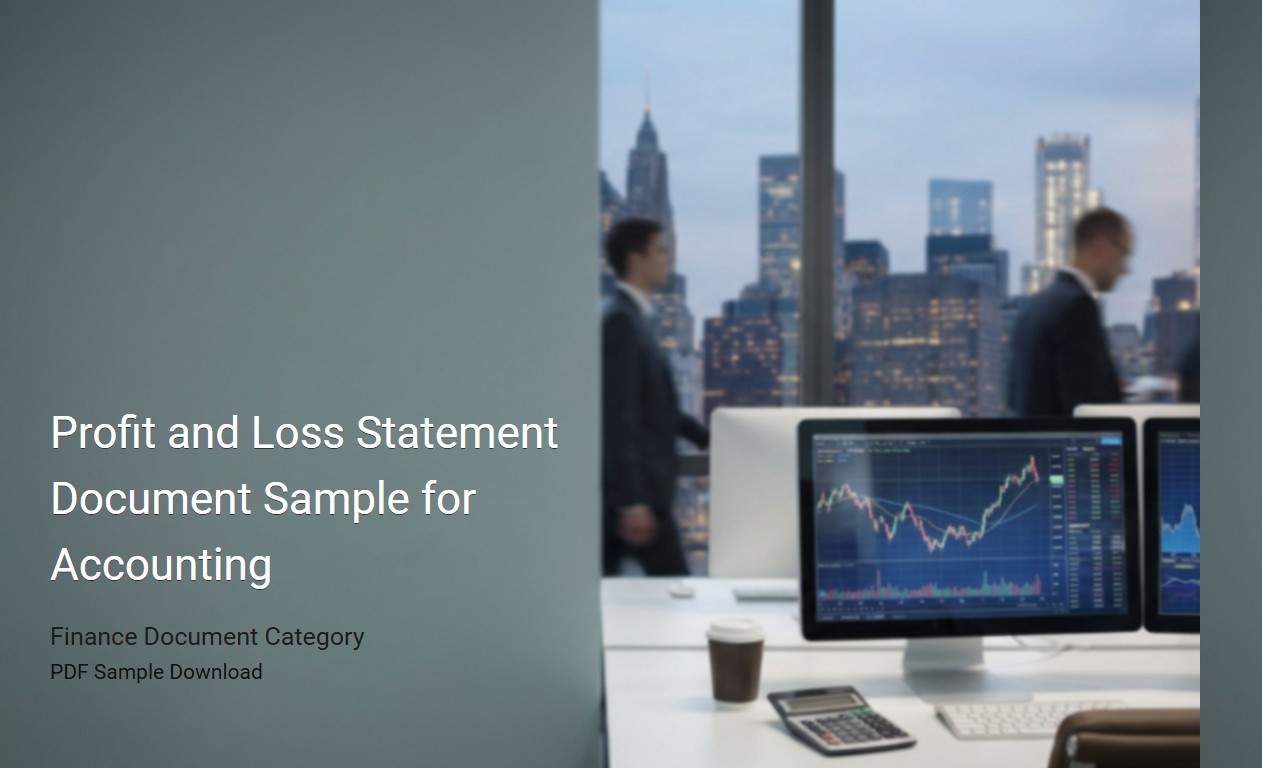

Monthly Profit and Loss Statement Example for Small Business

A

Monthly Profit and Loss Statement Example for Small Business is a financial document that summarizes revenues, costs, and expenses over a 30-day period, helping entrepreneurs track business performance. This statement provides clear insights into net profit or loss, enabling informed decisions to improve cash flow and profitability. Small business owners use it to identify trends, monitor operational efficiency, and plan for future growth.

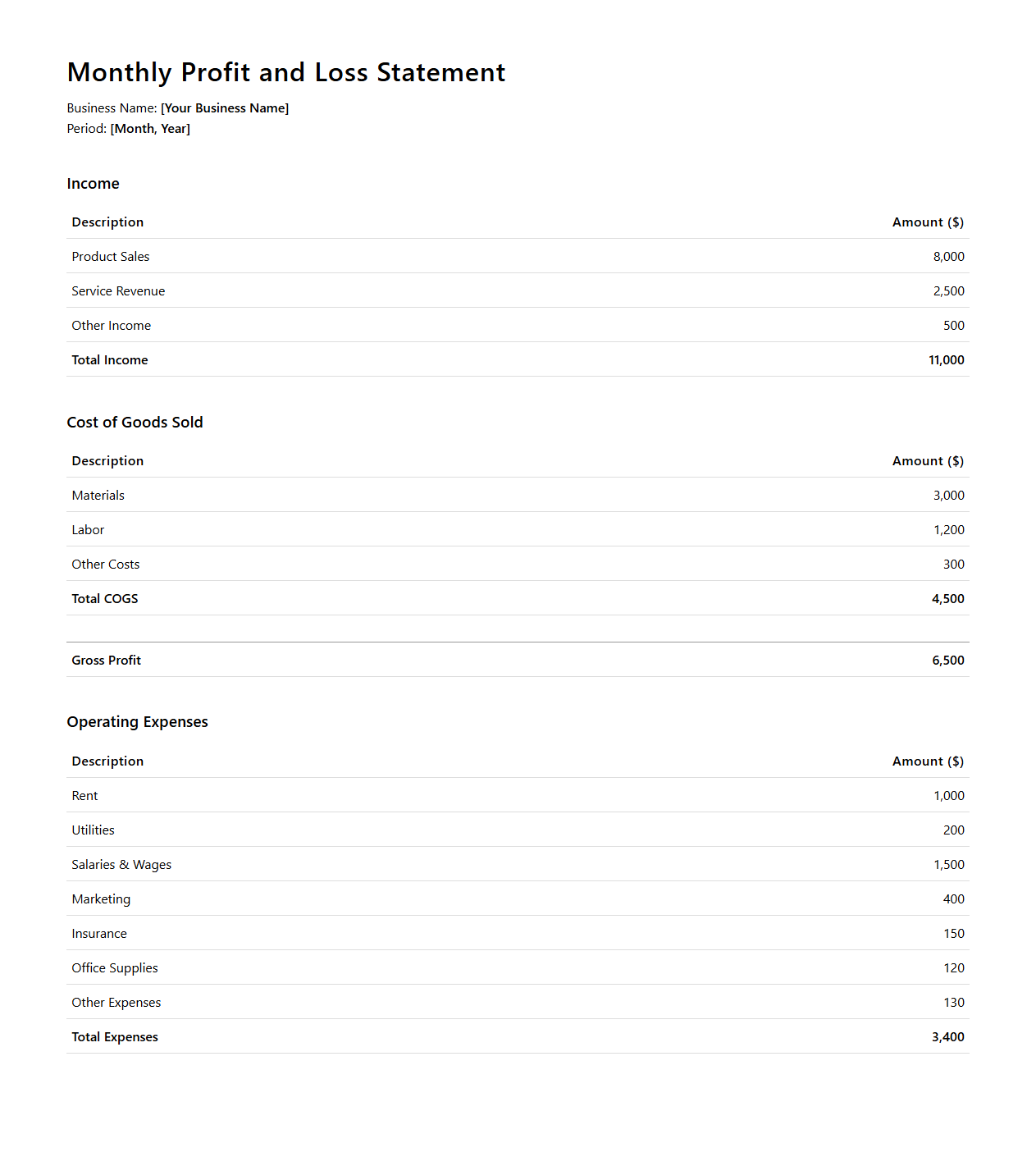

Restaurant Income Statement Template Example

A

Restaurant Income Statement Template Example document provides a structured format for tracking and analyzing revenue, costs, and expenses specific to a restaurant's operations. It helps restaurant owners and managers assess profitability by detailing sales from food and beverages, payroll, rent, utilities, and other operational expenses. This template serves as a crucial financial tool for budgeting, forecasting, and making data-driven decisions to optimize business performance.

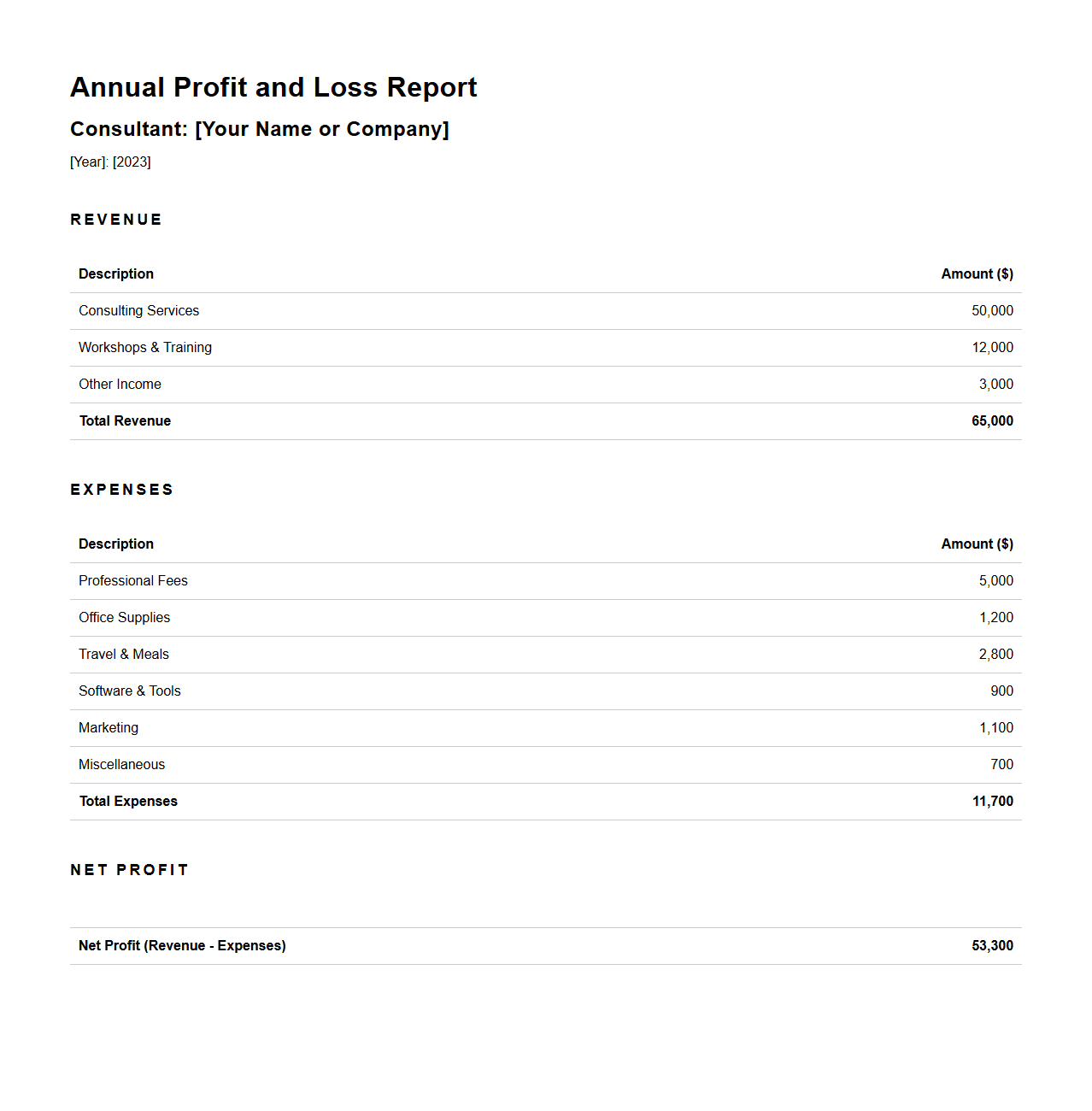

Annual Profit and Loss Report Sample for Consultants

The

Annual Profit and Loss Report Sample for Consultants document provides a detailed financial overview of a consultant's earnings and expenses over a fiscal year. It highlights key components such as gross revenue, operational costs, net profit, and tax liabilities, enabling consultants to assess their financial performance accurately. This sample serves as a practical template for preparing comprehensive profit and loss statements in consulting businesses.

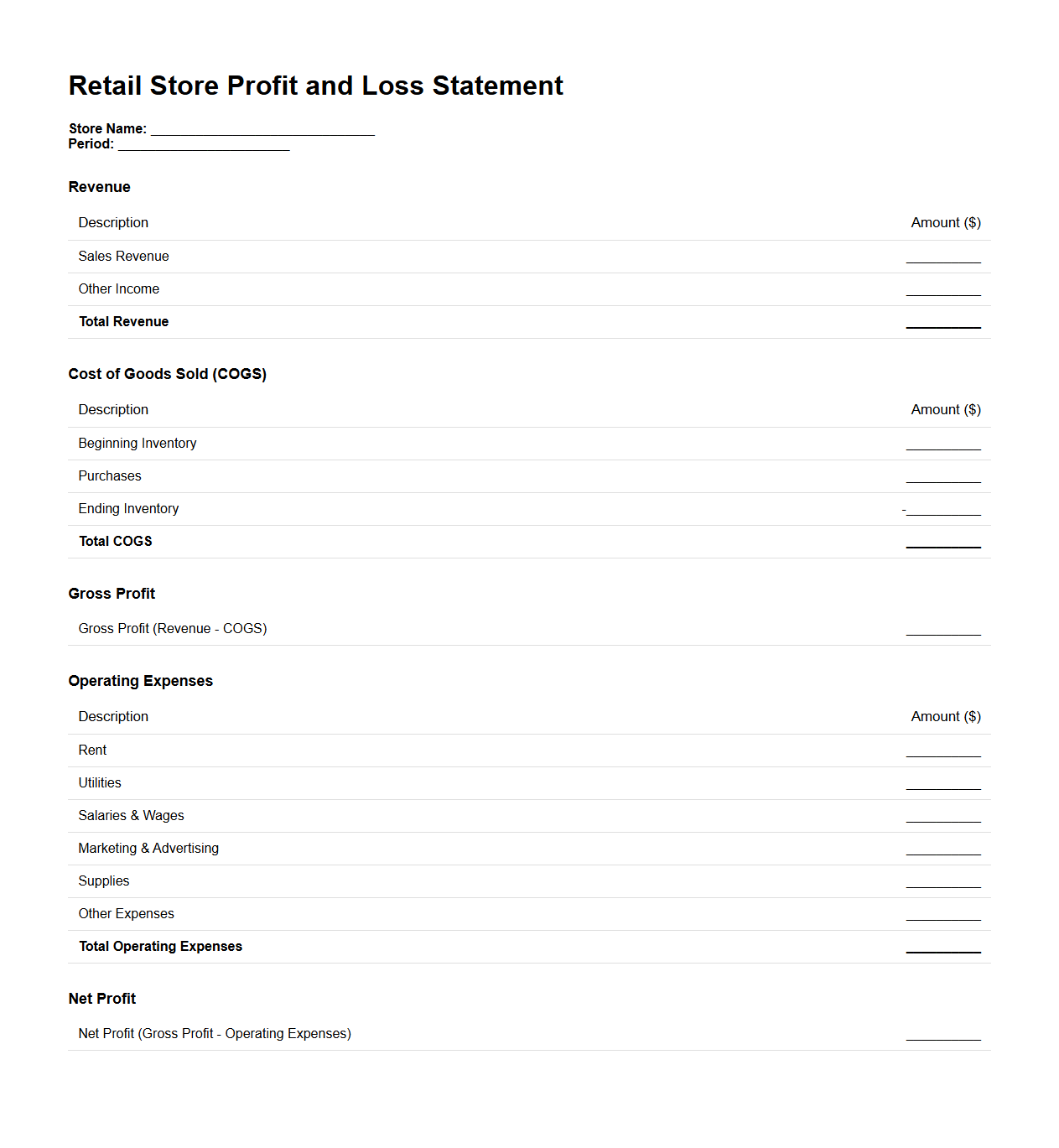

Retail Store Profit and Loss Statement Example

A

Retail Store Profit and Loss Statement Example document is a financial report that details the revenue, costs, and expenses incurred by a retail business over a specific period. It helps store owners and managers analyze profitability by breaking down sales, cost of goods sold (COGS), operating expenses, and net income. This example serves as a practical guide for preparing accurate statements to monitor business performance and make informed financial decisions.

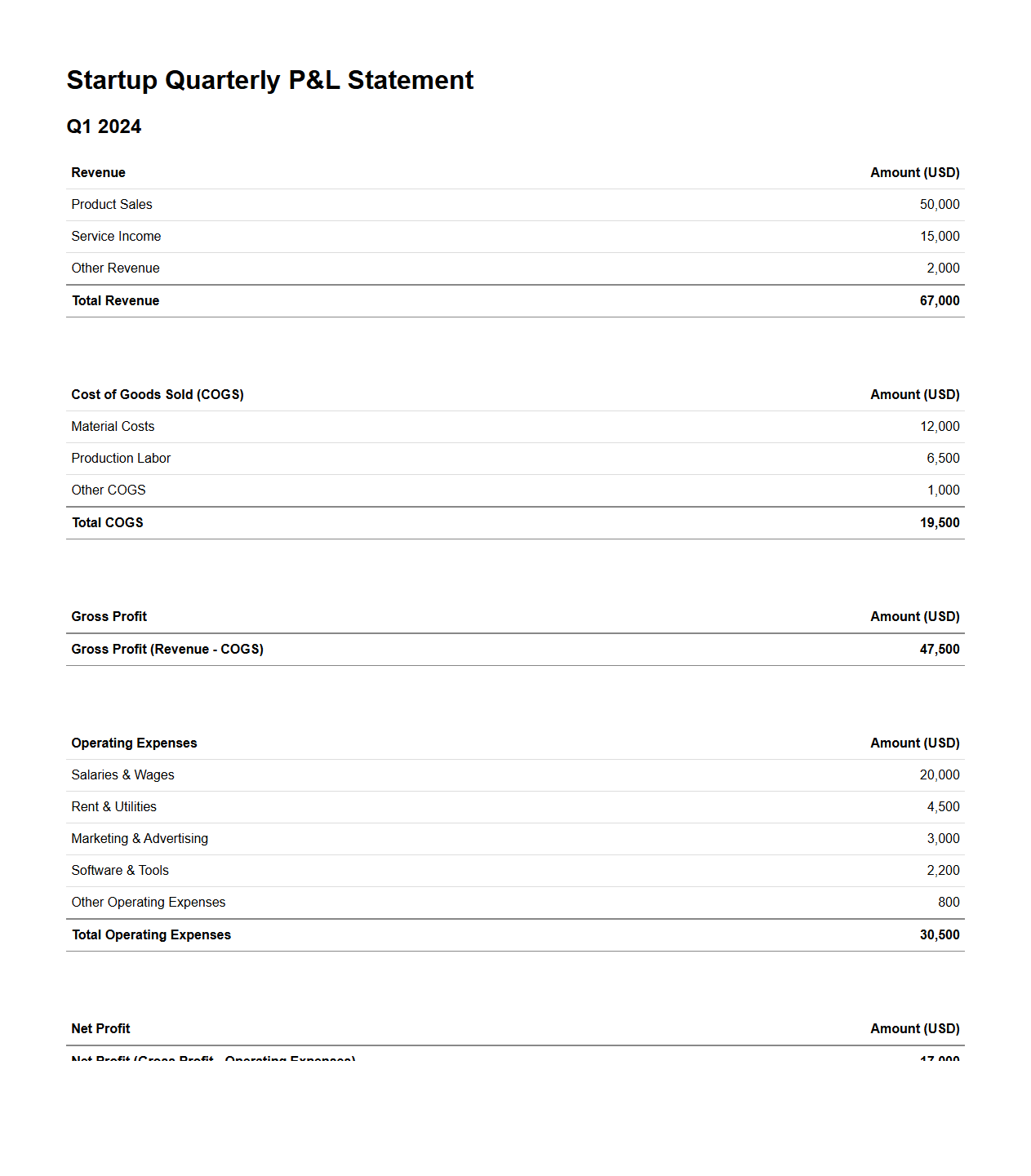

Startup Quarterly P&L Statement Sample

A

Startup Quarterly P&L Statement Sample document provides a detailed overview of a startup's revenues, costs, and expenses over a three-month period, helping track financial performance and profitability. It includes line items such as sales revenue, cost of goods sold, operating expenses, and net profit, offering valuable insights for investors and management decisions. This sample serves as a practical template for startups to forecast earnings and monitor financial health systematically.

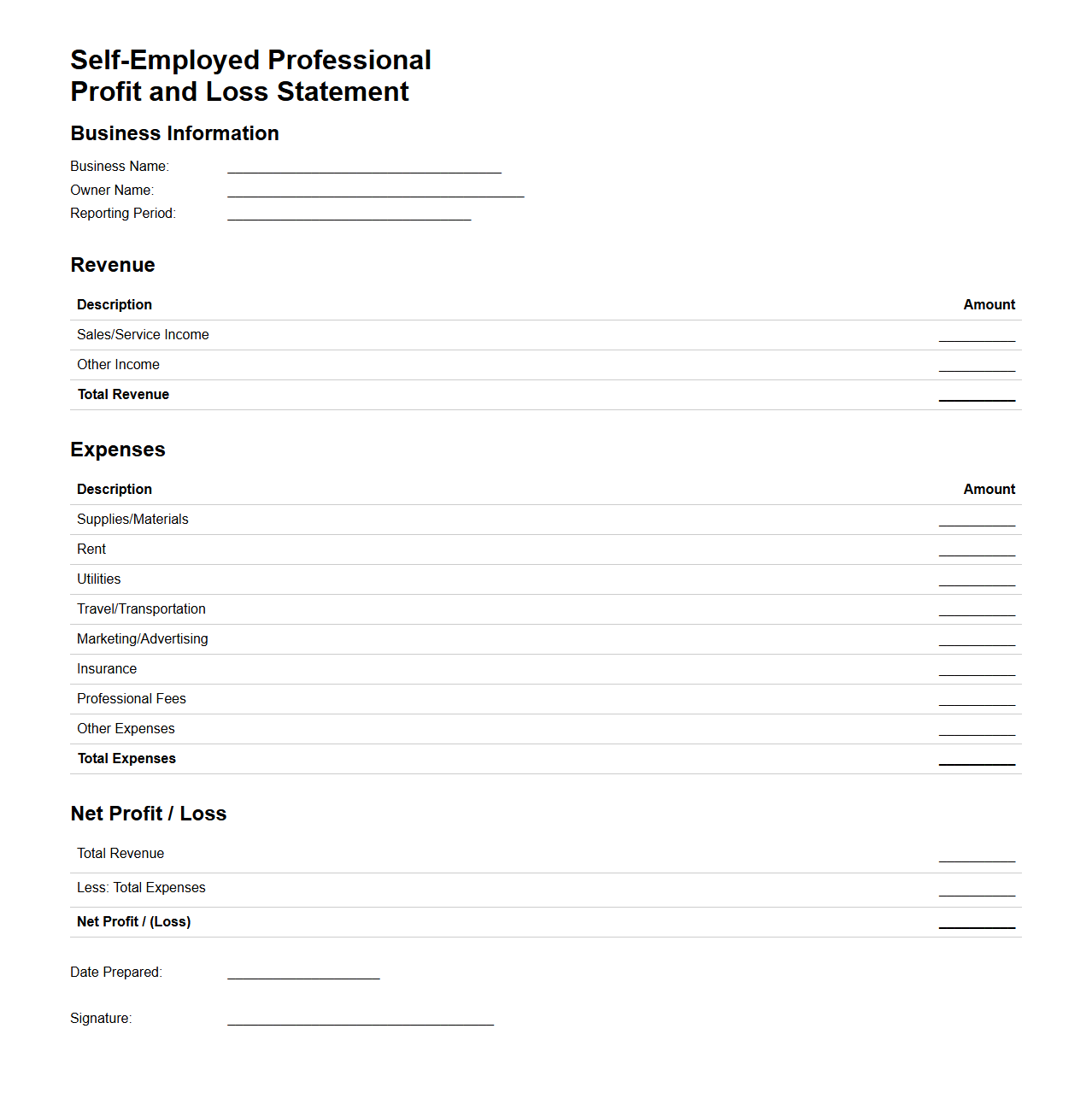

Self-Employed Professional Profit and Loss Statement Example

A

Self-Employed Professional Profit and Loss Statement example document outlines the revenue, expenses, and net income for an individual working independently. It helps track financial performance by itemizing income sources such as client fees and detailing deductible costs like office supplies, travel, and marketing. This document is essential for accurate tax reporting and business decision-making.

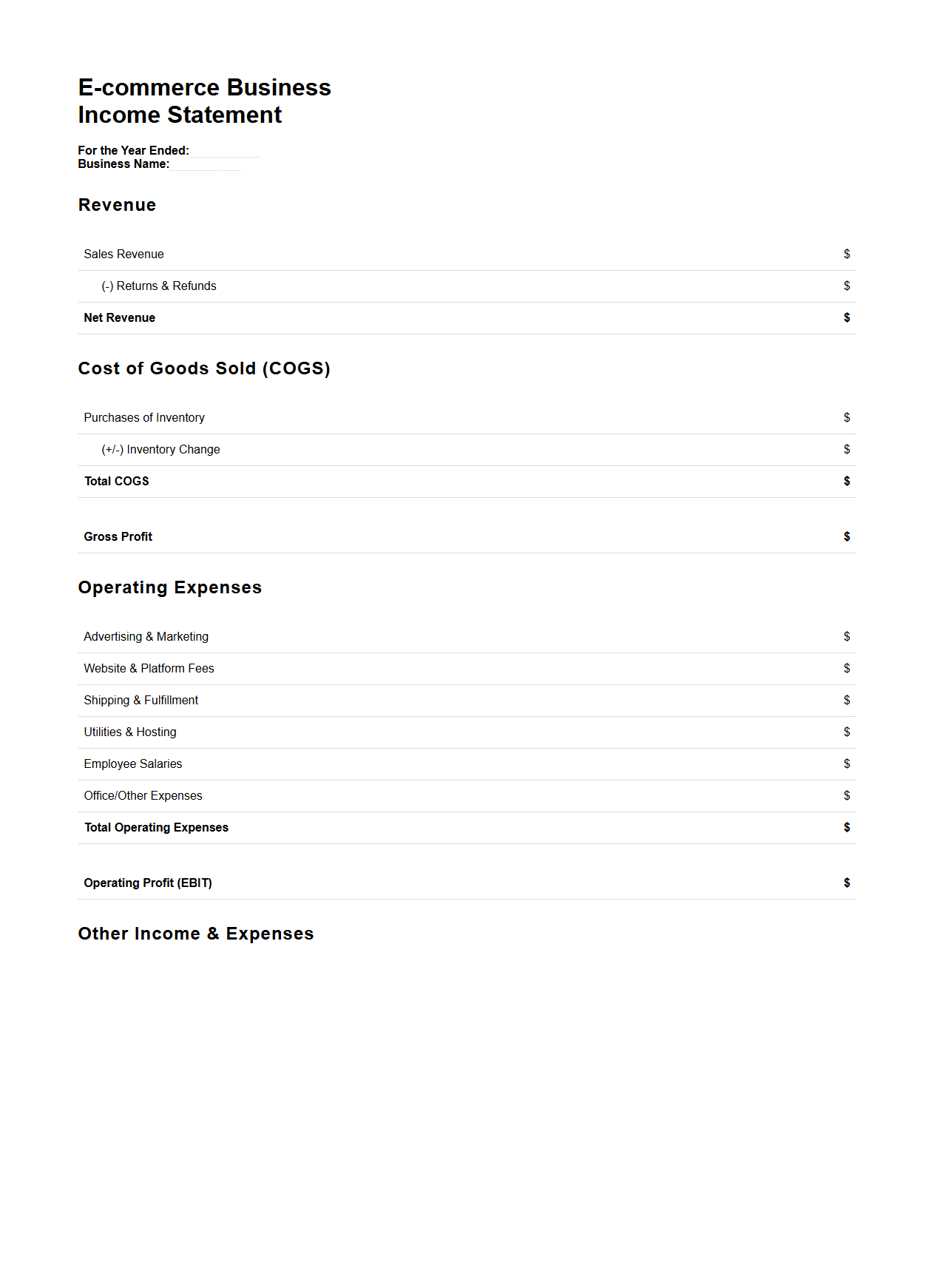

E-commerce Business Income Statement Template Sample

An

E-commerce Business Income Statement Template Sample document provides a structured format to track revenue, cost of goods sold, gross profit, operating expenses, and net income specific to online retail businesses. It helps e-commerce entrepreneurs analyze financial performance, monitor profitability, and make informed decisions based on accurate revenue and expense data. This template streamlines financial reporting by organizing sales channels, marketing costs, and fulfillment expenses in a clear, concise manner.

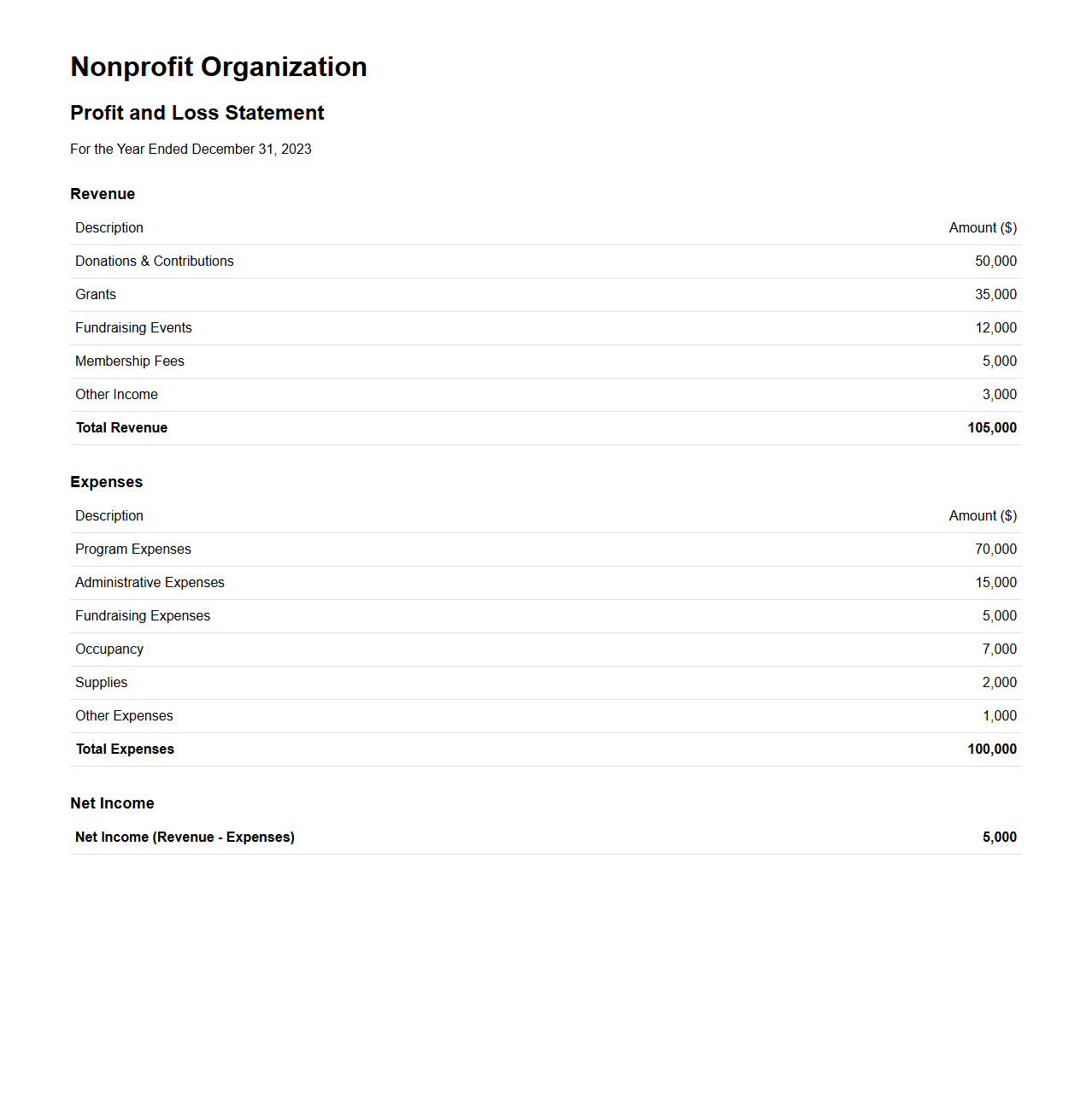

Nonprofit Organization Profit and Loss Statement Example

A

Nonprofit Organization Profit and Loss Statement Example document illustrates how revenues and expenses are tracked to assess financial performance over a specific period. This statement includes categories such as grants, donations, program service fees, operating expenses, and administrative costs. It serves as a vital tool for transparency, budgeting, and strategic planning within nonprofit financial management.

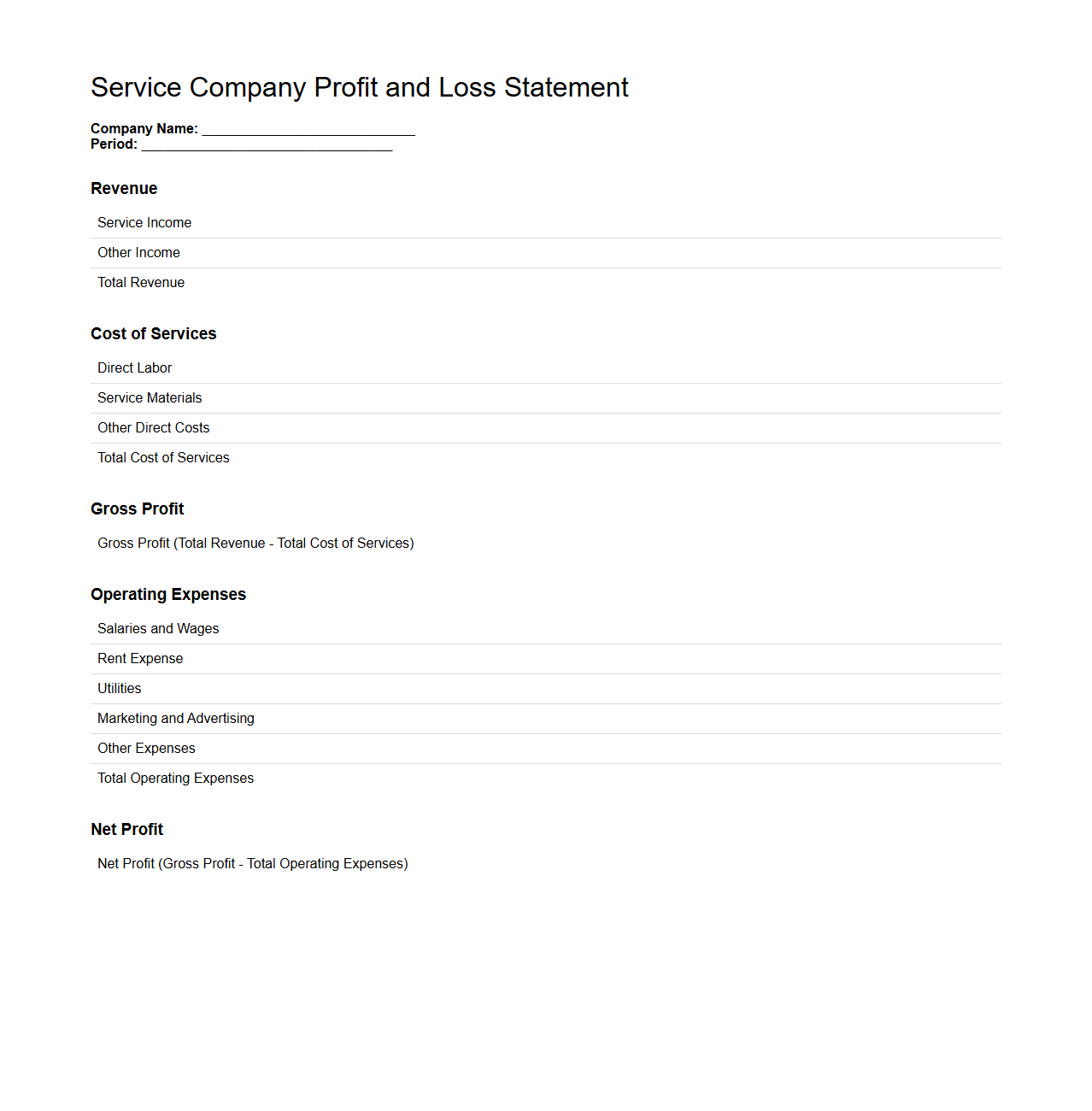

Service Company Profit and Loss Statement Sample

A

Service Company Profit and Loss Statement Sample document provides a detailed overview of a company's revenues, expenses, and net profit during a specific period. It helps businesses track financial performance, identify cost centers, and make informed decisions about budgeting and resource allocation. This sample serves as a practical template for service-based companies to accurately record income and operating costs.

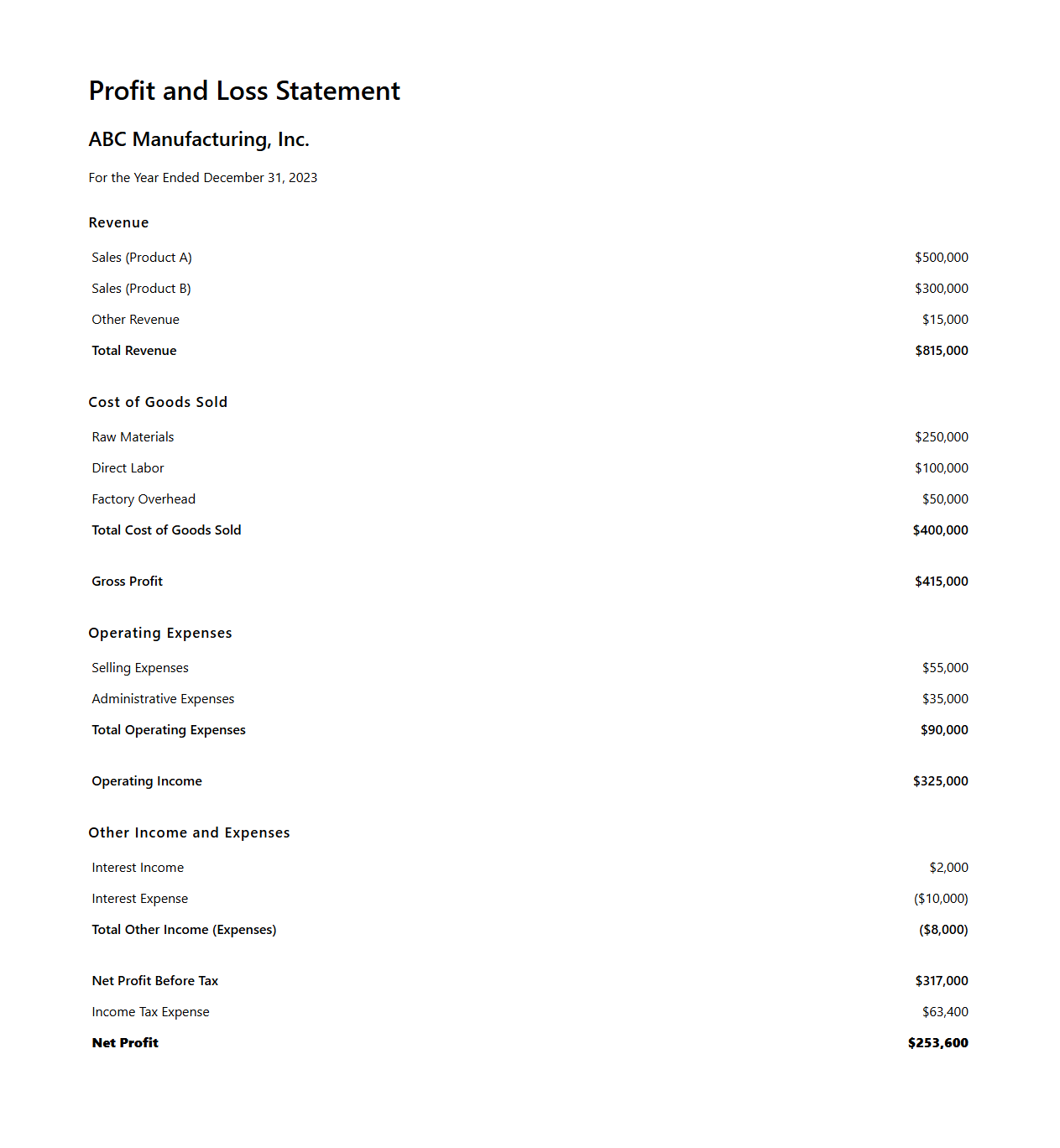

Manufacturing Firm Profit and Loss Statement Example

A

Manufacturing Firm Profit and Loss Statement Example document is a detailed financial report that outlines a manufacturing company's revenues, costs, and expenses over a specific period. It highlights key components such as gross profit, operating expenses, and net income, providing valuable insights into the firm's profitability and operational efficiency. This statement serves as an essential tool for stakeholders to assess financial health and make informed business decisions.

What supporting documents should accompany a Profit and Loss Statement for audit verification?

Supporting documents such as invoice copies and receipts must accompany the Profit and Loss Statement for thorough audit verification. Bank statements and payroll records provide additional evidence to ensure all transactions are accurately reported. These documents collectively establish the authenticity and integrity of the reported financial figures.

How should non-cash expenses be detailed in a Profit and Loss Statement letter?

Non-cash expenses like depreciation and amortization should be explicitly itemized in the Profit and Loss Statement letter. It is essential to explain their impact on net income despite not involving actual cash outflows. This clarification helps auditors and stakeholders better understand the company's financial position.

What is the required frequency for submitting updated P&L statements in compliance audits?

P&L statements are typically required to be submitted on a quarterly basis for compliance audits to ensure timely financial oversight. Some regulatory frameworks may demand more frequent monthly submissions depending on the industry. Regular updates facilitate continuous monitoring and prompt detection of financial discrepancies.

How do you reference preceding financial periods in a formal Profit and Loss Statement cover letter?

Preceding financial periods should be referenced by clearly stating the comparable prior period dates in the cover letter. This comparison provides context and highlights trends in financial performance over time. Including a brief narrative on changes helps reviewers interpret the financial results better.

What key ratios should be highlighted within the Profit and Loss Statement for stakeholder review?

Important ratios such as gross profit margin, net profit margin, and operating expense ratio should be emphasized for stakeholder analysis. These ratios offer insights into profitability, operational efficiency, and cost management. Highlighting these metrics aids stakeholders in making informed business decisions.