A Equity Contribution Document Sample for Shareholders serves as a formal template outlining the terms and conditions under which shareholders contribute capital to a company. It details the amount, form of contribution, and the rights granted in exchange for the equity stake. This document ensures clear understanding and legal protection for all parties involved in the equity funding process.

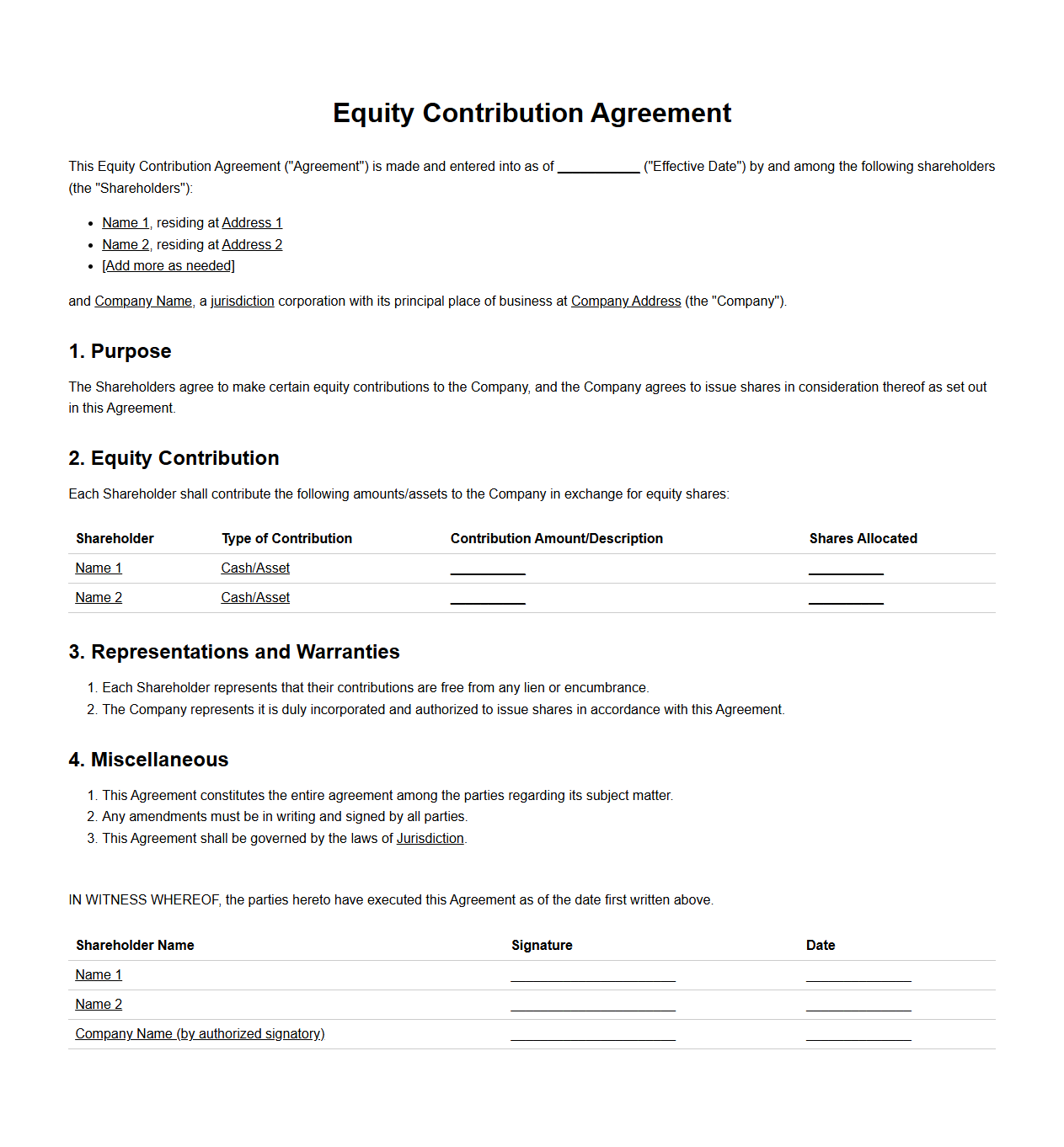

Equity Contribution Agreement Template for Shareholders

The

Equity Contribution Agreement Template for Shareholders outlines the terms and conditions under which shareholders agree to contribute capital to a company, ensuring clear documentation of financial commitments. This legal document specifies the amount, timing, and form of equity contributions, helping prevent disputes and protect both the company and its investors. It serves as a critical tool in corporate governance, facilitating transparency and accountability among shareholders.

Shareholder Capital Injection Form Example

A

Shareholder Capital Injection Form Example document serves as a formal record of additional funds contributed by shareholders to increase a company's equity base. It details the amount invested, payment method, and shareholder information, ensuring transparency and compliance with corporate governance requirements. This form is essential for documenting capital increases and supporting legal and financial audits.

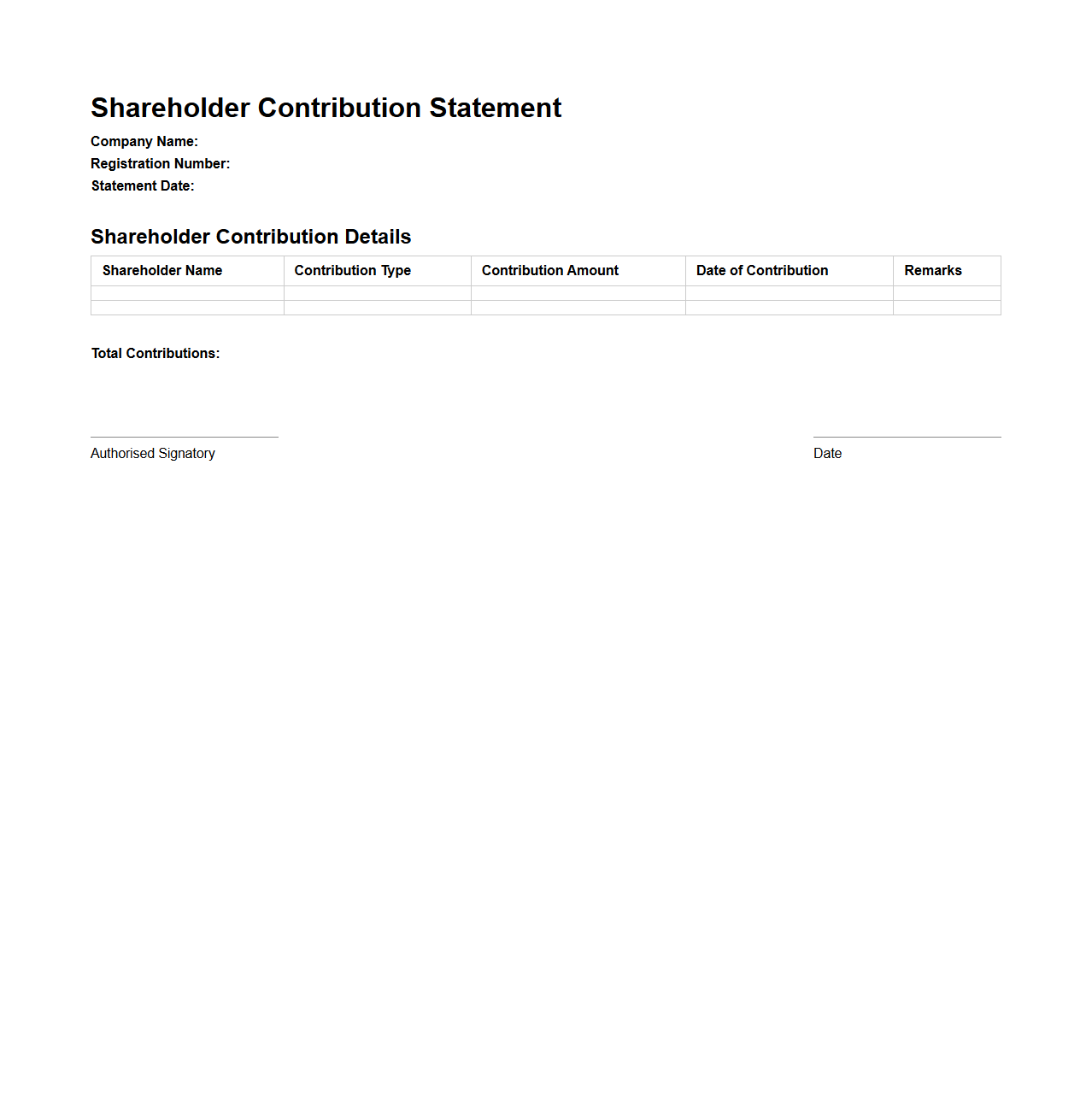

Shareholder Contribution Statement Format

A

Shareholder Contribution Statement Format document outlines the specific details and structure for recording the financial contributions made by shareholders to a company. It includes information such as the shareholder's name, amount contributed, date of contribution, and the method of payment, ensuring accurate tracking and transparency. This format helps maintain organized records for compliance, audit purposes, and shareholder equity management.

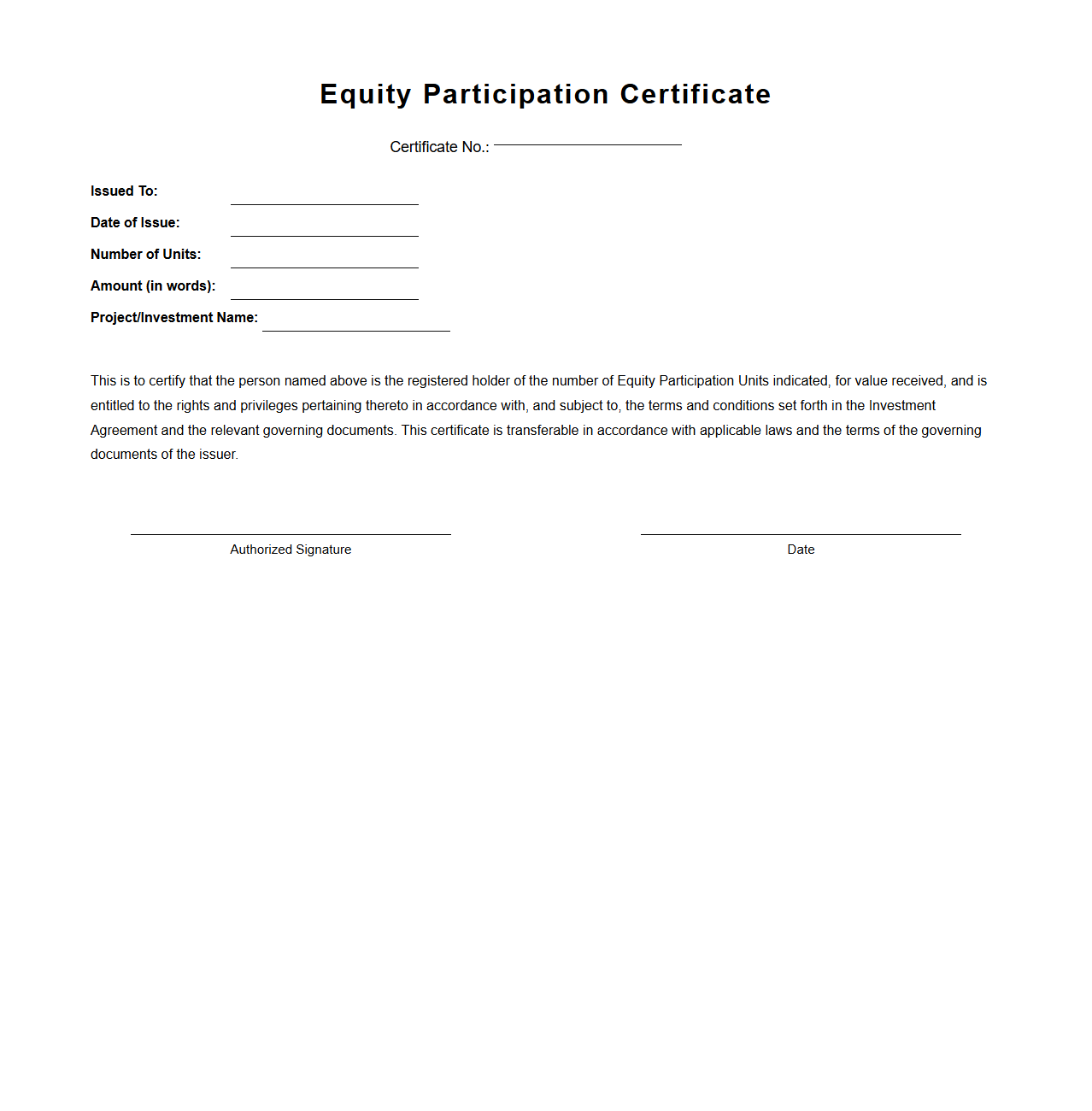

Equity Participation Certificate Sample

An

Equity Participation Certificate Sample document demonstrates the format and essential components of a legal agreement between investors and a company, detailing the proportion of ownership interest and profit-sharing rights. It includes key elements such as the certificate holder's name, percentage of equity held, duration, and terms of participation in the company's financial growth. This sample serves as a crucial reference for drafting accurate and compliant equity participation agreements.

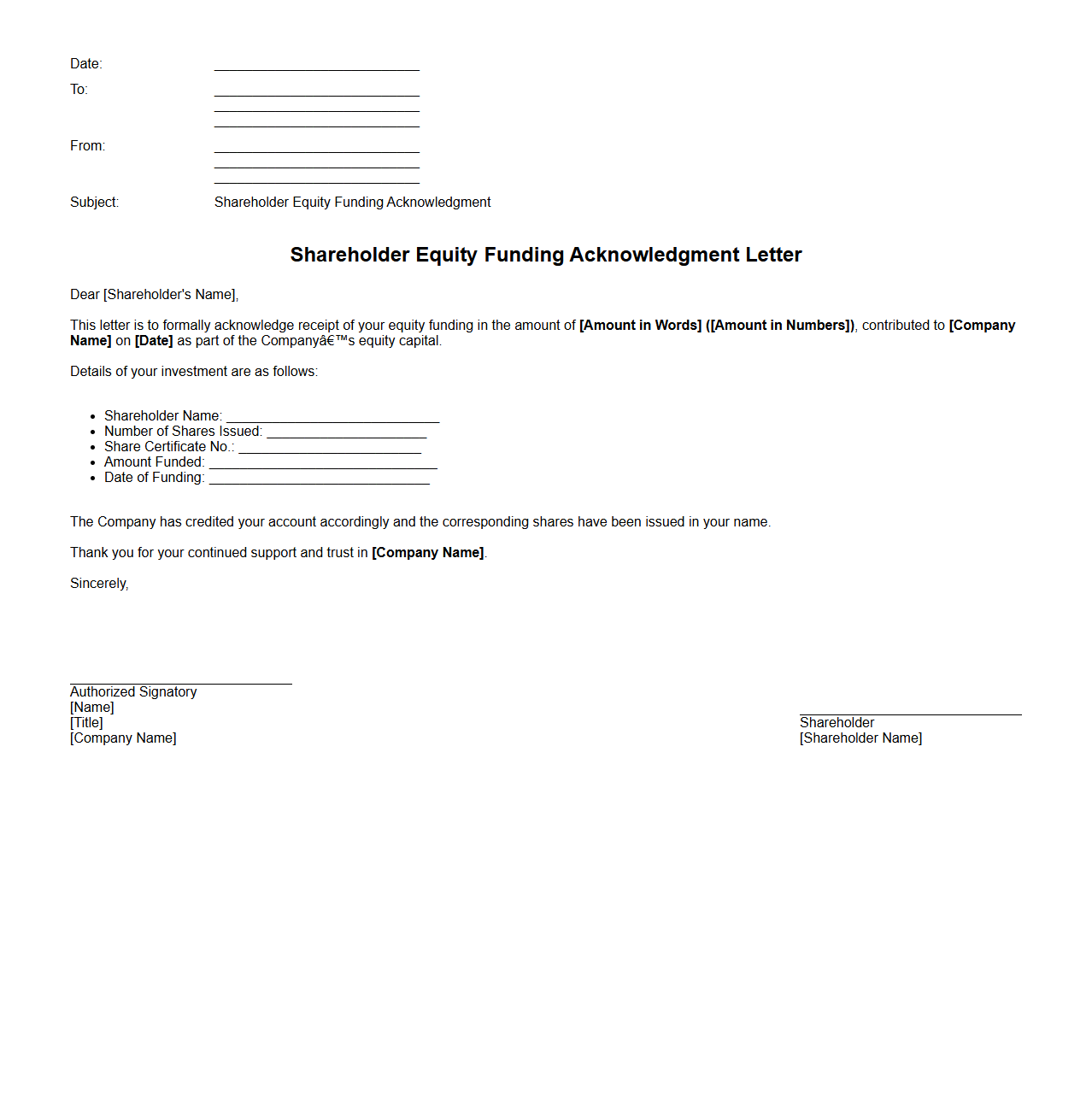

Shareholder Equity Funding Acknowledgment Letter

A

Shareholder Equity Funding Acknowledgment Letter is a formal document that confirms a shareholder's contribution of equity capital to a company. It serves as an official record of the amount invested and acknowledges the shareholder's stake in the company's ownership. This letter is essential for legal and accounting purposes, ensuring transparency and clarity in financial transactions between the company and its shareholders.

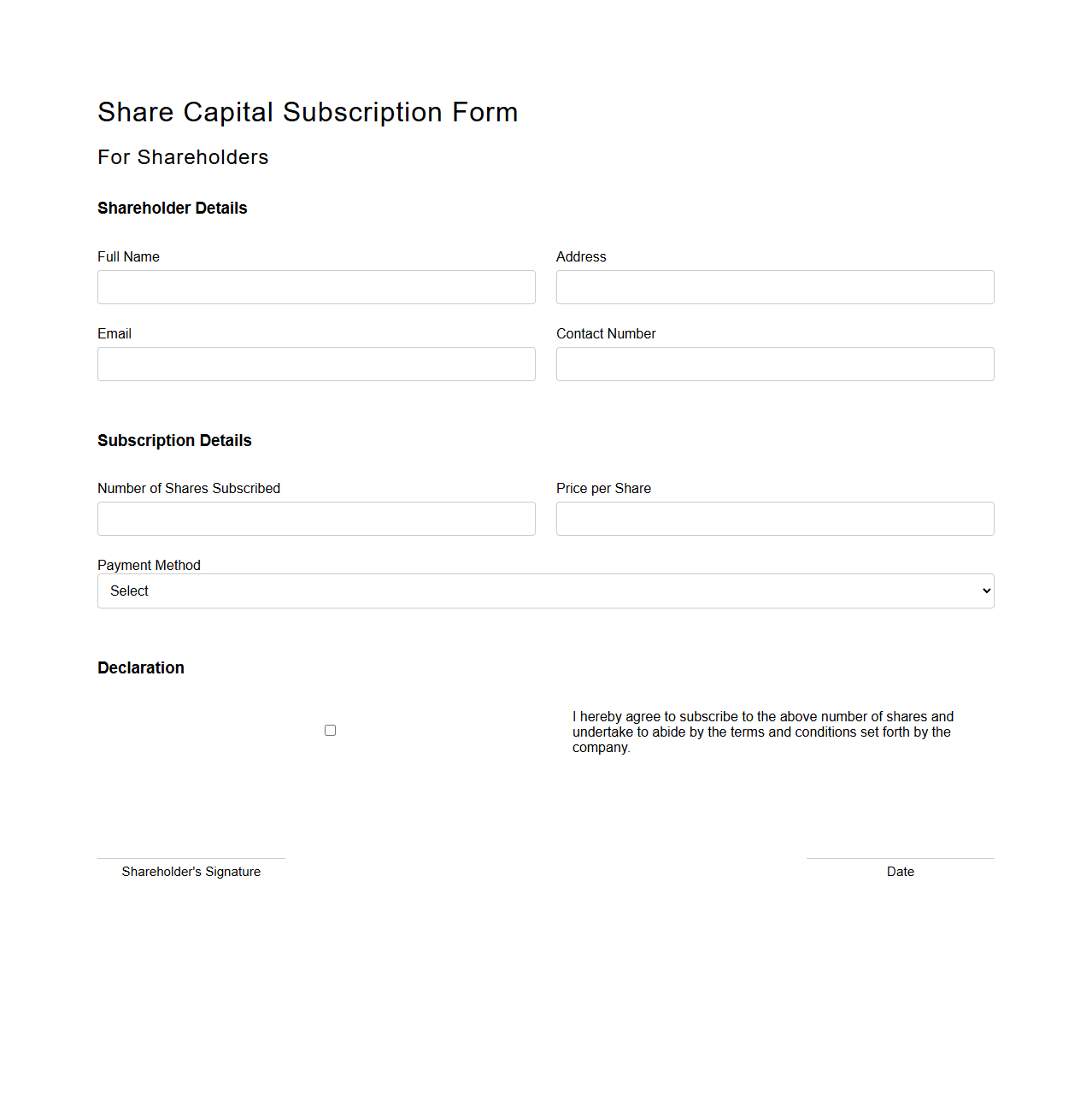

Share Capital Subscription Form for Shareholders

A

Share Capital Subscription Form for shareholders is a legal document used to record the commitment of investors to purchase a specified number of shares in a company. It details the number of shares subscribed, the price per share, and the total amount payable, serving as evidence of the shareholder's agreement to invest capital. This form is essential for maintaining accurate shareholder records and ensuring compliance with corporate governance regulations.

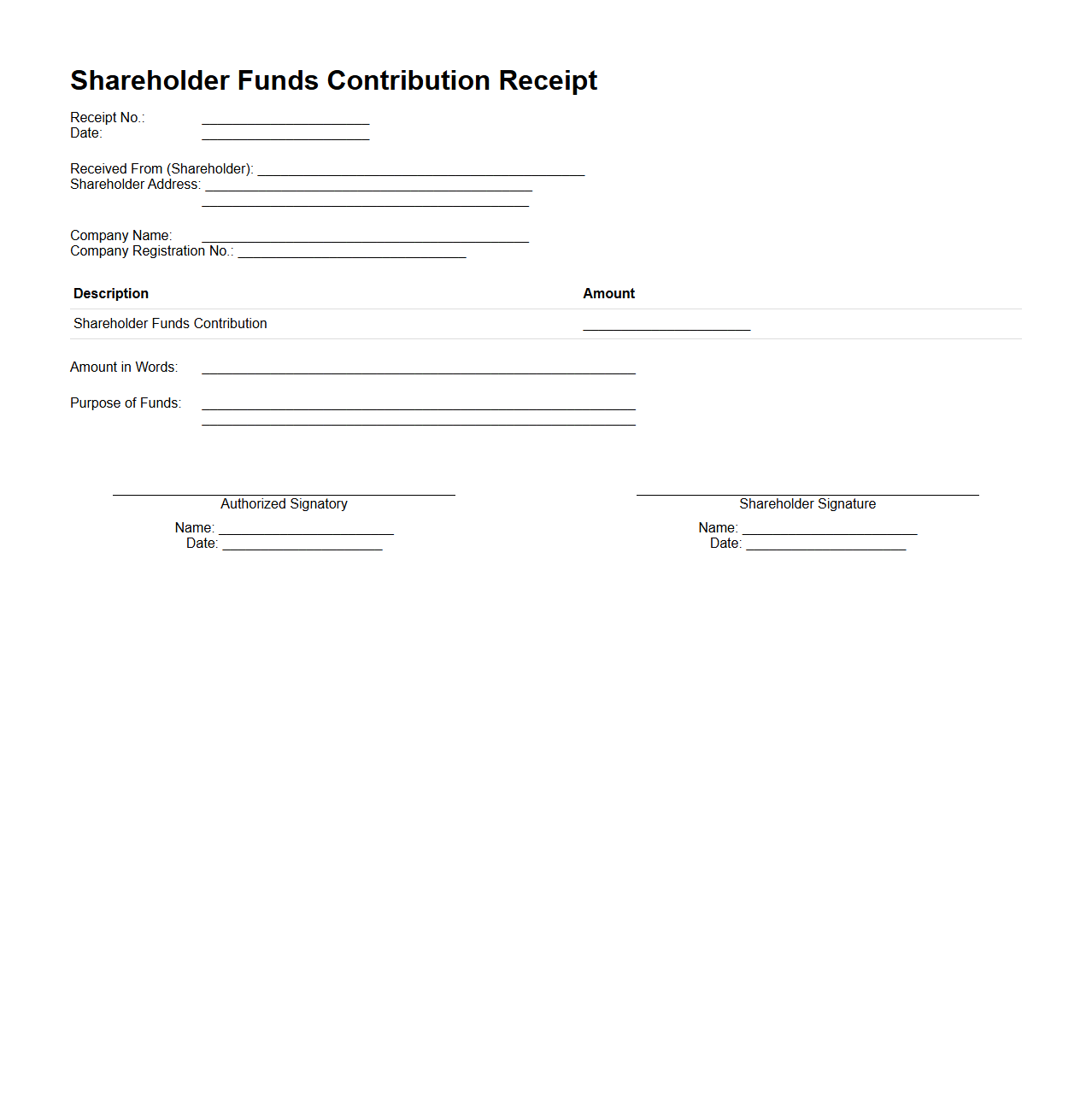

Shareholder Funds Contribution Receipt Template

A

Shareholder Funds Contribution Receipt Template document serves as formal proof acknowledging the receipt of funds contributed by shareholders to a company. This template ensures accurate recording of amounts received, dates, and shareholder details, facilitating transparent financial management and compliance. It is essential for maintaining clear financial records and supporting audit trails in corporate governance.

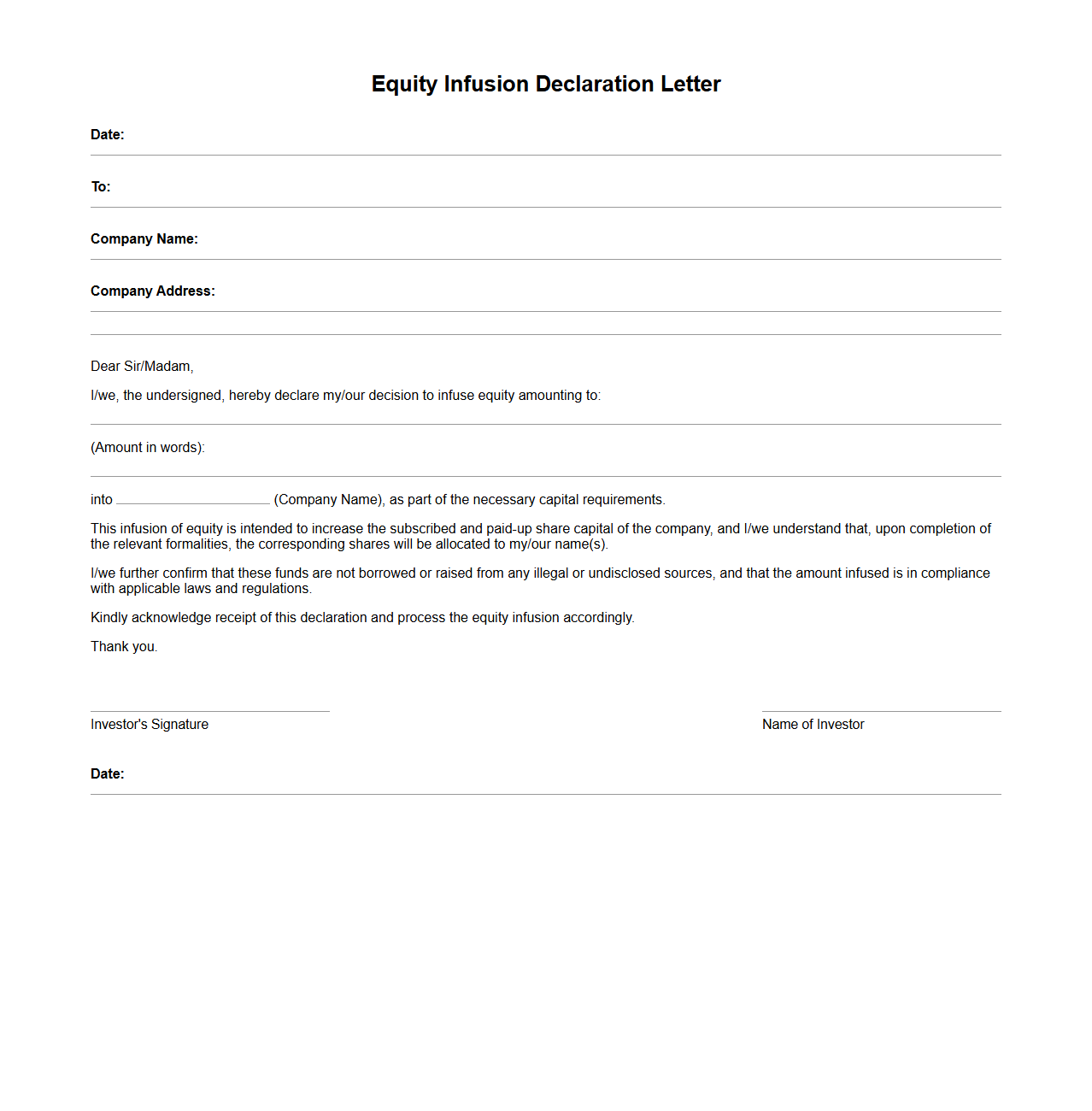

Equity Infusion Declaration Letter for Investors

An

Equity Infusion Declaration Letter for investors is a formal document that confirms a shareholder's commitment to invest a specified amount of capital into a company. This declaration serves as a binding assurance of equity funding, enhancing the company's financial stability and supporting its growth initiatives. Investors use this letter to outline the terms, timing, and amount of the equity infusion, ensuring transparency and accountability in the capital infusion process.

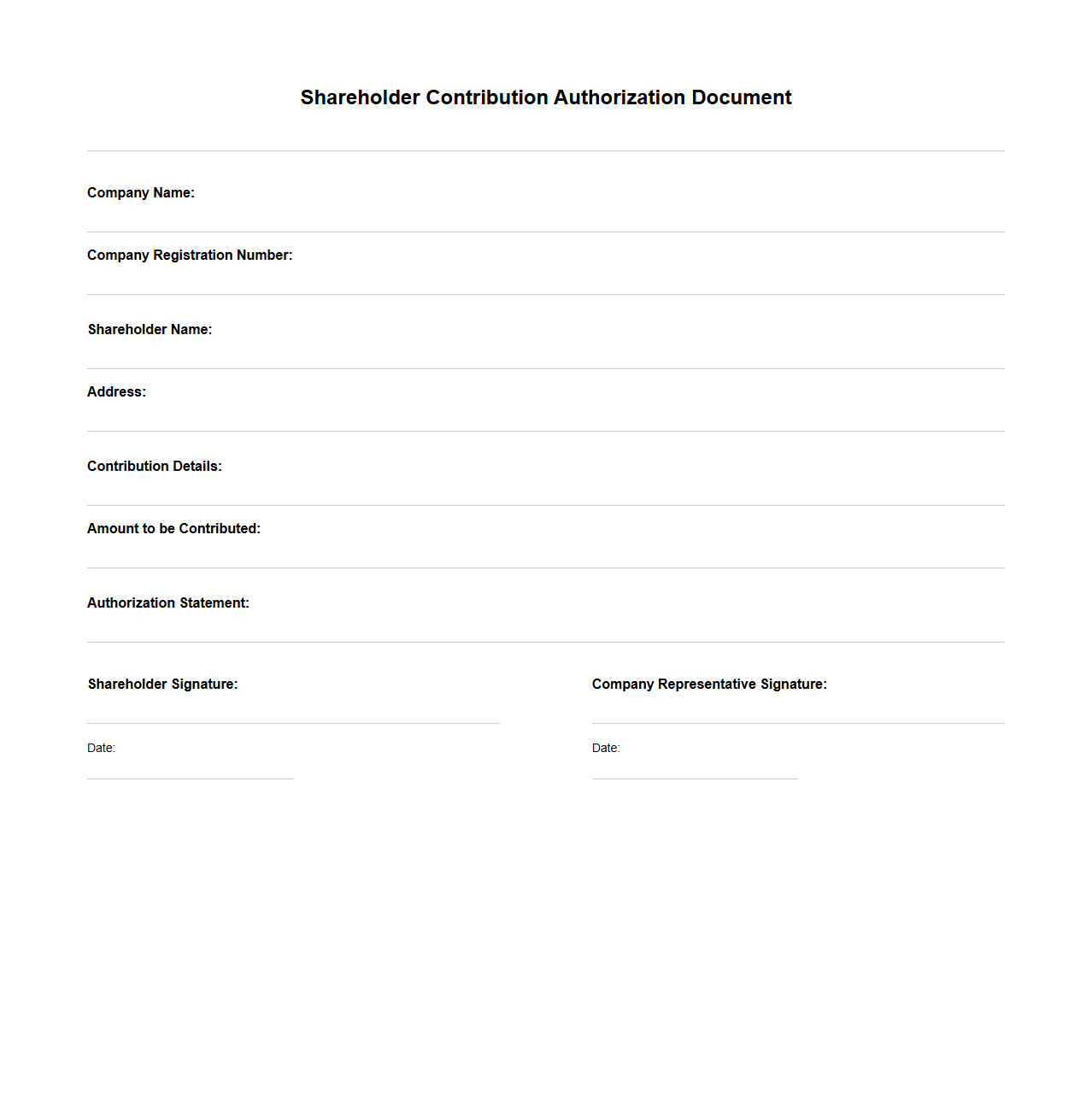

Shareholder Contribution Authorization Document

The

Shareholder Contribution Authorization Document is a formal agreement that grants permission for shareholders to make financial contributions to a company. It outlines the terms, amount, and conditions under which these contributions will be made, ensuring transparency and legal compliance. This document is essential for maintaining clear records of capital injections and protecting both the company and its shareholders.

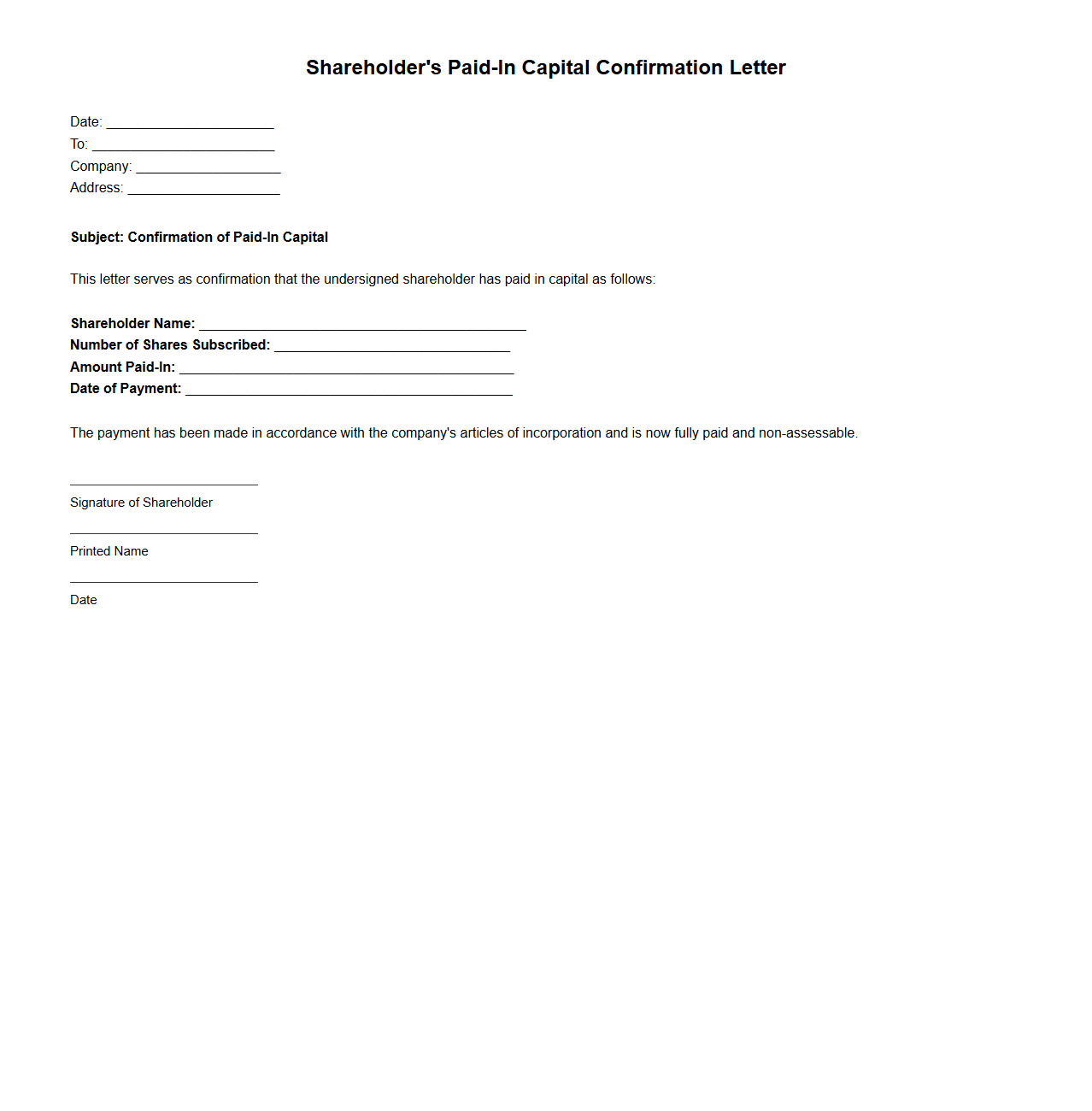

Shareholder's Paid-In Capital Confirmation Letter

A

Shareholder's Paid-In Capital Confirmation Letter is a formal document verifying the amount of capital that a shareholder has invested in a company. It serves as proof of the shareholder's equity contribution and is often required for financial audits, regulatory compliance, or investment documentation. This letter ensures transparency and accuracy in the company's capital structure records.

Key Provisions in Equity Contribution Documents for Minority Shareholders

An equity contribution document should clearly outline the rights and obligations of minority shareholders. It must include provisions on dividend entitlements, voting rights, and transfer restrictions. Additionally, protections such as tag-along rights and pre-emption rights are essential to safeguard minority interests.

Valuation Method Specification in Equity Contribution Letters for New Share Issuances

The equity contribution letter must specify the valuation method used to determine the price of new shares. Common approaches include discounted cash flow, comparable company analysis, or asset-based valuation. Clear articulation of the valuation process ensures transparency and fairness in share issuance.

Dispute Resolution Mechanisms in Shareholder Equity Contribution Agreements

Typically, shareholder agreements incorporate mechanisms like arbitration, mediation, or litigation clauses to resolve disputes. These provisions define the forum, governing law, and procedures for conflict resolution. Such mechanisms help to mitigate prolonged legal battles and ensure timely resolution.

Compliance Checks for Foreign Investors in Equity Contribution Documents

When drafting equity contribution documents involving foreign investors, rigorous regulatory compliance checks are mandatory. This includes adherence to foreign investment laws, anti-money laundering (AML) regulations, and securities regulations. Due diligence is also critical to verify investor credentials and legality of funds.

Addressing Dilution Protection in Equity Contribution Letters

The equity contribution letter should explicitly include dilution protection terms to safeguard existing shareholders. Common methods include anti-dilution clauses such as weighted average or full ratchet adjustments. These provisions ensure that existing shareholders maintain their relative ownership percentage despite new share issuances.