A Budget Planning Document Sample for Nonprofit Organizations provides a structured template to outline expected revenues and expenses, ensuring efficient allocation of resources. This document helps nonprofits maintain financial transparency and track funding sources, enabling better decision-making. Utilizing a well-organized budget plan supports sustainability and accountability in nonprofit operations.

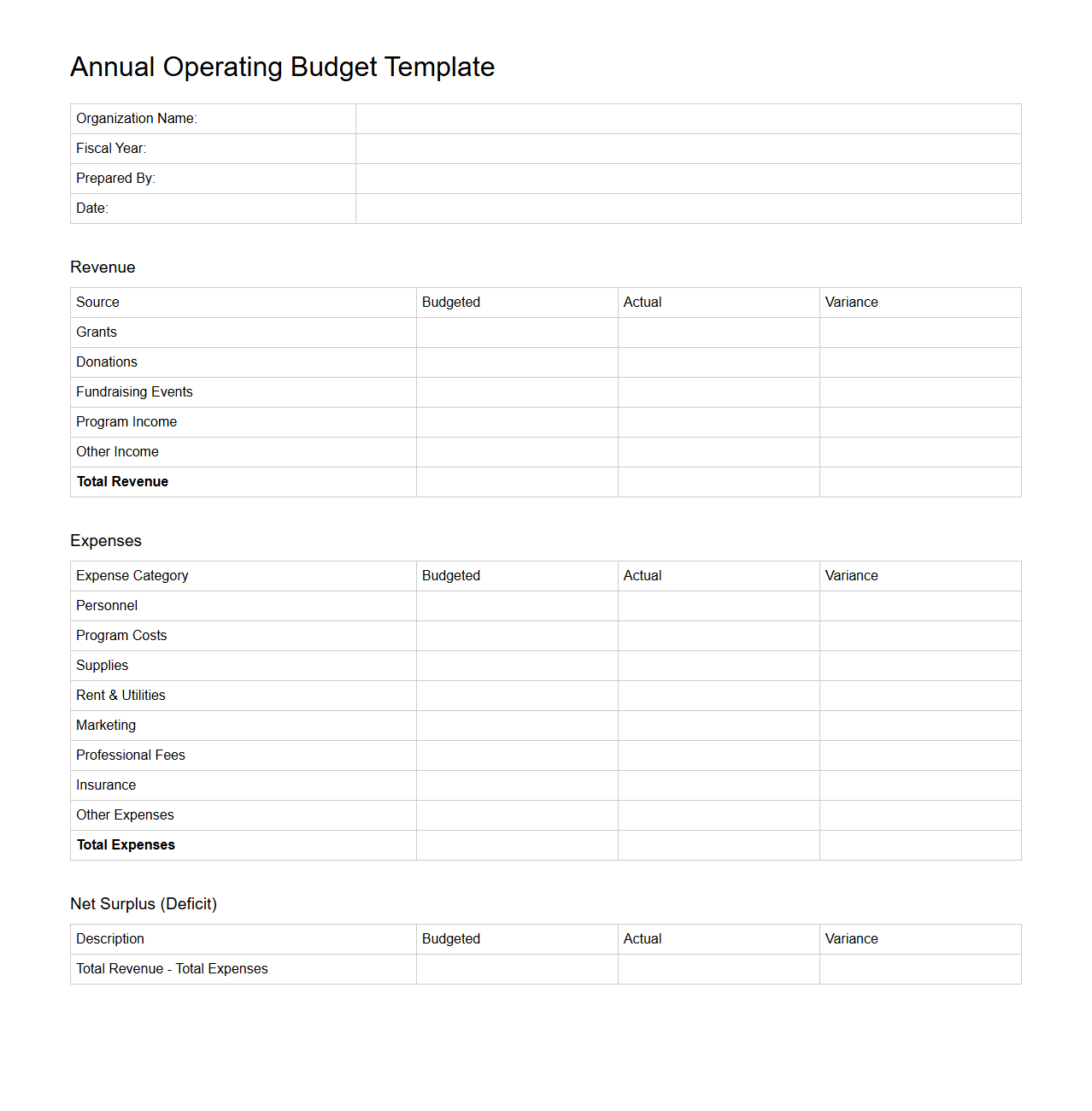

Annual Operating Budget Template for Nonprofit Organizations

An

Annual Operating Budget Template for Nonprofit Organizations is a structured financial plan that outlines projected revenues and expenses for the upcoming fiscal year, specifically tailored to the unique funding sources and expenditure categories of nonprofit entities. This document facilitates strategic allocation of resources, monitors program costs, and ensures transparency and accountability to stakeholders and donors. By providing a clear framework for budgeting, it helps nonprofit organizations maintain financial stability and effectively support their mission-driven activities.

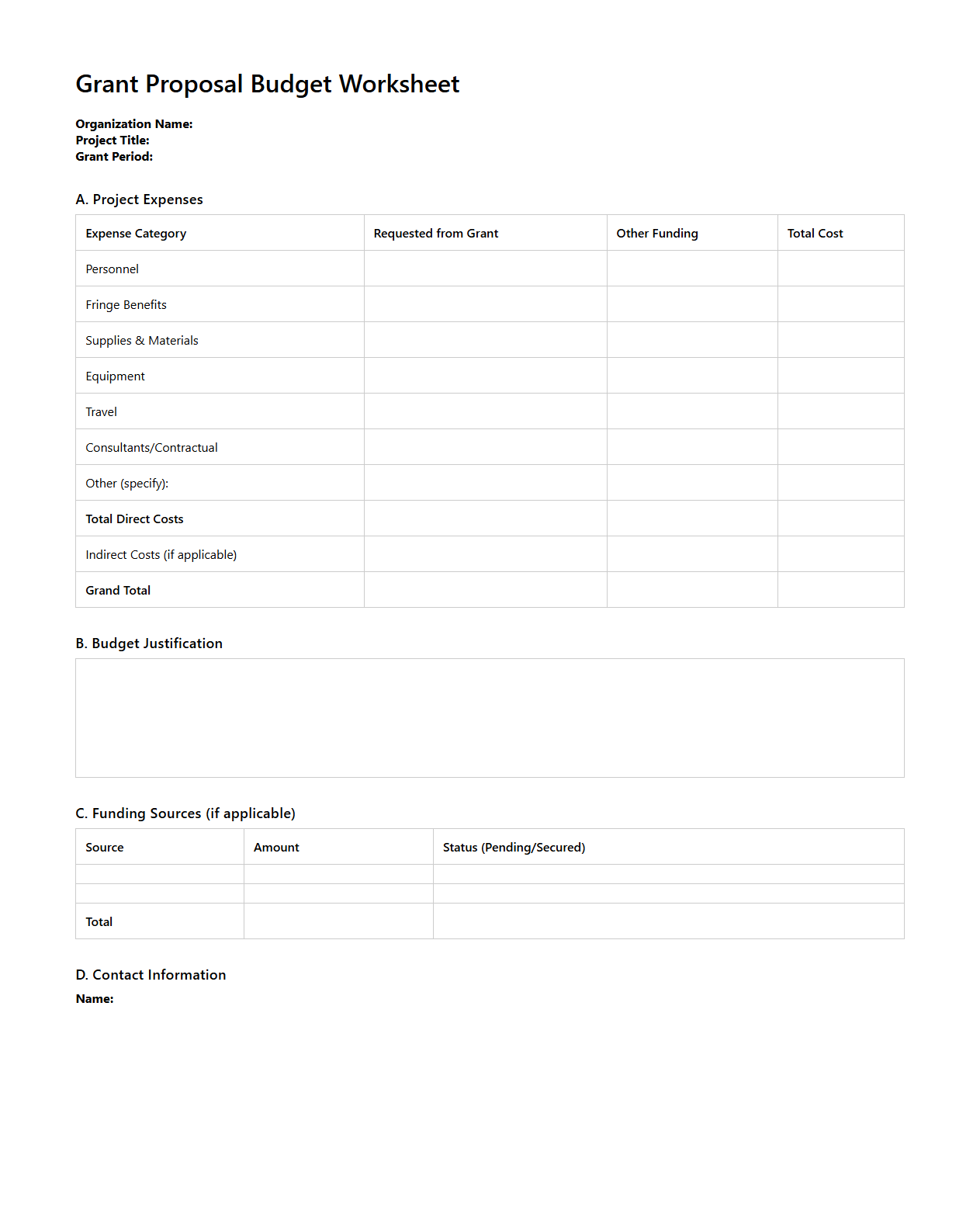

Grant Proposal Budget Worksheet for Nonprofits

The

Grant Proposal Budget Worksheet for nonprofits is a detailed financial plan that outlines the projected expenses and revenues associated with a grant-funded project. It helps organizations itemize costs such as personnel, equipment, supplies, and indirect expenses to ensure transparent and accurate budgeting. This document is essential for demonstrating fiscal responsibility and securing funding approval from grantmakers.

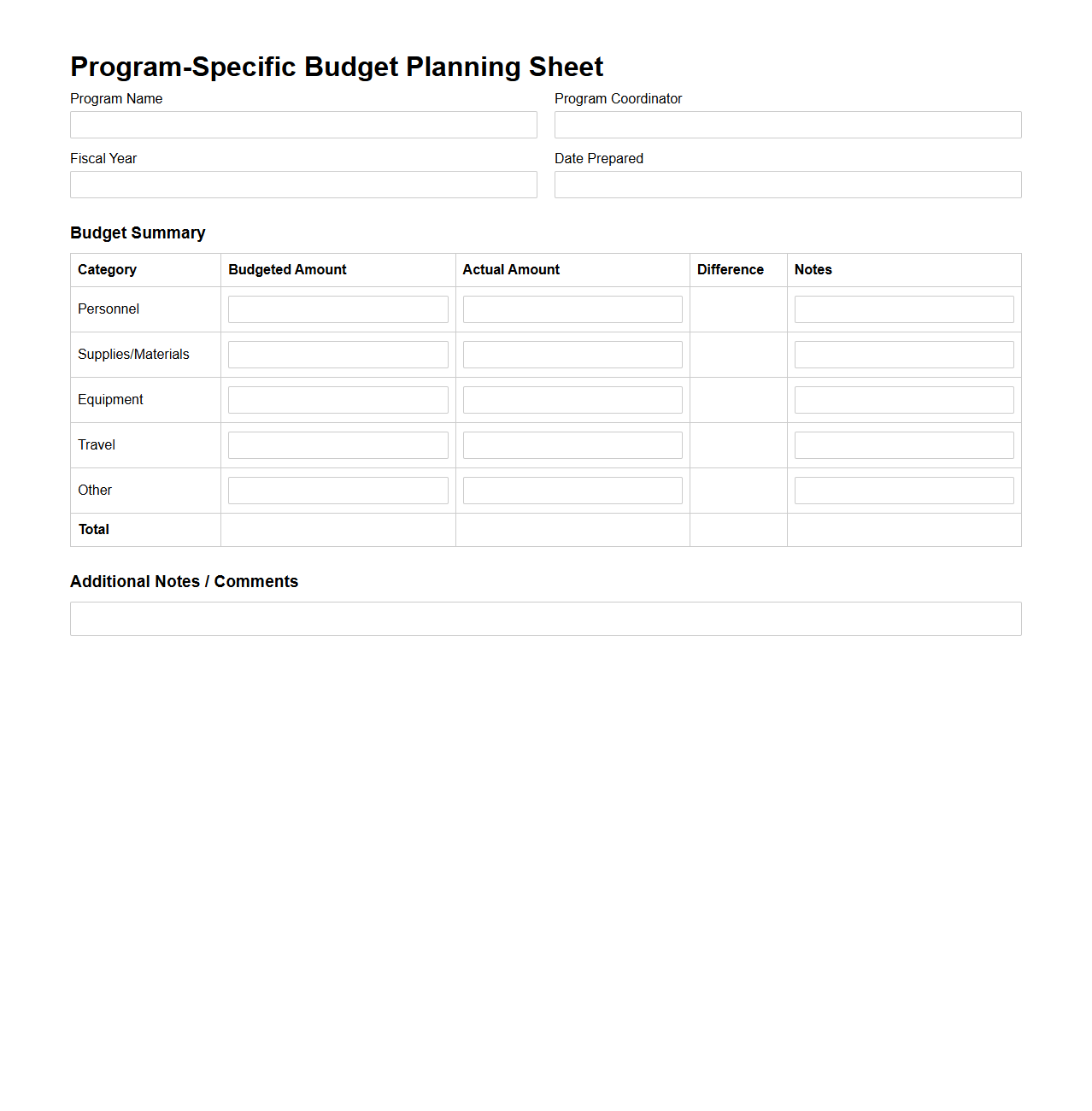

Program-Specific Budget Planning Sheet

A

Program-Specific Budget Planning Sheet is a detailed financial document that outlines projected expenses and revenues for a particular program or project. It helps organizations allocate resources efficiently by itemizing budget categories such as personnel, materials, and overhead costs. This sheet ensures accurate tracking and management of funds to support program goals and fiscal accountability.

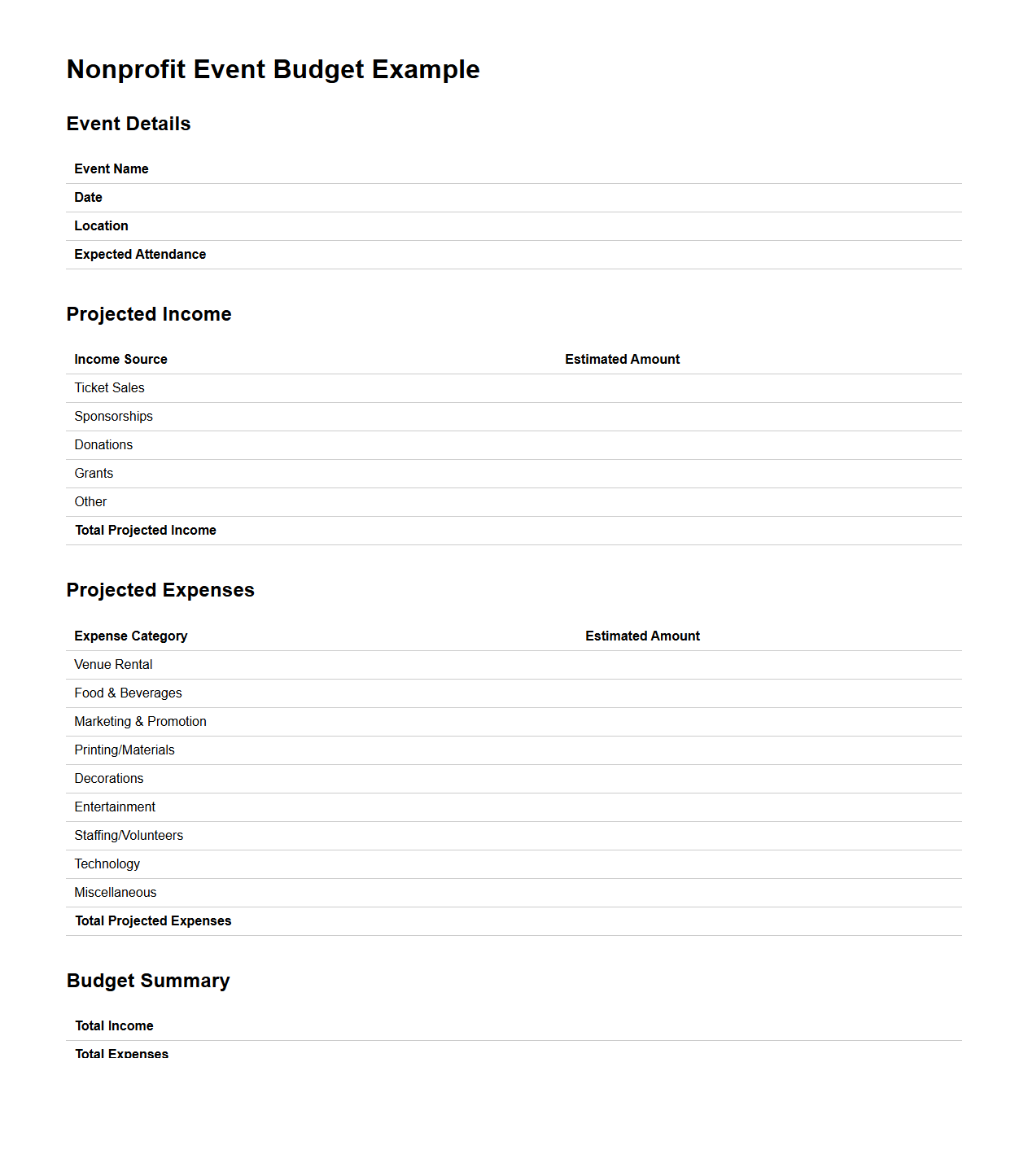

Nonprofit Event Budget Example

A

Nonprofit Event Budget Example document outlines anticipated income and expenses for fundraising or community events organized by nonprofit organizations. This template includes categories like venue costs, marketing expenses, volunteer staffing, and sponsorships to help plan and manage financial resources effectively. Using this example aids in maximizing impact while ensuring transparency and accountability in event financial management.

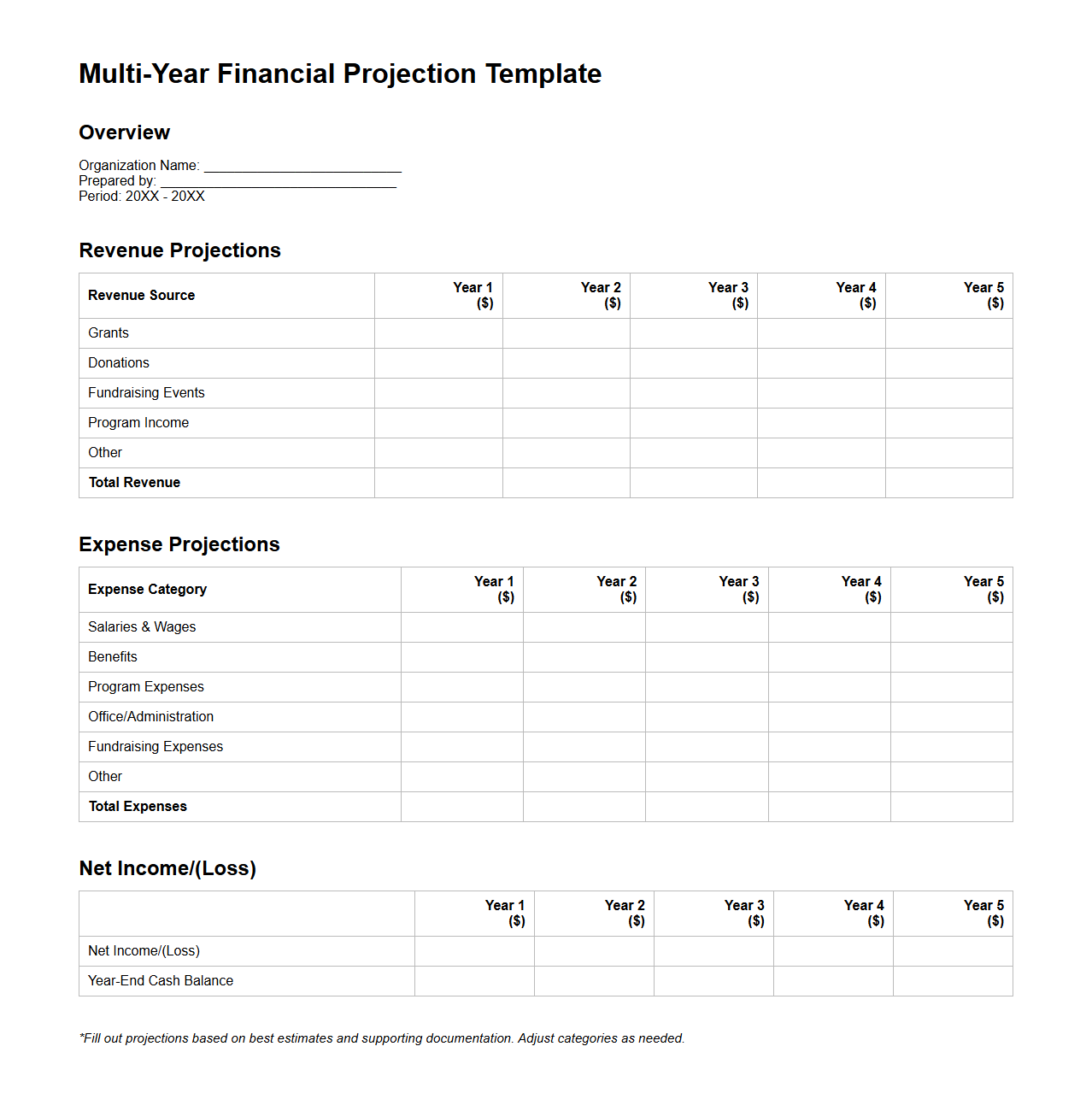

Multi-Year Financial Projection Template for Nonprofits

A

Multi-Year Financial Projection Template for Nonprofits is a strategic planning tool designed to forecast an organization's financial performance over several years, typically three to five. This document helps nonprofit leaders estimate future revenues, expenses, cash flow, and funding needs based on historical data and anticipated program growth. It supports informed decision-making by providing a clear financial roadmap to ensure sustainable operations and effective resource allocation.

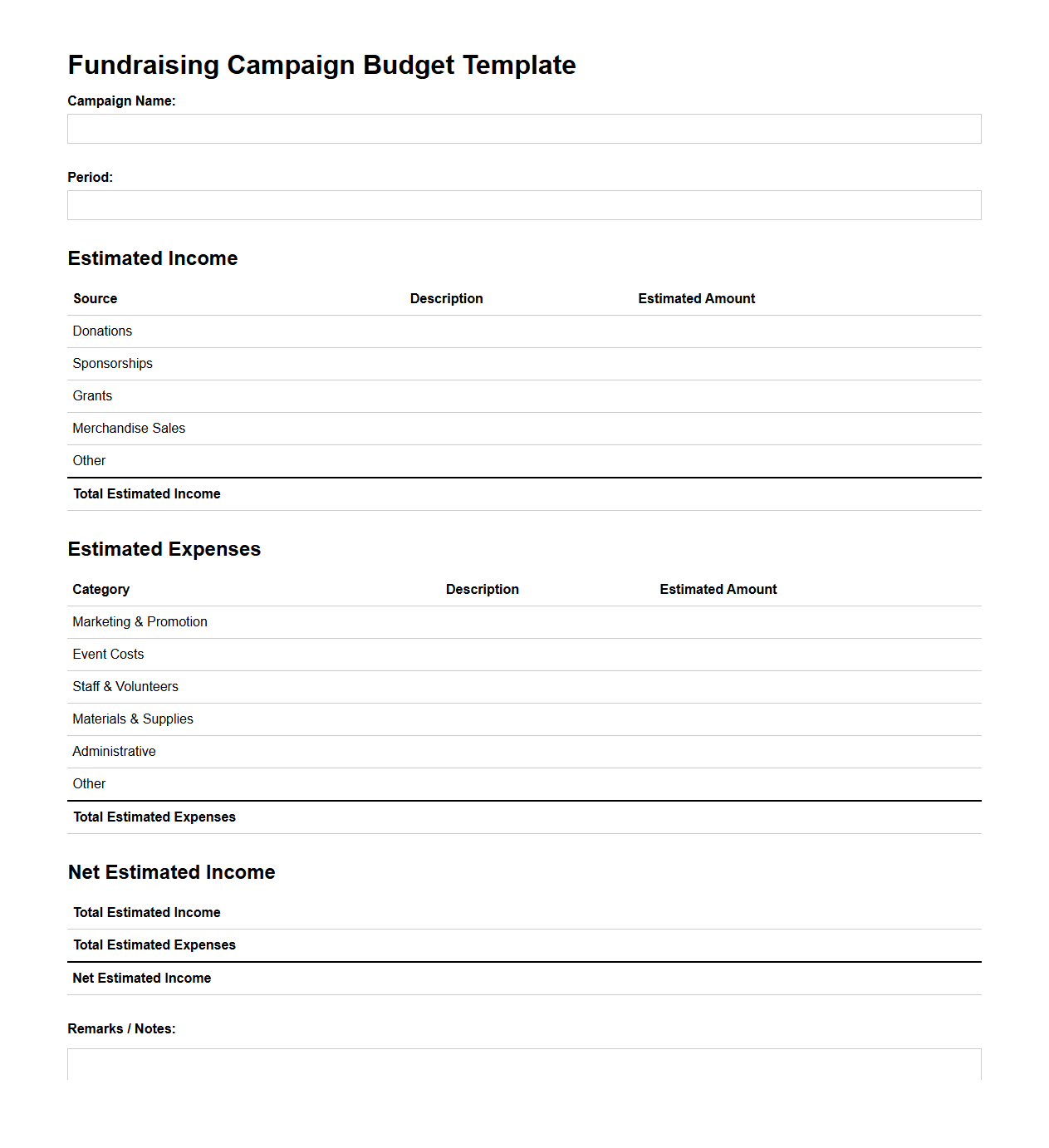

Fundraising Campaign Budget Template

A

Fundraising Campaign Budget Template document is a structured financial planning tool designed to outline and track all projected income and expenses for a fundraising initiative. It helps organizations allocate resources efficiently, monitor fundraising progress, and ensure transparency in financial management. This template typically includes categories such as event costs, marketing expenses, donation targets, and administrative fees to provide a comprehensive overview of the campaign's financial health.

Departmental Budget Allocation Spreadsheet for Nonprofits

The

Departmental Budget Allocation Spreadsheet for Nonprofits is a detailed financial tool designed to help organizations strategically distribute funds across various departments. It enables clear tracking of income sources, projected expenses, and allocated budgets, ensuring alignment with organizational goals and compliance with grant requirements. This spreadsheet enhances transparency, facilitates data-driven decision-making, and supports effective resource management within nonprofit entities.

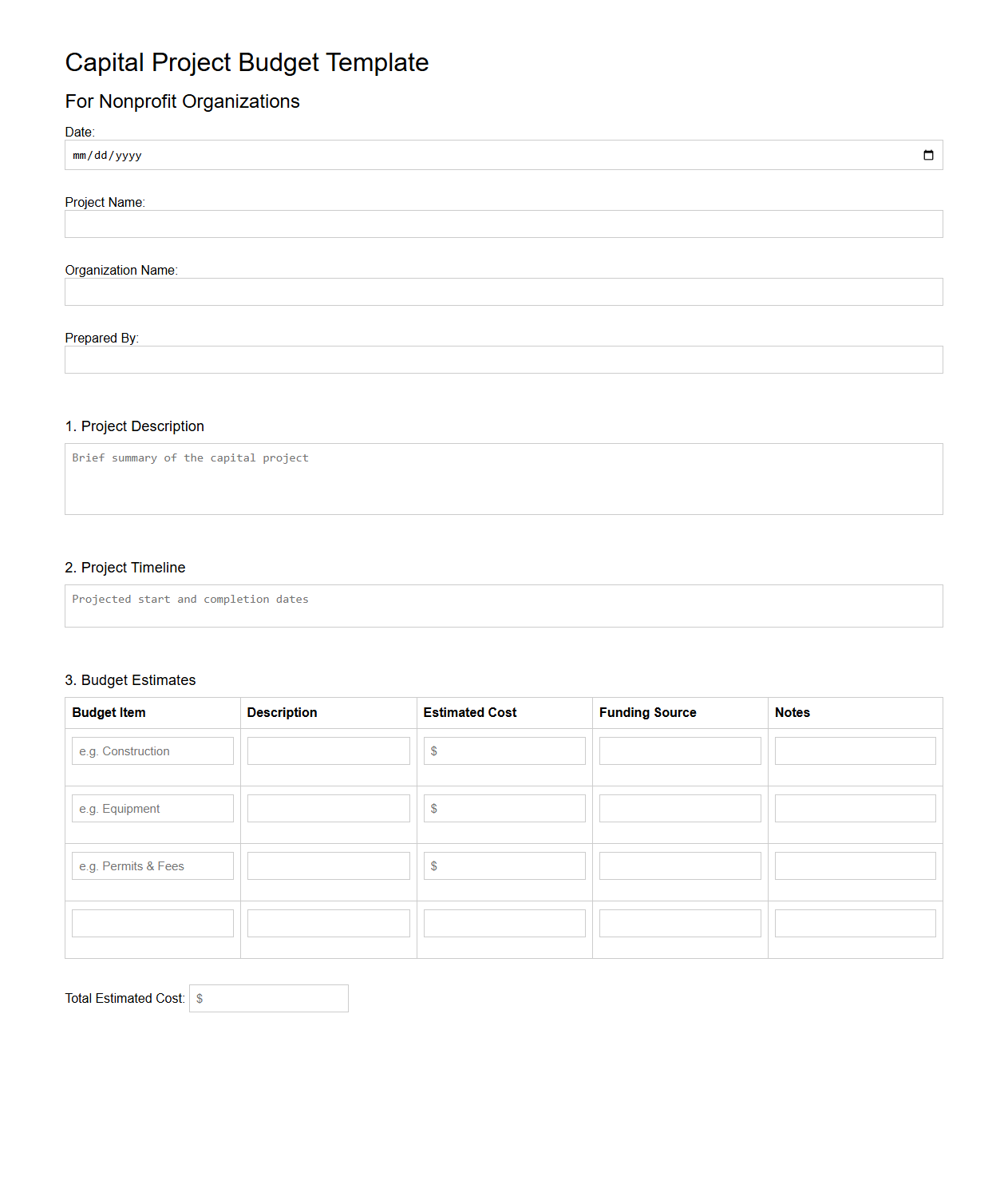

Capital Project Budget Template for Nonprofit Organizations

The

Capital Project Budget Template for nonprofit organizations is a comprehensive financial planning tool designed to outline and manage all costs associated with large-scale projects, such as facility renovations or new constructions. It enables nonprofits to accurately forecast expenses, allocate funds, and track spending against projected budgets, ensuring transparency and accountability to stakeholders and donors. This template typically includes categories for materials, labor, permits, and contingency funds, facilitating efficient resource management throughout the project lifecycle.

Expense Tracking Form for Nonprofit Budget Management

An

Expense Tracking Form for Nonprofit Budget Management is a structured document used to systematically record and monitor all expenditures related to nonprofit activities. This form helps ensure financial transparency, accountability, and accurate budgeting by providing detailed information on costs, dates, vendors, and expense categories. It supports effective financial oversight, enabling nonprofits to adhere to budgets and optimize fund allocation.

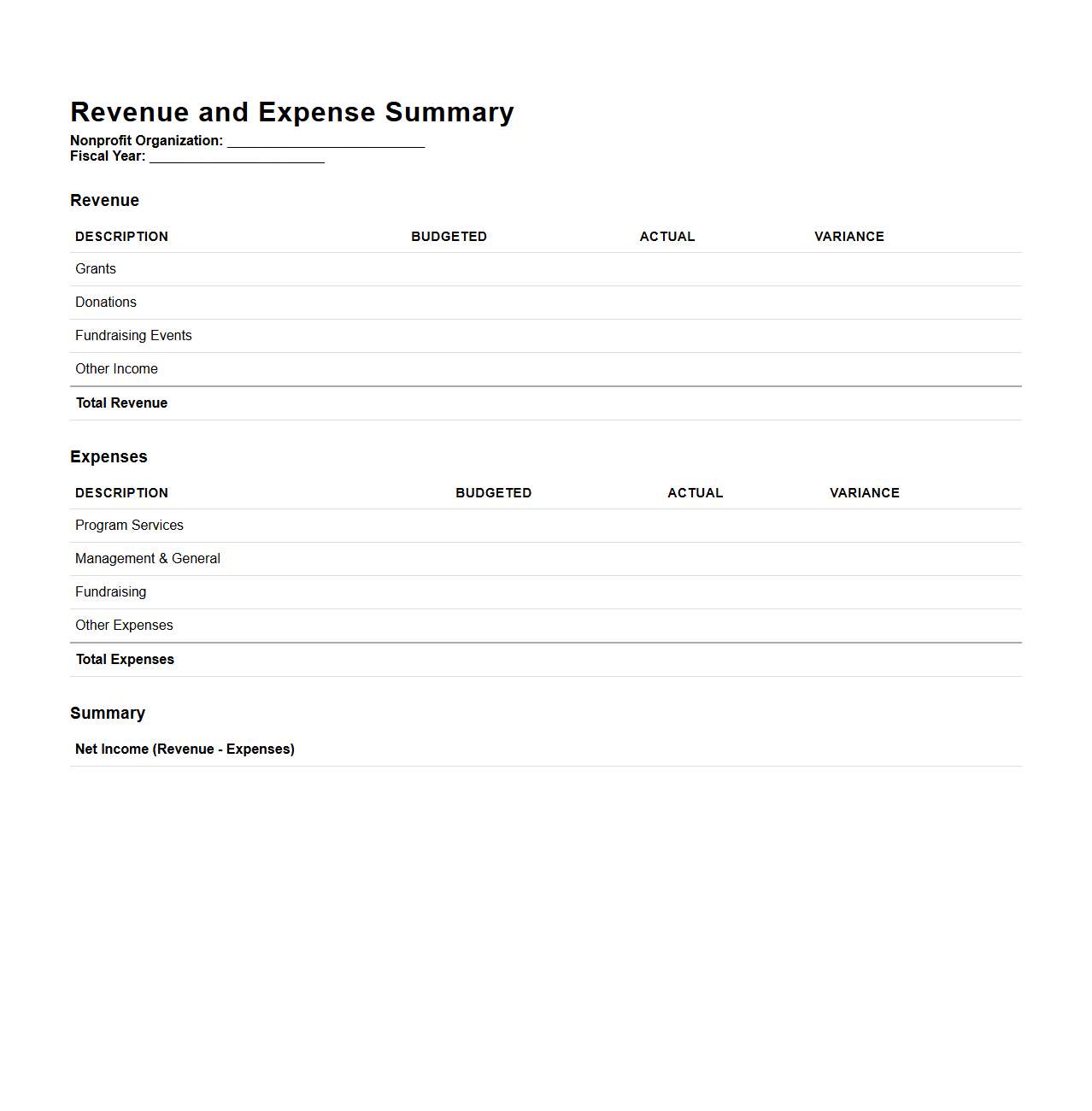

Revenue and Expense Summary Template for Nonprofit Boards

Revenue and Expense Summary Template for Nonprofit Boards is a structured document designed to provide clear financial insights by summarizing income and expenditure data. It helps nonprofit board members monitor budget performance, ensure transparency, and make informed decisions about resource allocation. This template typically includes categorized revenue streams, expense items, and variance analysis for effective financial oversight.

What key metrics should be included in a nonprofit's budget planning document for grant compliance?

Including revenue streams and expense categories is crucial for accurate budget planning. Metrics like grant allocation, program costs, and administrative expenses must be tracked for compliance. Additionally, monitoring cash flow timing ensures funds are used according to grant restrictions.

How can future restricted and unrestricted funding be anticipated in the budget letter?

Clearly forecasting restricted and unrestricted funds helps identify funding gaps and ensure effective resource allocation. The budget letter should differentiate between committed funds and projected income. Providing timelines for expected grant awards and donations improves financial planning.

What documentation supports budget variance explanations to nonprofit boards?

Variance explanations are strengthened by including monthly financial reports and detailed expense tracking. Supporting documents such as invoices, grant correspondence, and updated cash flow statements provide context. This transparency builds board trust and enhances financial oversight.

How should in-kind contributions be detailed within the budget planning narrative?

In-kind contributions must be quantified with fair market values to reflect true resource availability. The budget narrative should describe the nature and source of these non-cash donations clearly. Including these values highlights community support and operational capacity to funders.

What level of program vs. administrative cost breakdown is optimal for donor transparency?

An optimal breakdown allocates at least 70% of expenses to programs and under 30% to administration and fundraising. This ratio reassures donors of efficient resource use toward mission impact. Transparent reporting of these metrics fosters donor confidence and encourages ongoing support.