A Receipts Document Sample for Charitable Donations serves as a formal confirmation of contributions made to nonprofit organizations. It includes essential details such as donor information, donation amount, date, and the charity's identification, ensuring compliance with tax regulations. This document is crucial for donors to claim tax deductions and maintain accurate financial records.

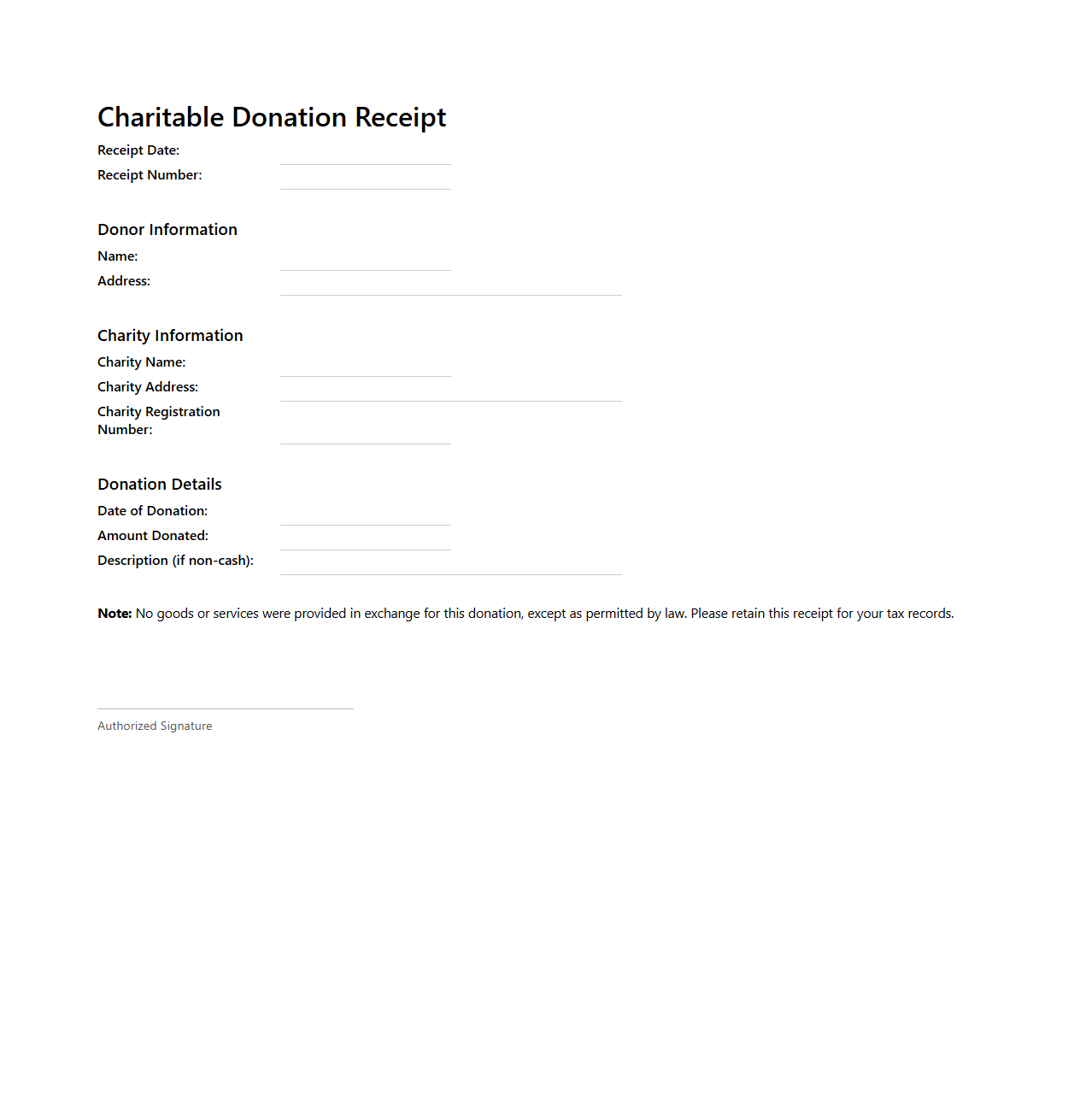

Charitable Donation Receipt Template for Tax Purposes

A

Charitable Donation Receipt Template for Tax Purposes is a standardized document used by nonprofits to provide donors with proof of their contributions. It includes key information such as the donor's name, donation amount, date, and the charity's tax-exempt status, ensuring compliance with tax regulations. This receipt helps donors claim tax deductions by verifying their charitable giving to tax authorities.

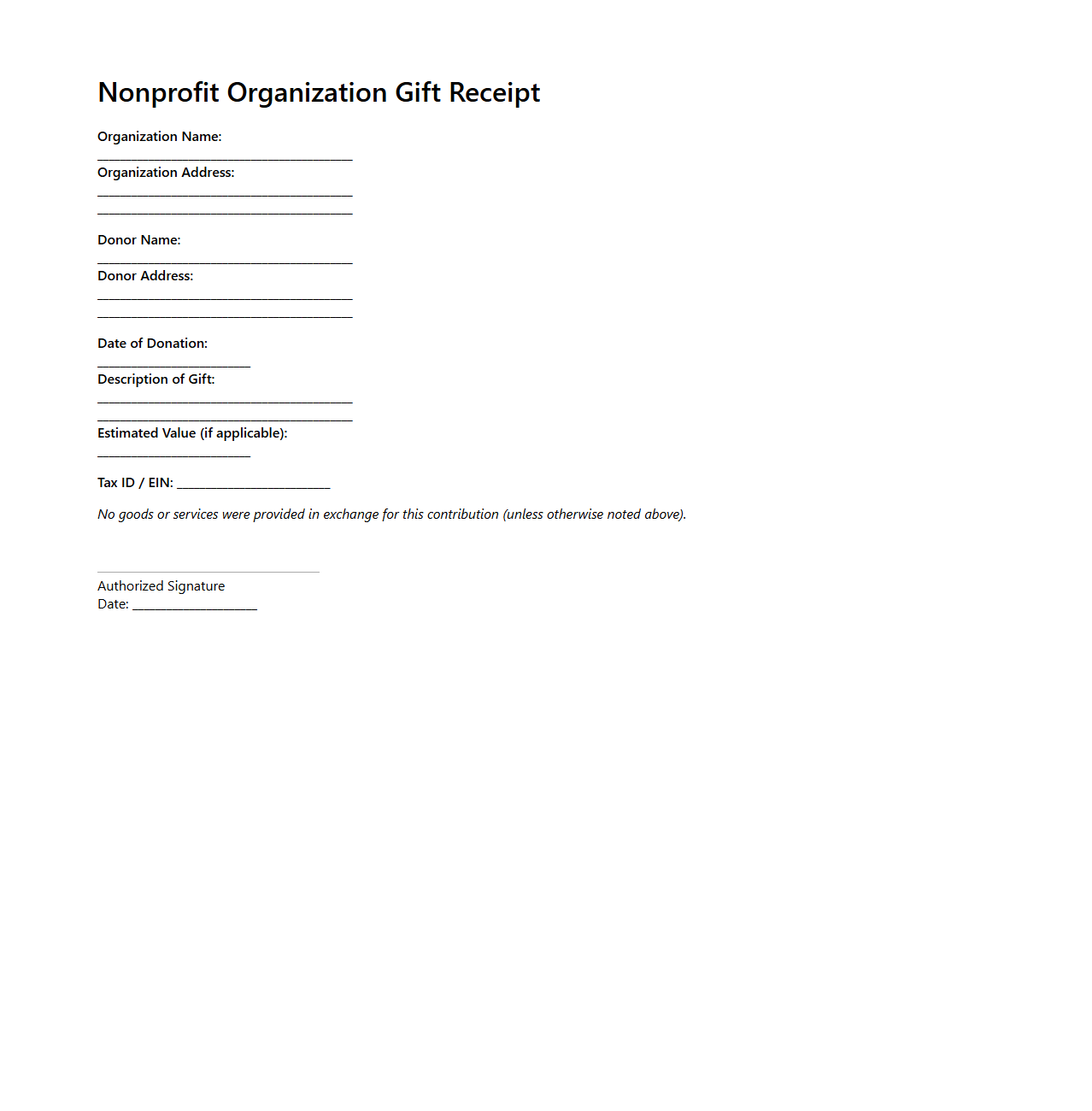

Nonprofit Organization Gift Receipt Sample

A

Nonprofit Organization Gift Receipt Sample document serves as an official acknowledgment issued by nonprofits to donors, confirming the receipt of a donation. This receipt includes essential details such as the donor's name, the date of donation, a description of the gift, and its estimated value, which is crucial for tax deduction purposes. It ensures transparency and compliance with IRS regulations, helping both the organization and donors maintain accurate financial records.

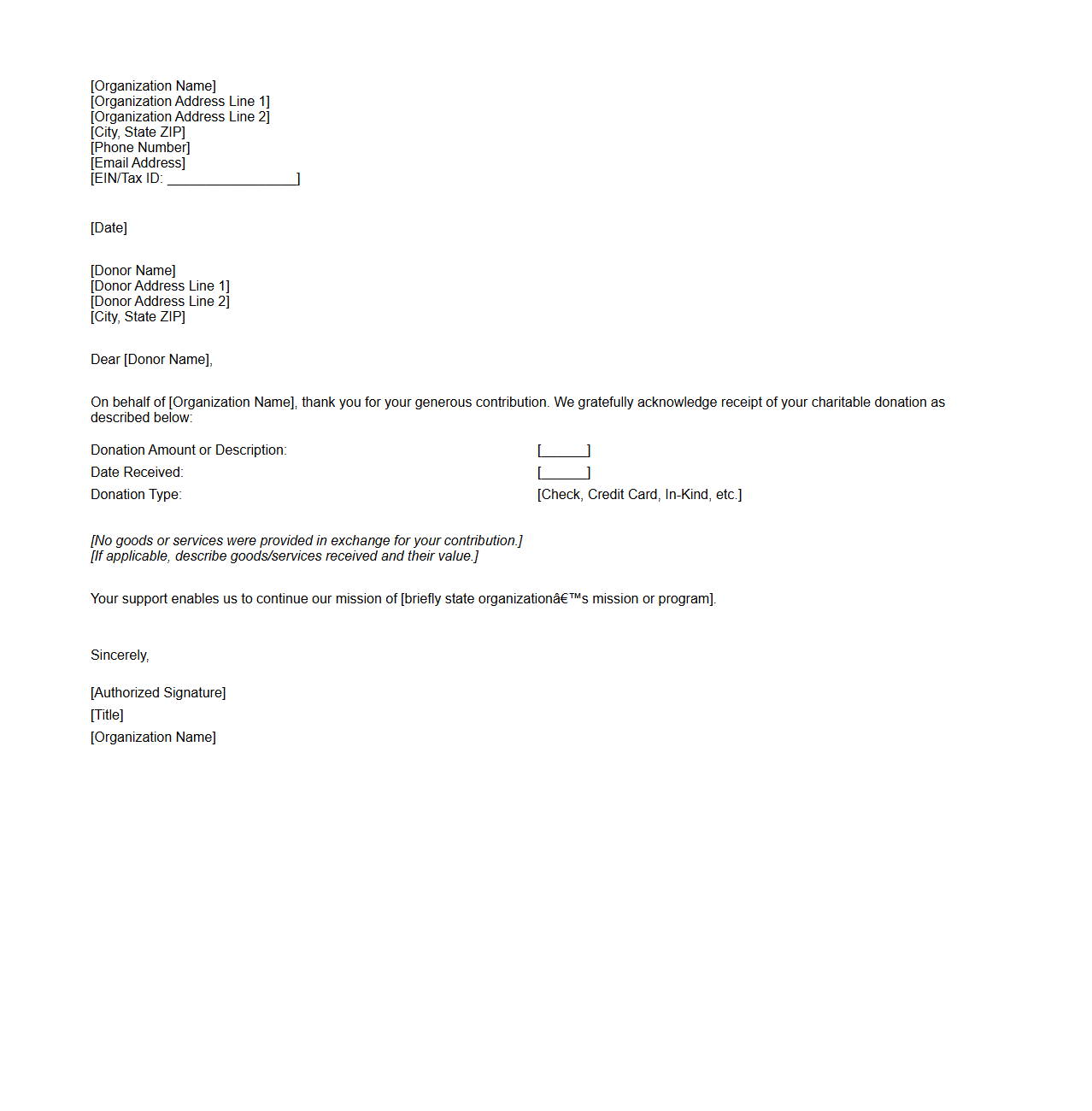

Official Charitable Contribution Acknowledgment Letter

An

Official Charitable Contribution Acknowledgment Letter is a formal document issued by a nonprofit organization to donors as proof of their charitable donations. It includes essential details such as the donor's name, donation amount, date of contribution, and a statement confirming that no goods or services were exchanged for the donation. This letter is crucial for taxpayers to claim tax deductions and comply with IRS regulations.

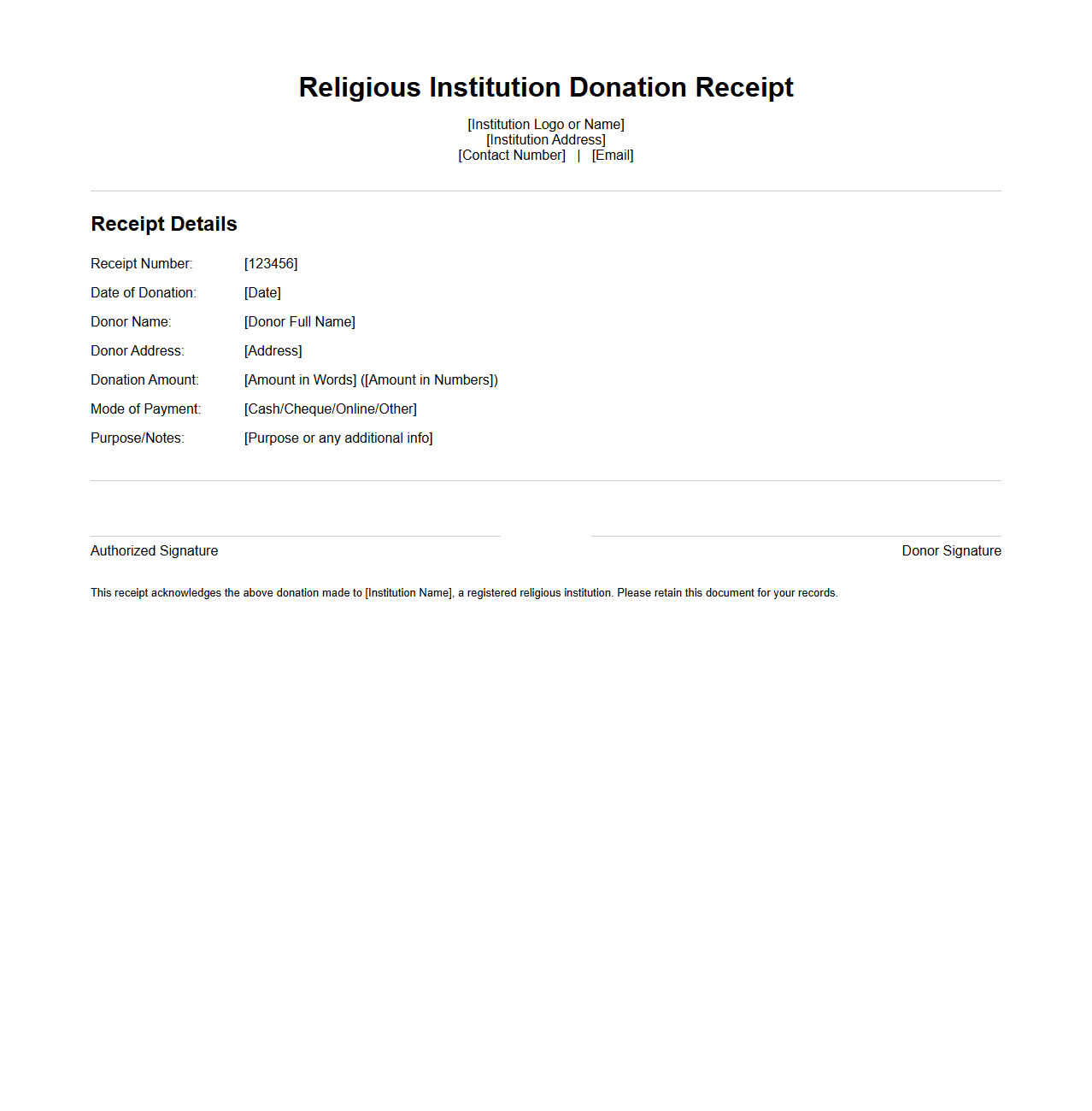

Religious Institution Donation Receipt Format

A

Religious Institution Donation Receipt Format document serves as a formal record acknowledging monetary or material contributions made to a religious organization. It typically includes essential details such as the donor's name, donation amount, date, and purpose or designation of the funds. This receipt not only ensures transparency and accountability but also helps donors claim tax deductions when applicable.

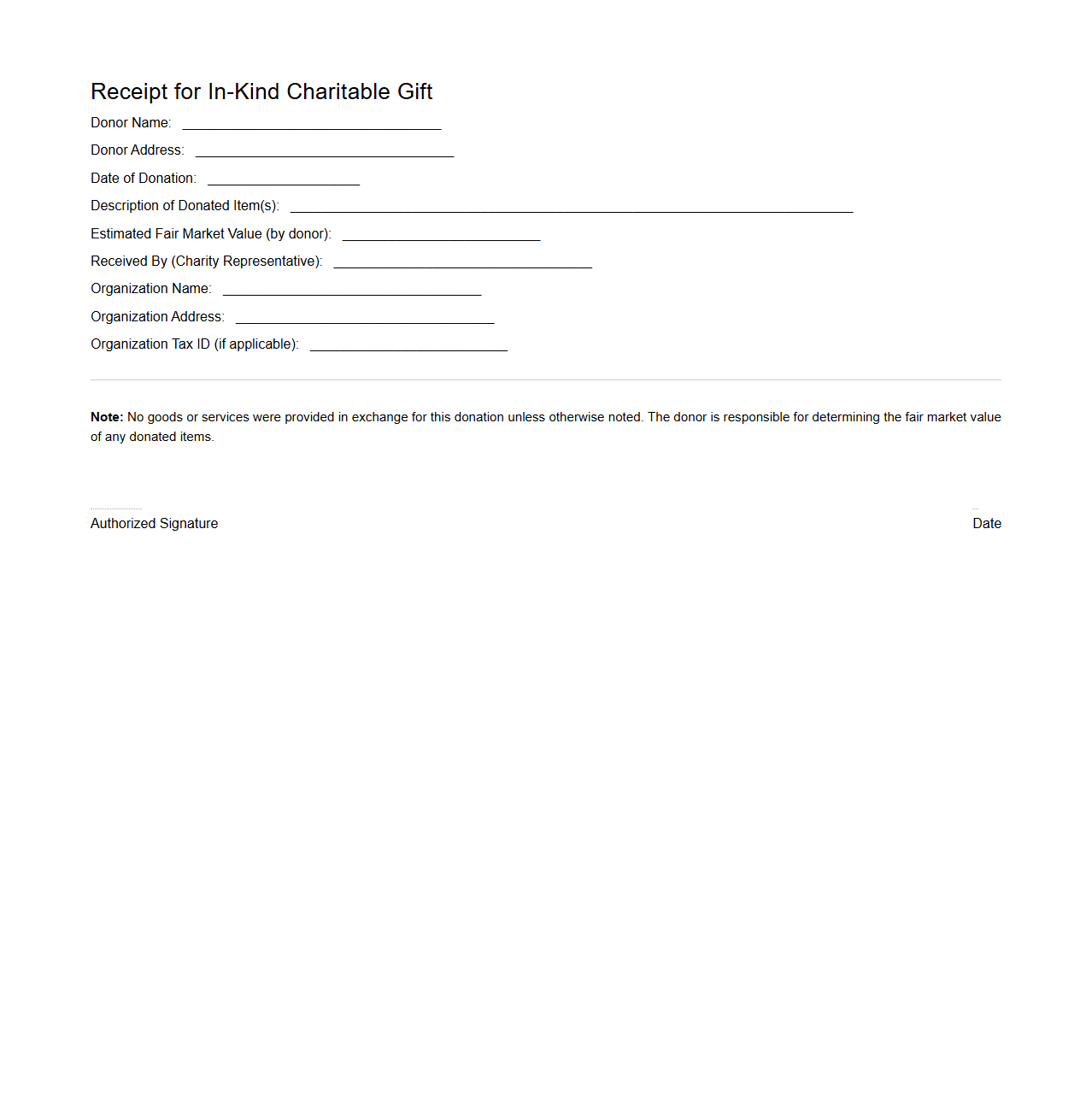

Receipt Example for In-Kind Charitable Gifts

A

Receipt Example for In-Kind Charitable Gifts document serves as tangible proof for donors, detailing non-cash contributions such as clothing, furniture, or services provided to a nonprofit organization. It typically includes the donor's name, description of donated items, estimated fair market value, date of donation, and the charity's acknowledgement. This document is essential for donors to claim tax deductions accurately and for charities to maintain transparent record-keeping.

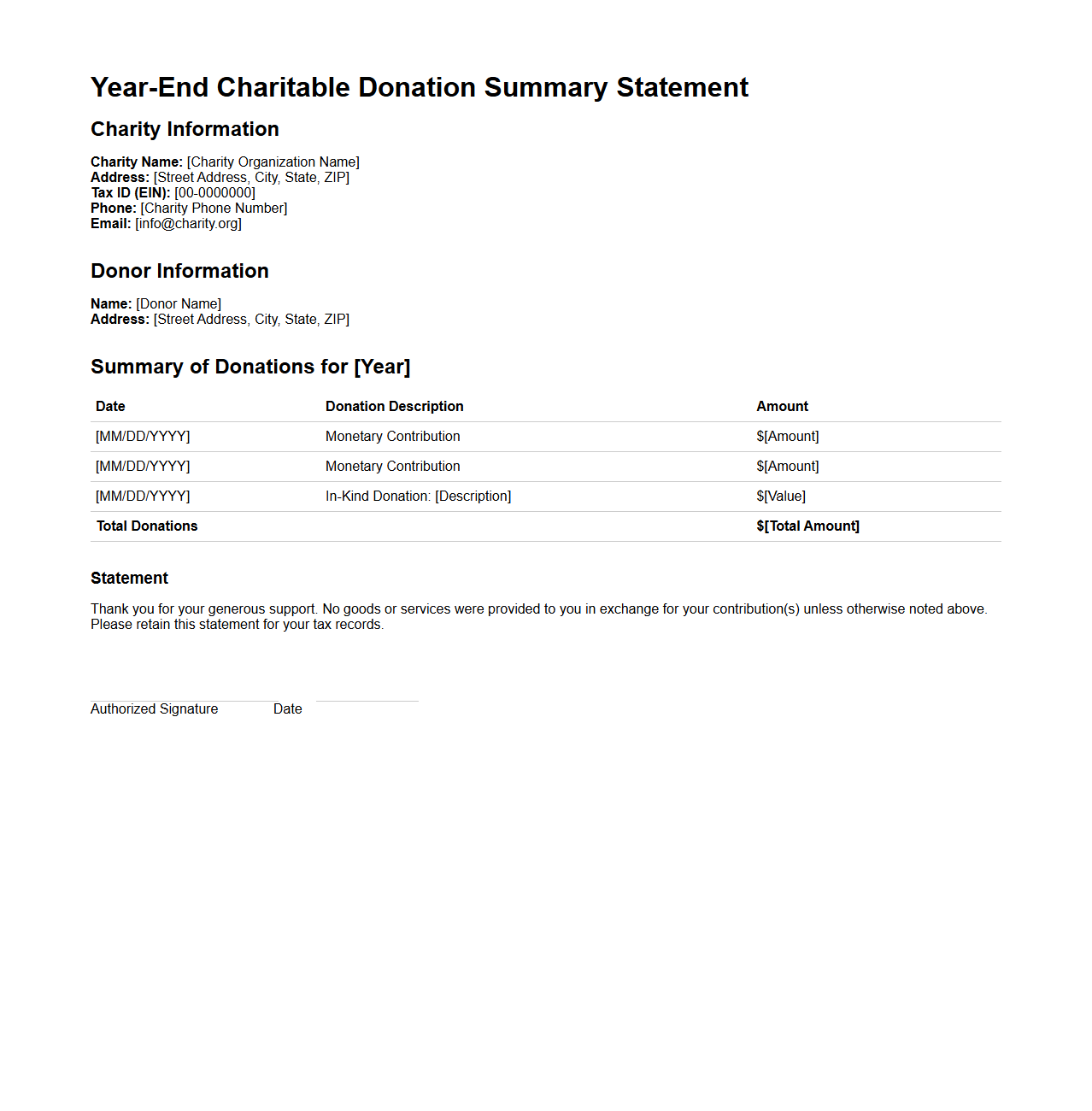

Year-End Charitable Donation Summary Statement

A

Year-End Charitable Donation Summary Statement details an individual's or organization's total contributions to nonprofit entities within a calendar year, serving as an essential document for tax reporting purposes. It summarizes donation dates, amounts, and recipient organizations, ensuring accurate records for claiming tax deductions under relevant IRS guidelines. This statement helps donors validate their philanthropy efforts and supports compliance with tax regulations.

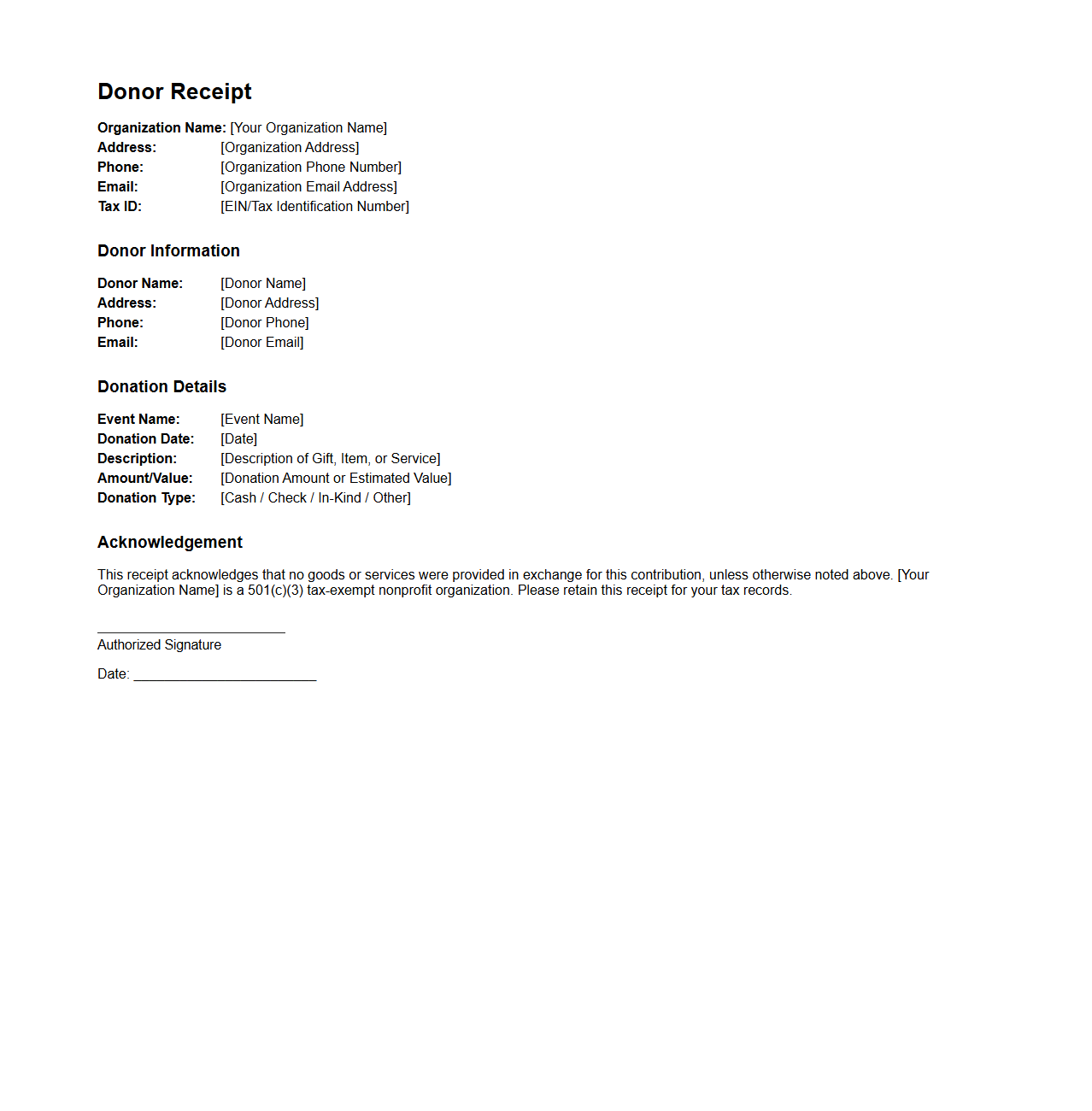

Donor Receipt Sample for Fundraising Events

A

Donor Receipt Sample for Fundraising Events is a standardized template that organizations use to provide official acknowledgment to contributors for their donations. This document typically includes essential details such as the donor's name, donation amount, date of contribution, and the organization's tax-exempt status, which is crucial for tax deduction purposes. Accurate donor receipts not only ensure compliance with legal requirements but also help build trust and transparency between fundraising entities and their supporters.

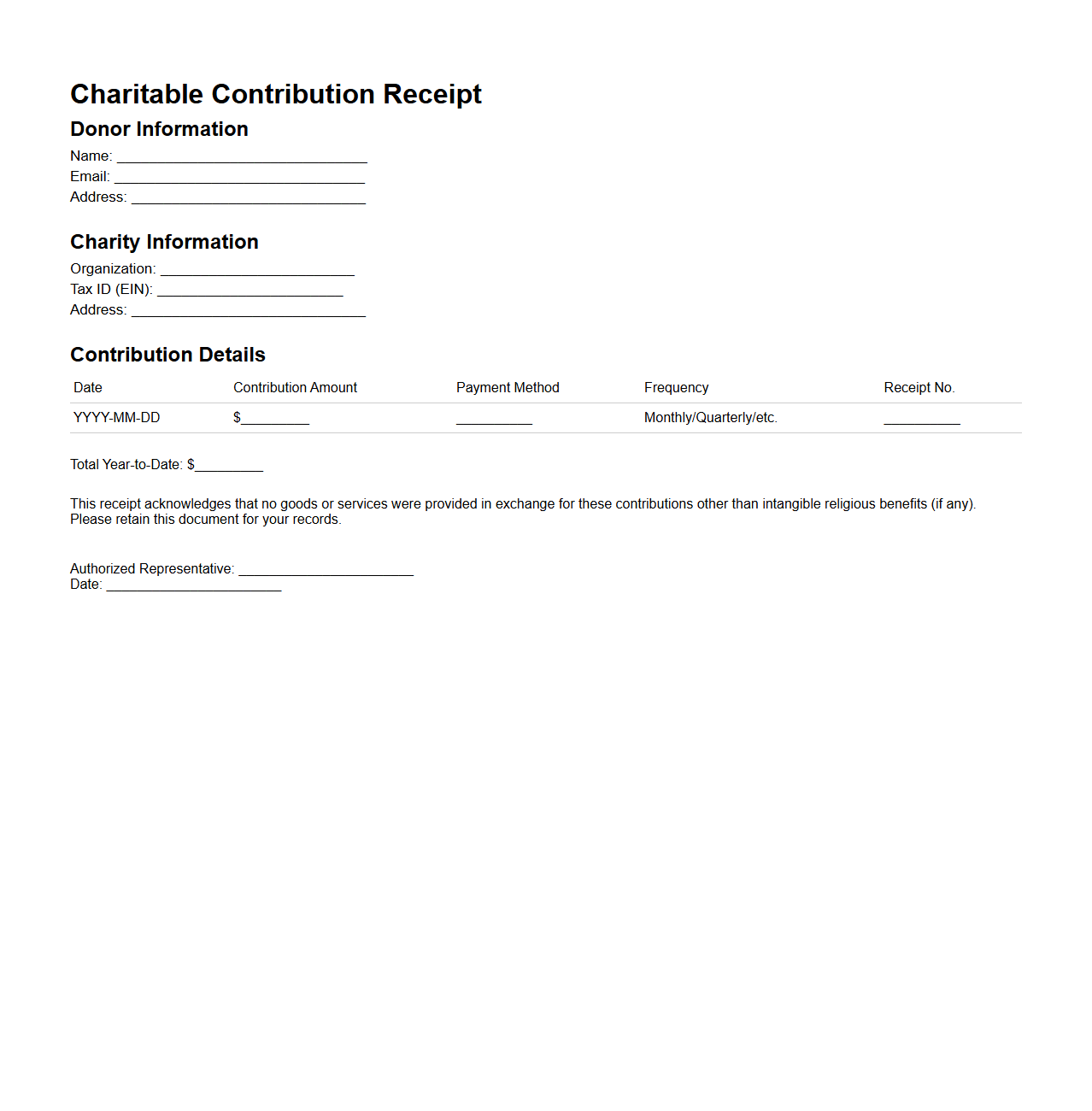

Sample Receipt for Recurring Charitable Contributions

A

Sample Receipt for Recurring Charitable Contributions document provides donors with official acknowledgment of their ongoing donations, detailing the donor's name, donation amount, frequency, and dates of contributions. This receipt serves as proof for tax deduction purposes and helps maintain transparency between the charity and the donor. It ensures compliance with legal requirements by documenting the recurring nature of charitable support.

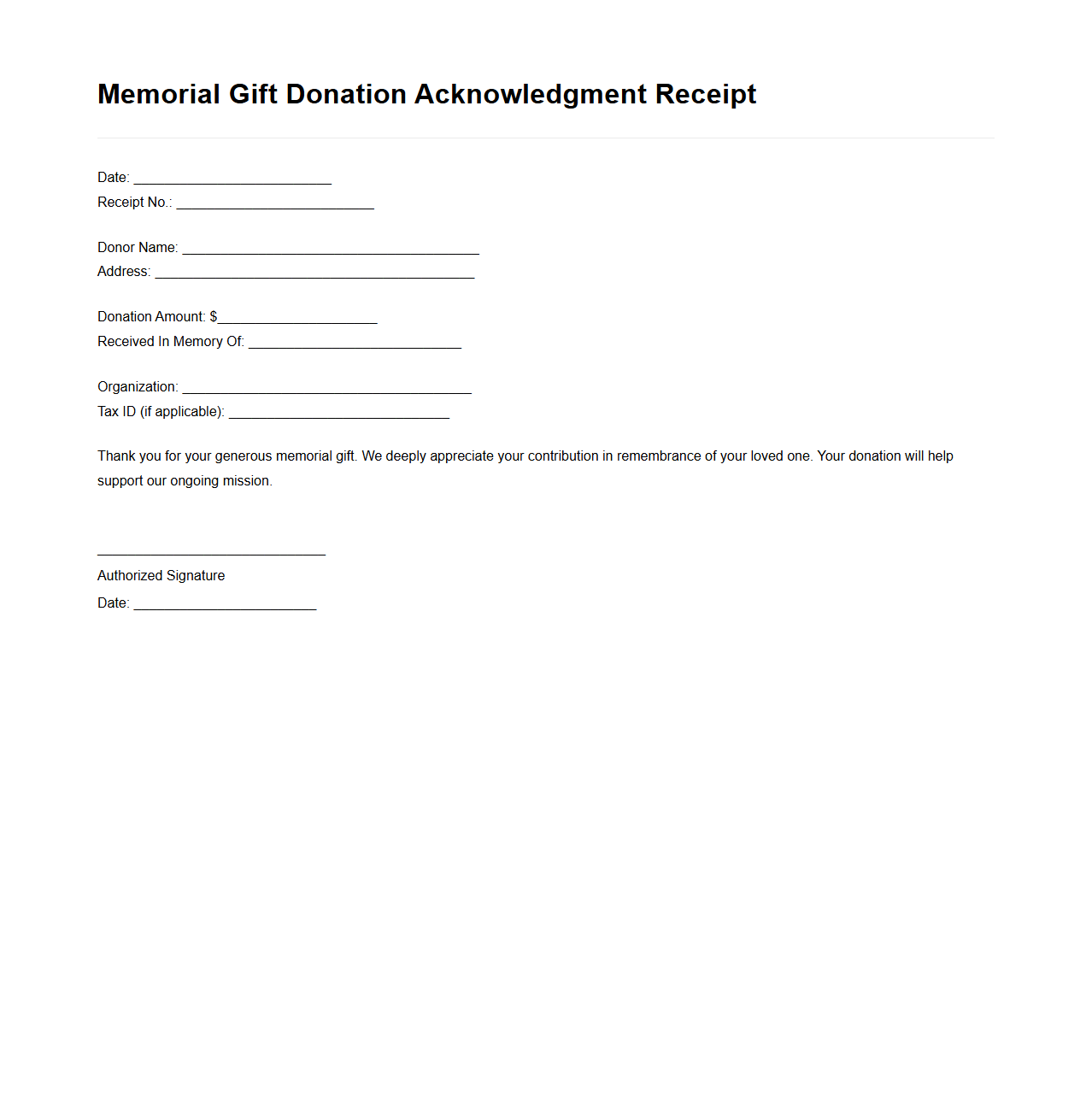

Memorial Gift Donation Acknowledgment Receipt

A

Memorial Gift Donation Acknowledgment Receipt document serves as an official record recognizing a contribution made in memory of a deceased individual. It details the donor's information, the amount or nature of the gift, and the honoree's name, ensuring transparency and proper acknowledgment. This receipt is essential for tax purposes and provides donors with formal appreciation for their support.

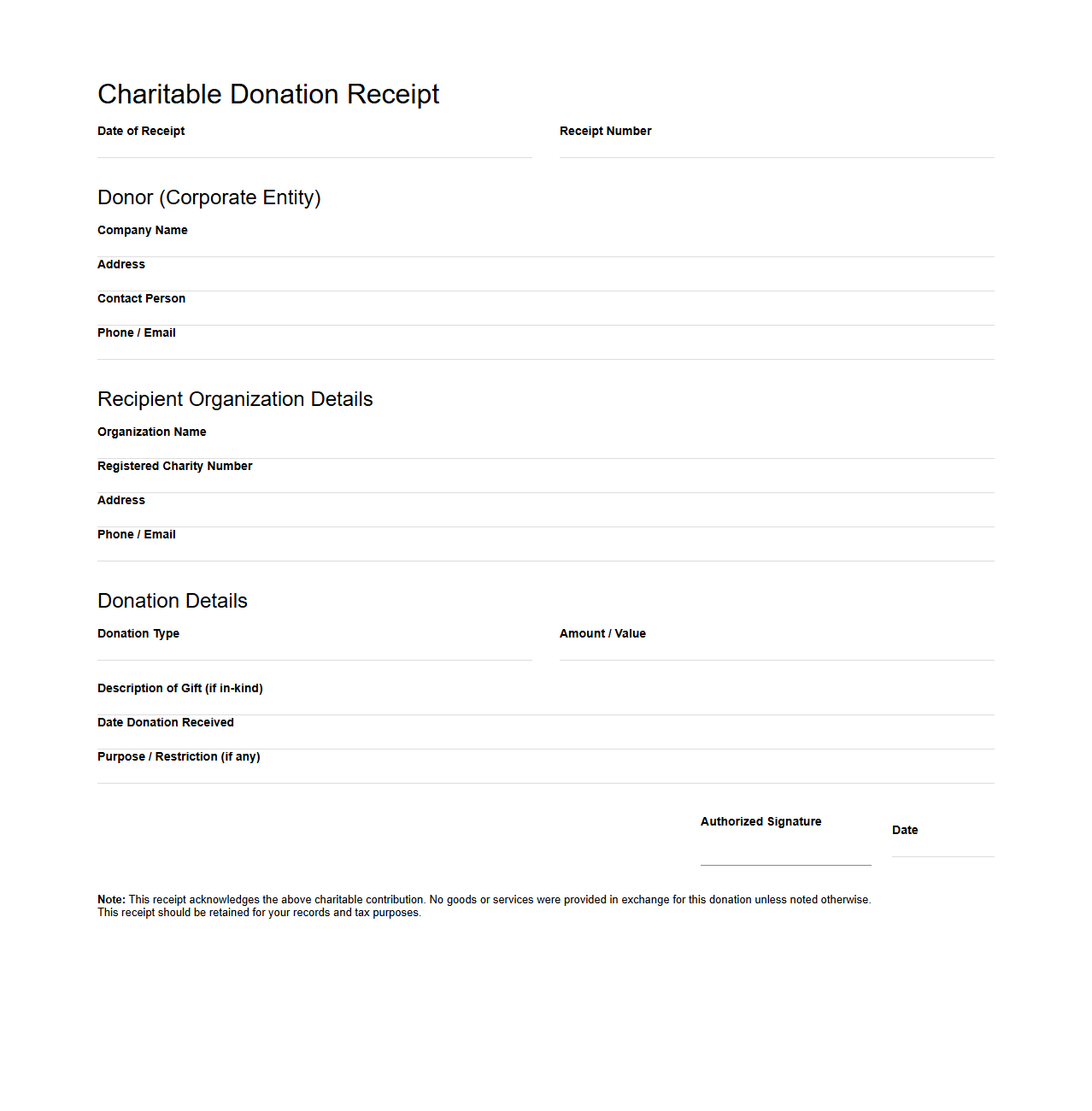

Charitable Donation Receipt Template for Corporate Donors

A

Charitable Donation Receipt Template for Corporate Donors is a standardized document used to officially acknowledge donations made by businesses to nonprofit organizations. It includes essential details such as donor information, donation amount, date of contribution, and a description of non-cash items if applicable. This template ensures compliance with tax regulations and provides corporations with accurate records for tax deduction purposes.

What IRS requirements must a charitable donation receipt document include?

A charitable donation receipt must include the organization's name, the date of the contribution, and the amount donated. It should also state whether any goods or services were provided in exchange for the donation. This documentation is essential for the donor's tax deduction claims with the IRS.

Can electronic receipts for donations be legally accepted for tax purposes?

Yes, the IRS legally accepts electronic donation receipts as valid documentation for tax deductions. These receipts must contain the same information as paper receipts, including the organization's details and donation amount. Donors should ensure electronic records are properly stored and accessible for tax reporting purposes.

How should non-cash charitable donation receipts be detailed?

Receipts for non-cash donations must include a detailed description of the items donated and their estimated fair market value. The donor's name, the date, and the organization's acknowledgment should also be present. Proper documentation is critical for accurately determining tax deductible amounts on these contributions.

What is the minimum donation amount that requires an official receipt document?

The IRS requires an official receipt for any donation of $250 or more. Donations below this threshold do not strictly require formal acknowledgment but should still be documented for accurate record-keeping. Donors seeking tax deductions must obtain receipts for qualifying contributions to comply with IRS rules.

Are year-end summary donation receipts sufficient for multiple contributions?

Year-end summary receipts can be sufficient if they provide a total amount donated and list each contribution's date. The summary must come from the charitable organization and include all required IRS information. Such documents help donors simplify their tax filing process by consolidating multiple donations into one official record.