A Loan Agreement Document Sample for Personal Finance provides a clear framework outlining the terms and conditions between the borrower and lender. It includes essential details such as loan amount, interest rate, repayment schedule, and consequences of default to protect both parties. This template ensures transparency and legal compliance, making personal loans more secure and manageable.

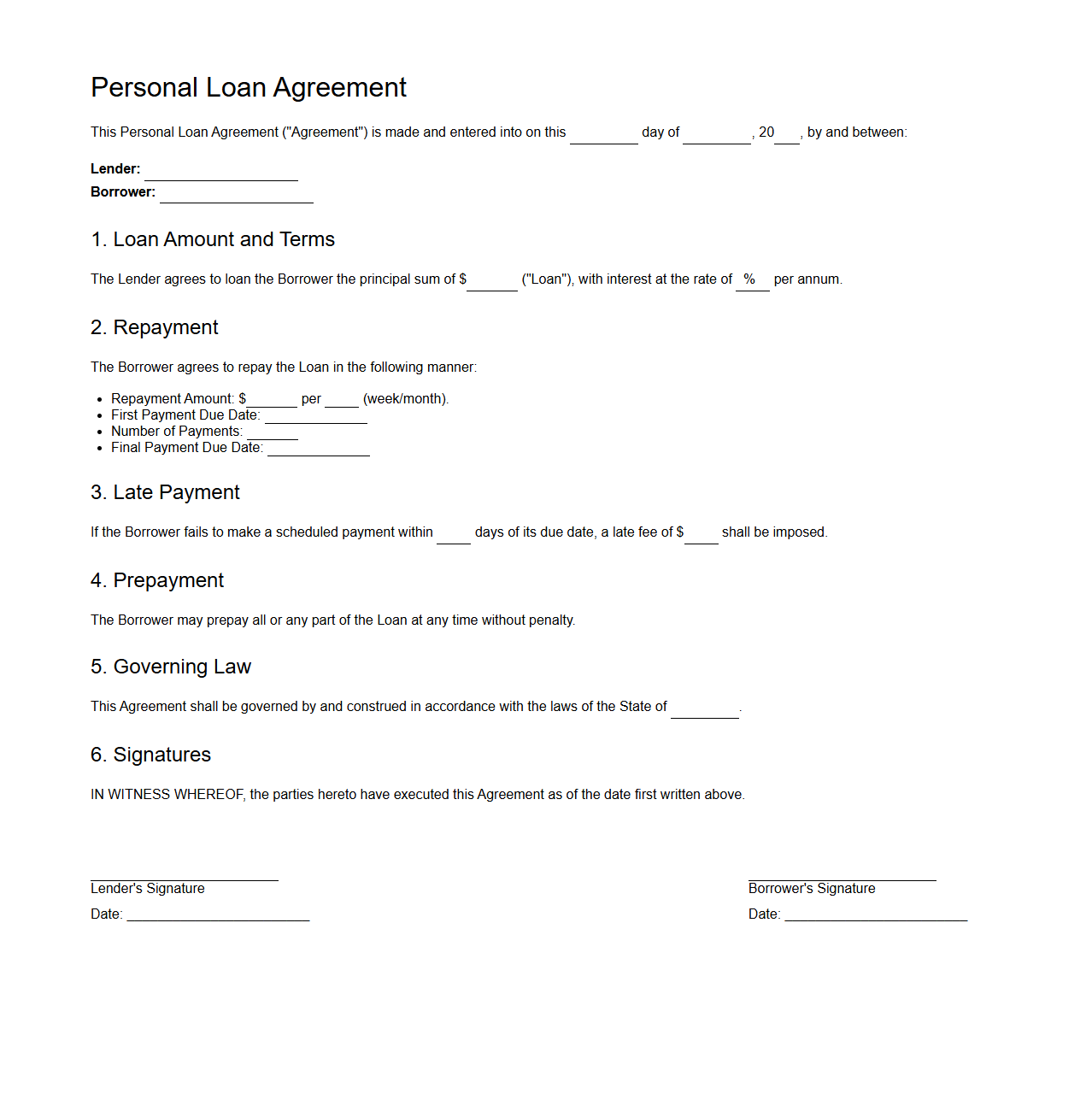

Personal Loan Agreement Sample for Individuals

A

Personal Loan Agreement Sample for Individuals is a legally binding document outlining the terms and conditions between a borrower and a lender for a personal loan. It specifies key details such as the loan amount, interest rate, repayment schedule, and consequences of default. This template helps ensure clarity, protect both parties, and facilitate smooth transactions.

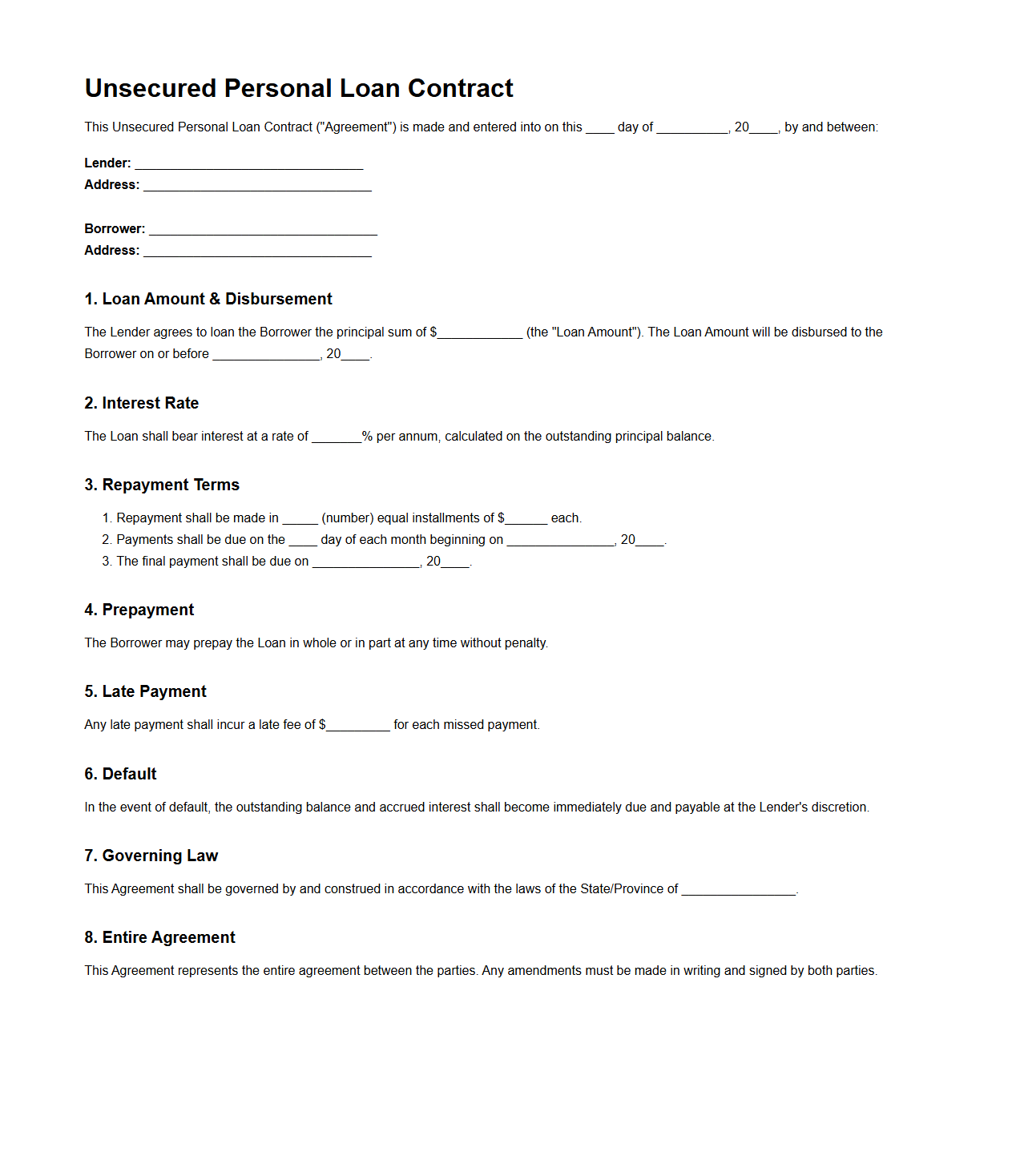

Unsecured Personal Loan Contract Template

An

Unsecured Personal Loan Contract Template is a legally binding document that outlines the terms and conditions between a lender and borrower for a personal loan without collateral. This template specifies the loan amount, interest rate, repayment schedule, and borrower obligations, ensuring clear agreement and protection for both parties. Using a standardized template helps streamline the loan process and minimize potential disputes.

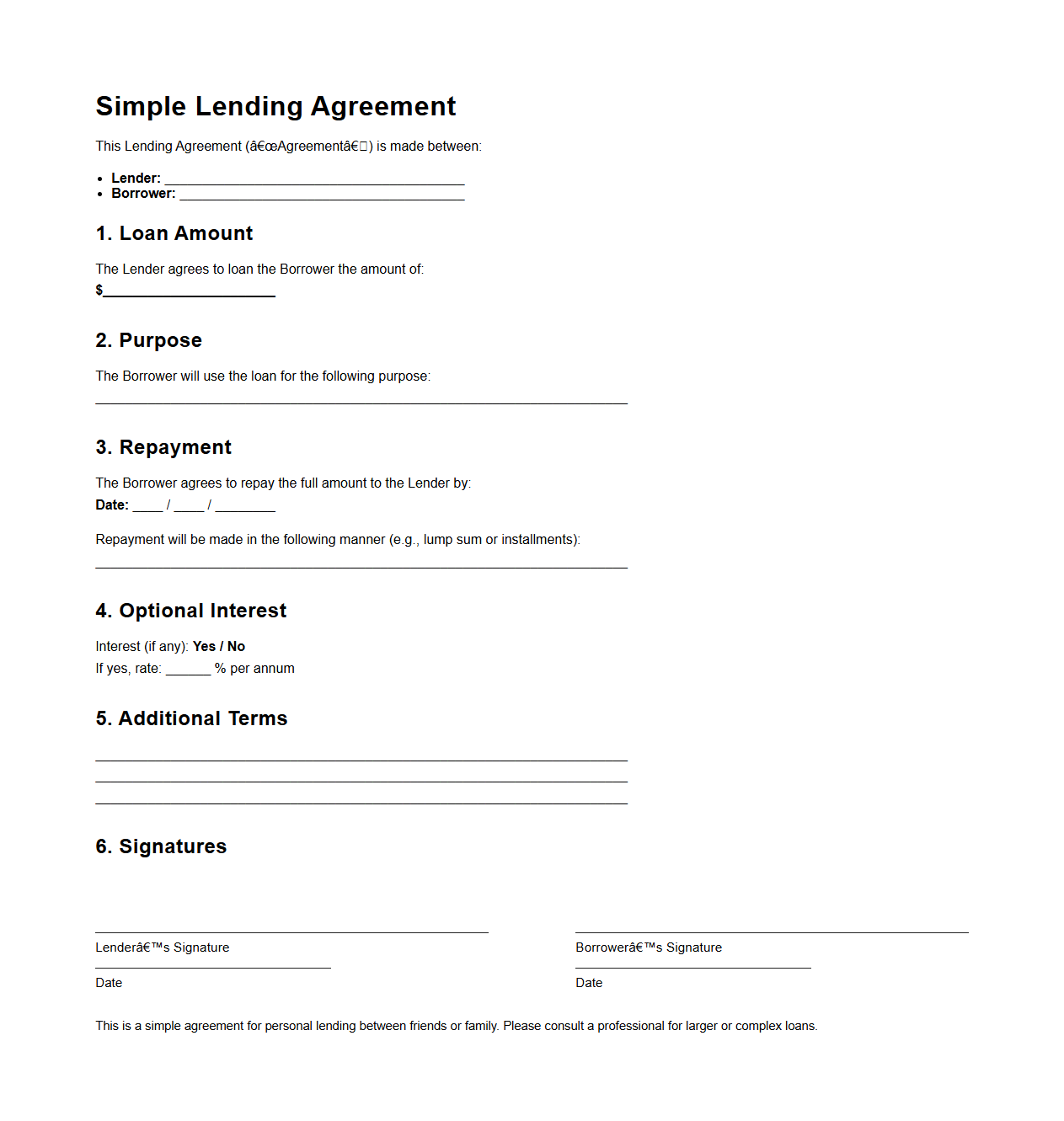

Simple Lending Agreement for Friends and Family

A

Simple Lending Agreement for Friends and Family document is a legally binding contract outlining the terms of a loan between individuals who share a close personal relationship. It specifies the loan amount, repayment schedule, interest rate (if any), and responsibilities of both lender and borrower to prevent misunderstandings. This agreement provides clarity and protection, ensuring financial transactions among friends and family are transparent and enforceable.

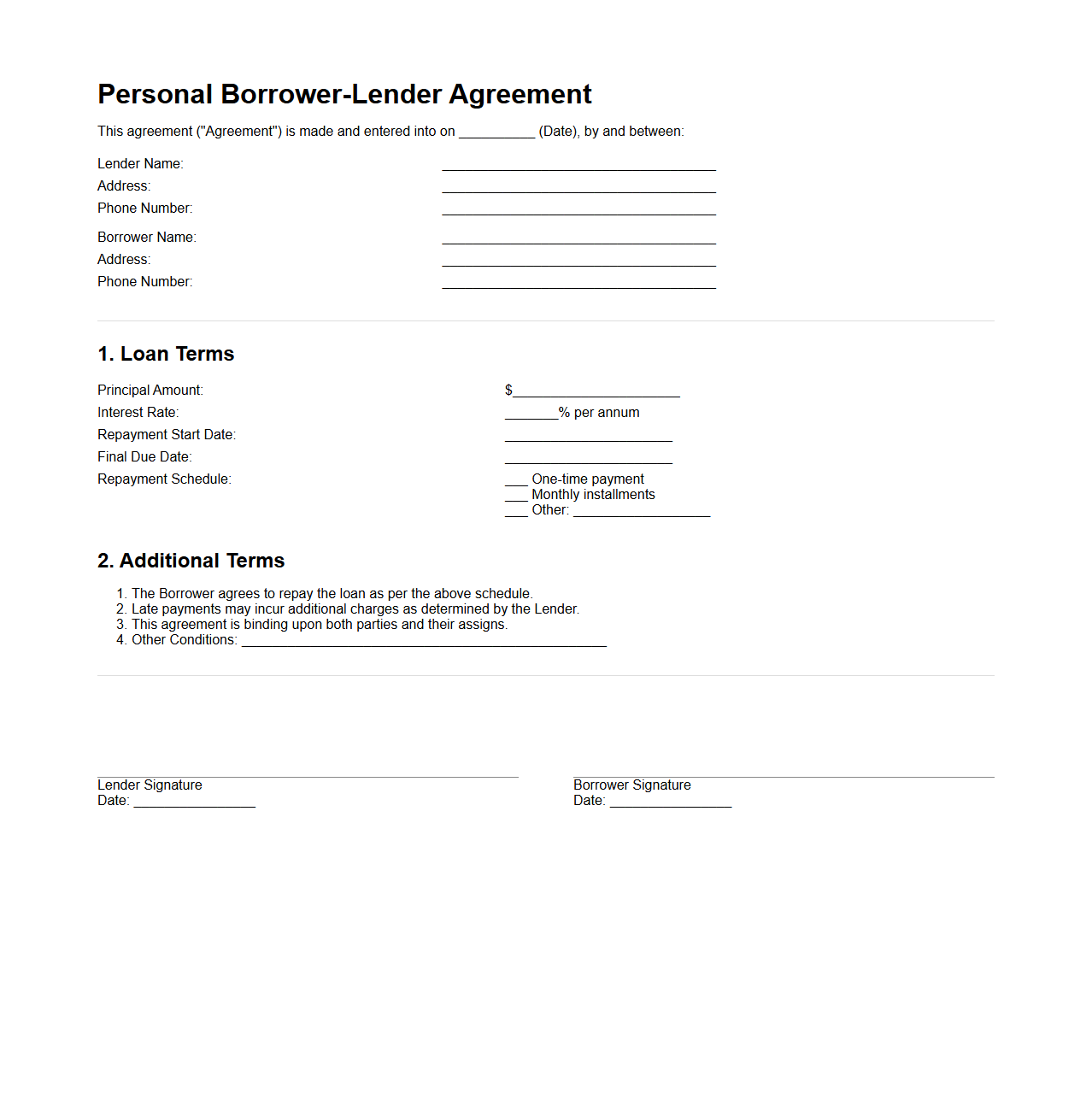

Personal Borrower-Lender Agreement Example

A

Personal Borrower-Lender Agreement Example document outlines the terms and conditions governing a loan between two private parties, detailing the loan amount, interest rate, repayment schedule, and obligations of both borrower and lender. This legally binding contract protects both parties by clearly defining financial responsibilities, preventing misunderstandings and potential disputes. It serves as a valuable reference for drafting a customized borrowing agreement that complies with relevant laws and ensures transparent communication.

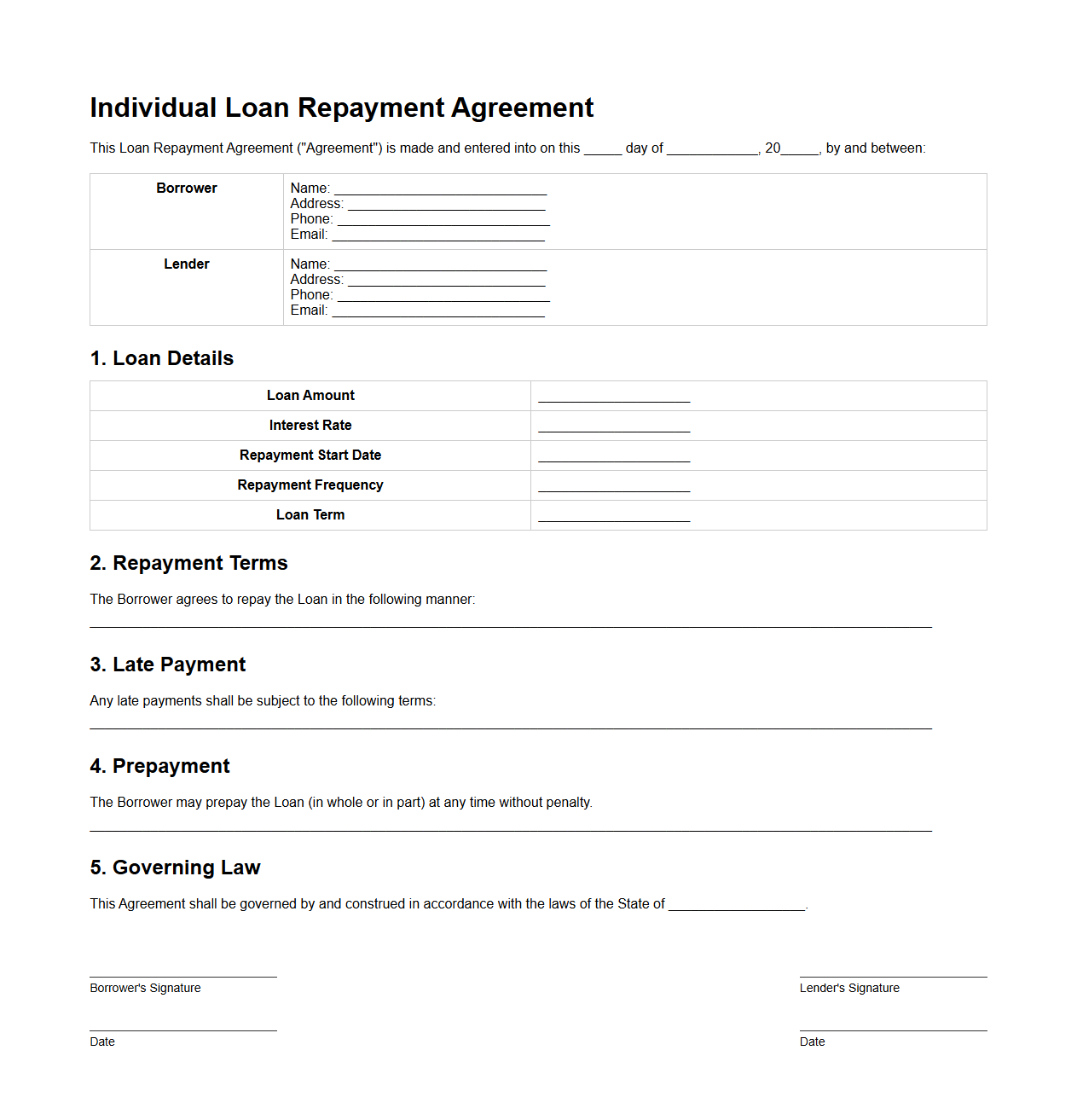

Individual Loan Repayment Agreement Format

An

Individual Loan Repayment Agreement Format document outlines the terms and conditions under which a borrower agrees to repay a specific loan amount to the lender. It clearly specifies the repayment schedule, interest rates, penalties for late payment, and other essential details to ensure mutual understanding and enforceability. This format serves as a legally binding contract that protects the rights and responsibilities of both parties involved in the loan transaction.

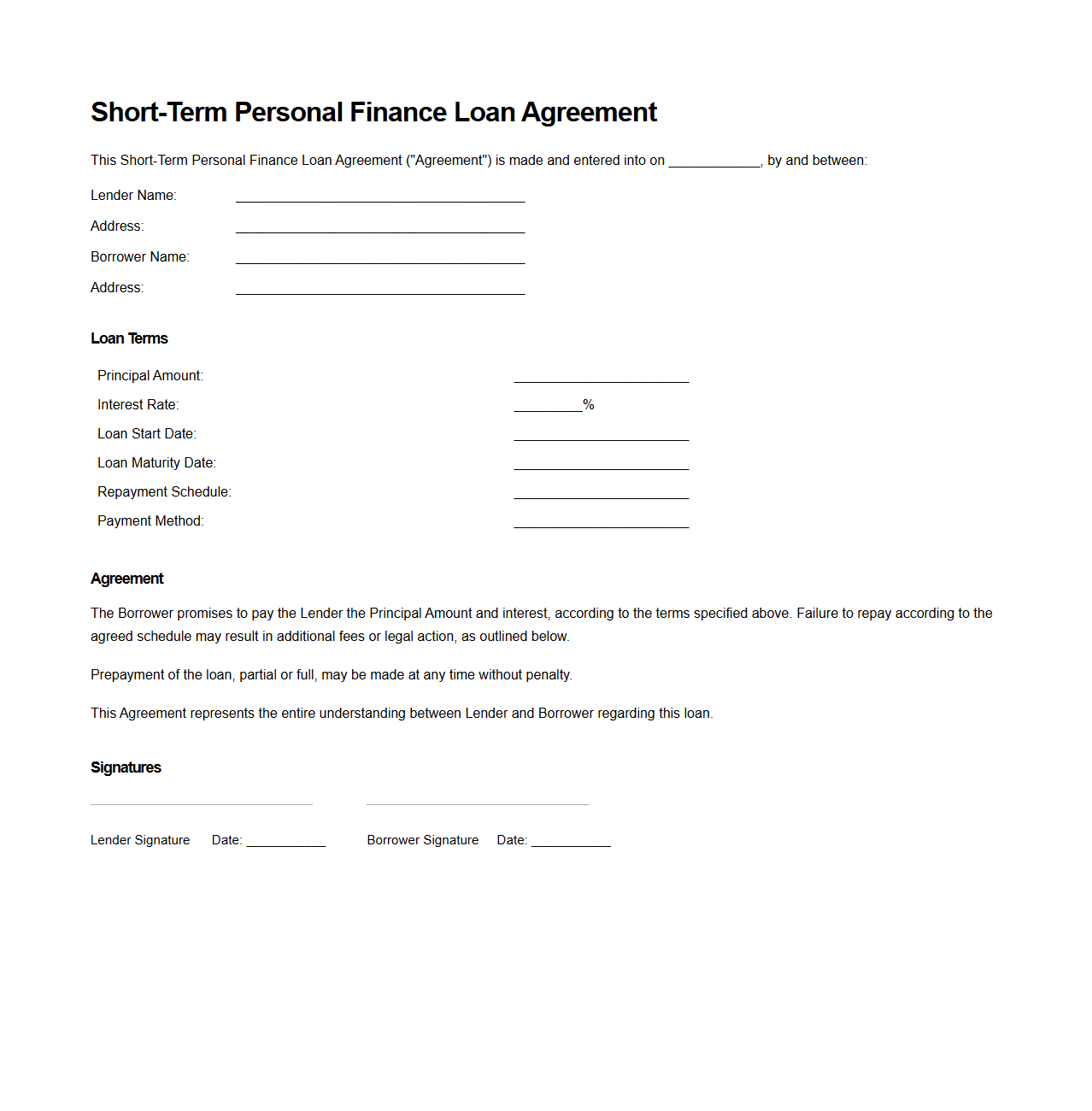

Short-Term Personal Finance Loan Document

A

Short-Term Personal Finance Loan Document is a legal agreement outlining the terms and conditions of a loan intended for immediate financial needs, typically repayable within a year. It details the loan amount, interest rate, repayment schedule, and any fees or penalties associated with early or late payments. This document serves as proof of the borrower's commitment and protects both parties' interests during the loan period.

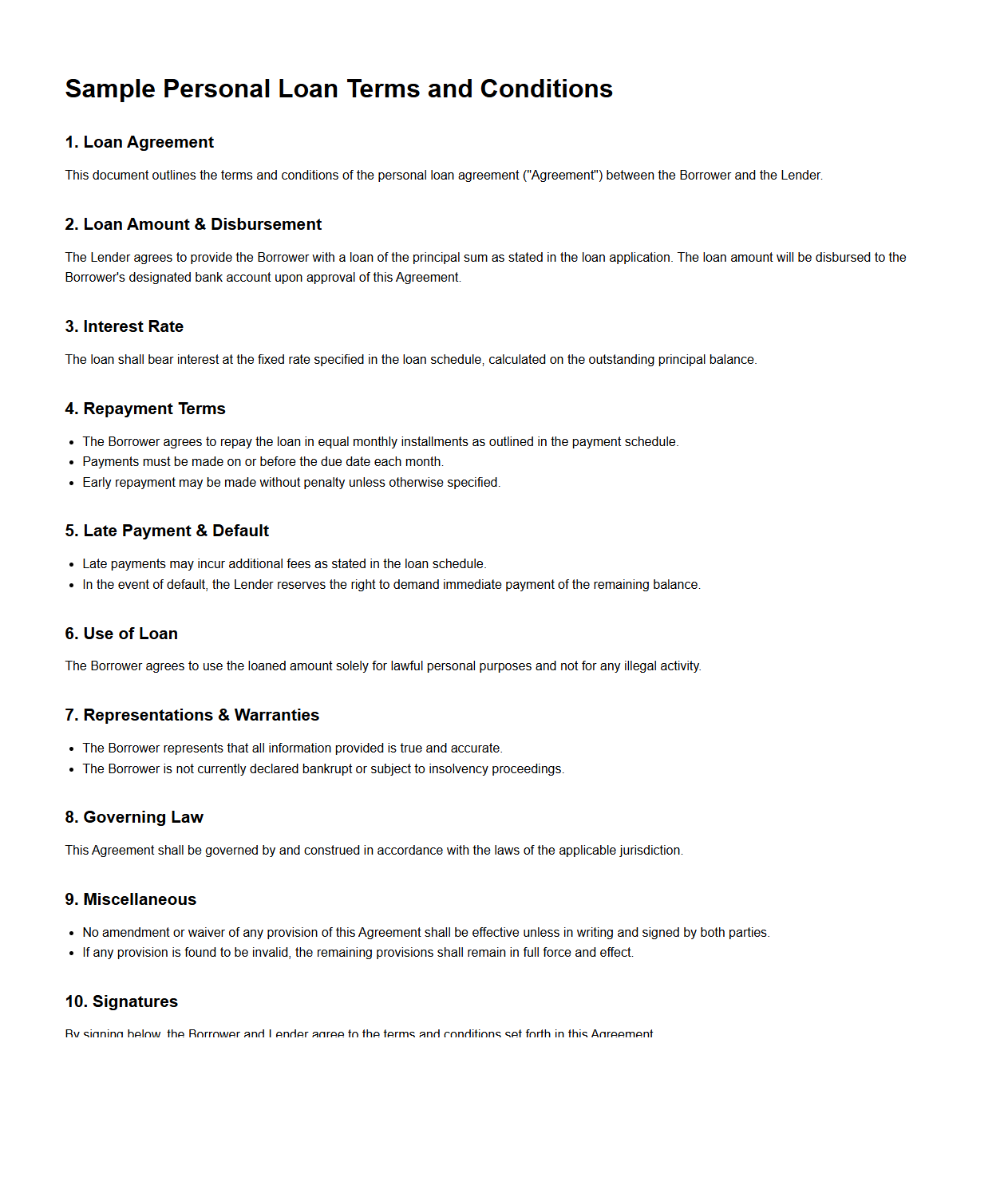

Sample Personal Loan Terms and Conditions

A

Sample Personal Loan Terms and Conditions document outlines the specific requirements, obligations, interest rates, repayment schedules, fees, and penalties associated with a personal loan agreement. This document serves as a legal framework that protects both the lender and borrower by defining the rights and responsibilities of each party during the loan period. It is crucial for ensuring transparency and preventing misunderstandings by clearly detailing all financial and procedural aspects of the loan.

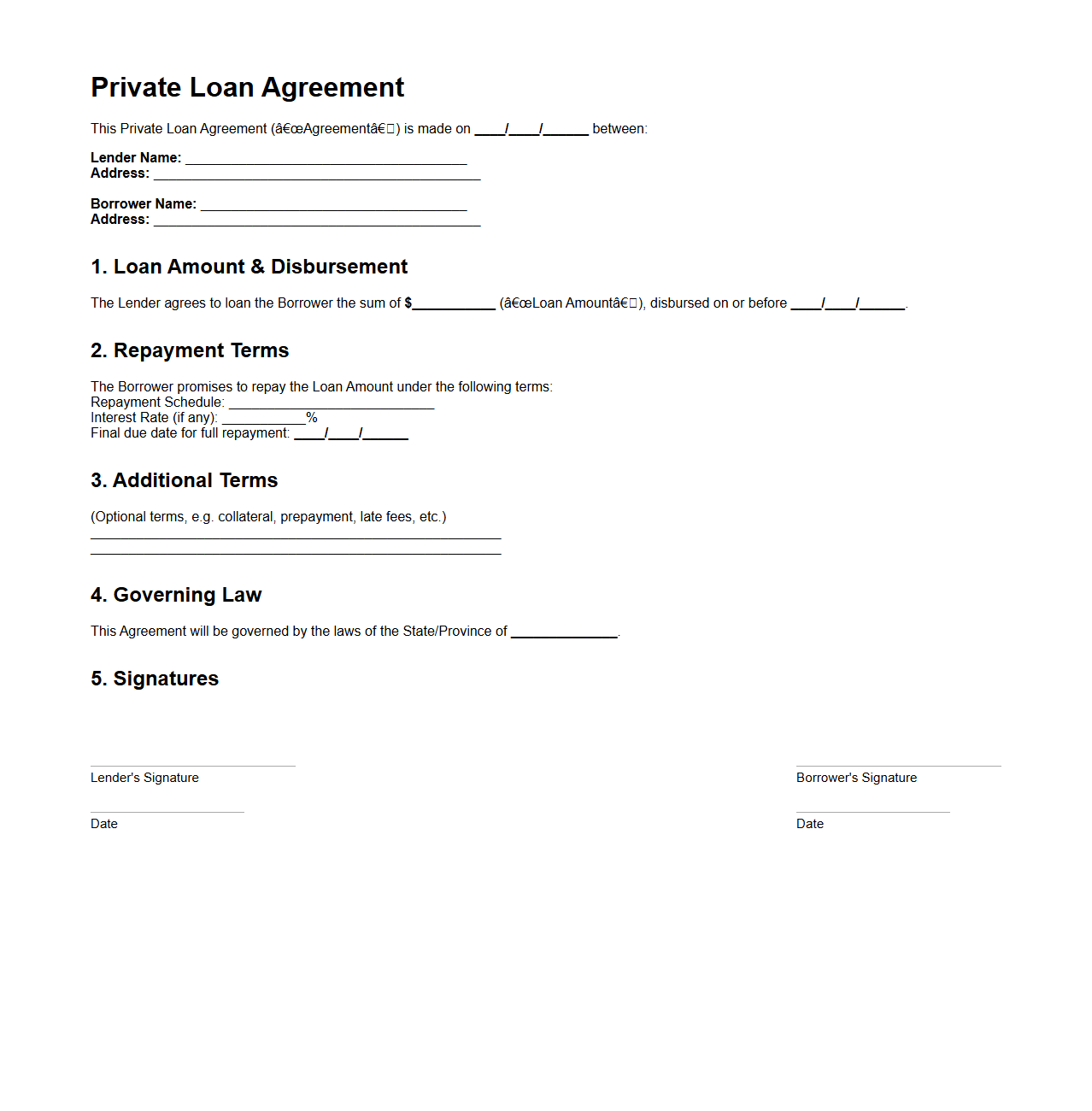

Basic Private Loan Agreement Between Persons

A

Basic Private Loan Agreement Between Persons document outlines the terms and conditions of a loan made from one individual to another without involving financial institutions. This agreement typically includes the loan amount, interest rate, repayment schedule, and default consequences. It serves to legally protect both parties by clearly defining their rights and obligations in the lending arrangement.

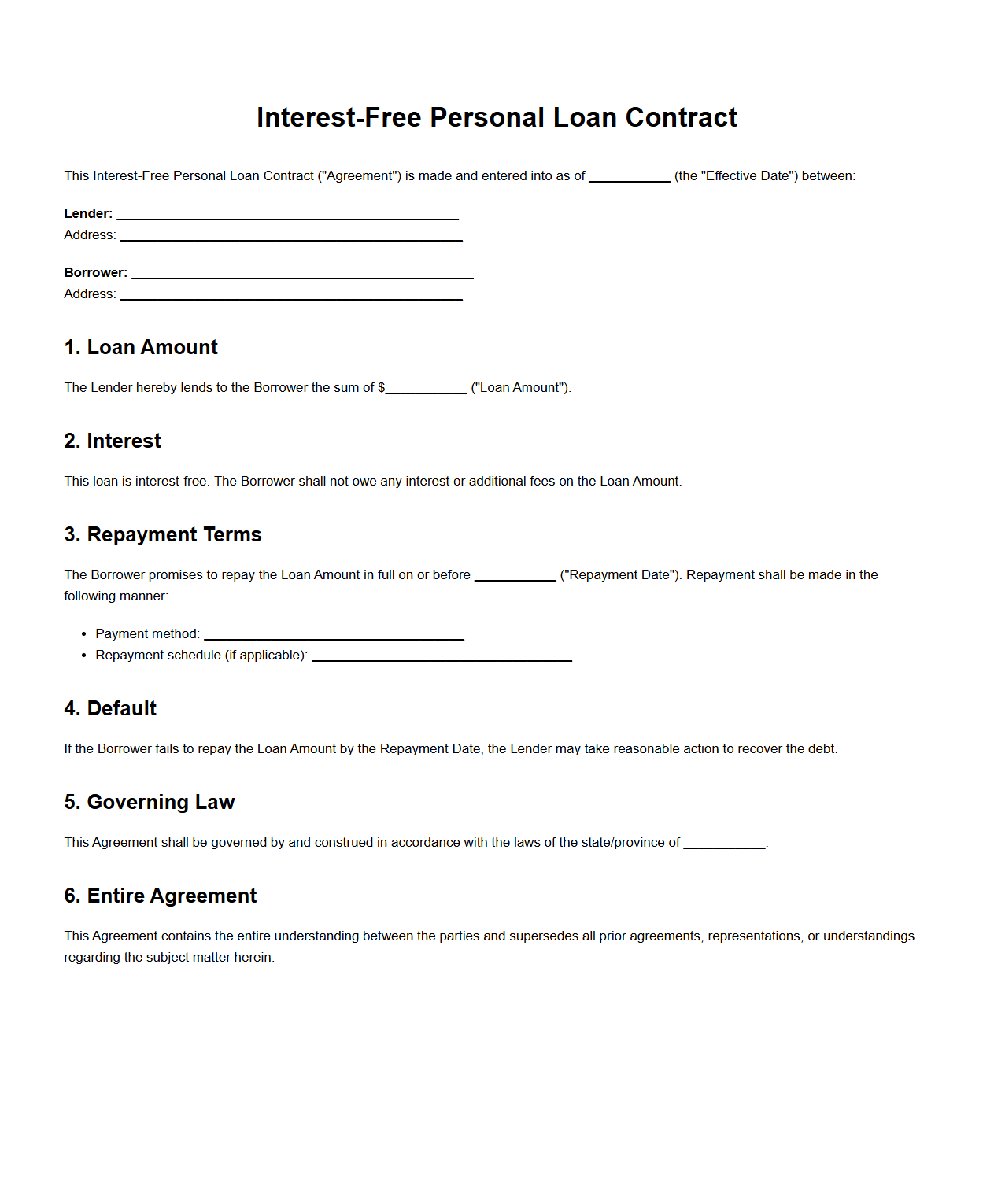

Interest-Free Personal Loan Contract Sample

An

Interest-Free Personal Loan Contract Sample document outlines the terms and conditions of a personal loan agreement without interest charges, specifying repayment schedules, loan amount, and obligations of both lender and borrower. This contract serves as a legally binding reference to ensure transparency and protect both parties in the loan transaction. It typically includes clauses on defaults, repayment methods, and signatures to validate the agreement.

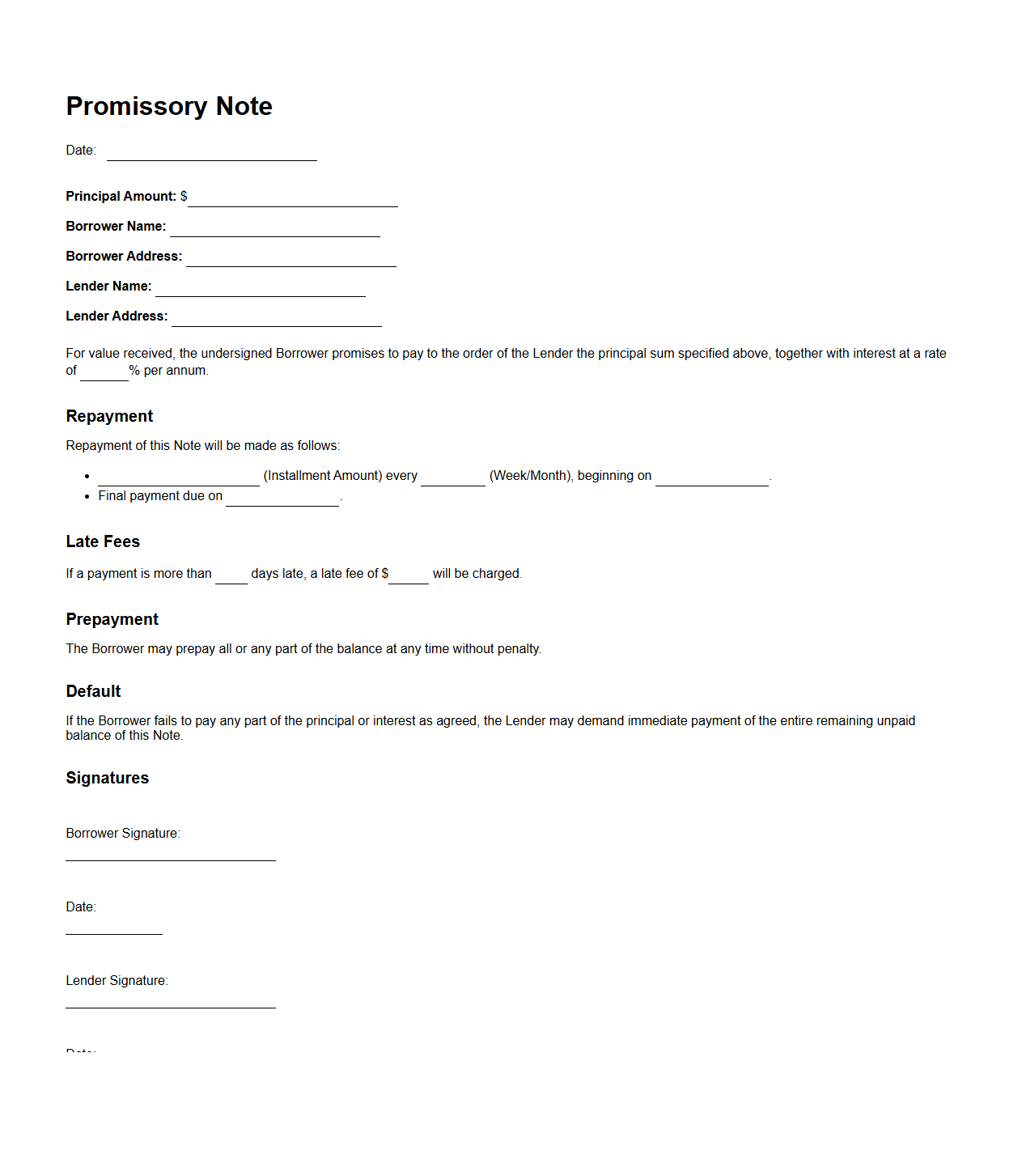

Promissory Note Template for Personal Loan

A

Promissory Note Template for Personal Loan is a legally binding document used to outline the terms of a personal loan agreement between a lender and a borrower. It specifies the loan amount, interest rate, repayment schedule, and consequences of default, ensuring clarity and protection for both parties. This template helps streamline the loan process by providing a standardized format that can be customized to fit individual agreements.

What key clauses are mandatory in a personal loan agreement for individual borrowers?

A personal loan agreement must include key clauses such as the loan amount, interest rate, and repayment schedule. These elements define the primary terms and obligations of both borrower and lender. Clarity in these clauses prevents future disputes and ensures mutual understanding.

How can collateral requirements be articulated in a personal finance loan document?

The collateral clause should clearly specify the asset offered as security, its value, and conditions for forfeiture. Detailed descriptions protect both parties and outline the rights if the borrower defaults. This clause helps mitigate lender risk while ensuring borrower awareness.

What are the best practices for outlining repayment terms in a personal loan agreement?

Repayment terms must include the payment schedule, amounts, methods, and any flexibility options. Clear articulation avoids confusion and facilitates timely payments. Including consequences for missed payments further strengthens the agreement.

How should late payment penalties be specified in a personal finance loan document?

Late payment penalties should be explicitly defined with the penalty amount or rate and the timeframe triggering it. This clarity encourages timely repayment and protects the lender's interests. Transparent penalties also provide borrowers with clear consequences of delays.

What legal disclosures are essential in personal loan agreements to ensure compliance?

Essential legal disclosures include the annual percentage rate (APR), borrower rights, and default implications. These disclosures comply with consumer protection laws and enhance transparency. Including them helps avoid legal disputes and fosters trust.