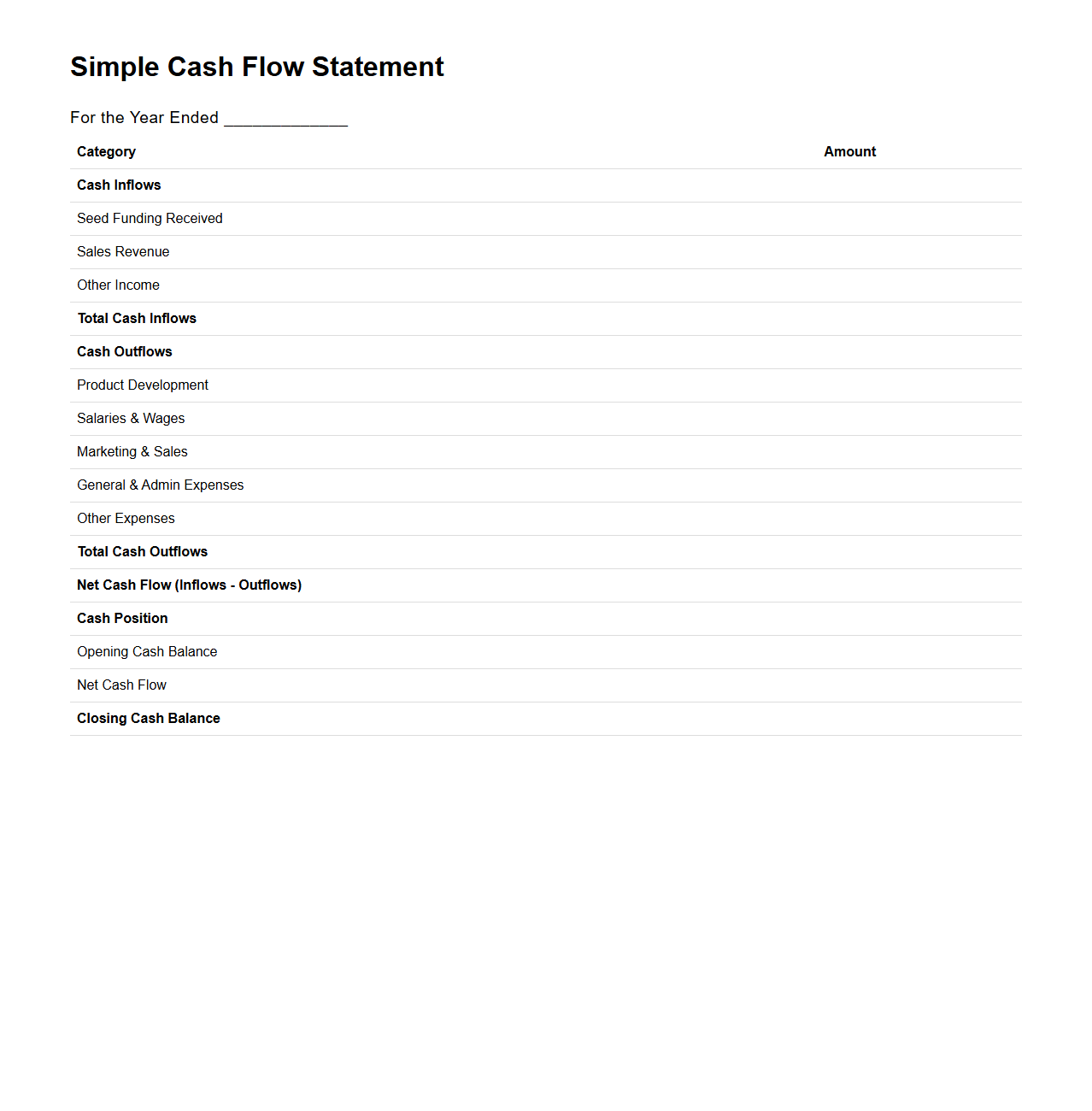

Simple Cash Flow Statement Format for Seed-Stage Companies

A

Simple Cash Flow Statement Format for seed-stage companies provides a clear and concise overview of cash inflows and outflows during the early phases of a startup. This document helps founders track operational, investing, and financing activities, ensuring effective cash management critical for sustaining growth and attracting investors. It emphasizes straightforward categories and timelines tailored to the unique financial circumstances of seed-stage ventures.

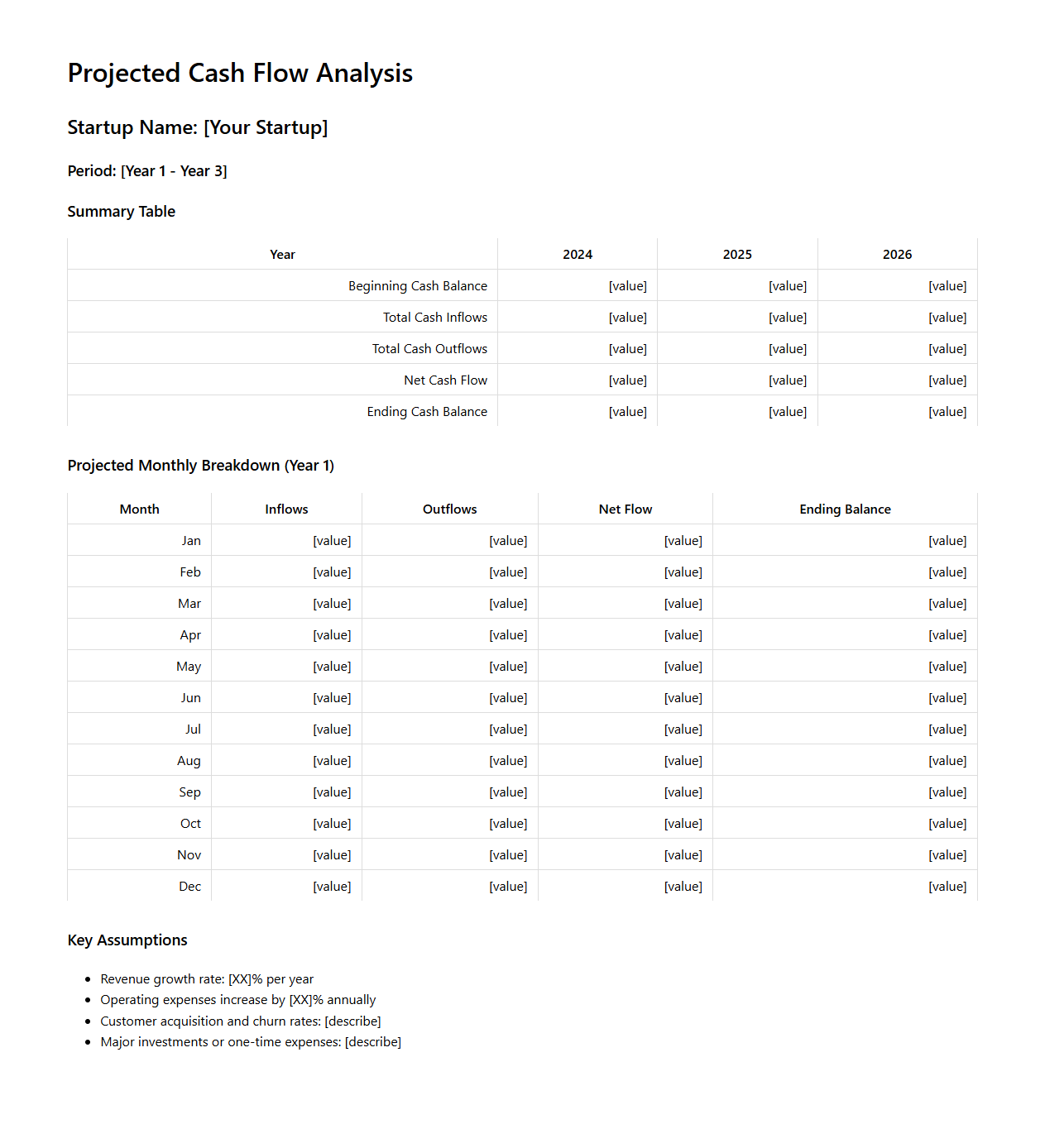

Projected Cash Flow Analysis Document for Startup Pitch Decks

The

Projected Cash Flow Analysis Document in startup pitch decks estimates future cash inflows and outflows over a specific period, highlighting the startup's liquidity and financial sustainability. It provides investors with a clear forecast of how the company plans to manage its cash resources to cover expenses, invest in growth, and achieve profitability. This document includes detailed assumptions on revenue streams, operational costs, capital expenditures, and financing activities essential for demonstrating the startup's financial viability.

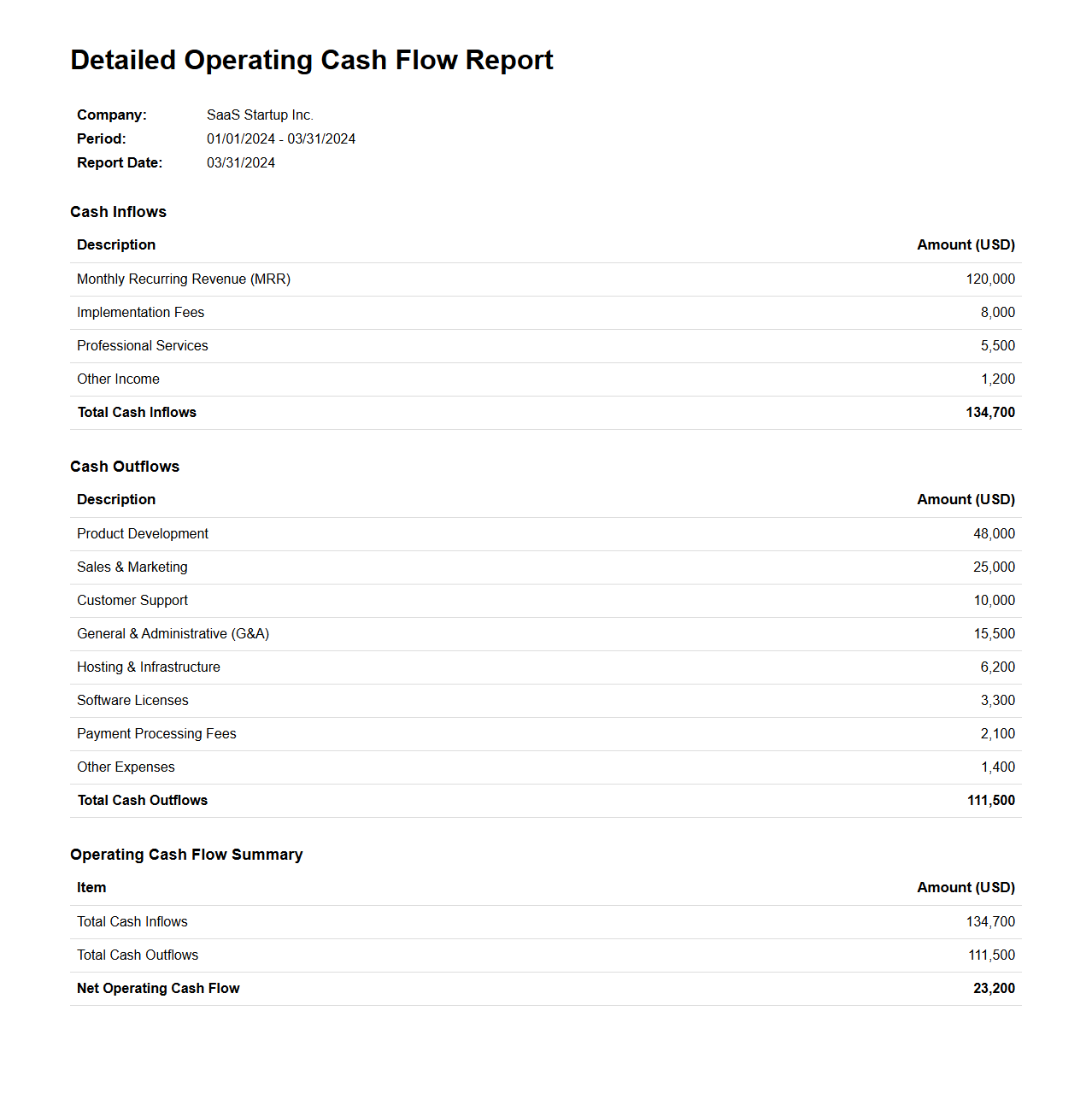

Detailed Operating Cash Flow Report for SaaS Startups

The

Detailed Operating Cash Flow Report for SaaS startups captures comprehensive insights into cash inflows and outflows related to core business operations, highlighting recurring revenue streams and subscription-based expenses. This report tracks critical metrics like customer acquisition costs, monthly recurring revenue (MRR), and churn rates to ensure precise cash management and growth forecasting. It serves as an essential financial tool for founders and investors aiming to optimize liquidity and operational efficiency in rapidly scaling SaaS companies.

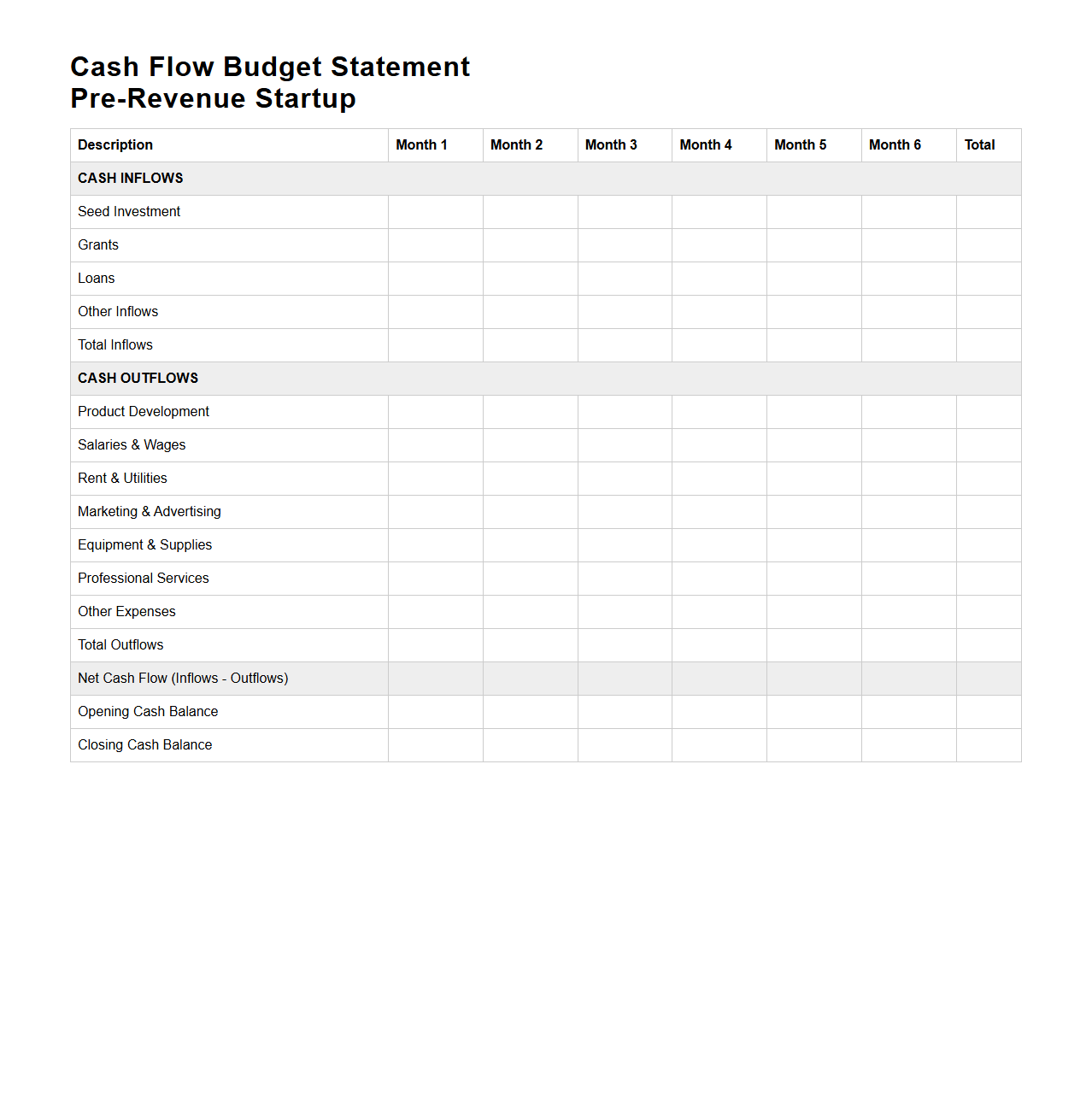

Cash Flow Budget Statement for Pre-Revenue Startups

A

Cash Flow Budget Statement for pre-revenue startups is a financial document that projects the inflows and outflows of cash over a specific period, helping entrepreneurs manage liquidity before generating revenue. It outlines anticipated expenses such as operating costs, salaries, and capital expenditures alongside expected funding sources like investments or loans. This statement is essential for maintaining financial control and ensuring the startup can cover its obligations during the critical early stages.

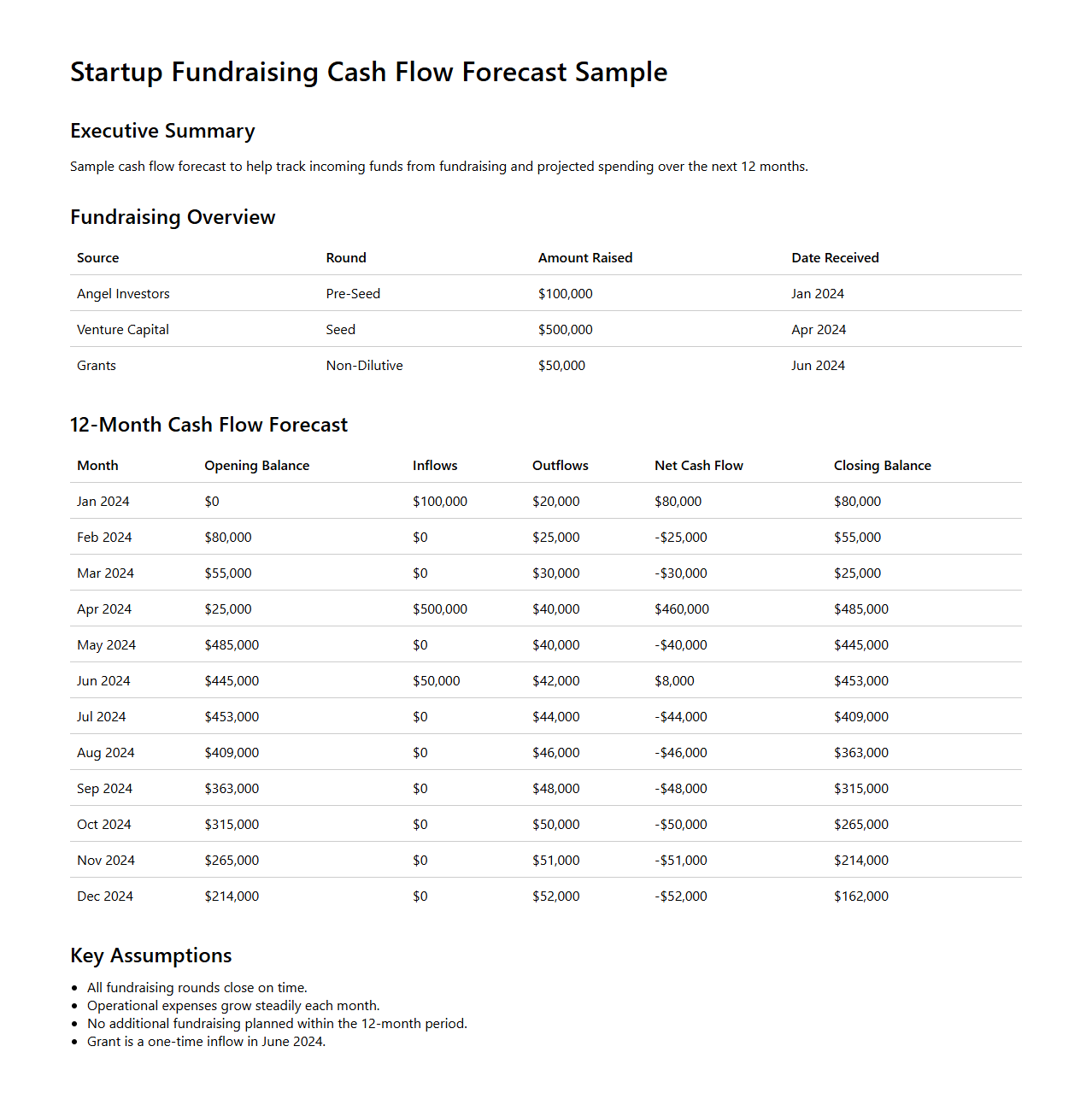

Startup Fundraising Cash Flow Forecast Sample

A

Startup Fundraising Cash Flow Forecast Sample document provides a detailed projection of cash inflows and outflows related to fundraising activities in a startup. It helps entrepreneurs estimate the timing and amount of capital they can expect from investors while managing expenses to ensure sufficient liquidity. This forecast is essential for strategic planning, investor presentations, and financial management during the fundraising phase.

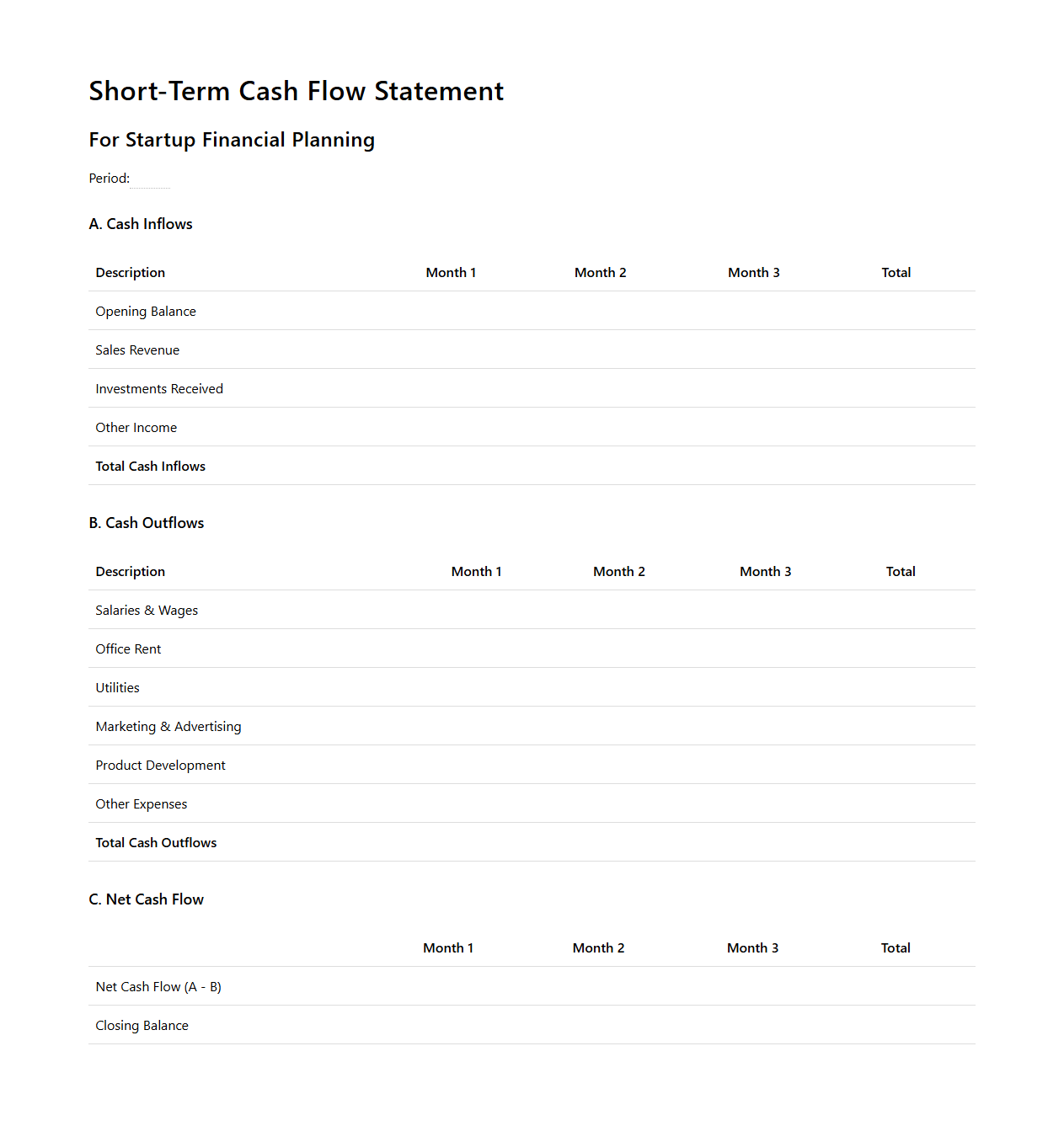

Short-Term Cash Flow Statement for Startup Financial Planning

A

Short-Term Cash Flow Statement for startup financial planning is a critical document that tracks the inflows and outflows of cash over a brief period, typically 30 to 90 days, to ensure liquidity. It helps startups anticipate cash shortages, manage expenses, and schedule payments, minimizing the risk of insolvency. This statement provides a clear snapshot of immediate financial health, enabling founders to make informed decisions about operational funding and resource allocation.

Key Sections in Cash Flow Statement for Early-Stage Startups

The cash flow statement for early-stage startups must include three primary sections: operating activities, investing activities, and financing activities. Operating activities capture cash inflows and outflows from core business operations, which is essential for tracking daily liquidity. Investing activities reflect cash used for capital expenditures like equipment or software development, and financing activities detail cash flows from loans, investments, or funding rounds.

Presentation of Non-Recurring Funding Sources

Non-recurring funding sources, such as one-time grants or equity raises, should be clearly classified under the financing activities section. These entries must be distinct and separately disclosed to avoid misinterpretation of steady cash flows. Accurate presentation helps stakeholders understand cash flow volatility and financial health.

Essential Disclosure Notes for Pre-Revenue Startups

Disclosure notes for pre-revenue startups should emphasize assumptions related to cash burn rate and funding runway. Important notes include clarifying the nature of cash inflows, liquidity risks, and any anticipated timing of revenue generation. This transparency provides a realistic picture of financial stability to investors and creditors.

Reflecting Founder Loans and Convertible Notes in Cash Flow Statements

Founder loans and convertible notes are financing activities and must be recorded as cash inflows when received and outflows upon repayment or conversion. It is critical to note the contingent nature of convertible notes, especially how they might convert into equity. Proper classification ensures the startup's cash position and obligations are accurately presented.

Best Practices for Forecasting Cash Inflows for SaaS Startups

Forecasting should incorporate subscription renewals, upsells, and churn rates to reflect recurring revenue realistically. Differentiating between monthly and annual contracts provides clarity in inflow timing and amounts. Utilizing historical data combined with market trends enhances forecast accuracy for SaaS cash flow planning.