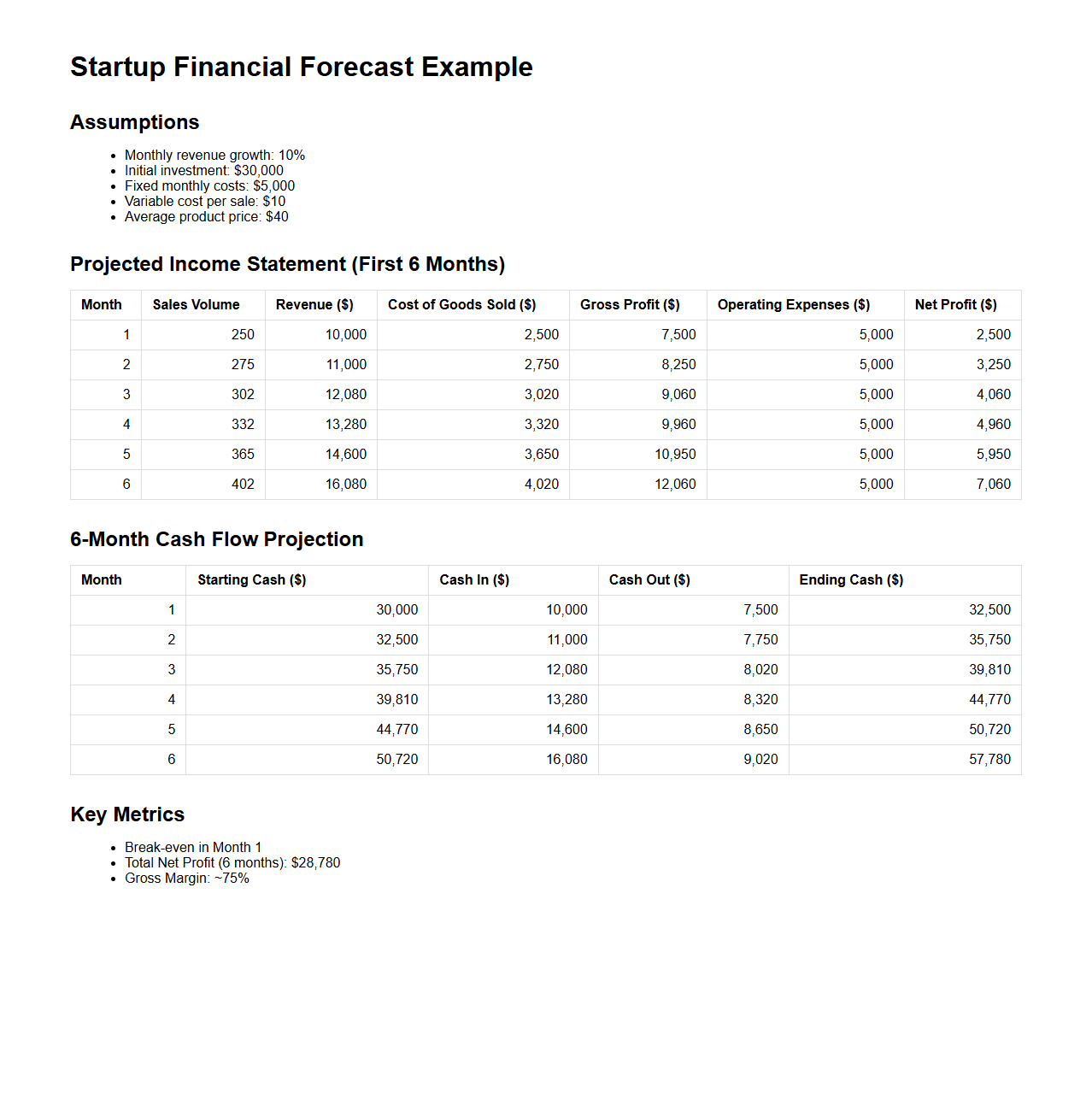

Startup Financial Forecast Example for New Businesses

A

Startup Financial Forecast Example for new businesses is a detailed projection of expected revenues, expenses, and cash flow over a specific period, typically 12 to 36 months. This document helps entrepreneurs anticipate financial needs, allocate resources efficiently, and attract investors by showcasing potential profitability and growth. It usually includes key components such as sales forecasts, operating costs, capital expenditures, and break-even analysis.

Small Business Revenue Projection Document Sample

A

Small Business Revenue Projection Document Sample is a financial planning tool that estimates future income based on sales forecasts, market trends, and pricing strategies. It outlines expected revenues over specific periods to guide budgeting, investment decisions, and performance evaluation. This sample document helps entrepreneurs understand cash flow potential and set realistic financial goals.

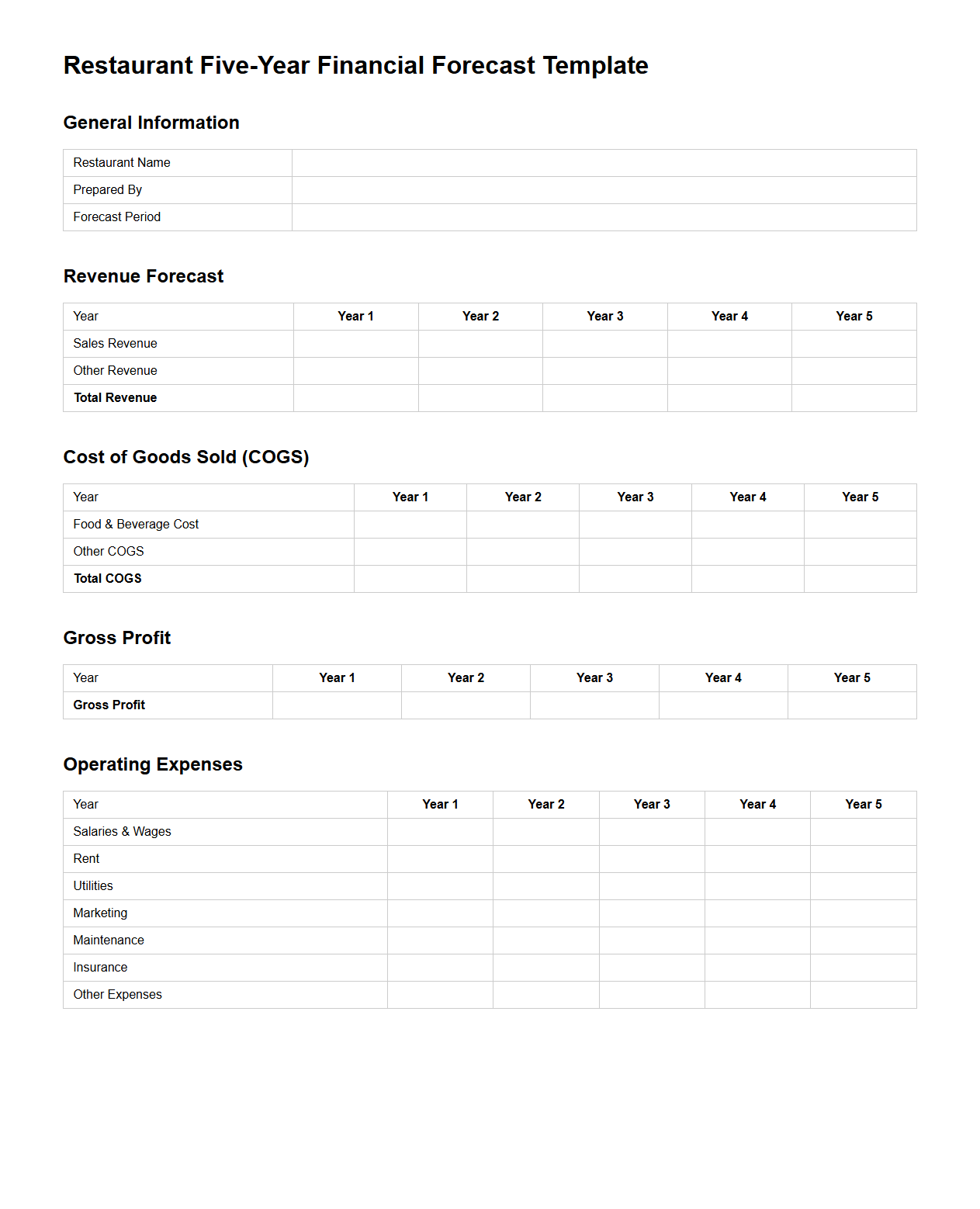

Restaurant Five-Year Financial Forecast Template

A

Restaurant Five-Year Financial Forecast Template is a detailed document designed to project a restaurant's financial performance over a five-year period. It includes key components such as revenue estimates, expense tracking, profit margins, cash flow analysis, and capital expenditure planning. This template helps restaurant owners and managers make informed decisions, secure funding, and strategize for sustainable growth.

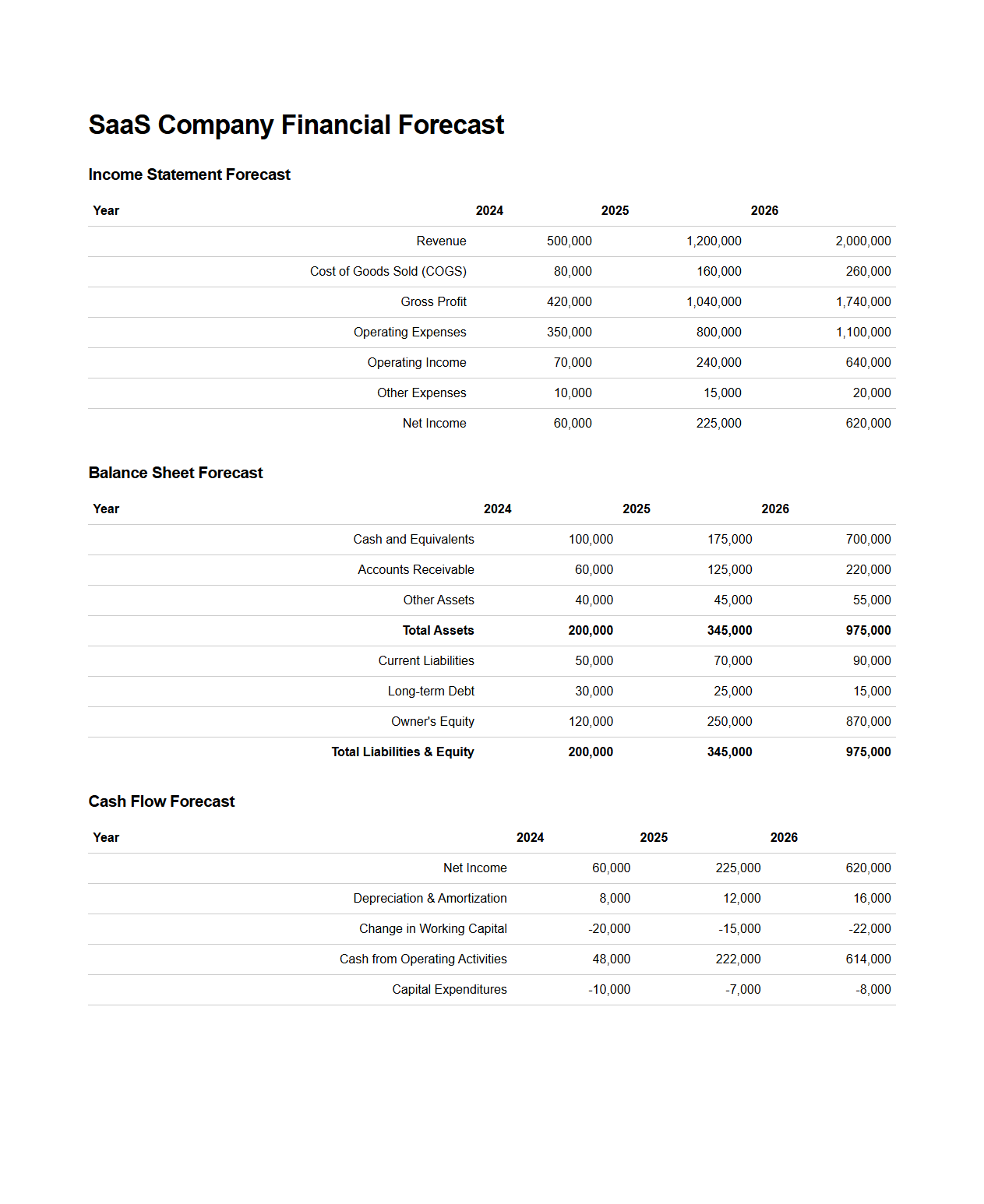

SaaS Company Financial Forecast Statement Sample

A

SaaS Company Financial Forecast Statement Sample document provides a detailed projection of future revenues, expenses, and cash flows specific to software-as-a-service businesses. It includes key metrics such as monthly recurring revenue (MRR), customer acquisition costs (CAC), churn rates, and gross margins to help stakeholders make informed decisions. This sample serves as a practical template for planning budgets, attracting investors, and managing growth strategies effectively.

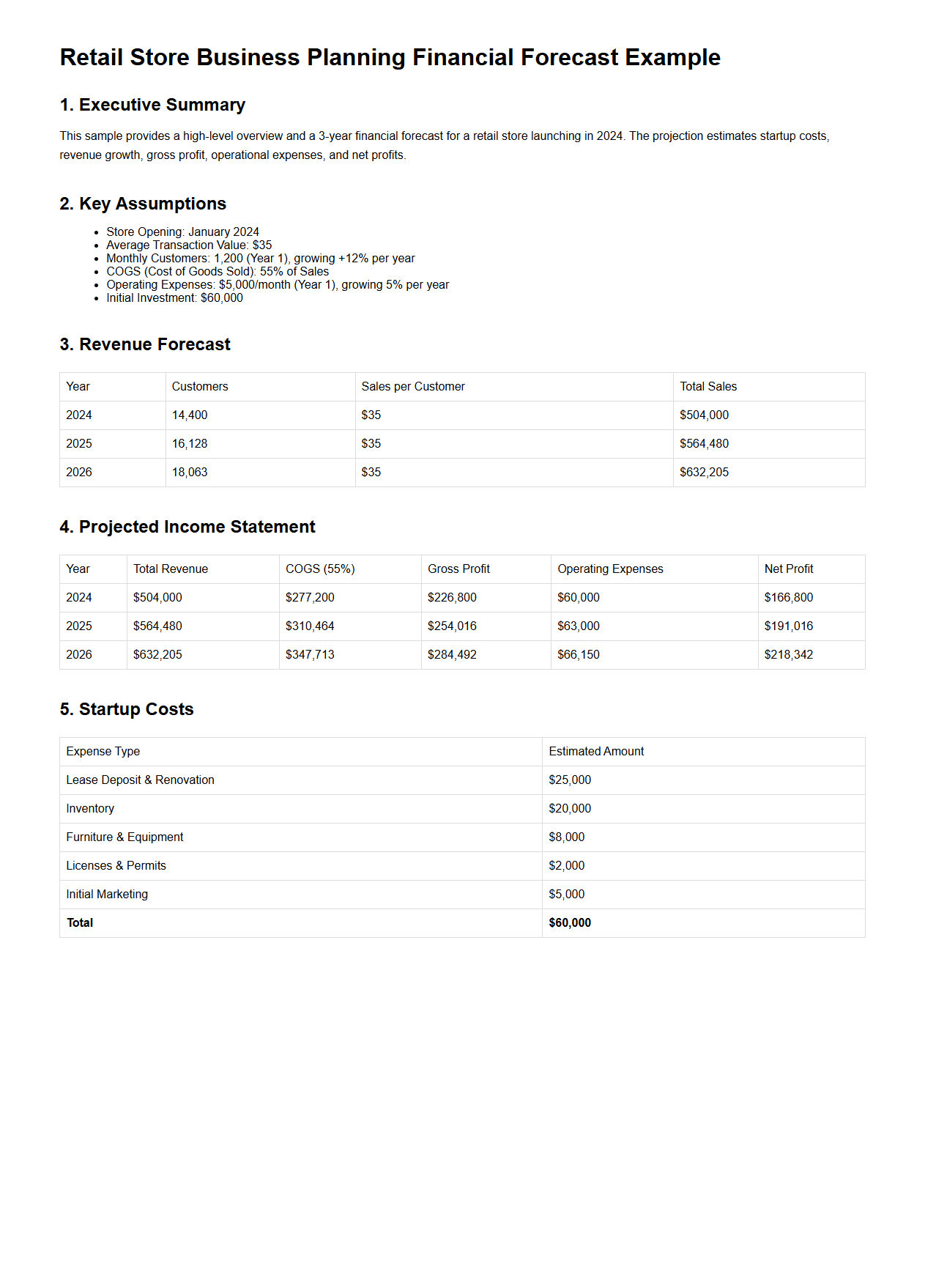

Retail Store Business Planning Financial Forecast Example

A

Retail Store Business Planning Financial Forecast Example document provides a detailed projection of a retail store's expected financial performance, including sales revenue, expenses, and profit margins. It serves as a crucial tool for entrepreneurs and investors to evaluate the viability and growth potential of the business over a specific period. This document typically includes monthly or annual forecasts, cash flow analyses, and budget plans to guide strategic decision-making.

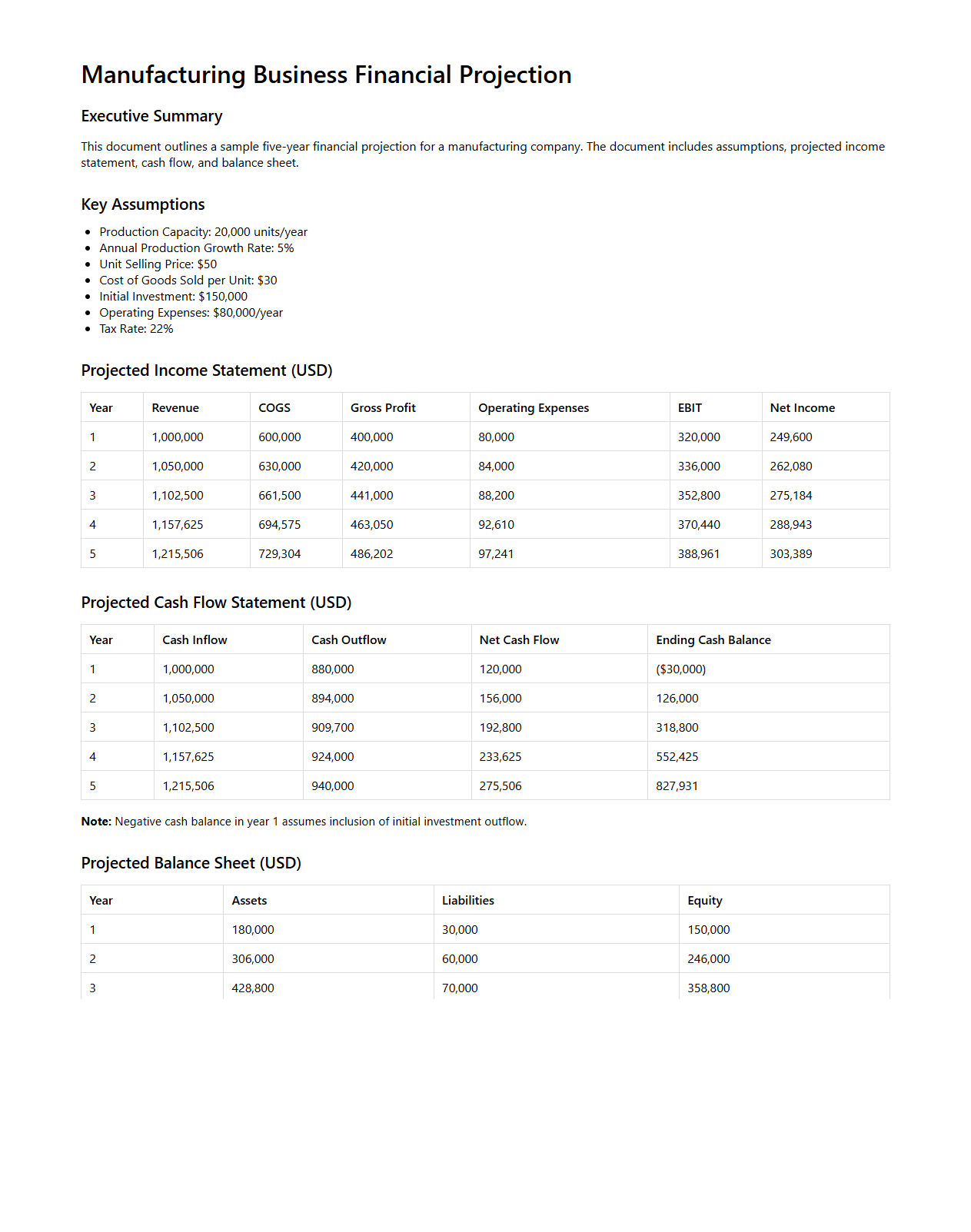

Manufacturing Business Financial Projection Document Sample

A

Manufacturing Business Financial Projection Document Sample provides a detailed forecast of a company's future financial performance, including revenue, expenses, cash flow, and profitability. It serves as a practical template for startups or existing manufacturers to plan budgets, secure funding, and make informed strategic decisions. The document typically includes projected income statements, balance sheets, and cash flow statements based on realistic market analysis and operational assumptions.

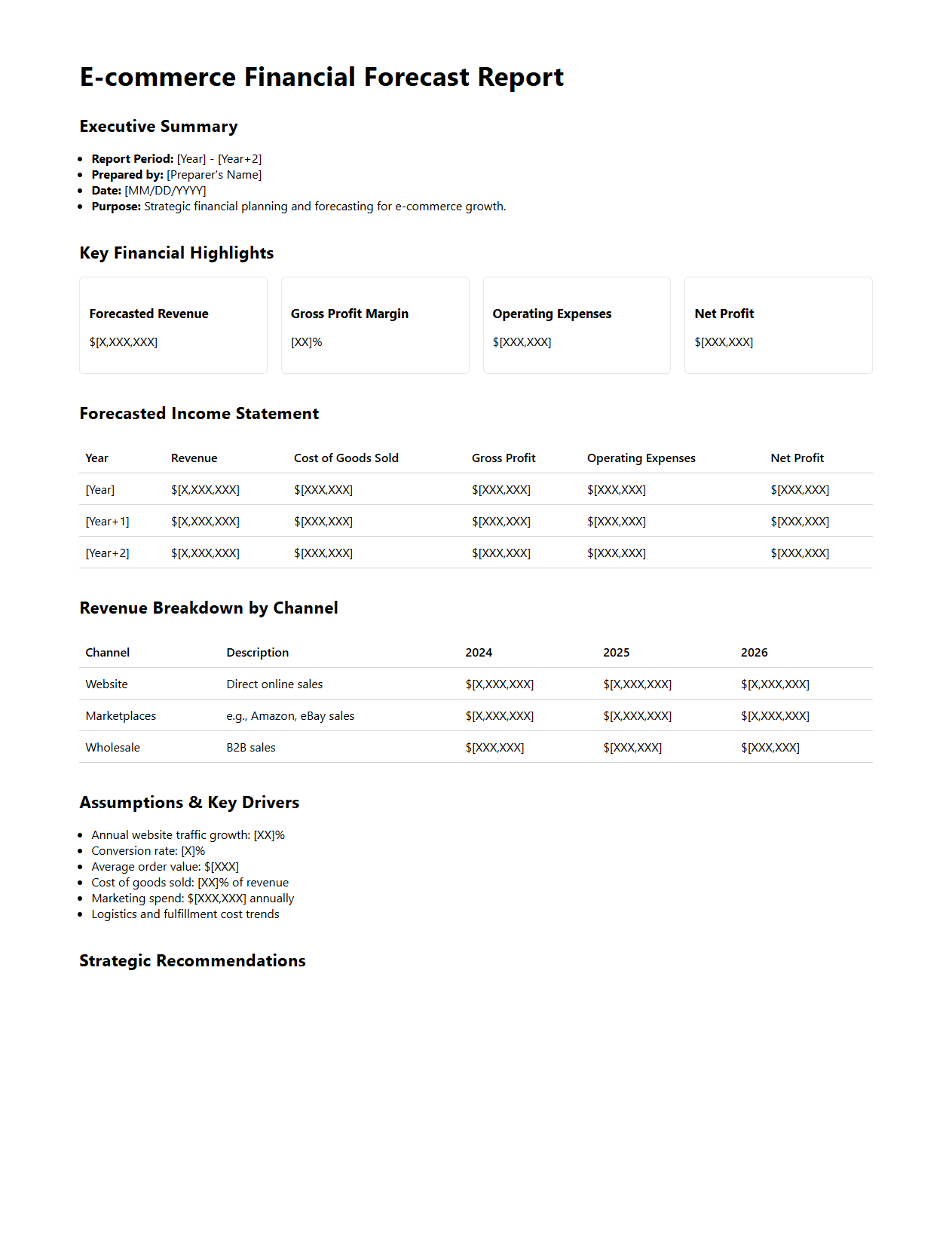

E-commerce Financial Forecast Report for Strategic Planning

The

E-commerce Financial Forecast Report for Strategic Planning is a detailed analysis that projects future financial performance based on current market trends, sales data, and consumer behavior patterns. It provides crucial insights into revenue growth, cost management, and profitability, enabling informed decision-making for budgeting and investment. This document helps businesses anticipate challenges and opportunities, ensuring sustainable long-term success in the competitive online marketplace.

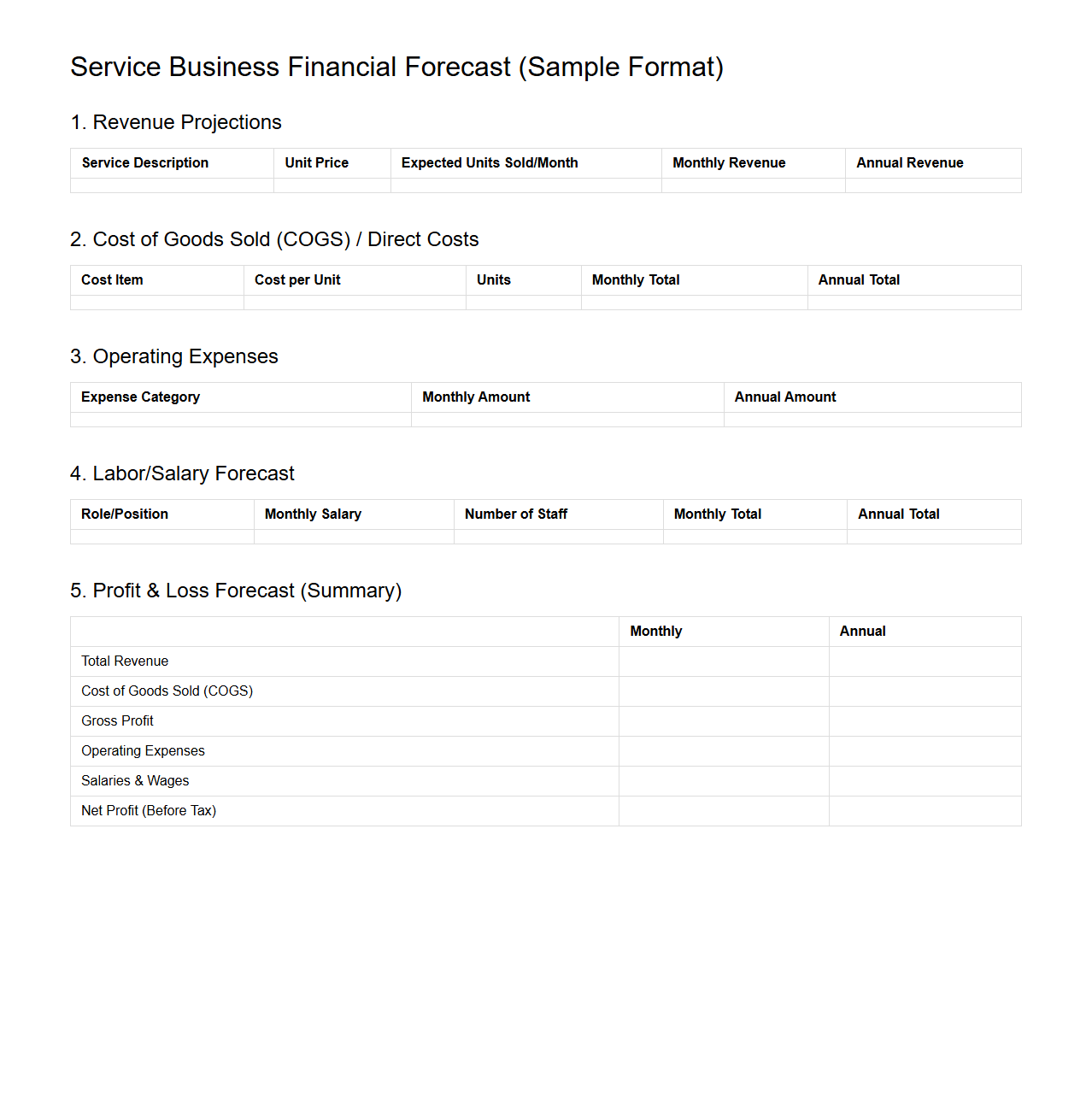

Service Business Financial Forecasting Format

A

Service Business Financial Forecasting Format document provides a structured template designed to project future revenues, expenses, and profitability for service-oriented companies. It typically includes key financial statements such as income statements, cash flow statements, and balance sheets, tailored to reflect the unique operational costs and revenue streams of service businesses. This format aids business owners and stakeholders in making informed decisions by offering clear visibility into financial expectations and potential growth opportunities.

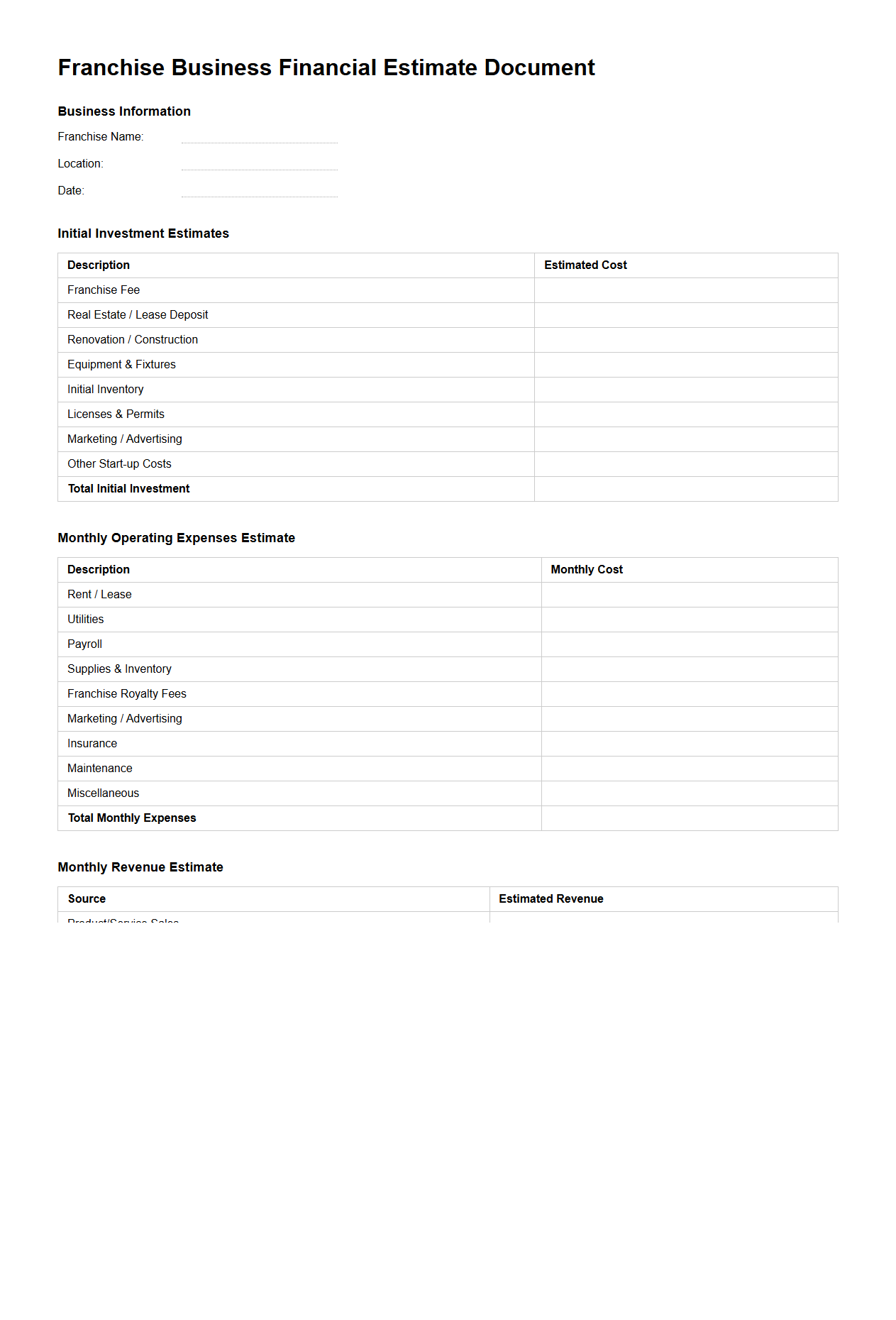

Franchise Business Financial Estimate Document Sample

A

Franchise Business Financial Estimate Document Sample provides a detailed projection of the expected costs, revenues, and profitability of a franchise operation. It typically includes key financial metrics such as initial investment, operational expenses, cash flow forecasts, and breakeven analysis to aid potential franchisees in evaluating the viability of the business opportunity. This document serves as an essential tool for financial planning and securing funding from investors or lenders.

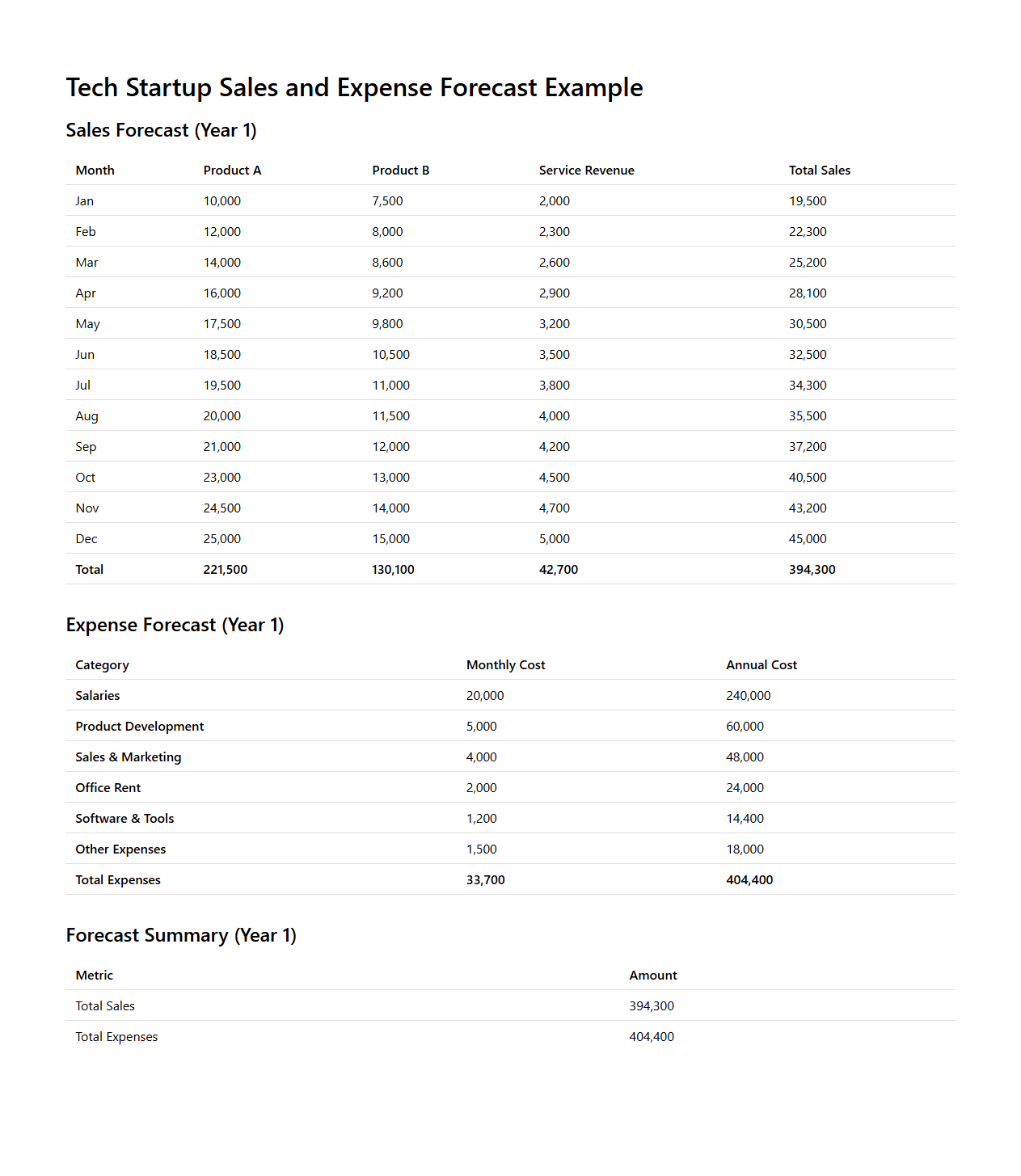

Tech Startup Sales and Expense Forecast Example

A

Tech Startup Sales and Expense Forecast Example document outlines projected revenue streams and anticipated costs for a new technology business, helping founders and investors gauge financial viability. It typically includes detailed monthly or quarterly estimates of sales growth, customer acquisition costs, operational expenses, and capital expenditures. This forecasting tool enables strategic planning, budget allocation, and performance tracking to drive sustainable growth.

What key assumptions drive the revenue projections in the financial forecast document?

The key assumptions driving revenue projections include market growth rates, customer acquisition costs, and pricing strategies. These assumptions are based on historical data and industry benchmarks to ensure accuracy. Sensitivity analysis is often employed to understand the impact of varying these assumptions on overall revenue.

How does the document address potential cash flow gaps over the planning period?

The document identifies potential cash flow gaps through detailed monthly cash flow statements and forecasts. It outlines strategies such as securing short-term financing or adjusting payment terms to mitigate these gaps. Additionally, contingency reserves are planned to maintain liquidity during unforeseen cash shortages.

Are contingency plans for fluctuating market conditions outlined in the forecast?

Yes, the forecast includes comprehensive contingency plans to handle fluctuating market conditions. These plans involve scenario analyses for best-case, worst-case, and most likely market environments. Risk mitigation strategies like cost adjustments and diversified revenue streams are also detailed.

What metrics are used to validate the credibility of the financial forecasts provided?

The forecast's credibility is validated using metrics such as variance analysis, accuracy of prior forecasts, and key financial ratios like gross margin and return on investment. Benchmarking against industry standards further supports the reliability of projections. These metrics offer transparency and build investor confidence in the financial model.

How frequently is the financial forecast document reviewed and updated within the business plan?

The financial forecast document is typically reviewed and updated on a quarterly basis to reflect changing market conditions and business performance. This regular update cycle ensures alignment with strategic goals and accurate financial planning. Ad hoc revisions may occur in response to significant business events or economic shifts.