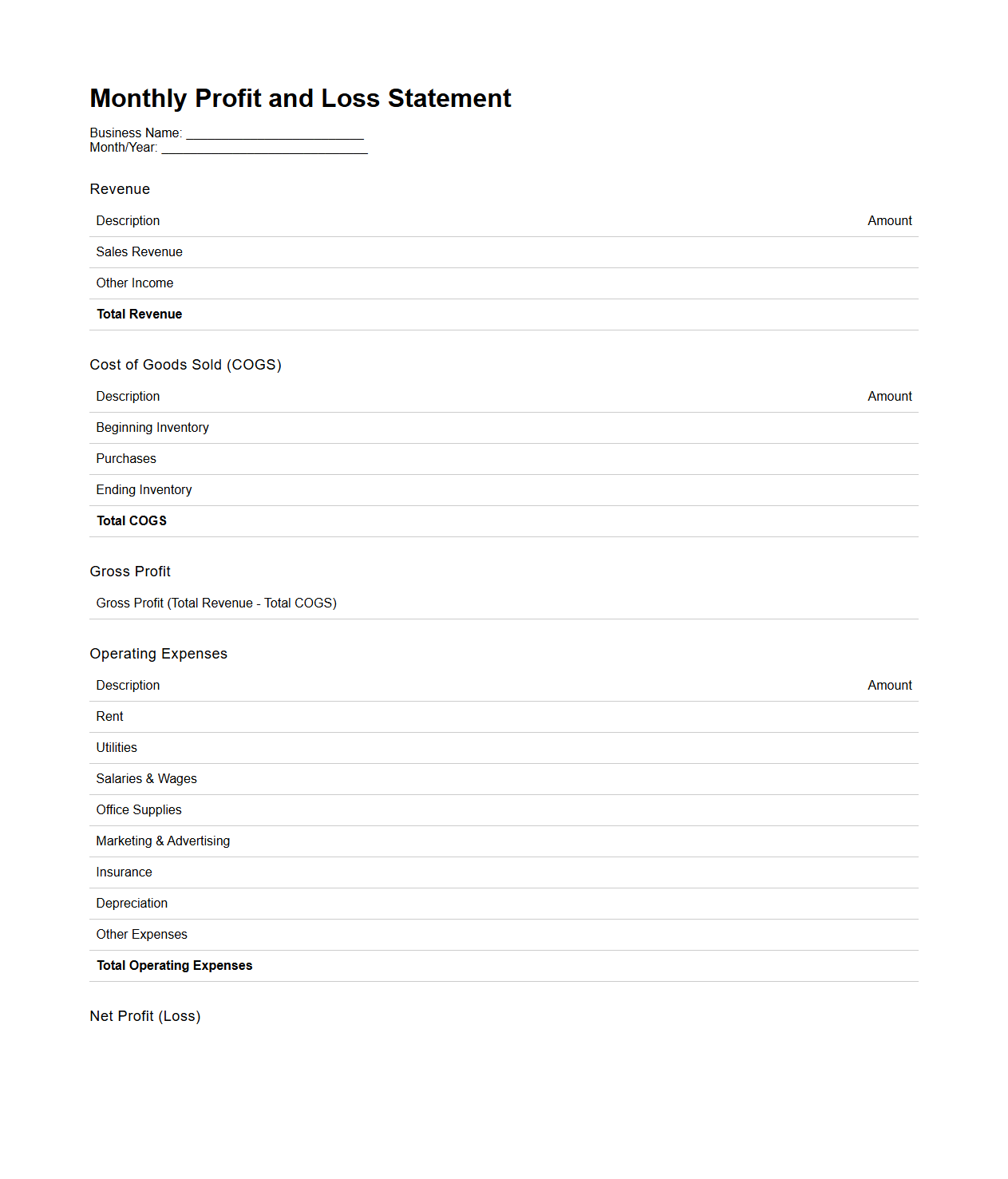

Monthly Profit and Loss Statement Template for Small Business

A

Monthly Profit and Loss Statement Template for Small Business is a financial document designed to track and summarize a company's revenues, costs, and expenses over a monthly period. It helps business owners monitor profitability, manage cash flow, and make informed decisions by providing clear insights into income sources and expenditure patterns. This template often includes sections for sales revenue, cost of goods sold, operating expenses, and net profit, facilitating easy and consistent financial analysis.

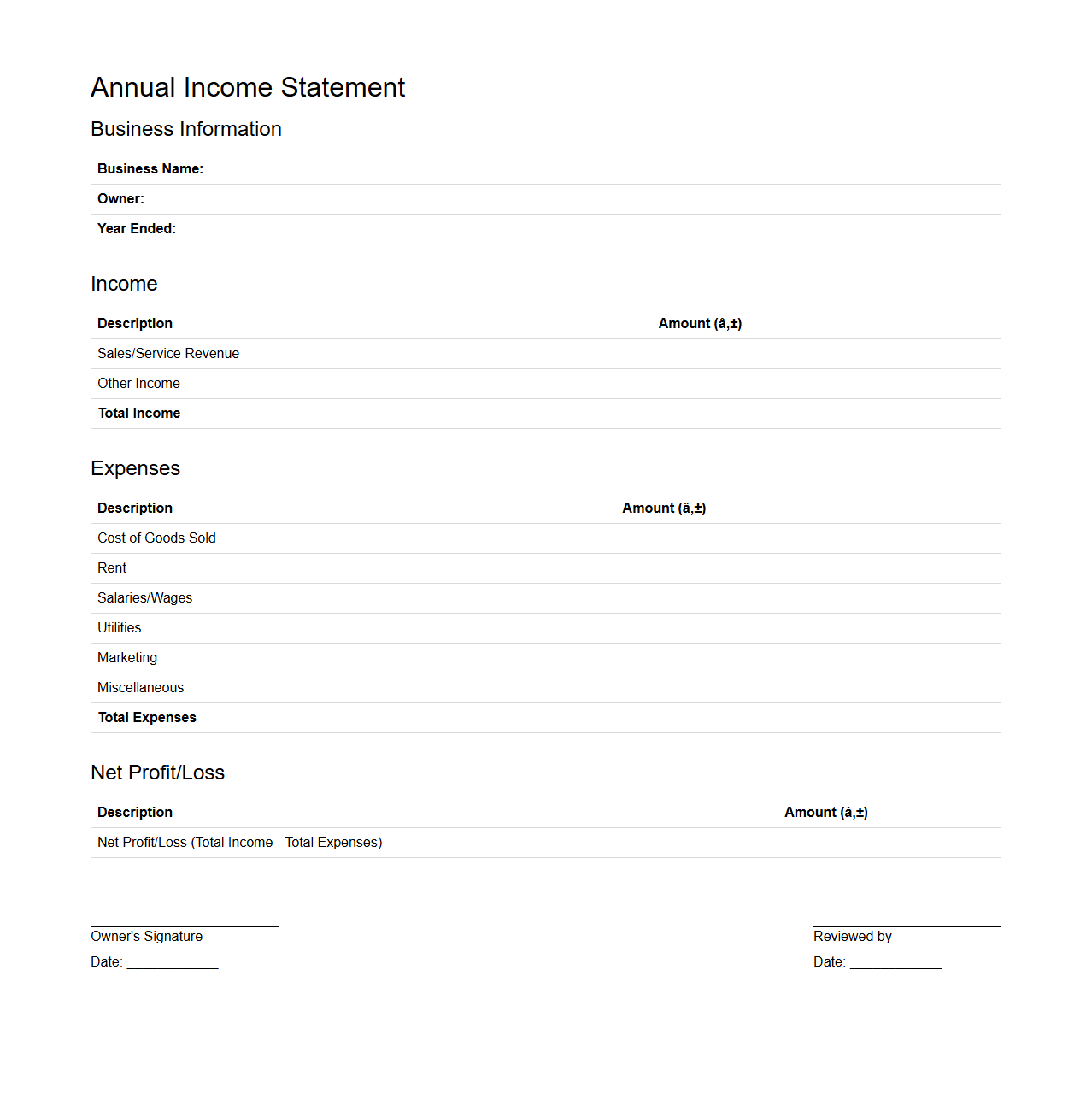

Annual Income Statement Document Example for Entrepreneurs

An

Annual Income Statement Document Example for Entrepreneurs serves as a comprehensive financial report detailing a business's revenues, expenses, and net profit or loss over a fiscal year. It helps entrepreneurs track financial performance, make informed decisions, and present clear financial data to investors or stakeholders. This document typically includes key sections like gross income, operating expenses, and net income, providing a valuable template for accurate bookkeeping and financial planning.

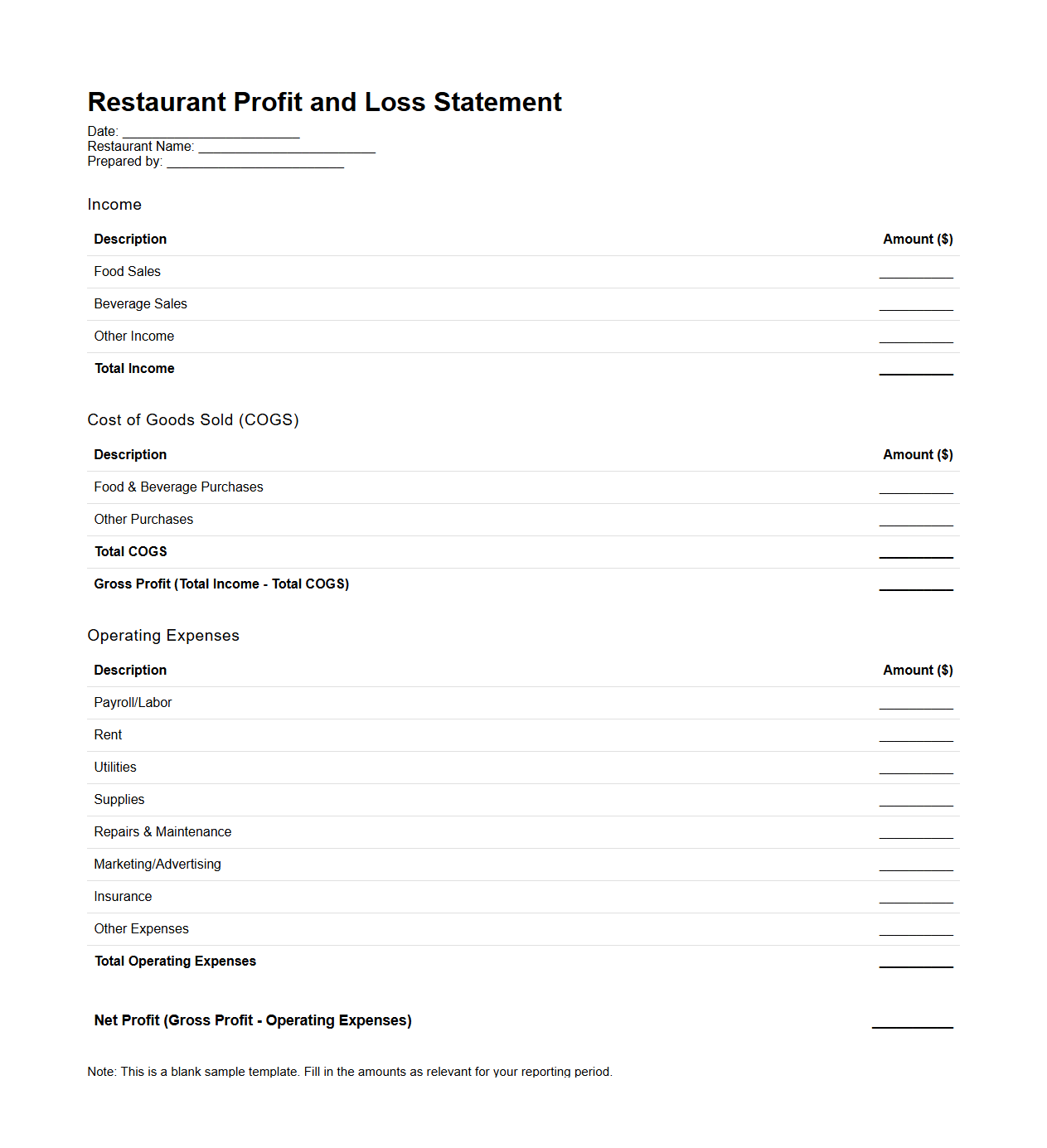

Restaurant Profit and Loss Statement Sample for Small Owners

A

Restaurant Profit and Loss Statement Sample for Small Owners is a financial document that outlines a small restaurant's revenues, costs, and expenses over a specific period to determine net profit or loss. It helps owners analyze sales performance, food costs, labor expenses, and operating costs, providing critical insights for budgeting and financial planning. This sample serves as a practical template to track economic health and make informed decisions for sustainable business growth.

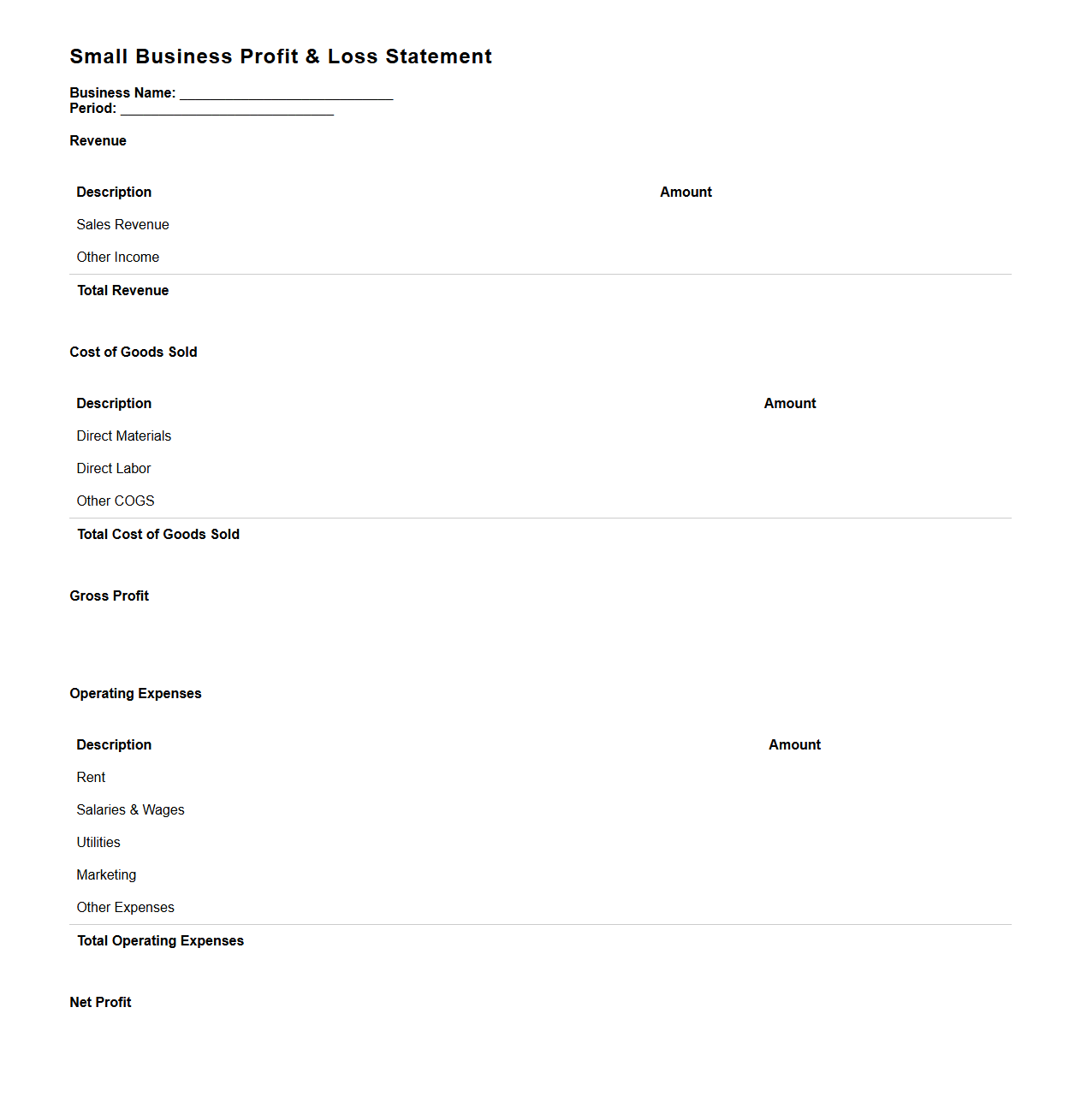

Simple Small Business P&L Statement Format

A

Simple Small Business P&L Statement Format document outlines the structure for recording a company's revenues, costs, and expenses over a specific period, providing a clear snapshot of profitability. This format typically includes sections for sales income, cost of goods sold, gross profit, operating expenses, and net profit or loss, tailored for small business needs. Using this document helps entrepreneurs monitor financial performance, make informed decisions, and prepare accurate tax filings.

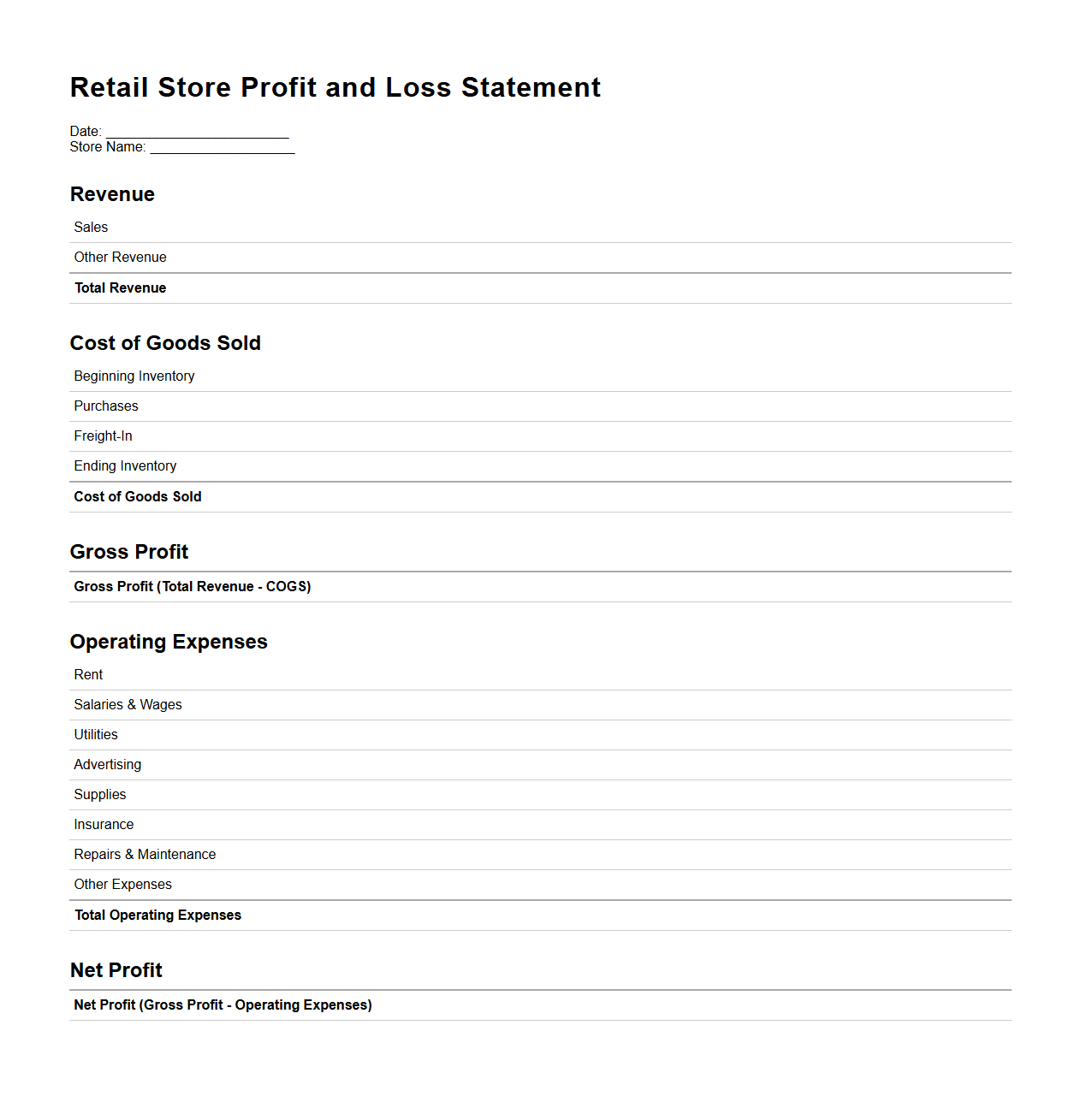

Retail Store Profit and Loss Statement Document Layout

The

Retail Store Profit and Loss Statement Document Layout outlines the structured format used to present a retail store's financial performance over a specific period. It includes key sections such as revenue from sales, cost of goods sold, gross profit, operating expenses, and net profit, providing a comprehensive overview of profitability. This document is essential for analyzing financial health, guiding budgeting decisions, and optimizing operational efficiency in retail management.

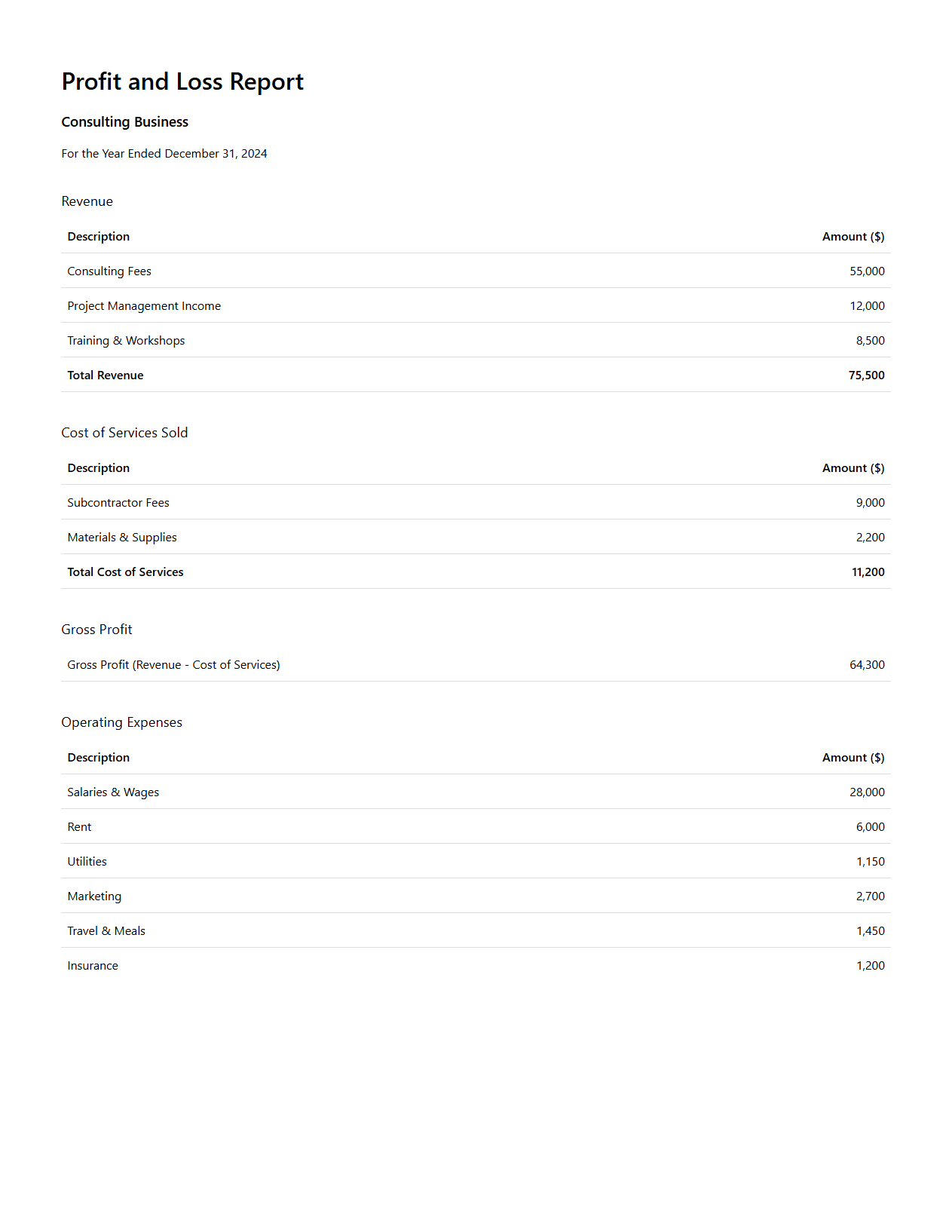

Consulting Business Profit and Loss Report Sample

A

Consulting Business Profit and Loss Report Sample document provides a detailed financial summary of revenues, expenses, and net profit for a consulting firm over a specific period. It helps business owners analyze income streams, control costs, and assess overall financial health, enabling informed decision-making. This sample serves as a practical template for tracking financial performance and preparing accurate reports for stakeholders.

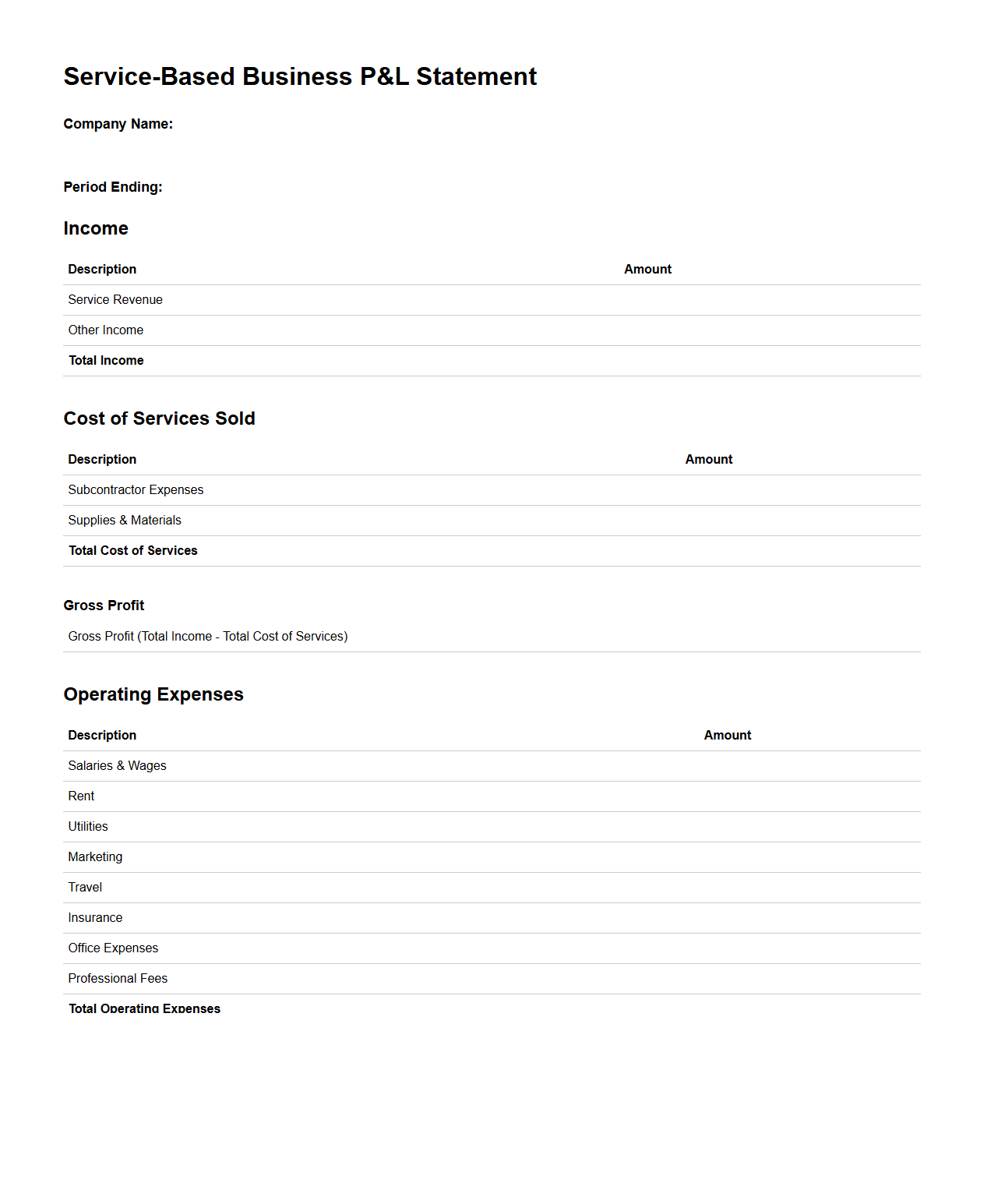

Service-Based Business P&L Statement Template

A

Service-Based Business P&L Statement Template document is a financial tool designed to track revenue, expenses, and profits specific to service-oriented companies. It helps businesses analyze operational costs, monitor profitability, and make informed financial decisions by categorizing income and expenses unique to service delivery. This template typically includes sections for service revenue, labor costs, overhead, and net profit, ensuring accurate and clear financial reporting.

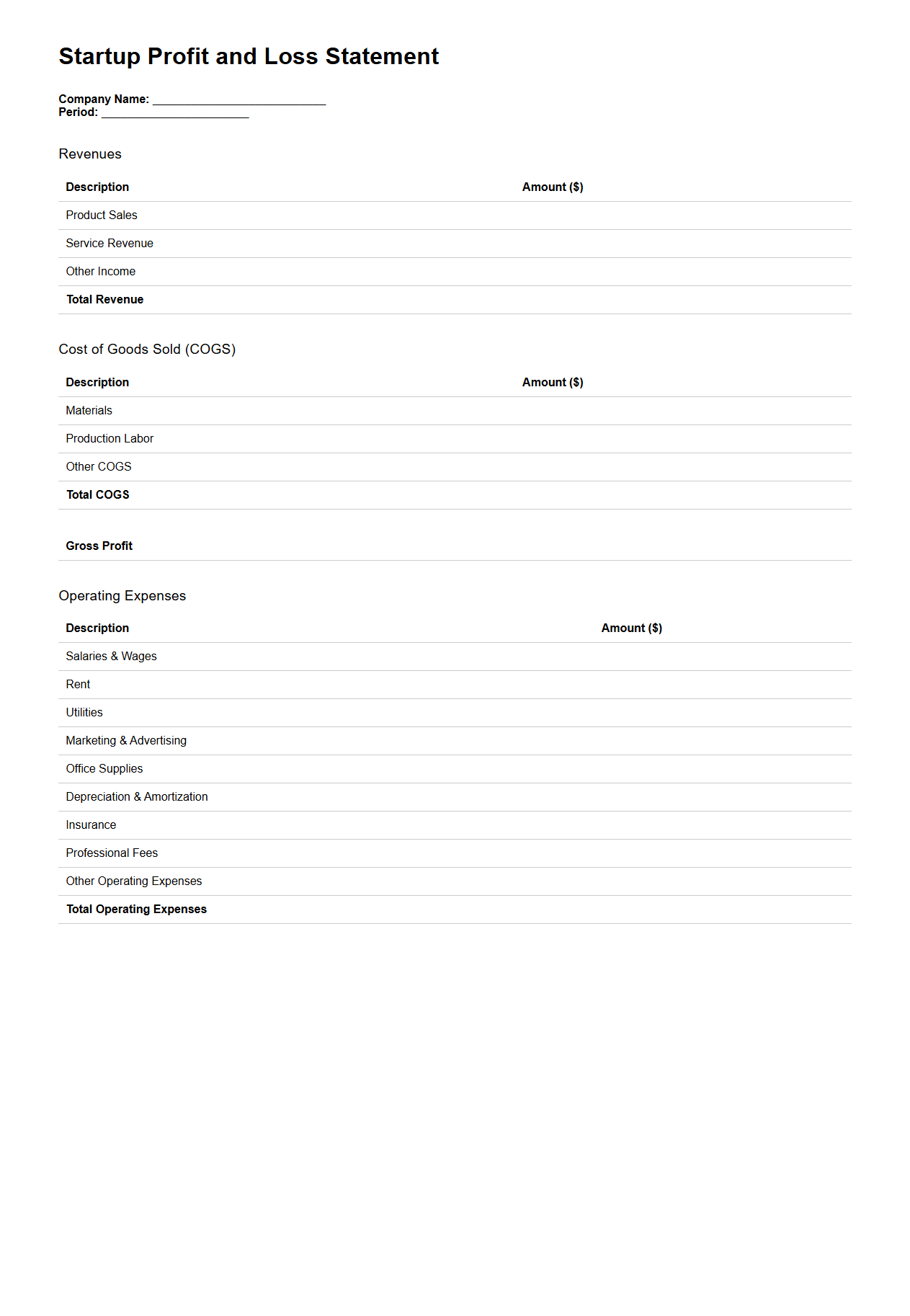

Startup Profit and Loss Statement Document Example

A

Startup Profit and Loss Statement Document Example provides a detailed financial summary outlining a startup's revenues, expenses, and net profit over a specific period. It helps entrepreneurs, investors, and stakeholders assess the financial performance, identify cost drivers, and make strategic decisions. This document typically includes sections for sales, operating costs, gross profit, and net income, offering a clear overview of the company's profitability trajectory.

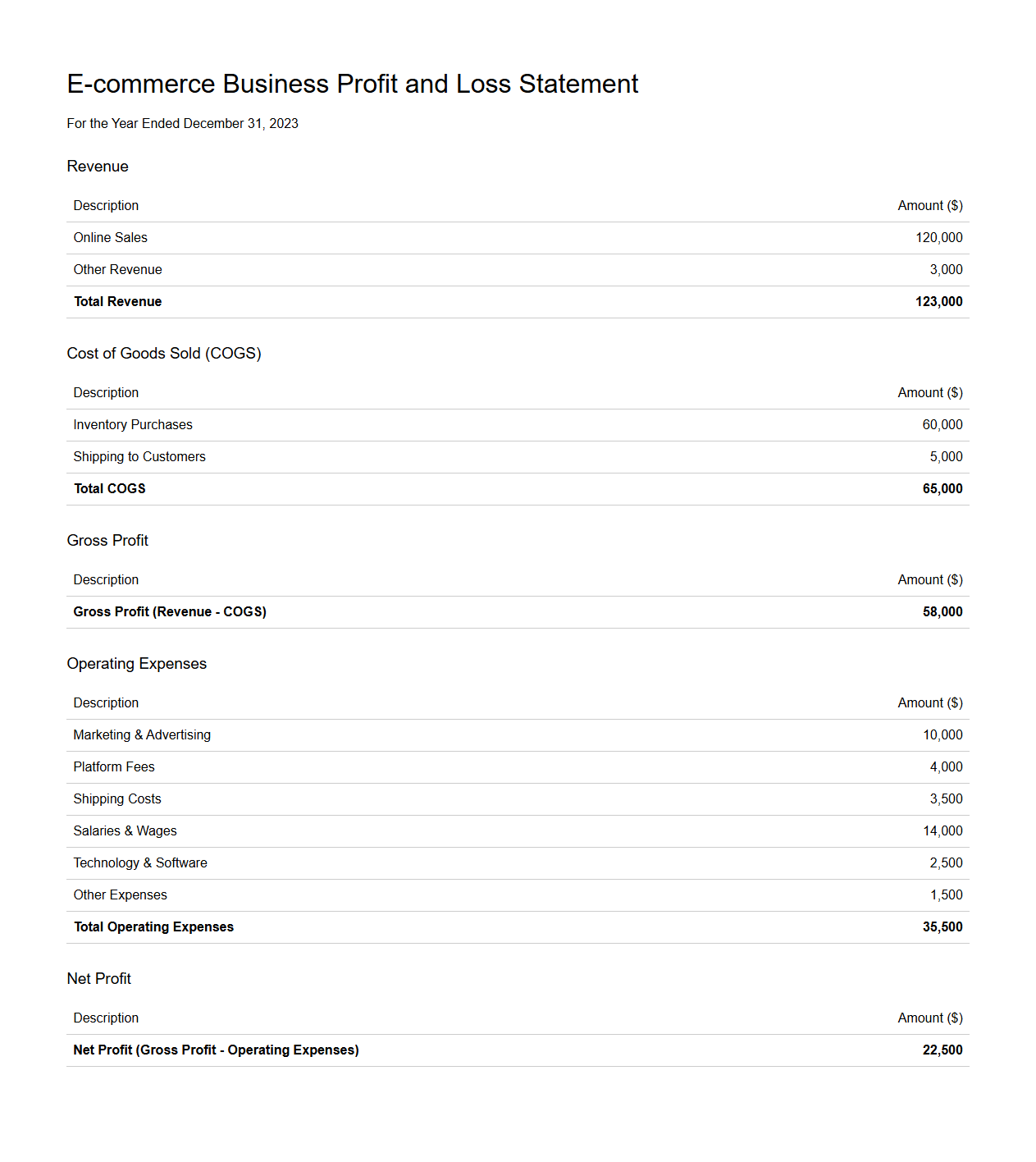

E-commerce Business Profit and Loss Statement Sample

A

Profit and Loss Statement sample document for an e-commerce business provides a detailed summary of revenue, costs, and expenses incurred over a specific period. It helps evaluate the financial performance by showing gross profit, net profit, and operational expenses like marketing, shipping, and platform fees. This document is essential for identifying profitability trends and making informed decisions to optimize the e-commerce business's financial health.

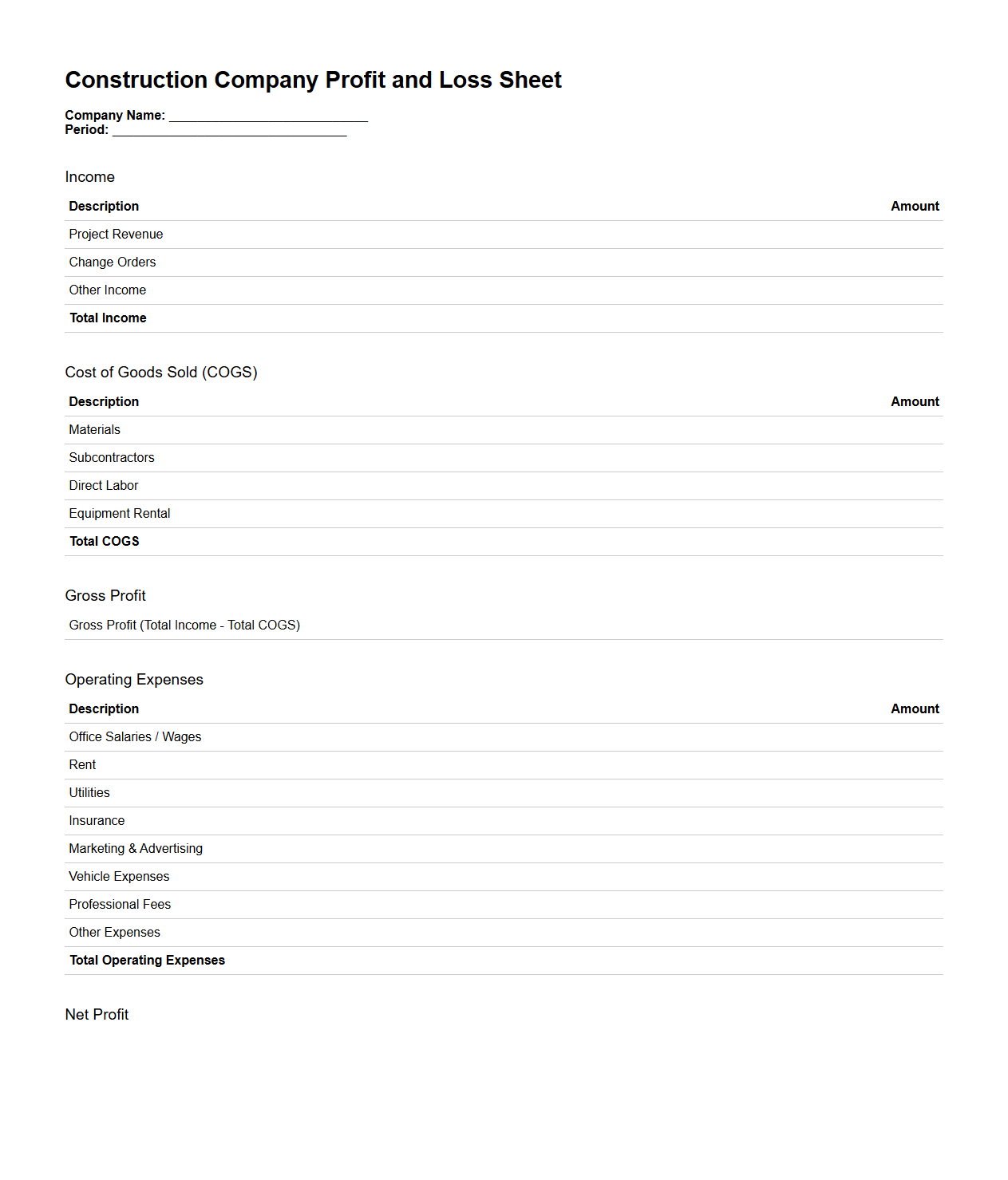

Construction Company Profit and Loss Sheet for Small Businesses

A

Construction Company Profit and Loss Sheet for small businesses is a financial document that tracks revenues, costs, and expenses specific to construction projects over a set period. It provides a clear overview of profitability by detailing income from contracts and deducting direct costs like materials and labor, as well as overhead expenses. This sheet helps small construction firms monitor financial health, make informed budget decisions, and identify areas to improve cost efficiency.

How should seasonal revenue fluctuations be presented in a small business profit and loss statement?

Seasonal revenue fluctuations should be clearly highlighted within the income section of the profit and loss statement to reflect the periods of high and low sales accurately. Utilizing monthly or quarterly breakdowns enables better visualization of these patterns. This approach helps owners and stakeholders make informed decisions based on observed trends.

What categories are essential for expense tracking on a small business P&L document?

Essential expense categories include cost of goods sold (COGS), operating expenses, payroll, rent, and utilities. Proper categorization ensures accurate tracking and analysis of where money is spent. This clarity aids in budgeting and identifying opportunities for cost reduction.

How does depreciation get recorded on a profit and loss statement for a small business?

Depreciation is recorded as a non-cash expense on the profit and loss statement to reflect the allocated cost of a business asset over its useful life. This reduces taxable income without affecting cash flow directly. Including depreciation provides a more accurate picture of asset value consumption.

Are owner's draws included or excluded from net profit calculations in a P&L statement?

Owner's draws are excluded from the profit and loss statement's net profit calculations because they represent distributions of profit rather than business expenses. These transactions affect the owner's equity account instead. Separating draws ensures the P&L reflects operational performance accurately.

What supporting documentation should be attached to validate entries on a small business P&L statement?

Supporting documentation such as invoices, receipts, bank statements, and contracts should be attached to validate entries on the profit and loss statement. This ensures transparency and accuracy during audits or financial reviews. Proper record-keeping helps prevent discrepancies and supports compliance.