A Financial Statement Document Sample for Small Businesses provides a clear template to organize income, expenses, assets, and liabilities efficiently. It helps small business owners track financial performance and make informed decisions. Using this sample ensures accurate reporting and compliance with accounting standards.

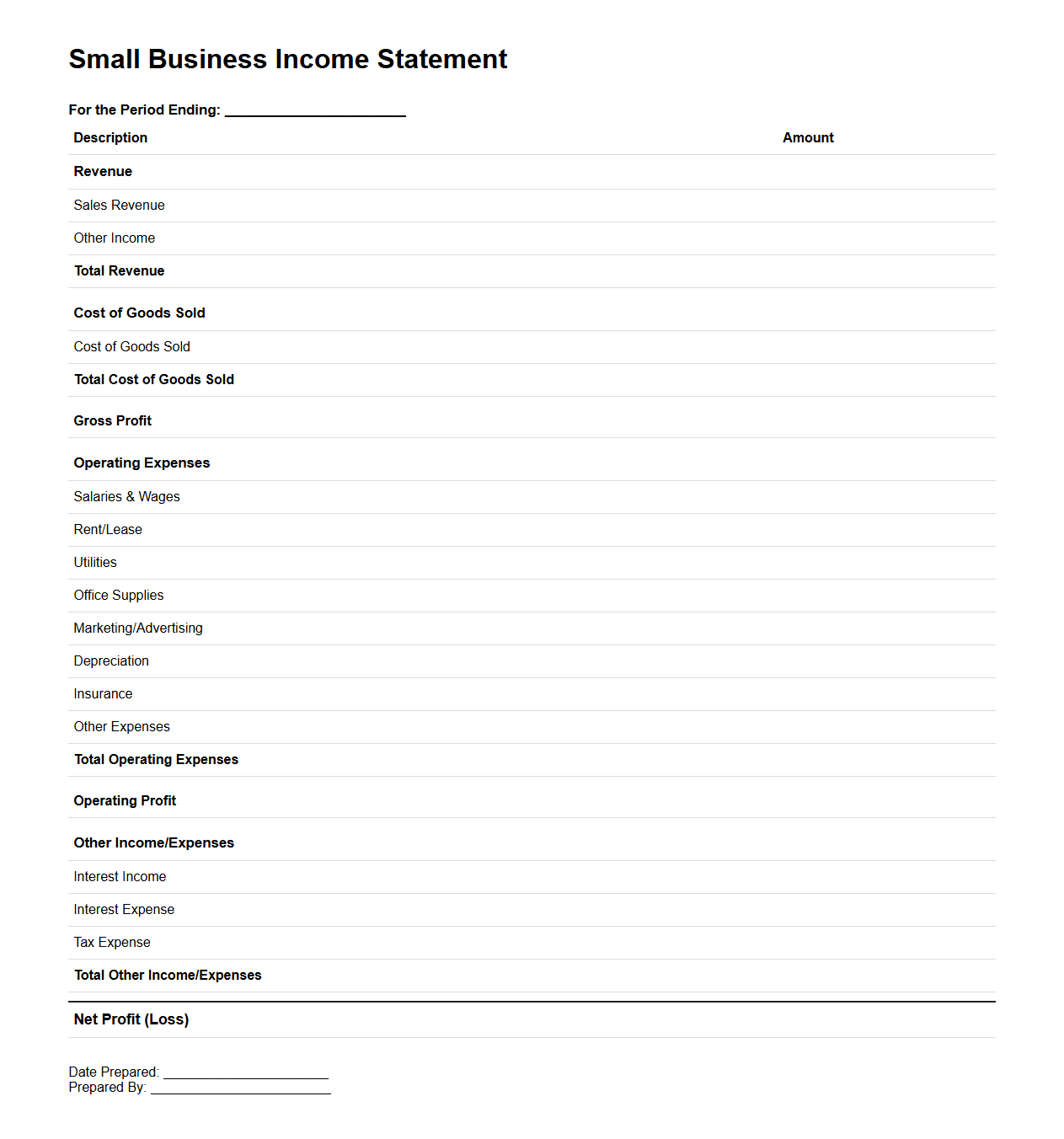

Small Business Income Statement Template

A

Small Business Income Statement Template document is a structured financial report used to track and summarize a company's revenues, costs, and expenses during a specific period. It enables business owners to evaluate profitability by clearly displaying net income or loss, facilitating informed decision-making. This template often includes sections for sales, operating expenses, and taxes, providing a comprehensive overview of financial performance.

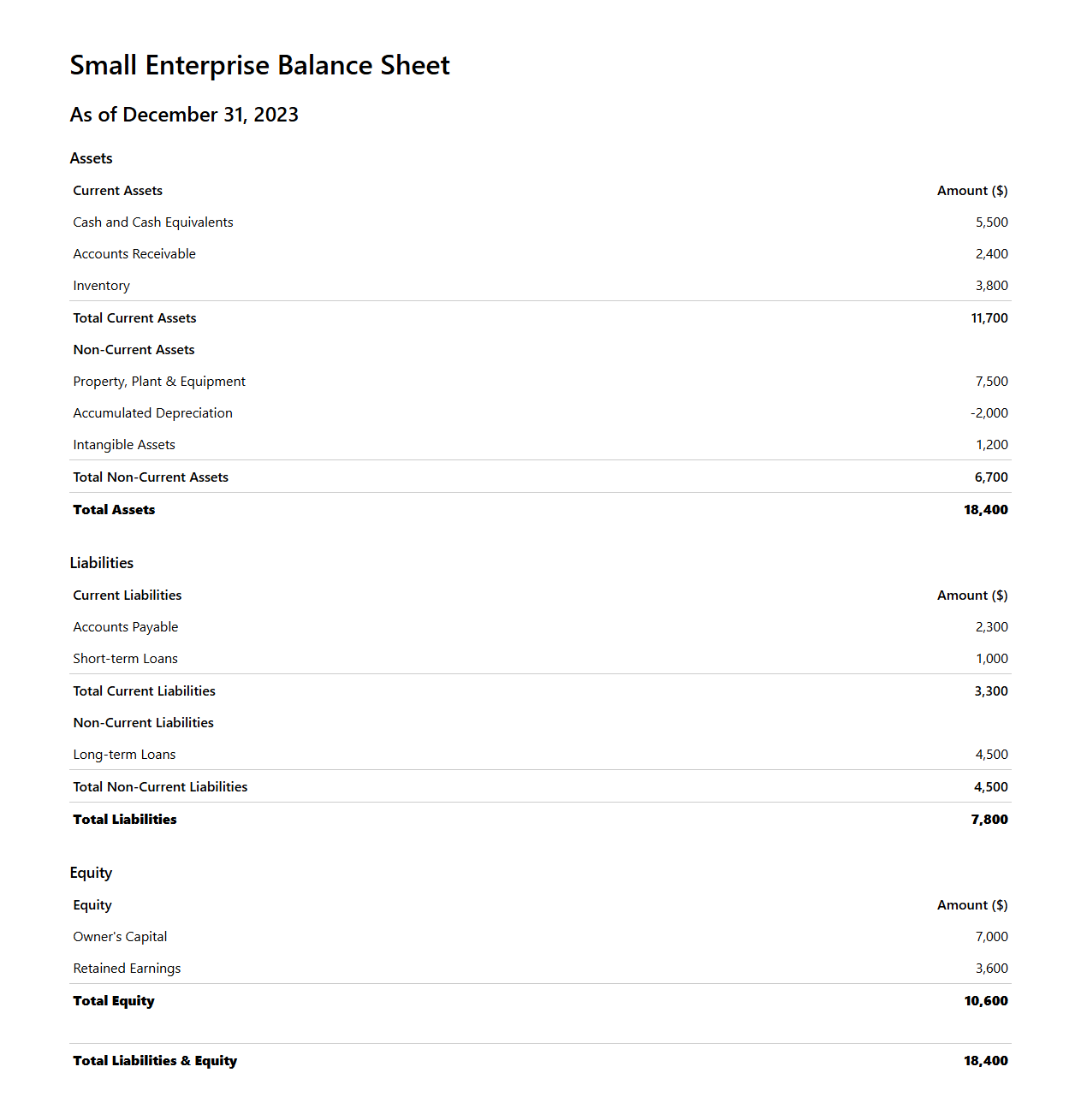

Balance Sheet Example for Small Enterprises

A

Balance Sheet Example for Small Enterprises document provides a clear template illustrating how small businesses can organize and present their financial position at a specific point in time. It typically outlines assets, liabilities, and equity in a structured format, enabling owners to assess financial health and make informed decisions. This example serves as a practical guide for accurate record-keeping and financial reporting tailored to the scale and needs of small enterprises.

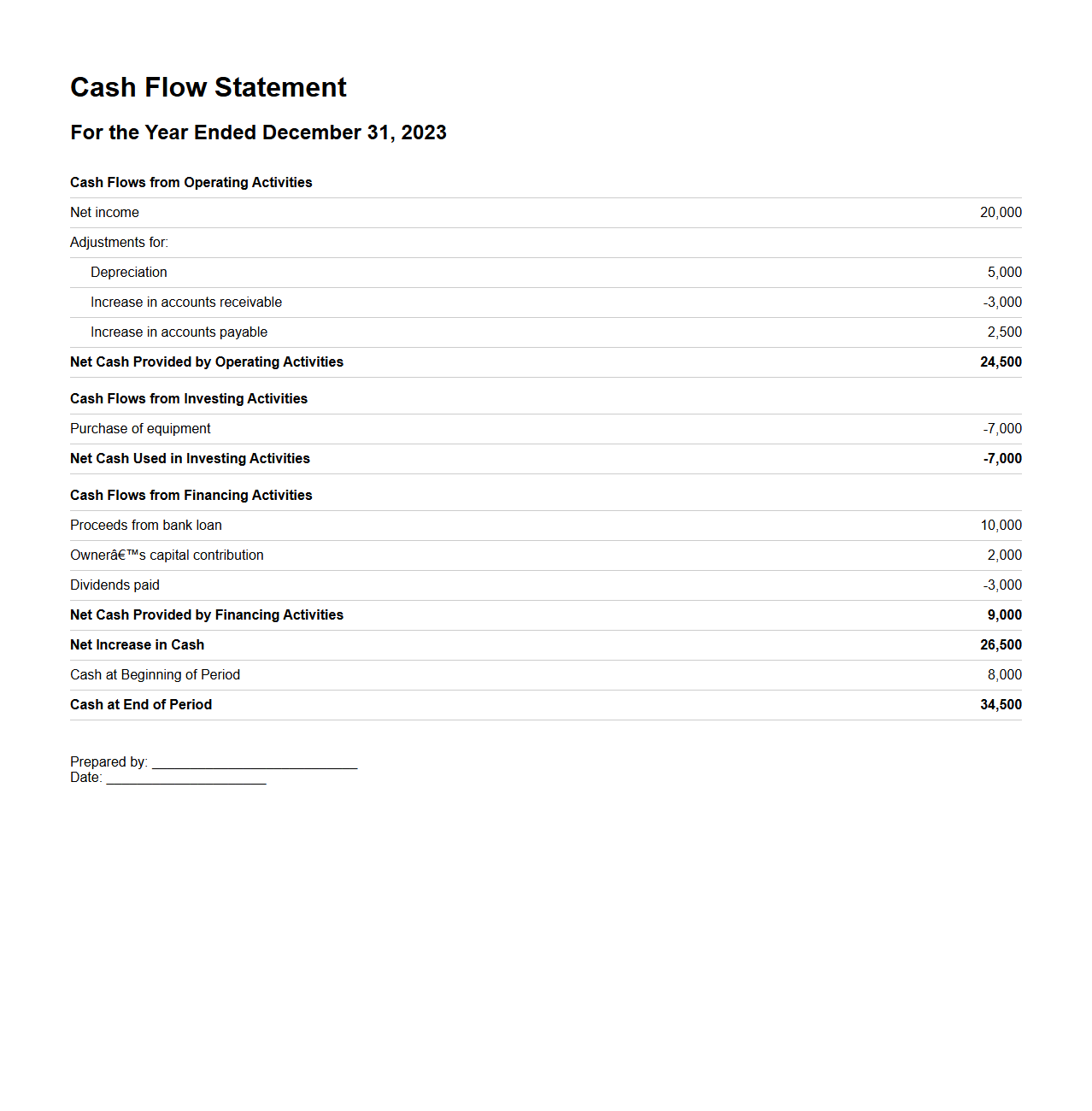

Cash Flow Statement Sample for SMEs

A

Cash Flow Statement Sample for SMEs document provides a practical template demonstrating how small and medium-sized enterprises can track their cash inflows and outflows over a specific period. It includes sections for operating, investing, and financing activities, helping businesses monitor liquidity and manage financial health effectively. This sample serves as a useful guide for SMEs to prepare accurate cash flow reports that support decision-making and strategic planning.

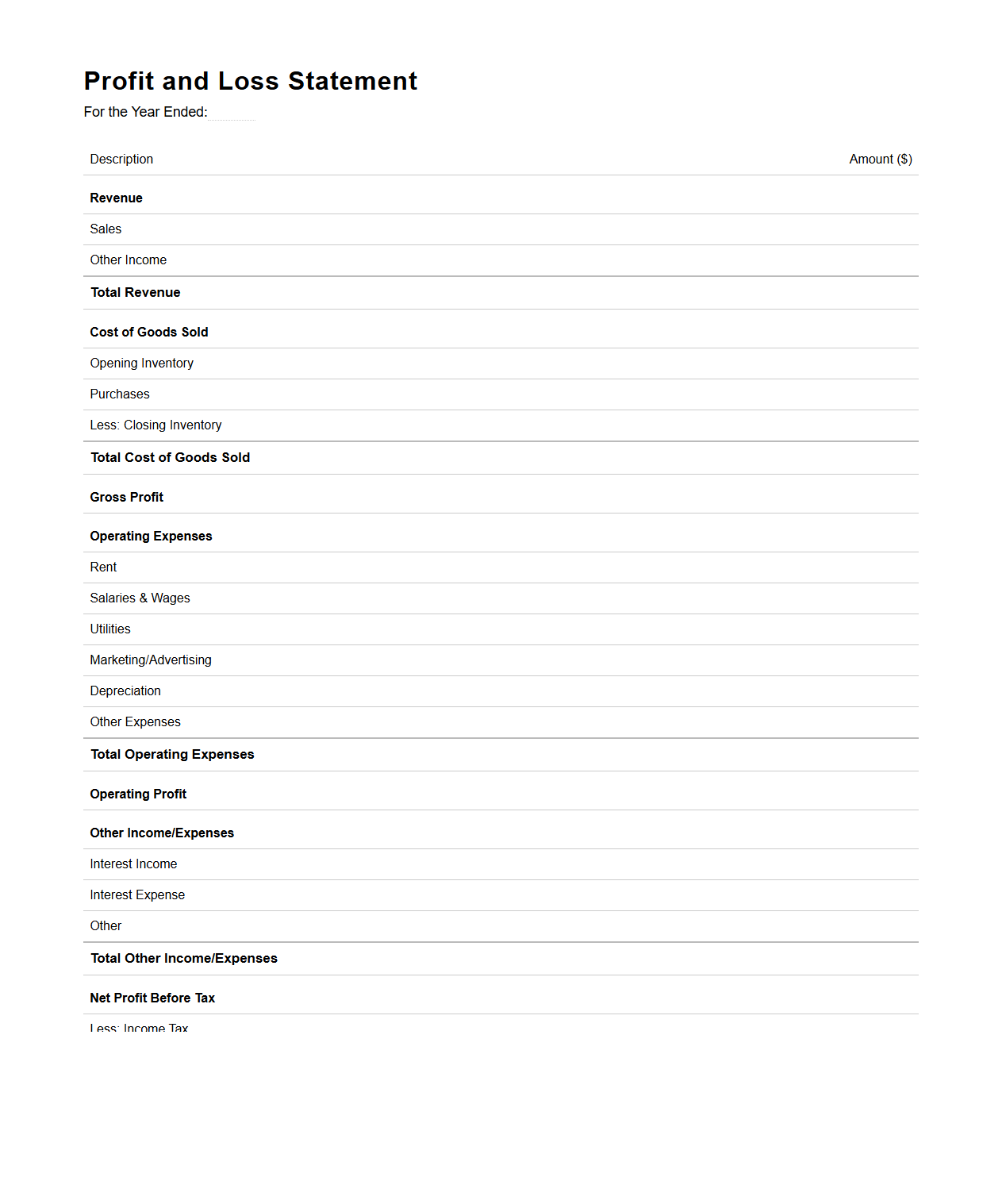

Profit and Loss Statement Format for Small Businesses

The

Profit and Loss Statement Format for small businesses is a structured financial document that outlines revenues, costs, and expenses over a specific period. It provides a clear summary of a company's ability to generate profit by subtracting total expenses from total income. This format helps small business owners monitor financial health, identify trends, and make informed decisions for growth and sustainability.

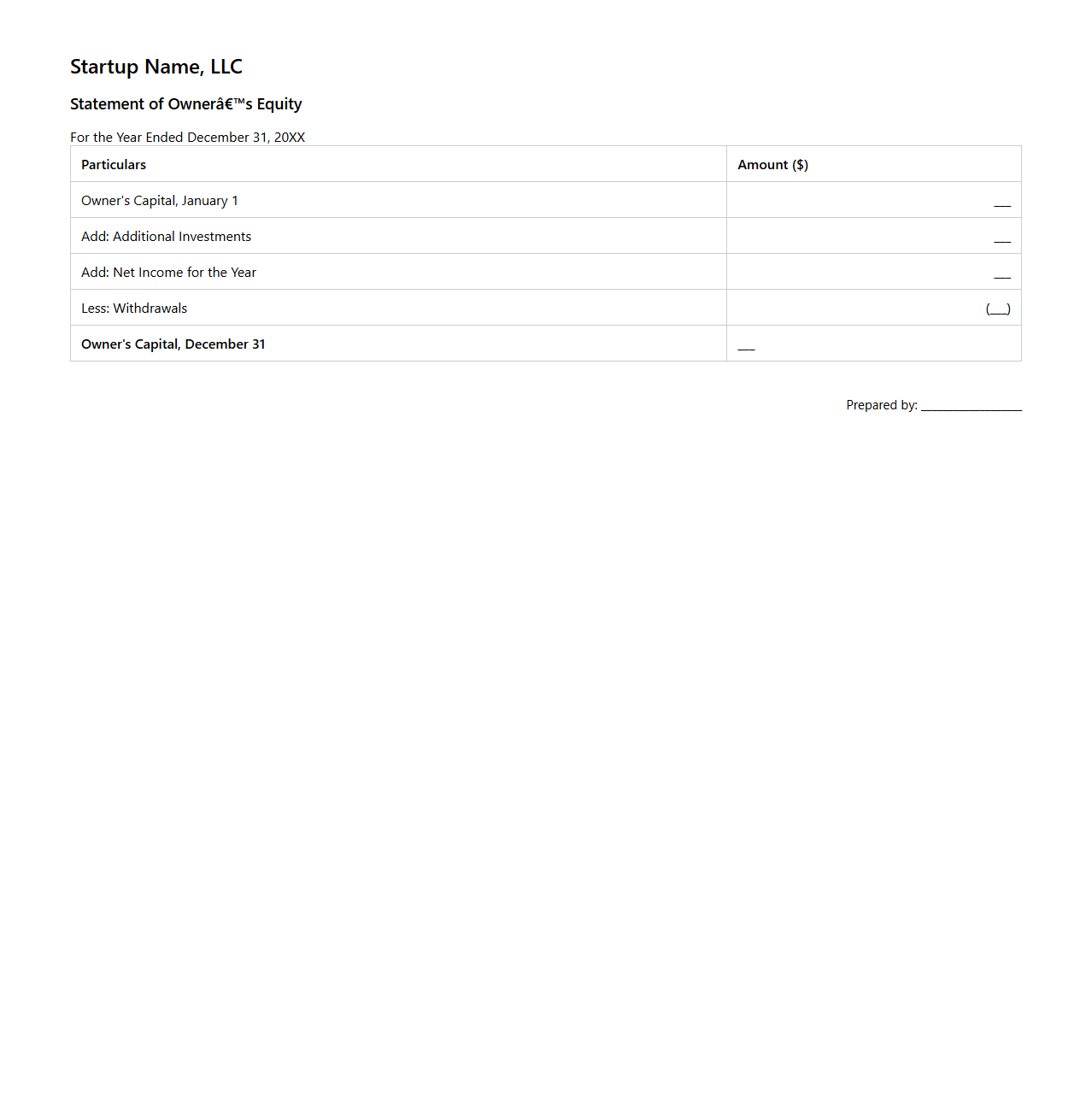

Statement of Owner’s Equity for Startups

The

Statement of Owner's Equity for startups is a financial document that outlines changes in the owner's investment in the company over a specific period. It details beginning equity, additional investments, net income or loss, withdrawals, and ending equity, providing a clear picture of ownership value growth or decline. This statement is essential for investors and management to understand how capital contributions and business performance impact overall equity.

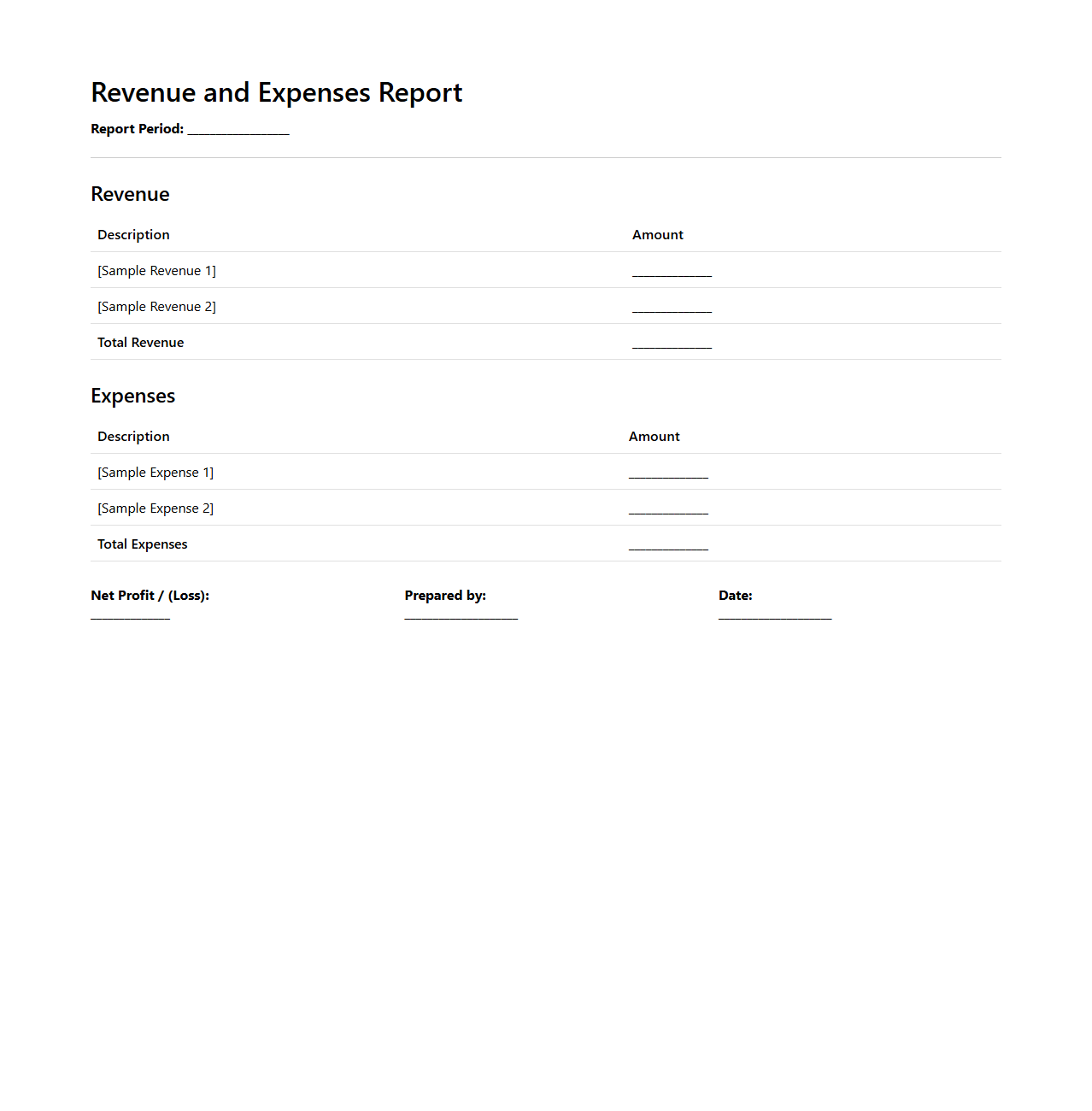

Revenue and Expenses Report Layout

A

Revenue and Expenses Report Layout document systematically organizes financial data to provide a clear overview of income streams and outgoing costs within a specific period. It highlights categories such as sales revenue, operational expenses, and net profit, enabling businesses to analyze profitability and cash flow effectively. This layout supports accurate financial planning and decision-making by offering detailed insights into expense allocation and revenue generation.

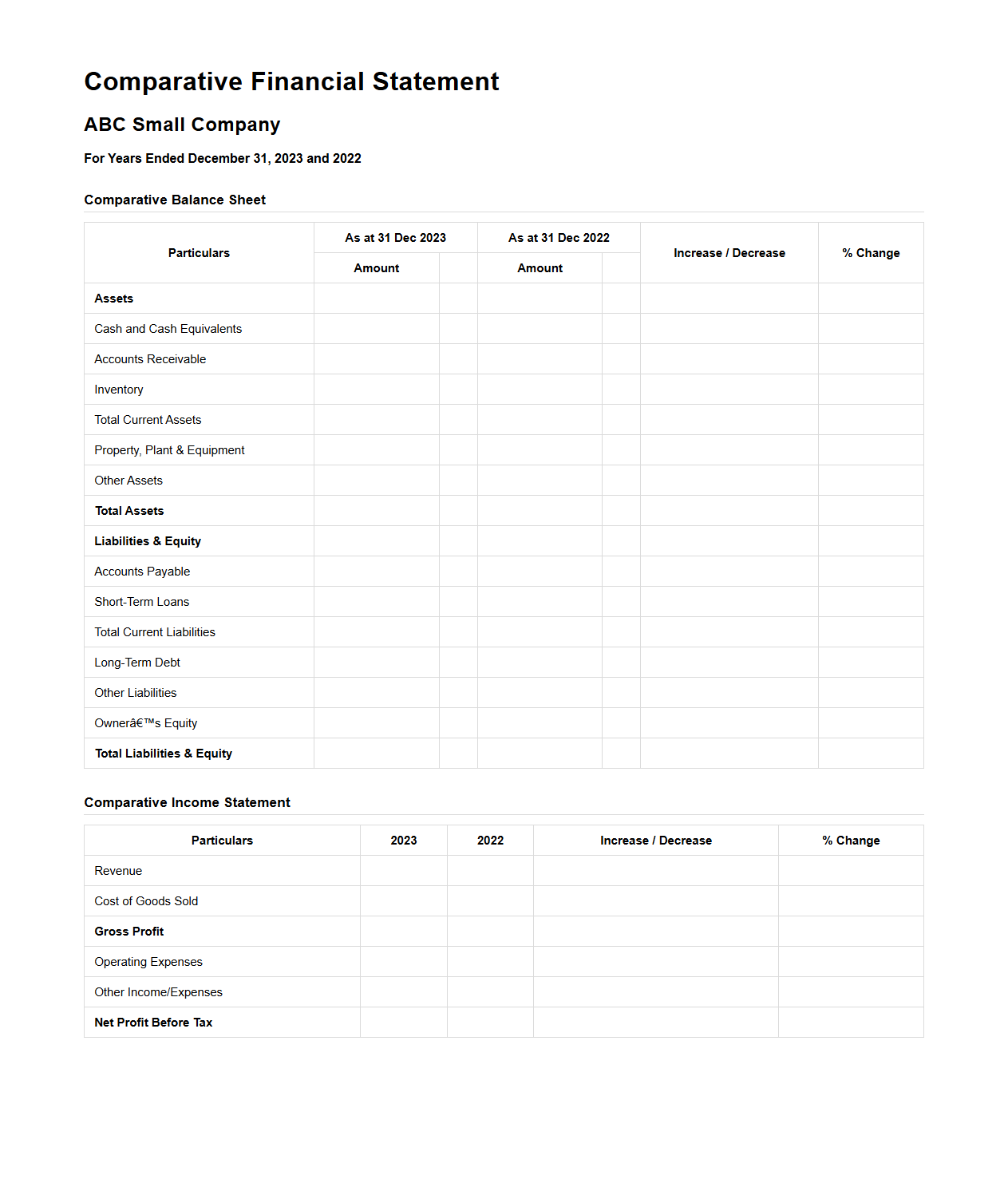

Comparative Financial Statement for Small Companies

A

Comparative Financial Statement for small companies is a financial document that presents the company's financial performance and position over multiple accounting periods side by side. This statement helps in analyzing trends, identifying growth patterns, and making informed business decisions by comparing key financial metrics such as revenue, expenses, assets, and liabilities. It is essential for small businesses to monitor progress, ensure compliance, and plan future strategies effectively.

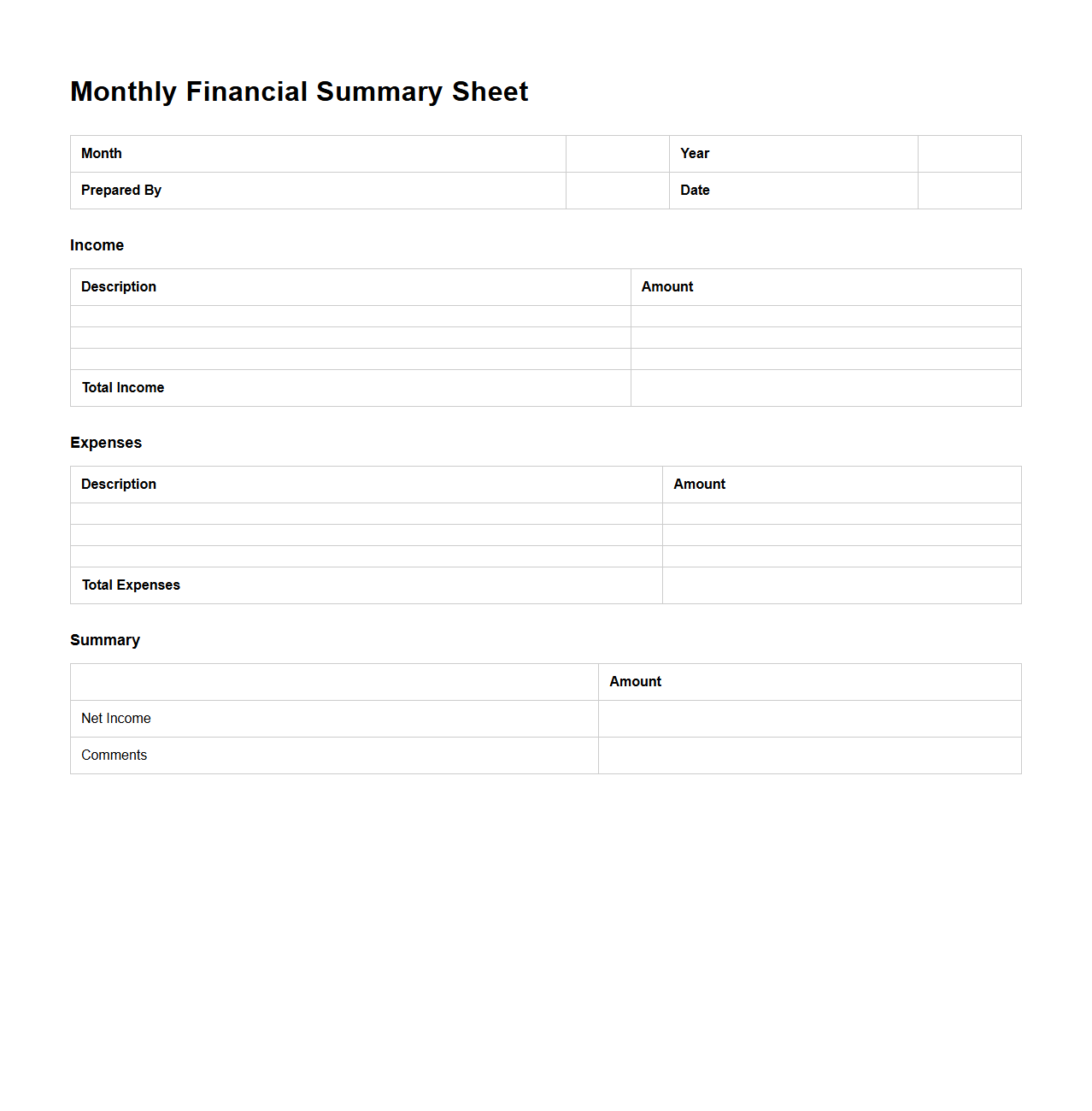

Monthly Financial Summary Sheet

A

Monthly Financial Summary Sheet is a document that consolidates an organization's financial data for a specific month, highlighting key metrics such as revenue, expenses, profits, and cash flow. It enables businesses to track financial performance, identify trends, and support informed decision-making. This summary is essential for budgeting, forecasting, and ensuring financial accountability within the company.

Annual Financial Statement for Local Businesses

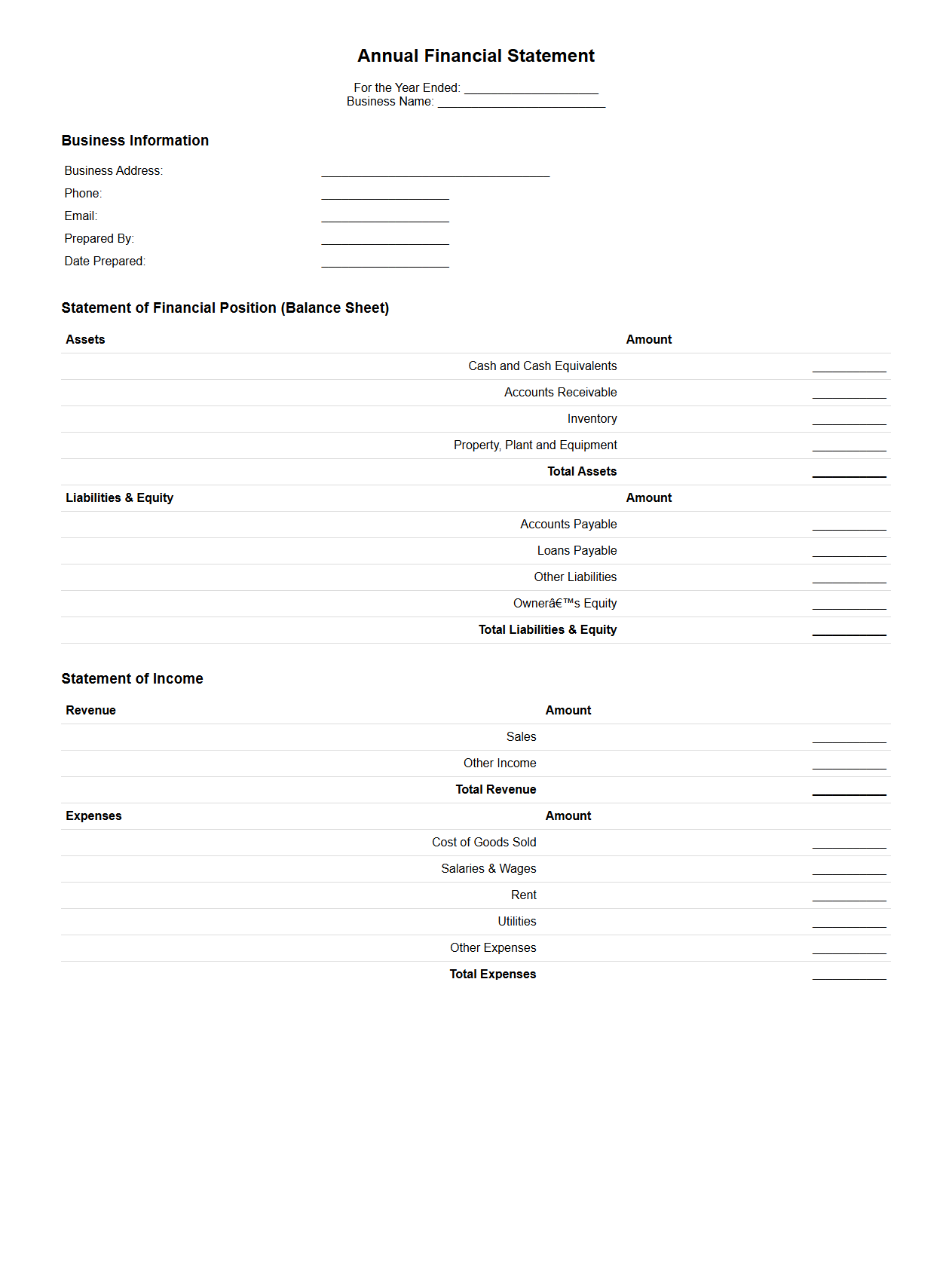

The

Annual Financial Statement for local businesses is a comprehensive report that summarizes the financial activities and condition of a company over a fiscal year. It typically includes key components such as the balance sheet, income statement, and cash flow statement, offering insight into profitability, liquidity, and operational efficiency. This document is essential for stakeholders, including investors, creditors, and regulatory authorities, to assess the business's financial health and compliance.

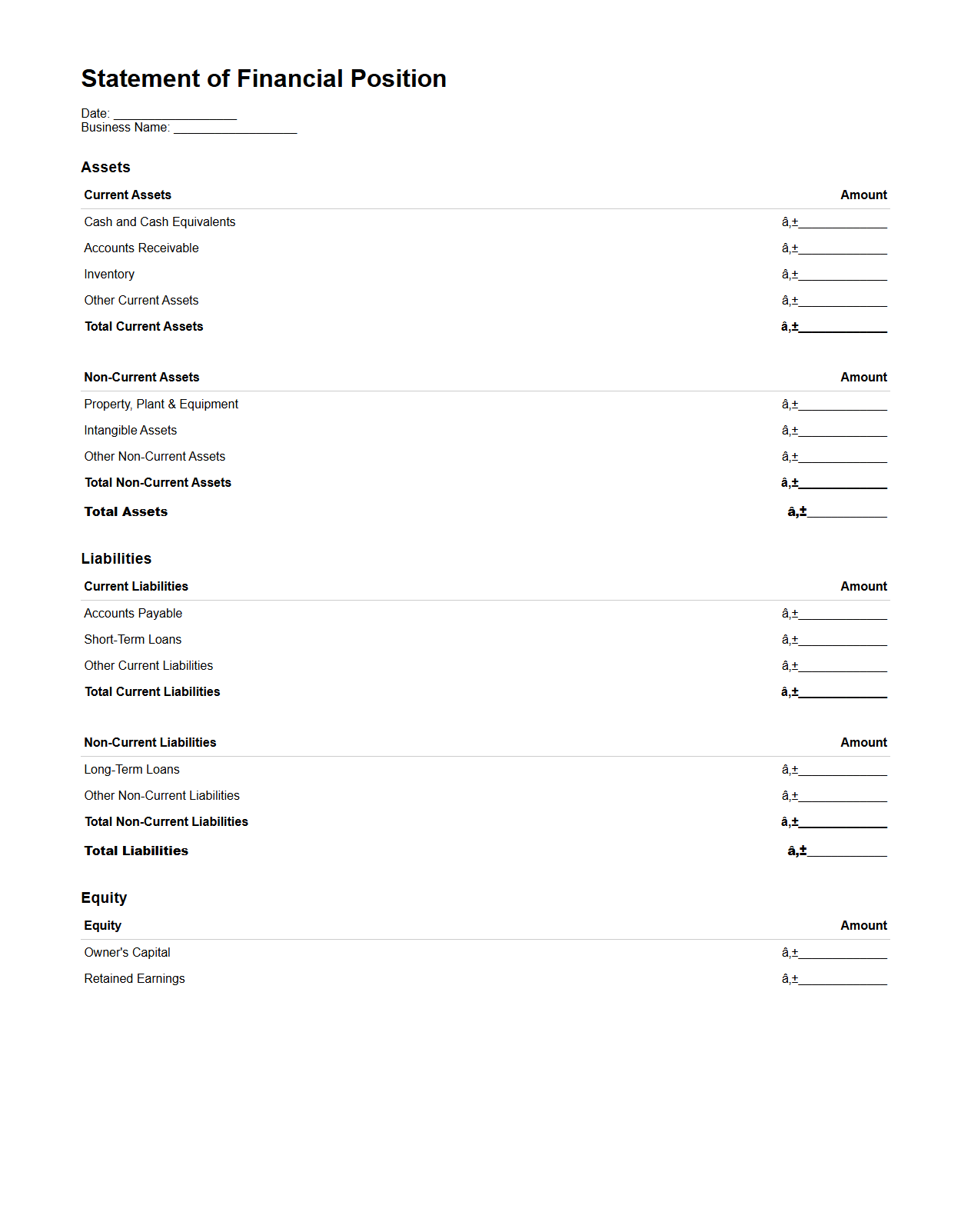

Statement of Financial Position Example for Entrepreneurs

A

Statement of Financial Position Example for Entrepreneurs document provides a detailed snapshot of a business's assets, liabilities, and equity at a specific point in time, enabling entrepreneurs to evaluate their financial health accurately. This document includes key financial data such as cash, accounts receivable, inventory, loans, and owner's equity, which are crucial for making informed business decisions. Entrepreneurs use this example as a practical guide to prepare their own statements, ensuring compliance with accounting standards and enhancing financial transparency.

What key financial ratios should small businesses highlight in their financial statement documents?

Small businesses should emphasize liquidity ratios such as the current ratio to demonstrate their ability to cover short-term obligations. Profitability ratios, including net profit margin, provide insight into business efficiency and earnings. Additionally, highlighting leverage ratios like debt-to-equity reveals the company's financial structure and risk level.

How often should small businesses update their financial statement letters for compliance?

Small businesses must update their financial statement letters at least annually to ensure compliance with legal and regulatory requirements. Quarterly updates may be necessary for businesses with fluctuating finances or lender obligations. Timely updates help maintain transparency and trust with stakeholders and financial institutions.

Which supporting documents must accompany financial statements for small businesses?

Key supporting documents include bank statements to verify cash balances and transactions. Invoices and receipts provide evidence of revenue and expenses, enhancing the financial statement's validity. Additionally, tax returns should accompany financial statements to confirm reported income and deductions.

What are common errors to avoid when drafting financial statement letters for lenders?

Avoiding inaccurate data is crucial, as errors can undermine credibility and delay loan approval. Omitting critical explanations or disclaimers may create confusion about financial health. Furthermore, failing to tailor the letter to lender requirements can reduce its effectiveness and perceived professionalism.

How can small businesses present cash flow details effectively in financial statements?

Using a clear cash flow statement broken down into operating, investing, and financing activities enhances understanding. Visual aids like charts can highlight cash inflows and outflows for better clarity. Providing detailed notes explaining significant cash movements ensures transparency and supports informed decision-making.