Partnership Deed for IT Consulting Firm

A

Partnership Deed for an IT consulting firm is a legal document outlining the roles, responsibilities, profit-sharing ratios, and decision-making processes among partners. It specifies capital contributions, dispute resolution mechanisms, and terms for admission or exit of partners to ensure clear governance. This deed helps prevent conflicts and establishes a transparent framework for smooth business operations within the IT consulting sector.

Partnership Deed for Restaurant Business

A

Partnership Deed for a restaurant business document outlines the terms and conditions agreed upon by partners, including profit-sharing ratios, roles, responsibilities, and capital contributions. This legal agreement helps prevent future disputes by clearly defining each partner's rights and obligations, ensuring smooth business operations. It serves as a crucial reference for managing financial decisions and resolving conflicts within the restaurant partnership.

Partnership Deed for Retail Store Operation

A

Partnership Deed for Retail Store Operation is a legal document outlining the roles, responsibilities, profit-sharing ratios, and duties of partners involved in running a retail business. It specifies terms such as capital contributions, decision-making processes, dispute resolution mechanisms, and duration of the partnership. This deed ensures clarity and prevents conflicts by legally binding all partners to agreed operational guidelines.

Partnership Deed for Law Firm

A

Partnership Deed for a law firm is a legal document that outlines the rights, responsibilities, and obligations of each partner involved in the practice. It details profit-sharing ratios, decision-making procedures, dispute resolution mechanisms, and the duration of the partnership, ensuring clarity and preventing conflicts among partners. This agreement is essential for smooth operation and legal compliance of the law firm.

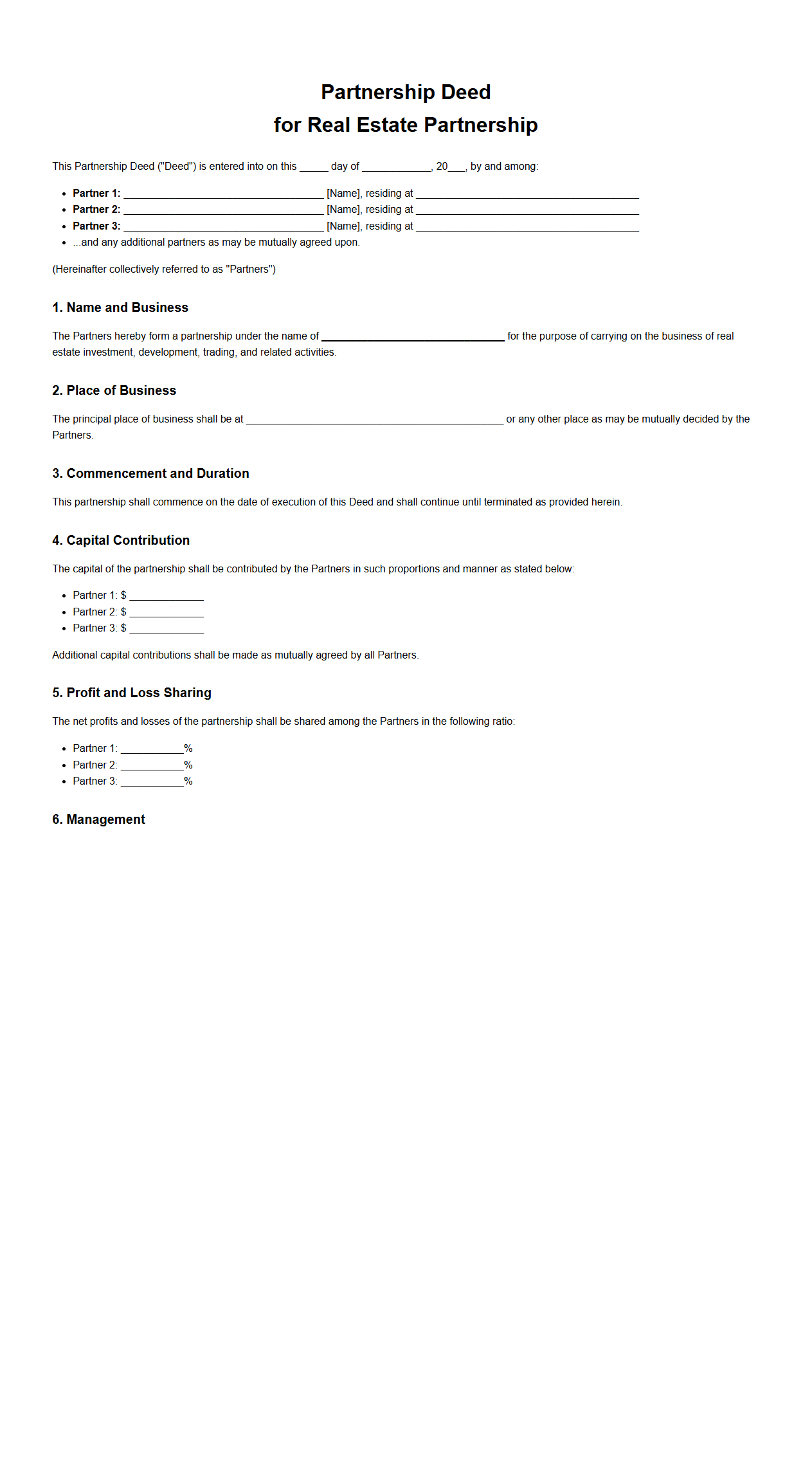

Partnership Deed for Real Estate Partnership

A

Partnership Deed for a real estate partnership is a legal document outlining the roles, responsibilities, profit-sharing ratios, and obligations of each partner involved in the property venture. It clearly defines the capital contribution, decision-making authority, dispute resolution methods, and duration of the partnership to ensure smooth operations and protect all parties' interests. This document is essential for avoiding conflicts and providing a structured framework for managing real estate investments collaboratively.

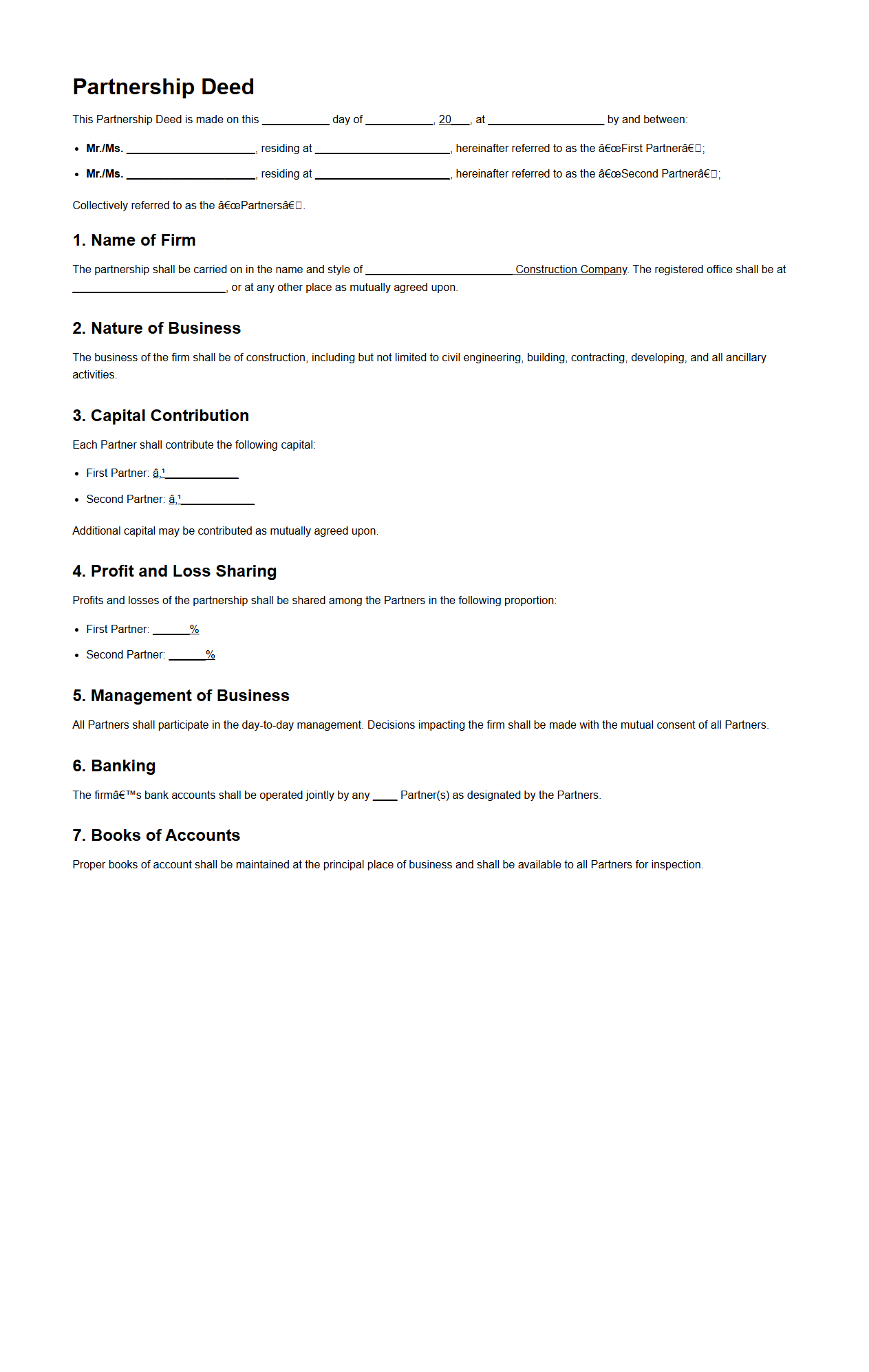

Partnership Deed for Construction Company

A

Partnership Deed for a construction company is a legal document that outlines the terms and conditions agreed upon by partners involved in the business. It specifies the roles, responsibilities, profit-sharing ratios, capital contributions, and dispute resolution mechanisms critical to the company's operations. This document ensures clarity and legal protection for all partners, facilitating smooth project execution and business growth.

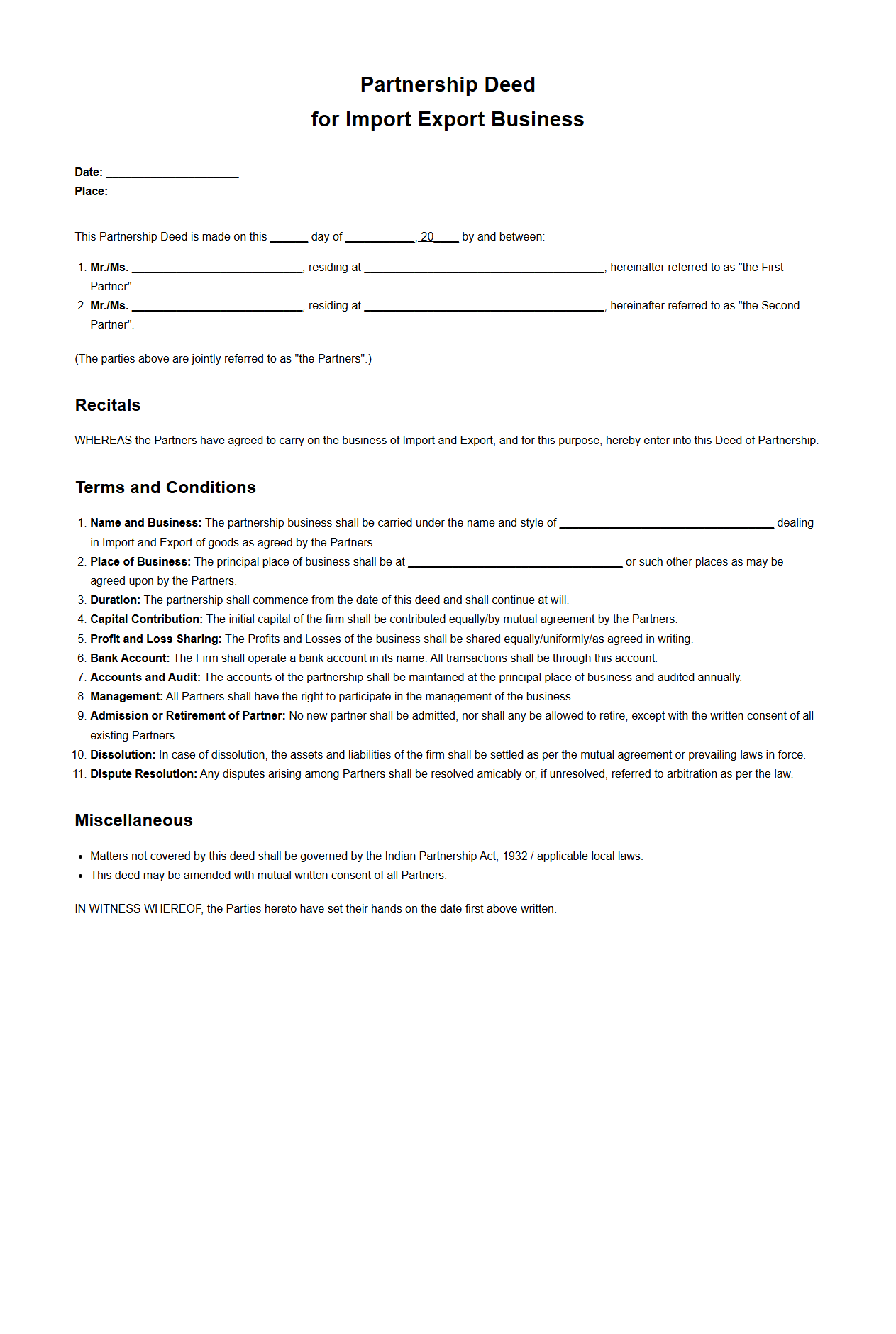

Partnership Deed for Import Export Business

A

Partnership Deed for an import-export business document is a legal contract that outlines the roles, responsibilities, profit-sharing ratios, and decision-making authority among business partners. It ensures clarity and prevents disputes by specifying terms related to capital contribution, profit distribution, business operations, and dispute resolution mechanisms. This document is crucial for establishing trust and smooth collaboration in international trade ventures.

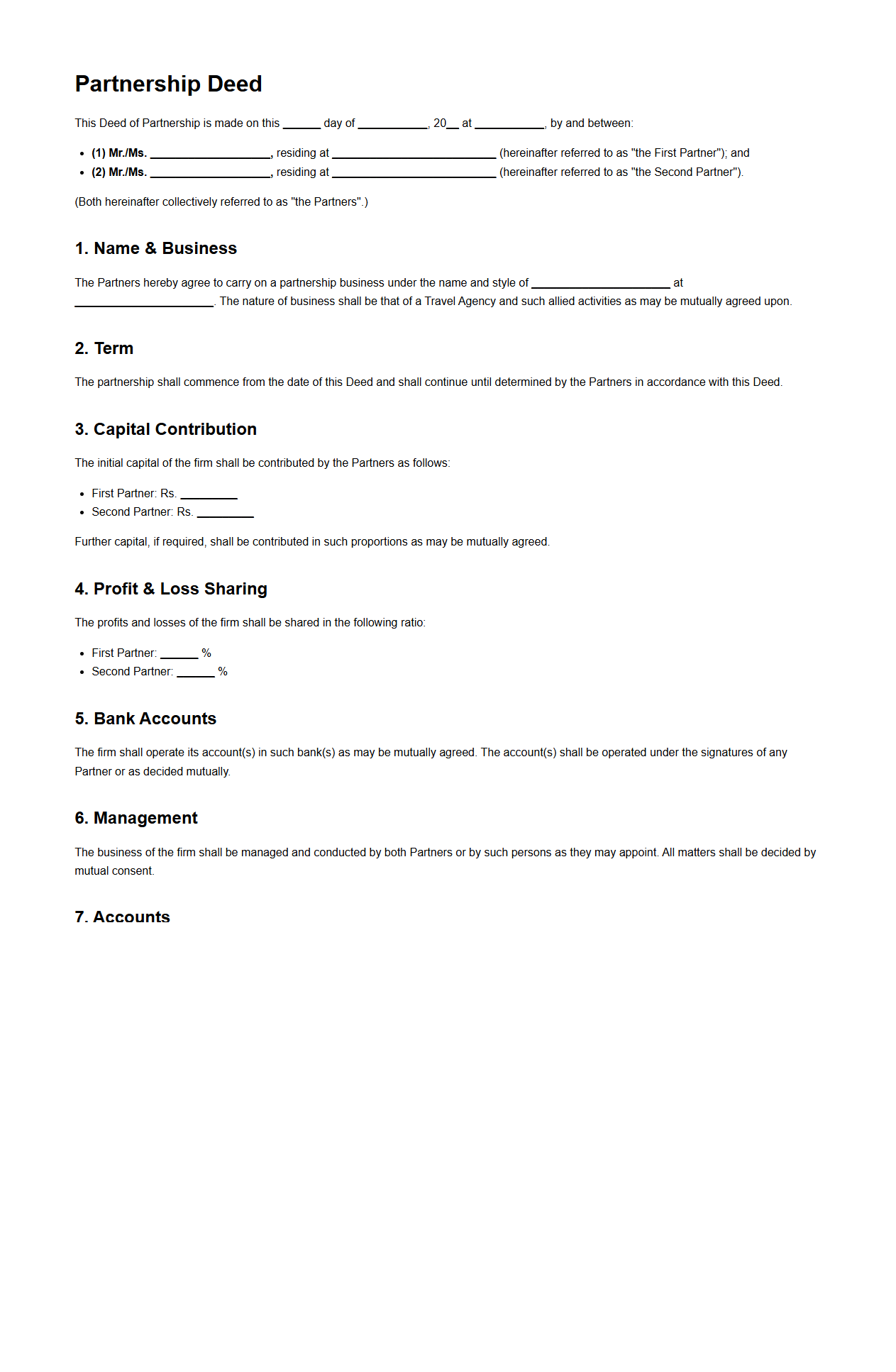

Partnership Deed for Travel Agency

A

Partnership Deed for a travel agency is a legal document that outlines the terms and conditions agreed upon by the partners involved in the travel business. It specifies roles, profit-sharing ratios, capital contributions, responsibilities, and dispute resolution mechanisms, ensuring clear operational guidelines. This document is crucial for establishing the legal foundation and smooth functioning of the travel agency.

Partnership Deed for Manufacturing Unit

A

Partnership Deed for Manufacturing Unit document is a legal agreement outlining the roles, responsibilities, profit-sharing ratios, and operational guidelines among partners involved in a manufacturing business. It defines the capital contributions, decision-making authority, dispute resolution methods, and terms for adding or removing partners, ensuring clarity and preventing conflicts. This document is crucial for smooth management and legal protection of the manufacturing partnership.

Partnership Deed for Accounting Services

A

Partnership Deed for Accounting Services is a legally binding document outlining the rights, responsibilities, and profit-sharing arrangements among partners in an accounting firm. It clearly specifies each partner's role, capital contributions, and procedures for dispute resolution and dissolution. This agreement ensures transparency and smooth operation within the partnership, complying with regulatory standards specific to accounting practices.

What are the required clauses in a partnership deed for legal business registration?

The partnership deed must include the name and address of the partnership firm and all partners involved. It should clearly state the business objectives and the duration of the partnership. Additionally, the deed must specify the capital contribution and roles of each partner for legal validity.

How is profit-sharing ratio specified in a partnership deed document?

The profit-sharing ratio clause defines how profits and losses are divided among partners. This ratio is usually expressed as fractions or percentages based on agreed contributions or roles. Clear specification avoids future disputes by ensuring transparent financial distribution.

Which documents must accompany the partnership deed during business registration?

Along with the partnership deed, identity proofs of partners, address proofs, and a business address proof are required during registration. Some jurisdictions may also demand PAN cards and photographs of partners. Proper documentation supports legal recognition and smooth registration.

How does the partnership deed address partner exit or retirement processes?

The exit or retirement clause outlines the procedure and terms for a partner leaving the firm. It typically covers notice periods, settlement of dues, and rights over firm assets. Such provisions ensure orderly transitions and protect the interests of remaining partners.

What dispute resolution methods are detailed in the partnership deed for conflicts?

The dispute resolution clause often mandates arbitration or mediation to handle conflicts among partners. It may specify the choice of arbitrators and the venue for proceedings. Clear dispute mechanisms help maintain business continuity and reduce legal complications.