A Tax Return Document Sample for Corporations illustrates the essential sections and information required for corporate tax filing, including income statements, deductions, and credits. This sample helps businesses ensure compliance with tax regulations and accurate reporting of financial data to the IRS. Reviewing a well-structured example streamlines the preparation process, reducing errors and audit risks.

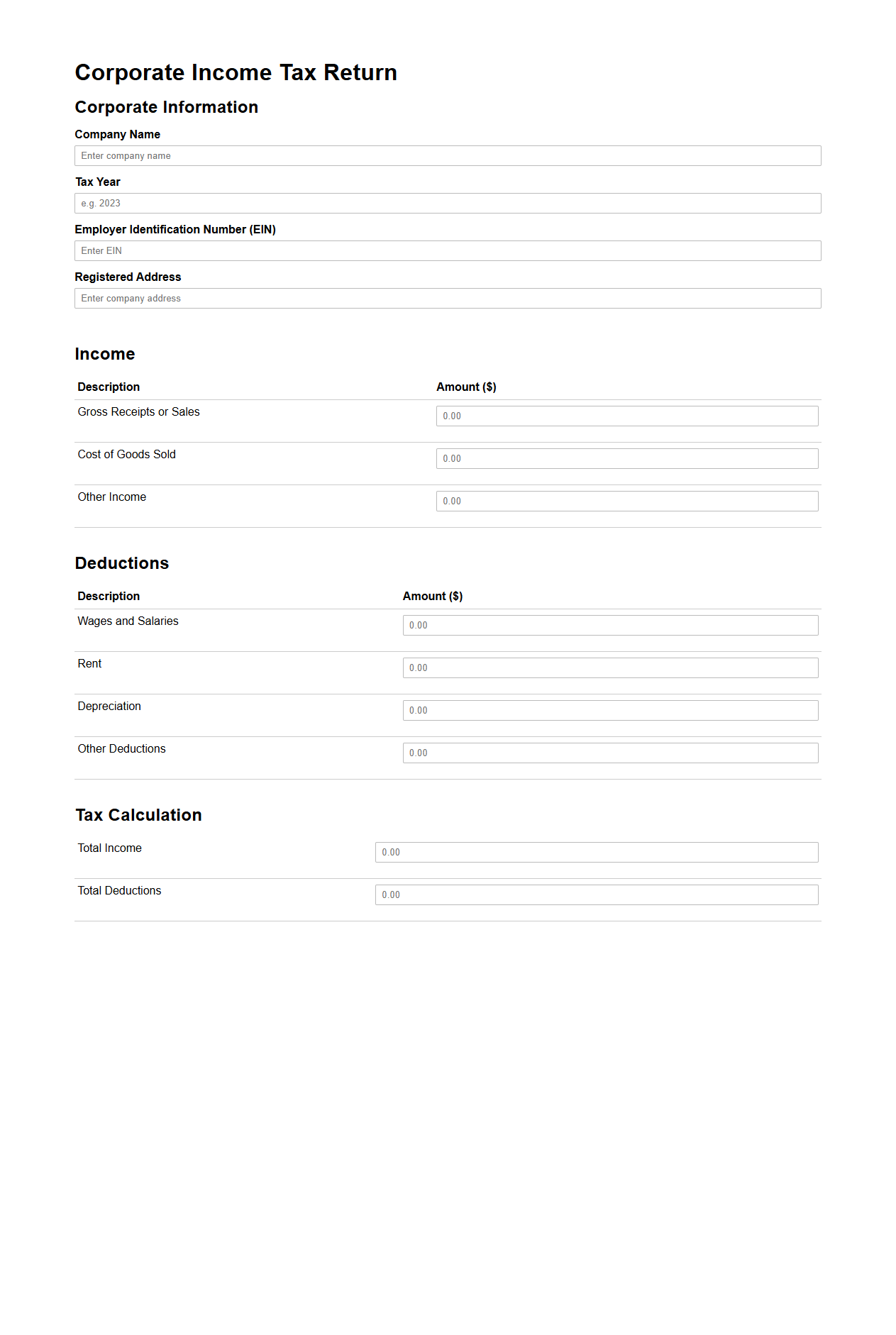

Corporate Income Tax Return Sample Template

A

Corporate Income Tax Return Sample Template document provides a structured format for businesses to accurately report their taxable income, deductions, and credits to tax authorities. It includes essential sections such as income details, allowable expenses, tax computations, and payment information, ensuring compliance with regulatory requirements. Utilizing this template helps streamline the tax filing process, reduce errors, and maintain organized financial records.

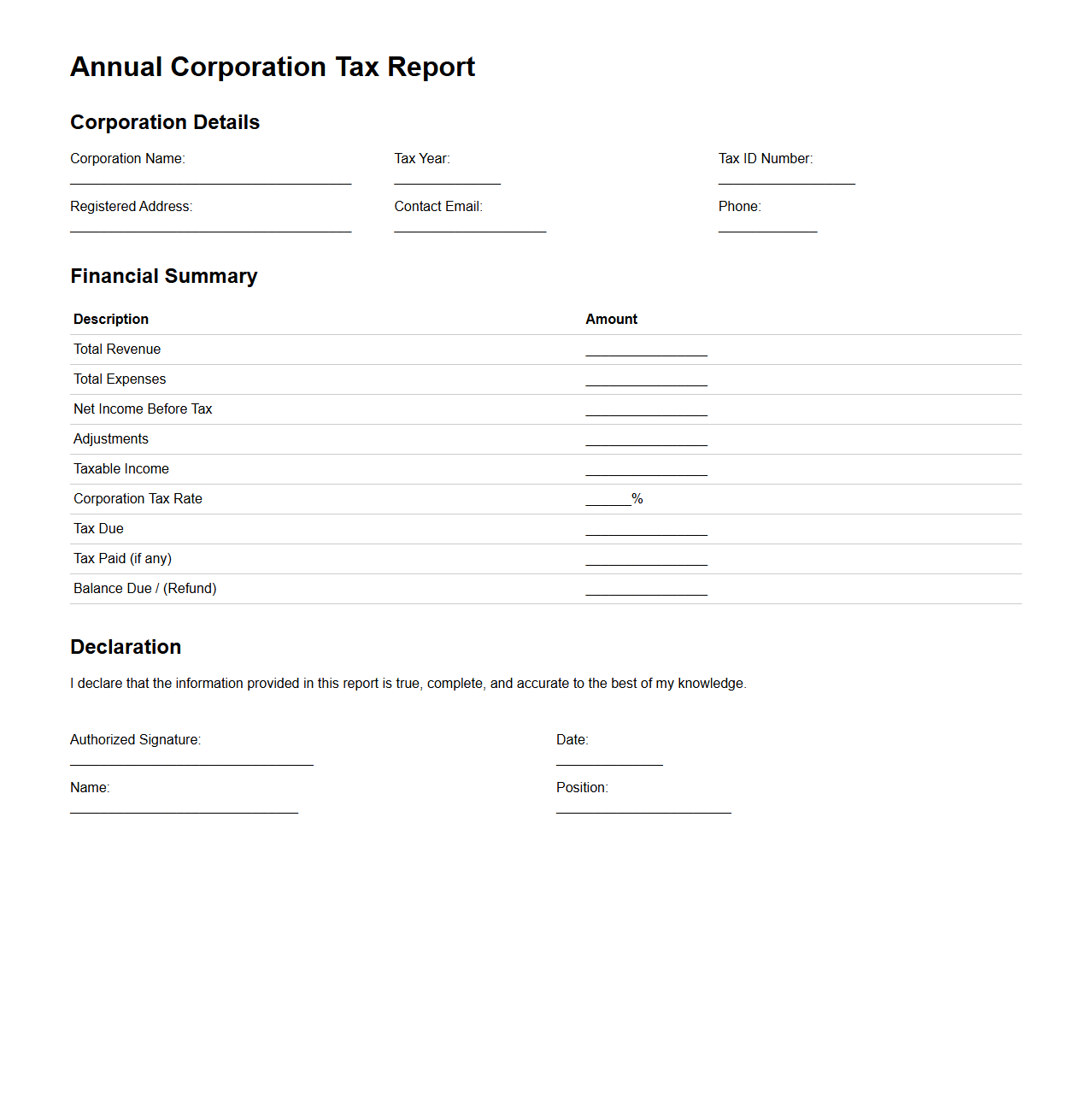

Annual Corporation Tax Report Example

An

Annual Corporation Tax Report Example document illustrates how a company's taxable income, deductions, and tax liabilities are calculated for a fiscal year. It provides a standardized format that shows key sections such as revenue, allowable expenses, tax adjustments, and the final corporation tax payable. This example aids businesses and accountants in understanding compliance requirements and ensures accurate tax return preparation.

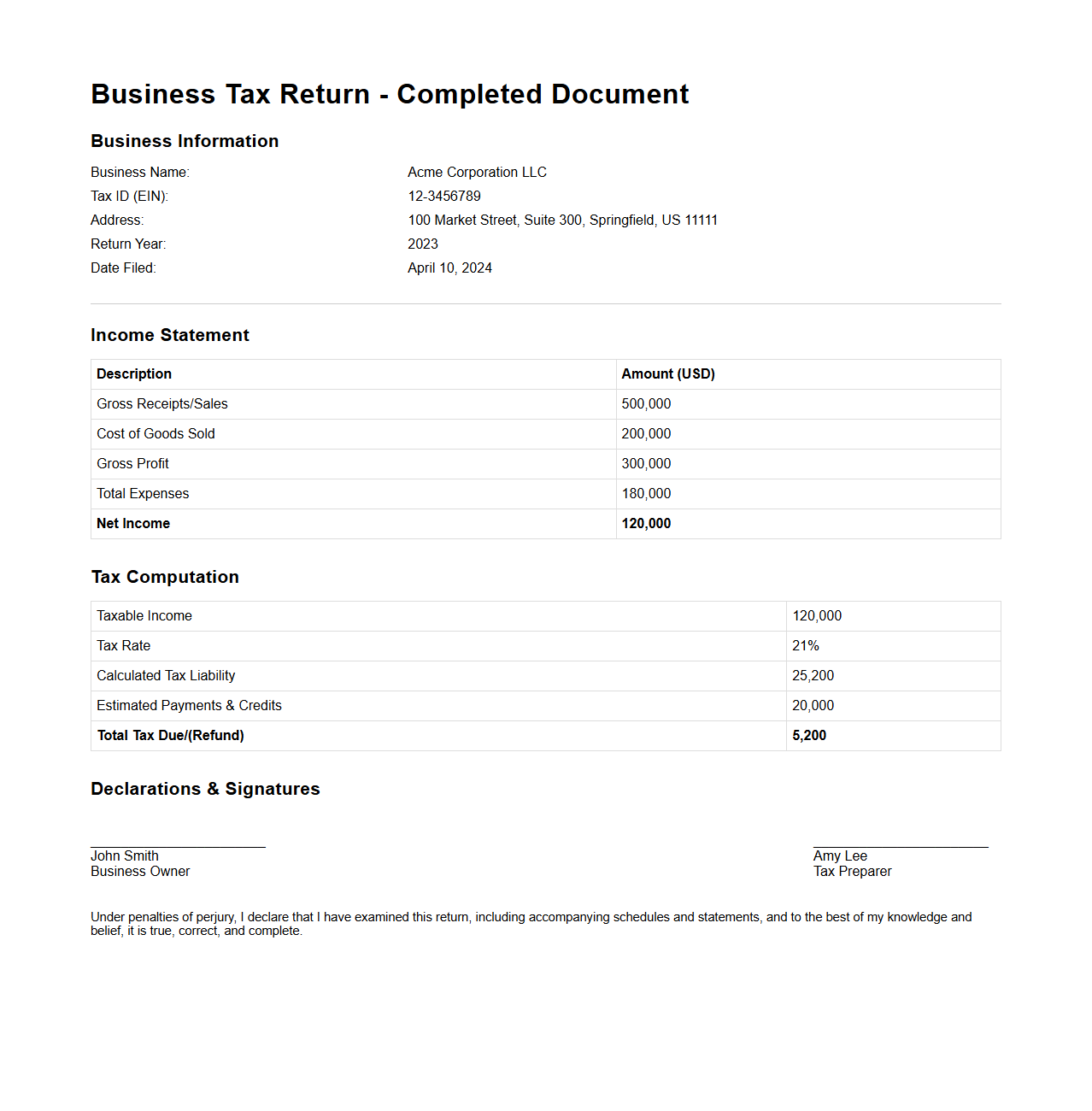

Completed Business Tax Return Document

A

Completed Business Tax Return Document is a finalized form submitted to tax authorities detailing a company's income, expenses, and tax obligations for a specific fiscal year. This document includes all necessary schedules, receipts, and supporting financial statements to ensure accurate tax assessment. Proper filing of this document is essential for compliance with government regulations and to avoid penalties.

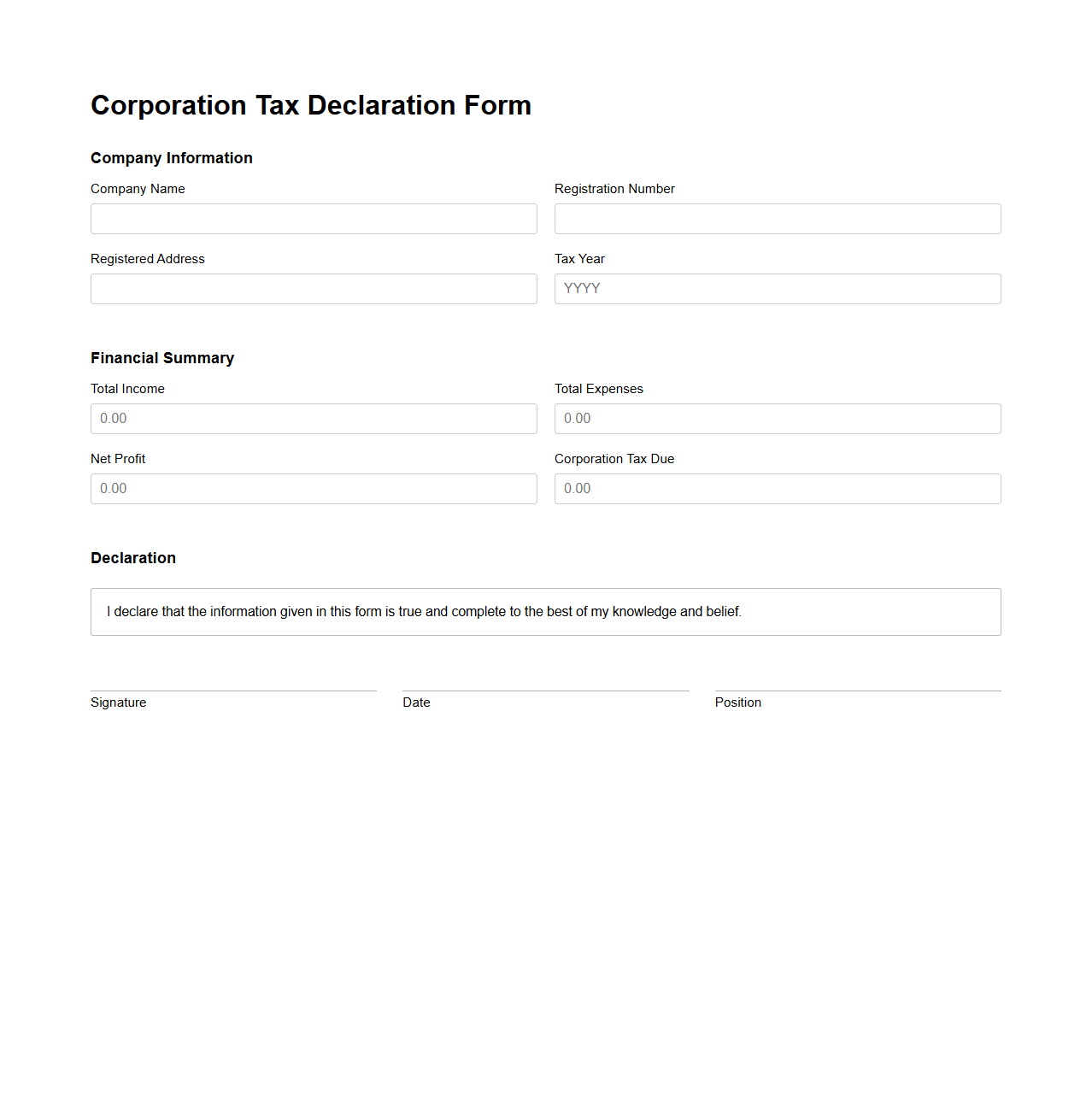

Corporation Tax Declaration Form Sample

Corporation Tax Declaration Form Sample documents provide a structured template for companies to report their taxable income and calculate their corporation tax liability accurately. These forms typically include sections for declaring income, allowable expenses, tax reliefs, and credits, ensuring compliance with tax regulations. Using a

Corporation Tax Declaration Form sample helps businesses prepare their filings efficiently and avoid errors during submission.

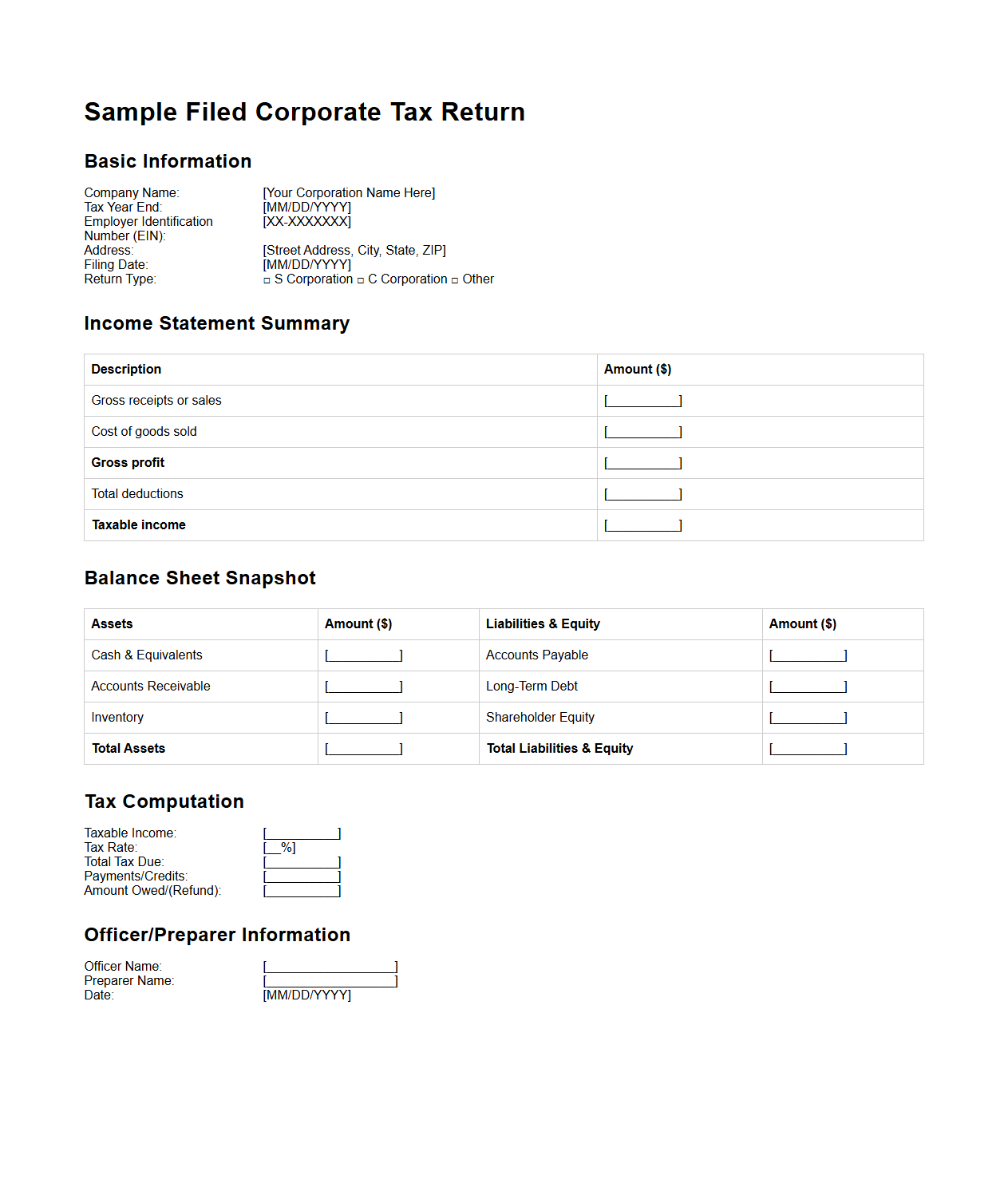

Sample Filed Corporate Tax Return

A

Sample Filed Corporate Tax Return document serves as a detailed example of the tax filing submitted by a corporation to tax authorities, demonstrating compliance with tax regulations. It includes financial statements, income details, deductions, credits, and tax calculations, providing a clear reference for preparing accurate corporate tax returns. This sample aids accountants, auditors, and business owners in understanding the required information and format for official tax submissions.

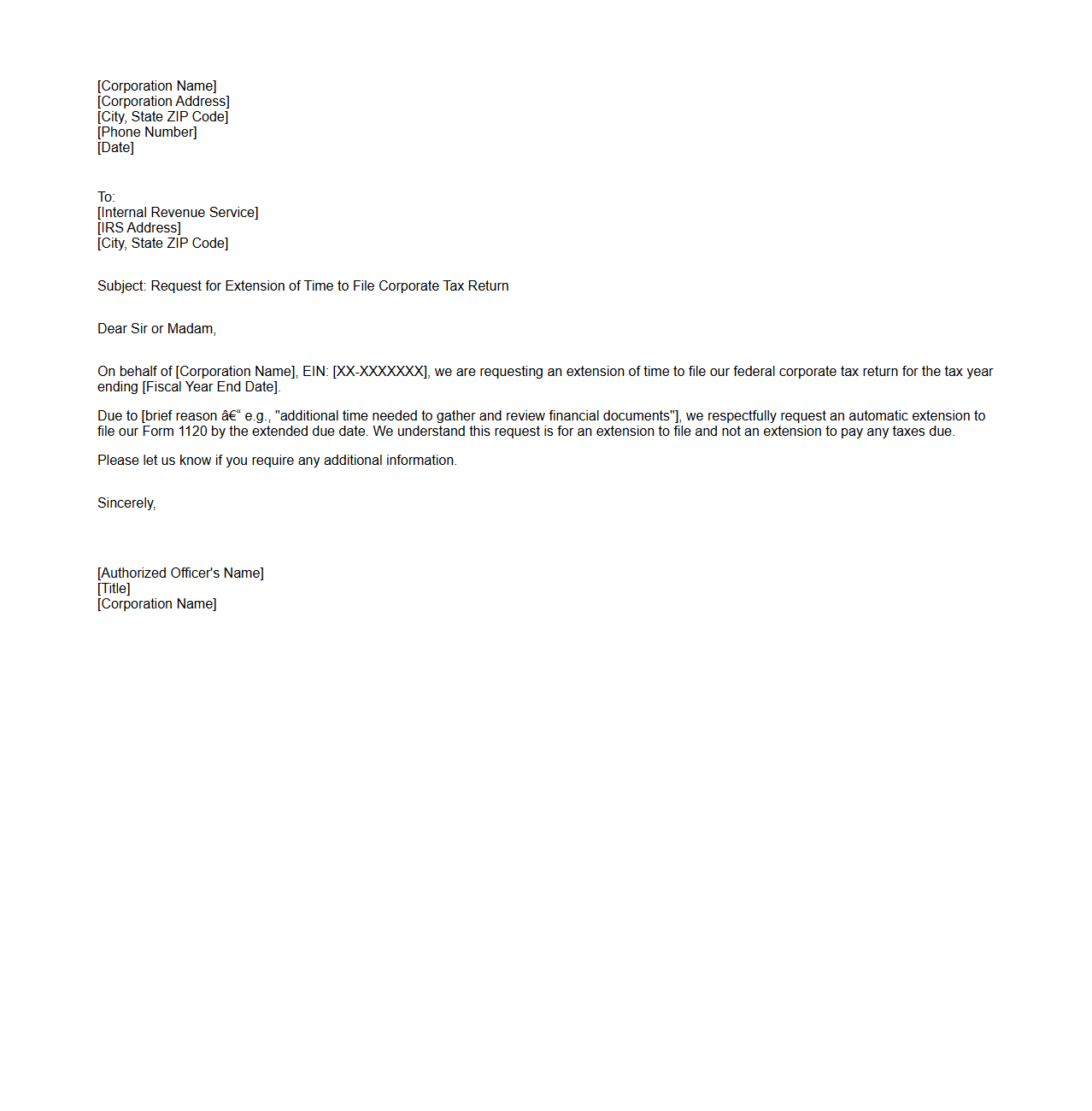

Tax Extension Request Letter for Corporations

A

Tax Extension Request Letter for Corporations is a formal document submitted to the IRS or relevant tax authority to request additional time to file corporate tax returns beyond the original deadline. This letter must include essential details such as the corporation's name, tax identification number, reason for extension, and the estimated tax liability. Filing this request on time helps avoid late-filing penalties while allowing the corporation more time to prepare accurate financial statements and tax documentation.

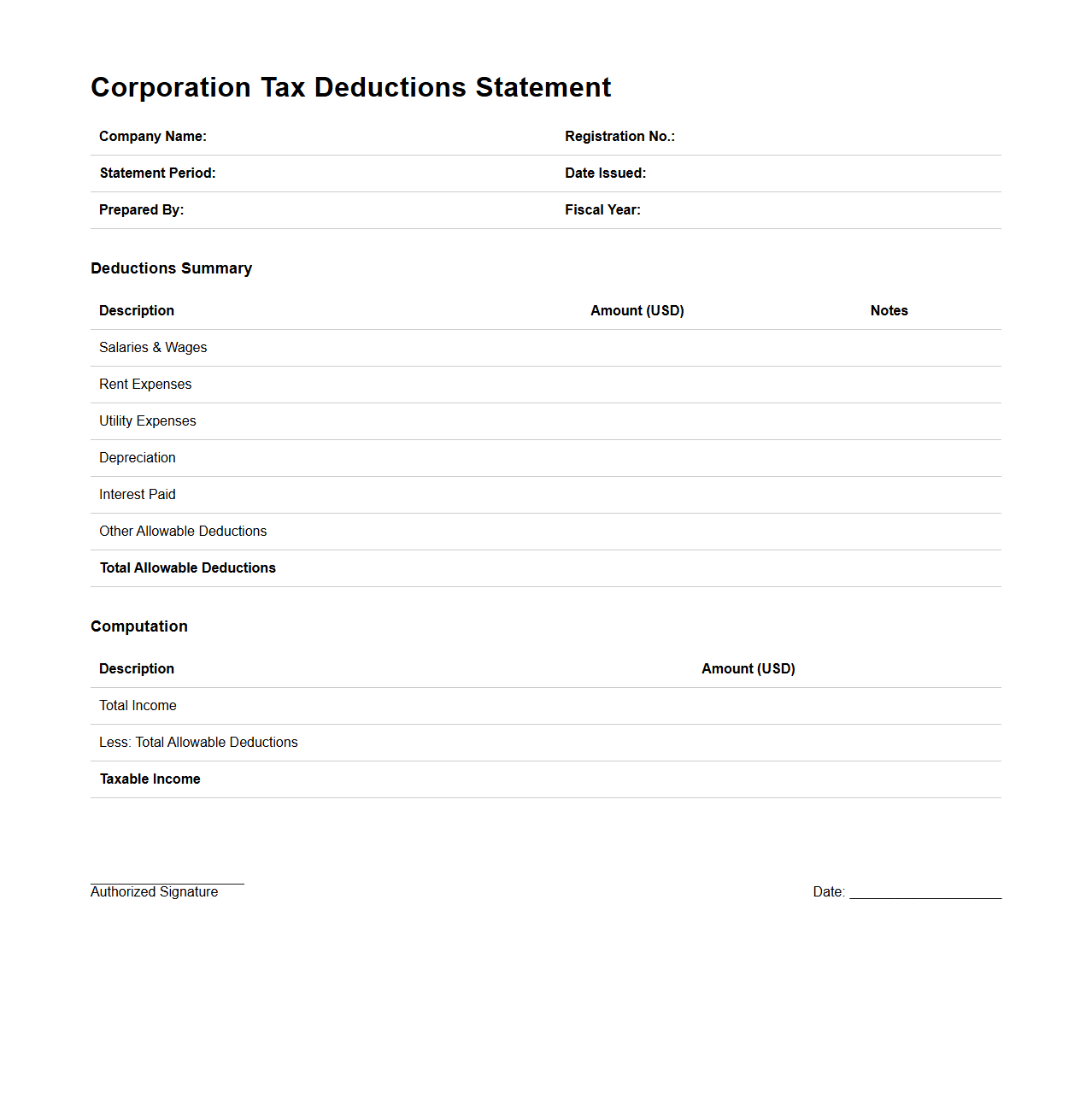

Corporation Tax Deductions Statement Sample

A

Corporation Tax Deductions Statement Sample document outlines the specific tax deductions a corporation can claim to reduce its taxable income. This statement typically includes detailed entries such as allowable expenses, capital allowances, and other deductible costs recognized by tax authorities. It serves as a crucial reference for businesses during tax filing to ensure compliance and optimize tax liability.

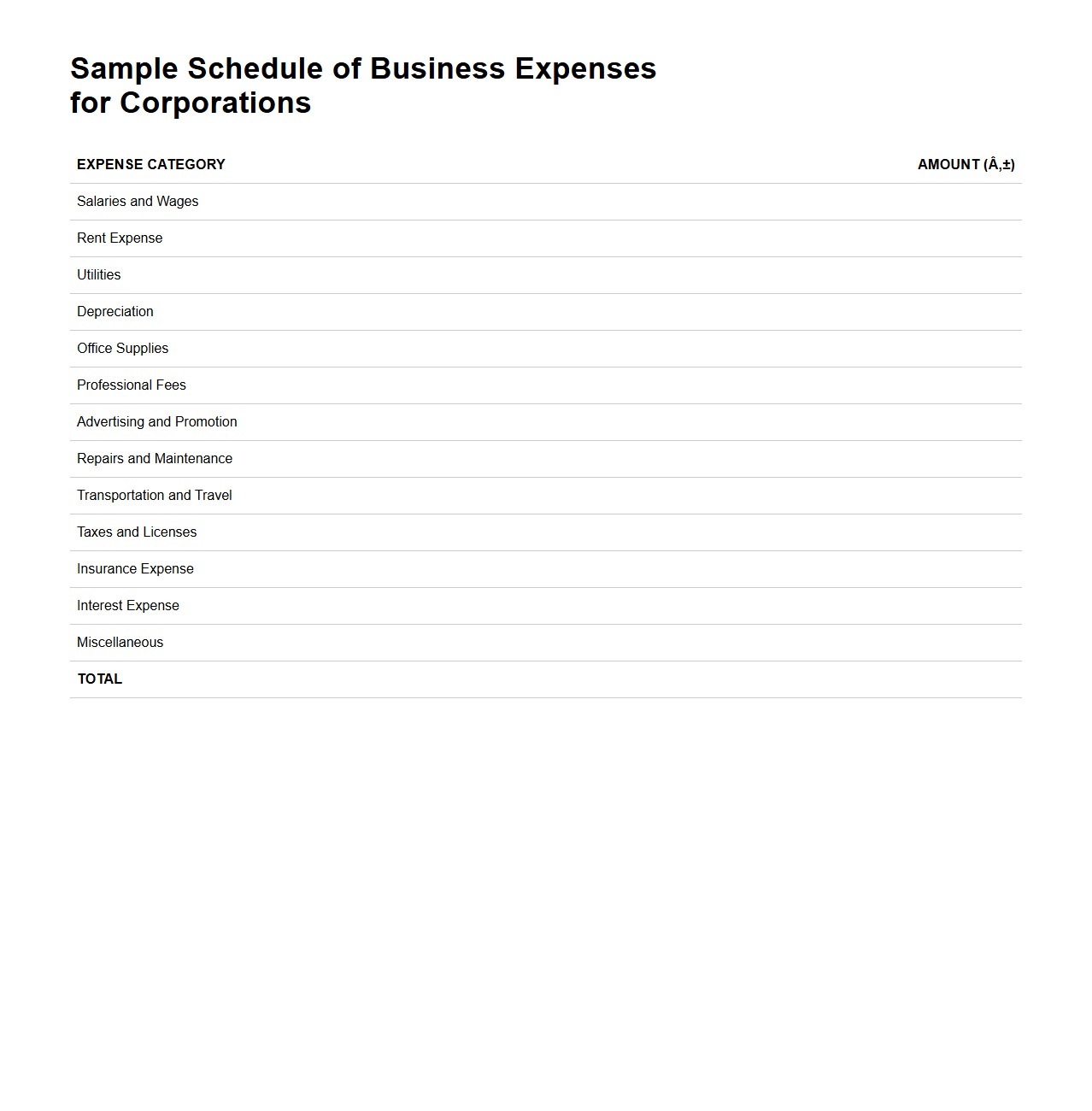

Sample Schedule of Business Expenses for Corporations

A

Sample Schedule of Business Expenses for Corporations document provides a detailed template outlining common expense categories and associated costs incurred by corporations during operations. It serves as a practical tool for organizing, tracking, and categorizing business expenditures such as salaries, office supplies, travel, and marketing expenses. This schedule aids in accurate financial reporting, budgeting, and tax preparation by ensuring all relevant expenses are systematically documented.

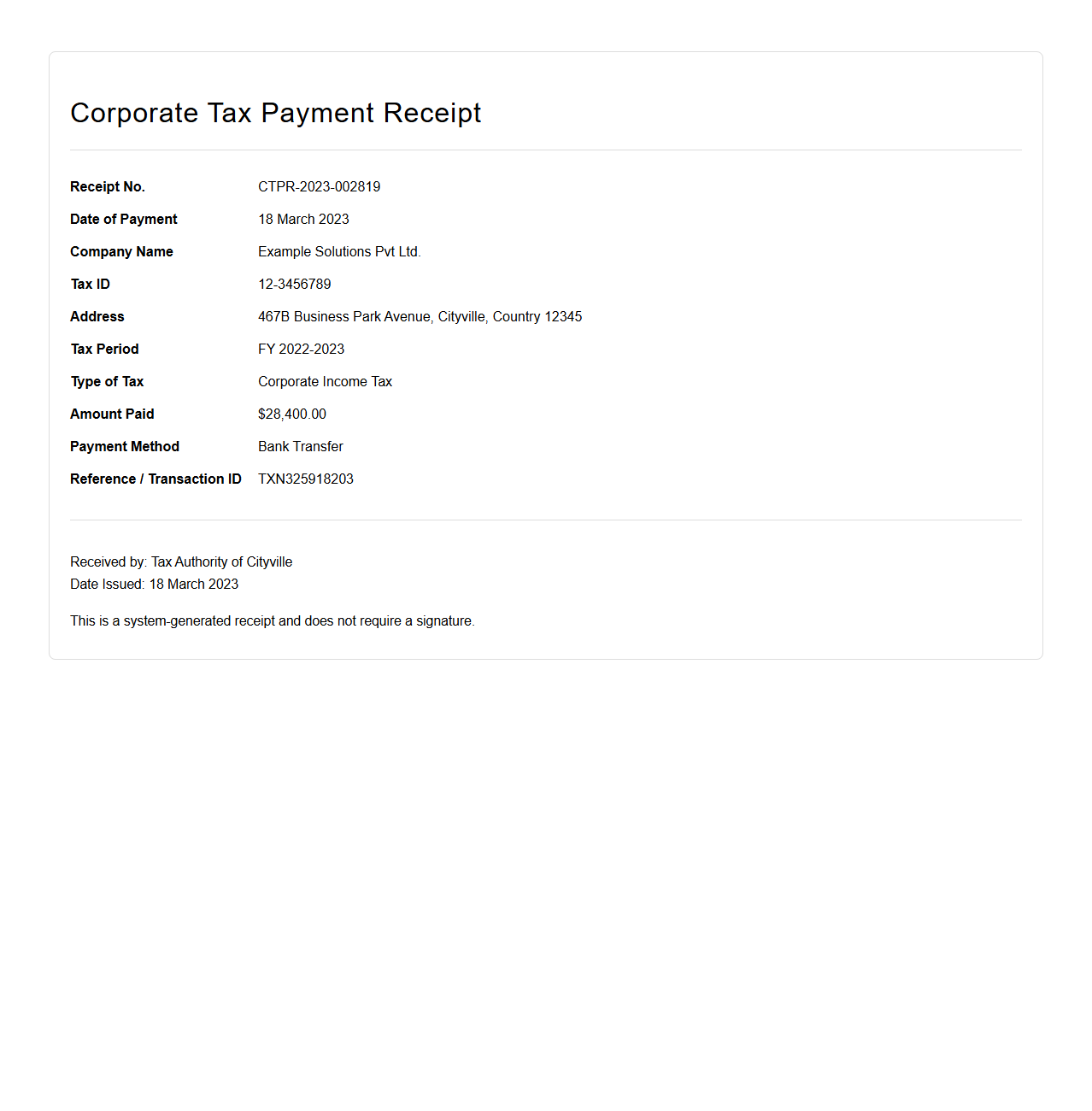

Corporate Tax Payment Receipt Example

A

Corporate Tax Payment Receipt is an official document issued by tax authorities confirming that a company has paid its required corporate taxes for a specific period. This receipt includes essential details such as the taxpayer identification number, payment amount, date of transaction, and the tax period covered. It serves as legal proof of compliance with tax obligations and is critical for maintaining accurate financial records and facilitating audits.

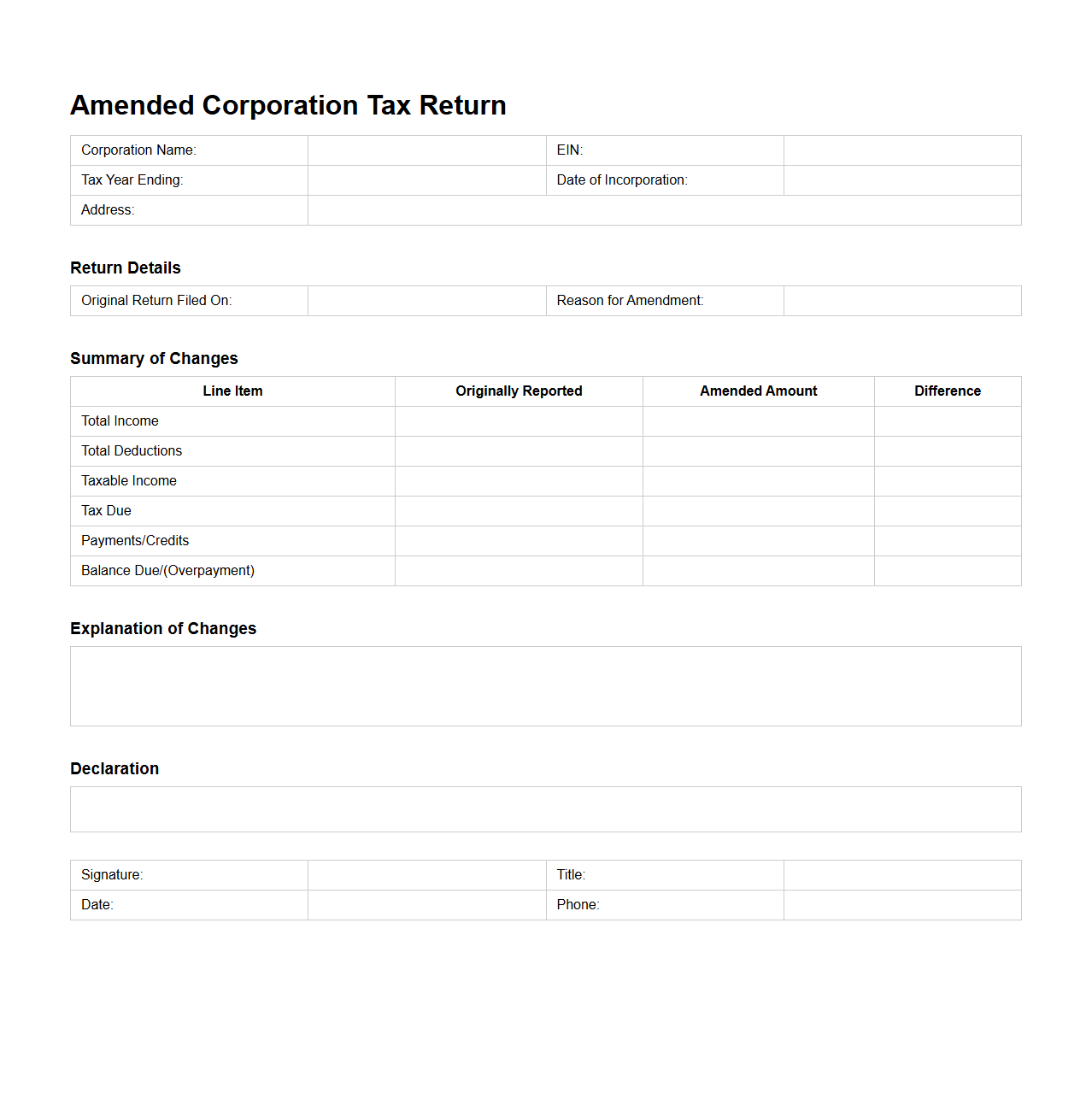

Amended Corporation Tax Return Sample

An

Amended Corporation Tax Return Sample document serves as an example or template illustrating how to correct previously submitted corporation tax returns. This document highlights the necessary adjustments, including revised figures for income, expenses, and tax liabilities, ensuring compliance with tax regulations. It is a valuable resource for companies seeking guidance on accurately filing amended returns with tax authorities.

Supporting Schedules for Reconciling Book Income to Taxable Income

The reconciliation of book income to taxable income requires detailed supporting schedules such as Schedule M-1 or M-3, depending on the size of the corporation. These schedules explain differences between book income and taxable income, including permanent and temporary differences. Proper completion of these schedules ensures accurate reporting and compliance with IRS requirements.

Reporting and Carrying Forward Net Operating Losses (NOLs)

Net operating losses must be reported on the corporate tax return using Schedule K to identify the NOL amount for the year. Corporations carry forward NOLs according to tax rules, generally applying unused losses against future taxable income. Proper documentation on the tax return ensures the accurate application of NOL carryforwards and compliance with IRS limitations.

Disclosure of Related-Party Transactions

All related-party transactions must be disclosed in specific sections of the corporate tax return, often on Schedule L or Schedule M-3, depending on report size and complexity. These disclosures provide transparency about dealings between affiliated companies that could affect taxable income. Compliance with these requirements helps prevent IRS audits and penalties related to transfer pricing and valuation issues.

Documentation for Claiming Foreign Tax Credits

To claim foreign tax credits, corporations must provide documentation such as Form 1118 along with supporting schedules detailing the type, amount, and foreign jurisdiction of taxes paid. This documentation substantiates the credit and ensures it complies with IRS rules limiting credit amounts. Properly preparing and attaching these documents helps corporations avoid double taxation on foreign income.

Reporting Intercompany Dividends on Consolidated Returns

Intercompany dividends must be carefully reported on consolidated corporate tax returns to avoid double counting income. Typically, these dividends are eliminated in consolidation schedules to reflect only the income earned from outside the affiliated group. Accurate reporting ensures compliance with IRS consolidation rules and prevents tax overpayment or audit issues.