A Balance Sheet Document Sample for Business Finance provides a clear snapshot of a company's financial position by detailing assets, liabilities, and equity at a specific point in time. This essential financial statement helps business owners and investors assess the company's stability and liquidity. Using an accurate and well-structured balance sheet sample ensures better financial planning and decision-making.

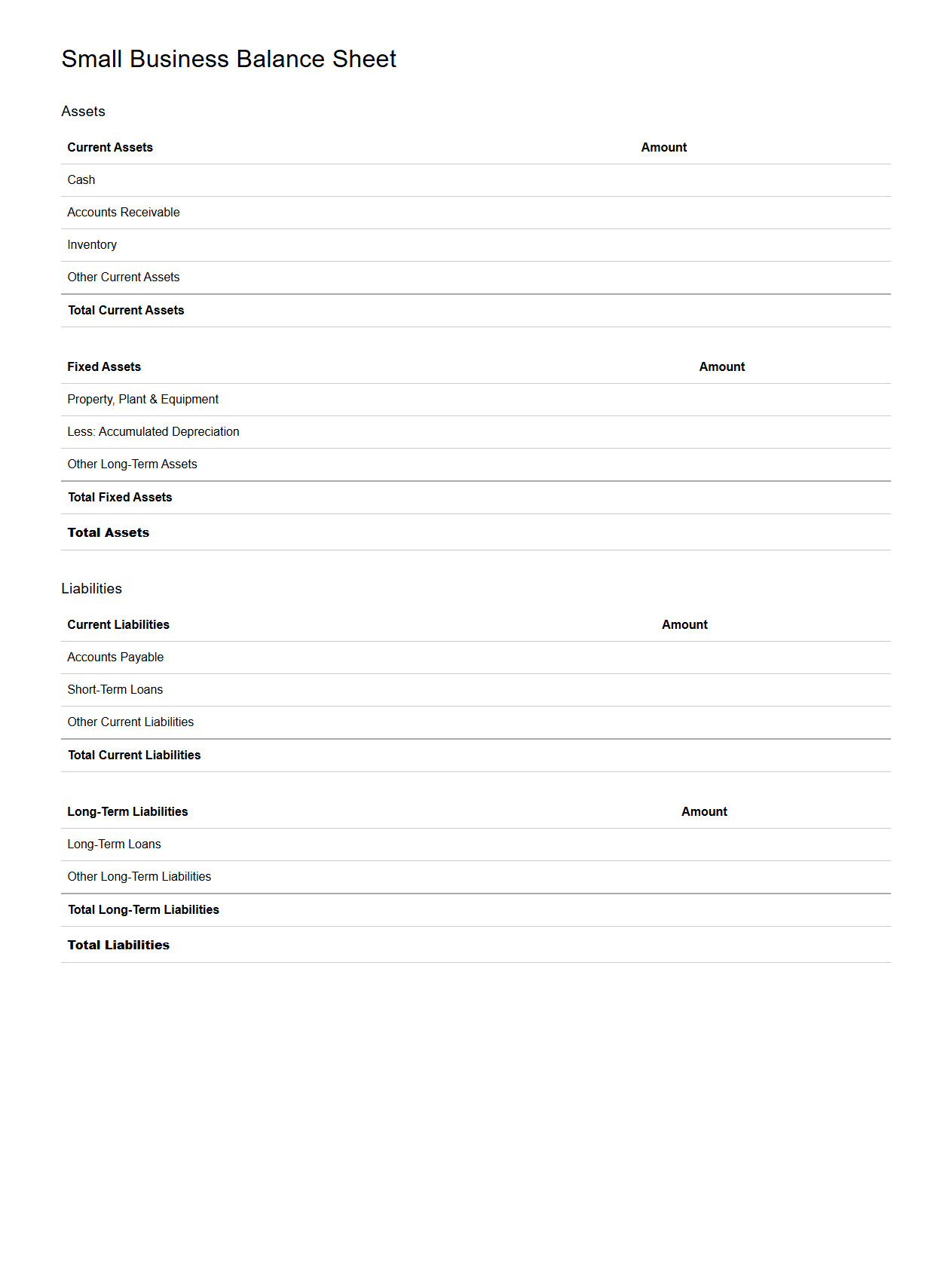

Small Business Balance Sheet Template

A

Small Business Balance Sheet Template is a financial document used to summarize a company's assets, liabilities, and owner's equity at a specific point in time. This template helps entrepreneurs and accountants organize and visualize the financial position of a small business, facilitating informed decision-making and financial planning. It typically includes sections for current assets, fixed assets, current liabilities, long-term liabilities, and equity.

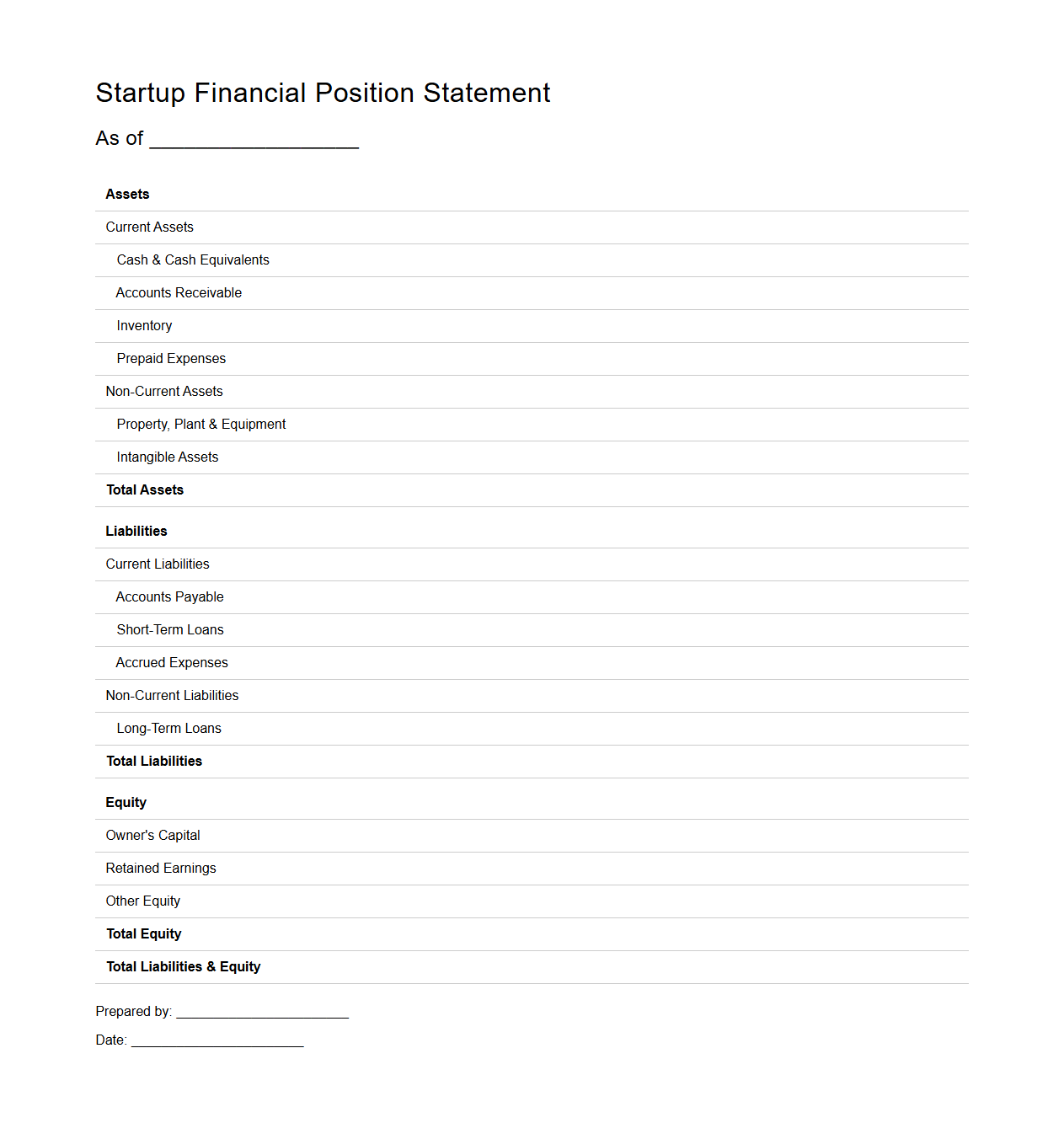

Startup Financial Position Statement Sample

A

Startup Financial Position Statement Sample document provides a detailed snapshot of a startup's financial health at a specific point in time, including assets, liabilities, and equity. It helps entrepreneurs and investors assess the company's solvency and liquidity, facilitating informed decision-making. This sample acts as a practical template for organizing financial data consistently and accurately.

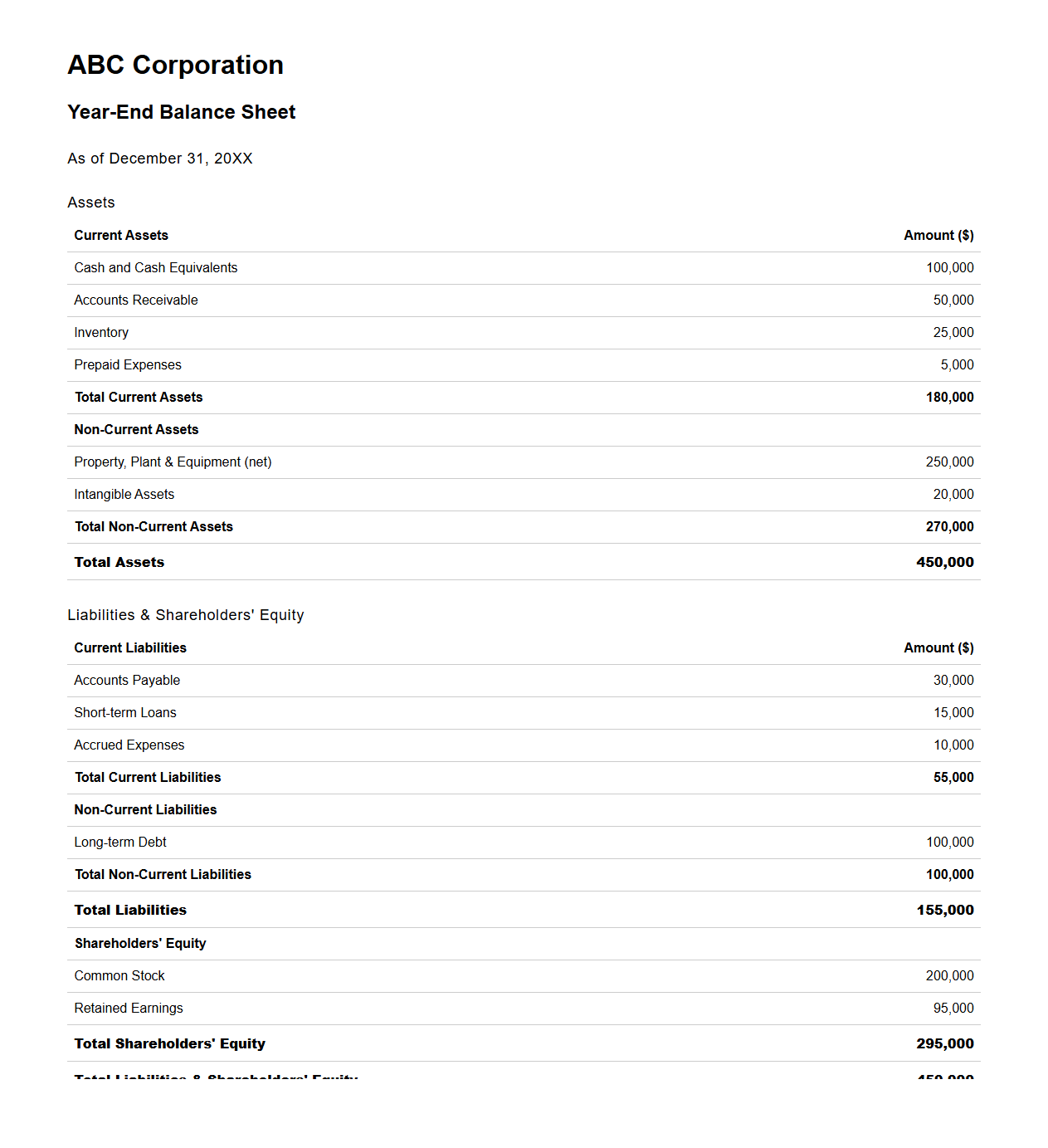

Corporate Year-End Balance Sheet Example

A

Corporate Year-End Balance Sheet Example document provides a detailed snapshot of a company's financial position at the end of its fiscal year, outlining assets, liabilities, and shareholders' equity. It serves as a critical tool for stakeholders to assess the company's financial health, performance, and stability over the accounting period. This example aids in ensuring accuracy, compliance with accounting standards, and transparency in financial reporting.

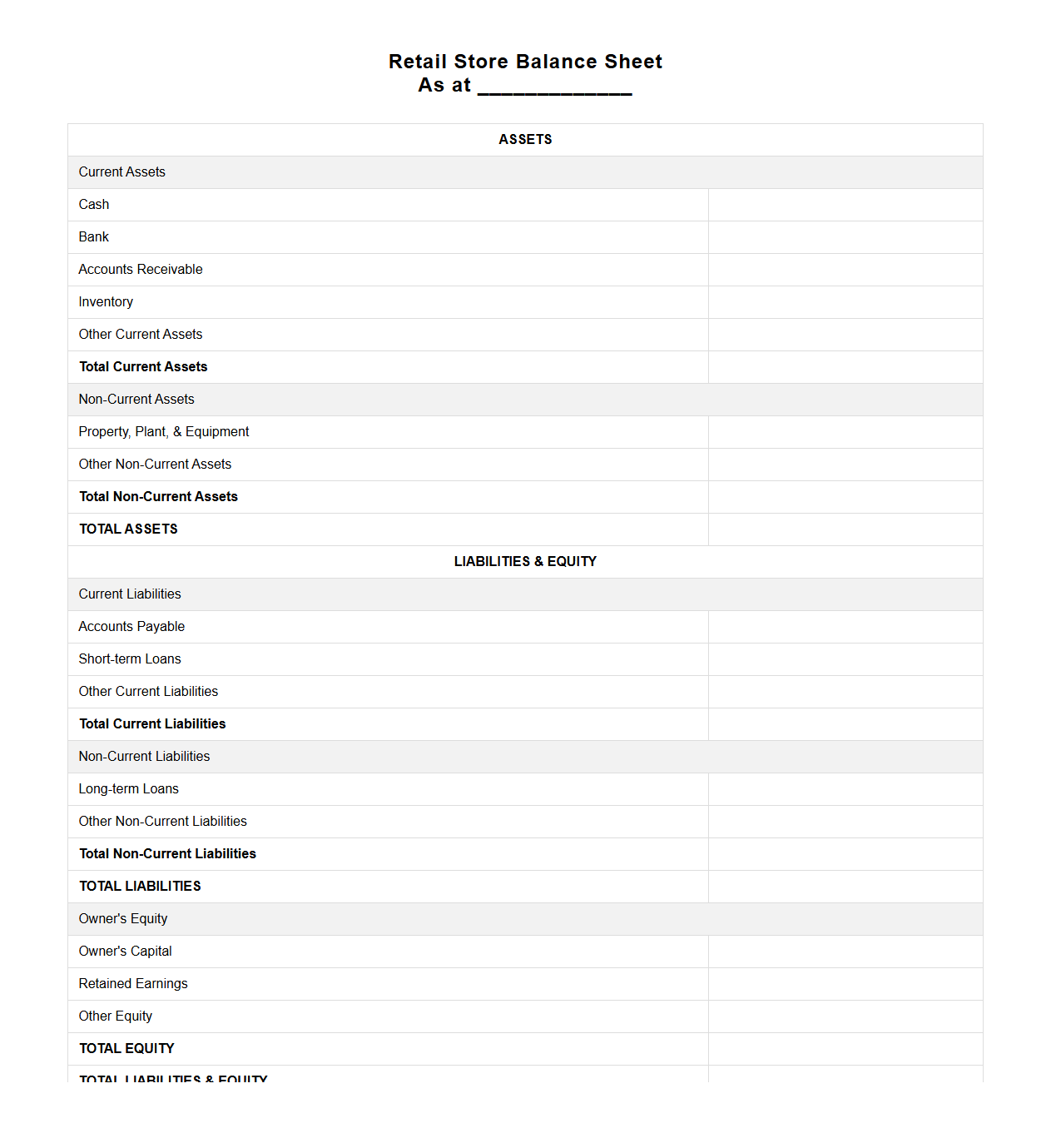

Retail Store Balance Sheet Format

A

Retail Store Balance Sheet Format document is a financial statement template designed to summarize a retail store's assets, liabilities, and equity at a specific point in time. It helps store owners and managers assess the financial health by presenting current and long-term assets such as inventory and equipment alongside short-term and long-term liabilities. This format provides a clear snapshot of the business's net worth, aiding in decision-making, financial planning, and reporting to stakeholders.

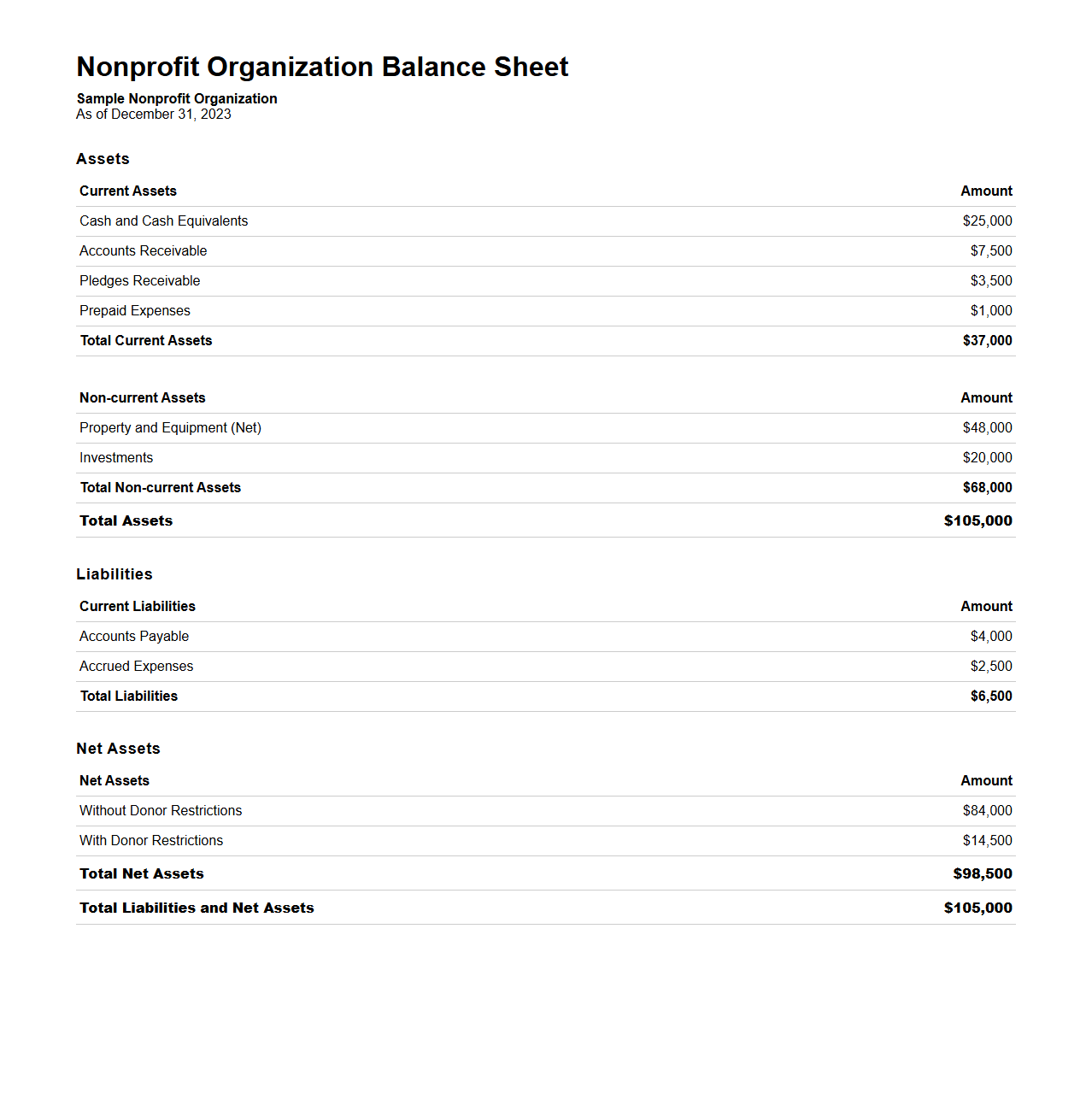

Nonprofit Organization Balance Sheet Sample

A

Nonprofit Organization Balance Sheet Sample document provides a detailed snapshot of an organization's financial position at a specific point in time, listing assets, liabilities, and net assets. It helps stakeholders evaluate the fiscal health and sustainability of the nonprofit by clearly displaying resources owned and obligations owed. This sample serves as a template for preparing accurate financial statements in compliance with accounting standards applicable to nonprofit entities.

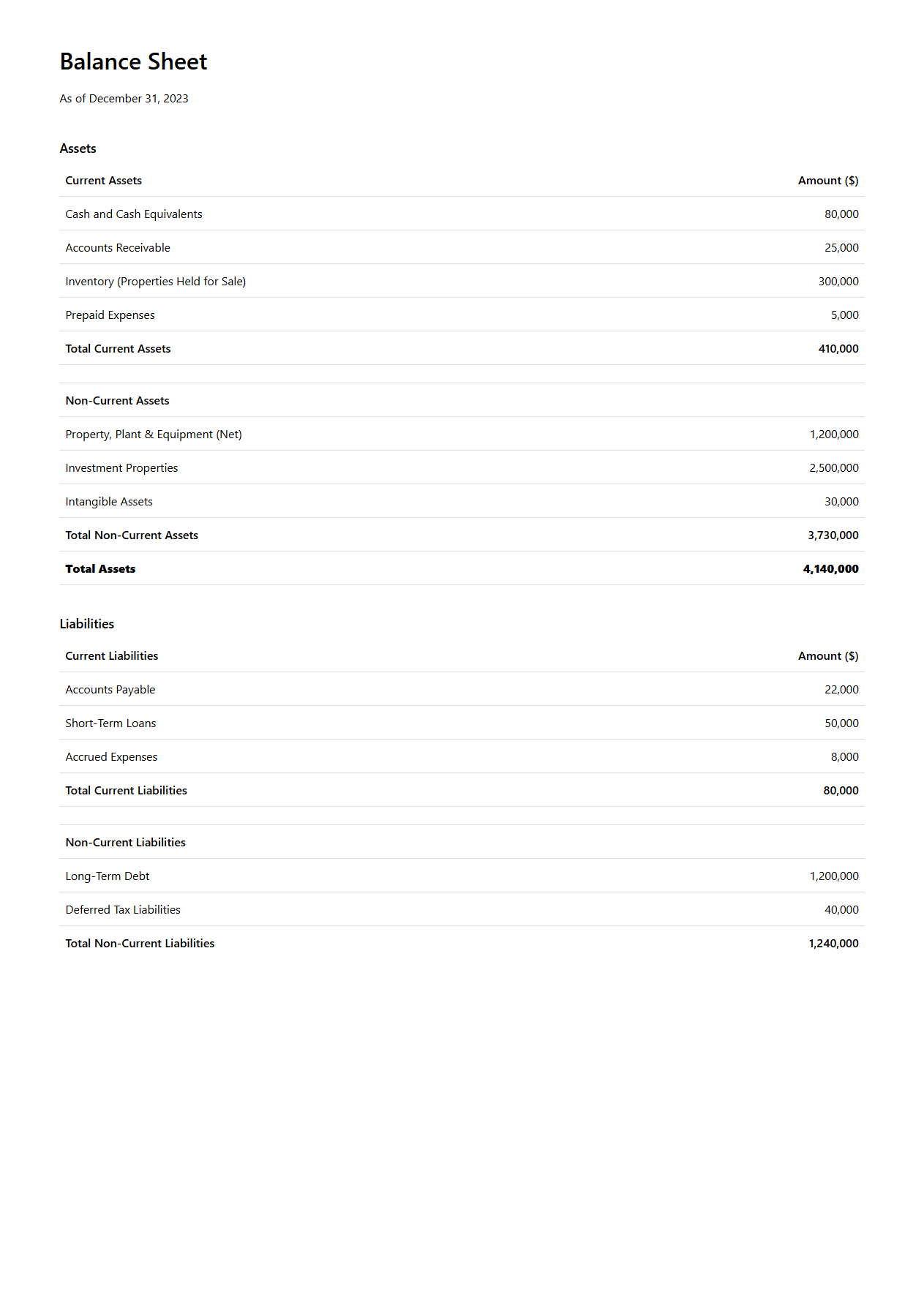

Real Estate Company Balance Sheet Example

A

Real Estate Company Balance Sheet Example document provides a detailed snapshot of a real estate company's financial position at a specific point in time, listing its assets, liabilities, and equity. It highlights key components such as property holdings, accounts receivable, mortgage liabilities, and owner's equity, reflecting the company's financial health. This document is essential for investors, lenders, and management to assess the company's solvency and operational stability.

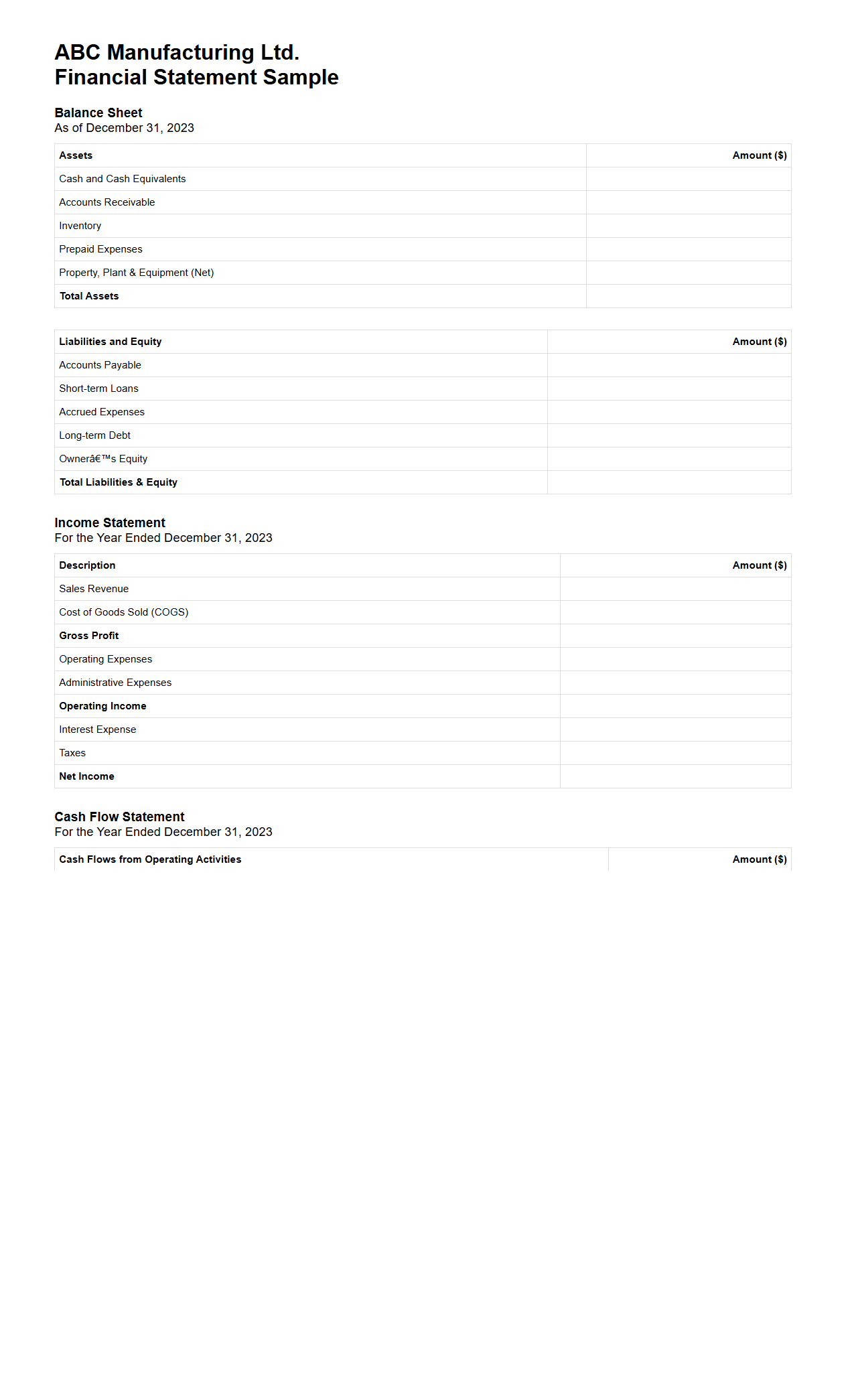

Manufacturing Business Financial Statement Sample

A

Manufacturing Business Financial Statement Sample document provides a detailed overview of a company's financial health, including key components such as the balance sheet, income statement, and cash flow statement specifically tailored for manufacturing operations. It reflects critical data like production costs, inventory levels, and capital expenditures, helping stakeholders assess profitability and operational efficiency. This document serves as a practical template for tracking manufacturing expenses and revenues, facilitating financial planning and decision-making.

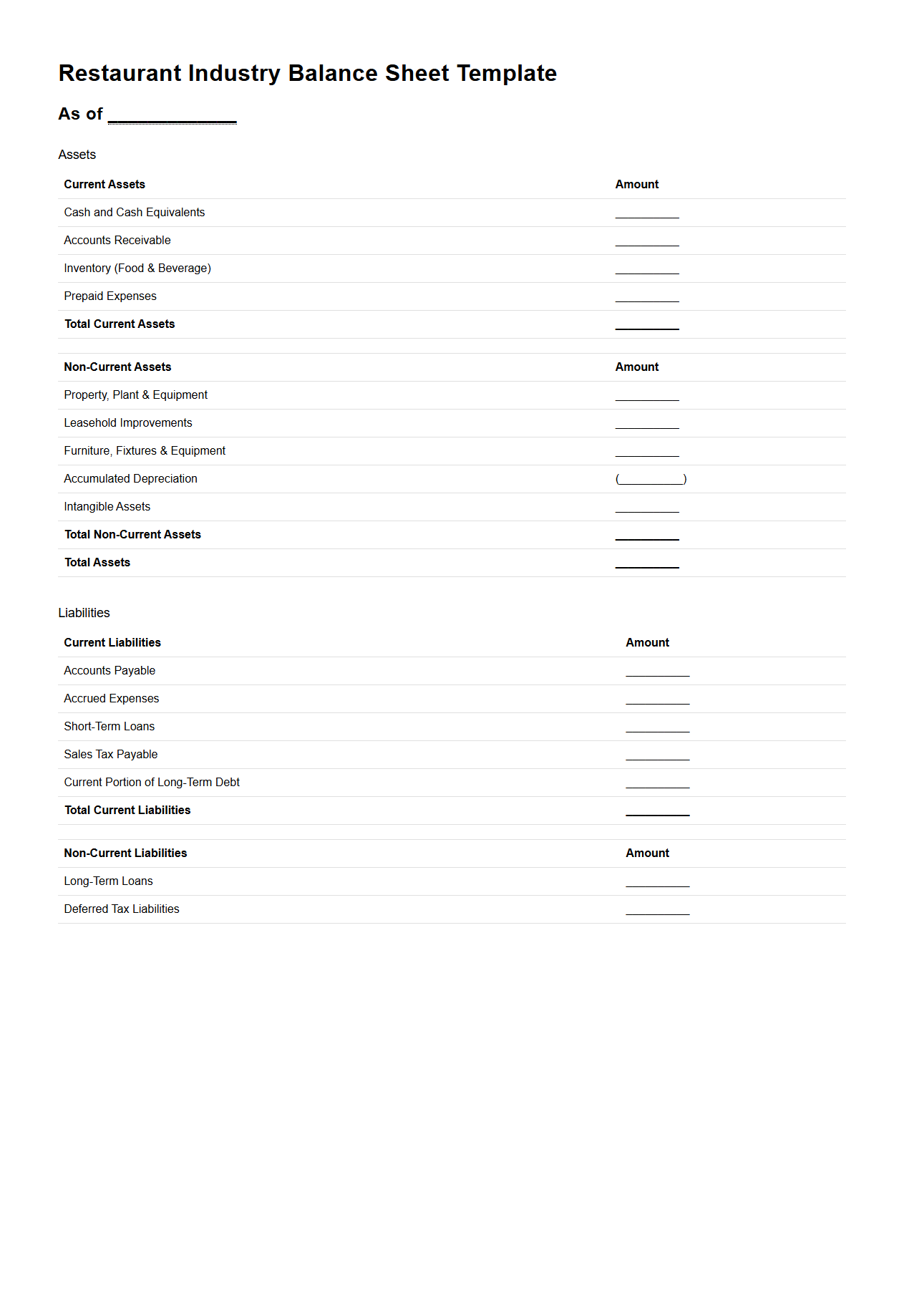

Restaurant Industry Balance Sheet Template

A

Restaurant Industry Balance Sheet Template is a financial document designed to systematically capture and present a restaurant's assets, liabilities, and owner's equity at a specific point in time. This template helps restaurateurs monitor financial health by clearly organizing cash, inventory, equipment, accounts payable, and other critical financial components. Utilizing this template allows for precise financial analysis, aiding in budgeting, forecasting, and making informed operational decisions.

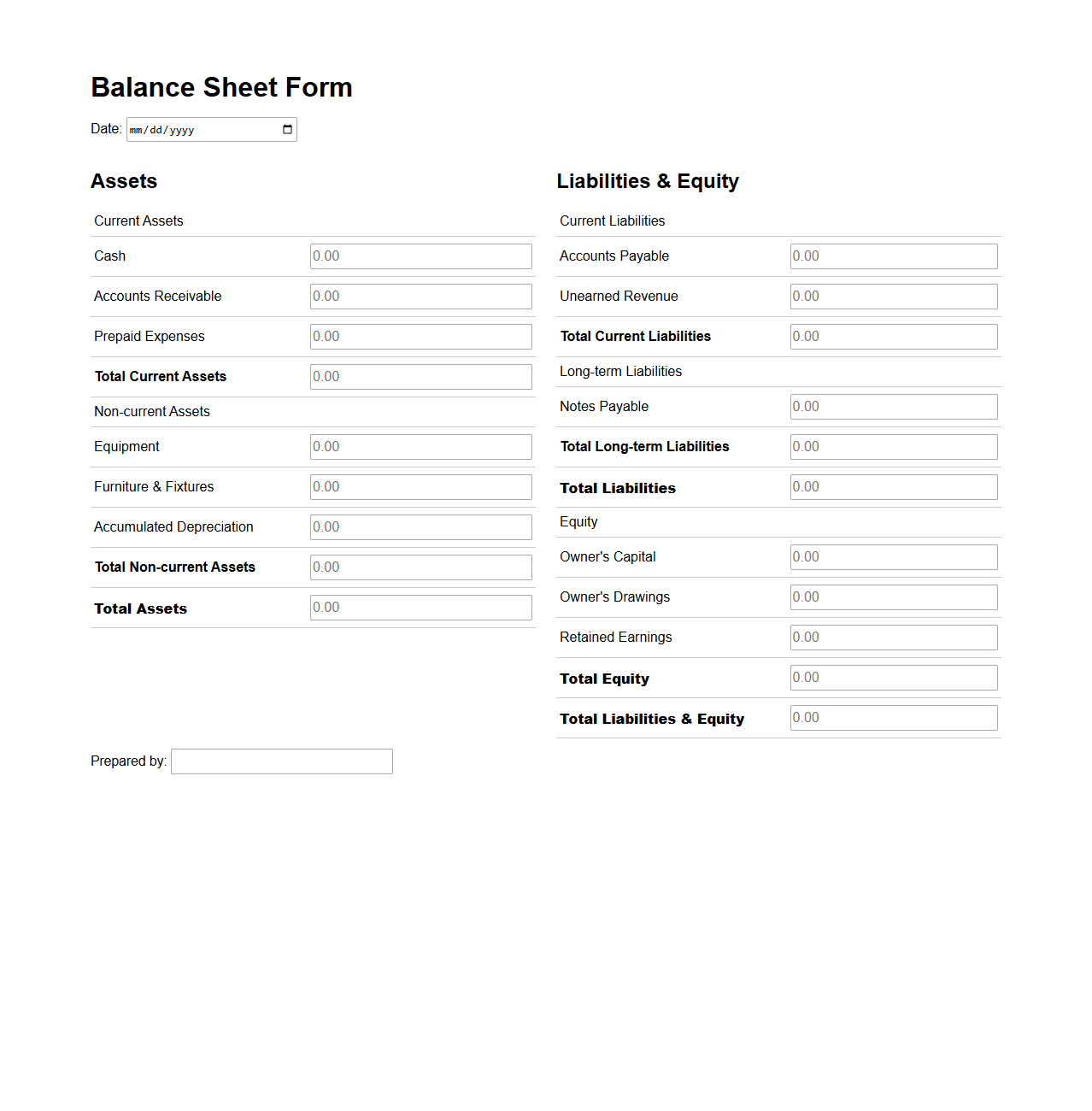

Service Business Balance Sheet Form

A

Service Business Balance Sheet Form is a financial statement used to summarize a service company's assets, liabilities, and equity at a specific point in time. This document helps business owners and stakeholders evaluate the financial health and stability of the service enterprise by providing a clear snapshot of what the company owns and owes. Accurate completion of this form is essential for making informed decisions regarding budgeting, investments, and strategic planning.

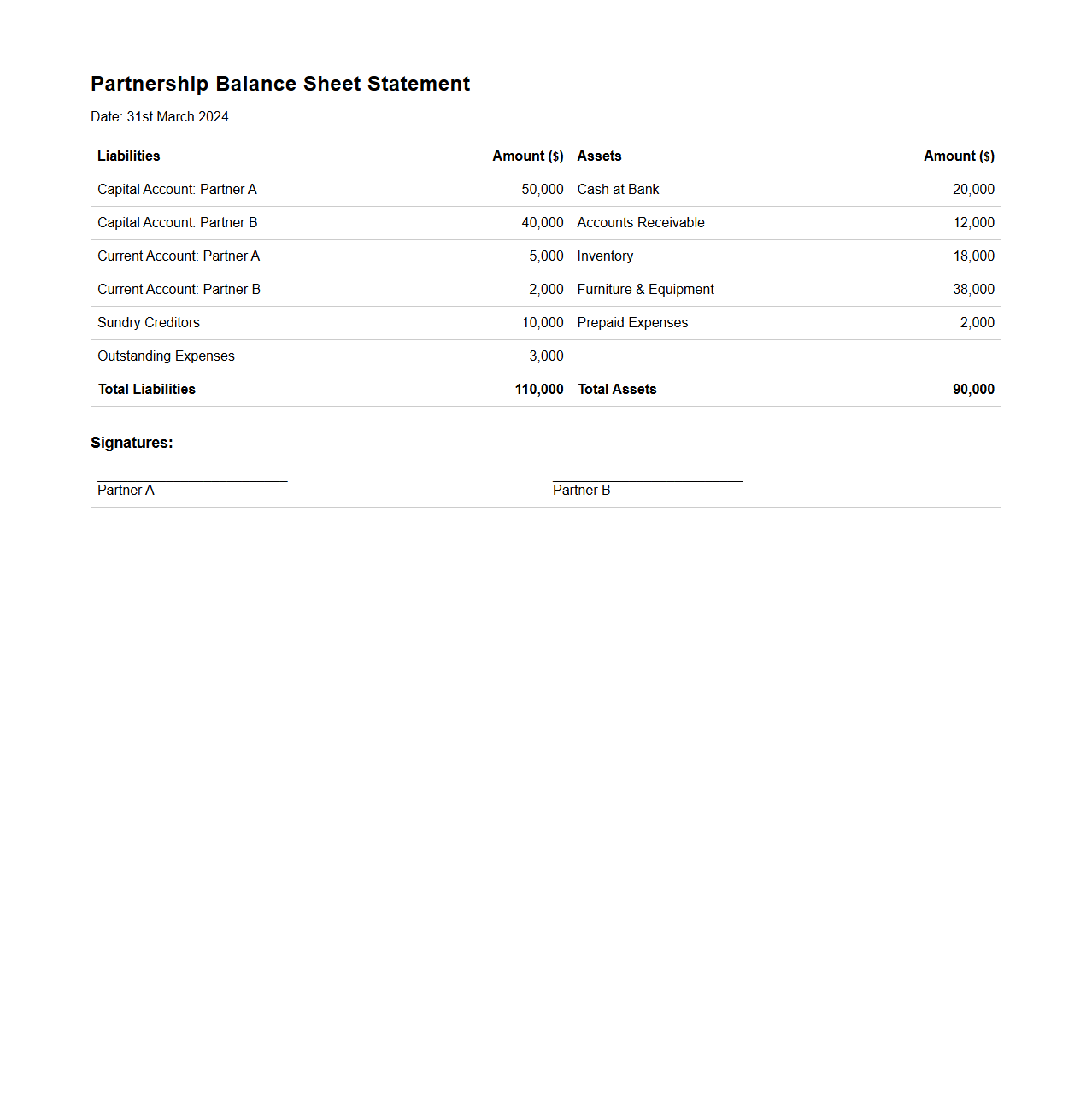

Partnership Balance Sheet Statement Example

A

Partnership Balance Sheet Statement Example is a financial document that outlines the assets, liabilities, and equity of a partnership at a specific point in time. It provides a clear snapshot of the partnership's financial position, showing the capital contributions of each partner and the distribution of profits or losses. This example serves as a practical guide for preparing accurate and compliant balance sheets in accordance with accounting standards.

What key ratios can be derived directly from a business balance sheet document?

The balance sheet provides essential data to calculate key ratios such as the current ratio, which measures a company's liquidity by comparing current assets to current liabilities. Another important ratio is the debt-to-equity ratio, reflecting financial leverage by dividing total liabilities by shareholders' equity. Additionally, the quick ratio gives insight into short-term liquidity by excluding inventory from current assets.

Which line items impact owner's equity the most in a typical balance sheet?

The primary line items influencing owner's equity include retained earnings, contributed capital, and treasury stock. Retained earnings reflect accumulated profits reinvested in the business, significantly affecting equity growth. Contributed capital represents funds invested by shareholders, while treasury stock reduces overall owner's equity when shares are repurchased.

How does the balance sheet reflect deferred revenue in business finance?

Deferred revenue is recorded as a liability on the balance sheet because it represents payments received for goods or services yet to be delivered. This unearned revenue increases current liabilities until the company fulfills its obligations, at which point it becomes recognized revenue. Properly accounting for deferred revenue ensures accurate matching of income and expenses in financial statements.

What are common balance sheet document errors affecting financial analysis?

Common errors include misclassification of assets and liabilities, such as improper grouping of current and non-current items, which distort financial ratios. Another frequent mistake is overlooking off-balance-sheet liabilities, leading to understated debt levels. Additionally, failure to update asset valuations or recognize impairments impacts the accuracy of financial health assessments.

How should intangible assets be listed and valued on a business balance sheet?

Intangible assets should be listed separately from tangible assets to highlight their non-physical nature, typically under non-current assets. Valuation requires careful consideration of costs, such as acquisition or development expenses, and may involve amortization over their useful life. Accurate reporting of intangible assets enhances transparency and provides insight into a company's intellectual property and goodwill.