A Balance Sheet Document Sample for Financial Reporting provides a clear template illustrating how a company's assets, liabilities, and equity are organized at a specific point in time. This sample aids in accurate financial analysis and compliance by showcasing standardized financial data presentation. Utilizing such a document ensures transparency and consistency in financial reporting processes.

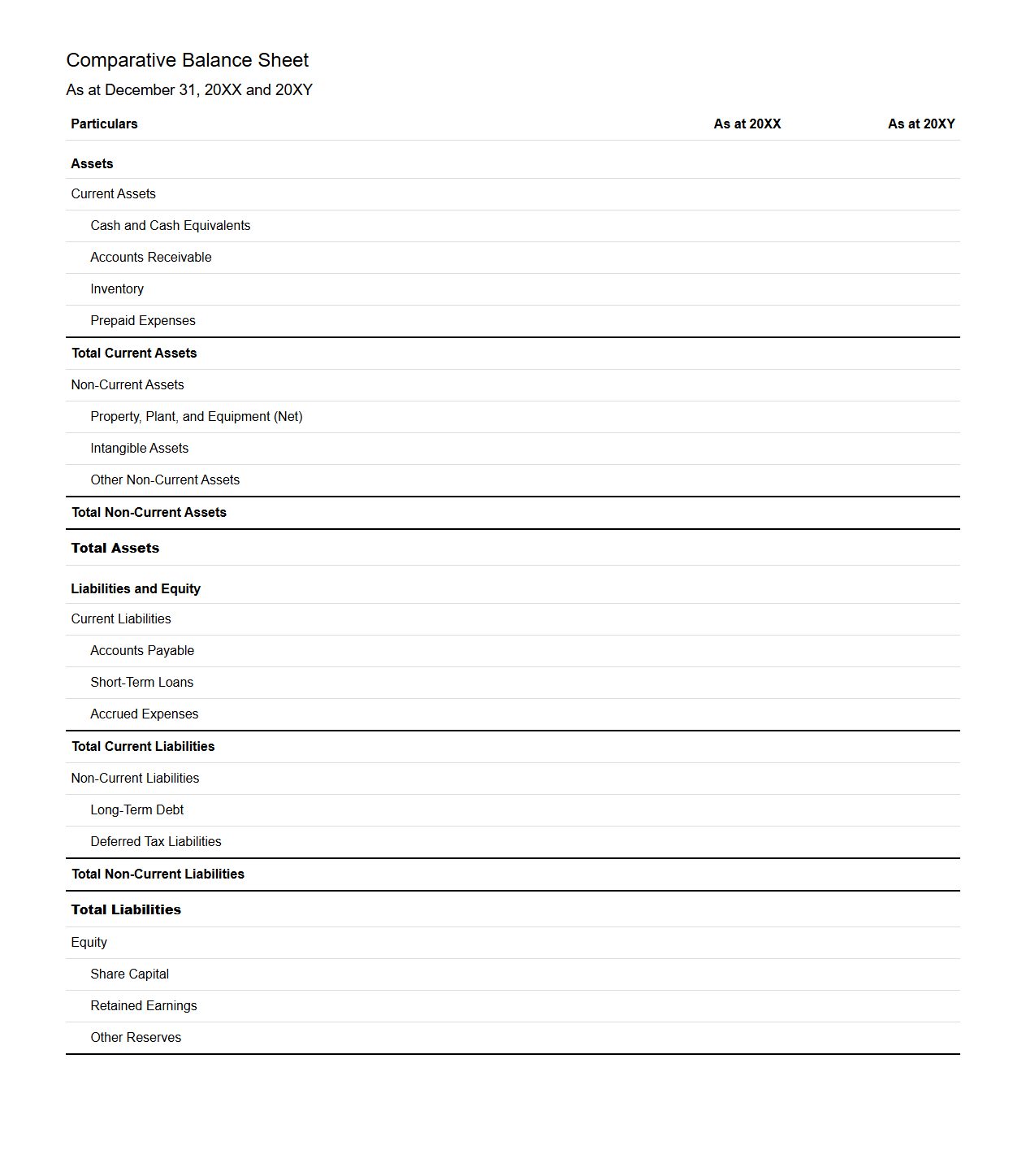

Comparative Balance Sheet Template for Annual Financial Statements

A

Comparative Balance Sheet Template for Annual Financial Statements is a structured financial document that allows businesses to present their assets, liabilities, and equity side-by-side for multiple fiscal years. This template enhances clarity in financial analysis by facilitating the comparison of financial positions over time, highlighting trends and variances. It supports stakeholders in making informed decisions by providing a clear view of an organization's financial stability and growth trajectory.

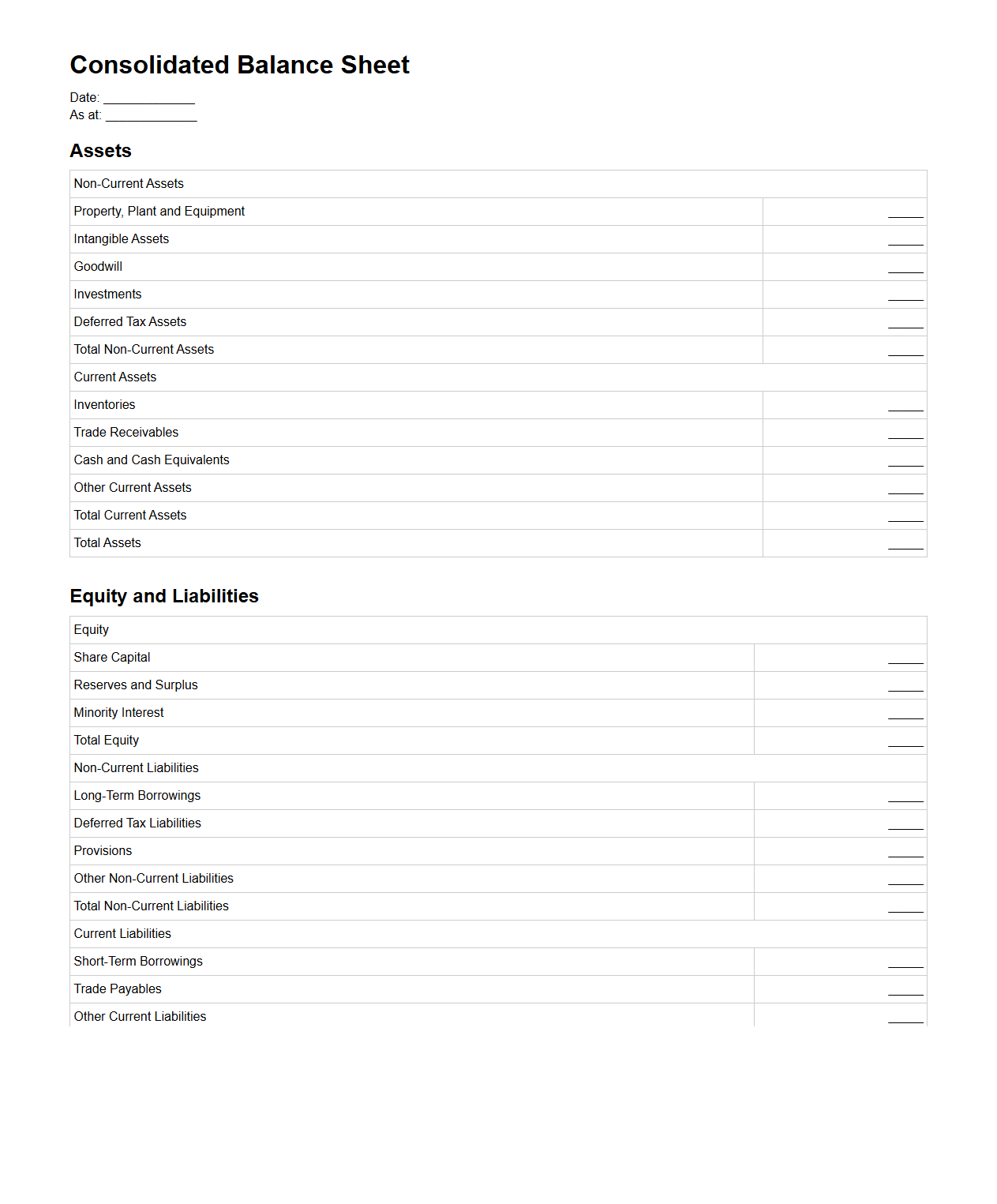

Consolidated Balance Sheet Format for Corporate Accounts

The

Consolidated Balance Sheet Format for Corporate Accounts is a standardized financial statement that combines the assets, liabilities, and equity of a parent company and its subsidiaries into a single overview. This document provides a comprehensive snapshot of the entire corporate group's financial position, ensuring transparency for stakeholders and compliance with accounting regulations like IFRS or GAAP. It eliminates intercompany transactions and balances to present an accurate reflection of the group's consolidated financial health.

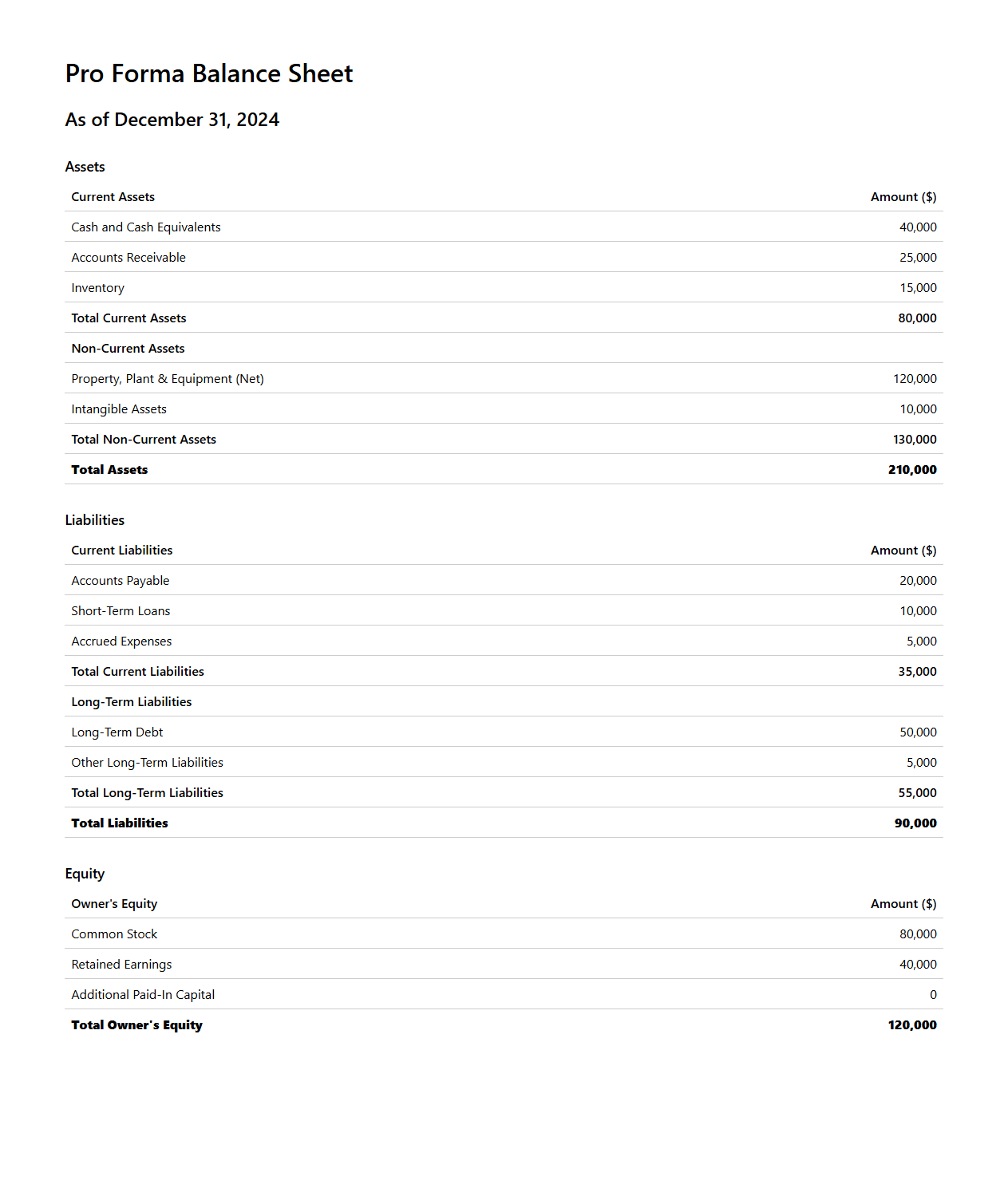

Pro Forma Balance Sheet Example for Business Planning

A

Pro Forma Balance Sheet example for business planning is a financial statement that projects a company's future assets, liabilities, and equity based on anticipated business activities and assumptions. This document helps entrepreneurs and investors evaluate the potential financial position of a business at a specific future date, supporting informed decision-making. It is essential for budgeting, securing financing, and strategic growth planning by illustrating expected solvency and financial stability.

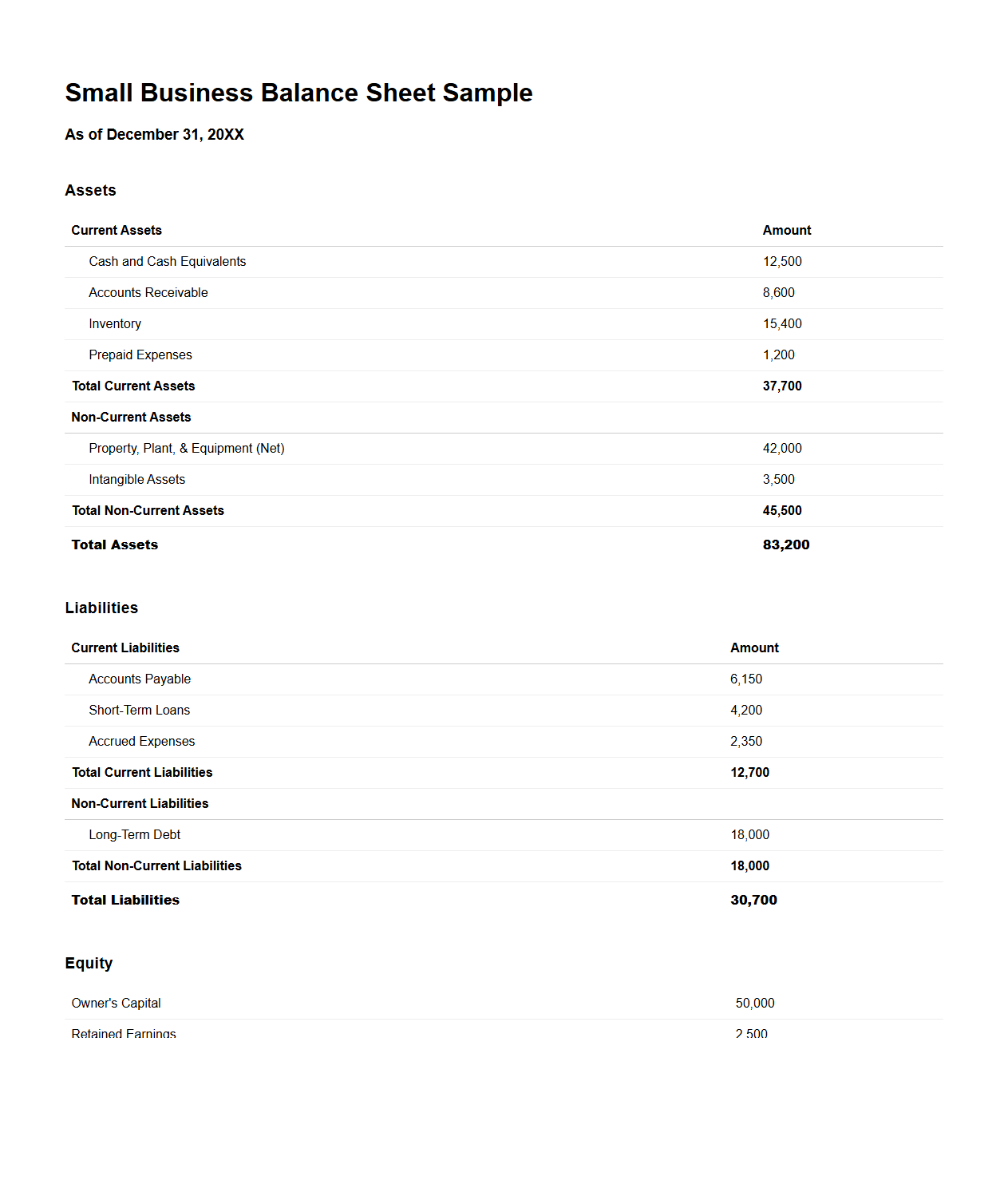

Small Business Balance Sheet Sample for Financial Analysis

A

Small Business Balance Sheet Sample for Financial Analysis is a detailed financial statement that provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It helps business owners and analysts assess the company's financial health, liquidity, and capital structure. This document serves as a critical tool for informed decision-making, budgeting, and securing funding.

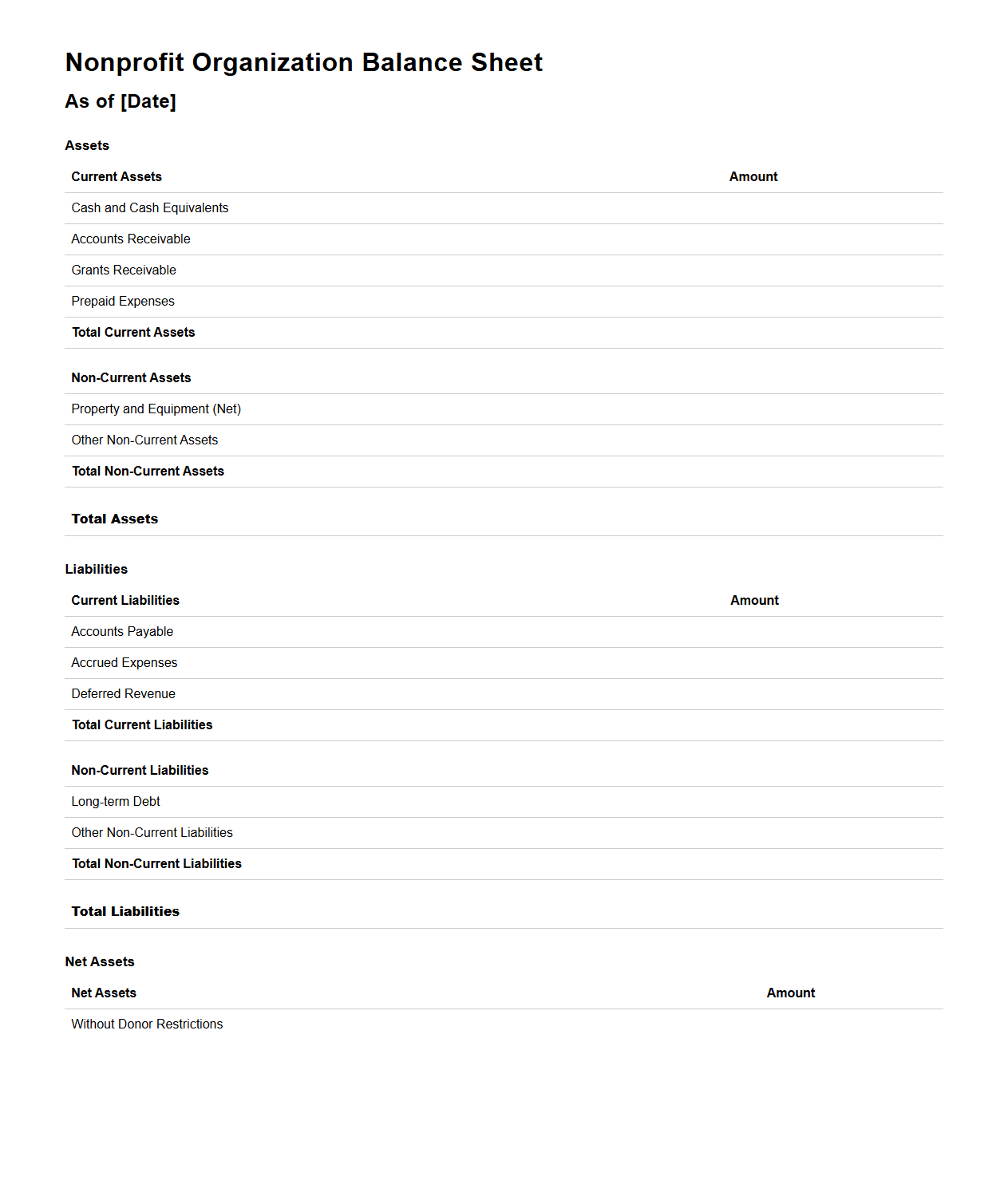

Nonprofit Organization Balance Sheet Layout for Reporting

A

Nonprofit Organization Balance Sheet Layout for reporting is a financial statement format tailored to present the assets, liabilities, and net assets of a nonprofit entity. It categorizes resources and obligations clearly, often separating unrestricted, temporarily restricted, and permanently restricted net assets to comply with accounting standards for nonprofits. This layout provides stakeholders a snapshot of the organization's financial position, enabling transparency and informed decision-making.

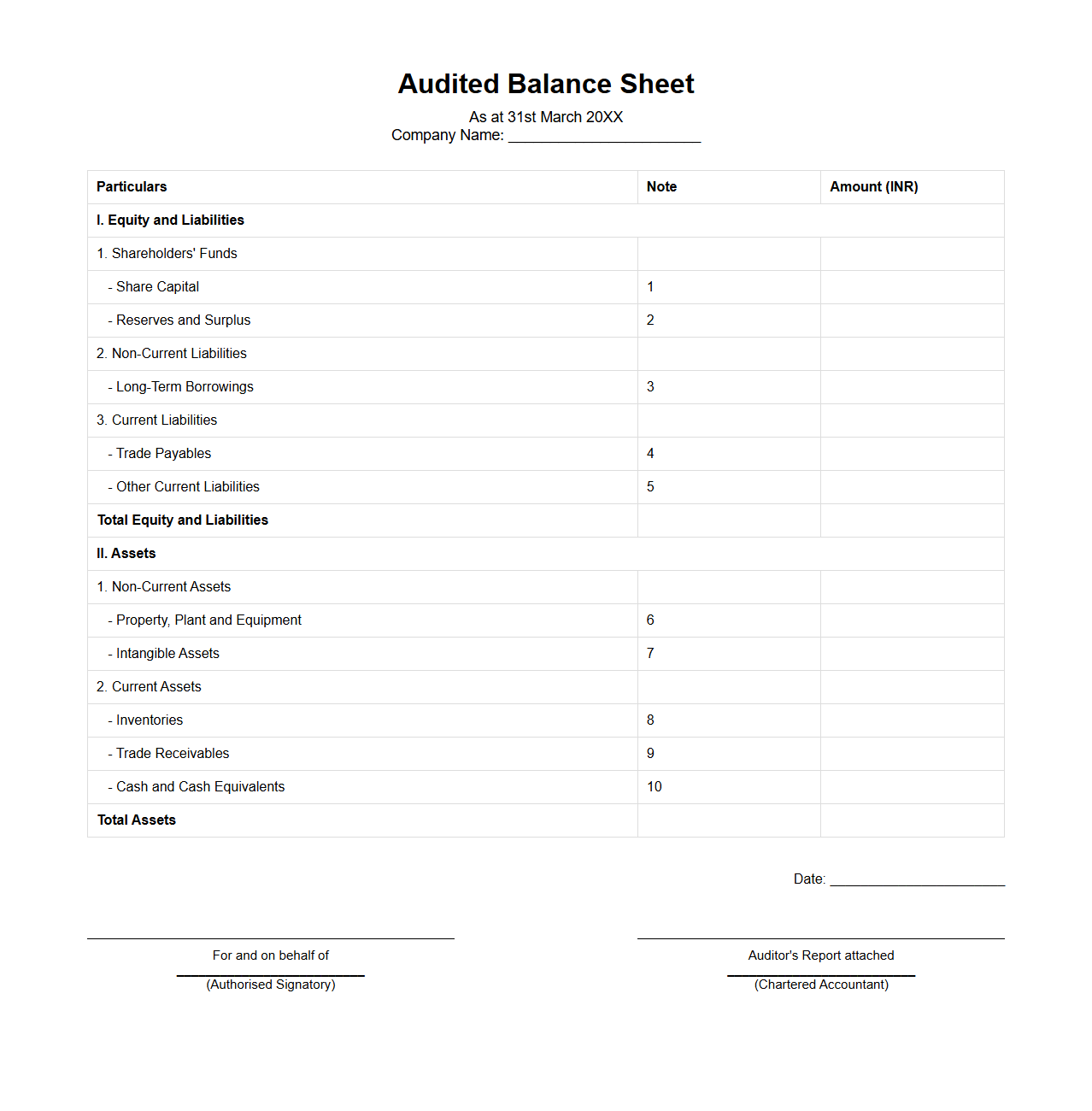

Audited Balance Sheet Example for Compliance

An

audited balance sheet example for compliance documents demonstrates the accurate financial position of a company, verified by an independent auditor to ensure adherence to regulatory standards. It includes detailed asset, liability, and equity figures, reflecting the company's financial health as of a specific date. This example serves as a vital tool for stakeholders to assess financial integrity and maintain transparency in financial reporting.

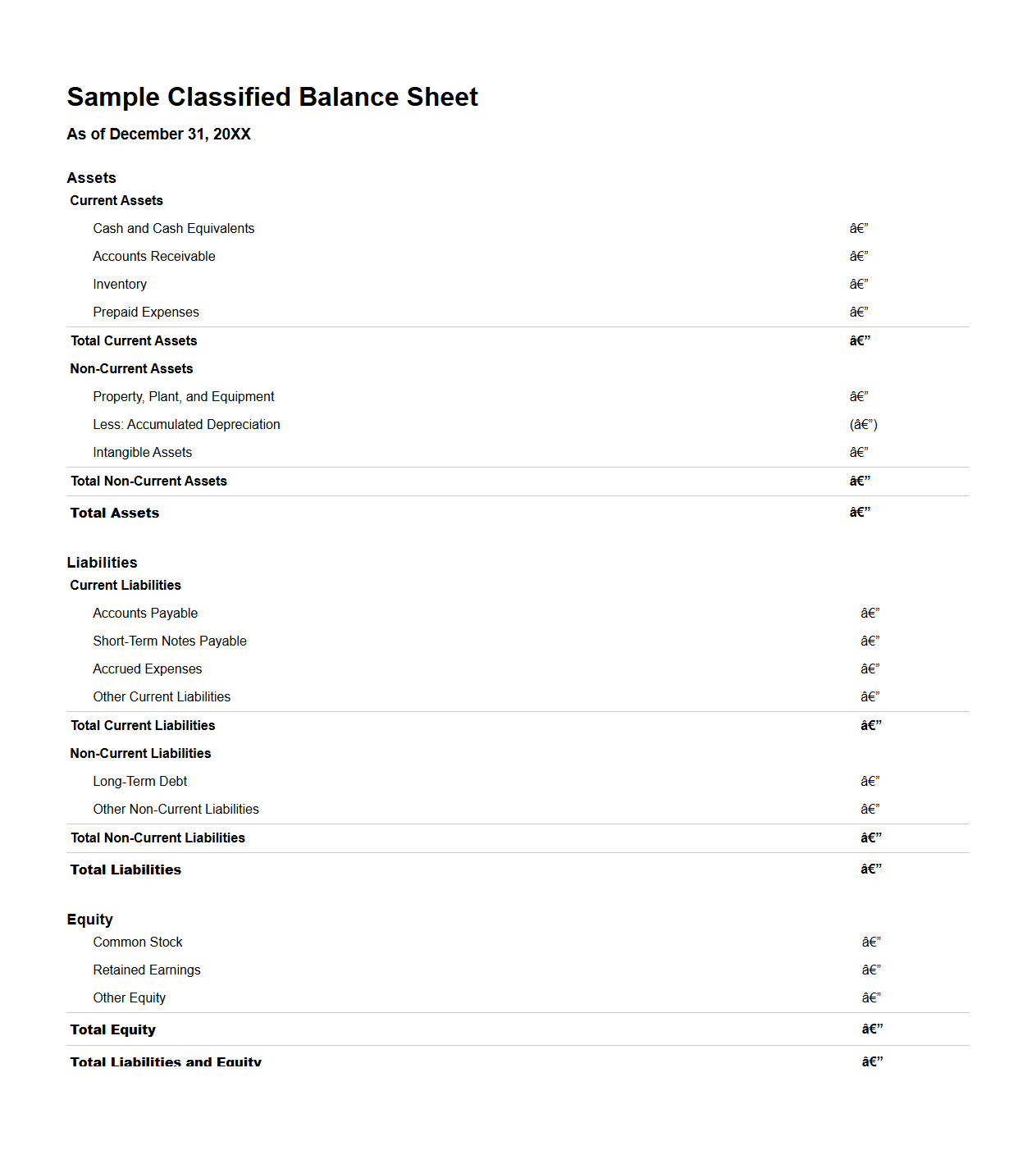

Classified Balance Sheet Sample for Internal Review

A

Classified Balance Sheet Sample for Internal Review is a structured financial statement used within organizations to organize assets, liabilities, and equity into specific categories for easier analysis. It separates current assets and liabilities from long-term items, providing a clear overview of the company's financial health and liquidity. This document serves as a reference tool for internal stakeholders to assess financial stability and make informed decisions.

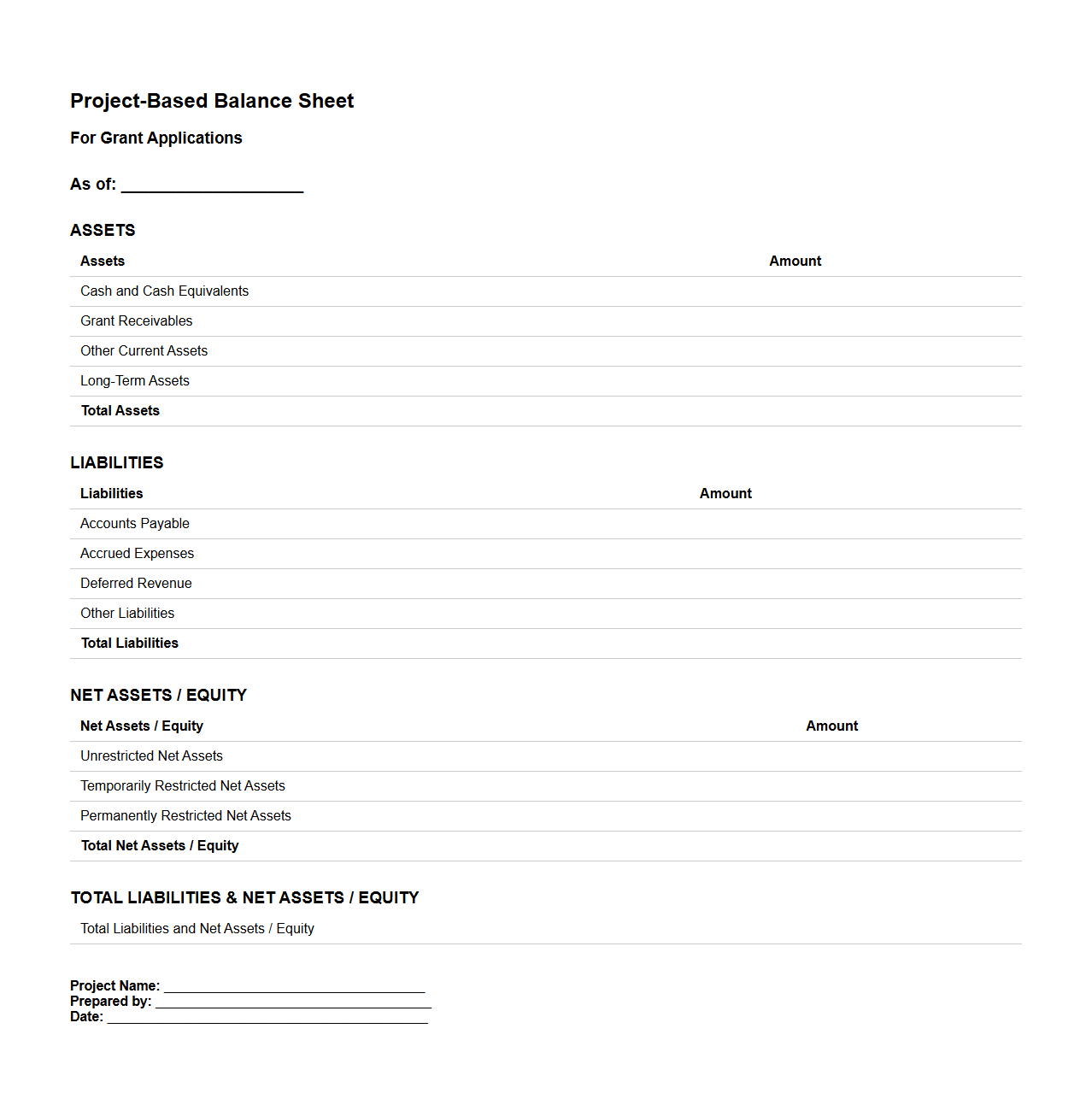

Project-Based Balance Sheet Format for Grant Applications

The

Project-Based Balance Sheet Format for grant applications is a specialized financial statement that outlines the assets, liabilities, and equity specifically associated with a project, providing clear insight into its fiscal health. This format helps grant reviewers evaluate the financial stability and resource allocation of the project, ensuring that funds will be managed effectively. It typically includes sections for project-specific cash, receivables, payables, and any restricted funds tied directly to the grant.

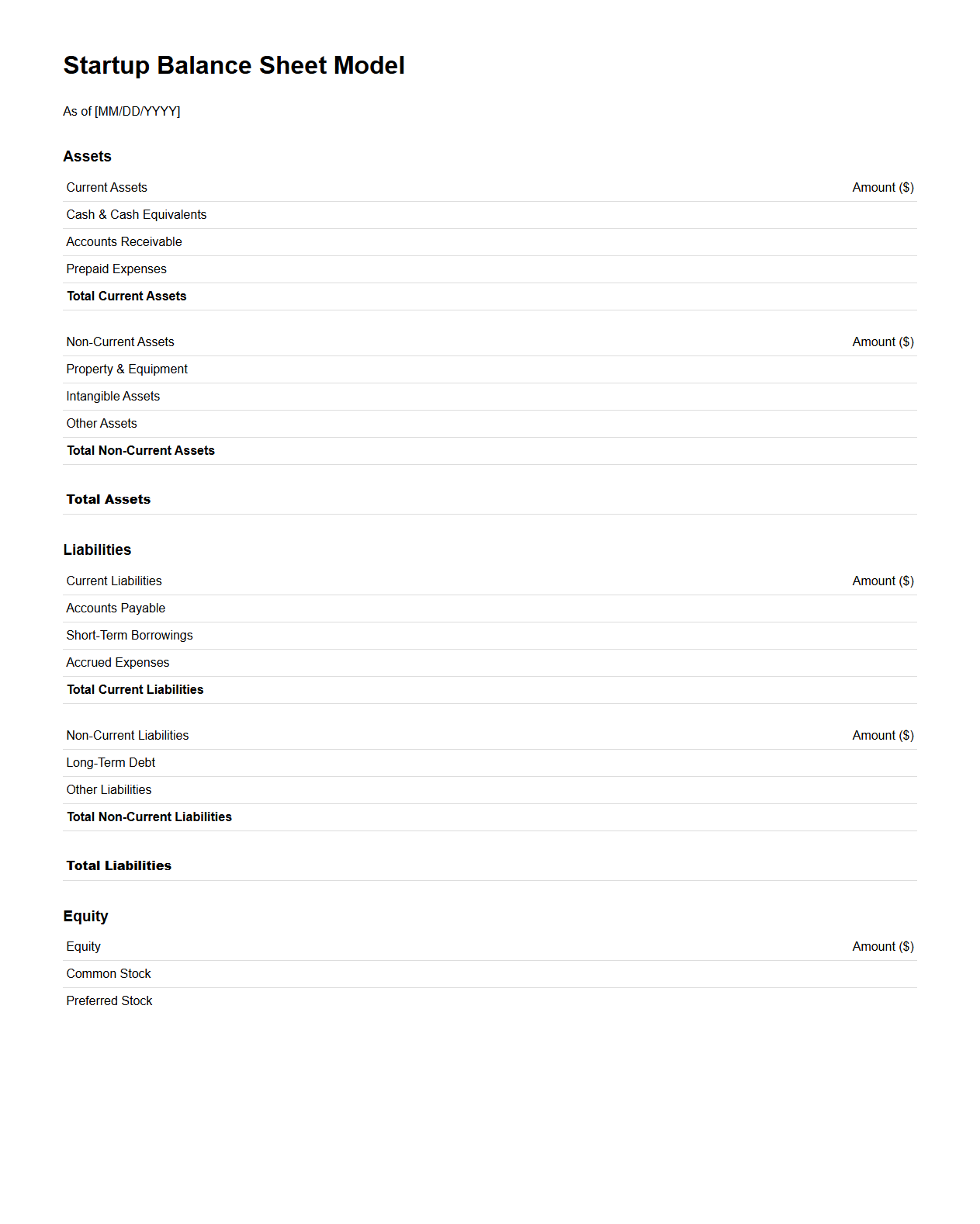

Startup Balance Sheet Model for Investor Presentations

A

Startup Balance Sheet Model for investor presentations is a detailed financial statement that outlines a startup's assets, liabilities, and equity at a specific point in time. It provides potential investors with a clear picture of the company's financial health and capital structure, helping them assess risk and growth potential. This document is essential for demonstrating fiscal responsibility and planning during fundraising discussions.

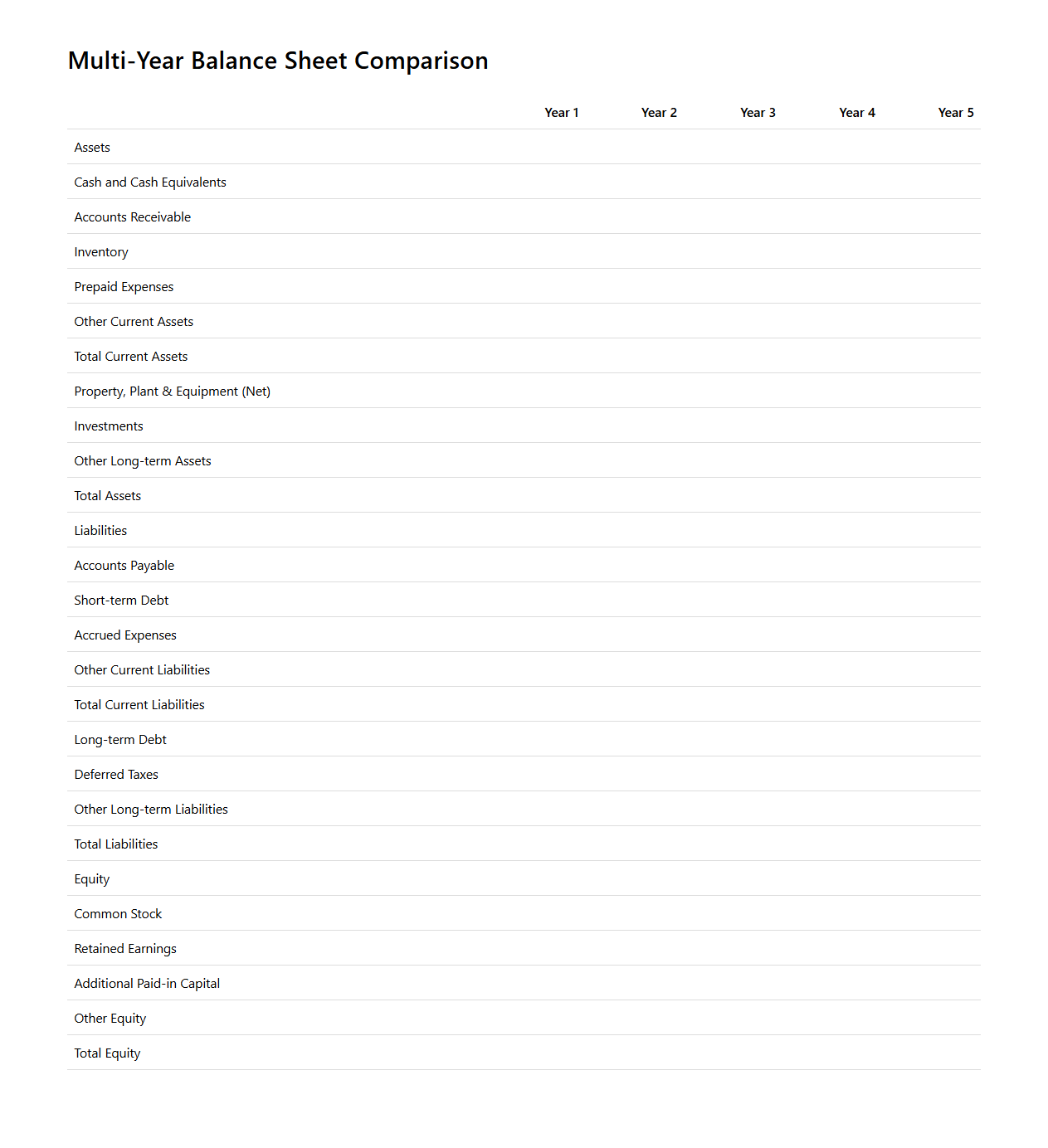

Multi-Year Balance Sheet Comparison Template for Trend Analysis

A

Multi-Year Balance Sheet Comparison Template for Trend Analysis document is a tool that facilitates the evaluation of a company's financial health over multiple fiscal periods by systematically organizing assets, liabilities, and equity figures side-by-side. This template enables analysts to identify patterns, growth trajectories, and potential financial risks by comparing year-over-year changes. It supports effective decision-making by providing clear visual representations of financial trends and stability.

What supporting schedules are typically attached to a balance sheet document for audit trails?

Supporting schedules such as the accounts receivable aging report and fixed assets schedule are commonly attached to a balance sheet to enhance audit trails. These schedules provide detailed proof of the balances reported and facilitate thorough verification during audits. Additionally, debt schedules and inventory valuation reports help auditors validate the accuracy of key account balances.

How does the balance sheet document address off-balance-sheet liabilities for compliance?

The balance sheet document addresses off-balance-sheet liabilities by providing detailed disclosures in the notes section. This includes commitments, contingencies, and lease obligations not recorded directly on the balance sheet. Transparent reporting ensures compliance with accounting standards and offers stakeholders a clear understanding of potential liabilities.

What are the common footnotes required in a balance sheet for IFRS reporting?

Common footnotes in IFRS reporting include disclosures on accounting policies, contingent liabilities, and valuation methods. These notes clarify critical assumptions and provide context for significant balance sheet items. They also enhance financial statement transparency and comparability under international standards.

How is intangible asset valuation disclosed in the balance sheet document?

Intangible asset valuation is disclosed by detailing the cost, accumulated amortization, and impairment losses in the notes to the balance sheet. This disclosure explains the method used for valuation and any significant changes during the reporting period. It assists users in understanding the carrying value and recoverability of intangible assets.

In what section does the balance sheet detail related-party transaction balances?

Related-party transaction balances are typically disclosed in the notes or supplementary schedules attached to the balance sheet. This section outlines the nature, amount, and terms of transactions with related parties. Such disclosures ensure transparency and help prevent conflicts of interest in financial reporting.