A Debt Settlement Document Sample for Creditors provides a clear template outlining the terms and conditions agreed upon between a debtor and creditor to resolve outstanding debts. This document typically includes payment amount, settlement timeline, and release clauses to protect both parties. Using a well-structured settlement agreement helps ensure transparency and legally binding commitments in debt resolution.

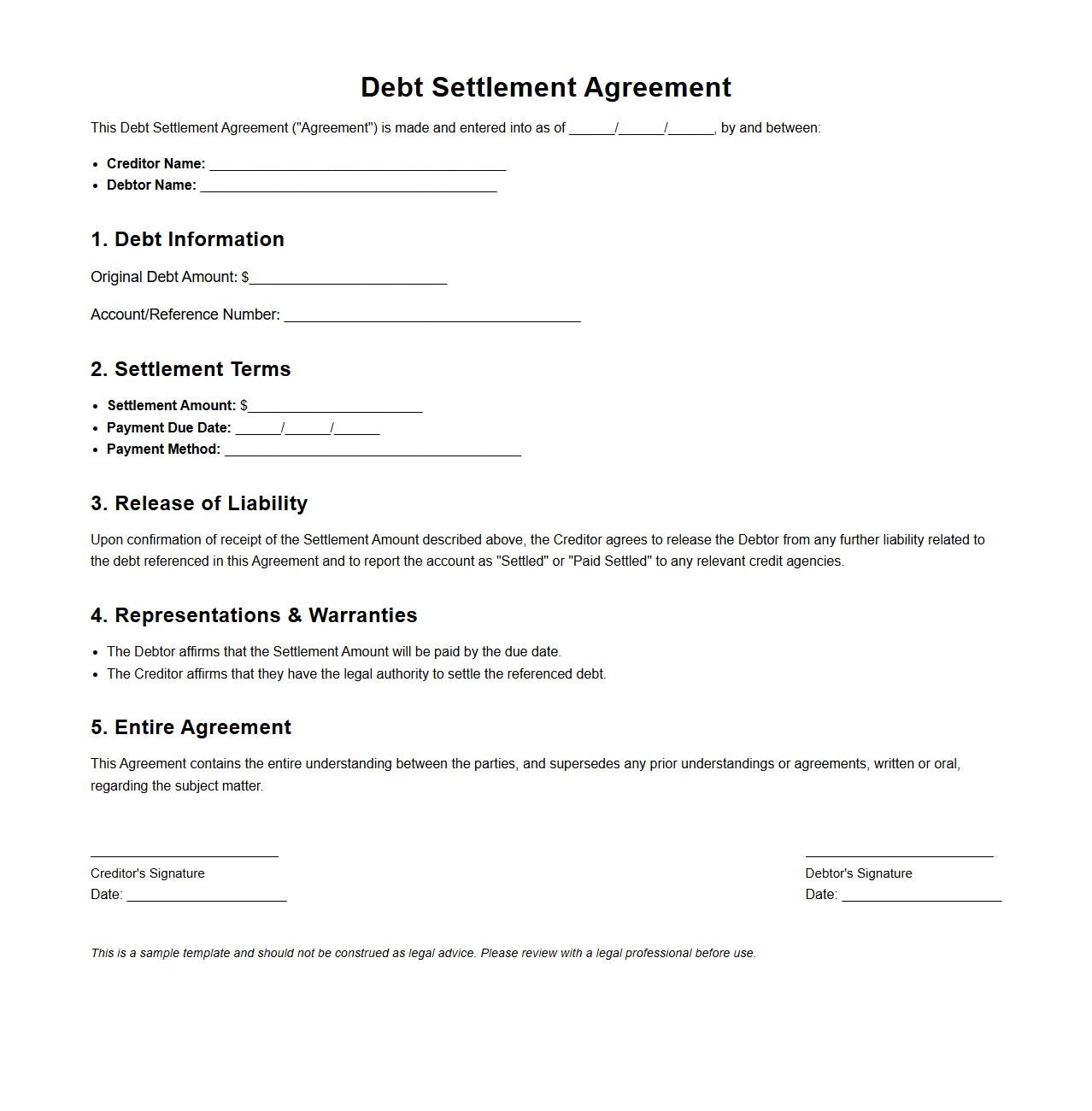

Debt Settlement Agreement Template for Creditors

A

Debt Settlement Agreement Template for Creditors is a legally binding document designed to outline the terms and conditions under which a debtor agrees to repay a creditor a reduced balance over a specified period. This template helps creditors formalize the settlement process, clearly defining payment amounts, deadlines, and consequences of default to minimize financial risk and dispute. Using a standardized agreement improves communication and ensures enforceable commitments between parties involved in debt resolution.

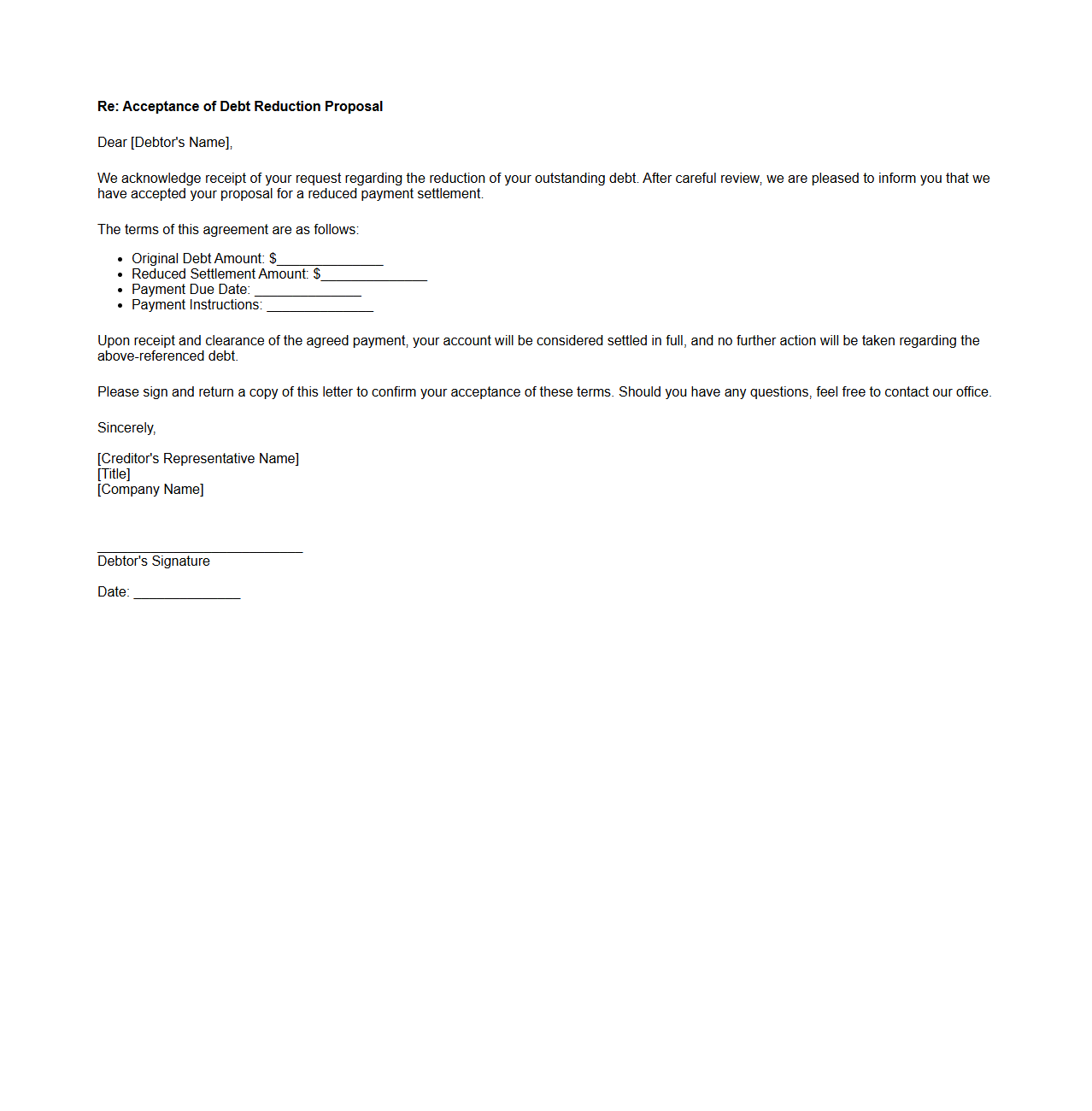

Creditor Acceptance Letter for Debt Reduction

A

Creditor Acceptance Letter for Debt Reduction is a formal document in which a creditor agrees to reduce the outstanding debt owed by a debtor. This letter outlines the terms and conditions under which the creditor accepts a lower repayment amount, helping to resolve debt disputes efficiently. It serves as legal proof that the creditor has consented to the negotiated debt reduction arrangement.

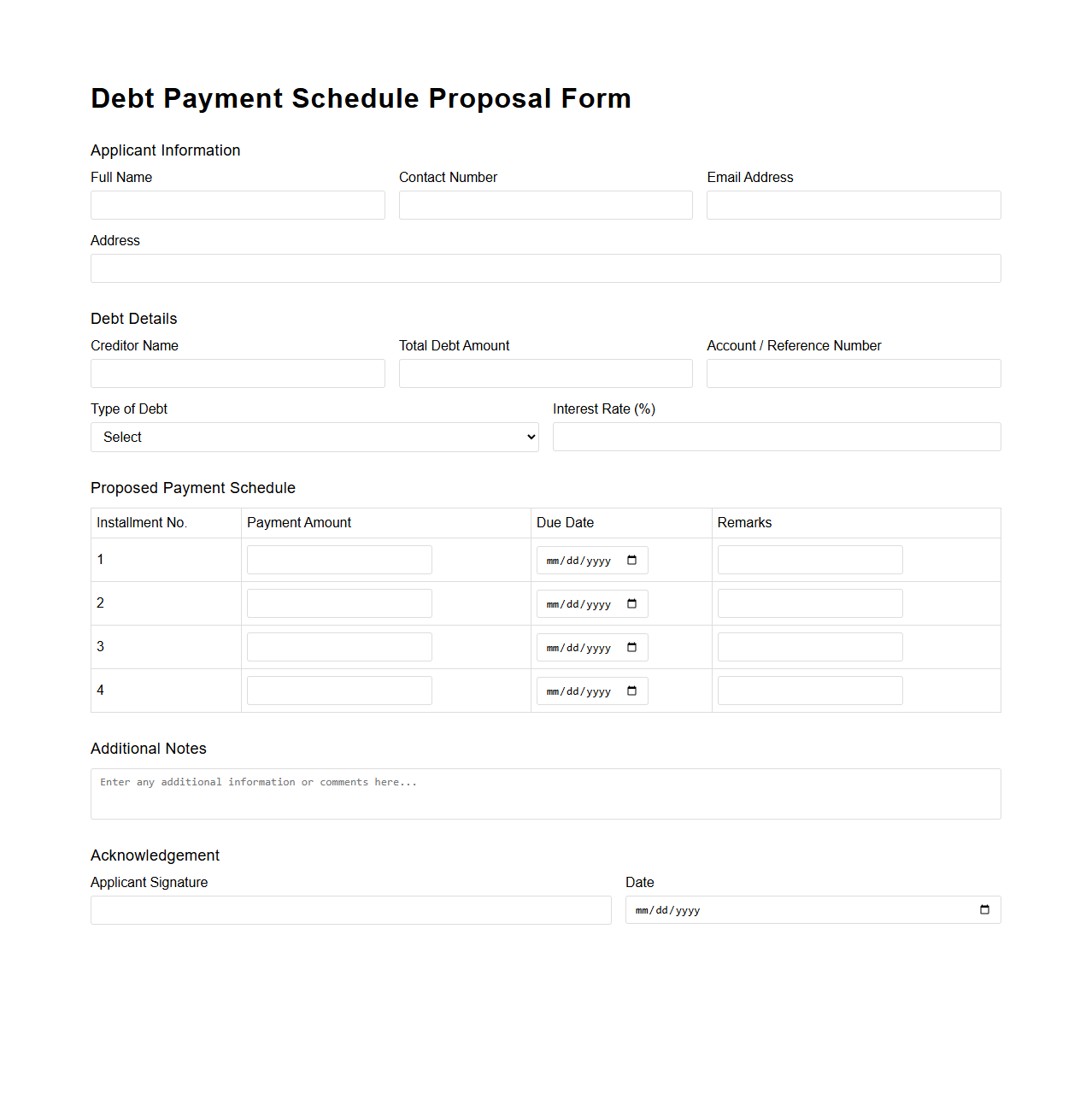

Debt Payment Schedule Proposal Form

A

Debt Payment Schedule Proposal Form is a document used by borrowers to outline a structured plan for repaying outstanding debts. It details proposed payment amounts, frequency, and timelines to help creditors assess the feasibility of the repayment plan. This form facilitates clear communication between debtors and creditors, promoting transparency and negotiated settlements.

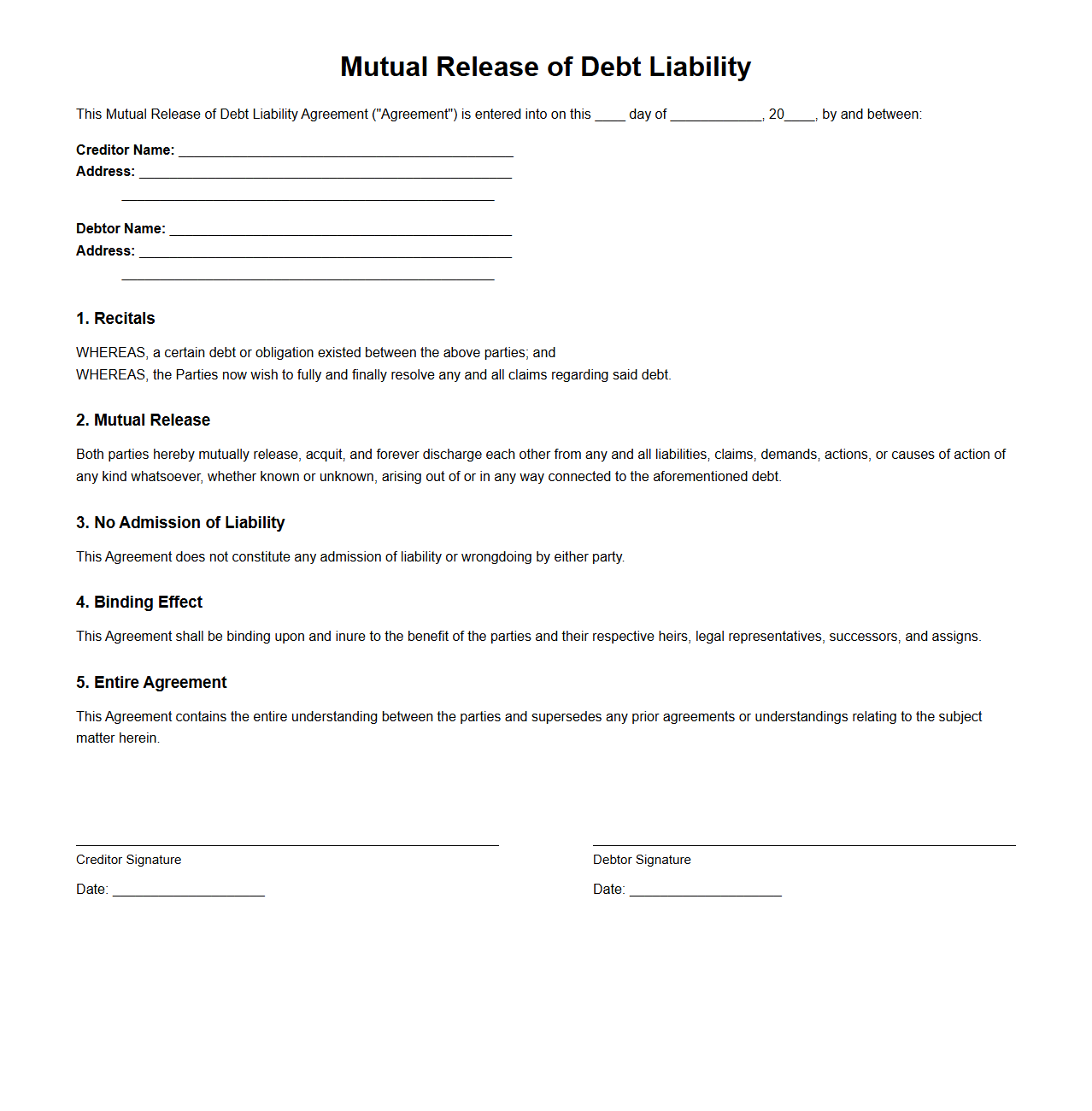

Mutual Release of Debt Liability Document

A

Mutual Release of Debt Liability Document is a legal agreement in which both parties agree to discharge any existing debts or claims against each other, effectively releasing all financial obligations between them. This document ensures that neither party can pursue further legal action or claims related to the specified debts. It is commonly used to settle disputes, close accounts, or finalize financial relations without the need for litigation.

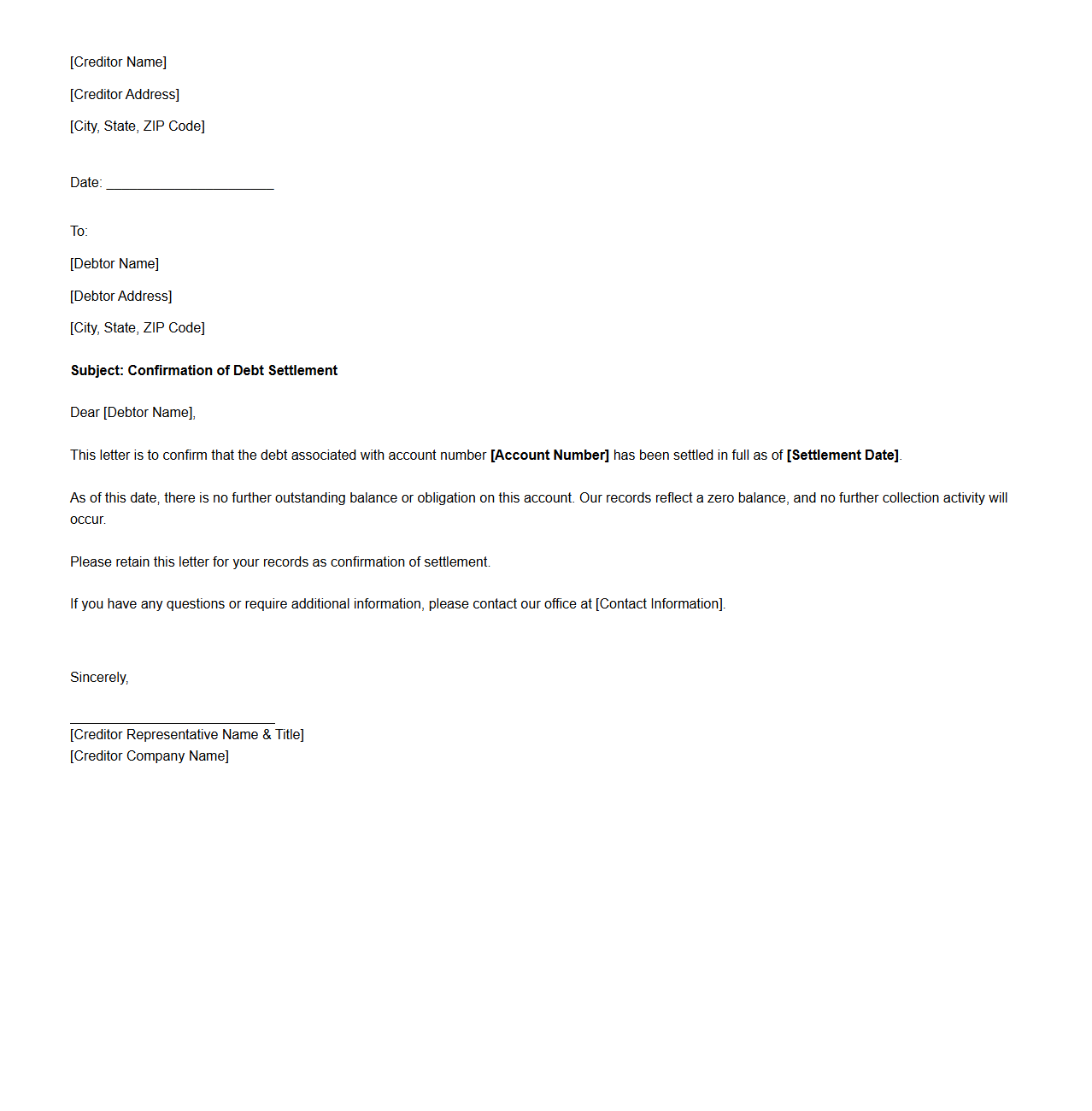

Creditor Confirmation Letter for Settled Debt

A

Creditor Confirmation Letter for Settled Debt is an official document issued by a creditor to acknowledge that a debtor has fully paid off a specified debt. This letter serves as proof that the outstanding balance has been resolved, preventing future disputes regarding the settlement. It is crucial for individuals and businesses to retain this letter for credit record accuracy and financial transparency.

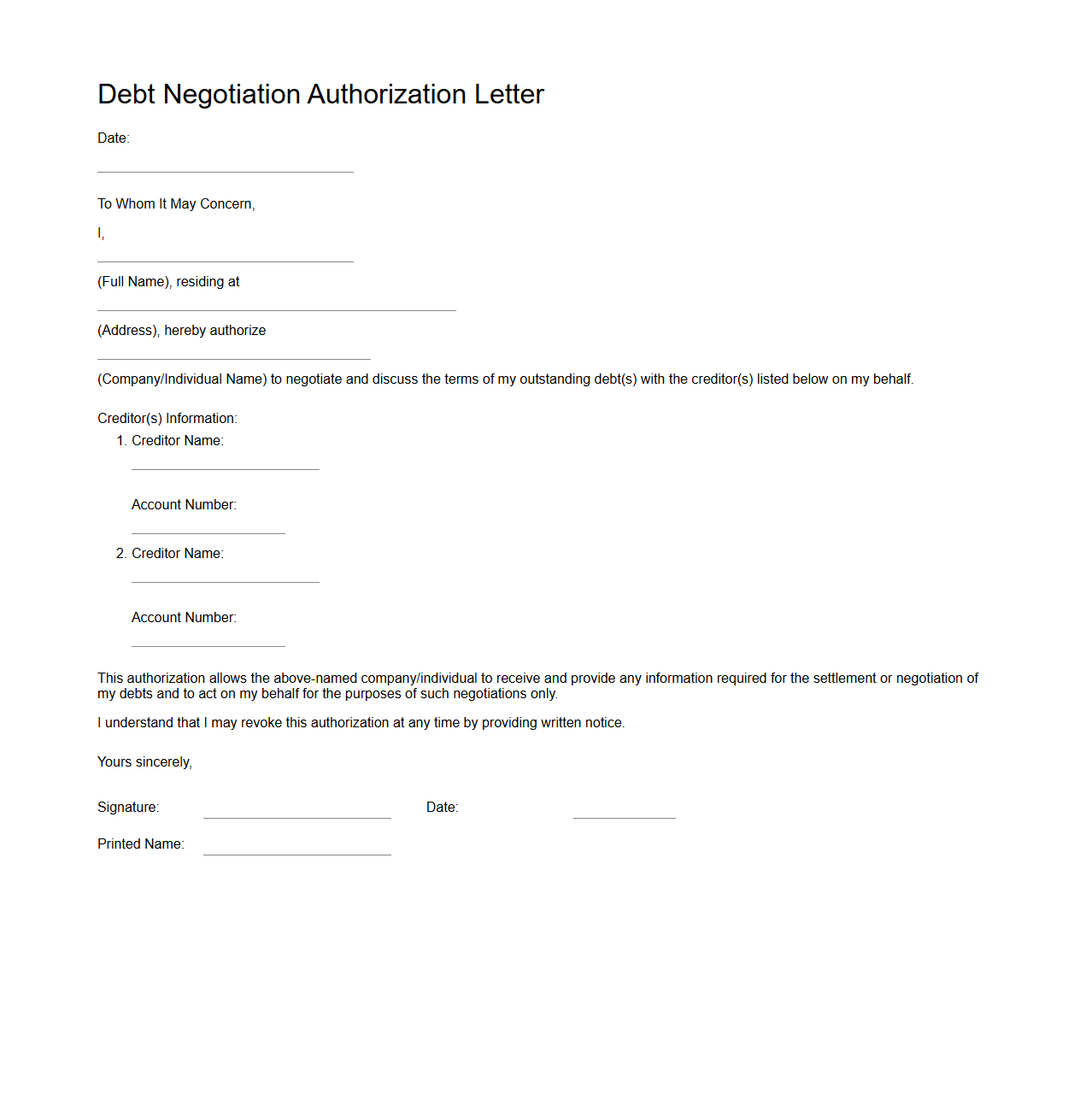

Debt Negotiation Authorization Letter

A

Debt Negotiation Authorization Letter is a formal document that grants a third party, such as a debt negotiator or attorney, the legal authority to negotiate and settle outstanding debts on behalf of a debtor. This letter typically outlines the scope of negotiation, specifying which debts or creditors the agent can interact with, ensuring clear communication and authorization. It serves as a critical tool to protect the interests of the debtor while allowing authorized representatives to manage debt resolutions efficiently.

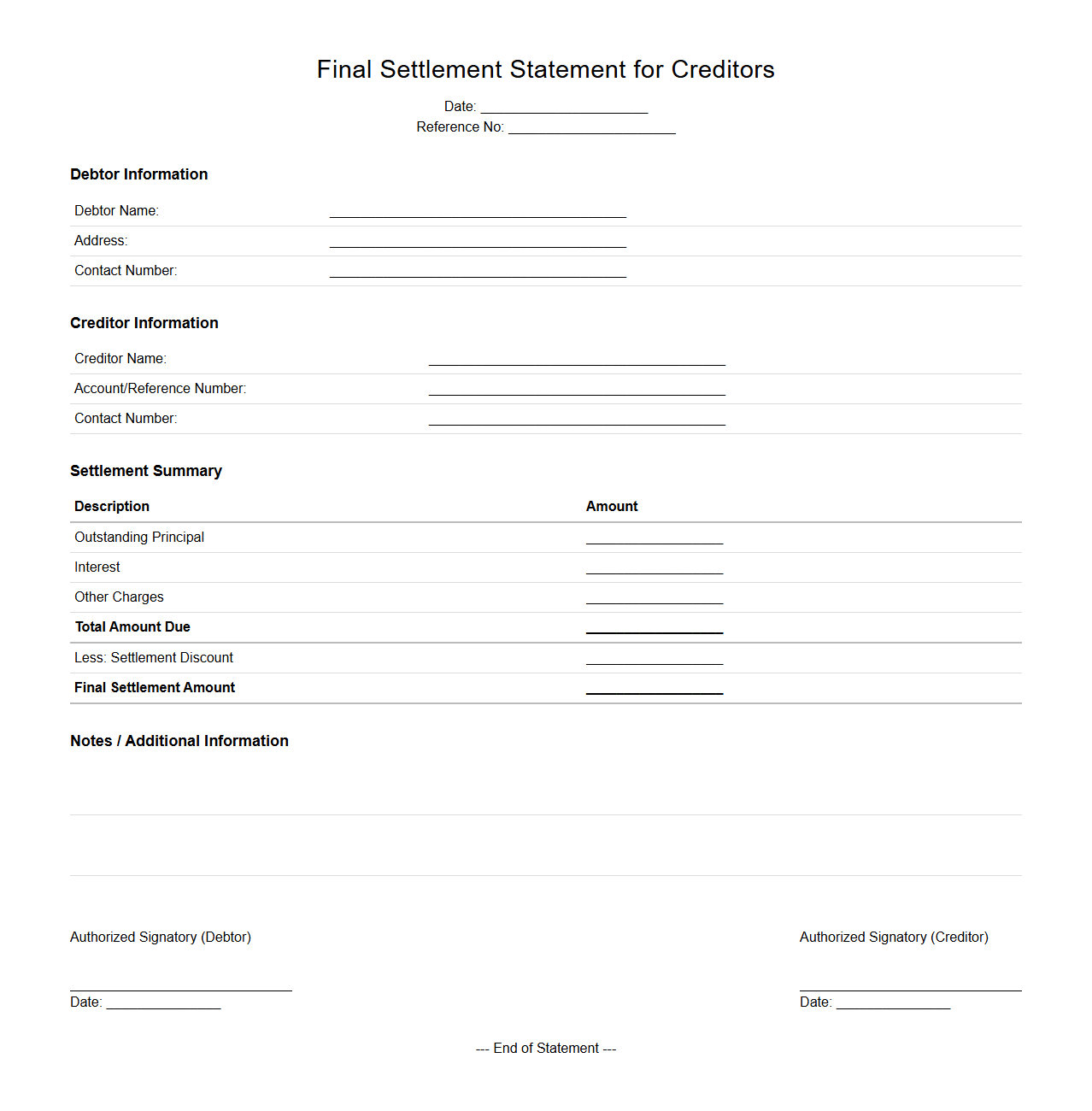

Final Settlement Statement for Creditors

The

Final Settlement Statement for Creditors is a legal document detailing the complete financial distribution to creditors during the closure of a company or estate. It lists all outstanding debts, payments made, and remaining balances to ensure transparent and accurate resolution of financial obligations. This statement serves as an official record confirming that all creditor claims have been settled according to agreed terms or court directives.

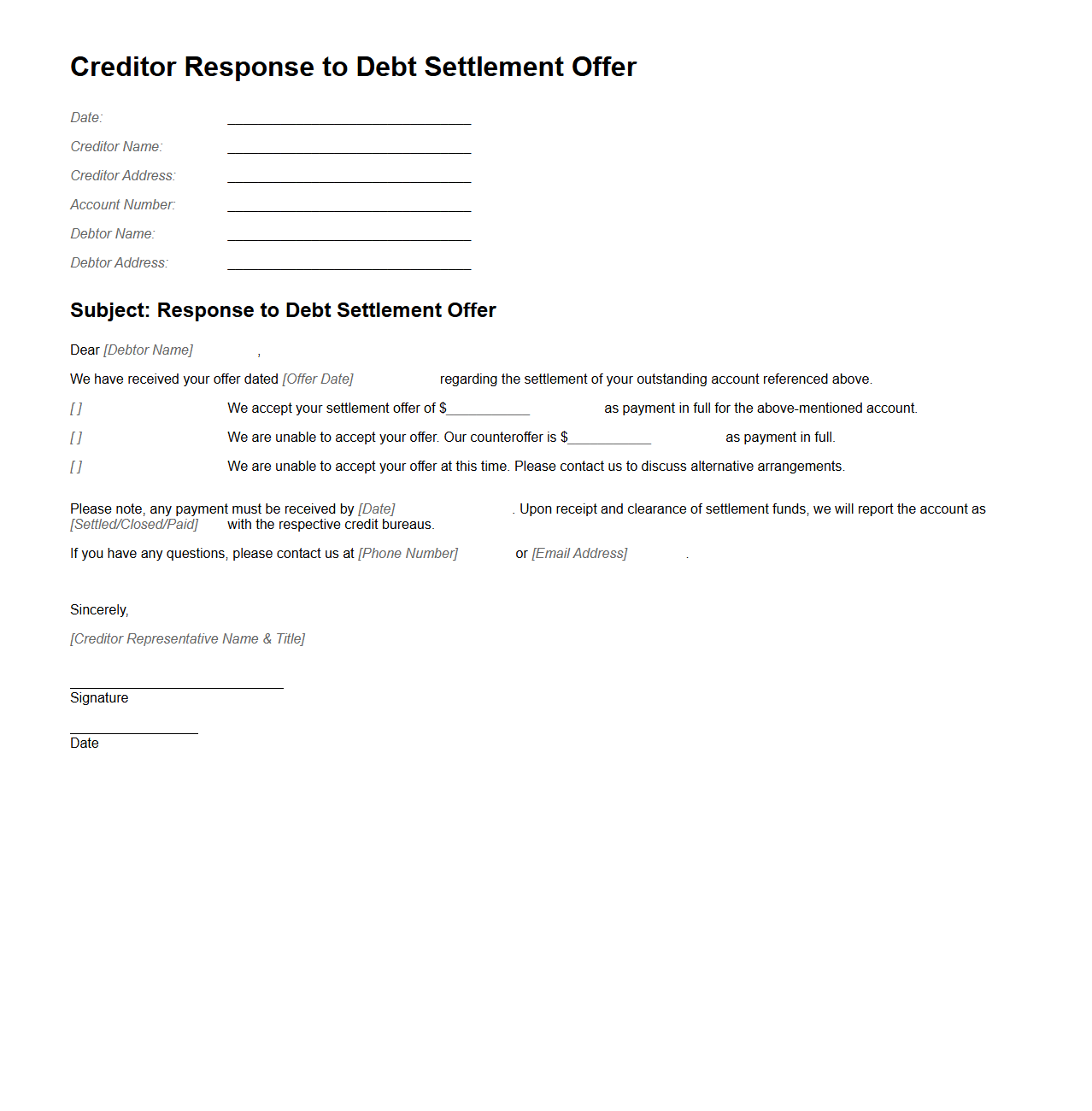

Creditor Response to Debt Settlement Offer

A

Creditor Response to Debt Settlement Offer document is an official communication from a creditor acknowledging and addressing a debtor's proposal to resolve outstanding debt for less than the total amount owed. It outlines the acceptance, rejection, or counteroffer terms, including payment schedules, settlement amounts, and conditions for release from further liability. This document serves as a legally binding reference that protects both parties and ensures clarity throughout the debt negotiation process.

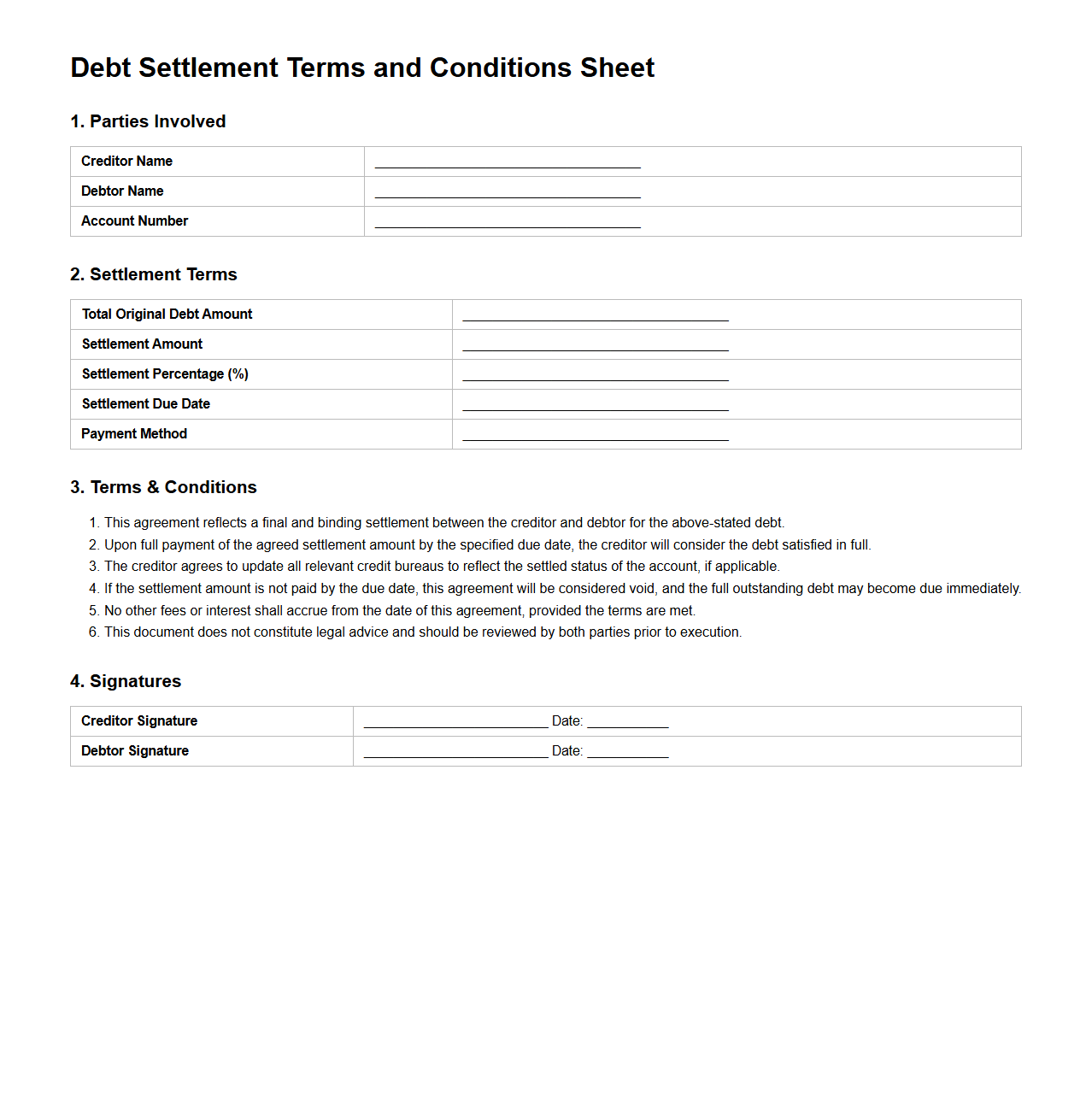

Debt Settlement Terms and Conditions Sheet

The

Debt Settlement Terms and Conditions Sheet is a formal document outlining the specific agreements between a debtor and creditor regarding the settlement of outstanding debt. It details the negotiated payment amounts, timelines, interest adjustments, and any fees associated with the debt resolution. This sheet serves as a legally binding record to ensure both parties adhere to the agreed-upon terms, protecting rights and preventing future disputes.

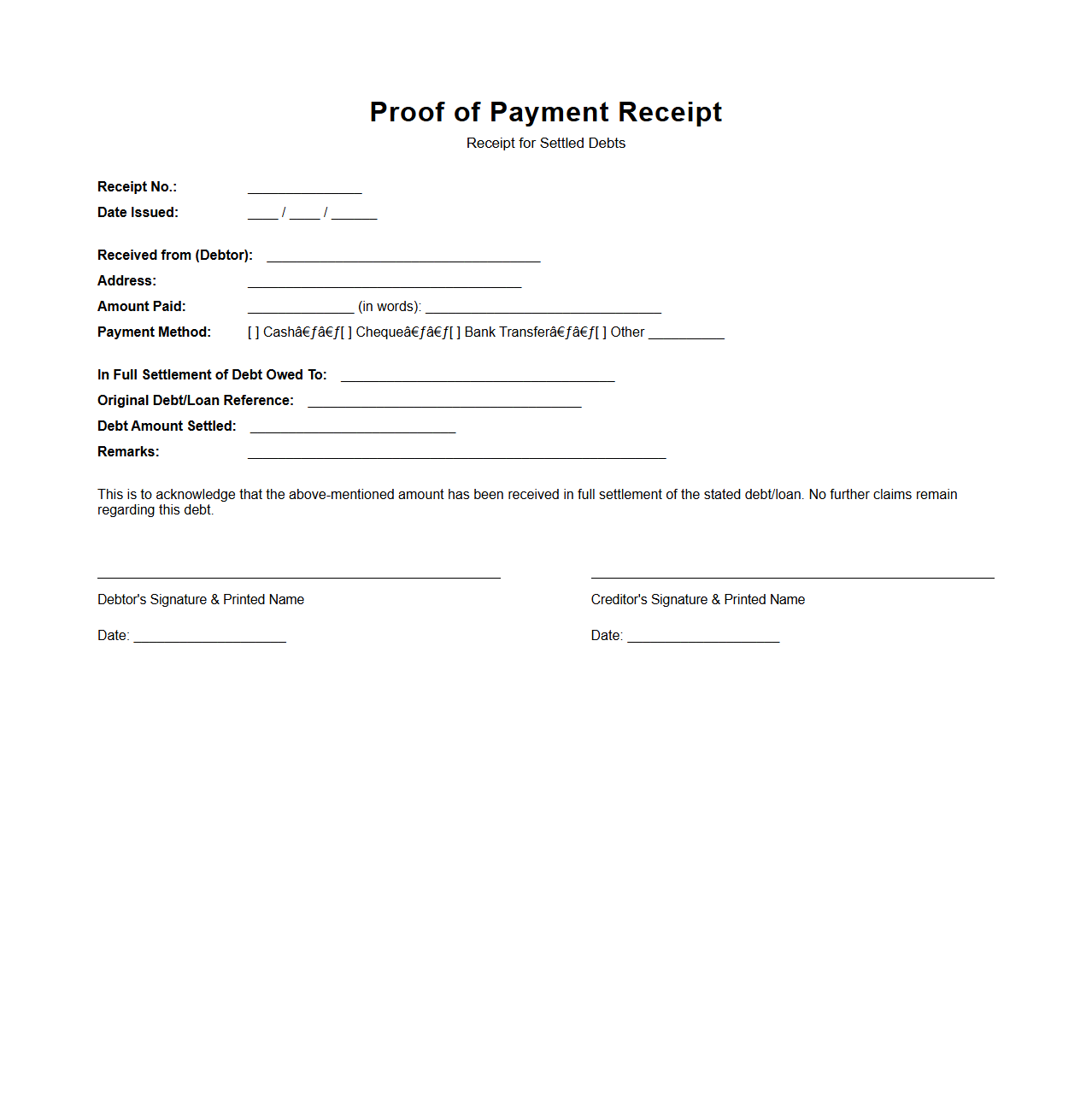

Proof of Payment Receipt for Settled Debts

A

Proof of Payment Receipt for Settled Debts document serves as official evidence that a debt has been fully paid and settled between the debtor and the creditor. This receipt typically includes critical details such as the amount paid, payment date, method of payment, and confirmation of no outstanding balance. It provides legal protection to the debtor by verifying settlement and preventing future claims on the settled debt.

What are mandatory clauses in a debt settlement document for creditors?

Mandatory clauses in a debt settlement document typically include the settlement amount, payment terms, and the deadline for repayment. The document must clearly define the release of liability upon full payment to protect creditors. Additionally, clauses about the confirmation of debt validity and dispute resolution methods are essential.

How does the document address creditor rights post-settlement?

The document usually specifies that creditors waive any further claims once the agreed settlement amount is paid. It often includes a clause that prevents creditors from pursuing additional legal action regarding the settled debt. However, it may also state the creditor's right to report the settlement status to credit agencies.

Are there stipulations about credit reporting within the agreement?

Yes, debt settlement agreements often contain clauses regarding credit reporting. These clauses define how the settlement will be reported to credit bureaus, such as marking the debt as "settled" or "paid in full." This helps ensure transparency and impacts the debtor's credit score accordingly.

What legal recourse is outlined if the debtor defaults after settlement?

The agreement typically includes provisions detailing creditor rights if the debtor defaults post-settlement. This may include reinstating the original debt amount and pursuing collections or legal action. Clear default conditions and remedies protect the creditor's financial interests.

Does the document specify tax implications for the forgiven debt?

Debt settlement documents often address the potential tax implications of forgiven debt for the debtor. They may clarify whether the forgiven amount will be reported to tax authorities as taxable income. This informs the debtor of possible liabilities arising from the settlement.