A Fund Transfer Document Sample for Online Banking provides a clear template outlining essential transaction details such as sender and receiver information, transfer amount, date, and confirmation numbers. This document ensures accuracy and transparency during online fund transfers, helping users verify and record their financial activities. Utilizing a well-structured sample improves security and compliance with banking regulations.

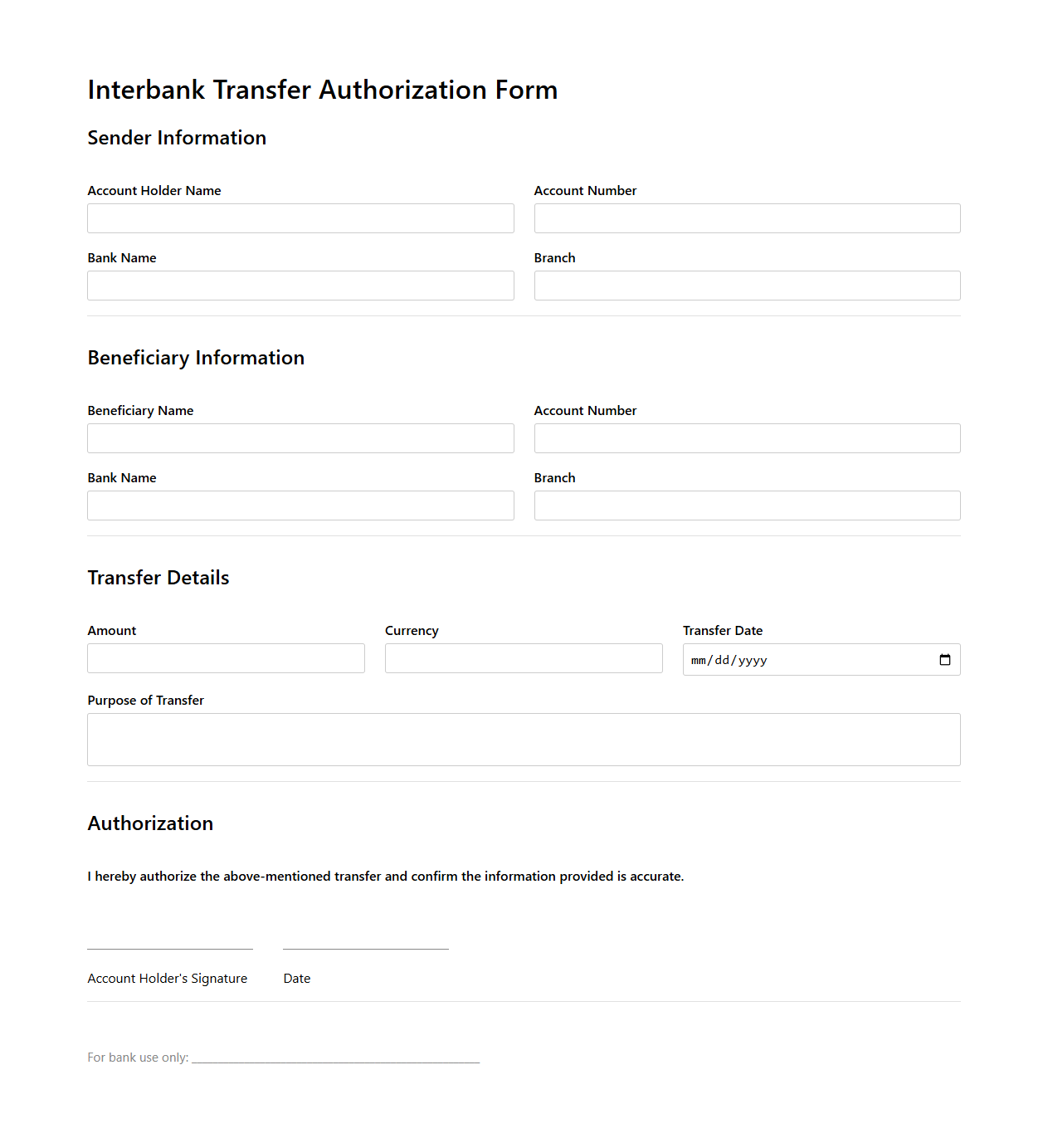

Interbank Transfer Authorization Form

An

Interbank Transfer Authorization Form is a crucial financial document used to authorize the transfer of funds between accounts held at different banks. It typically includes details such as the sender's and recipient's bank information, account numbers, transfer amount, and authorization signatures. This form ensures secure, accurate, and compliant interbank transactions while minimizing the risk of errors or fraud.

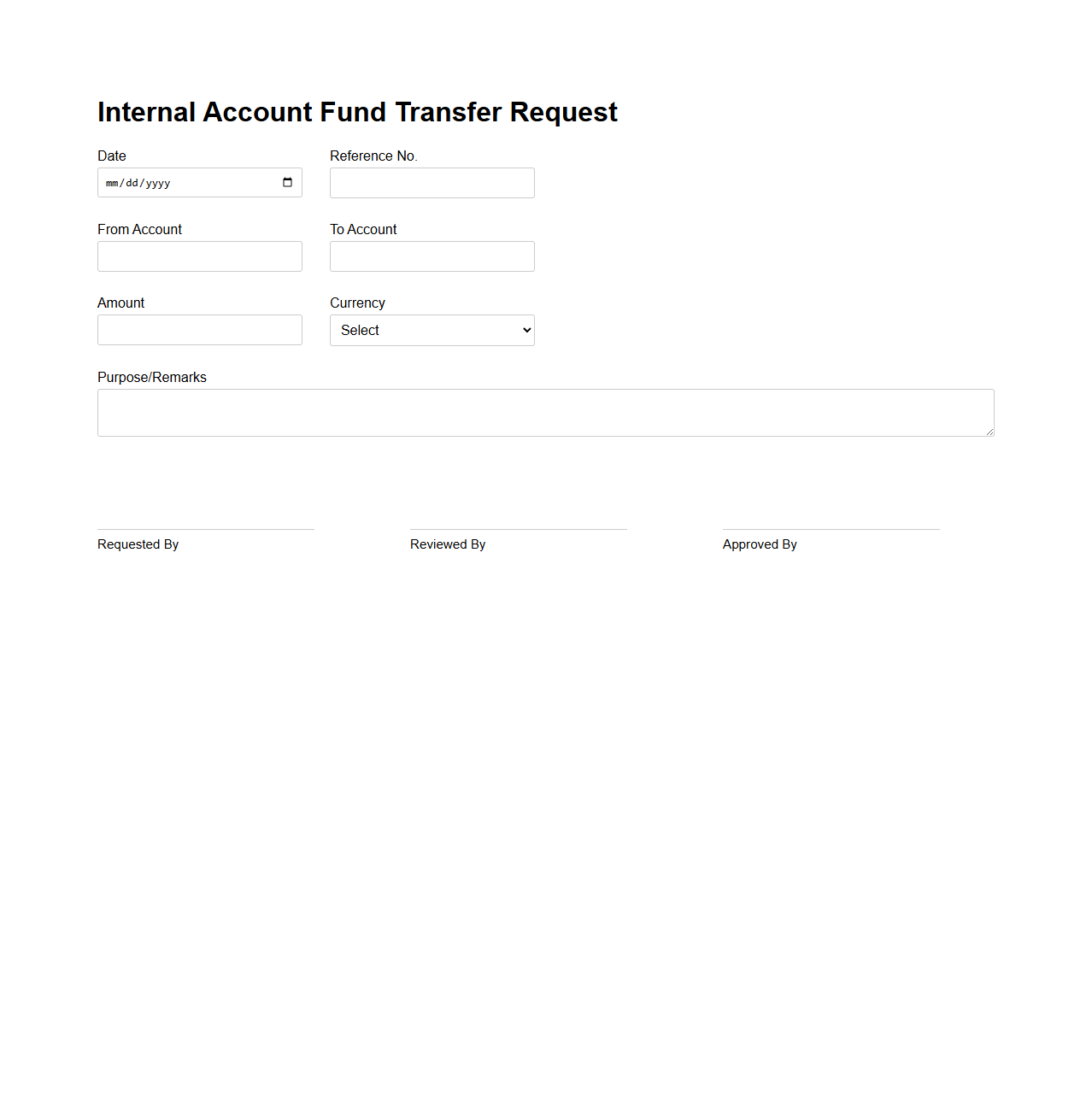

Internal Account Fund Transfer Request

The

Internal Account Fund Transfer Request document is used within an organization to facilitate the authorized movement of funds between internal accounts, ensuring accurate tracking and accountability. This document typically includes details such as the source and destination accounts, transfer amount, date, and approval signatures to maintain financial control and audit compliance. It serves as an official record for internal financial transactions, helping departments manage budgets and reconcile accounts effectively.

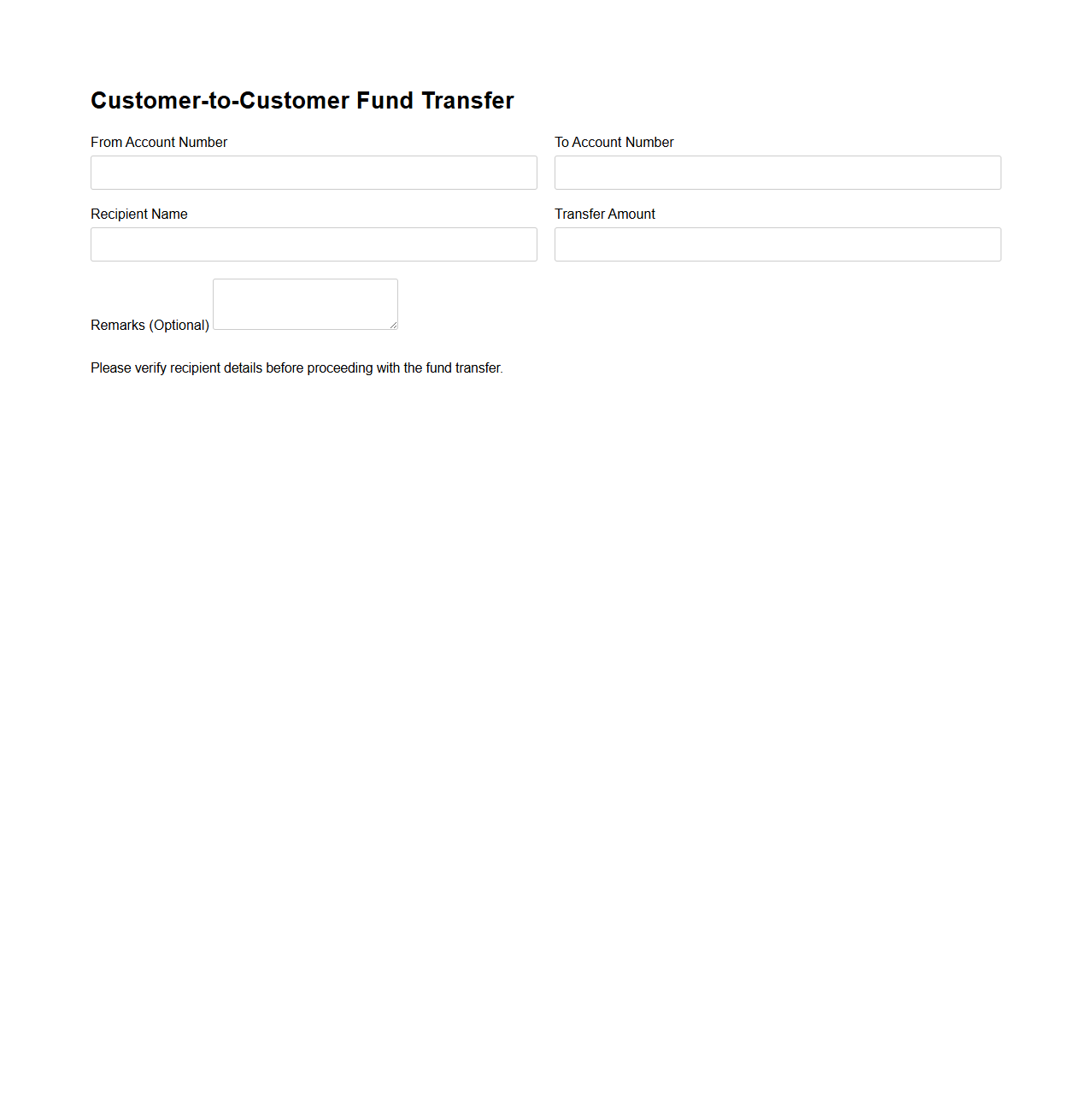

Customer-to-Customer Fund Transfer Template

A

Customer-to-Customer Fund Transfer Template document standardizes the process of transferring funds between two customers, ensuring accuracy and compliance with banking regulations. It typically includes essential details such as sender and receiver information, account numbers, transfer amount, date, and transaction reference number. This template minimizes errors, streamlines transaction processing, and enhances transparency for both financial institutions and customers.

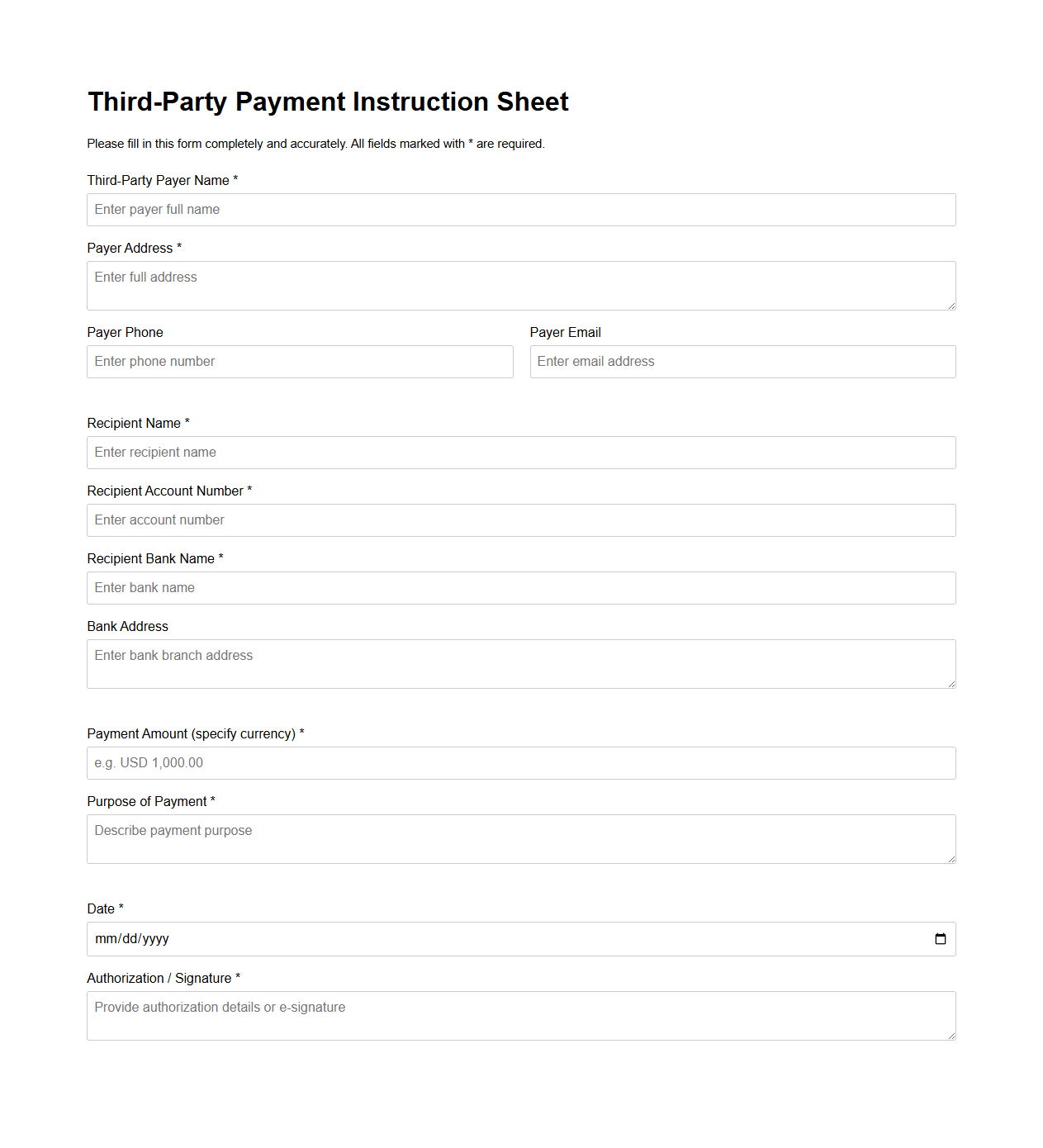

Third-Party Payment Instruction Sheet

A

Third-Party Payment Instruction Sheet is a formal document used to authorize payment transactions to be processed on behalf of a third party. It includes detailed information such as the payer's and payee's identification, payment amount, transaction reference, and specific instructions for the financial institution handling the payment. This document ensures clarity, compliance, and security in outsourcing payment responsibilities to trusted external entities.

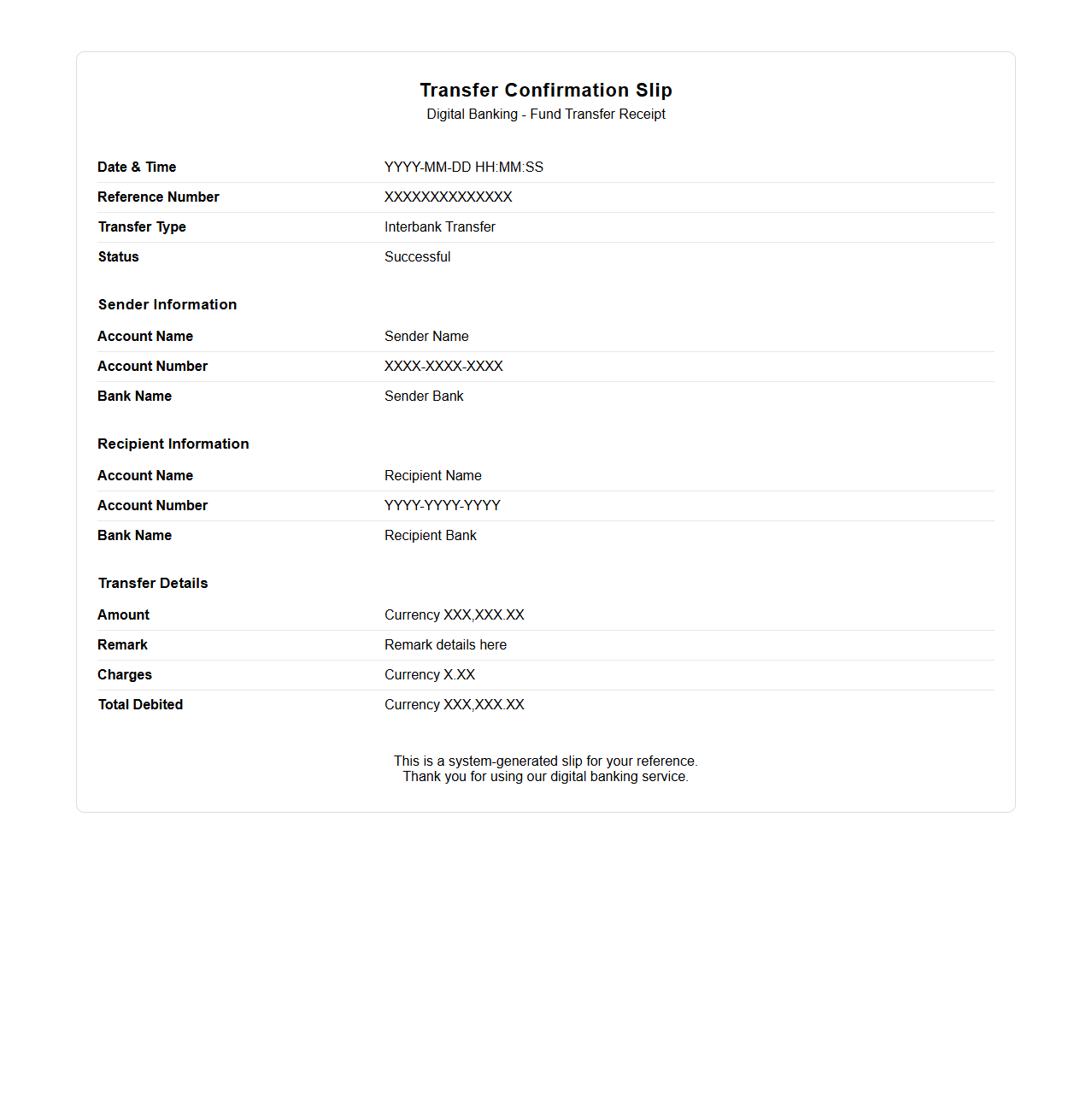

Digital Banking Transfer Confirmation Slip

A

Digital Banking Transfer Confirmation Slip is an official document generated after a successful electronic funds transfer, serving as proof of payment between parties. It contains critical transaction details such as date, amount, sender and receiver account information, and unique transaction reference numbers. This slip is essential for record-keeping, dispute resolution, and verification of completed digital banking transactions.

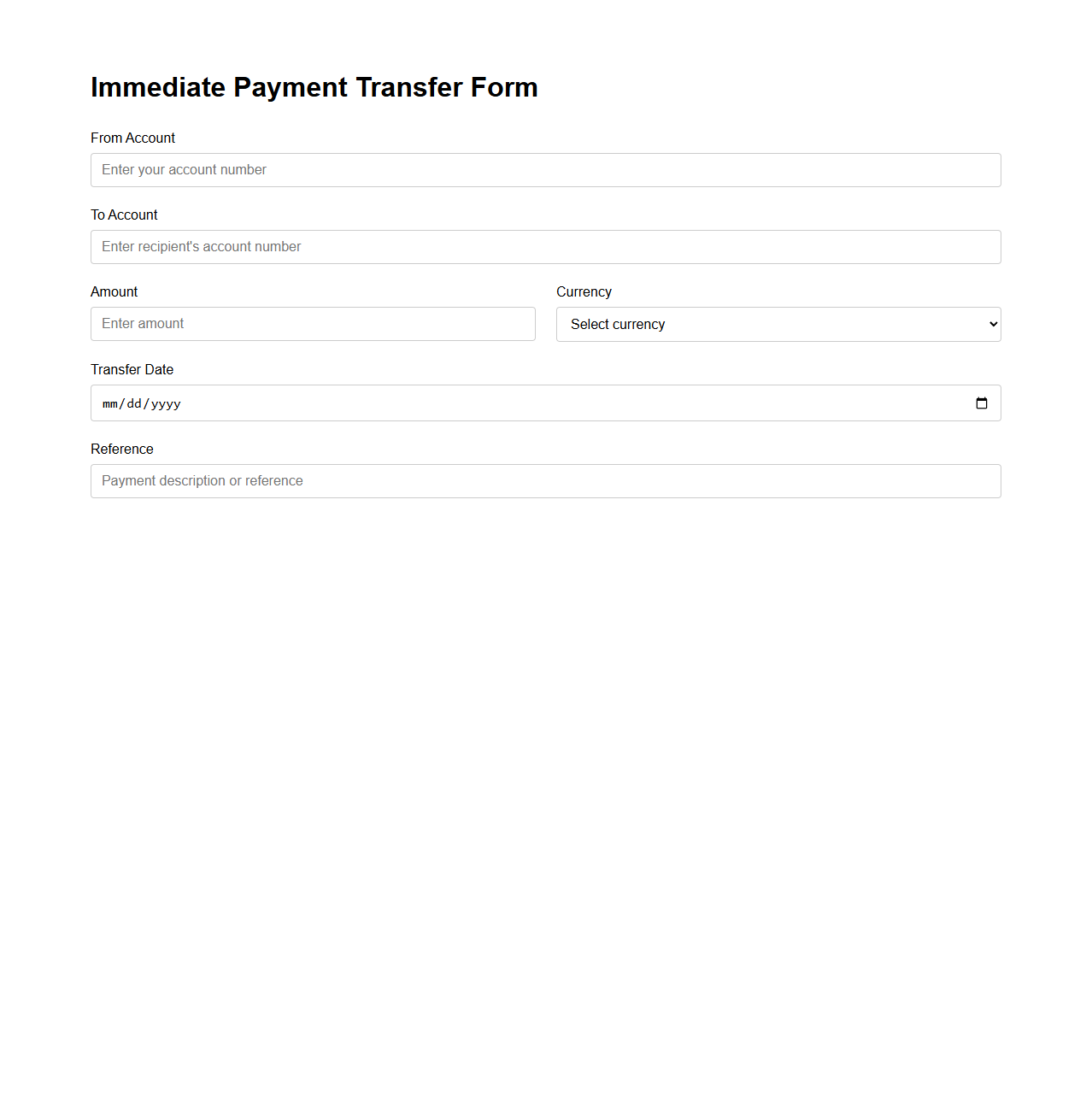

Immediate Payment Transfer Form

The

Immediate Payment Transfer Form is a financial document used to authorize instant fund transfers between bank accounts, ensuring swift transaction processing. It contains essential details such as the sender's and recipient's bank information, transfer amount, and purpose of payment. This form is crucial for facilitating quick payments in banking and corporate environments, minimizing delays.

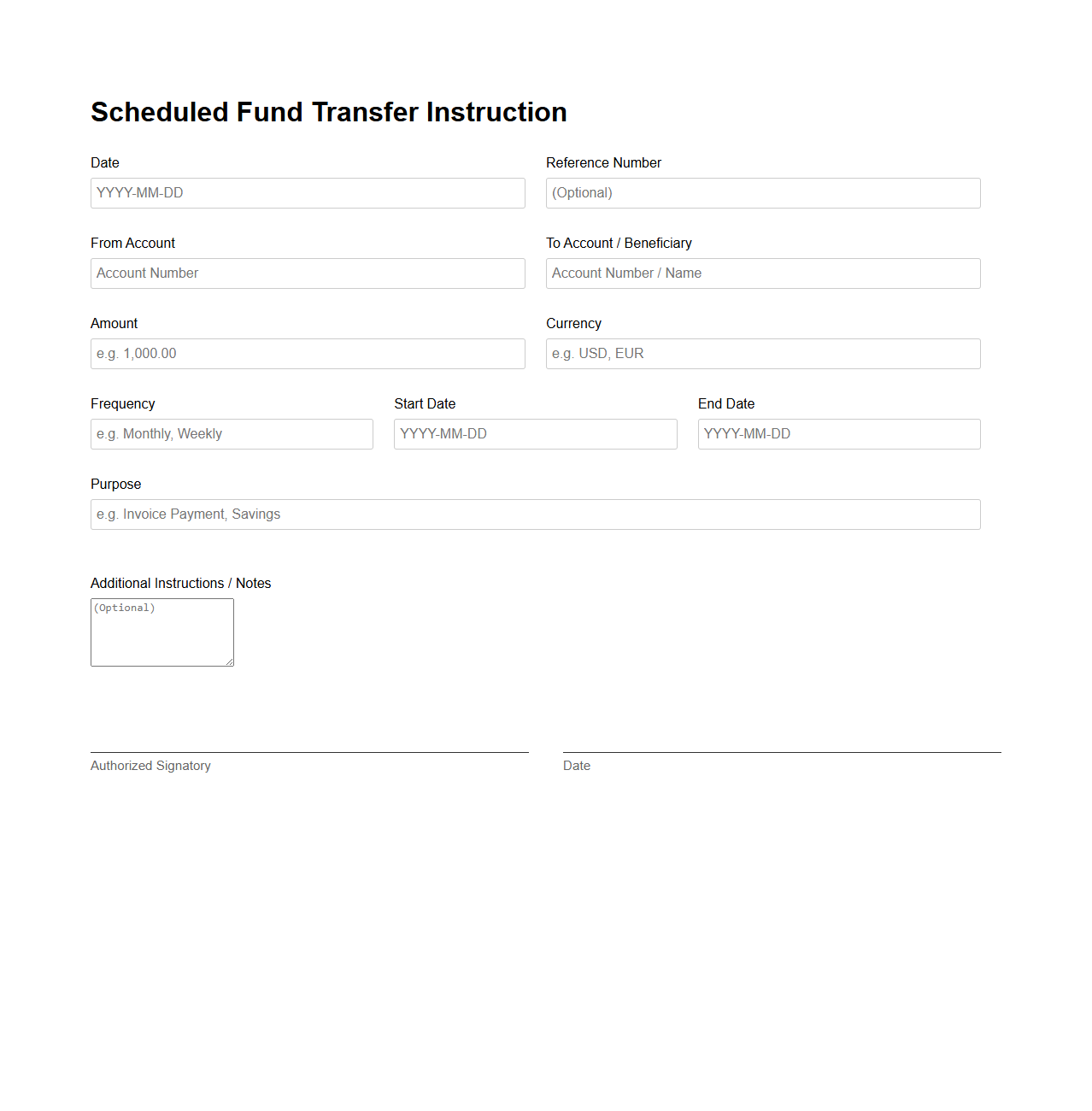

Scheduled Fund Transfer Instruction

A

Scheduled Fund Transfer Instruction document is a formal authorization used to initiate automated, recurring transfers of funds between bank accounts on specified dates. This document outlines key details such as the amount, source and destination accounts, frequency, and duration of the transfers, ensuring timely and accurate execution by financial institutions. It is essential for managing regular payments like loan installments, rent, or subscription fees without manual intervention.

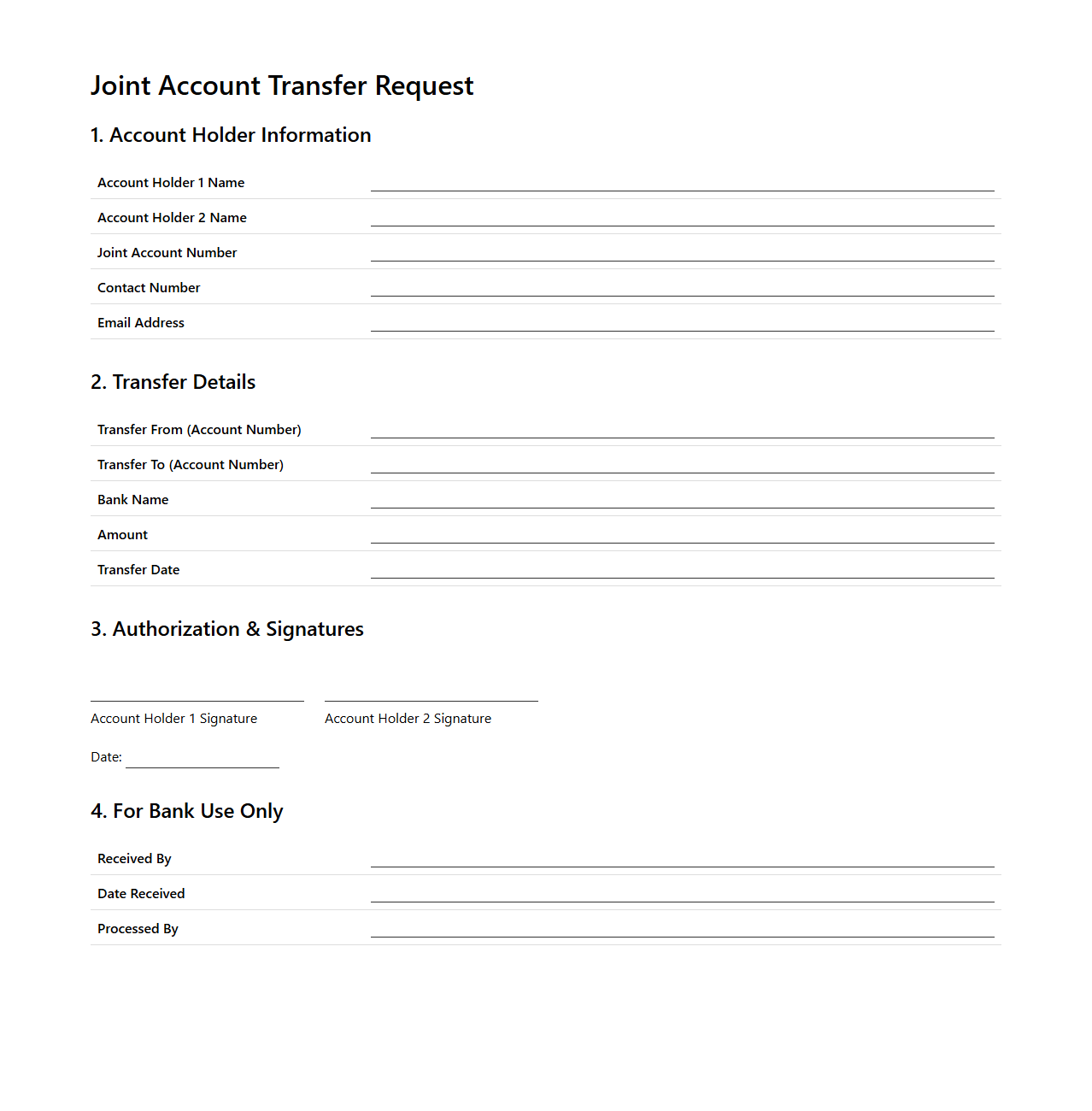

Joint Account Transfer Request Document

A

Joint Account Transfer Request Document is a formal form used by account holders to initiate the transfer of funds or ownership within a joint bank account. This document typically requires signatures from all account holders to authorize the transaction, ensuring compliance with banking policies and security protocols. It serves as a legal record that facilitates the smooth transfer of assets while protecting the rights of all parties involved.

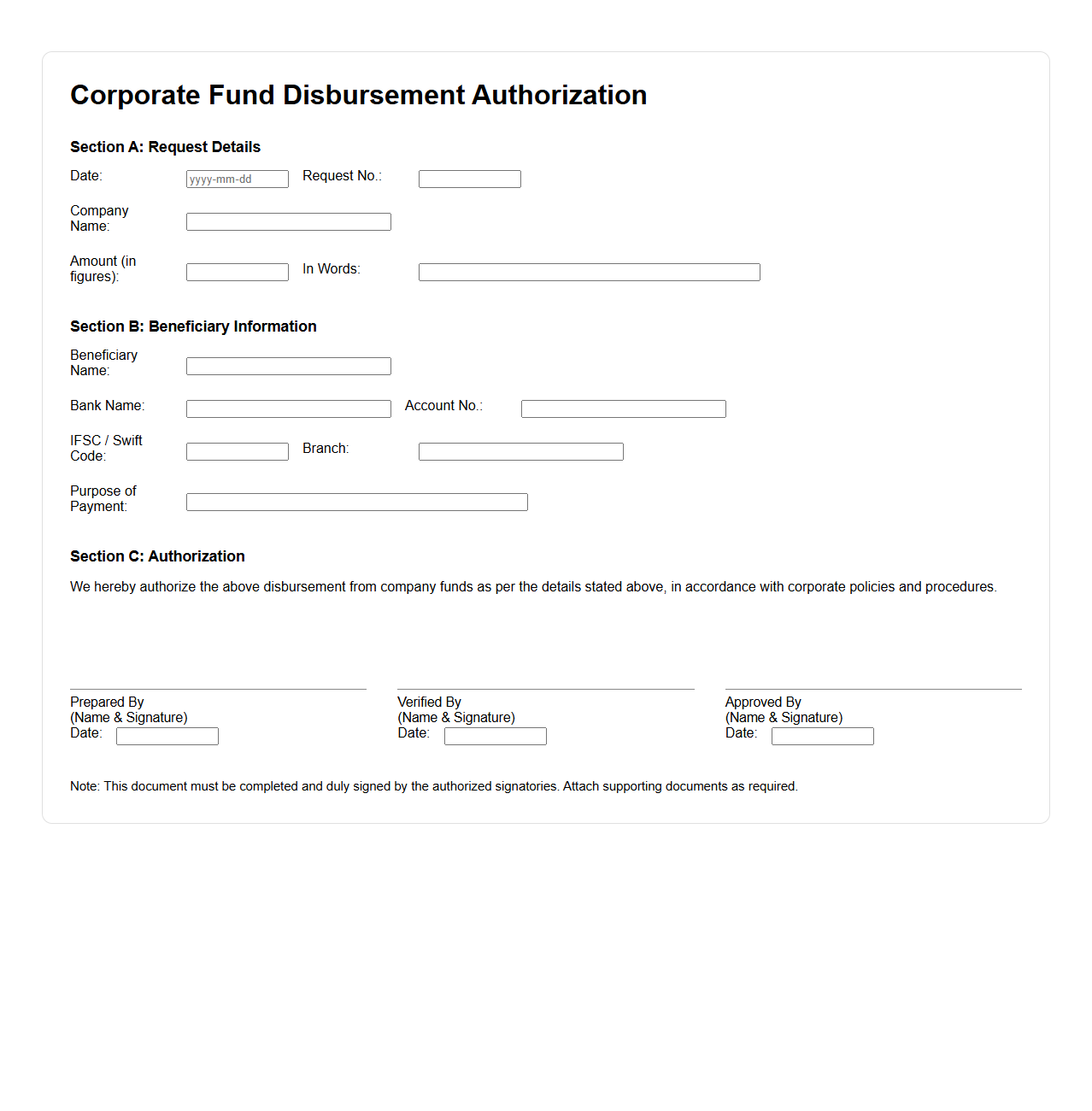

Corporate Fund Disbursement Authorization

A

Corporate Fund Disbursement Authorization document is an official record that grants approval for the release of company funds to designated parties or for specific expenses. This document outlines the amount, purpose, authorized signatories, and relevant financial controls to ensure compliance with corporate policies and regulatory standards. It serves as a critical element in maintaining transparency and accountability within corporate financial management.

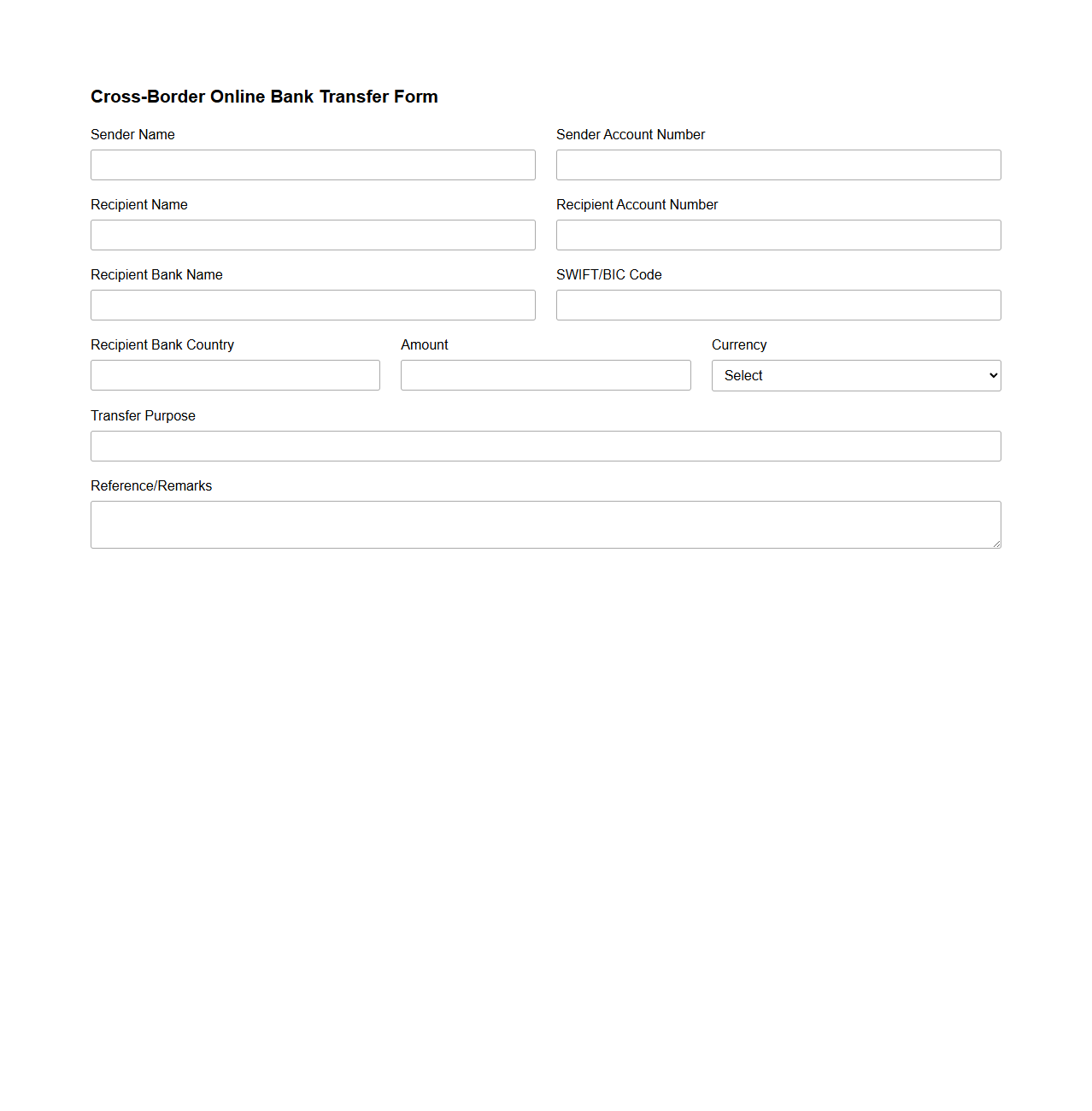

Cross-Border Online Bank Transfer Form

A

Cross-Border Online Bank Transfer Form is a document used to initiate and authorize international fund transfers between bank accounts across different countries. It typically requires detailed information such as the sender's and recipient's bank details, SWIFT/BIC codes, currency type, and transfer amount to ensure accurate processing. This form facilitates secure and compliant transactions by adhering to banking regulations and anti-money laundering protocols.

What security features are standard in a Fund Transfer Document for online banking?

Standard security features include multi-factor authentication, ensuring user identity verification before transaction approval. Encryption protocols like SSL/TLS safeguard the document's data integrity and privacy during transmission. Additionally, secure audit trails provide a detailed log of transaction activities to prevent fraud and ensure accountability.

How should beneficiary details be formatted in an online fund transfer letter?

The beneficiary details must be clearly structured, including the full name, bank account number, and bank branch information. Accurate inclusion of the International Bank Account Number (IBAN) or SWIFT code is critical for international transfers. Proper formatting minimizes errors and ensures timely and successful fund delivery.

What digital signatures are accepted for authorizing Fund Transfer Documents online?

Trusted digital signatures like those compliant with eIDAS or UETA standards are commonly accepted to authorize fund transfer documents. These signatures provide a secure and verifiable method to confirm the transaction originator's identity. Usage of Public Key Infrastructure (PKI) enhances authenticity and prevents tampering.

Which legal compliances must be noted in Fund Transfer Documents for international online transfers?

Legal compliances include adherence to Anti-Money Laundering (AML) regulations and the Foreign Account Tax Compliance Act (FATCA). Documentation must also comply with the Bank Secrecy Act (BSA) and international sanctions lists. Ensuring these compliances helps prevent legal penalties and secures cross-border transactions.

How are transaction reference numbers generated and included in online Fund Transfer Documents?

Transaction reference numbers are generated using unique alphanumeric sequences, ensuring each transfer is distinctly identifiable. These numbers are embedded in the document header and confirmation sections for easy tracking and reconciliation. Automated systems typically generate them to maintain consistency and reduce errors.