A Credit Note Document Sample for Customer Refunds serves as an official record issued by a seller to a buyer, outlining the refund or credit amount due. It details the original invoice reference, refund reason, and adjustment amount to ensure transparency and accurate accounting. This document is essential for both parties to reconcile transactions and maintain clear financial records.

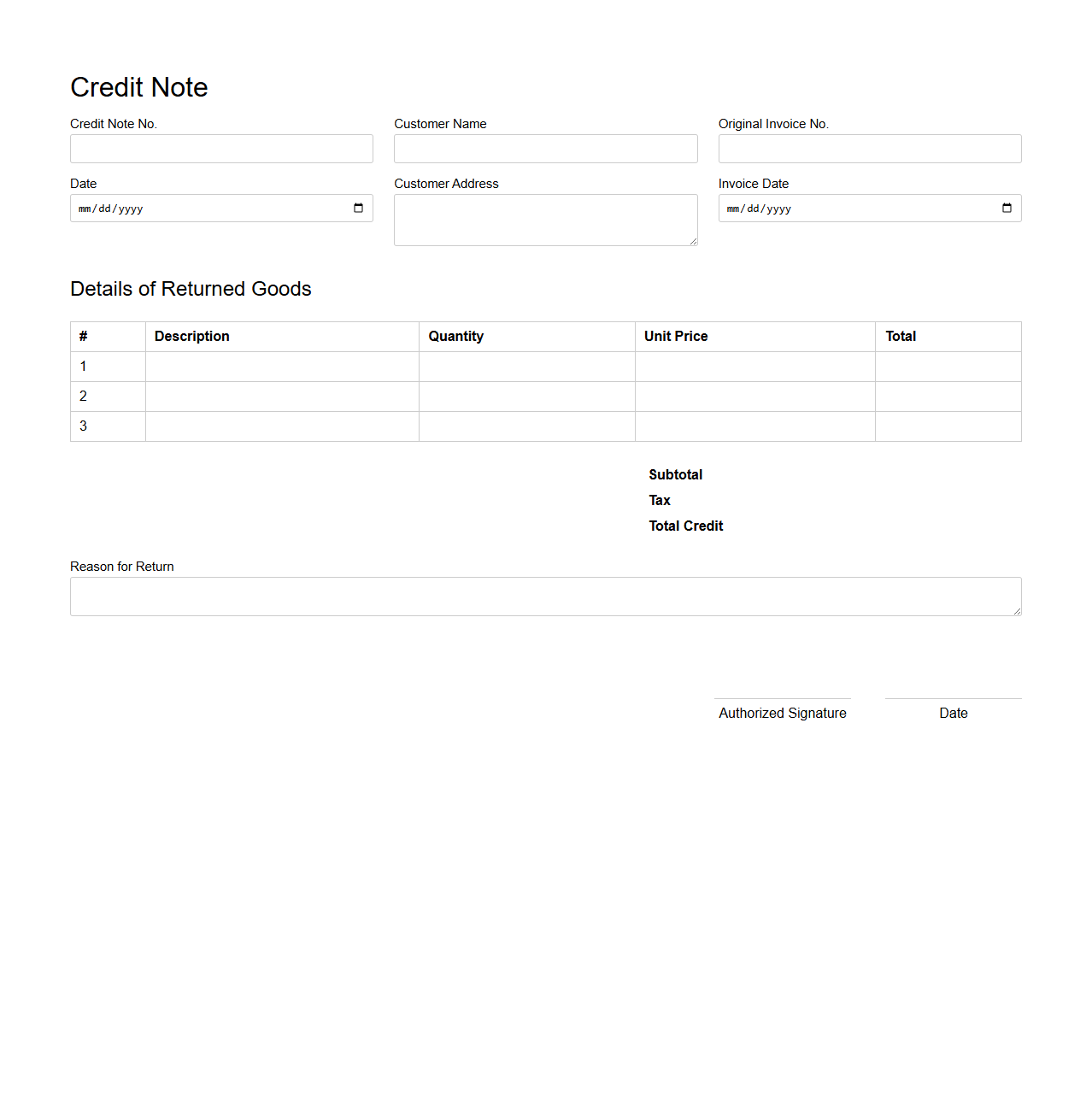

Credit Note Template for Returned Goods

A

Credit Note Template for Returned Goods is a standardized document used by businesses to formally acknowledge the return of products from a customer and to adjust the original invoice accordingly. It includes important details such as the returned items, quantities, reasons for return, and the credit amount issued to the customer. This template streamlines the returns process, ensures accurate financial records, and improves customer service by providing clear evidence of the transaction adjustment.

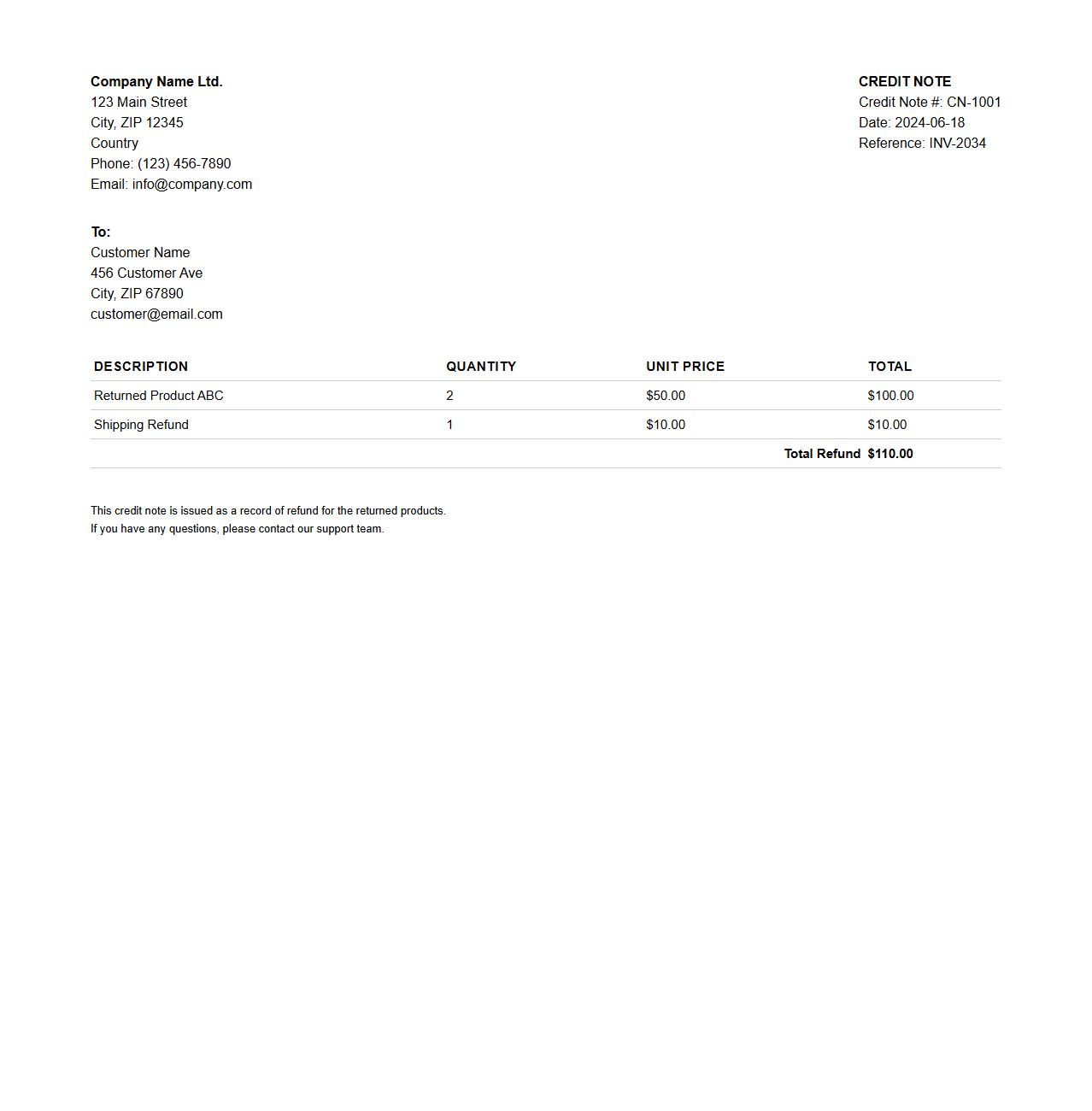

Customer Refund Credit Note Example

A

Customer Refund Credit Note Example document serves as an official record issued by a company to acknowledge a refund due to a customer, typically after a return or an overpayment. It details the refunded amount, the original invoice reference, and the reason for the refund, ensuring clear communication and accounting accuracy. This document supports financial reconciliation and maintains transparent customer relations by providing proof of the credit issued.

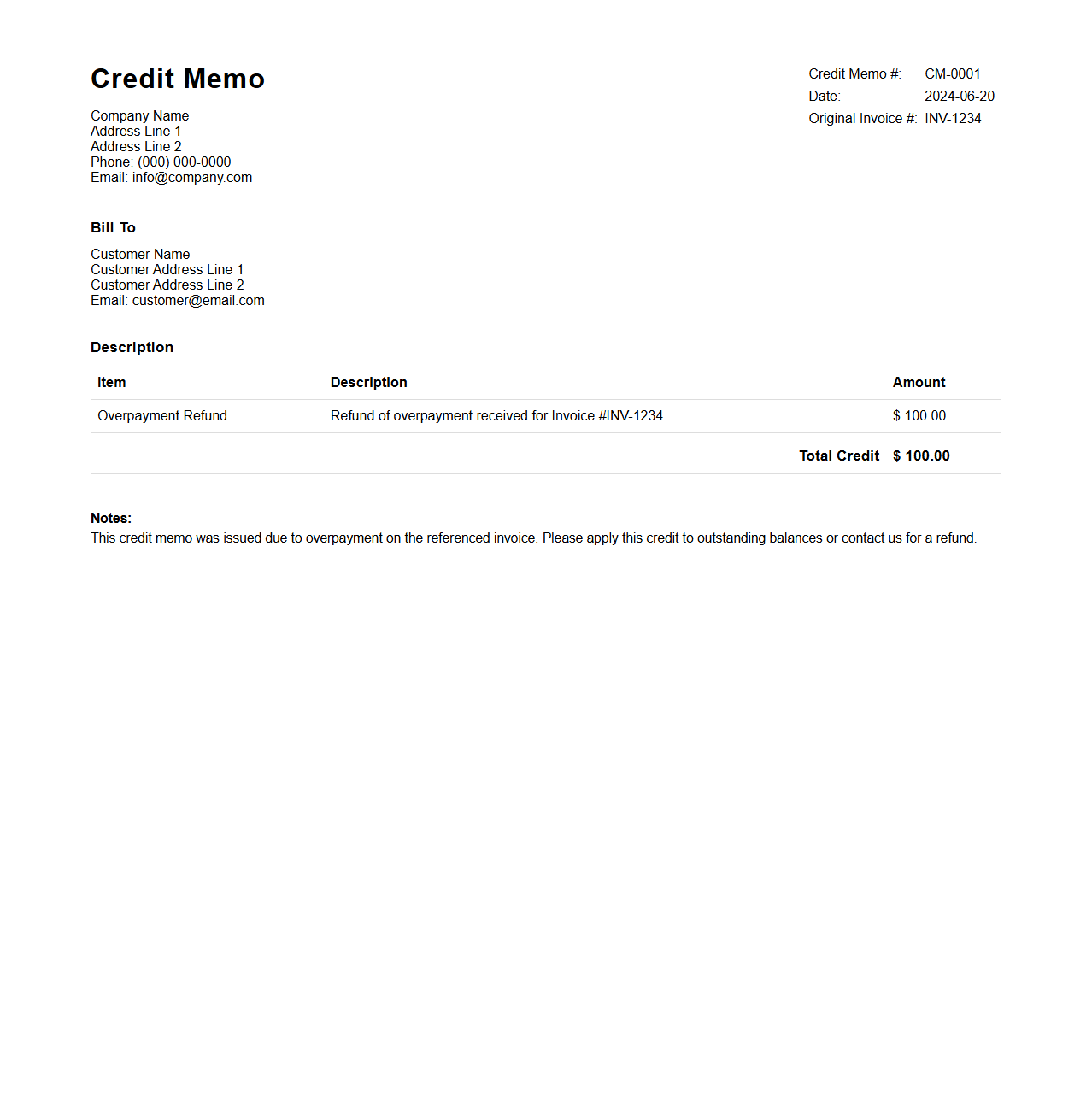

Credit Memo Format for Overpayment

A

Credit Memo Format for Overpayment document outlines the structure and essential details required to formally acknowledge and record an excess payment made by a customer. This format typically includes fields such as the customer's information, invoice number related to the overpayment, the amount credited, and the reason for the credit memo issuance. Properly using this format ensures accurate accounting, facilitates refund processing, and maintains clear communication between the business and its customers regarding the overpayment adjustments.

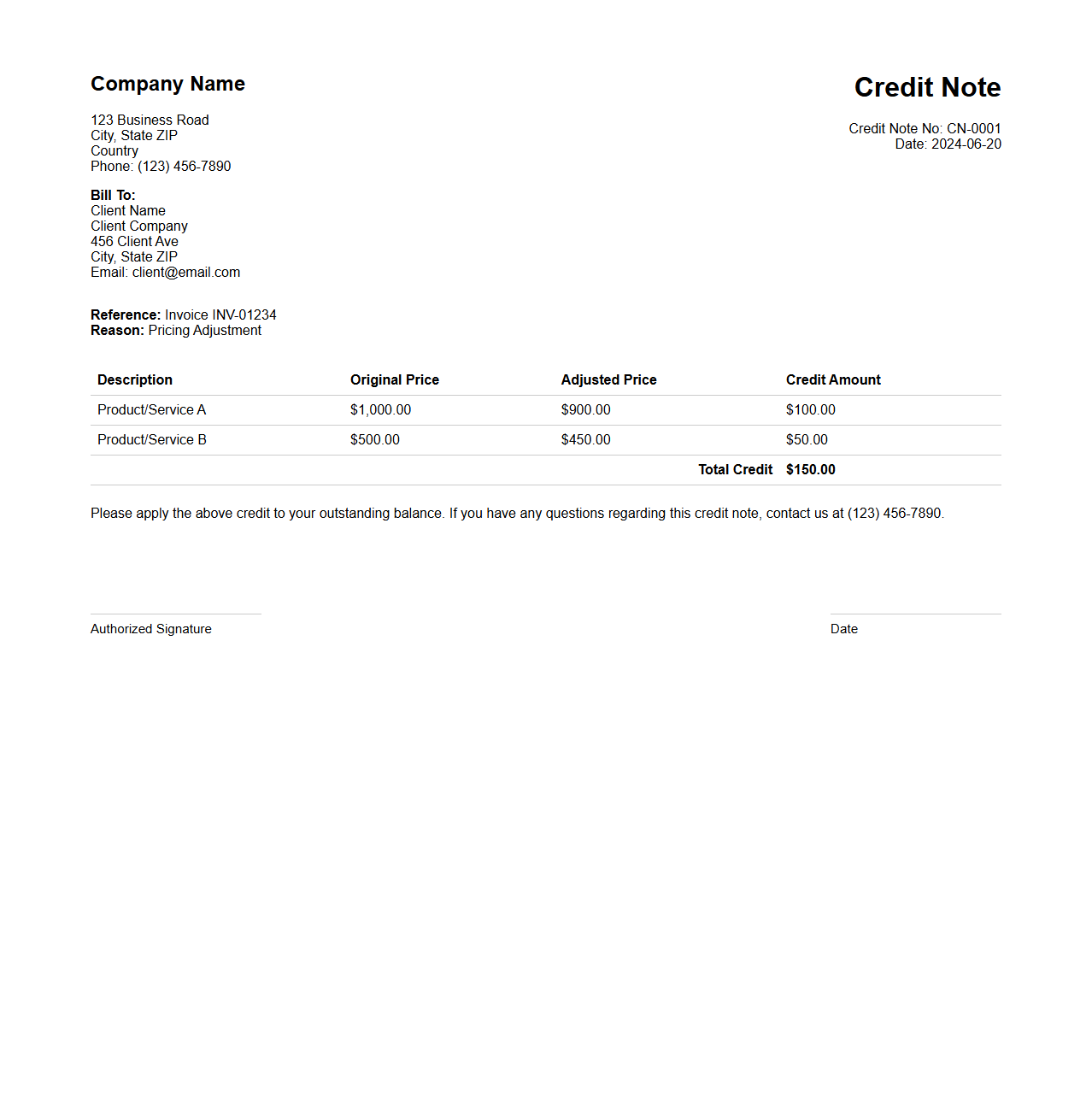

Sample Credit Note for Pricing Adjustment

A

Sample Credit Note for Pricing Adjustment document is a formal record issued by a seller to a buyer that reflects a reduction in the original invoice amount due to price corrections or negotiated discounts. It details the specific pricing changes, including adjusted quantities, unit prices, and the total credit amount granted. This document helps maintain accurate financial records and ensures transparency in the correction of billing discrepancies.

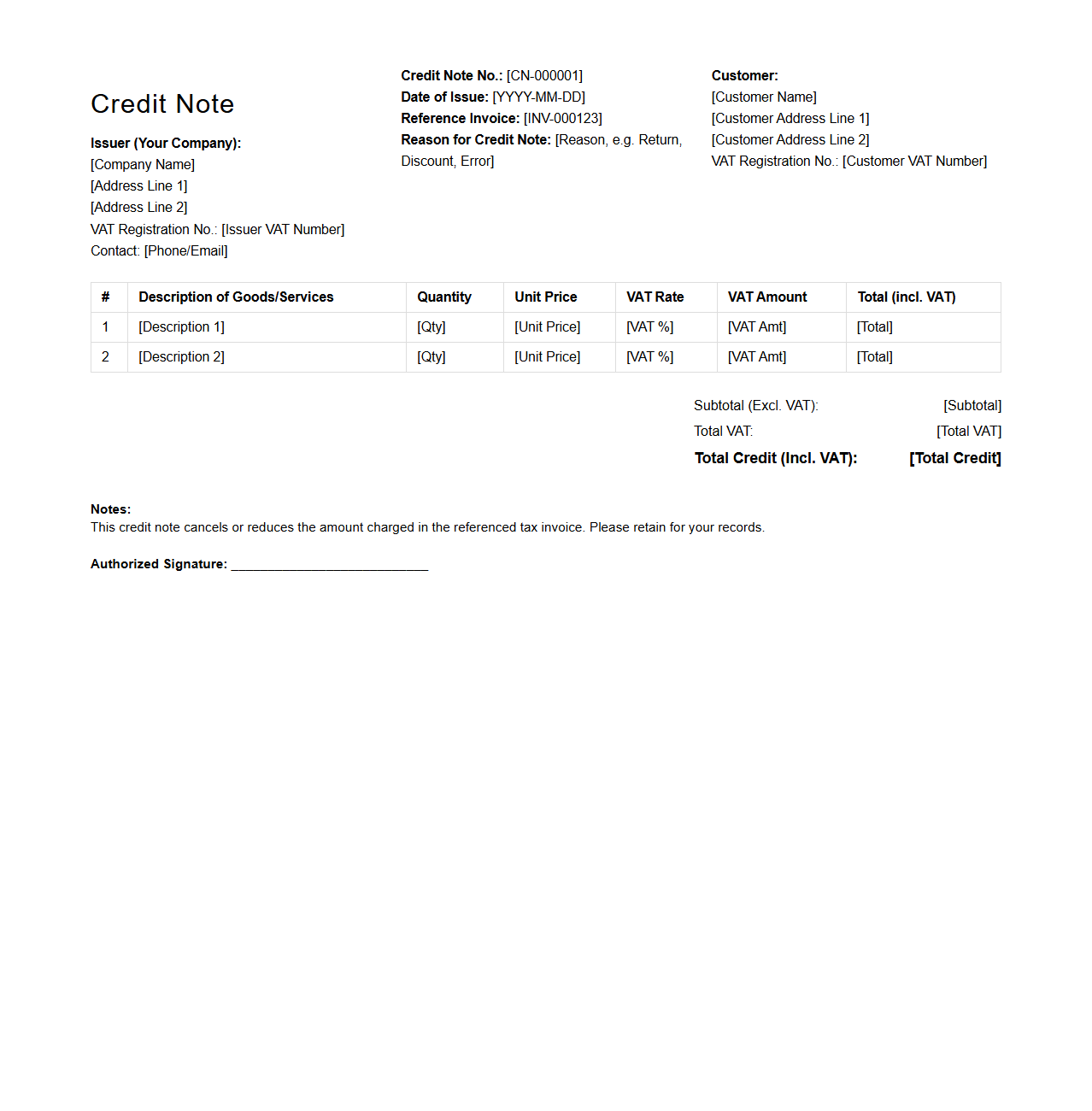

VAT-Compliant Customer Credit Note

A

VAT-Compliant Customer Credit Note is an official document issued by a seller to a buyer, reflecting a reduction in the amount owed due to returned goods, discounts, or billing errors, fully adhering to Value Added Tax regulations. It must include essential details such as the original invoice number, date, customer information, VAT rate, and the adjusted taxable amount to ensure proper tax reporting and compliance with local tax authorities. This document helps maintain accurate financial records and enables businesses to claim VAT adjustments correctly.

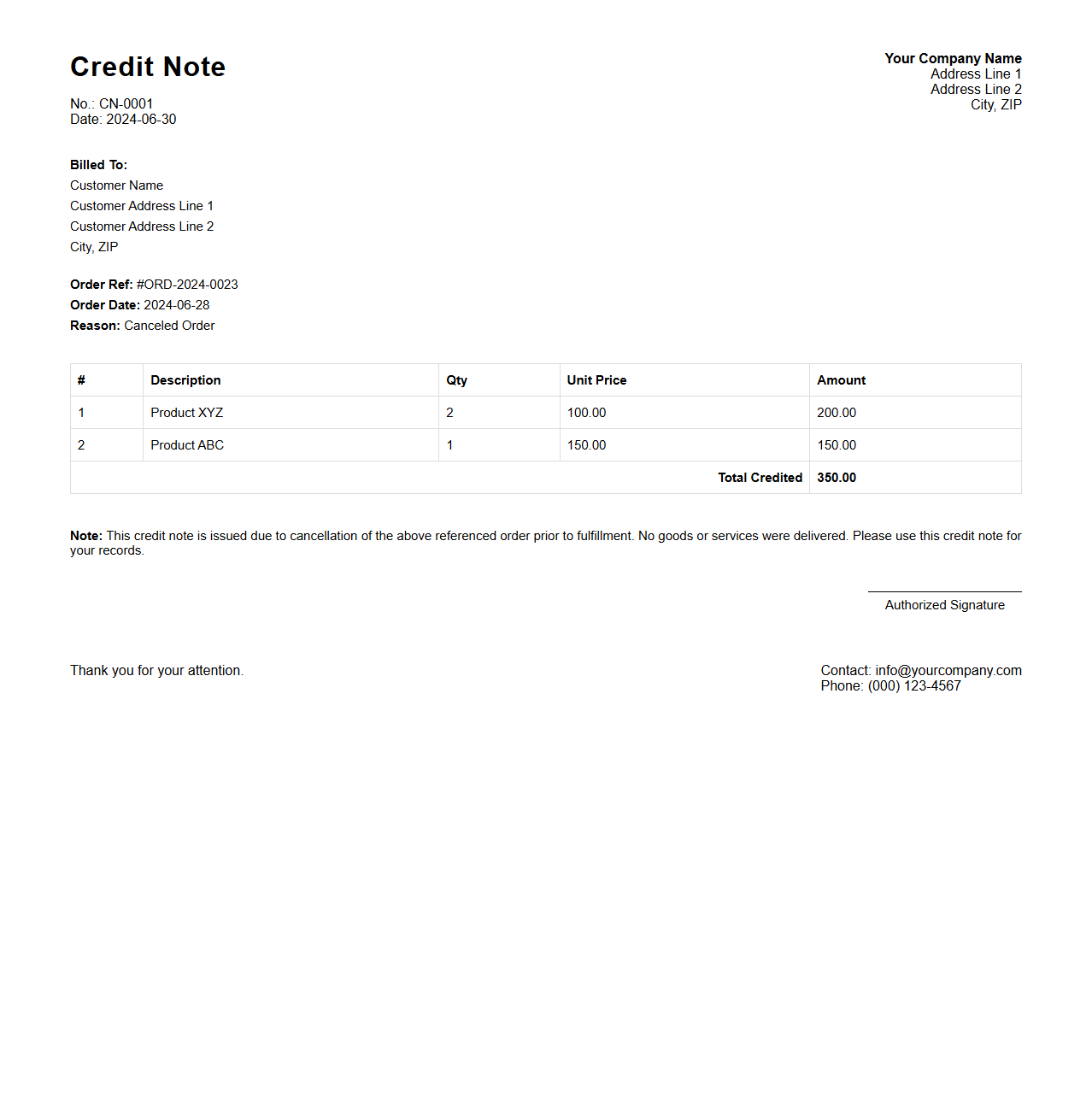

Credit Note for Canceled Order

A

Credit Note for Canceled Order is a financial document issued by a seller to a buyer, indicating a reduction in the amount owed due to order cancellation. This note serves as proof of the credited amount that can be applied against future purchases or refunded to the customer. It includes details such as the original invoice number, canceled products or services, and the total credit amount granted.

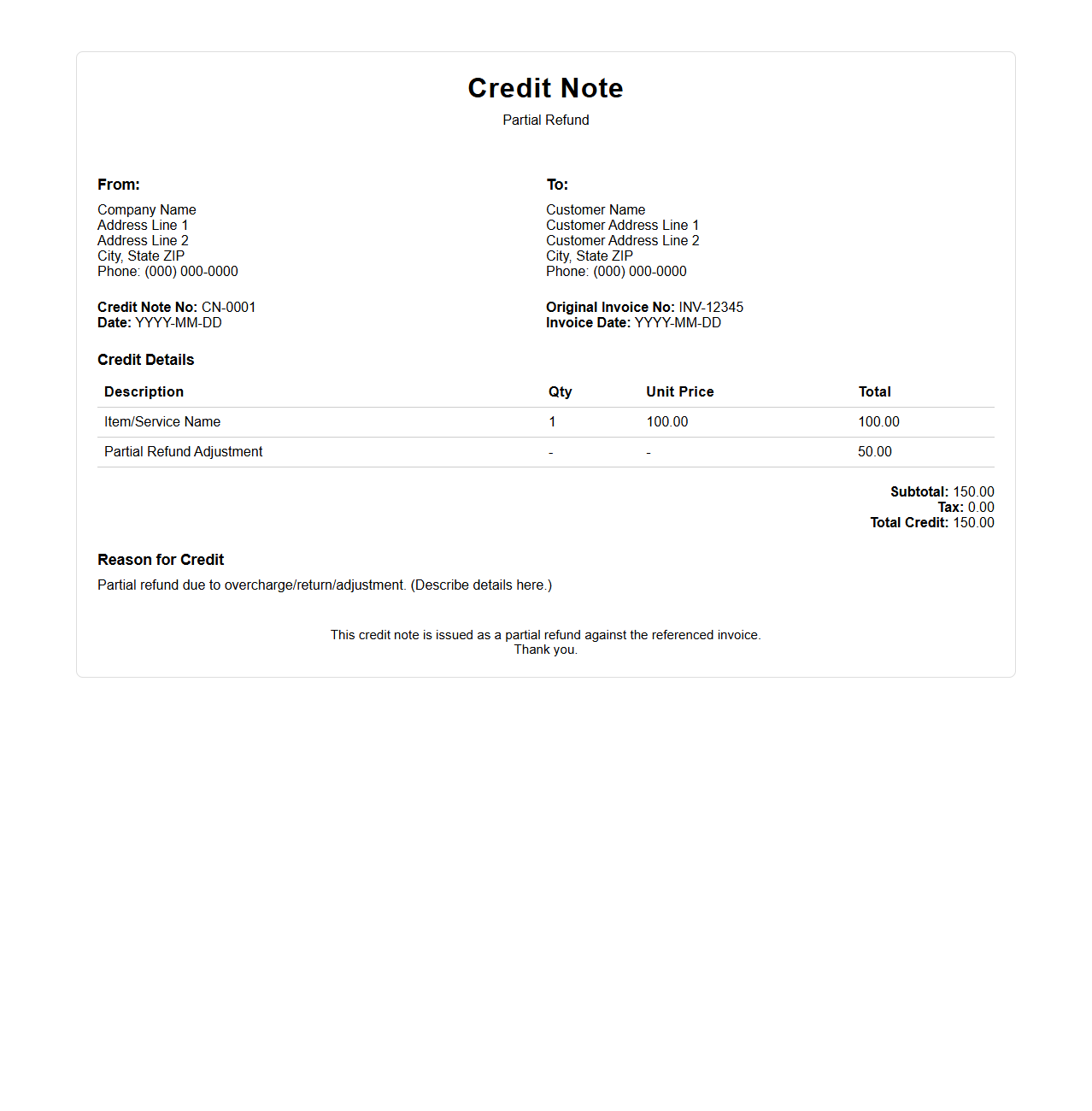

Partial Refund Credit Note Sample

A

Partial Refund Credit Note sample document serves as an official record issued by a seller to a buyer, indicating a partial refund for goods or services. It outlines the refund amount, the reason for the partial refund, and references the original invoice to maintain accurate financial tracking. This document ensures transparency in accounting and facilitates proper adjustment of accounts receivable.

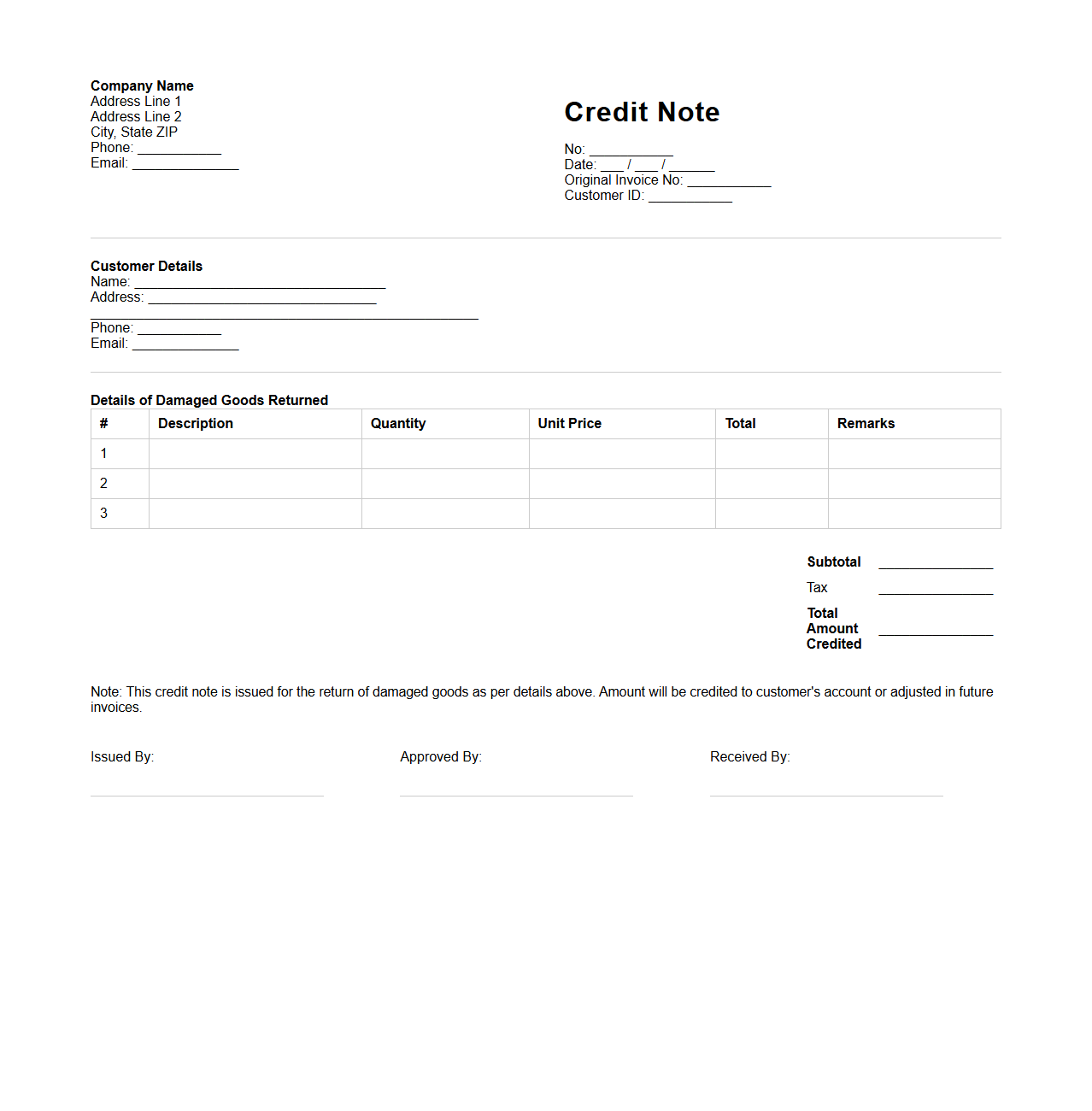

Credit Note for Damaged Goods Return

A

Credit Note for Damaged Goods Return is a financial document issued by a seller to a buyer to acknowledge the return of damaged or defective products. It serves as proof that the buyer is entitled to a refund or a reduction in the outstanding invoice amount. This document helps maintain accurate accounting records and supports transparency in the return and refund process.

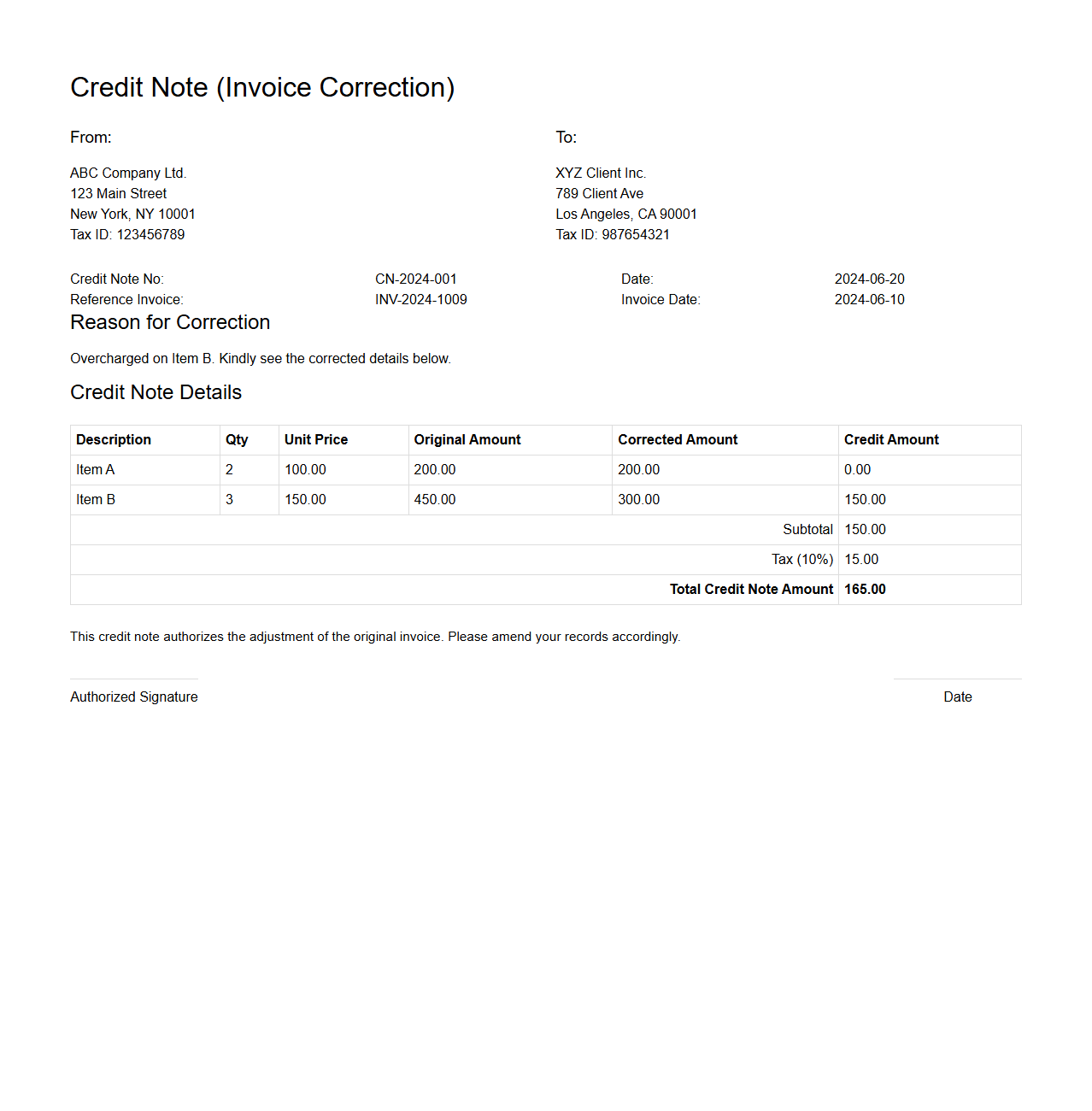

Invoice Correction Credit Note Example

An

Invoice Correction Credit Note document is issued to rectify errors in a previously sent invoice, such as incorrect amounts, quantities, or pricing. It serves as an official record that adjusts the original invoice, reducing the amount owed by the buyer without canceling the entire transaction. This document is essential for maintaining accurate financial records and ensuring compliance with accounting standards and tax regulations.

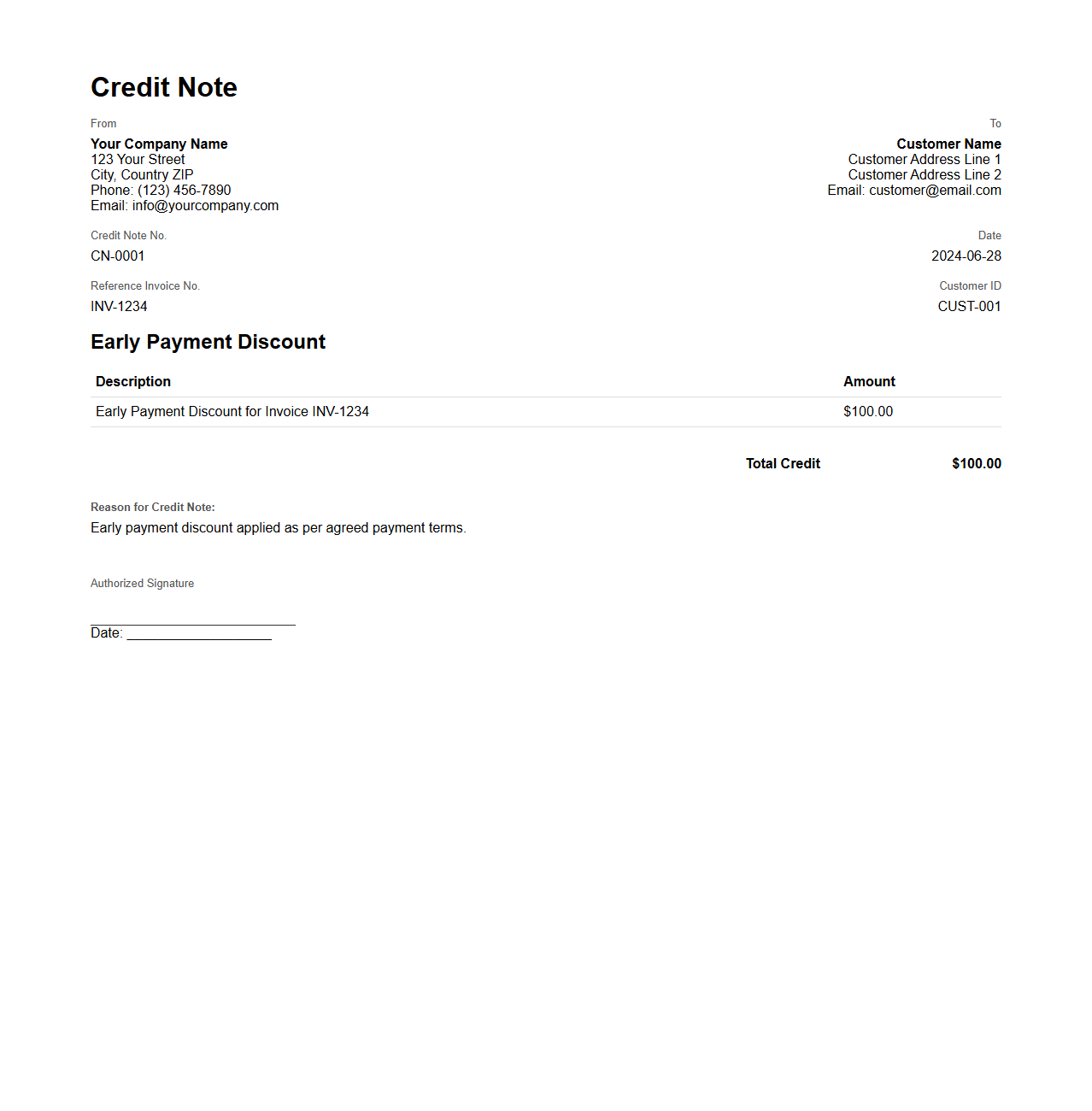

Credit Note for Early Payment Discount

A

Credit Note for Early Payment Discount is a financial document issued by a seller to a buyer, reflecting a reduction in the invoice amount due to early settlement of payment. This document serves as formal acknowledgment of the discounted amount granted as an incentive for prompt payment, ensuring accurate accounting records. It facilitates transparent transaction adjustments and improves cash flow management for both parties involved.

What key details must be included in a customer refund credit note document?

A customer refund credit note must contain essential information such as the credit note number, date of issue, and details of the original invoice. It should clearly specify the amount being refunded along with the reason for the refund to ensure transparency. Additionally, customer identification and detailed product or service descriptions are crucial for accurate record-keeping.

How can credit notes for partial refunds be efficiently tracked in accounting systems?

Efficient tracking of partial refund credit notes requires linking them directly to the original invoice within the accounting software. Utilizing dedicated fields or tags for partial refunds helps differentiate them from full refunds, simplifying reporting. Automated reconciliation tools can also reduce errors and streamline the refund tracking process.

What are common compliance risks in issuing digital credit note documents to customers?

Common compliance risks include ensuring the digital credit note adheres to local tax regulations and contains all required fields such as VAT or GST details. Failure to maintain proper digital signatures or timestamps can undermine legal validity. Additionally, secure storage and audit trail maintenance are critical to meet regulatory standards.

How should currency fluctuations be handled on international customer refund credit notes?

When dealing with currency fluctuations, it is important to state the refund amount in both the transaction and refund currency with the applicable exchange rate clearly documented. Using a consistent date for exchange rate application helps prevent discrepancies between accounts. Transparency about exchange rate sources ensures clarity and compliance in international refunds.

What is the best practice for referencing original invoices in credit note documents for refunds?

The best practice is to explicitly reference the original invoice number and date on the credit note to establish a clear audit trail. This linkage simplifies reconciliation and supports accurate financial reporting. Including a brief description of the reason for the refund further enhances clarity for both parties.