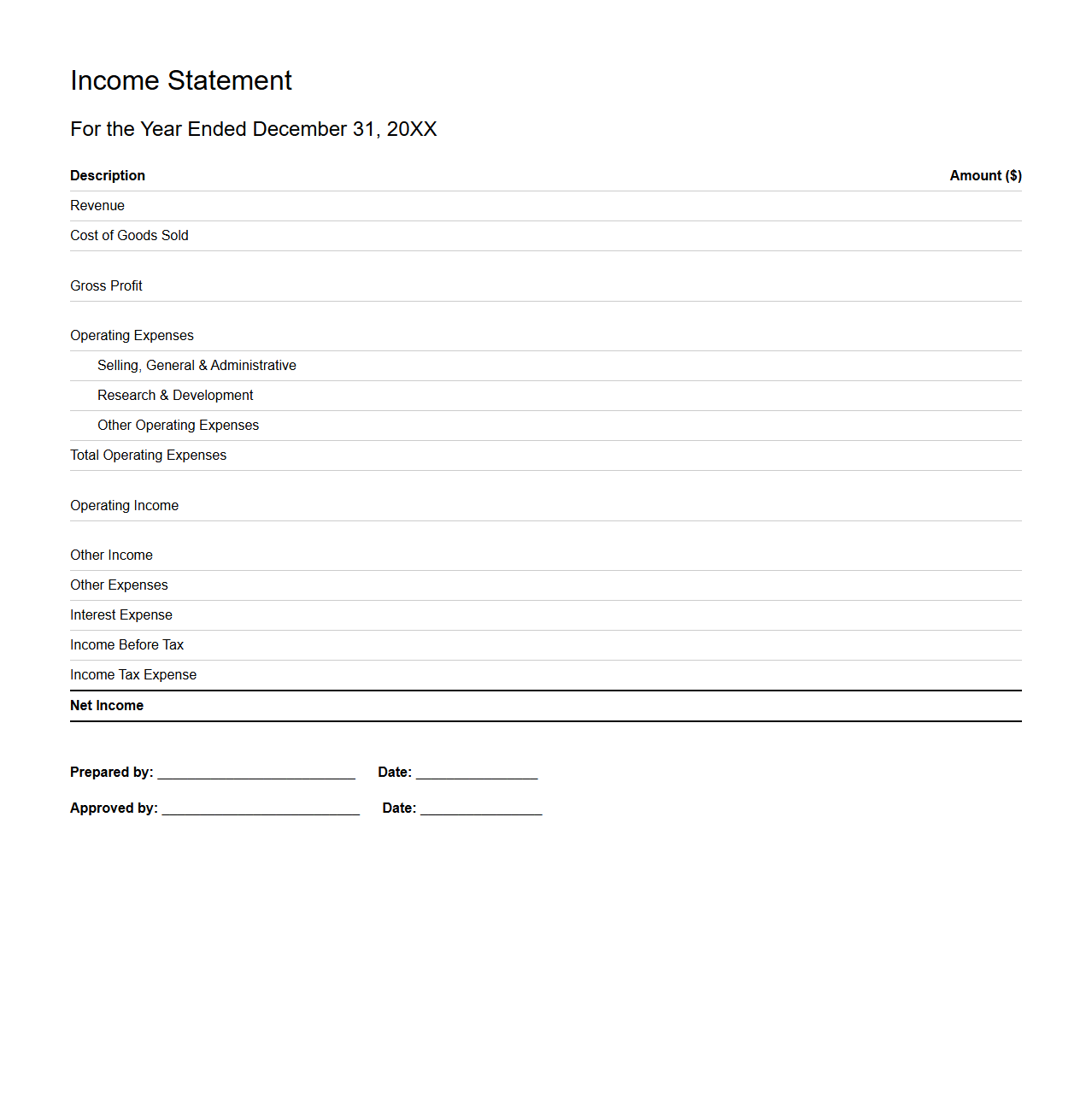

Income Statement Template for Annual Corporate Reporting

An

Income Statement Template for Annual Corporate Reporting document is a structured financial report used to present a company's revenues, expenses, and net profit or loss over a fiscal year. It standardizes the format to ensure consistency, accuracy, and compliance with accounting standards such as GAAP or IFRS, facilitating clear financial performance analysis for stakeholders. This template often includes sections for operating income, cost of goods sold, taxes, and other income or expenses to provide a comprehensive overview of the company's profitability.

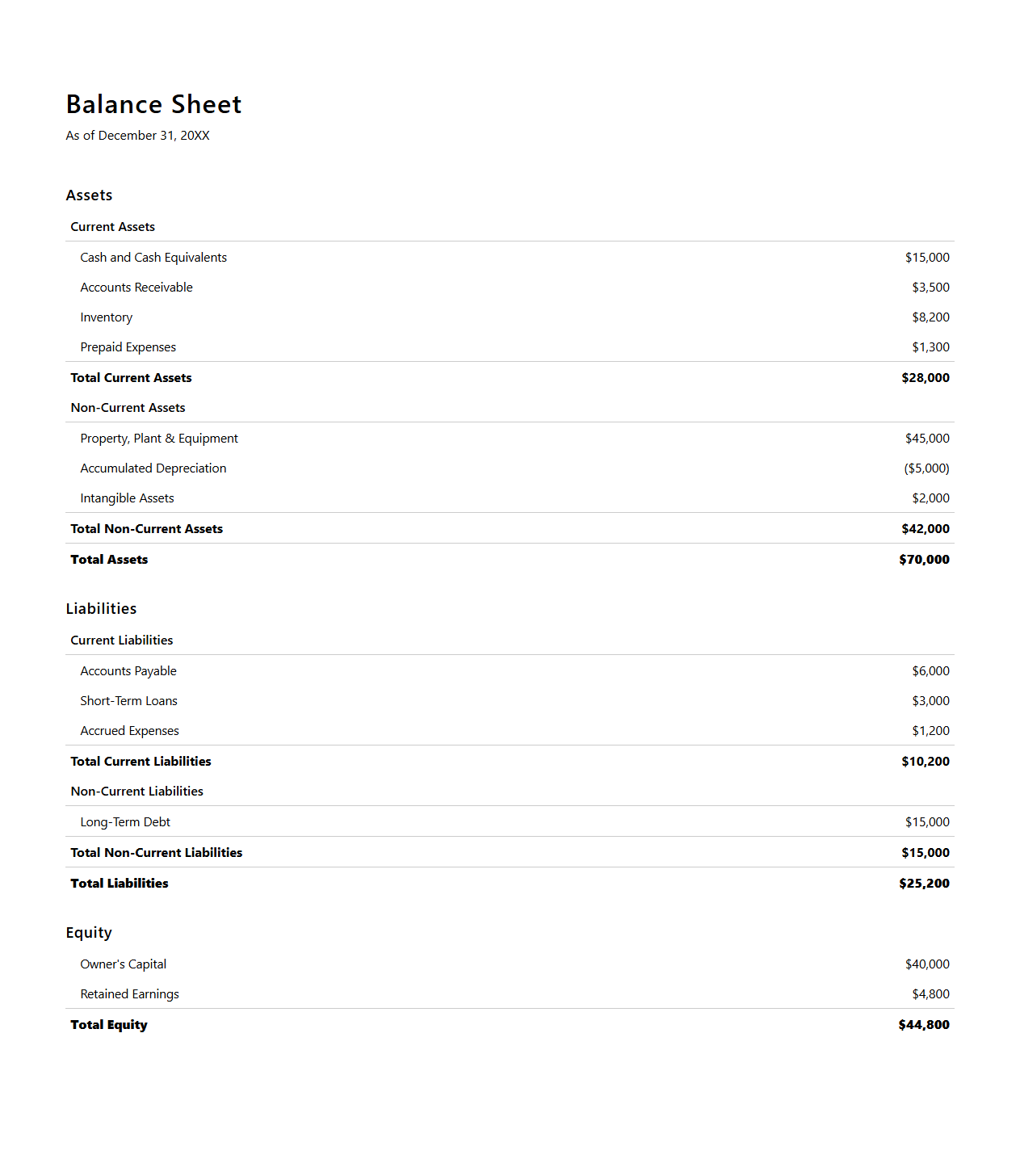

Balance Sheet Example for Business Financial Overview

A

Balance Sheet example in a Business Financial Overview document provides a snapshot of a company's financial position at a specific point in time, detailing assets, liabilities, and shareholders' equity. It helps stakeholders assess the organization's liquidity, solvency, and capital structure by clearly presenting current and long-term financial obligations alongside owned resources. This financial statement is essential for informed decision-making, investment analysis, and regulatory compliance.

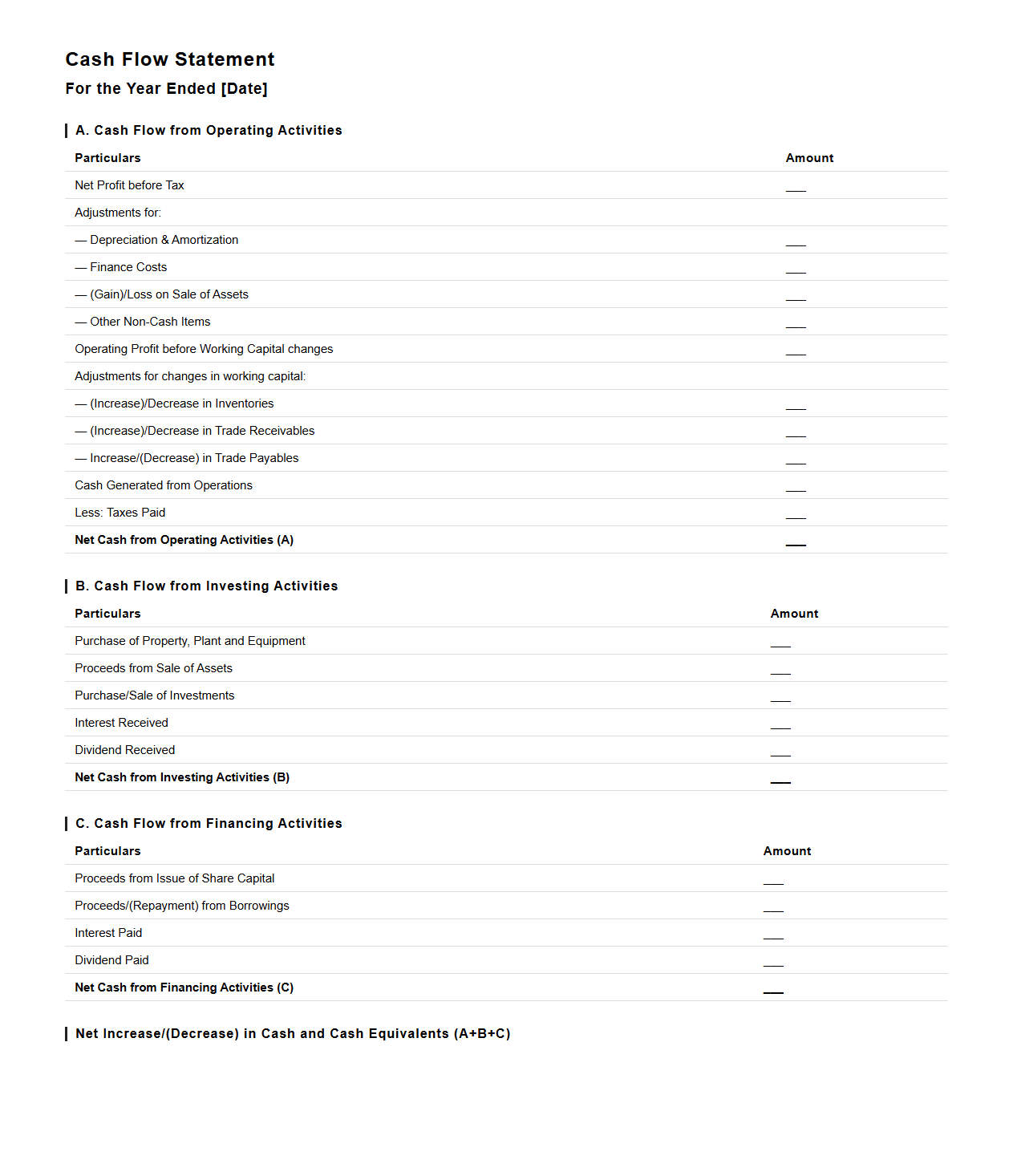

Cash Flow Statement Format for Corporate Analysis

The

Cash Flow Statement Format for Corporate Analysis document provides a structured layout to track the inflow and outflow of cash within a company, categorizing activities into operating, investing, and financing sections. This format enables analysts to assess a corporation's liquidity, financial flexibility, and overall cash management performance. Proper understanding of this document aids in making informed decisions regarding investment, creditworthiness, and operational efficiency.

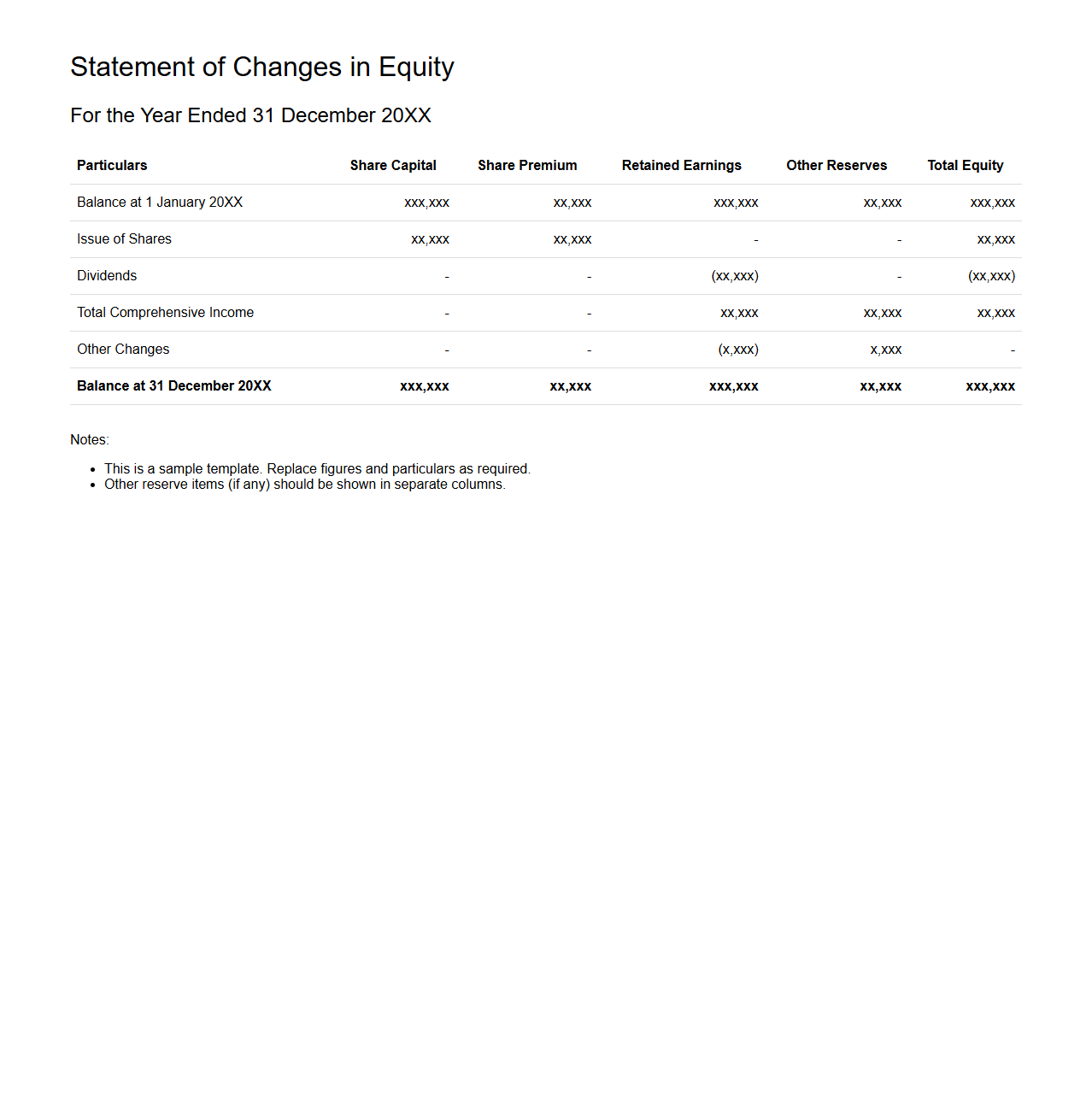

Statement of Changes in Equity for Company Reports

The

Statement of Changes in Equity details the movement in a company's equity accounts over a financial period, reflecting changes from net income, dividends, issuance or repurchase of shares, and other comprehensive income. It helps stakeholders understand how profits are retained, distributed, or reinvested, offering insights into the company's financial health and shareholder value. This statement is a critical component of company reports, complementing the balance sheet and income statement by highlighting equity fluctuations.

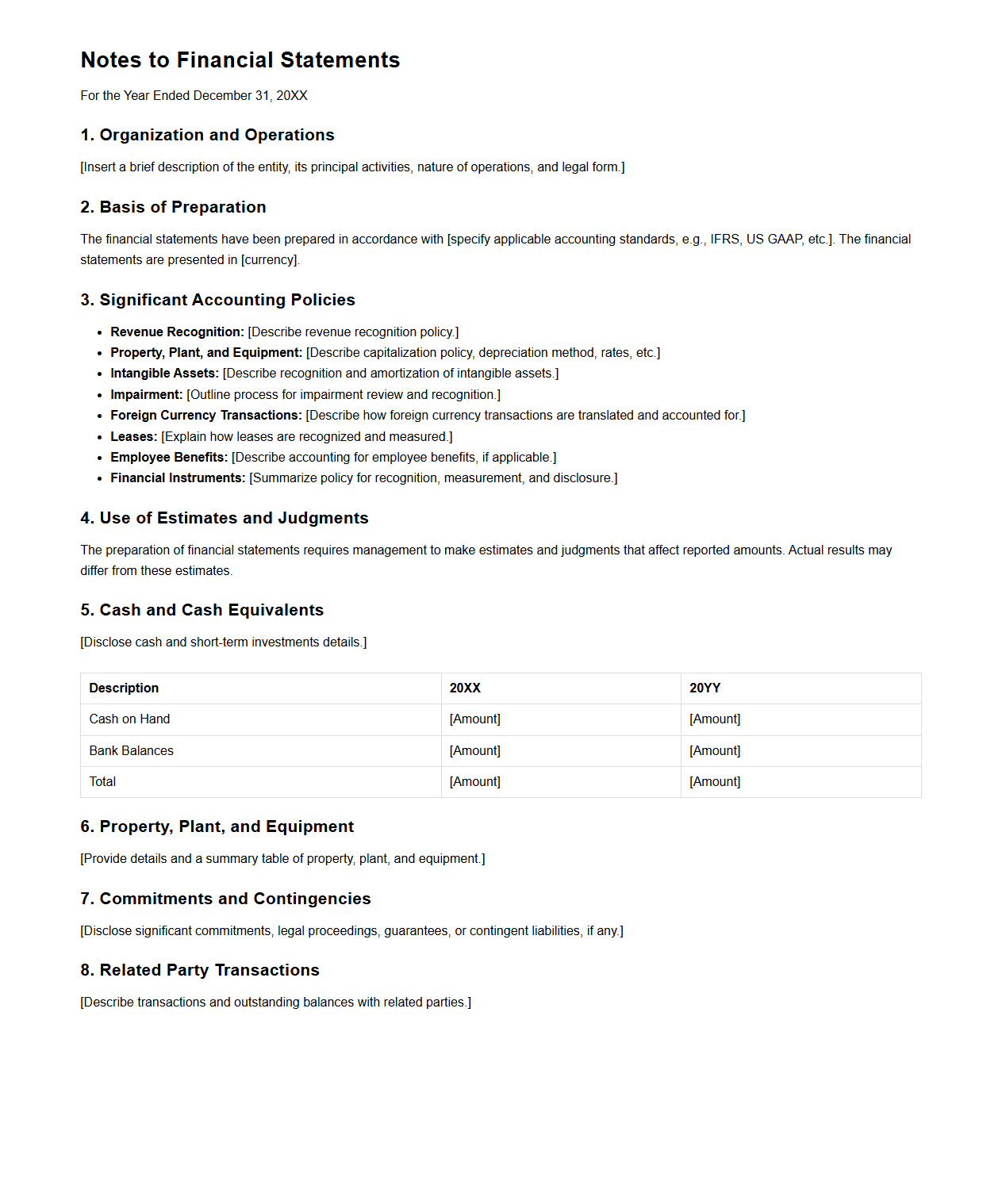

Notes to Financial Statements for Transparency in Reporting

Notes to Financial Statements provide detailed explanations and additional context to the figures presented in the main financial statements, enhancing the accuracy and clarity of financial reporting. They include information about accounting policies, contingent liabilities, and any significant events or transactions that impact the company's financial position. This transparency is crucial for stakeholders to make informed decisions based on a comprehensive understanding of the organization's financial health.

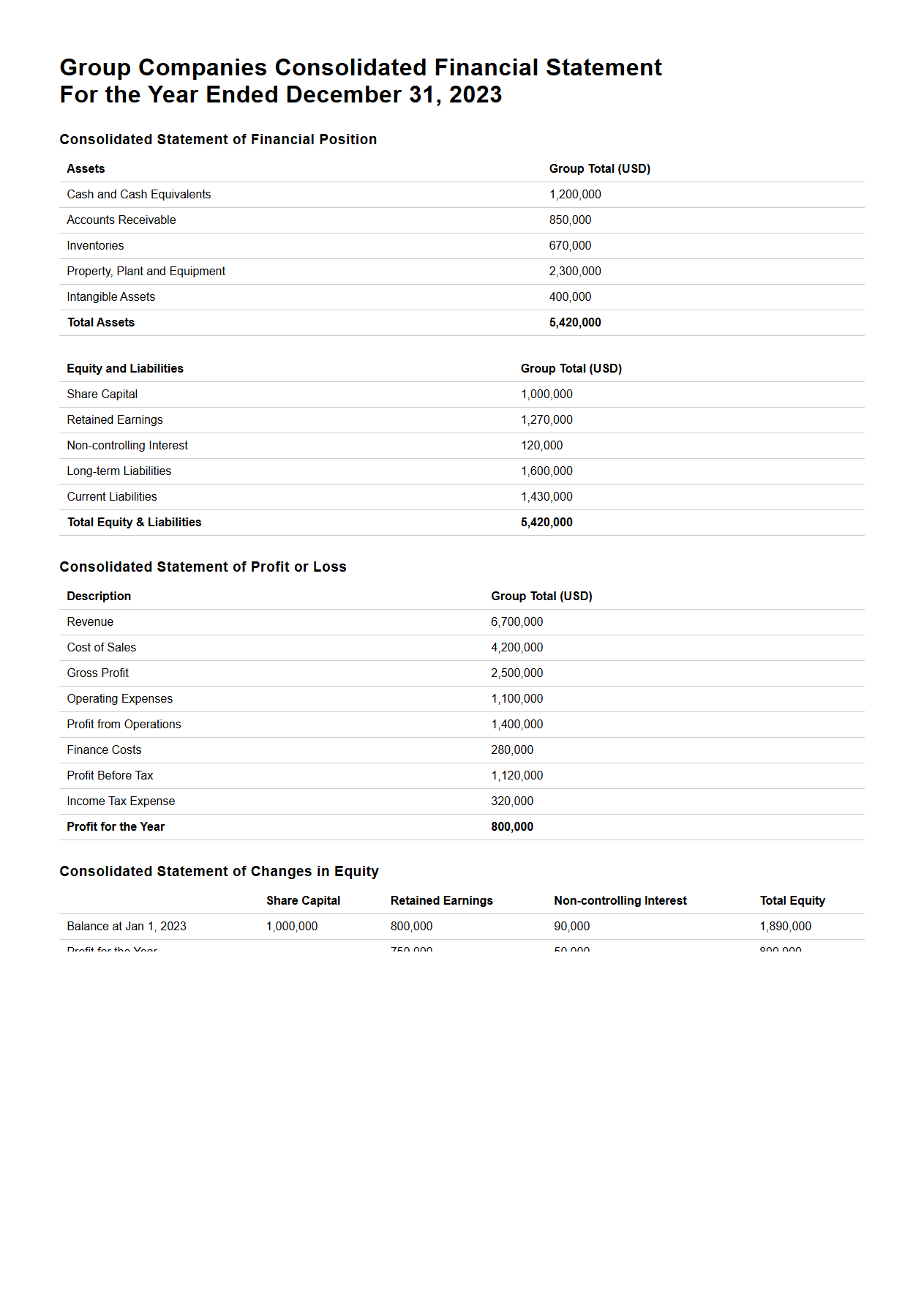

Consolidated Financial Statement Sample for Group Companies

A

Consolidated Financial Statement Sample for Group Companies is a comprehensive document that combines the financial information of a parent company and its subsidiaries into a single set of statements. It includes the consolidated balance sheet, income statement, cash flow statement, and notes, presenting an overall financial position and performance of the entire corporate group. This sample serves as a reference for preparing accurate and compliant consolidated reports in accordance with accounting standards such as IFRS or GAAP.

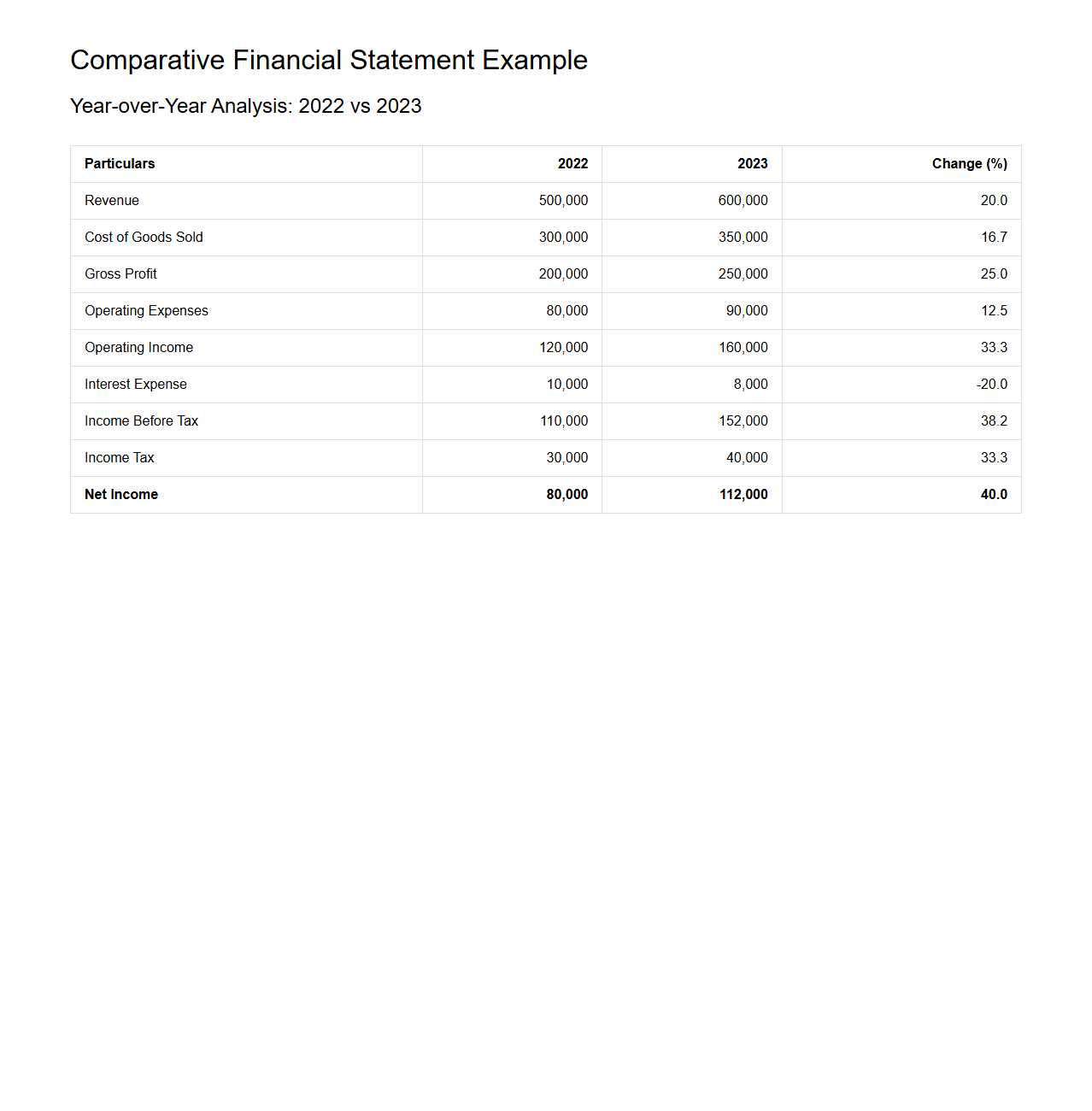

Comparative Financial Statement Example for Year-over-Year Analysis

A

Comparative Financial Statement Example for Year-over-Year Analysis document presents side-by-side financial data from multiple fiscal periods, highlighting changes in key metrics such as revenue, expenses, and net income. This format allows businesses to evaluate performance trends, identify growth patterns, and detect financial anomalies by comparing figures from one year directly to those of another. Analysts and stakeholders use this tool to make informed decisions based on a clear visual representation of financial progress over time.

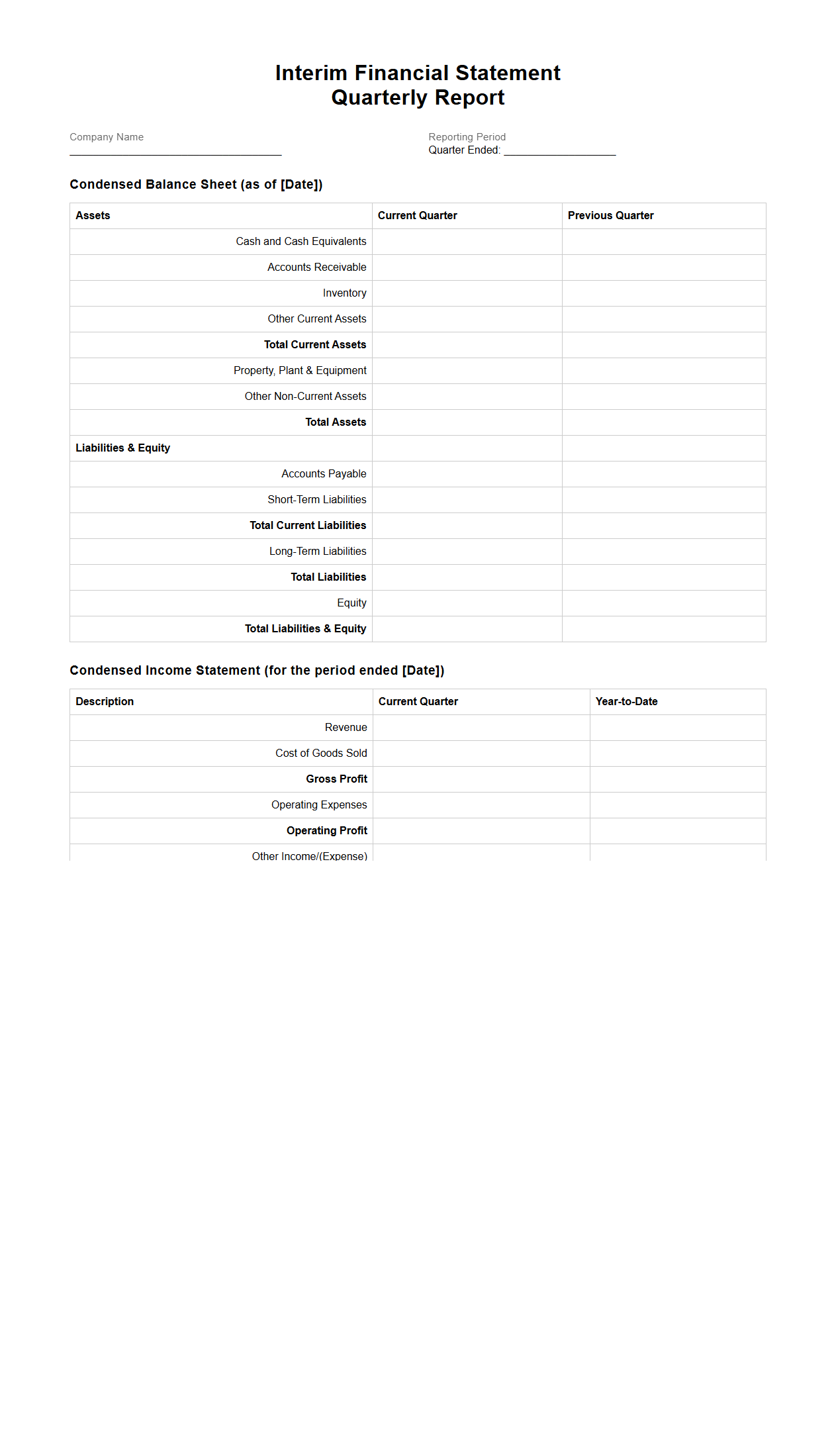

Interim Financial Statement Template for Quarterly Reporting

An

Interim Financial Statement Template for Quarterly Reporting document is a standardized framework used by companies to present their financial performance during a three-month period. It includes key components such as the balance sheet, income statement, and cash flow statement, enabling stakeholders to assess financial health and operational outcomes between annual reports. This template ensures consistency, accuracy, and compliance with regulatory requirements, facilitating efficient financial analysis and decision-making.

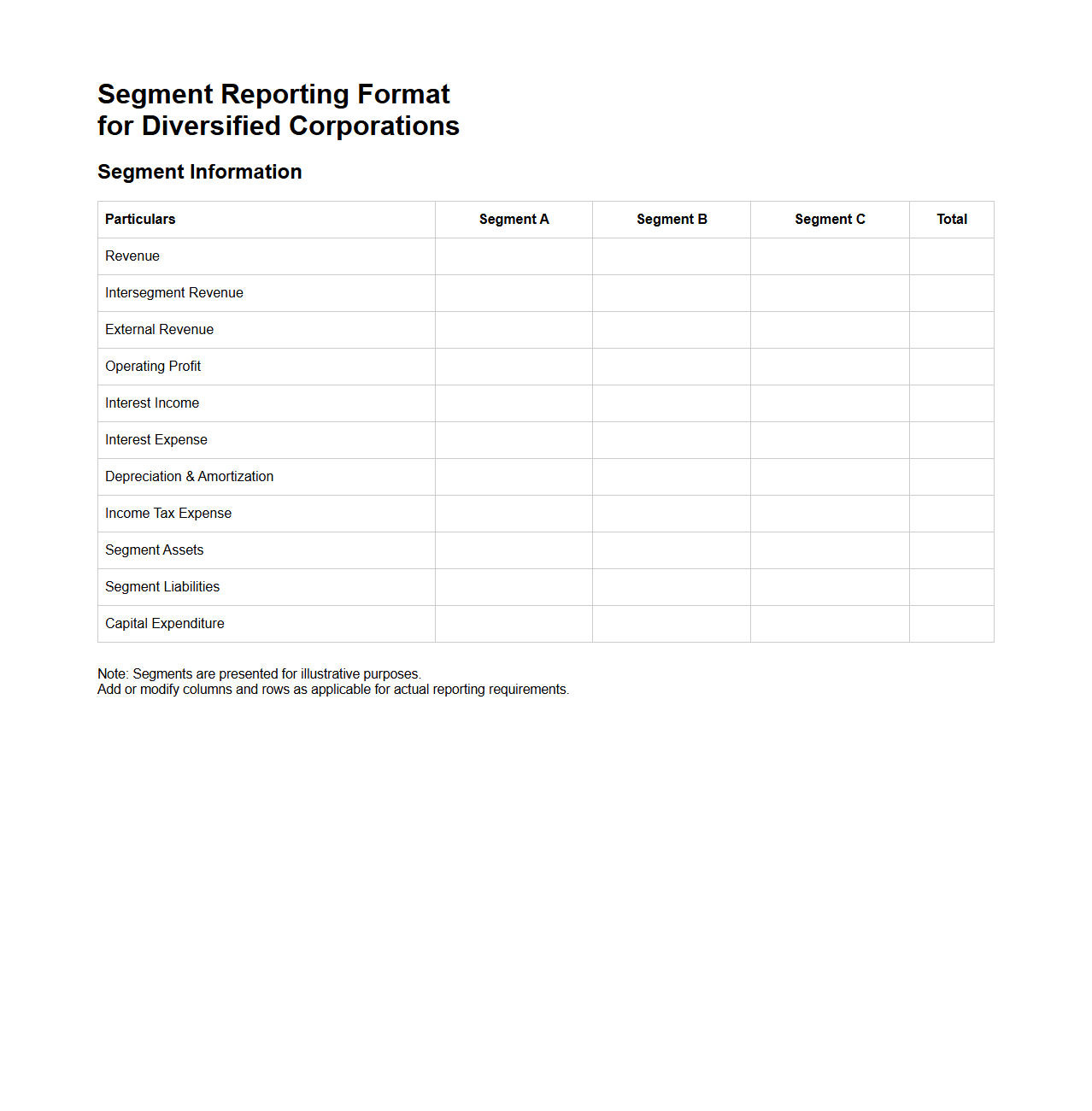

Segment Reporting Format for Diversified Corporations

Segment Reporting Format for Diversified Corporations is a structured financial report that provides detailed information about a company's various business segments. This document outlines revenue, profit, assets, and liabilities for each segment, enabling stakeholders to assess the performance and risks associated with different areas of the corporation. The

segment reporting format enhances transparency and aids in regulatory compliance by presenting a clear view of operational diversity.

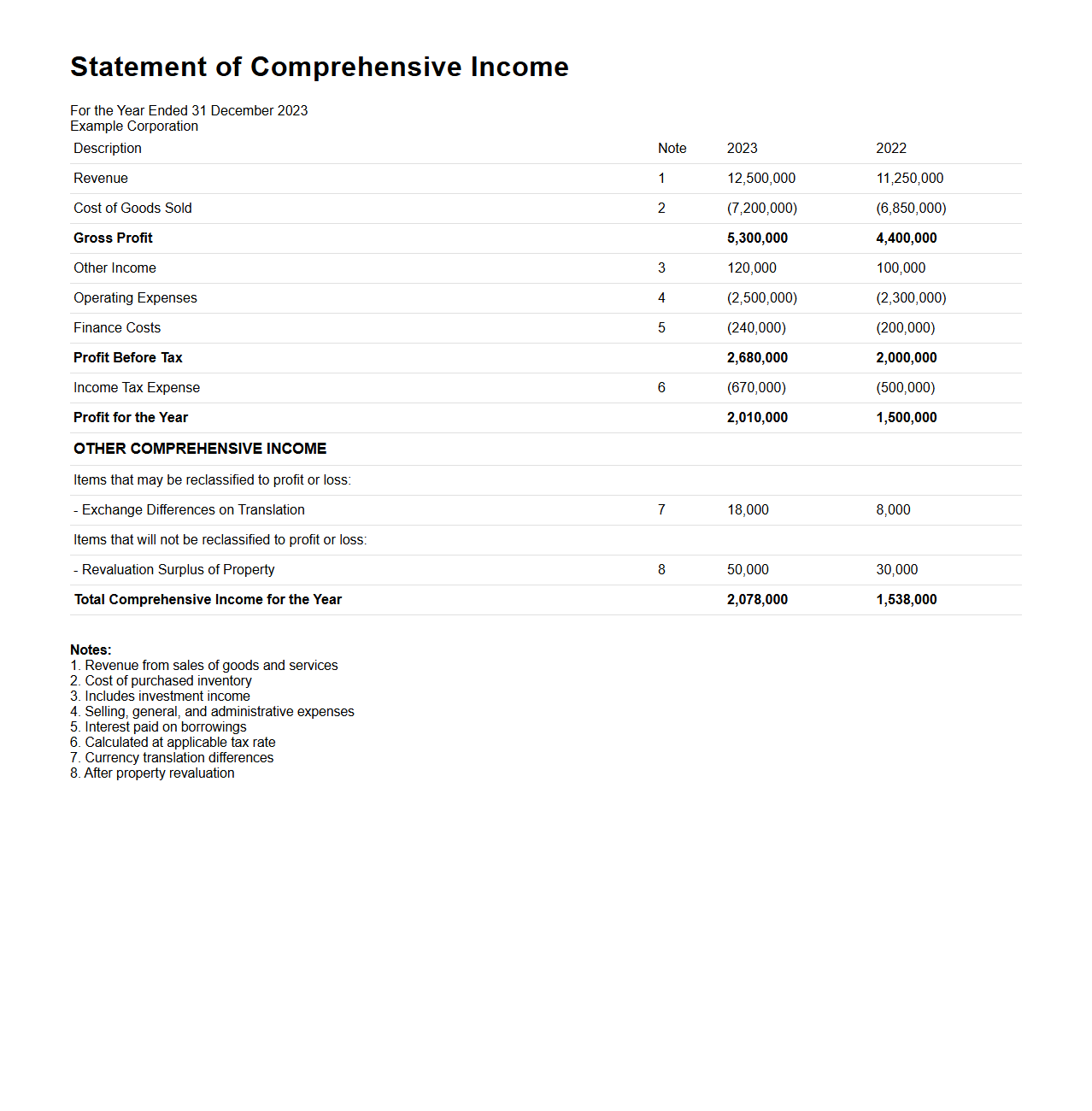

Statement of Comprehensive Income Example for Corporate Disclosure

A

Statement of Comprehensive Income example for a corporate disclosure document illustrates how a company reports its financial performance, including net income and other comprehensive income items such as unrealized gains or losses on investments and foreign currency translation adjustments. This statement provides stakeholders with a complete view of a company's total earnings beyond traditional profit or loss, reflecting changes in equity from non-owner sources. It is essential for transparency in financial reporting and helps investors assess the overall financial health and sustainability of the business.

What are the essential compliance checkpoints for financial statement documents in corporate reporting?

Ensuring accuracy in financial figures is critical for corporate reporting compliance. Companies must verify adherence to applicable accounting standards like GAAP or IFRS. Additionally, disclosures must comprehensively cover all significant policies and risks related to financial performance.

How are material misstatements identified and disclosed in annual financial statements?

Material misstatements are typically identified through rigorous audit procedures and internal control evaluations. Once detected, companies are required to disclose these misstatements clearly in the notes to financial statements. This disclosure ensures stakeholders are informed about potential impacts on financial credibility.

What supporting schedules are typically attached to consolidated financial statement documents?

Common supporting schedules include detailed breakouts of subsidiary balances, intercompany eliminations, and segment reporting. These schedules provide transparency and aid in understanding consolidated results. They are essential for auditors and regulatory bodies to perform comprehensive reviews.

Which metadata fields are mandatory for digital financial statement submissions under XBRL?

Mandatory metadata fields in XBRL submissions include entity identifiers, reporting period, and taxonomy references. These data points ensure proper classification and retrieval of financial information in digital databases. Compliance with these metadata standards is required by regulatory authorities worldwide.

How do internal control narratives integrate with financial statement documentation for audits?

Internal control narratives describe the control environment, risk assessment, and monitoring activities. They complement financial statements by providing auditors with insights into the effectiveness of controls over financial reporting. This integration enhances the audit process and substantiates the reliability of financial disclosures.