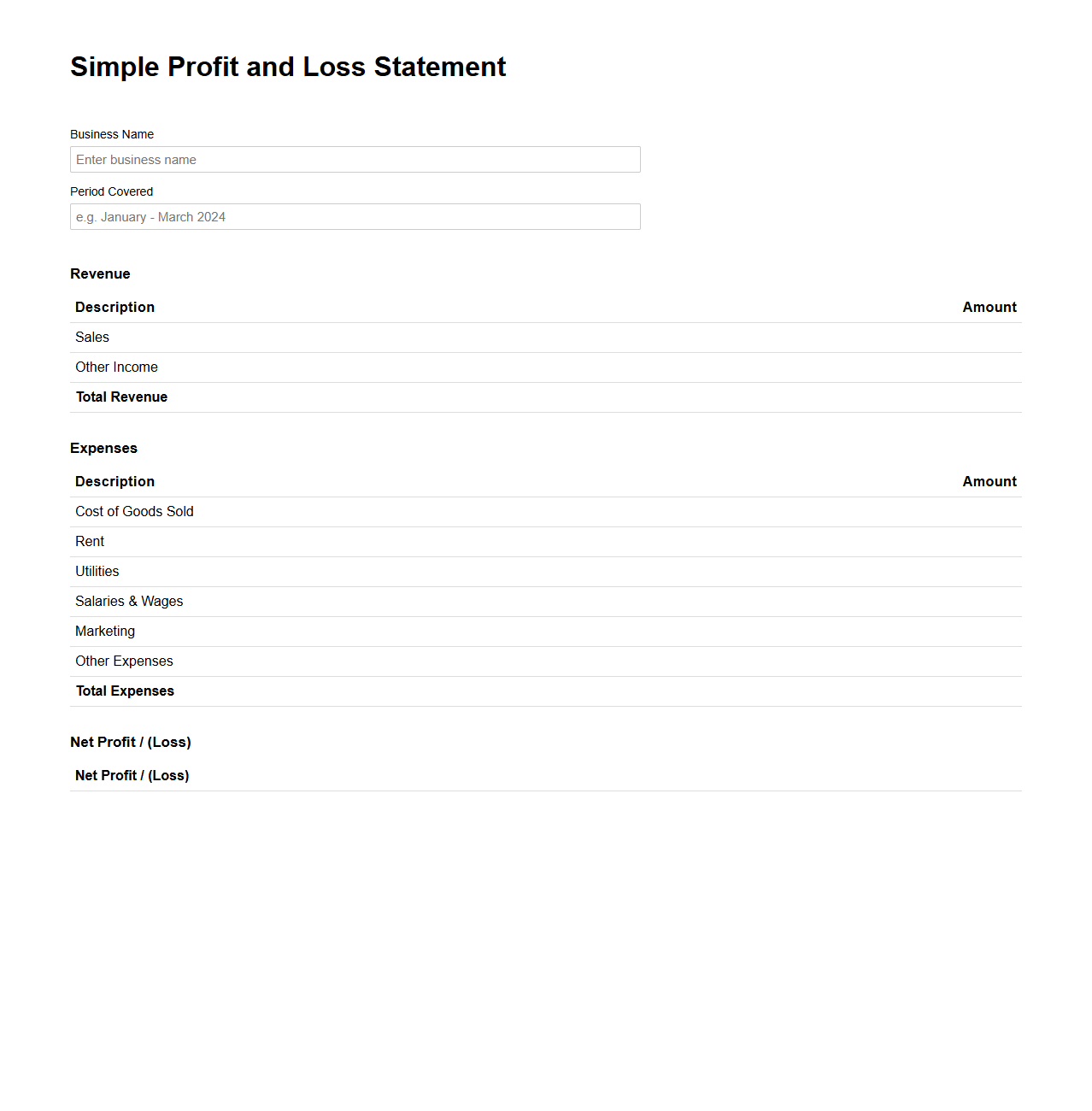

Simple Profit and Loss Statement Template for Small Business

A

Simple Profit and Loss Statement Template for Small Business is a streamlined financial document designed to track revenue, expenses, and net profit over a specific period. This template helps small business owners monitor profitability, manage cash flow, and make informed financial decisions without the complexity of full accounting software. It typically includes categories for sales income, cost of goods sold, operating expenses, and net income, providing clear insights into business performance.

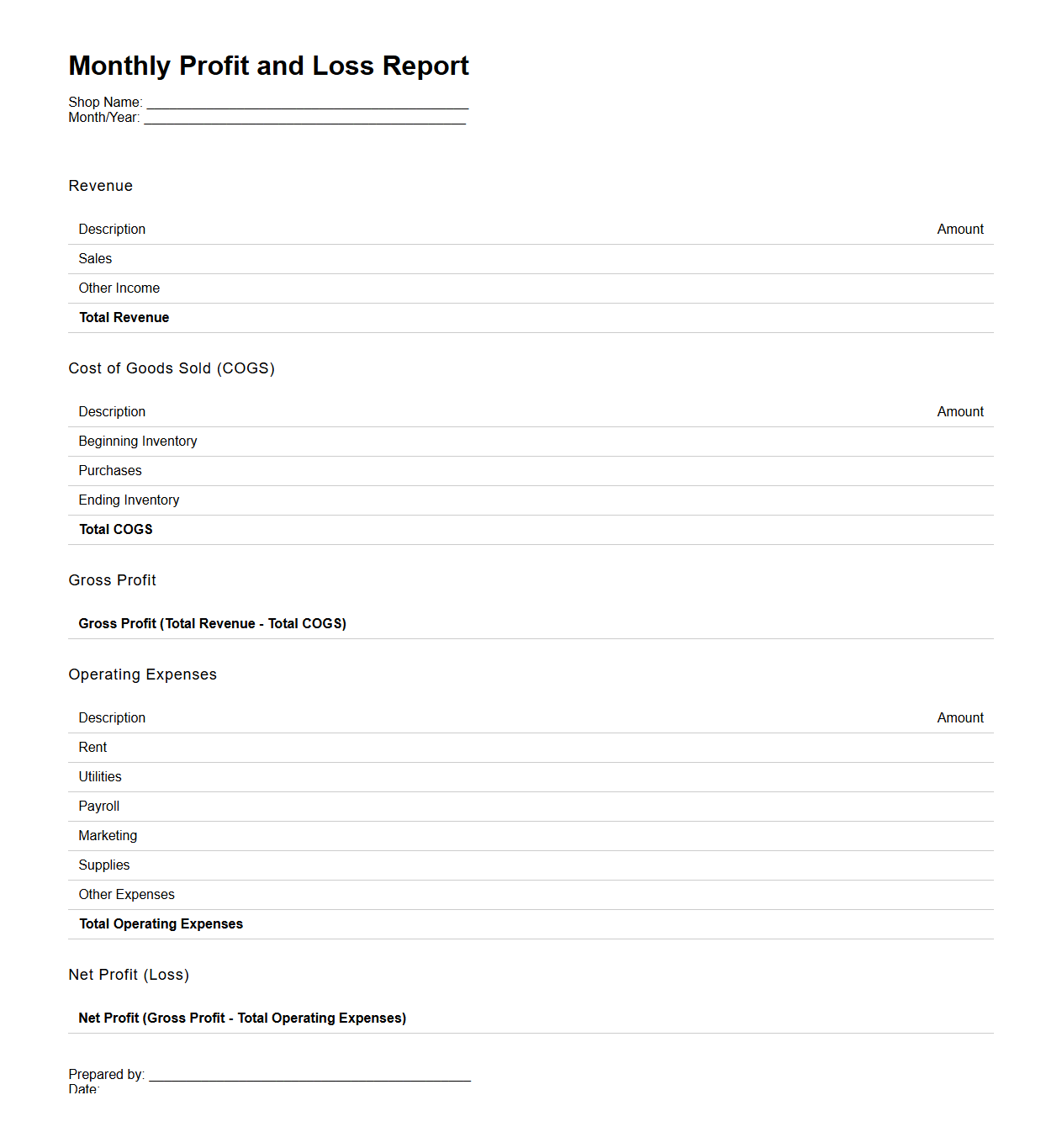

Monthly Profit and Loss Report for Retail Shops

A

Monthly Profit and Loss Report for retail shops is a financial document that summarizes the revenue, costs, and expenses incurred during a specific month to determine the net profit or loss. It provides detailed insights into sales performance, cost of goods sold, operating expenses, and gross margin, enabling shop owners to assess financial health and make informed business decisions. Accurate tracking of this report supports effective budgeting, inventory management, and strategic planning for sustained profitability.

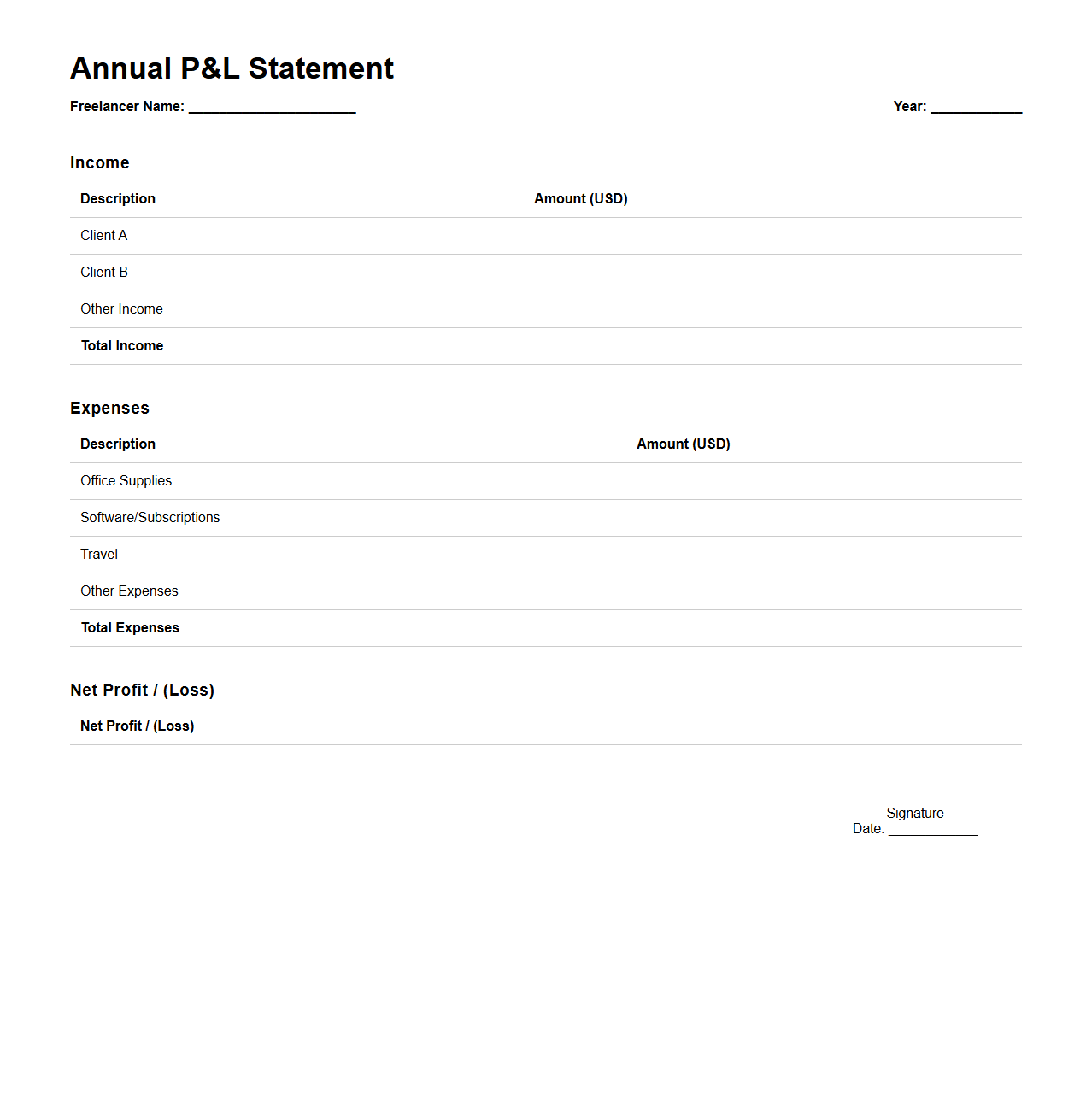

Annual P&L Statement for Freelancers

The

Annual P&L Statement for Freelancers is a financial document summarizing total income and expenses over a fiscal year, providing a clear snapshot of profitability. It helps freelancers track revenue streams, categorize deductible costs, and assess overall business performance. This statement is essential for tax reporting, budgeting, and strategic planning in freelance careers.

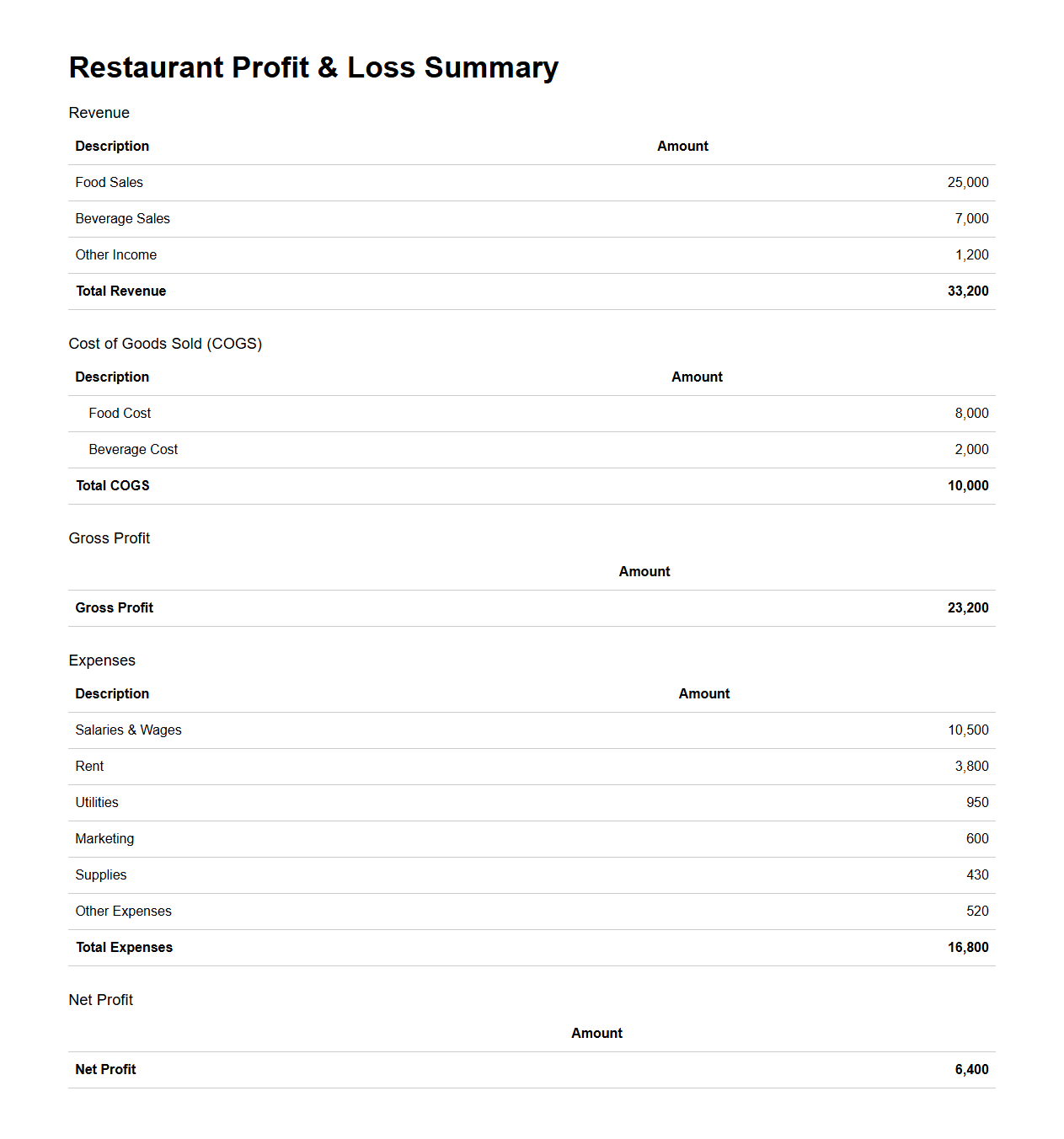

Restaurant Profit and Loss Summary Example

A

Restaurant Profit and Loss Summary Example document outlines the financial performance of a restaurant by detailing total revenues, cost of goods sold (COGS), operating expenses, and net profit or loss over a specific period. This summary helps restaurant owners, managers, and investors analyze key metrics such as gross margin and operating income to make informed business decisions. Accurate tracking of income and expenses in this document supports budgeting, financial planning, and identifying areas for profit improvement.

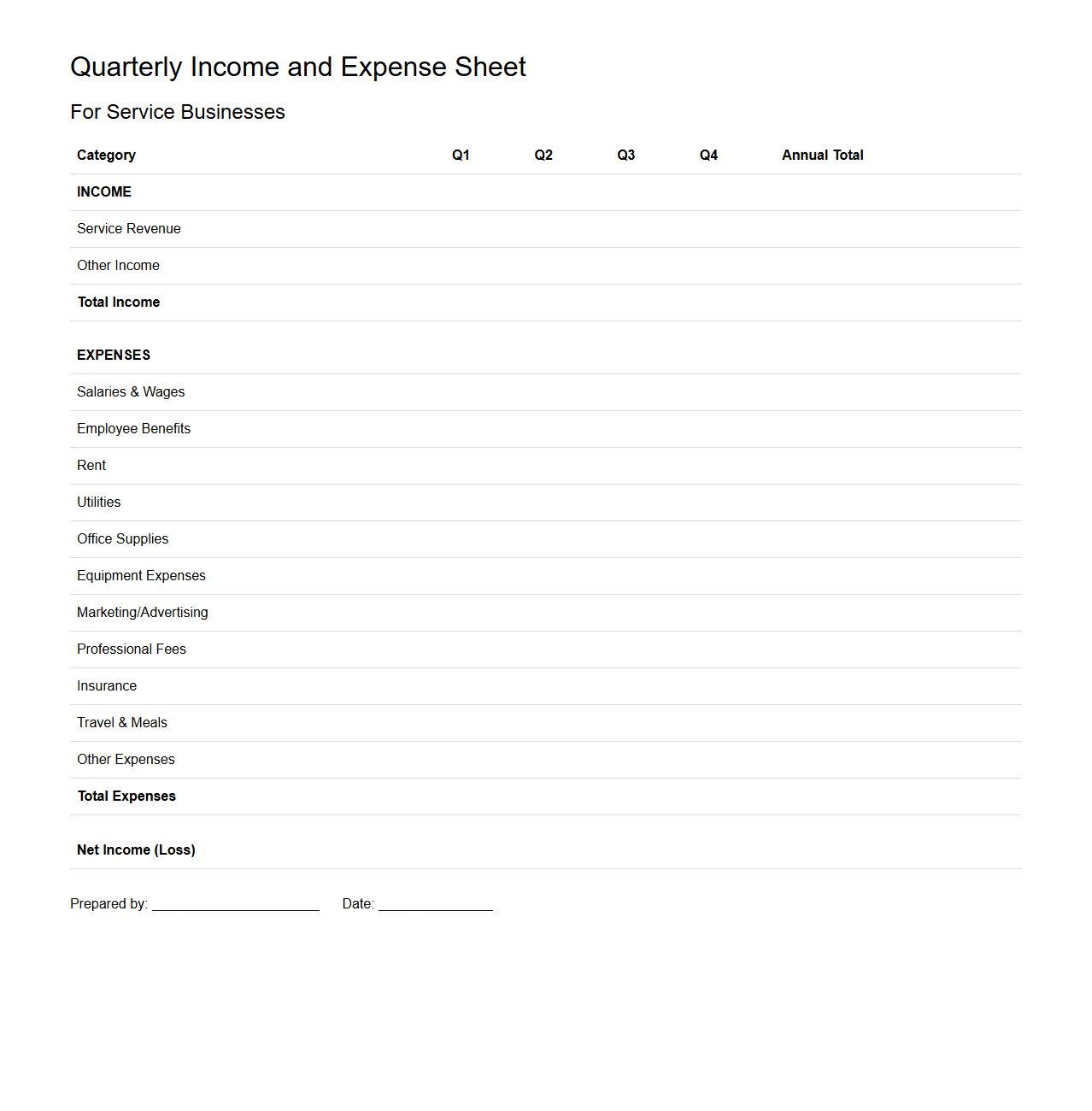

Quarterly Income and Expense Sheet for Service Businesses

The Quarterly Income and Expense Sheet for Service Businesses document provides a detailed record of all revenues earned and costs incurred during a three-month period, specifically designed for service-oriented companies. This financial statement helps track cash flow, monitor profit margins, and identify trends essential for effective budgeting and financial planning. Maintaining a

Quarterly Income and Expense Sheet ensures accurate reporting and aids in strategic decision-making to optimize business performance.

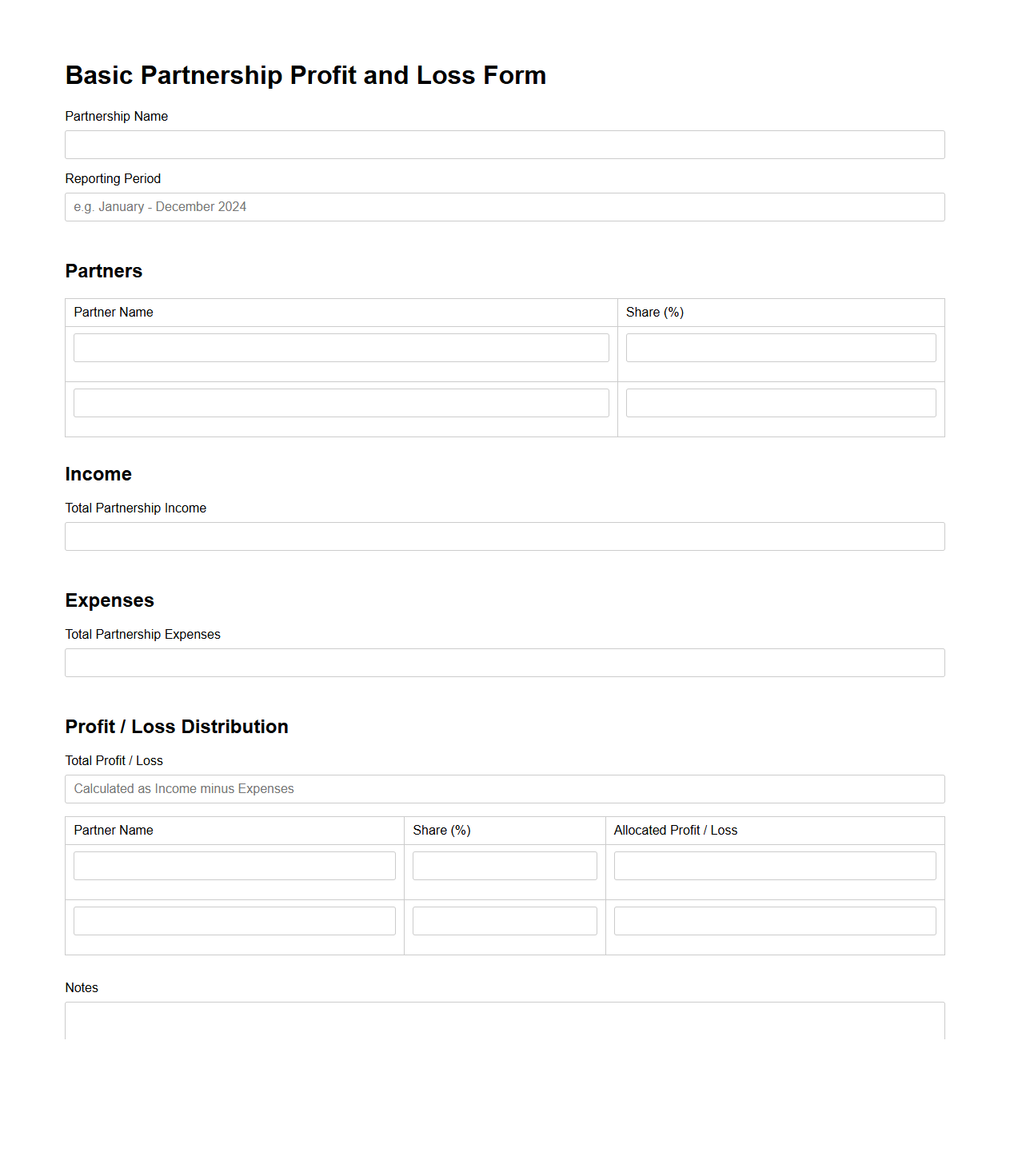

Basic Partnership Profit and Loss Form

The

Basic Partnership Profit and Loss Form document is used to report the financial performance of a partnership by detailing the income, expenses, and net profit or loss during a specific fiscal period. It provides a clear breakdown of operational revenue streams and costs, enabling partners to assess the business's profitability. This form is essential for accurate tax reporting and informed decision-making within the partnership.

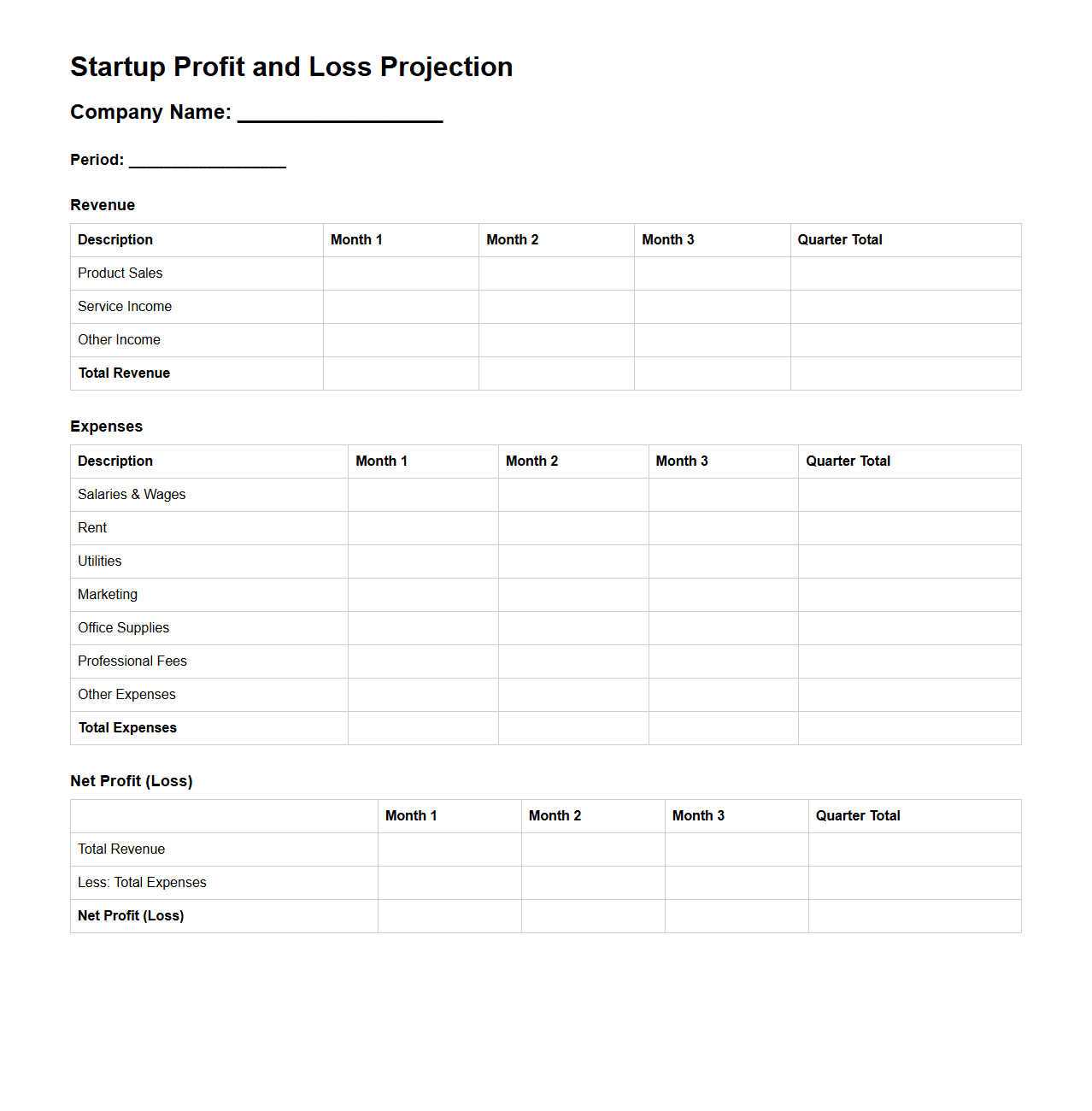

Startup Profit and Loss Projection Format

A

Startup Profit and Loss Projection Format document outlines the anticipated revenues, costs, and expenses over a specific period, helping entrepreneurs forecast financial performance. It serves as a crucial tool for budgeting, identifying potential profit margins, and securing investor confidence by showcasing expected profitability. This format typically includes detailed line items such as sales forecasts, cost of goods sold, operating expenses, and net profit calculations.

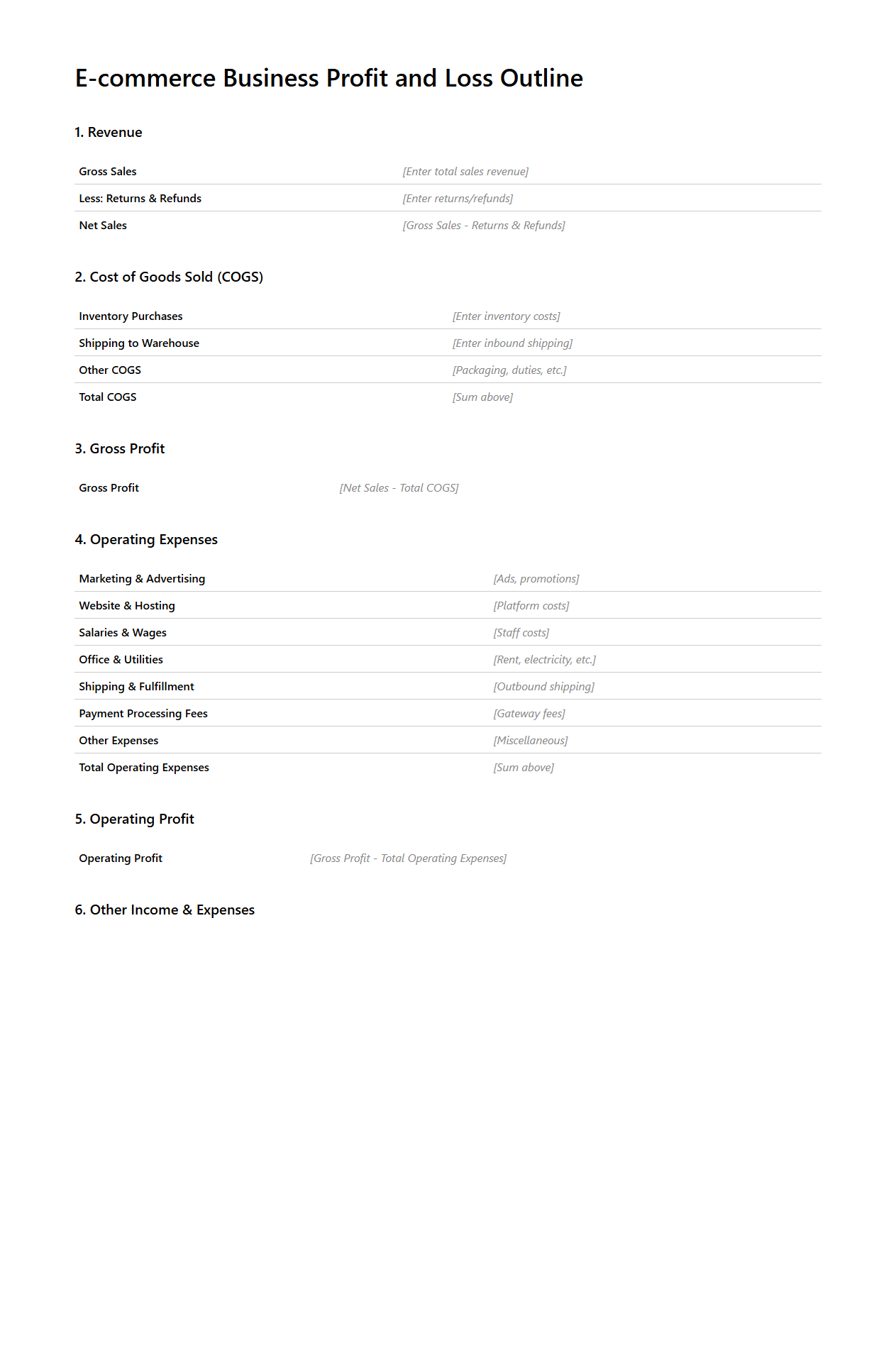

E-commerce Business Profit and Loss Outline

An

E-commerce Business Profit and Loss Outline document provides a detailed summary of revenues, costs, and expenses associated with an online retail operation. It highlights key financial metrics such as gross profit, net profit, sales revenue, cost of goods sold (COGS), and operating expenses to evaluate business performance. This outline is essential for tracking profitability, identifying cost-saving opportunities, and guiding strategic financial decision-making in e-commerce ventures.

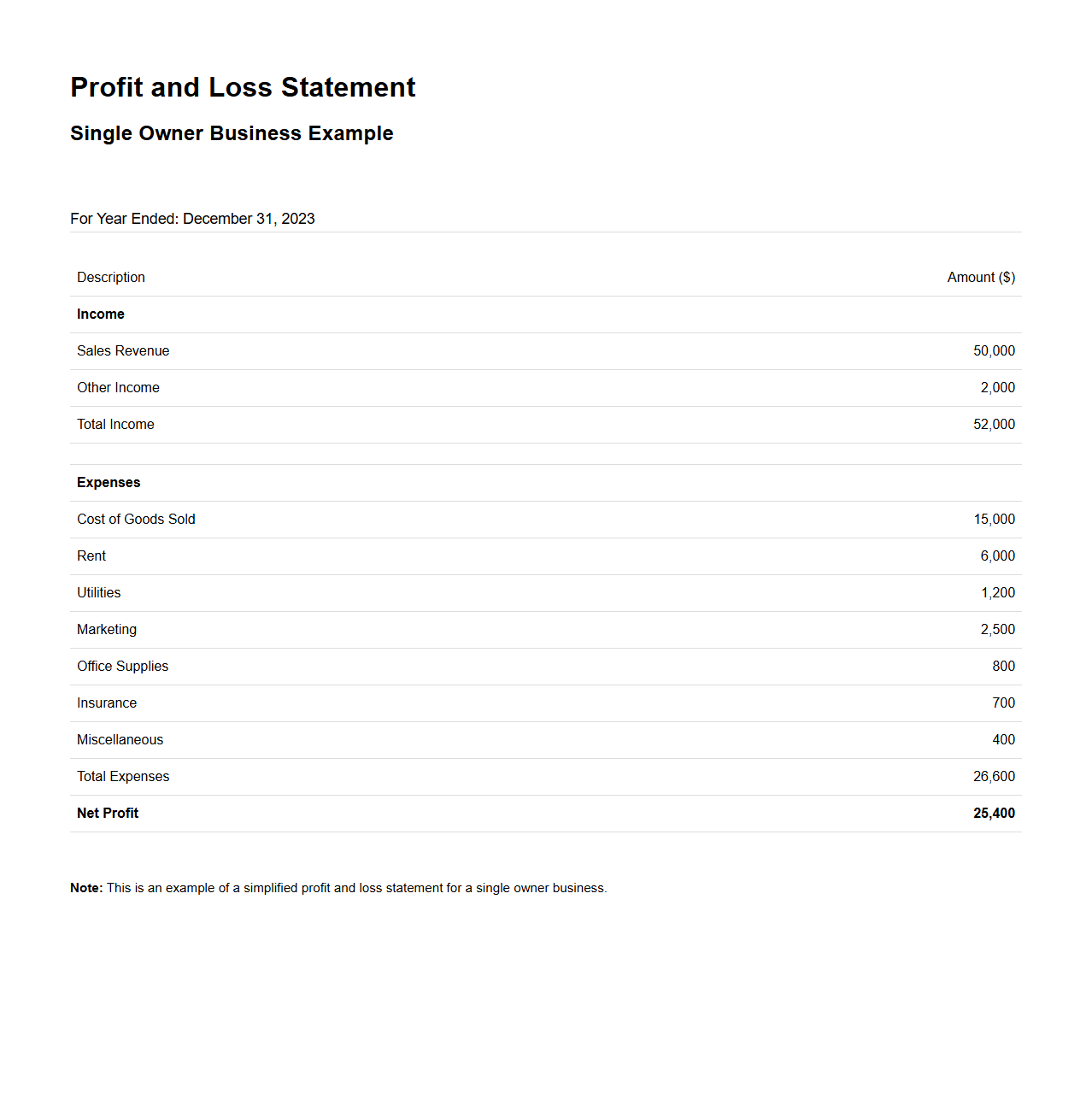

Single Owner Business Profit and Loss Example

A

Single Owner Business Profit and Loss Example document illustrates the financial performance of a sole proprietorship by detailing revenues, costs, and expenses over a specific period. It helps business owners understand profitability, manage cash flow, and make informed decisions. This document typically includes gross income, operating expenses, and net profit, providing a clear snapshot of business health.

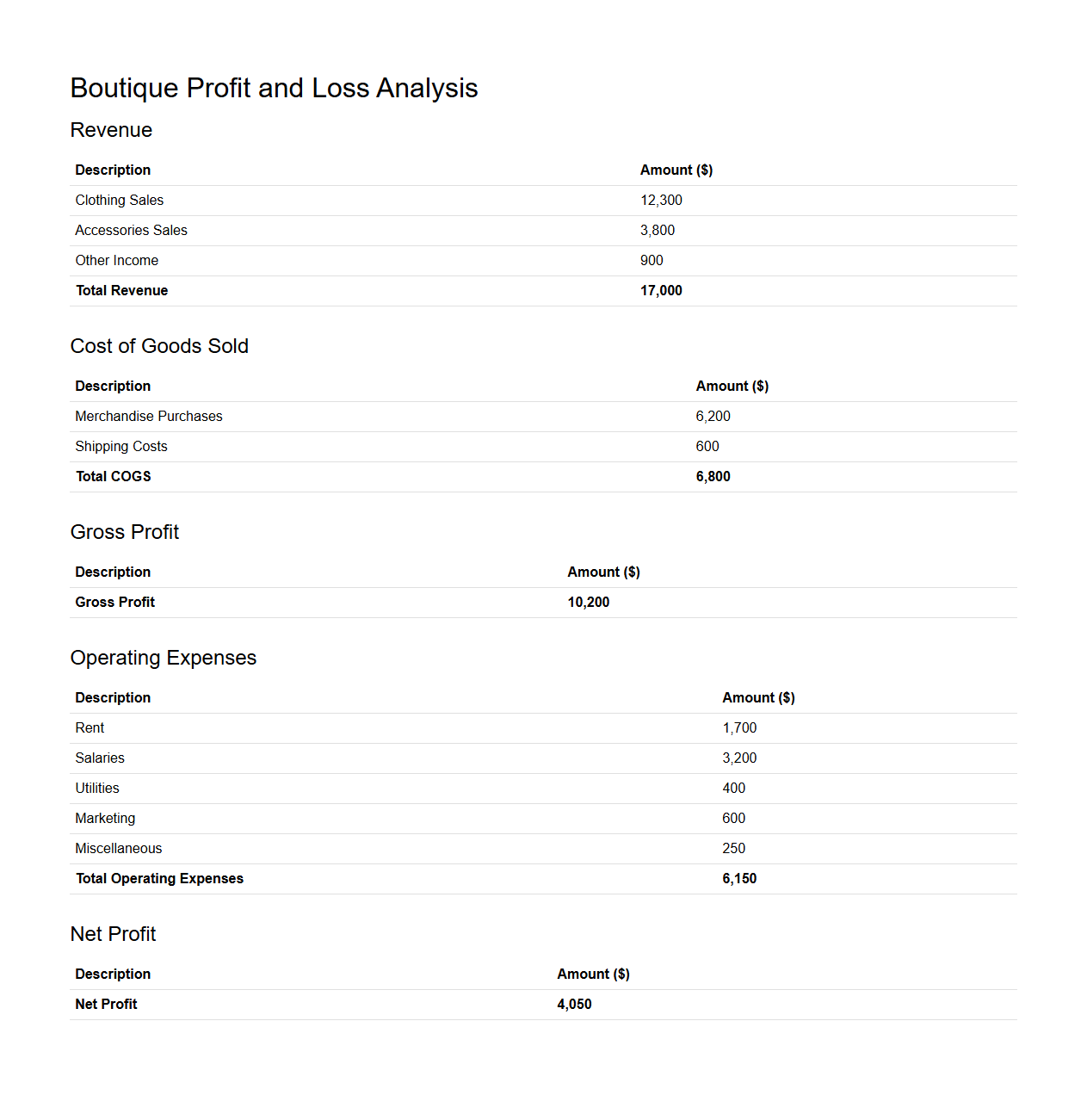

Boutique Profit and Loss Analysis Sample

A

Boutique Profit and Loss Analysis Sample document provides a detailed financial overview of a boutique's revenues, expenses, and net income over a specific period. It helps business owners identify profitable product lines, control operational costs, and improve financial decision-making. This document is essential for tracking business performance, securing funding, and planning growth strategies.

What key details must a small business include in a Profit and Loss document for tax compliance?

A small business must include total revenue earned during the tax period to accurately report income. Detailed records of expenses, categorized by type such as operational, payroll, and marketing costs, are essential for deductions. Lastly, the document should clearly show the net profit or loss to comply with tax reporting requirements.

How often should a small business update its Profit and Loss statement?

Small businesses should update their Profit and Loss statement monthly to maintain current financial insights. Regular updates help in tracking performance and identifying areas for improvement promptly. Additionally, updating quarterly can suffice for tax planning and compliance but may delay important business decisions.

What common mistakes do small businesses make on Profit and Loss documents?

One frequent mistake is failing to accurately categorize expenses, leading to inaccurate financial analysis. Businesses often overlook tracking all sources of income, which skews profitability figures. Another common error is neglecting to reconcile data with bank statements, causing discrepancies in reported figures.

How do you categorize irregular expenses in a Profit and Loss statement?

Irregular expenses should be recorded under a separate non-recurring or one-time expenses category to differentiate them from regular operating costs. This distinction helps in analyzing ongoing business profitability more accurately. Properly categorizing them prevents these expenses from distorting financial trends over time.

What software best streamlines Profit and Loss document creation for small businesses?

Software like QuickBooks is highly effective for automating Profit and Loss document creation with real-time data integration. FreshBooks is another user-friendly option designed specifically for small business accounting needs. These tools offer customizable templates and intuitive interfaces that enhance accuracy and save time.